Abstract

Malaysia, as one of the top energy subsidizing countries, has announced to remove energy subsidies necessarily, not only to reduce energy consumption and the government budget deficit but also to improve overall efficiency and air quality. Therefore, this study evaluates the impacts of rationalizing energy subsidy and its energy efficiency improvement during 2010–2030 using a dynamic recursive computable general equilibrium model. Results revealed that reducing energy subsidies decreases energy consumption and emissions of all air pollutants. While the economic performance of the country improves in the long run due to stimulation in capital demand and investment, it reduces in the short run. Energy efficiency also improves by 1.1% and 2.3%, in the short run, in response to a reduction of 10% and 100% in energy subsidies, respectively. Energy efficiency improvements decrease the negative effects of pure subsidy policies on real GDP, trade, investment, and household consumption. The efficiency improvement policies also are effective in reducing more level of the rebound effect and lead to more energy saving in the economy, particularly in the petroleum products sector. The impacts on the rebound effect also differ across economic sectors. The results of this study provide new insights for energy subsidy policy and energy efficiency and suggest that additional tools and policies are required for improving the energy efficiency caused by phasing out energy subsidies.

Graphic abstract

Malaysia, as one of the top energy subsidized countries, attempts to reduce the level of energy subsidies over time and, consequently, decline the use of fossil fuels in the economy. Therefore, this study analyzes the impacts of different subsidy reform policy on energy efficiency and, consequently, on economic and environmental performance and rebound effect of Malaysia by a recursive dynamic computable general equilibrium model.

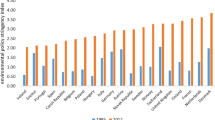

Adopted from Solaymani and Kari (2014)

Similar content being viewed by others

Notes

Constant Elasticity of Transformation (CET).

References

Acharya RH, Sadath AC (2017) Implications of energy subsidy reform in India. Energy Policy 102:453–462

Akinyemi O, Alege PO, Ajayi PO, Okodua H (2017) Energy pricing policy and environmental quality in Nigeria: a dynamic computable general equilibrium approach. Int J Energy Econ Policy 7(1):268–276

AlShehabi OH (2012) Energy and labour reform: evidence from Iran. J Policy Model 34(3):441–459

Asian Development Bank (2015) Fossil fuel subsidies in Indonesia: trends, impacts, and reforms. Asian Development Bank, Mandaluyong City. https://www.adb.org/sites/default/files/publication/175444/fossil-fuel-subsidies-indonesia.pdf

Avagyan AB (2018) Algae to energy and sustainable development. Technologies, resources, economics and system analyses. New design of global environmental policy and live conserve industry. Amazon, ISBN-13: 978-1718722552, ISBN-10: 1718722559

Avagyan AB, Singh B (2019) Biodiesel: feedstocks, technologies, economics and barriers assessment of environmental impact in producing and using chains. ISBN: 978-981-13-5746-6

Barkhordar ZA, Samaneh F, Siamak S (2018) The role of energy subsidy reform in energy efficiency enhancement: lessons learnt and future potential for Iranian industries. J Clean Prod 197(1):542–550

Bye B, Fæhn T, Rosnes O (2018) Residential energy efficiency policies: costs, emissions and rebound effects. Energy 143:191–201

Clements B, Jung H-S, Gupta S (2007) Real and distributive effects of petroleum price liberalization: the case of Indonesia. Dev Econ 45(2):220–237

Coady D, Parry I, Le N-P, Shang B (2019) Global fossil fuel subsidies remain large: an update based on country-level estimates. IMF working paper WP/19/89.

Cockburn J, Robichaud V, Tiberti L (2018) Energy subsidy reform and poverty in Arab countries: a comparative CGE-microsimulation analysis of Egypt and Jordan. Rev Income Wealth 64(S1):S248–S273

Feng K, Klaus H, Yu L, Estefanía M, Adrien V-S (2018) Managing the distributional effects of energy taxes and subsidy removal in Latin America and the Caribbean. Appl Energy 225:424–436

Glomm G, Jung J (2015) A macroeconomic analysis of energy subsidies in a small open economy. Econ Inq 53(4):1783–1806

Hanley ND, McGregor PG, Swales JK, Turner K (2006) The impact of a stimulus to energy efficiency on the economy and the environment: a regional computable general equilibrium analysis. Renew Energy 31:161–171

He YX, Liu YY, Du M, Zhang JX, Pang YX (2015) Comprehensive optimisation of China’s energy prices, taxes and subsidy policies based on the dynamic computable general equilibrium model. Energy Convers Manag 98:518–532

