Abstract

This paper investigates the effects of coronavirus disease 2019 (COVID-19) on housing prices at the U.S. county level. The effects of COVID-19 cases on housing prices are formally investigated by using a two-way fixed effects panel regression, where county-specific factors, time-specific factors, and mobility measures of individuals are controlled for. The benchmark results show evidence for negative and significant effects of COVID-19 cases on housing prices, robust to the consideration of several permutation tests, where the negative effects are more evident in counties with higher poverty rates. Exclusion tests further suggest that U.S. counties in the state of California or the month of May 2020 are more responsible for the empirical results, although the results based on other counties and months are still in line with the benchmark results.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The coronavirus disease 2019 (COVID-19) has resulted in not only a health crisis through its direct effects but also an economic one through its indirect effects. These indirect effects are reflected in housing prices within the U.S. in an unequal way across counties, where housing prices have increased by about \(\$1{,}408\) on average across counties on a monthly basis (between February 2020 and August 2021), with a range between \(\$1{,}979\) of a reduction and \(\$14{,}963\) of an increase. Within this context, what is the contribution of COVID-19 cases on this heterogeneity representing unequal changes in housing prices across U.S. counties? The answer to this equation depends on several channels that affect the housing market at the local (U.S. county) level.

On one hand, health risks can create uncertainties related to both economic and health-related concerns as indicated by studies such as by Viscusi (1989) or Viscusi (1990). From a broad perspective, these uncertainties can lead to reductions in overall spending (including housing) as suggested by Baker et al. (2020) or specifically to reductions in housing demand (and thus prices) as suggested by studies such as by Wong (2008). On the other hand, expansionary monetary policy of the Federal Reserve Bank or stimulus packages representing unemployment benefits or cash payments by the federal government can increase the demand for housing and thus housing prices as suggested by studies such as by Schwab (1982); Brueckner and Follain (1989); Harris (1989) or Sommer and Sullivan (2018).Footnote 1 Especially when these alternative channels work differently across U.S. counties due to local factors (e.g., overall housing market or health system of a county), they may result in the investigated heterogeneity representing unequal changes in housing prices across U.S. counties. It is implied that investigating this heterogeneity requires controlling for county-specific factors. Moreover, when a nationwide development affects housing prices in all U.S. counties, it should also be controlled for to investigate the sources of heterogeneity across counties.

This paper investigates this heterogeneity representing unequal changes in housing prices across U.S. counties due to COVID-19 cases. The formal investigation is achieved by using a two-way fixed effects panel regression, where county-specific and time-specific factors are controlled for. Several mobility measures of individuals are also considered as control variables as they not only represent the overall economic activity at the U.S. county level over time (e.g., see studies such as by Yilmazkuday 2021) but also the developments in the housing sector at the U.S. county level over time due to staying at home as a housing-demand shifter (e.g., see studies such as by D’Lima et al. 2022 or Ling et al. 2020).

The benchmark empirical results show evidence for negative and significant effects of COVID-19 cases on housing prices, and they have been confirmed by several robustness checks based on permutation tests, exclusion tests, or interactions with other variables. This is consistent with studies such as by Wong (2008); Ambrus et al. (2020); Del Giudice et al. (2020); Ling et al. (2020); Allen-Coghlan and McQuinn (2021), or Francke and Korevaar (2021) who have shown negative effects of health crises on housing prices. This result is also consistent with earlier studies such as by Haurin et al. (2002); Green and Hendershott (2001); Mayer and Somerville (2000) or Baker et al. (2020) who have shown that reductions in current or future income and increases in uncertainty (related to both economic and health-related concerns) can discourage people to buy houses, which correspond to a reduction in housing demand.

When the channels of COVID-19 effects on housing prices are further investigated as in studies such as by Stein (1995) or Genesove and Mayer (2001), poverty is shown to be an important factor. Specifically, the U.S. counties with higher rates of poverty have experienced more reductions in housing prices due to COVID-19, whereas those with lower rates of poverty have experience almost no changes (or sometimes increases) in housing prices. Therefore, there is evidence for unequal effects of COVID-19 on housing prices across U.S. counties due to poverty differences.

