Abstract

This paper analyzes the market structure of the Hungarian bank market and the effects of the financial crisis of 2008 on it. With a static and a dynamic panel model we estimate the elasticity of total revenues with respect to changes in input prices so that we can determine the market structure based on the Panzar and Rosse methodology for the period between 2003 and 2020. We test the input price elasticity according to the balance sheet and profit and loss data of the top 13 companies. The results show that the Hungarian bank market was a monopolistic competition or a monopoly market in long run equilibrium. To see the effects of the financial crisis we use three subsamples, furthermore we estimate and test the H-statistic with a fixed effect model. During the examined period the level of factor price elasticity increased in time.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Examining the market structure of a sector is an interesting question both from the consumer protection and the supervision point of view. The stability of the Systematically Important Financial Institutions is a crucial issue due to the financial crises. Difficulties in the banking sector are quickly spreading to other markets. Therefore, it is an important question to examine the market structure of the banking sector, as well as to analyze the impact of a financial crisis. Financial markets are often mentioned as an example of the perfect competition market.

This paper focuses on the Hungarian bank sector. After the change of regime more private banks appeared in the country, while joining the European Union was also a huge step for Hungary. We examine whether the market can be considered perfectly competitive. Furthermore, taking into account the evolution of the market structure over time, we separately examine the period before the financial crisis of 2008, the years of the crisis, and the years after that. This study addresses the question about the development of the market structure of the Hungarian bank sector before and after the financial crisis of 2008. The objective of this research is to determine whether the monopoly or the perfect competition case fits better the factor price elasticity calculated by the balance sheet data between 2003 and 2020.

The determination of the market structure is based on the Panzar and Rosse methodology (Panzar and Rosse 1987). The model gives a testable hypothesis about factor price elasticity which allows us to distinguish between cases of monopoly, monopolistic competition, and perfect competition. We estimate and test the input price elasticity according to the balance sheet data of the top 13 companies in the time-period between 2003 and 2020. We create three subperiods to determine the development of the market structure before and after the crisis.

We estimate factor price elasticity with a static and a dynamic panel model to test the market structure and create subperiods to see the changes after the crisis. The results show that the H-statistic increased during the three periods in Hungary. Before the crisis the bank sector was a monopoly market, during the crisis (2008–2012) the market was not in long run equilibrium. Examining the whole period we used a static and a dynamic estimation, the structure of the Hungarian bank market differs significantly from the perfect competition case. Between 2003 and 2020 the bank market was in long-run equilibrium and the market structure was a monopolistic competition or a monopoly market.

The rest of the paper is organized as follows. First, Sect. 2 contains a literature review, and Sect. 3 presents the methodology of the Panzar and Rosse model and the dynamic panel model approach. Section 4 describes the dataset, while Sect. 5 contains the main results of the paper. Finally, Sect. 6 discusses the findings, and Sect. 7 concludes.

2 Literature review

The Panzar and Rosse method is often used to determine the market structure of a bank market. Most studies use static panel estimation, although according to Goddard and Wilson (2009) the dynamic panel model should be used to estimate the Panzar–Rosse H-statistic as the static model can cause bias. Apergis (2015) also uses a static Panzar and Rosse model to determine the changes in the market structure caused by the crisis with three subperiods in the case of emerging market economies. The results show that after the crisis a lower level of competition can be seen between 2000 and 2012.

The market structure of the Hungarian bank sector has been already studied, however, with another methodology. Hosszú and Dancsik (2018) estimate the efficiency of Hungarian banks with stochastic frontier analysis and data envelopment analysis models and calculate the Lerner index for both the household and the corporate credit market. The two segments show a mixed picture, on the corporate credit market the competition is stronger. According to the article, the Hungarian banking sector is homogeneous from the perspective of cost efficiency, but it is heterogeneous in terms of profit efficiency. The crisis had a positive effect on cost efficiency. After 2008, the profit efficiency deteriorated at first, but by rationalizing activities it improved after.