International Energy Agency (IEA) (2012) World energy outlook: impact of high oil prices on the economy. p 5. http://www.iea.org/media/impact_of_high_oil_prices.pdf

Khalid SA, Salman V (2020) Welfare impact of electricity subsidyreforms in Pakistan: a micro model study. Energy Policy 137:111097

Li K, Jiang Z (2016) The impacts of removing energy subsidies on economy-wide rebound effects in China: an input-output analysis. Energy Policy 98:62–72

Li K, Lin B (2015) How does administrative pricing affect energy consumption and CO2 emissions in China? Renew Sustain Energy Rev 42:952–962

Li H, Bao Q, Ren X, Xie Y, Ren J, Yang Y (2017a) Reducing rebound effect through fossil subsidies reform: a comprehensive evaluation in China. J Clean Prod 141:305–314

Li Y, Xunpeng S, Bin S (2017b) Economic, social and environmental impacts of fuel subsidies: a revisit of Malaysia. Energy Policy 110:51–61

Li F, Xie J, Wang W (2019) Incentivizing sustainable development: the impact of a recent policy reform on electricity production efficiency in China. Sustain Dev 27(4):70–780

Lin B, Liu X (2013) Electricity tariff reform and rebound effect of residential electricity consumption in China. Energy 59:240–247

Lockwood M (2015) Fossil fuel subsidy reform, rent management and political fragmentation in developing countries. New Polit Econ 20(4):475–494

Magné B, Jean C, Rob D (2014) Global implications of joint fossil fuel subsidy reform and nuclear phase-out: an economic analysis. Clim Change 123(3–4):677–690

Mahinizadeh M, Feizpour MA, Abedi M (2017) Analysis of electricity efficiency in Iranian manufacturing industries with regard to subsidies reform. J Iran Energy Econ 6(22):165–203

Manzoor D, Shahmoradi A, Haqiqi I (2012) An analysis of energy price reform: a CGE approach. OPEC Energy Rev 36(1):35–54

Martínez-Moya J, Vazquez-Paja B, Jose AGM (2019) Energy efficiency and CO2 emissions of port container terminal equipment: evidence from the Port of Valencia. Energy Policy 131:312–319

Mills E (2017) Global kerosene subsidies: an obstacle to energy efficiency and development. World Dev 99:463–480

Ministry of Economic Affairs Malaysia (2019) Socioeconomic Statistics. Ministry of Economic Affairs Malaysia, Putrjaya, Malaysia

Oh TH, Md H, Jeyraj S, Siew CT, Shing CC (2018) Energy policy and alternative energy in Malaysia: issues and challenges for sustainable growth—an update. Renew Sustain Energy Rev 81(2):3021–3031

Oktaviani R, Hakim DB, Sahara D, Siregar H (2007) Impact of a lower oil subsidy on Indonesian macroeconomic performance, agricultural sector and poverty incidences: a recursive dynamic computable general equilibrium analysis (December 2007). MPIA working paper no. 2007-28. https://doi.org/10.2139/ssrn.1086380

Qin Q, Li X, Li L, Wei Z, Yi-Ming W (2017) Air emissions perspective on energy efficiency: an empirical analysis of China’s coastal areas. Appl Energy 185(1):604–614

Roos EL, Adams PD (2020) The economy-wide impact of subsidy reform: a CGE analysis 19(S1):s18–s38

Sarrakh R, Suresh R, Subashini S, Sabah M (2020) Impact of subsidyreform on the kingdom of Saudi Arabia’s economy and carbon emissions. Energy Strategy Rev 28:100465

Schaffitzel F, Jakob B, Soria R, Vogt-Schilb A, Ward H (2019) Can government transfers make energy subsidy reform socially acceptable? A case study on Ecuador. Inter-American Development Bank (IDB), working paper series, 1026

Solaymani S (2016) Impacts of energy subsidy reform on poverty and income inequality in Malaysia. Qual Quant 50(6):2707–2723

Solaymani S (2020) Energy subsidy reform evaluation research-review in Iran. Science and Technology, Greenhouse Gases. (Forthcoming)

Solaymani S, Kari F (2013) Environmental and economic effects of high petroleum prices on transport sector. Energy 60:435–441

Solaymani S, Kari F (2014) Impacts of energy subsidy reform on the Malaysian economy and transportation sector. Energy Policy 70:115–125

Solaymani S, Kari F, Hazly Zakaria R (2014) Evaluating the role of subsidy reform in addressing poverty levels in Malaysia: a CGE poverty framework. J Dev Stud 50(4):556–569

Solaymani S, Kardooni R, Kari F, Yusoff SB (2015a) Economic and environmental impacts of energy subsidy reform and oil price shock on the Malaysian transport sector. Travel Behav Soc 2(2):65–77