As studies such as by Tanrıvermiş (2020); Liu and Su (2021) or Qian et al. (2021) have shown that the relationship between COVID-19 cases and housing prices may further depend on population levels, further robustness checks are achieved to show that COVID-19 cases have been more effective on housing prices in lower-populated counties. When exclusion tests are achieved as additional robustness checks, it is shown that the U.S. counties in the state of California or the month of May 2020 are relatively more responsible for the benchmark empirical results.

With respect to the existing literature, this paper contributes in several dimensions. First, to our knowledge, this is the first paper investigating the effects of COVID-19 cases on housing prices at the U.S. county level. This is important for identification-related concerns, especially due to the high number of U.S. counties investigated. Second, this paper controls for county-specific factors that are constant over time and time-specific factors that are common across U.S. counties. This is essential as U.S. counties have a significant heterogeneity regarding the changes in COVID-19 cases and housing prices. Third, county-and-time specific mobility measures of individuals are considered as control variables in the empirical investigation as they not only represent the overall economic activity but also the developments in the housing sector due to staying at home as a housing-demand shifter. Fourth, empirical results are shown to be robust to the consideration of interaction terms, permutation tests, and exclusion tests. Fifth, several policy suggestions are provided (at the end of this paper).

The rest of the paper is organized as follows. The next section introduces the estimation methodology. Sect. 3 describes the data set and discusses the corresponding descriptive statistics. Sect. 4 depicts the empirical results, whereas Sect. 5 achieves robustness checks. Sect. 6 concludes with providing certain policy suggestions.

2 Estimation Methodology

This section depicts the technical details of the formal analysis, where the effects of COVID-19 on housing prices are investigated at the U.S. county level.

2.1 Effects of COVID-19 on Housing Prices

The effects of COVID-19 on housing prices at the U.S. county level are investigated by considering the corresponding number of COVID-19 cases. The formal investigation is achieved by using the following two-way fixed effects panel regression, where lagged explanatory variables are considered as in studies such as by Hu et al. (2021) to allow enough time for the effects of COVID-19 to show up:

where \(\Delta H_{t}^{c}\) represents the monthly changes (in U.S. dollars) in housing prices in county \(c\) in month \(t\) (with respect to the previous month) so that the empirical results can easily be interpreted in terms of U.S. dollars, \(\Delta C_{t-1}^{c}\) represents the monthly percentage changes in cumulative COVID-19 cases in county \(c\) in the previous month, \(\phi_{c}\) represents county-fixed effects, \(\tau_{t}\) represents month-fixed effects, \(\Delta M_{i,t-1}^{c}\)’s represent control variables of monthly changes in six different mobility measures of individuals in county \(c\) in the previous month (to be discussed below), and \(\varepsilon_{t}^{c}\) represents residuals.Footnote 2

Having the investigation in differences (rather than levels) is essential not only for the identification of COVID-19 effects through the time dimension but also to control for changes that are county or month specific. Lagged values of percentage changes in COVID-19 cases are used in Eq. (1) to identify the effects of COVID-19 on housing prices through the time dimension as in studies such as by Hu et al. (2021). Changes in mobility of individuals are used as control variables as they not only represent the overall economic activity at the U.S. county level (e.g., see studies such as by Yilmazkuday 2021) but also the developments in the housing sector due to staying at home as a housing-demand shifter (e.g., see studies such as by D’Lima et al. 2022 or Ling et al. 2020).

County-fixed effects \(\phi_{c}\)’s are dummy variables taking a value of 1 for each U.S. county \(c\); they are used in Eq. (1) to control for other county-specific factors (that are constant over time) such as the overall housing market or health system in each county. Month-fixed effects \(\tau_{t}\)’s are dummy variables taking a value of 1 for month in the sample; they are used in Eq. (1) to control for time-specific factors (that are common across U.S. counties) such as the Declaration of National Emergency by the White House, having nationwide vaccination through federal programs, or having overall higher national demand for housing during the COVID-19 era.