The Hungarian National Bank also has working papers, which deal with the question of the market structure. Móré and Nagy (2003) uses structural methods (structure-conduct-performance and relative market power hypotheses) to measure the competition in the pricing behavior and profitability of Central and Eastern European banks. They use the data of individual banks of eight Central and Eastern European countries (Estonia, Lithuania, Latvia, the Czech Republic, Slovakia, Poland, Hungary, and Slovenia) from the period of 1998–2001. According to the results, the market concentration has no positive correlation with either the net interest margin or Return on Assets. This implies that in more concentrated markets, banks did not earn higher profits. But the results show that dominant banks of the countries in the region earned extra profit and caused a welfare loss by exploiting their pricing advantage arising from the relative market power and by behaving in a manner that limited competition. Móré and Nagy (2004) focuses only on the Hungarian sector between 1996 and 2003, using the Bresnahan model, which is a non-structural approach of measuring competition. Based on the results, the degree of competition in the loan and deposit markets is between perfect competition and the Cournot equilibrium. On the other hand, the consumer credit market is characterized by a lower degree of competition, between Cournot equilibrium and perfect collusion. Molnár et al. (2007) compares the level of the profit margin in the Hungarian market with the theoretical values of Bertrand orphans and collusion. The comparison of the observed data between 2003 and 2005 with the theoretical models show that the competitive market is limited, the degree of competition in the other segments can be considered low.

Aczél et al. (2016) studied the reason of the high level of the average spread of Hungarian home loans above the three-month interbank interest rate before 2016. They found that the higher premium is currently primarily caused by the high proportion of products with fixed interest rates beyond one year, the relatively large stock of non-performing loans, credit losses, high operating costs, demand-side peculiarities, and the low degree of competition observed in certain regions. According to the results of the used panel model, the distribution of branches plays an important role in the evolution of mark-ups. The findings indicate that the Hungarian population chooses from a well-defined, narrow circle of banks when making loan decisions. This is due to the territorial distribution of the banks’ branch network, the banks’ business model, and the taste patterns observed in the society. These constraints and patterns give banks opportunities to price their products according to oligopolistic competition.

Although the literature of the Hungarian market structure is abundant, the impact of the crisis on it is rarely studied. González (2016) investigated the impact of the global financial crisis and the level of market competition of banks on corporate investment across countries. Lyons (2009) concentrated on bank bailouts and government money. Várhegyi (2010) focuses on the Hungarian bank market and studies the effect of international and Hungarian regulations based on the Herfindhal-Hirschman index, the concentration ratio, the market share of the companies, and balance sheet data.

In the literature, the Panzar and Rosse method is often used in the bank sector. Table 1 summarizes the results of these studies for different time periods and different countries. In most countries the bank sector is a monopolistic competition in long run equilibrium. In Canada in 1982, in Italy between 1998 and 2004, and in Nepal between 2010 and 2019 the hypothesis of the perfect competition cannot be rejected. On the other hand, there are bank markets with monopoly structure where the decision of the companies does not depend on the rivals, which implies huge market power, e.g., in Italy between 1986 and 1989, in Japan between 1986 and 1988, in the case of small banks in France and Germany between 1992 and 1996, in Japan, UK, US between 1998 and 2004, and in Bosnia and Herzegovina and Syria between 2005 and 2016.

Some research also includes Hungary. Drakos and Konstantinou (2005) focuses on post socialist countries between 1992 and 2000, Weill (2013) studies the countries of the European Union (EU) and Andrade (2017) collects data from the whole European Union, but it does not contain results about the individual countries. These studies use static models, OLS, or fixed effect panel estimations, and according to these results the European Union market and the Hungarian market was in long run monopolistic competition before 2010.

3 Methods

There are several structural and non-structural models to determine the market structure of a sector. The data request of the non-structural Panzar and Rosse method is relatively small, it gives a testable hypothesis of profit maximizing companies in different market structures. Its advantage is that there is no need for explicit information about the structure of the market. Only the sum of the factor price elasticities of the reduced form revenue equation (denoted by H) should be estimated with the help of revenues, and factor prices of the companies calculated from the balance sheet data. It allows to distinguish between the monopoly, monopolistic competition, and perfectly competitive market structures.

