Abstract

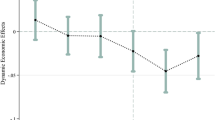

The environmental protection tax (EPT) reform is a major strategic measure to further implement green development and is the most important environmental economic policy in China. Using data from 3339 companies listed on the A-shares in China's Shanghai and Shenzhen from 2006 to 2021, this paper evaluates the policy impact of the EPT on corporate carbon emissions and its internal mechanism from the perspective of green innovation by the DID method. The results show that EPT reform effectively promotes corporate carbon emission reduction, and the conclusion remains valid after robustness tests such as the DDD and DML method. The EPT reform mainly promotes carbon emission reduction in companies with high executive compensation levels and high environmental information disclosure, and mature companies. Furthermore, the EPT reform promotes enterprises to reduce carbon emissions by forcing them to adopt strategic and endpoint green innovation, and this "forcing" effect is mainly reflected in internal incentives and external pressure.

Graphical Abstract

Similar content being viewed by others

Data availability

Data will be made available on request.

Notes

Including Hebei, Henan, Jiangsu, Shandong, Hunan, Sichuan, Chongqing, Guizhou, Hainan, Guangxi, Shanxi, and Beijing.

Including thermal power, iron and steel, cement, electrolytic aluminum, coal, metallurgy, chemical industry, petrochemical, building materials, papermaking, brewing, pharmaceutical, fermentation, textile, tanning, and mining.

Including environmental liability disclosure, environmental performance and governance disclosure; if the quantitative and qualitative combination of disclosure = 2, qualitative disclosure = 1, no disclosure = 0.

Including environmental management disclosure, environmental certification disclosure and environmental information disclosure; if disclosure = 2, no disclosure = 0.

References

Arf WB, Hikkerova L, Sahut JM (2018) External knowledge sources, green innovation and performance. Technol Forecast Soc Chang 129:210–220

Brav A, Jiang W, Ma S, Tian X (2018) How does hedge fund activism reshape corporate innovation? J Financ Econ 130(2):237–264

Cai X, Lu Y, Wu M, Yu L (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J Dev Econ 123:73–85

Chen YC, Hung M, Wang Y (2018a) The effect of mandatory CSR disclosure on firm profitability and social externalities: evidence from China. J Account Econ 65(1):169–190

Chen Z, Kahn ME, Liu Y, Wang Z (2018b) The Consequences of spatially differentiated water pollution regulation in China. J Environ Econ Manag 88:468–485

Chen Y, Yao Z, Zhong K (2022) Do environmental regulations of carbon emissions and air pollution foster green technology innovation: evidence from China's prefecture-level cities. J Clean Prod, 350.

Chernozhukov V, Chetverikov D, Demirer M, Duflo E, Hansen C, Newey W, Robins J (2018) Double/debiased machine learning for treatment and structural parameters. Economet J 21(1):C1–C68

Cui J, Dai J, Wang Z, Zhao X (2022) Does environmental regulation induce green innovation? A panel study of Chinese listed firms. Technol Forecast Soc 176:121492

Dai J, Cantor DE, Montabon FL (2015) How environmental management competitive pressure affects a focal firm's environmental innovation activities: a green supply chain perspective. J Bus Logist 36(3):242–259

Deschenes O, Greenstone M, Shapiro JS (2017) Defensive investments and the demand for air quality: evidence from the NOx budget program. Am Econ Rev 107(10):2958–2989

Du L, Lin W, Du J, Jin M, Fan M (2022) Can vertical environmental regulation induce enterprise green innovation? A new perspective from automatic air quality monitoring station in China. J Environ Manag 317:115349

Du G, Zhou C, Ma Y (2023) Impact mechanism of environmental protection tax policy on enterprises’ green technology innovation with quantity and quality from the micro-enterprise perspective. Environ Sci Pollut R, 1–19.

Fajgelbaum PD, Goldberg PK, Kennedy PJ, Khandelwal AK (2020) The return to protectionism. Q J Econ 135(1):1–55

Gao X, Liu N, Hua Y (2023) Environmental protection tax law on the synergy of pollution reduction and carbon reduction in China: evidence from a panel data of 107 cities. Sustain Prod Consump 33:425–437

Grossman GM, Helpman E (2018) Growth, trade, and inequality. Econometrica 86(1):37–83

Guo B, Wang Y, Feng Y, Liang C, Tang L, Yao X, Hu F (2022) The effects of environmental tax reform on urban air pollution: a quasi-natural experiment based on the environmental protection tax law. Front Public Health 10:967524

Hamid S, Wang K (2023) Are emerging BRICST economies greening? An empirical analysis from green innovation efficiency perspective. Clean Technol Envir, 1–18.