2.2 Effects of COVID-19 on Housing Prices through Poverty

Once the effects of COVID-19 on housing prices are determined, we would like to know whether such effects are different across U.S. counties with different poverty measures, motivated by studies such as by Stein (1995) or Genesove and Mayer (2001). Accordingly, for this investigation, we modify Eq. (1) as follows:

where the only difference with respect to Eq. (1) is having percentage changes in COVID-19 cases interacting with poverty measures, \(P_{i}^{c}\)’s. These poverty measures of \(P_{i}^{c}\)’s for \(i\in\left\{1,2,3,4\right\}\) are dummy variables taking a value of 1 when the poverty of county \(c\) is in the first, second, third, or fourth quartile of the poverty distribution across all U.S. counties, respectively.

3 Data and Descriptive Statistics

3.1 Data Sources

Monthly data on housing prices at the U.S. county level have been obtained from Zillow.com for the period between February 2020 and August 2021.Footnote 3 We use Zillow Home Value Index, which is a smoothed, seasonally adjusted measure of a typical home value in each county. For the very same months, the cumulative number of COVID-19 cases at the U.S. county level have been obtained from New York Times.Footnote 4

Google mobility measures at the U.S. county level have been obtained from Google.Footnote 5 Since these mobility measures are at the daily frequency, they have been converted into monthly terms by taking their average across days of each month. As detailed in studies such as by Yilmazkuday (2020), these mobility measures have been constructed by comparing visits and lengths of stays at certain places compared to a baseline using information from Google Maps; all measures are represented as percentage deviations from the baseline. Within this data set, retail and recreation data provide information on mobility trends for places like restaurants, cafes, shopping centers, theme parks, museums, libraries, and movie theaters. Grocery and pharmacy data provide information on mobility trends for places like grocery markets, food warehouses, farmers markets, specialty food shops, drug stores, and pharmacies. Transit stations data provide information on mobility trends for places like public transport hubs such as subway, bus, and train stations. Workplaces data provide information on mobility trends for places of work. Finally, data on time spent at home provide information on trends for staying at home.

3.2 Descriptive Statistics

As monthly changes in housing prices, COVID-19 cases, and mobility measures are used in the estimation of Eqs. (1) and (2), they are further discussed in this subsection before moving to the estimation results. We focus on average monthly changes of the variables used in Eqs. (1) and (2) during the sample period. The corresponding descriptive statistics (across U.S. counties) are provided in the Appendix Table 5, whereas county-specific measures are provided as continental U.S. maps in the Appendix figures.

3.2.1 Housing Prices

On a monthly basis during the sample period, housing prices have increased by about \(\$1{,}408\) on average across U.S. counties, although the reduction (increase) in housing prices is as much as about \(\$1{,}979\) (\(\$14{,}963\)). The corresponding standard deviation (and coefficient of variation) suggest evidence for a high degree of heterogeneity across U.S. counties, which is also reflected in the Appendix Fig. 3. In particular, the U.S. counties close to the West Coast and the East Coast seem to experience higher housing price changes, whereas the U.S. counties in the Midwest seem to experience lower housing price changes.

3.2.2 COVID-19 Cases

The U.S. counties have experienced monthly percentage increases in cumulative COVID-19 cases on average about 39%, although they range between 1.1% and 75% across counties. The corresponding standard deviation (and coefficient of variation) suggest evidence for a high degree of heterogeneity across U.S. counties as well. According to the Appendix Fig. 4, higher percentage changes in COVID-19 cases have been observed around certain cities, especially in the West Coast.

3.2.3 Mobility Measures

Monthly changes in mobility measures have been highly heterogenous as well. Across U.S. counties, changes in visits to retail and recreation range between −54% and −27%, changes in visits to grocery and pharmacy range between −30 and 57%, changes in visits to parks range between −37% and 26%, changes in visits to transit stations range between −30% and 24%, changes in visits to workplaces range between −22% and 12%, and changes in time spend at home range between −1% and 1%. The corresponding distributions across U.S. counties are also given in the Appendix Figs. 5–10.

