Abstract

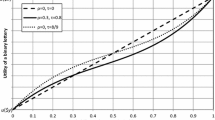

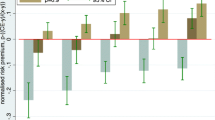

We define a premium principle under the continuous cumulative prospect theory which extends the equivalent utility principle. In prospect theory, risk attitude and loss aversion are shaped via a value function, whereas a transformation of objective probabilities, which is commonly referred as probability weighting, models probabilistic risk perception. In cumulative prospect theory, probabilities of individual outcomes are replaced by decision weights, which are differences in transformed, through the weighting function, counter-cumulative probabilities of gains and cumulative probabilities of losses, with outcomes ordered from worst to best. Empirical evidence suggests a typical inverse-S shaped function: decision makers tend to overweight small probabilities, and underweight medium and high probabilities; moreover, the probability weighting function is initially concave and then convex. We study some properties of the behavioral premium principle. We also assume an alternative framing of the outcomes; then, we discuss several applications to the pricing of insurance contracts, considering different value functions and probability weighting functions proposed in the literature, and an alternative mental accounting. Finally, we focus on the shape of the probability weighting function.

Similar content being viewed by others

Notes

The book of Wakker (2010) provides a thorough treatment on prospect theory.

See Quiggin (1993), p. 56.

When there is no ambiguity, we simply use the notation \(F(x) = {\mathbb {P}}(X\le x)\) and \(S(x) = 1- F(x) = {\mathbb {P}}(X > x)\), and f for the probability density function of the random loss X.

The premium principle defined in Wang (1996) assumes an increasing and concave distortion function and maintains the second-order stochastic dominance.

See Thaler (1985), p. 202.

Time-value of money is normally disregarded when dealing with non-life insurance contracts, but may become important on a multi-year horizon.

Note that \({\mathbb {E}}_{w^+w^-} (cX) = c {\mathbb {E}}_{w^+w^-} (X)\), for \(c\ge 0\).

In general, linearity does not hold for the generalized Choquet integral. In Sect. 3.1, we discussed the case with \(w^+=w^-\). When \(w^+\ne w^-\), and \(c\in {\mathbb {R}}\), we apply the following result

$$\begin{aligned} {\mathbb {E}}_{w^+w^-}(X+c) = {\mathbb {E}}_{w^+w^-}(X) + c + \int _0^c [w^-({\mathbb {P}}(-X>s))-\overline{w}^+({\mathbb {P}}(-X>s))]\,\mathrm{{d}}s, \end{aligned}$$where \(\overline{w}\) is the dual probability weighting function. See Kaluszka and Krzeszowiec (2012) for the proof and discussion of further properties of the generalized Choquet integral.

We have \(u(0)=0\), \(u^\prime >0\), \(u^\prime (0)=b/a\), \(u^{\prime \prime }<0\). Heilpern (2003) considers the normalized case \(a=b\).

The same result arises also when \(a=b\) and with \(W=0\).

We have \(u(0)=0\), \(u^\prime >0\), \(u^\prime (0)=b/a\), and \(u^{\prime \prime }>0\), which may be useful to model the value function in the domain of losses.

Observe that \(\int _0^c \psi (F(x))f(x)\mathrm{{d}}x = w(F(c))\).

In the literature discontinuous (neo-additive) weighting functions are also considered.

In the same paper, Prelec derives two other probability weighting functions: the conditionally-invariantexponential-power and the projection-invarianthyperbolic-logarithm function.

This is not the case for weighting function (25); when \(a \ne b\), both parameters controls for curvature and all parameters may influence elevation.

References

Abdellaoui, M.: Parameter-free elicitation of utility and probability weighting functions. Manag. Sci. 46, 1497–1512 (2000)

Abdellaoui, M., Barrios, C., Wakker, P.P.: Reconciling introspective utility with revealed preference: Experimental arguments based on prospect theory. J. Econom. 138, 336–378 (2007)

Abdellaoui, M., L’Haridon, O., Zank, H.: Separating curvature and elevation: a parametric probability weighting function. J. Risk Uncertain. 41, 39–65 (2010)

Allais, M.: Le comportement de l’homme rationnel devant le risque: Critique des postulats et axiomes de l’école Américaine. Econometrica 21(4), 503–546 (1953)

Allais, M.: The general theory of random choices in relation to the invariant cardinal utility function and the specific probability function. The \((U, \theta )-\)Model: a general overview. In: Munier, B.R. (ed.) Risk, Decision and Rationality, pp. 231–289. D. Reidel Publishing Company, Dordrecht, Holland (1988)