Solaymani S, Najafi SMB, Kari F, Satar NBM (2015b) Aggregate and regional demand for electricity in Malaysia. J Energy South Afr 26(1):46–54

Sovacool BK (2017) Reviewing, reforming, and rethinking global energy subsidies: towards a political economy research agenda. Ecol Econ 135:150–163

Timilsina GR, Pargal S (2020) Economics of energysubsidyreforms in Bangladesh. Energy Policy 142:111539

Wang X, Lin B (2017) Impacts of residential electricity subsidy reform in China. Energy Eff 10(2):499–511

Wei T, Liu Y (2017) Estimation of global rebound effect caused by energy efficiency improvement. Energy Econ 66:27–34

Whitley S, van der Burg L (2015) Fossil fuel subsidy reform: from rhetoric to reality. New Climate Economy, London and Washington, DC. http://newclimateeconomy.report/misc/working-papers

Ying LS, Harun M (2019) The impact of removing fuel subsidies on domestic outputs in Malaysia. Int J Acad Res Bus Soc Sci 9(3):641–653

Yusma N, Bekhet HA (2016) Impacts of energy subsidy reforms on the industrial energy structures in the Malaysian economy: a computable general equilibrium approach. Int J Energy Econ Policy 6(1):88–97

Acknowledgement

Authors confirm that there is no any funding from any organizations for our research.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: Model specification

Appendix A: Model specification

Sets | ||

|---|---|---|

i | Sectors | (1,2, …, 25) |

f | Factors of production | (Labor, capital and energy) |

h | Households | (Rural and urban) |

br | Lending institutions | (Domestic, Foreign) |

ie(i) | Export sectors | |

ien(i) | Non-export sectors | |

TP | Simulation experiments | (SAM2010, 2010 * 2030) |

TFUT(TP) | Future Time Periods | (2010 * 2030) |

T(TP) | Current experiment | |

P | Pollutants | (PM, SO2, NOx, CO, CH4,N2O,CO2) |

E1(i) | Energy sectors | /ngs, col, mot, dis, ful, lpg, opt, ele/ |

FL(i) | Fuels sectors | /ngs, col, mot, dis, ful, opt, lpg/ |

EL(i) | Electricity sector | /eLe/ |

NEL(i) | Nonelectricity sectors | /ngs, col, mot, dis, ful, lpg, opt/ |

NG(I) | Natural | Gas/NGS/ |

PT(I) | Petroleum products | /mot, dis, ful, opt, lpg/ |

E2(i) | Non-energy sectors | /pad, fod, veg, fru, rub, pal, liv, frs, fis, oag, min, fdp, tex, ind, trn, fin, svc/Alias (i,j) |

Lc(f) | Labor and capital | |

Alias | (E1,E1P) | |

Alias | (E2,E2P),(NG,NGP) | |

Alias | (F,FP),(FL,FLP) |

Equations

Price block equations | ||

|---|---|---|

(1) | \({\text{PM}}_{i} = {\text{PWM}_{i}} . \, \left( {1 + {\text{tm}}_{i} } \right).{\text{EXR}}\) | Domestic prices of import goods |

(2) | \({\text{PE}}_{i} = {\text{PWE}}_{i} . \, \left( {1 - {\text{te}}_{i} } \right).{\text{EXR}}\) | Domestic prices of export goods |

(3) | \({\text{PQ}}_{i} = \left( {{\text{PD}}_{i} .D_{i} + {\text{ PM}}_{i} .M_{i} } \right)/Q_{i}\) | Average price of composite goods Q |

(4) | \({\text{PX}}_{i} = \left( {{\text{PD}}_{i} .D_{i} + {\text{ PE}}_{i} .E_{i} } \right)/X_{i}\) | Average price of sectoral output X |

(5) | \({\text{PV}}_{i} = \frac{{\left[ {{\text{PX}}_{i} .X_{i} .(1 - ({\text{tx}}_{i} - {\text{subsh}}_{i} )) - \sum\limits_{j} {{\text{io}}_{ji} .X_{i} .} {\text{PQ}}_{i} } \right]}}{{{\text{KL}}_{i} }}\) | Value added price equation included subsidies |

(6) | \({\text{PEKL}}_{i} = \left( {{\text{PEN}}_{i} .{\text{EN}}_{i} + {\text{PV}}_{i} .{\text{KL}}_{i} } \right)/{\text{EKL}}_{i}\) | Price of factor of production (labor, capital and energy) |

(6) | x \({\text{PEN}}_{i} = \left( {{\text{PELEC}}_{i} .{\text{ELEC}}_{i} + {\text{PFUL}}_{i} .{\text{FUL}}_{i} } \right)/{\text{EN}}_{i}\) | Price of energy |