The reduced form revenue equation is the following:

where \(R(y,z)\) is the reduced form revenue function, \(y\) is the decision variable, and \(z\) are further exogenous variables which influence the revenue function. \(C(y,w,t)\) is the cost function, where \(w\) is the vector of exogenous factor prices, and \(t\) is the vector of additional exogenous variables that influence the costs.

The testable expression is the sum of the factor price elasticities of the reduced form revenue equation:

where * means the profit maximizing values.

The factor price elasticity is unique in the case of perfectly competitive companies in long-run equilibrium (H = 1). In the neoclassical monopoly model the elasticity is nonpositive (\(H\le 0\)). In this case the decision of a company does not depend on the rivals’ decisions. For a monopolistic competitor in long run equilibrium the factor price elasticity is between 0 and 1 (0 < H < 1) (Table 2).

To test the long run equilibrium empirically the Return on Assets (ROA) can be estimated with the same independent variables used in the estimation of the factor price elasticity. In long run competitive equilibrium the return rates are not correlated with the input prices so the sum of the factor price elasticities here should be zero.

Goddard and Wilson (2009) showed that the dynamic rather than a static formulation of the revenue equation should be used to identify the Panzar–Rosse H-statistic, because the fixed effect estimator of the H-statistic can be biased towards zero. We use static and dynamic panel estimations as well when the sample size makes it possible. The static approach means that the model specification does not contain autoregressive, lagged variables. The dynamic approach uses the autoregressive specification of the dependent variable as an explanatory variable. When the lagged value of the dependent variable correlates with the error term, the fixed effect model is not appropriate to solve the problem of endogeneity: the parameters could be biased in that situation. Arellano and Bond (1991) used Generalized Method of Moments (GMM) estimation in which they use first differences to eliminate the individual effects. They solve the endogeneity problem by using all the lagged values of the dependent variables as instruments. The method is also called one-step GMM panel estimation.

Another important improvement is that Bikker et al. (2012) shows that only an unscaled revenue equation gives unbiased estimation. Thus, the dependent variable of interest income should not be scaled, and the model should not contain the total asset as a control variable. In most models the level of total assets is a control variable, also in Drakos and Konstantinou (2005) and Weill (2013). Our model does not contain the level of total assets as an independent variable to avoid bias.

4 Data

In our analysis we focus on public companies. In 2020 a total of 34 bank corporations are in the market according to the supervisor’s (Hungarian National Bank) collection. During the data collection we ignore mortgage banks, savings banks, and some further banks with special focus (i.e., export–import, development). We used the data of 13 banksFootnote 1 from between 2003 and 2020, all of them operated during the whole period and there was no fusion between these companies until 2022. The loan portfolio of the 13 banks covered 85% of the bank market loan portfolio in 2020 if we do not consider the mortgage banks and saving banks. Memic (2015) used the data of 73% of the bank sector in Bosnia and Herzegovina, Kasman and Turgutlu (2008) collected the data of non-life insurance companies in Turkey that covered 80% of the market’s industry assets. Although Hosszú and Dancsik (2018) showed that the strength of the competition differs between the household and the corporate credit market, we cannot calculate the used variables separately for these two segments. Thus, we analyze the sector together.

We estimated the factor price elasticity according to a balanced panel dataset with 13 cross-section observations and 17 time periods. As a main source, the statistical report of the Hungarian National Bank (Aranykönyv) was used. To collect more details, we also used the Annual Reports (the balance sheet data, financial reports, and annual reports). With the help of collected values (Total Assets, Cash, Loans, Total deposits, Borrowings, Equity, Operating expenses, Net profit, Interest income, Interest expenses, Personal expenses, General and administrative expenses, Number of employees, Number of branches) we defined the dependent variable as the interest income (Interest Income, source: Aranykönyv). As factor prices the following variables were defined in a way that is often used in the literature as well:

-

unit price of labor (PL: personnel expenses/number of employees, source: Annual Report),

-

unit price of business services (PK: operating costs/number of branches, source: Annual Report)

-

unit price of capital (PF: interest expenses/total deposit + total credit, source: Aranykönyv).