Balbás, A., Garrido, J., Mayoral, S.: Properties of distortion risk measures. Methodol. Comput. Appl. Probab. 11, 385–399 (2009)

Bell, D.E.: Disappointment in decision making under uncertainty. Oper. Res. 33, 1–27 (1985)

Belles-Sampera, J., Merigó, J.M., Guillén, M., Santolino, M.: The connection between distortion risk measures and ordered weighted averaging operators. Insur. Math. Econ. 52(2), 411–420 (2013)

Belles-Sampera, J., Guillén, M., Santolino, M.: The use of flexible quantile-based measures in risk assessment. Commun. Stat. Theory Methods 45(6), 1670–1681 (2016)

Birnbaum, M.H., McIntosh, W.R.: Violations of branch independence in choices between gambles. Organ. Behav. Hum. Decis. Process. 67, 91–110 (1996)

Bleichrodt, H., Pinto, J.L.: A parameter-free elicitation of the probability weighting function in medical decision analysis. Manag. Sci. 46, 1485–1496 (2000)

Bleichrodt, H., Pinto, J.L., Wakker, P.P.: Making descriptive use of prospect theory to improve the prescriptive use of expected utility. Manag. Sci. 47, 1498–1514 (2001)

Currim, I.S., Sarin, R.K.: Prospect versus utility. Manag. Sci. 35(1), 22–41 (1989)

Davies, G.B., Satchell, S.E.: The behavioural components of risk aversion. J. Math. Psychol. 51, 1–13 (2007)

Diecidue, E., Schmidt, U., Zank, H.: Parametric weighting functions. J. Econ. Theory 144(3), 1102–1118 (2009)

Gerber, H.U.: An Introduction to Mathematical Risk Theory. S.S. Huebner Foundation for Insurance, University of Pennsylvania, Philadelphia (1979)

Gerber, H.U.: On additive principles of zero utility. Insur. Math. Econ. 4, 249–251 (1985)

Goldstein, W.M., Einhorn, H.J.: Expression theory and the preference reversal phenomena. Psychol. Rev. 94(2), 236–254 (1987)

Gonzalez, R., Wu, G.: On the shape of the probability weighting function. Cognit. Psychol. 38, 129–166 (1999)

Goovaerts, M.J., Kaas, R., Laeven, R.J.A.: A note on additive risk measures in rank-dependent utility. Insur. Math. Econ. 47(2), 187–189 (2010)

Goovaerts, M.J., Kaas, R., Laeven, R.J.A., Tang, Q.: A comonotonic image of independence for additive risk measures. Insur. Math. Econ. 35(3), 581–594 (2004)

Hamada, M., Sherris, M.: Contingent claim pricing using probability distortion operators: methods from insurance risk pricing and their relationship to financial theory. Appl. Math. Finance 10, 19–47 (2003)

Heilpern, S.: A rank-dependent generalization of zero utility principle. Insur. Math. Econ. 33(1), 67–73 (2003)

Hey, J.D., Orme, C.: Investigating generalizations of expected utility theory using experimental data. Econometrica 62(6), 1291–1326 (1994)

Kahneman, D., Tversky, A.: Prospect theory: an analysis of decision under risk. Econometrica 47(2), 263–291 (1979)

Kaluszka, M., Krzeszowiec, M.: Pricing insurance contracts under cumulative prospect theory. Insur. Math. Econ. 50(1), 159–166 (2012)

Kaluszka, M., Krzeszowiec, M.: On iterative premium calculation principles under cumulative prospect theory. Insur. Math. Econ. 52(3), 435–440 (2013)

Kaluszka, M., Okolewski, A.: An extension of Arrow’s result on optimal reinsurance contract. J. Risk Insur. 75(2), 275–288 (2008)

Karmarkar, U.S.: Subjectively weighted utility: a descriptive extension of the expected utility model. Organ. Behav. Hum. Perform. 21, 61–72 (1978)

Karmarkar, U.S.: Subjectively weighted utility and the Allais paradox. Organ. Behav. Hum. Perform. 24, 67–72 (1979)

Kilka, M., Weber, M.: What determines the shape of the probability weighting function under uncertainty? Manag. Sci. 47(12), 1712–1726 (2001)

Kothiyal, A., Spinu, V., Wakker, P.P.: Prospect theory for continuous distributions: a preference foundation. J. Risk Uncertain. 42, 195–210 (2011)

Lattimore, P.K., Baker, J.R., Witte, A.D.: The influence of probability on risky choice: a parametric examination. J. Econ. Behav. Organ. 17(3), 377–400 (1992)