4 Estimation Results

This section depicts the empirical results based on the estimation of Eqs. (1) and (2).

4.1 Effects of COVID-19 on Housing Prices

The estimation results based on Eq. (1) are given in Table 1, where alternative specifications have been considered to investigate the effects COVID-19 on housing prices. As is evident, having a 1% monthly increase in COVID-19 cases results in a reduction in housing prices as much as \(\$3.759\) when all control variables are included at the same time, although the reduction is as low as \(\$0.855\) when mobility measures are not considered as control variables. As the percentage changes in COVID-19 cases have been as high as 74.5% in certain counties, it is implied that certain U.S. counties have experienced reductions in housing prices due to COVID-19 as much as \(\$280\) on average across months. It is important to emphasize that this reduction is on top of the nationwide changes that are common across the U.S. counties as we control for such changes through the month-fixed effects. Moreover, as our monthly regressions are in differences, the reduction (of as much as \(\$280\)) in housing prices due to COVID-19 represents average monthly changes that can accumulate over time through months of the sample period.

On top of using mobility alternative measures as control variables, since county-fixed effects and month-fixed effects are controlled for in Eq. (1), these negative and significant effects are robust to the consideration of county-specific factors that are constant over time and month-specific factors that are common across counties. These negative and significant effects of COVID-19 cases on housing prices are consistent with studies such as by Wong (2008); Ambrus et al. (2020); Del Giudice et al. (2020); Ling et al. (2020) or Francke and Korevaar (2021) who have shown negative effects of health crises on housing prices. This result is also consistent with earlier studies such as by Haurin et al. (2002); Green and Hendershott (2001); Mayer and Somerville (2000) or Baker et al. (2020) who have shown that reductions in current or future income and increases in uncertainty (related to both economic and health-related concerns) can discourage people to buy houses, which correspond to a reduction in housing demand.

4.2 Effects of COVID-19 on Housing Prices through Poverty

The estimation results based on Eq. (2) are given in Table 2, where, again, alternative specifications have been considered to investigate the effects COVID-19 on housing prices, this time through poverty. When all control variables are considered in the last column of Table 2, having a 1% monthly increase in COVID-19 cases results in a reduction in housing prices of about \(\$8.822\) for the U.S. counties in the fourth quartile of the poverty distribution (i.e., counties with the highest percentage of individuals living in poverty), whereas the effects on the first quartile of the poverty distribution (i.e., counties with the lowest percentage of individuals living in poverty) are statistically insignificant.

It is implied that the U.S. counties with higher poverty measures have been negatively affected more than others. This is also supported in by other columns of Table 2, where alternative control variables are considered. Specifically, when alternative control variables are considered, the housing prices in the U.S. counties in the first quartile of the poverty distribution have even increased following increases in COVID-19 cases, suggesting unequal effects of COVID-19 on housing prices across U.S. counties. On top of using alternative mobility measures as control variables, since county-fixed effects and month-fixed effects are controlled for in Eq. (2), these negative and significant effects are again robust to the consideration of county-specific factors that are constant over time and month-specific factors that are common across counties.

5 Robustness Checks

We have so far shown that the effects of COVID-19 cases on housing prices have been negative and significant at the U.S. county level, robust to the consideration of alternative control variables. In this section, we achieve further robustness checks to reduce any concern about possible violations of common trend assumptions.

First, since studies such as by Tanrıvermiş (2020); Liu and Su (2021) or Qian et al. (2021) have shown that the relationship between housing prices and COVID-19 developments may depend on high population levels, we consider alternative population cutoff points while estimating our benchmark regression represented by Eq. (1). The results are given in Table 3, where all control variables are used (that corresponds to the last column of Table 1 in the benchmark regression). As is evident, independent of the population cutoff considered, the effects of COVID-19 cases on housing prices are negative and significant. In terms of magnitude, 1% of a monthly increase in COVID-19 cases results in about \(\$4\) of a reduction in housing prices, independent of the population cutoff considered.