(8) | \({\text{PNEN}}_{i} = \sum\limits_{e2p} {{\text{ane}}_{e2p,i} .{\text{PQ}}_{e2p} }\) | Price of non-energy commodities |

(9) | PELECi = PQele | Price of Electricity |

(10) | \({\text{PK}}_{i} = \mathop \sum \limits_{j} {\text{ccmat}}_{ji} .{\text{PQ}}_{j}\) | Capital prices equation |

(11) | \({\text{PINDEX}} = \mathop \sum \limits_{j} {\text{wtq}}_{i} .{\text{PQ}}_{i}\) | Consumer price index |

(12) | \({\text{PINDOM}} = \mathop \sum \limits_{j} {\text{wtd}}_{i} .{\text{PD}}_{i}\) | Domestic price index |

Production and trade block equations

(13) | \(X_{i} = {\text{tech}}_{i} .\alpha_{i}^{x} .{\text{EN}}_{i}^{{\alpha_{i}^{x} }} .{\text{KL}}_{i}^{{(1 - \alpha_{i}^{x} )}}\) | Domestic production function |

(14) | \({\text{tech}}_{i} .{\text{PEKL}}_{i} .{\text{EN}}_{i} = X_{i} .{\text{PV}}_{i} .\alpha_{i}^{x}\) | Value added function |

(15) | \({\text{NEN}}_{i} = {\text{amt}}_{i} .X_{i}\) | Non-energy function |

(16) | \({\text{EN}}_{i} = \alpha_{i}^{{{\text{en}}}} .\left[ {\beta_{i}^{{{\text{en}}}} .{\text{FUL}}_{i}^{{{ - \rho_{i}{{\text{en}}}} }} + (1 - \beta_{i}^{{{\text{en}}}} ).{\text{ELEC}}_{i}^{{{ - \rho_{i}{{\text{en}}}} }} } \right]^{{ - \tfrac{1}{{\rho_{i}^{{{\text{en}}}} }}}}\) | CES energy function |

(17) | \(\frac{{{\text{FUL}}_{i} }}{{{\text{ELEC}}_{i} }} = \left( {\frac{{{\text{PELEC}}_{i} }}{{{\text{PFUL}}_{i} }}.\frac{{\beta_{i}^{{{\text{en}}}} }}{{(1 - \beta_{i}^{{{\text{en}}}} )_{i} }}} \right)^{{\tfrac{1}{{1 + \beta_{i}^{{{\text{en}}}} }}}}\) | F.O.C. of Energy Function |

(18) | \({\text{ELEC}}_{i} = \sum\limits_{{{\text{elp}}}} {{\text{io}}_{{{\text{elp}},i}} } .X_{i}\) | Electricity function |

(19) | \({\text{FUL}}_{i} = \alpha_{i}^{{{\text{fl}}}} .\left[ {\beta_{i}^{{{\text{fl}}}} .{\text{PETROL}}_{i}^{{{ - \rho_{i}{{\text{fl}}}} }} + (1 - \beta_{i}^{{{\text{fp}}}} ).{\text{COALNGS}}_{i}^{{{ - \rho_{i}{{\text{fl}}}} }} } \right]^{{ - \tfrac{1}{{\rho_{i}^{{{\text{fl}}}} }}}}\) | CES Fuels function |

(20) | \(\frac{{{\text{PETROLD}}_{i} }}{{{\text{COALNGAS}}_{i} }} = \left( {\frac{{{\text{PCOLNGS}}_{i} }}{{{\text{PPETROL}}_{i} }}.\frac{{\beta_{i}^{{{\text{fl}}}} }}{{(1 - \beta_{i}^{{{\text{fl}}}} )_{i} }}} \right)^{{\tfrac{1}{{1 + \beta_{i}^{{{\text{fl}}}} }}}}\) | F.O.C. of Fuels Function |

(21) | \({\text{PETROLD}}_{j} = \alpha_{j}^{{{\text{pt}}}} \prod\limits_{pt} {({\text{PETROL}}_{{{\text{pt}},j}} )^{{\beta_{{{\text{pt}},j}} }} }\) | Cobb–Douglas Petroleum products function |

(22) | \({\text{PETROL}}_{{{\text{pt}},j}} = \,\,\frac{{\beta_{{{\text{pt}},j}} .{\text{PPETROL}}_{j} .{\text{PETROLD}}_{j} }}{{{\text{PQ}}_{j} }}\) | F.O.C. of Petroleum products function |