Further control variables are the ratios:

-

number of branches to total number of branches (ratio of br),

-

loans to total assets (loans),

-

interbank deposits to total assets (interbank deposit),

-

equity to total assets (equity)

-

cash to total assets (liquidity).

The estimated equation is as follows.

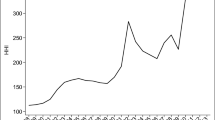

The descriptive statistics by years (minimum, maximum, mean and standard deviation) of the interest income and the input prices are in the Appendix. The mean value of the interest income increased until 2008, however, after the crisis it decreased until 2014 (see Appendix Table 7). From 2008 to 2009 the unit price of inputs decreased, which is consistent with the results of Hosszú and Dancsik (2018), the cost efficiency is better after the crisis although the interest income decreased. In Fig. 1 one can see the growing level of interest income between 2003 and 2020 of the top five banks in Hungary. The market leader is OTP Bank. The curves are similar in all cases: after the crisis of 2008 the interest income decreased in every bank, that stopped around 2013, and a new rise started after 2015.

By forming subsamples we also examine the evolution of the H statistic over time, which lead to smaller sample sizes. Olivero et al. (2011) calculated H statistics according to 3 year long subsamples in Asian and American countries to test the robustness of the result about the whole continent. In several cases the estimation was made based on fewer than 50 observations (i.e., between 1997 and 1999 the sample contains from Bolivia 27, from Paraguay 18, from Peru 28, from Singapore 21, from Thailand 41 and from Uruguay 17 banks). Also, Kasman and Turgutlu (2008) built three year long subsamples on the Turkish insurance market, the sizes of the samples are the following: 66, 77, 47.

To see the changes of the H statistic we used the following subperiods: 2003–2007, 2008–2012 and 2013–2020. Hosszú and Dancsik (2018) studied the efficiency of the Hungarian bank sector before and after the crisis with different methods, they used the following grouping: 2001–2004 balanced growth, 2005–2008 excessive credit expansion and indebtedness in foreign currencies, 2009–2012 crisis years, 2013–2016 period of recovery. Apergis (2015) studied the effect of the crisis with the H statistic of Panzar and Rosse in emerging market economies, the subsamples were 2000–2007 and 2008–2011.

5 Results

We estimated the factor price elasticity with a fixed effect and a dynamic GMM model. The dependent variable is the interest income. In the dynamic model the lagged value of the interest income is in the model as an independent variable as well. Taking the logarithm of the variables, the factor price elasticity is the sum of the estimated coefficients of the factor prices (\({\beta }_{1}+{\beta }_{2}+{\beta }_{3}\)).

Table 3 contains the estimated revenue equations and the associated H-statistics for the Hungarian banking system over the full sample in the time-period of 2003–2020. The table shows the coefficients of the significant variables. According to the AR(1) and AR(2) tests two lags are sufficient in the dynamic model. The Sargan over-identification test shows that over-identification can occur in the model because of the large number of instruments, so the results should be treated with reservations. We estimated a pooled OLS, a fixed effect, and a random effect model. According to the joint significance of differing group means test, the pooled OLS estimation is not adequate compared to the fixed effect model. According to the Hausman test the random effect estimation is not consistent, so we also decide in favor of the fixed effect model in the case of our dataset. The fixed effect model could treat the problem of unobserved effect (endogeneity) by a time-demeaned/within transformation (Wooldridge 2012).

To test the market structure, we have to test 2 parameter restrictions, which are simple linear parameter restrictions, so we implemented an F test and Chi-square test for the sum of coefficients. The estimated factor price elasticity is 0.52 in the fixed effect model and 0.15 in the dynamic model. In the case of monopoly, the elasticity is nonpositive (H0:H ≤ 0). We reject the null hypothesis in the case of the fixed effect model, and we cannot reject it in the case of the dynamic model. That means that the revenue function does not depend on the decisions of the rivals, the dynamic model suggest high market concentration. In the long run competitive equilibrium, the elasticity is unique (H0:H = 1). We reject the null hypothesis in both models, so there is no perfect competition between 2003 and 2020 in Hungary. The results of the two tests show that the bank market could be a monopolistic competition, because the factor price elasticity is between 0 and 1.