Second, as an additional robustness check based on population levels, we also estimate Eq. (1) by using weighted least squares, where population levels of U.S. counties are used as weights. The results are given in Table 4, where alternative control variables are considered as in Table 1. It is evident in Table 4 that the effects of COVID-19 cases on housing prices are negative and significant, independent of the control variable(s) considered, although the estimated coefficients are lower in magnitude. It is implied that COVID-19 cases have been more effective on housing prices in lower-populated counties.

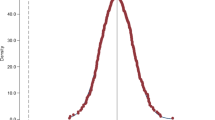

Third, we consider alternative permutation tests, where (i) we permute counties within each month, (ii) we permute months within each county, and (iii) we assign random (fake) values to percentage changes in COVID-19 cases (between −100% and 100%) for each county in each month. The motivation behind these tests based on placebo laws is that these permutations (in counties, months or COVID-19 cases) should not generate any significant effect on housing prices, and thus, the estimated coefficients should be zero. These tests (with 1,000 simulations) are achieved by using the benchmark regression represented by Eq. (1), where all control variables are included. The results are given in Fig. 1, where 1,000 simulations coming from each permutation test are represented. As is evident, estimated coefficients (representing the placebo effects of COVID-19 cases on housing prices under permutation) are around zero, independent of the permutation test considered. Moreover, none of the placebo estimates are below the estimated coefficient (of 3.759) in the benchmark case in Table 1 (when all control variables are included). Therefore, all permutation results confirm the reliability of our benchmark estimates in Table 1.

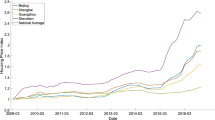

Fourth, we consider alternative exclusion tests to investigate whether our results are driven by certain U.S. counties, certain U.S. states or certain months within our sample period. These exclusion test are achieved by (i) excluding one U.S. county at a time, (ii) excluding counties in one U.S. state at a time, or (iii) excluding one month at a time, using the benchmark regression represented by Eq. (1), where all control variables are included. The results are given in Fig. 2, where estimated coefficients under exclusion and the corresponding t‑statistics are depicted. As is evident, the benchmark results in Table 1 are robust to the consideration of excluding any one U.S. county according to the top panel of Fig. 2. However, when the exclusion test is achieved by using U.S. states, the negative and significant coefficient (representing the effects of COVID-19 on housing prices) drop to about −1.57 when the state of California is excluded. It is implied that the estimation results are partly driven by the developments in the state of California, although the results obtained by using data from other U.S. states (and their counties) still suggest that the effects of COVID-19 cases on housing prices have been negative and significant. Similarly, when the exclusion test is achieved by using months, the negative and significant coefficient (representing the effects of COVID-19 on housing prices) drop to about −1.59 when the month of May 2020 is excluded. It is implied that the estimation results are partly driven by the developments in the month of May 2020 as well, although the results obtained by using data from other months still suggest that the effects of COVID-19 cases on housing prices have been negative and significant. These results are consistent with studies such as by Francke and Korevaar (2021) who have shown that the effects of pandemics on housing prices have been observed in areas heavily-affected by pandemics (e.g., the state of California) and have historically been transitory (e.g., the month of May 2020).

Based on these robustness checks, it is confirmed that the effects of COVID-19 on housing prices are negative and significant.

6 Concluding Remarks and Policy Suggestions

This paper has investigated the heterogeneity of unequal changes in housing prices across U.S. counties due to COVID-19. The formal investigation has been achieved by using a two-way fixed effects panel regression, where the effects of COVID-19 on housing prices have been investigated after controlling for county-fixed effects, time-fixed effects, and mobility measures of individuals that are county-and-time specific. The empirical results have shown evidence for negative and significant effects of COVID-19 cases on housing prices; several permutation tests confirm the robustness of these empirical results. The negative and significant effects of COVID-19 cases on housing prices have been shown to be higher for U.S. counties with higher poverty rates. Population-weighted regression results have further shown that COVID-19 cases have been more effective on housing prices in lower-populated counties. When exclusion tests are achieved as additional robustness checks, it is shown that the U.S. counties in the state of California and the month of May 2020 are relatively more responsible for the benchmark empirical results.