(23) | \({\text{COALNGS}}_{i} = \alpha_{i}^{{{\text{cong}}}} .\left[ {\beta_{i}^{{{\text{cong}}}} .{\text{COAL}}_{i}^{{{ - \rho_{i}{{\text{cong}}}} }} + (1 - \beta_{i}^{{{\text{cong}}}} ).{\text{NGASD}}_{i}^{{{ - \rho_{i}{{\text{cong}}}} }} } \right]^{{ - \tfrac{1}{{\rho_{i}^{{{\text{cong}}}} }}}}\) | CES Coal and natural gas aggregate function |

(24) | \(\frac{{{\text{COAL}}_{i} }}{{{\text{NGASD}}_{i} }} = \left( {\frac{{{\text{PNGAS}}_{i} }}{{{\text{PCOAL}}_{i} }}.\frac{{\beta_{i}^{{{\text{cong}}}} }}{{(1 - \beta_{i}^{{{\text{cong}}}} )_{i} }}} \right)^{{\tfrac{1}{{1 + \beta_{i}^{{{\text{cong}}}} }}}}\) | F.O.C. of Coal and natural gas aggregate function |

(25) | NGASDi = iongs,i.Xi | Natural gas function |

(26) | COALi = iocol,i.Xi | Coal function |

(27) | \({\text{KL}}_{i} = \alpha_{i}^{{{\text{kl}}}} .\left[ {\sum\limits_{{{\text{lc}}}} {\beta_{{i,{\text{lc}}}}^{{{\text{kl}}}} .({\text{LCSC}}_{{i,{\text{lc}}}} )^{{{ - \rho_{i}{{\text{kl}}}} }} } } \right]^{{\tfrac{ - 1}{{\rho_{i}^{{{\text{kl}}}} }}}}\) | labor and capital function |

(28) | \(\frac{{{\text{LCSC}}_{{i,{\text{lc}}}} }}{{{\text{KL}}_{i} }} = \left( {\frac{{\beta_{{i,{\text{lc}}}}^{{{\text{kl}}}} .{\text{PV}}_{i} }}{{(\alpha_{i}^{{{\text{kl}}}} )^{{{\rho_{i}{{\text{kl}}}} }} .{\text{PKL}}_{i} .{\text{PKLSEC}}_{{i,{\text{lc}}}} }}} \right)^{{\tfrac{1}{{1 + \rho_{i}^{{{\text{kl}}}} }}}}\) | Labor and capital’ demand function |

(29) | \(X_{{{\text{ie}}}} = \propto_{{{\text{ie}}}}^{t} .\left[ {\beta_{{{\text{ie}}}}^{t} .E_{{{\text{ie}}}}^{{\rho_{{{\text{ie}}}}^{t} }} + \left( {1 - \beta_{{{\text{ie}}}}^{t} } \right).D_{{{\text{ie}}}}^{{\rho_{{{\text{ie}}}}^{t} }} } \right]^{{\frac{1}{{\rho_{{{\text{ie}}}}^{t} }}}} , \ldots X_{{{\text{ien}}}} = \, D_{{{\text{ien}}}}\) | Producers’ transformation choice between domestic and export sales |

(30) | \(E_{{{\text{ie}}}} = D_{{{\text{ie}}}} .\left[ {\frac{{{\text{PE}}_{{{\text{ie}}}} }}{{{\text{PD}}_{{{\text{ie}}}} }}.\frac{{(1 - \propto_{{{\text{ie}}}}^{t} )}}{{ \propto_{{{\text{ie}}}}^{t} }}} \right]^{{\frac{1}{{( \propto_{{{\text{ie}}}}^{t} - 1)}}}} \quad {\text{or}}\quad E_{{{\text{ied}}}} = \gamma_{{{\text{ied}}}} .\left[ {\frac{{{\text{PWE}}_{{{\text{ied}}}} }}{{{\text{PWSe}}_{{{\text{ied}}}} }}} \right]^{{ - \rho_{{{\text{ied}}}} }}\) or | First-order condition of the CET function = Export demand |

(31) | \(Q_{{{\text{im}}}} = \propto_{{{\text{im}}}}^{c} .\left[ {\beta_{{{\text{im}}}}^{c} .M_{{{\text{im}}}}^{{ - \rho_{{{\text{im}}}}^{c} }} + (1 - \beta_{{{\text{im}}}}^{c} ).D_{{{\text{im}}}}^{{\rho_{{{\text{im}}}}^{c} }} } \right]^{{ - \frac{1}{{\rho_{{{\text{im}}}}^{c} }}}}\) | Armington (CES) function |