Han F, Li J (2020) Assessing impacts and determinants of China’s environmental protection tax on improving air quality at the provincial level based on Bayesian statistics. J Environ Manage 271:111017

Hu J, Pan X, Huang Q (2020) Quantity or quality? The impacts of environmental regulation on firms’ innovation–Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol Forecast Soc 158:120122

Hu S, Wang A, Du K (2023) Environmental tax reform and greenwashing: evidence from Chinese listed companies. Energ Econ, 106873.

Jiang L, Bai Y (2022) Strategic or substantive innovation?–The impact of institutional investors’ site visits on green innovation evidence from China. Technol Soc 68:101904

Jiang Z, Wang Z, Zeng Y (2020) Can voluntary environmental regulation promote corporate technological innovation? Bus Strateg Environ 29(2):390–406

Jiang C, Zhang F, Wu C (2021) Environmental information disclosure, political connections and innovation in high-polluting enterprises. Sci Total Environ 764:144248

Kiss AN, Barr PS (2017) New product development strategy implementation duration and new venture performance: a contingency-based perspective. J Manage 43(4):1185–1210

Kong D, Wei Y, Ji M (2021) A study on the impact of environmental protection fee to tax on corporate green information disclosure. China Secur Market Herald 08:2–14

Kong L, Wang S, Xu K (2023) The impact of environmental protection tax reform on total factor energy efficiency. Clean Technol Envir, 1–16.

Li P, Lu Y, Wang J (2016) Does flattening government improve economic performance? Evidence from China. J Dev Econ 123:18–37

Li J, Ren H, Zhang C, Li Q, Duan K (2020) Substantive innovation or strategic innovation? Research on multiplayer stochastic evolutionary game model and simulation. Complexity 2020:1–15

Li P, Lin Z, Du H, Feng T, Zuo J (2021) Do environmental taxes reduce air pollution? Evidence from fossil-fuel power plants in China. J Environ Manage 295:113112

Li X, Guo F, Xu Q, Wang S, Huang H (2023) Strategic or substantive innovation? The effect of government environmental punishment on enterprise green technology innovation. Sustain Dev 31:3365–3386

Lian G, Xu A, Zhu Y (2022) Substantive green innovation or symbolic green innovation? The impact of ER on enterprise green innovation based on the dual moderating effects. J Innov Knowl 7(3):100203

Liao Z, Chen J, Weng C, Zhu C (2023) The effects of external supervision on firm-level environmental innovation in China: are they substantive or strategic? Econ Anal Policy 80:267–277

Lin B, Zhang A (2023) Can government environmental regulation promote low-carbon development in heavy polluting industries? Evidence from China’s new environmental protection law. Environ Impact Asses 99:106991

Lin Y, Liao L, Yu C, Yang Q (2023) Re-examining the governance effect of China’s environmental protection tax. Environ Sci Pollut R 30(22):62325–62340

Liu J, Xiao Y (2022) China’s environmental protection tax and green innovation: leverage effect or crowding out effect? China Econ Res J 57(01):72–88

Liu S, Lin Z, Leng Z (2020) Do tax incentives improve the level of corporate innovation?–A test based on firm life cycle theory. China Econ Res J 55(06):105–121

Liu C, Xin L, Li J (2022a) Environmental regulation and manufacturing carbon emissions in China: a new perspective on local government competition. Environ Sci Pollut R 29(24):36351–36375

Liu G, Zhang L, Xie Z (2022c) Environmental taxes and corporate cash holdings: evidence from China. Pac-Basin Financ J 76:101888

Liu G, Yang Z, Zhang F, Zhang N (2022b) Environmental tax reform and environmental investment: a quasi-natural experiment based on China's environmental protection tax law. Energ Econ, 109.

Long F, Lin F, Ge C (2022) Impact of China’s environmental protection tax on corporate performance: empirical data from heavily polluting industries. Environ Impact Asses 97:106892

Luo Y, Mensah CN, Lu Z, Wu C (2022) Environmental regulation and green total factor productivity in China: a perspective of Porter’s and Compliance hypothesis. Ecol Indic 145:109744

Nazir R, Gillani S, Shafiq MN (2023) Realizing the direct and indirect impact of environmental regulations on pollution: a path analysis approach to explore the mediating role of green innovation in G7 economies. Environ Sci Pollut R 30(15):44795–44818

Nie C, Zhong Z, Feng Y (2023) Can digital infrastructure induce urban green innovation? New insights from China. Clean Technol Envir, 1–18.