This is true if the market is in long run equilibrium. To test this assumption we estimated the equation with the same control variables, but the dependent variable is the Return on Assets (ROA). In equilibrium the dependent variable should not be correlated with the input prices. Thus, we need to test the same hypothesis, for which we cannot reject that the input price elasticity is zero (H0:E = 0), that the market is in long run equilibrium between 2003 and 2020 (Table 4).

To determine the effect of the financial crisis we build three subsamples (2003–2007, 2008–2012, 2013–2020) and estimate the market structure in the same way. Because of the lower number of observations, we used the static panel model approach, so a fixed effect model was fitted. To be able to compare the results the estimated equations contain all the control variables. The results are presented in Table 5.

We tested the hypothesis of the long run equilibrium in every subperiod, see the results in Table 6.

Before the financial crisis (2003–2007) the Hungarian bank sector’s market structure significantly differs from perfect competition (H0:H = 1). The value of H-statistic is − 0.29. The hypothesis of the monopoly market (H0:H = 0) cannot be rejected on any usual significance levels, where the companies’ decisions are not influenced by the other companies of the sector.

In the years of the crisis (2008–2012) we get similar results, we cannot reject the hypothesis of monopoly and reject the perfect competition. The H-statistic (0.23) is significantly different from one (H = 1), but not significantly differs from zero (H = 0). It has a positive value, so it also allows the case of monopolistic competition. However, the hypothesis of monopolistic competition holds only if the market is in long run equilibrium. During this time-period the market is not in long run equilibrium according to the test in Table 6.

The results of the post-crisis period (2013–2020) are not straightforward. The market is in long run equilibrium, but the factor price elasticity is 0.99. We cannot reject either of the two hypotheses.

6 Discussion

We analyze the market structure of the Hungarian bank sector. This is an important factor of the competitiveness analysis of the sector. However, measuring the competitiveness is a much more complex problem. Ábel and Polivka dealt with this question in 1997 (Ábel and Polivka 1997). They focused on the development of the sector after the regime change, the transaction costs, and the foreign-owned companies. Mester et al. (2017) mentioned that predictable taxation and the regulatory system are important features of competitiveness in the current banking system. Thus, the strong policy influences (state support for credit and extra taxation of banks) also have a great effect on the sector. The Hungarian National Bank developed two competitiveness indicators, which are based on 14 basic pillars to measure the competitiveness of the bank sector (Baksay and Horváth 2017). The indicators contain macroeconomic aspects (tax environment) as well as the profitability, so the factor price elasticity can be an important factor.

There are several structural and non-structural models to determine the market structure of a sector. Comparing the results of some of these methods could serve as a sense of robustness test. The structural approach includes the different market hypotheses, i.e., structure-conduct-performance paradigm, efficiency hypothesis and the concentration ratios: the k bank Concentration Ratio (CRk), the Herfindahl-Hirschman Index (HHI), the Hall-Tideman Index, the Rosenbluth Index, the Comprehensive Industrial Concentration Index, the Entropy measure, the Hannah and Kay Index (HKI), and the U Index (U) (Bikker and Haaf 2002b). As non-structural models, the Iwata model (1974), Bresnahan model (1982), and Panzar and Rosse model (1987) are often used. The first two methods are based on the profit maximizing problem of the oligopolies. The Panzar and Rosse model uses the comparative static properties of the reduced-form revenue approach. The Bresnahan and Iwata model is rarely applied in the case of bank market analysis (Bikker and Haaf 2002b), whereas the Panzar and Rosse method is widely used, see Table 1. It is also used in connection with other markets, for instance the Hungarian insurance market (Varga and Madari 2023). The necessary data to carry out the analysis is relatively small, it is often used with small sample size in the literature, as we presented earlier.