(32) | \(M_{{{\text{im}}}} = D_{{{\text{im}}}} .\left[ {\frac{{{\text{PD}}_{{{\text{im}}}} }}{{{\text{PM}}_{{{\text{im}}}} }}.\frac{{\beta_{{{\text{im}}}}^{c} }}{{(1 - \beta_{{{\text{im}}}}^{c} )}}} \right]^{{\frac{1}{{(1 + \rho_{{{\text{im}}}}^{c} )}}}}\) | First-order condition of the CET function |

Income and saving block equations

(33) | \({\text{YF}}_{f} = \mathop \sum \limits_{i} {\text{WF}}_{f} .{\text{FDSC}}_{if} .{\text{wfdist}}_{if}\) | Factors income |

(34) | \({\text{YCOMP}} = {\text{YF}}_{{{\text{capi}}}} {-}{\text{EXR.REPAT}} + {\text{INTERS}}_{{{\text{comp}}}}\) | Companies income |

(35) | \(\begin{aligned} {\text{YH}} _{h} & = \mathop \sum \limits_{f} {\text{hhdis}}_{hf} .{\text{YF}}_{f} + {\text{ gtrn}}_{h} .{\text{ GOVTRN}} + {\text{ctrn}}_{h} .{\text{ YCOMP}}. \\ & \quad \left( {1 - {\text{ctax}}} \right).\left( {1 - {\text{csav}}} \right) + {\text{sfin}}_{h} .{\text{FACTIN.EXR}} \\ \end{aligned}\) | Households income |

(36) | \({\text{TARIFF}} = \mathop \sum \limits_{i} {\text{pwm}}_{i} .{\text{M}}_{i} .{\text{tm}}_{i} .{\text{ EXR}}\) | Tariffs |

(37) | \({\text{INTAX}} = \mathop \sum \limits_{i} {\text{PX}}_{i} .{\text{X}}_{i} .{\text{tx}}_{i}\) | Indirect taxes |

(38) | \({\text{HHTAX}} = \mathop \sum \limits_{{\text{h}}} {\text{YH}}_{{\text{h}}} .\tau_{{\text{h}}}^{{\text{h}}}\) | Household income taxes |

(39) | \({\text{ COMTAX }} = {\text{ctax }}.{\text{YCOMP}}\) | Company taxes |

(40) | \({\text{EXPTAX}} = \mathop \sum \limits_{{{\text{ie}}}} {\text{pwe}}_{{{\text{ie}}}} .{\text{E}}_{{{\text{ie}}}} .(1 - te_{{{\text{ie}}}} ).{\text{EXR}}\) | Export taxes |

(41) | \({\text{GR}} = {\text{TARIFF}} + {\text{INDTAX}} + {\text{HHTAX}} + {\text{EXPTAX}} + {\text{COMTAX}}\) | Government revenues |

(42) | \({\text{HHSAV}} = \mathop \sum \limits_{{\text{h}}} {\text{YH}}_{{\text{h}}} .(1 - {\text{th}}_{{\text{h}}} ).{\text{mps}}_{{\text{h}}}\) | Household savings |

(43) | \({\text{COMSAV}} = {\text{YCOMP}}.\left( {1 - {\text{ctax}}} \right).{\text{csav}}\) | Company savings |

(44) | \({\text{SAVING}} = {\text{HHSAV}} + {\text{GOVSAV}} + {\text{COMSAV}} - {\text{CURACT}}{\text{. EXR}}\) | Total savings |

(45) | \({\text{TSUB}} = \sum\limits_{i} {{\text{SUB}}_{i} }\) |

Expenditure block equations

(46) | \({\text{ THCON}}_{{\text{h}}} = \mathop \sum \limits_{i} \left[ {{\text{hhclesi}}_{{i,{\text{h}}}} .{\text{YH}}_{{\text{h}}} .\left( {1 - {\text{mps}}_{{\text{h}}} } \right).\left( {1 - \tau_{h} } \right)} \right]\) | Total household consumption |

(47) | \({\text{HDM}}_{{{\text{h}},i}} \, = \, \frac{{C\_\min_{{{\text{h}},i}} .{\text{PQ}}_{i} + \, \gamma_{{{\text{h}},i}} .\left[ {{\text{THCON}}_{{\text{h}}} - \sum\limits_{i} {C\_\min_{{{\text{h}},i}} } .{\text{PQ}}_{i} } \right]}}{{{\text{PQ}}_{i} }}\) | Demand for commodities by households |

(48) | \({\text{GD}}_{i} = {\text{ggs}}_{i} .{\text{GOVCON}}\) | Government demand |

(49) | \({\text{STK}}_{i} = {\text{inv}}_{i} . \, X_{i}\) | Demand for new inventories |