Pei Y, Zhu Y, Liu S, Wang X, Cao J (2019) Environmental regulation and carbon emission: the mediation effect of technical efficiency. J Clean Prod 236:117599

Qi S, Lin S, Cui J (2018) Can the environmental equity trading market induce green innovation?–Evidence based on green patent data of listed companies in China. China Econ Res J 53(12):129–143

Shang S, Chen Z, Shen Z, Shabbir MS, Bokhari A, Han N, Klemes JJ (2022) The effect of cleaner and sustainable sewage fee-to-tax on business innovation. J Clean Prod,361.

Shao S, Hu Z, Cao J, Yang L, Guan D (2020) Environmental regulation and enterprise innovation: a review. Bus Strateg Environ 29(3):1465–1478

Sinn HW (2008) Public policies against global warming: a supply side approach. Int Tax Public Finan 15(4):360–394

Song M, Peng L, Shang Y, Zhao X (2022) Green technology progress and total factor productivity of resource-based enterprises: a perspective of technical compensation of environmental regulation. Technol Forecast Soc, 174.

Vorst P, Yohn TL (2018) Life cycle models and forecasting growth and profitability. Account Rev 93(6):357–381

Wang Z, Chu E (2023) Can creating information infrastructure achieve “emission reduction” and “efficiency enhancement” simultaneously? Based on the perspective of green technology innovation. Modern Finan Econs-J Tianjin Univ Finac Econ 43(10):74–89

Wang Q, Qu J, Wang B, Wang P, Yang T (2019) Green technology innovation development in China in 1990–2015. Sci Total Environ 696:134008

Wang H, Liu J, Zhang L (2022) Carbon emissions and asset pricing—Evidence from China’s listed companies. China J Econom 9(02):28–75

Wang Y, Xu S, Meng X (2023) Environmental protection tax and green innovation. Environ Sci Pollut R 30(19):56670–56686

Wang H, Wei W (2019) Coordinating technological progress and environmental regulation in CO2 mitigation: the optimal levels for OECD countries emerging economies. Energ Econ, 104510.

Wu S, Qu Y, Huang H, Xia Y (2023) Carbon emission trading policy and corporate green innovation: internal incentives or external influences. Environ Sci Pollut R 30(11):31501–31523

Xie L, Zuo S, Xie Z (2023) Environmental protection fee-to-tax and enterprise investment efficiency: evidence from China. Res Int Bus Financ 66:102057

Xu A, Wang W, Zhu Y (2023a) Does smart city pilot policy reduce CO2 emissions from industrial firms? Insights from China J Innov Knowl 8(3):100367

Xu H, Pan X, Li J, Feng S, Guo S (2023b) Comparing the impacts of carbon tax and carbon emission trading, which regulation is more effective? J Environ Manage 330:117156

Xu Y, Wen Sh, Chang-Qi T (2023c) Impact of environmental tax on pollution control: a sustainable development perspective. Econ Anal Policy 9:89–106

Zhang G, Qiu S, Zhang W (2018) Does strengthening environmental regulations affect corporate RD innovation: an empirical analysis based on the implementation of the new environmental protection law of PRC. J Guangdong Univ Fin Econ 33(06):8088–8101

Zhang G, Tong M, Li H, Chen F (2019) Evaluation of economic growth effect and policy effectiveness in pilot poverty alleviation reform zone. China Ind Econ 8:136–154

Zhang M, Yan T, Gao W, Xie W, Yu Z (2023) How does environmental regulation affect real green technology innovation and strategic green technology innovation? Sci Total Environ 872:162221

Zhu L, Hao Y, Lu ZN, Wu H, Ran Q (2019) Do economic activities cause air pollution? Evidence from China’s major cities. Sustain Cities Soc 49:101593

Zou Z, Xin P, Chao Y, Zhu X (2019) Research on the influence of executive green cognition and corporate green behavior on its green performance—based on data of Shandong Light Industry Enterprises. East China Econ Manag 33(12):35–41

Funding

This study is funded by Key Project of Jiangsu Province Social Science Applied Research Excellence Program (Grant No. 23SYA-001); Key Research Project of Jiangsu Province in the "14th Five-Year Plan" for Education Science (Grant No. B/2022/01/102); University Philosophy, Social Science Research Fund project of Jiangsu Province (Grant No. 2019SJA0857).

Author information

Authors and Affiliations

Contributions

Rongrong Wei was involved in conceptualization, methodology, software, formal analysis, investigation, and writing—original draft, review, and editing. Meiling Wang was responsible for conceptualization, supervision, and validation. Yueming Xia carried out data curation, visualization, and reviewing.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wei, R., Wang, M. & Xia, Y. Environmental protection tax and corporate carbon emissions in China: a perspective of green innovation. Clean Techn Environ Policy (2024). https://doi.org/10.1007/s10098-024-02754-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10098-024-02754-w