Nevertheless, there are also some weaknesses of this model. The different size of the firms can cause problems (Bikker et al. 2012), Shaffer and Spierdijk (2015) showed that the H statistic can be negative or positive at any level of competition, and it was also suggested that the value of the statistic could be presented as a pass-through rate not a market power measure (Sanchez-Cartas 2020). We built in the further critics about the empirical application of the Panzar and Rosse model to the analysis. According to Goddard and Wilson (2009) the dynamic panel model estimation should be used, and Bikker et al. (2012) shows that only an unscaled revenue equation gives unbiased estimation, thus the model does not contain the total asset as a control variable.

According to Andrade (2017), studying the European Union countries together between 2004 and 2011, all countries had monopolistic competition. However, the operation of the bank market, especially in the household sector, is country specific so it is worth examining the countries individually. Drakos and Konstantinou (2005) estimate H statistic between 1992 and 2000 with fixed effects estimation and total assets is used as a control variable, they calculate that the market is under monopolistic competition. According to our dynamic and unscaled estimation the hypothesis of the monopoly market in Hungary between 2003 and 2020 cannot be rejected.

It is worth noting that the effect of the crisis in the most studied countries decreased the level of H statistics, i.e., the EU15 and EU27 average (Weill 2013) and in emerging markets (Apergis 2015). But in Hungary the H value increased between 2008 and 2009 from 0.65 to 0.77 (Weill 2013). We get a similar result with panel estimation. Between 2003 and 2007 the H static was negative (− 0.29), the monopoly market hypothesis cannot be rejected. During the years of the crisis (2008–2012) the competition increased (H = 0.23) and during the recovery period (2013–2020) the H value was 0.99. The Hungarian market tends to the perfect competition in the analyzed years.

The Panzar and Rosse method focuses on the whole market, but it would be interesting to study the household and corporation credit market separately. It is a statistical estimation, thus, it can contain some bias, although suggestions for improvement have been taken into account and the observations cover a large part of the market.

7 Conclusion

We examined the effect of the financial crisis of 2008 on the market structure of the Hungarian bank sector. Between 2003 and 2020 the H-statistics increased. Before and during the years of the crisis the market was a monopoly market. The market was not in long run equilibrium so further conclusions cannot be made. Extending the results of the papers that studied similar questions in this area we estimated H-statistic with a dynamic panel estimation in the whole time-period. Based on the Panzar and Rosse methodology we tested the hypothesis of the monopoly and the perfect competition markets, and we rejected the hypothesis of the perfect competition. According to the dynamic model we cannot reject the monopoly case. This research has shown that the Hungarian bank sector is a monopolistic competition market or a monopoly in long run equilibrium between 2003 and 2020.

The results are in some sense similar to the ones gained in previous research in the area with fixed effect estimation. Contrary to the result of Apergis (2015), who shows the decrease in the level of competition in emerging markets, the value of H-statistics in Hungary is constantly increasing during the examined three time periods. The main limitation of this study was the paucity of sample size, greater efforts are needed to extend the number of observations or to carry out the investigation on a regional level. Further control variables could also improve the results, using other revenues from fees and commissions for instance. Studying the impact of digital banking trends on the market structure can be also an interesting further research question.

Notes

Bank of China, Budapest Bank, CIB Bank, Commerzbank, ERSTE Bank, Kereskedelmi és Hitelbank, Magyar Cetelem Bank, Merkantil Váltó és Vagyonbefektető Bank, MKB Bank, OTP Bank, Raiffeisen Bank, Sberbank Magyarország, UniCredit Bank.