(50) | \({\text{FXDINV}} = {\text{INVEST}} - \mathop \sum \limits_{i} {\text{PQ}}_{i} .{\text{STK}}_{i}\) | Total nominal fixed investment |

(51) | \({\text{DK}}_{i} = \frac{{{\text{zz}}_{i} .{\text{FXDINV}}}}{{\mathop \sum \nolimits_{j} {\text{ccmat}}_{ji} .{\text{PQ}}_{j} }}\) | Investment allocation |

(52) | \({\text{ID}}_{i} = \mathop \sum \limits_{j} {\text{ccmat}}_{ij} .{\text{DK}}_{j}\) | Demand for investment goods |

(53) | \({\text{GDPVA}} = \mathop \sum \limits_{i} {\text{PV}}_{i} .V_{i} + {\text{INDTAX}} + {\text{TARIFF}} + {\text{EXPTAX - TSUB}}\) | Nominal GDP |

(54) | \({\text{REGDP}} = \mathop \sum \limits_{i} \left( {{\text{THCON}}_{i} + {\text{GD}}_{i} + {\text{ID}}_{i} + {\text{STK}}_{i} + \mathop \sum \limits_{{{\text{ie}}}} E_{{{\text{ie}}}} - \mathop \sum \limits_{{{\text{im}}}} (1 - {\text{tmreal}}_{{{\text{im}}}} ).M_{{{\text{im}}}} } \right)\) | Real GDP |

(55) | \(Z_{h} = \, \sum\limits_{j} {C\_{\text{MIN}}_{hj} } .{\text{PQ}}_{j}\) | Poverty line |

Constraints block equations

(56) | \(Q_{i} = {\text{INTM}}_{i} + {\text{THCON}}_{i} + {\text{GD}}_{i} + {\text{ID}}_{i} + {\text{STK}}_{i }\) | Product market equilibrium |

(57) | \(\mathop \sum \limits_{i} {\text{FDSC}}_{if} = {\text{FS}}_{f}\) | Factor market equilibrium |

(58) | \({\text{CURACT}} = \mathop \sum \limits_{{{\text{im}}}} {\text{pwm}}_{{{\text{im}}}} .M_{{{\text{im}}}} .{\text{EXR}} + \mathop \sum \limits_{{{\text{ie}}}} {\text{PWE}}_{{{\text{ie}}}} .(1 - {\text{te}}_{{{\text{ie}}}} ).E_{{{\text{ie}}}} .{\text{EXR}}\) | Market-clearing in the foreign exchange market |

(59) | \({\text{GOVSAV}} = {\text{GR}} - \mathop \sum \limits_{i} {\text{PQ}}_{i} .{\text{GD}}_{i} - {\text{EXR}}{\text{.INTERS}}_{{{\text{br}}}} - {\text{INTERS}}_{{{\text{comp}}}} - {\text{GOVTRN}} - {\text{TSUB}}\) | Government budget balance |

(60) | \({\text{SAVING}} = {\text{INVEST}}\) | Saving and investment balance |

Air pollutant function

(61) | CO2fl,p = EMISSIONfl,p.FULfl |

Dynamic section of the model

(62) | \({\text{FS}}_{f} = {\text{FS}}_{f} + \sum\limits_{i} {{\text{ID}}_{i} } .{\text{fr}}\_{\text{inv}}\) | Here f = capital |

(63) | \({\text{FS}}_{f} = {\text{FS}}_{f} .(1 + G)\) | Here f = labor and G (population growth rate) = 2% |

(64) | CURACT = CURACT. (1 + G) | G = 2% |

List of variables and their definition

Variables | Definition | Variables | Definition |

|---|---|---|---|

EXR | Exchange rate | \({\text{PKLSEC}}_{{i,{\text{lc}}}}\) | Factor price sectoral proportionality ratios |

PDi | Domestic prices | YFi | Factor income |

PEi | Domestic price of exports | THCONi | Final demand for private consumption |

PINDEX | Consumption price index | CORSAV | Corporate savings |

PINDOM | Domestic price level | CORTAX | Corporate taxes |

PKi | Price of composite capital good | GOVSAV | Government savings |

PMi | Domestic price of imports | GOVTRN | Government transfers |

PQi | Price of composite goods | GR | Government revenue |

PVi | Value added price by sector | HHSAV | Total household savings |

PWEi | World price of exports | IDi | Final demand for productive investment |

PXi | Average output price by sector | INDTAX | Indirect tax revenue |

PENi | Energy prices by sector | ioi,j | Intermediates uses coefficients |

PNENi | Non-Energy prices by sector | INVEST | Total investment |

PEKLi | Energy, capital and labor prices | mpsh | Marginal to save by household type |