As COVID-19 has negatively affected housing prices across U.S. counties after controlling for other factors, especially in counties with higher poverty rates, it is implied that counties that have experienced higher COVID-19 cases need more homeowner assistance programs to make their mortgage payments. This requirement is mostly due to facing affordability problems through having lower housing prices and lower income at the same time as in studies such as by Foote et al. (2008). These assistance programs can be similar to the earlier programs such as Home Affordable Modification Program or Home Affordable Refinance Program (HARP) with the purpose of lowering required mortgage payments to meet a target payment-to-income ratio; another assistance program can be through forbearance, where payments are reduced or canceled for a limited period as suggested in studies such as by Amromin et al. (2020).

As many individuals, especially the vulnerable, have lost their jobs, and some of them will continue to be unemployed as suggested in studies such as by Barrero et al. (2020), one policy suggestion can be to ease income verification requirements for refinancing. This is in line with studies such as by Agarwal et al. (2019) or DeFusco and Mondragon (2020) who have shown how such a policy not only would benefit mortgage borrowers and lenders but also enhance the transmission of monetary policy across U.S. counties. Having less complicated homeowner assistance programs with less institutional complications may also help borrowers to avoid complex screening mechanism as indicated by Barr et al. (2020). Combined with lower mortgage rates through unconventional monetary policies such as purchasing mortgage backed securities, reducing the complexity of refinancing may further help fighting against the negative effects of COVID-19 on housing prices. Subsidizing refinancing in U.S. counties with higher COVID-19 cases, such as by reducing the insurance premiums for borrowers as suggested by Ehrlich and Perry (2015), may also be helpful in reducing the negative effects of COVID-19 on housing prices. Reducing mortgage payments rather than debt forgiveness may also help as suggested in studies such as by Eberly and Krishnamurthy (2014) or Scharlemann and Shore (2016).

Notes

Also see earlier studies such as by Del Giudice et al. (2020) or Balemi et al. (2021) who have discussed several channels for the effects of COVID-19 on housing prices, including the closure of entire neighborhoods or cities, concerns about long-run contagion/distrust of the effectiveness of sanitation effort, general economic decline as well as specific housing market factors.

In an alternative framework, we also considered having the lagged dependent variable on the right hand side of the regression. The corresponding results based on a GMM estimation, which are available upon request, were very similar to those obtained by estimating Eq. (1).

The web page is https://www.zillow.com/research/data/.

The web page is https://github.com/nytimes/covid-19-data/.

The web page is https://www.google.com/covid19/mobility/.

References

Agarwal S, Amromin G, Ben-David I, Chomsisengphet S, Zhang Y (2019) Holdup by junior Claimholders: evidence from the mortgage market. J Financ Quant Anal 54(1):247–274

Allen-Coghlan M, McQuinn KM (2021) The potential impact of Covid-19 on the Irish housing sector. Int J Hous Mark Anal 14(4):636–651

Ambrus A, Field E, Gonzalez R (2020) Loss in the time of cholera: long-run impact of a disease epidemic on the urban landscape. Am Econ Rev 110(2):475–525

Amromin G, Dokko JK, Dynan KE et al (2020) Helping homeowners during the Covid-19 pandemic: lessons from the great recession. Chic Fed Lett 443. https://doi.org/10.21033/cfl-2020-443

Baker SR, Farrokhnia RA, Meyer S, Pagel M, Yannelis C (2020) How does household spending respond to an epidemic? Consumption during the 2020 COVID-19 pandemic. Rev Asset Pricing Stud 10(4):834–862

Balemi N, Füss R, Weigand A (2021) COVID-19’s impact on real estate markets: review and outlook. Financ Mark Portfolio Manag: 1–19. https://doi.org/10.1007/s11408-021-00384-6

Barr M, Jackson H, Tahyar M (2020) The financial response to the COVID-19 pandemic https://doi.org/10.2139/ssrn.3666461

Barrero JM, Bloom N, Davis SJ (2020) COVID-19 is also a reallocation shock. Working Paper 27137. National Bureau of Economic Research