References

Ábel I, Polivka G (1997) A versenyképességet befolyásoló tényezők a bankrendszerben,—A bankszektor és a pénzügyi közvetítés jellemzőinek hatása a vállalati versenyképesség tényezőire—alprojekt zárótanulmánya, (Factors affecting competitiveness in the banking system,—The effect of the characteristics of the banking sector and financial intermediation on the factors of corporate competitiveness) In: A „Versenyben a világgal”—A magyar gazdaság versenyképességének mikrogazdasági tényezői c. kutatási program műhelytanulmány sorozata. Sorozatszerkesztő: Chikán Attila, programigazgató Technikai szerkesztő: Koblász Mária Készült 100 példányban. Budapest, 1997. június 18

Aczél Á, Banai Á, Borsos A, Dancsik B (2016) A lakáshitelek felárát meghatározó tényezők azonosítása a magyar bankrendszerben. (Identification of the factors determining the loan premium in the Hungarian banking system.) Hitelintézeti Szemle, 15(4):5–44. o

Aktan B, Masood O (2010) The state of competition of the Turkish banking industry: an application of the Panzar-Rosse model. J Bus Econ Manag 11(1):131–145

Arellano M, Bond S (1991) Some tests of specification for panel data: monte carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Andrade S (2017) Assessing competition with the panzar-rosse model: an empirical analysis of European Union banking industry. Dissertation, GEE Papers

Apergis N (2015) Competition in the banking sector: new evidence from a panel of emerging market economies and the financial crisis. Emerg Mark Rev 25(2015):154–162

Baksay G, Hortváth G (2017) Bankrendszeri versenyképesség: mérhetővé válik az eddig mérhetetlen? (Competitiveness of the banking system: does the hitherto immeasurable become measurable?) Magyar Közgazdasági Társaság Vándorgyűlése, 2017 Eger

Bikker JA, Haaf A (2002a) Competition, concentration and their relationship: an empirical analysis of the banking industry. J Bank Finan 26(2002):2191–2214

Bikker JA, Haaf A (2002b) Measures of competition and concentration in the banking industry: a review of the literature. Econ Financ Model Summer 9:53–98

Bikker JA, Shaffer S, Spierdijk L (2012) Assessing competition with the Panzar-Rosse model: the role of scale, costs, and equilibrium. Rev Econ Stat 94(4):1025–1044

Bresnahan TF (1982) The oligopoly solution concept is identified. Econ Lett 10:87–92

Budhathoki PB, Rai CK, Rai A (2020) Assessing bank competition in Nepal using Panzar-Rosse model. J Asian Finan, Econ Bus 7(11):759–768

Cleassen S, Laeven L (2003) What Drives Bank Competition? Some International Evidence. Policy Research Working Paper 3113, The World Bank Financial Sector Operations and Policy Department 2003

Coccorese P (1998) Assessing the competitive conditions in the Italian banking system: some empirical evidence. NL Q Rev 205:172–191

De Bandt O, Davis E (2000) Competition, contestability and market structure in European banking sectors on the eve of EMU. J Bank Finan 24:1045–1066

Diwani MM (2021) How competitive is the Syrian banking sector? Empirical evidence from ‘pre/post’ war Syria. Pac Econ Rev 2022:1–43

Drakos K, Konstantinou P (2005) Competition and contestability in transition banking: an empirical analysis. South-East Europe J Econ 2:183–209

Goddard J, Wilson JOS (2009) Competition in banking: a disequilibrium approach. J Bank Finan 33(2009):2282–2292

González F (2016) Creditor rights, bank competition, and corporate investment during the global financial crisis. J Corp Finan 37(2016):249–270

Hamza RA (2011) Validation Panzar-Rosse model in determining the structural characteristics of Tunisian banking industry. J Econ Int Finan 3(5):259–268

Hosszú Z, Dancsik B (2018) Measuring bank efficiency and market power in the household and corporate credit markets considering credit risks. Acta Oeconomica 68(2):175–207

Iwata G (1974) Measurement of conjectural variations in oligopoly. Econometrica 42:947–966

Kasman A, Turgutlu E (2008) Competitive conditions in the Turkish non-life insurance industry. Rev Middle East Econ Finan 4(1):1–16

Lyons B (2009) Competition Policy, Bailouts and the Economic Crisis. Working Paper series, University of East Anglia, Centre for Competition Policy (CCP) 2009-04, Centre for Competition Policy, University of East Anglia, Norwich