PELECi | Electricity prices | RGDP | Real GDP |

PFULi | Fuels prices | SAVING | Total savings |

PPETROLi | Petroleum products price | STKi | Inventory investment by sector |

Di | Domestic sales of domestic output | TARIFF | Tariff revenue |

Ei | Exports by sector | HHTAX | Household tax revenue |

Mi | Imports by sector | REMIT | Remittance from abroad |

Qi | Composite goods supply | FACTIN | Interest from abroad |

Xi | Domestic output by sector | CURACT | Current account |

FSf | Factor supply | BORROWbr | Current borrowing |

LCSCi,f | Factor demand by sector | INTERSbr | Interest payments on foreign debt |

PKLlc | Average capital and labor price | Tech | Efficiency parameter |

C_mini,h | Minimum consumption | EN | Energy demand |

THCONh | Total household consumption | NEN | Non-Energy demand |

Z h | Poverty line in household h | ELEC | Electricity demand |

HDMh,c | Demand for commodities | FUL | Fuels demand |

SUB | Government subsidy to Enterprises | COALNGS | Coal and natural gas demand |

TSUB | Total subsidies | PETROLD | Petroleum products demand |

DKi | Vol. of investment by destination | PETROLpt,j | Sectoral petroleum demand by sector |

EXPTAX | Export tax revenue | COALNGS | Aggregate coal and natural gas demand |

FXDINV | Fixed capital investment | COAL | Coal demand |

GDi | Final demand for govt. consumption | NGASD | Natural gas demand |

GDPVA | Value added in market prices: GDP | COALNGS | Coal and natural gas demand |

GOVCON | Total volume of govt. consumption | PCOAL | Coal price |

List of parameters and their definition

Parameters and scalars | Definition | Parameters and scalars | Definition |

|---|---|---|---|

CSAV | Saving rate for corporations | \(\beta_{i}^{c}\) | Armington function share parameter |

CTAX | Tax rate for corporate income | SUMSH | Sum of share correction parameter |

CTRNh | Share of distributed corporate income | SUMHSHh | Sum of share for h consumption shares |

DEVBUD | Development budget as reported by government | SUMCCSHi | Sum of share for ccmat and 10 tables |

GGi | Government consumption shares | tmreali | Real tariff rate |

GTRNh | Share of government subsidies | WTDi | Domestic price index weights |

INVi | Ratio of inventory investment to gross output | WTQi | Composite price index weights |

\(\rho_{i}^{c}\) | Armington function exponent | \({\text{io}}_{i,j}\) | Input–output coefficients |

\(\rho_{i}^{e}\) | Export demand price elasticity | ROUTIN | Government routine expenditures |

\(\rho_{i}^{t}\) | CET function exponent | TXi | Indirect tax rates |

\(\rho_{i}^{v}\) | Value added function exponent | TVAi | Value added tax rates (indirect plus export) |

\(\propto_{i}^{c}\) | Armington function shift parameter | TMi | Tariff rates on imports |

\(\propto_{i}^{t}\) | CET function shift parameter | THh | Income tax rate by household type |

\(\propto_{i}^{\nu }\) | Value added function shift parameter | SFINh | Share of foreign income for each household |

\(\propto_{i}^{x}\) | Production function shift parameter | ZZi | Shares of investment by sector of destination |

\(\beta_{i}^{t}\) | CET function share parameter | TEi | Export duty rates |

\(\beta_{i,f}^{x}\) | Production function share parameter | \(\alpha_{i}\) | Utility function exponent |

\(\alpha_{i}^{{{\text{en}}}}\) | Shift parameter of energy function | \(\alpha_{i}^{{{\text{kl}}}}\) | Shift parameter of KL function |

\(\beta_{i}^{{{\text{en}}}}\) | Share parameter of energy function | \(\beta_{i}^{{{\text{kl}}}}\) | Share parameter of KL function |

\(\rho_{i}^{{{\text{en}}}}\) | Substitution elasticity of energy function | \(\rho_{i}^{{{\text{kl}}}}\) | Substitution elasticity of KL function |

\(\alpha_{i}^{{{\text{fl}}}}\) | Shift parameter of fuel function | ||

\(\beta_{i}^{{{\text{fl}}}}\) | Share parameter of fuel function | ||

\(\rho_{i}^{{{\text{fl}}}}\) | Substitution elasticity of fuel function |

Rights and permissions

About this article

Cite this article

Li, Z., Solaymani, S. Effectiveness of energy efficiency improvements in the context of energy subsidy policies. Clean Techn Environ Policy 23, 937–963 (2021). https://doi.org/10.1007/s10098-020-02005-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-020-02005-8