Loomes, G., Moffatt, P.G., Sugden, R.: A microeconometric test of alternative stochastic theories of risk choice. J. Risk. Uncertain. 24, 103–130 (2002)

Luce, D.R.: Utility of Gains and Losses: Measurement-Theoretical and Experimental Approaches. Lawrence Erlbaum Publishers, London (2000)

Luce, D.R.: Reduction invariance and Prelec’s weighting functions. J. Math. Psychol. 45, 167–179 (2001)

Luce, D.R., Mellers, B.A., Chang, S.J.: Is choice the correct primitive? On using certainty equivalents and reference levels to predict choices among gambles. J. Risk Uncertain. 6, 115–143 (1993)

Nardon, M., Pianca, P.: European option pricing under cumulative prospect theory with constant relative sensitivity probability weighting functions. Comput. Manag. Sci. 16, 249–274 (2018). https://doi.org/10.1007/s10287-018-0324-y

Pfiffelmann, M.: Solving the St. Petersburg paradox in cumulative prospect theory: the right amount of probability weighting. Theory Decis. 75, 325–341 (2011)

Prelec, D.: The probability weighting function. Econometrica 66, 497–527 (1998)

Quiggin, J.: A theory of anticipated utility. J. Econ. Behav. Organ. 3, 323–343 (1982)

Quiggin, J.: Generalized Expected Utility Theory: The Rank-Dependent Model. Springer, Netherlands (1993)

Rieger, M.O., Wang, M.: Cumulative prospect theory and the St Petrsburg paradox. J. Econ. Theory. 28, 665–679 (2006)

Rieger, M.O., Wang, M.: Prospect theory for continuous distributions. J. Risk Uncertain. 36, 83–102 (2008)

Röell, A.: Risk aversion in Quiggin and Yaari’s rank-order model of choice under uncertainty. Econ. J. 97, 143–159 (1987)

Safra, Z., Segal, U.: Constant risk aversion. J. Econ. Theory 83, 19–42 (1998)

Schmeidler, D.: Subjective probability and expected utility without additivity. Econometrica 57, 571–587 (1989)

Shiller, R.J.: Human behavior and the efficiency of the financial system. In: Taylor, J.B., Woodford, M. (eds.) Handbook of Macroeconomics, vol. 1C, pp. 1305–1340. Elsevier, Amsterdam (1999)

Sung, K.C.J., Yam, S.C.P., Yung, S.P., Zhou, J.H.: Behavioral optimal insurance. Insur. Math. Econ. 49, 418–428 (2011)

Thaler, R.H.: Mental accounting and consumer choice. Mark. Sci. 4, 199–214 (1985)

Tsanakas, A.: To split or not to split: capital allocation with convex risk measures. Insur. Math. Econ. 44, 268–277 (2009)

Tversky, A., Fox, C.R.: Weighting risk and uncertainty. Psychol. Rev. 102, 269–283 (1995)

Tversky, A., Kahneman, D.: Advances in prospect theory: cumulative representation of the uncertainty. J. Risk Uncertain. 5, 297–323 (1992)

van der Hoek, J., Sherris, M.: A class of non-expected utility risk measures and implications for asset allocations. Insur. Math. Econ. 28(1), 69–82 (2001)

Wakker, P.P.: Prospect Theory: For Risk and Ambiguity. Cambridge University Press, Cambridge (2010)

Walther, H.: Normal randomness expected utility, time preferences and emotional distortions. J. Econ. Behav. Organ. 52, 253–266 (2003)

Wang, S.S.: Premium calculation by transforming the layer premium density. ASTIN Bull. 26(1), 71–92 (1996)

Wang, S.S.: A class of distortion operators for pricing financial and insurance risks. J. Risk Insur. 67(1), 15–36 (2000)

Werner, K.M., Zank, H.: A revealed reference point for prospect theory. J. Econ. Theory (2018). https://doi.org/10.1007/s00199-017-1096-2

Wu, G., Gonzalez, R.: Curvature of the probability weighting function. Manag. Sci. 42(12), 1676–1690 (1996)

Wu, G., Gonzalez, R.: Nonlinear decision weights in choice under uncertainty. Manag. Sci. 45(1), 74–85 (1999)

Yaari, M.: The dual theory of choice under risk. Econometrica 55(1), 95–115 (1987)

Acknowledgements

The authors thank two anonymous referees for useful comments and suggestions of references.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Nardon, M., Pianca, P. Behavioral premium principles. Decisions Econ Finan 42, 229–257 (2019). https://doi.org/10.1007/s10203-019-00246-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-019-00246-x

Keywords

- Continuous cumulative prospect theory

- Insurance premium principles

- Zero utility principle

- Framing

- Probability weighting function