Matousek R, Nguyen T, Stewart C (2016) Performance of the Banking Sector of a Developing Country: A Non-structural Model Using the Disequilibrium Approach. Economics Discussion Papers, 2

Memic D (2015) Banking competition and efficiency: empirical analysis on the Bosnia and Herzegovina using Panzar-Rosse model. Business Syst Res 6(1):72–92

Mester É, Tóth R, Kozma T (2017) Banking Competitiveness. Management, Enterprise and Benchmarking in the 21st Century, Budapest 2017

Mkrtchyan A (2005) The evolution of competition in banking in a transition economy: an application of the Panzar-Rosse model to Armenia. Eur J Comp Econ 2(1):67–82

Molnár J, Nagy M, Horváth C (2007) A structural empirical analysis of retail banking competition: the case of Hungary. MNB Working Papers, 2007/1. Magyar Nemzeti Bank

Molyneux P, Lloyd-Williams D, Thornton J (1994) Competitive conditions in European banking. J Bank Finance 18:445–459

Molyneux P, Thornton J, Michael Lloyd-Williams D (1996) Competition and market contestability in Japanese commercial banking. J Econ Bus 48:33–45

Móré Cs, Nagy M (2003) Relationship between Market Structure and Bank Performance: Empirical Evidence for Central and Eastern Europe. MNB Working Papers, 2003/12. Magyar Nemzeti Bank

Móré Cs, Nagy M (2004) Competition in the Hungarian Banking Market. MNB Working Papers, 2004/9. Magyar Nemzeti Bank

Nathan A, Neave E (1989) Competition and contestability in Canada’s financial system: empirical results. Canadian J Econ/revue Canadienne D’economique 22(3):576–594

Olivero MP, Li Y, Jeon BN (2011) Competition in banking and the lending channel: evidence from bank-level data in Asia and Latin America. J Bank Finance 35(2011):560–571

Panzar JC, Rosse JN (1987) Testing For ‘Monopoly’ equilibrium. J Ind Econ 35(4):443–456

Sanchez-Cartas JM (2020) The Panzar-Rosse H statistics and monopoly issues on its use as a market power measure. BE J Econ Anal Policy 20(4):1–11

Shaffer S (1983) Non-structural measures of competition toward a synthesis of alternatives. Econ Lett 12(1983):349–353

Shaffer S, Spierdijk L (2015) The Panzar-Rosse revenue test and market power in banking. J Banking Finance 61:340–347

Varga V, Madari Z (2023) The Hungarian insurance market structure: an empirical analysis. Central European Journal of Operations Research, Springer; Slovak Society for Operations Research; Hungarian Operational Research Society; Czech Society for Operations Research; Österr. Gesellschaft für Operations Research (ÖGOR); Slovenian Society Informatika—Section for Operational Research; Croatian Operational Research Society 31(3):927–940

Várhegyi É (2010) A válság hatása a magyarországi bankversenyre (The impact of the crisis on banking competition in Hungary). Közgazdasági Szemle, LVII 825–846

Vesala J (1995) Testing for competition in banking: behavioral evidence from Finland. Bank Finland Stud E:1

Weill L (2013) Bank competition in the EU: how has it evolved? Int Fin Markets Inst Money 26:100–112

Wooldridge JM (2012) Introductory Econometrics a modern approach 5th Edition

Acknowledgements

Supported by the ÚNKP-21-3 New National Excellence Program of the Ministry for Innovation and Technology from the source of the National Research, Development and Innovation Fund.

Funding

Open access funding provided by Corvinus University of Budapest.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The authors have no financial or proprietary interests in any material discussed in this article.

Data availability

The datasets generated and analyzed during the current study are not publicly available due the fact that they constitute an excerpt of research in progress but are available from the corresponding author on reasonable request.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Szádoczkiné Varga, V., Madari, Z. Empirical analysis of the market structure of the Hungarian bank market. Cent Eur J Oper Res (2024). https://doi.org/10.1007/s10100-024-00916-1

Accepted:

Published:

DOI: https://doi.org/10.1007/s10100-024-00916-1