Brueckner JK, Follain JR (1989) ARms and the demand for housing. Reg Sci Urban Econ 19(2):163–187

DeFusco AA, Mondragon J (2020) No job, no money, no refi: frictions to refinancing in a recession. J Financ. https://doi.org/10.1111/jofi.12952

Del Giudice V, De Paola P, Del Giudice FP (2020) Covid-19 infects real estate markets: short and mid-run effects on housing prices in Campania region (Italy). Soc Sci 9(7):114

D’Lima W, Lopez LA, Pradhan A (2022) COVID-19 and housing market effects: evidence from US shutdown orders. Real Estate Econ 50(2):303–339

Eberly J, Krishnamurthy A (2014) Efficient credit policies in a housing debt crisis. Brookings Pap Econ Act 2014(2):73–136

Ehrlich G, Perry J (2015) Do large-scale refinancing programs reduce mortgage defaults? Evidence from a regression discontinuity design. In: Evidence from a regression discontinuity design (October 22, 2015)

Foote CL, Gerardi K, Willen PS (2008) Negative equity and foreclosure: theory and evidence. J Urban Econ 64(2):234–245

Francke M, Korevaar M (2021) Housing markets in a pandemic: evidence from historical outbreaks. J Urban Econ 123:103333

Genesove D, Mayer C (2001) Loss aversion and seller behavior: evidence from the housing market. Q J Econ 116(4):1233–1260

Green RK, Hendershott PH (2001) Home-ownership and unemployment in the US. Urban Stud 38(9):1509–1520

Harris JC (1989) The effect of real rates of interest on housing prices. J Real Estate Finan Econ 2(1):47–60

Haurin DR, Dietz RD, Weinberg BA (2002) The impact of neighborhood homeownership rates: A review of the theoretical and empirical literature. J Hous Res 13(2):119–151

Hu MR, Lee AD, Zou D (2021) COVID-19 and housing prices: Australian evidence with daily hedonic returns. Financ Res Lett 43:101960

Ling DC, Wang C, Zhou T (2020) A first look at the impact of COVID-19 on commercial real estate prices: Asset-level evidence. Rev Asset Pricing Stud 10(4):669–704

Liu S, Su Y (2021) The impact of the Covid-19 pandemic on the demand for density: evidence from the US housing market. Econ Lett 207:110010

Mayer CJ, Somerville CT (2000) Residential construction: Using the urban growth model to estimate housing supply. J Urban Econ 48(1):85–109

Qian X, Qiu S, Zhang G (2021) The impact of COVID-19 on housing price: evidence from China. Financ Res Lett: 101944. https://doi.org/10.1016/j.frl.2021.101944

Scharlemann TC, Shore SH (2016) The effect of negative equity on mortgage default: evidence from hamp’s principal reduction alternative. Rev Financ Stud 29(10):2850–2883

Schwab RM (1982) Inflation expectations and the demand for housing. Am Econ Rev 72(1):143–153

Sommer K, Sullivan P (2018) Implications of US tax policy for house prices, rents, and homeownership. Am Econ Rev 108(2):241–274

Stein JC (1995) Prices and trading volume in the housing market: a model with down-payment effects. Q J Econ 110(2):379–406

Tanrıvermiş H (2020) Possible impacts of COVID-19 outbreak on real estate sector and possible changes to adopt: A situation analysis and general assessment on Turkish perspective. J Urban Manag 9(3):263–269

Viscusi WK (1989) Prospective reference theory: Toward an explanation of the paradoxes. J Risk Uncertainty 2(3):235–263

Viscusi (1990) Sources of inconsistency in societal responses to health risks. Am Econ Rev 80(2):257–261

Wong G (2008) Has SARS infected the property market? Evidence from Hong Kong. J Urban Econ 63(1):74–95

Yilmazkuday H (2020) Stay-at-home works to fight against COVID-19: international evidence from Google mobility data. J Hum Behav Soc Environ. https://doi.org/10.1080/10911359.2020.1845903

Yilmazkuday (2021) Welfare costs of COVID-19: Evidence from US counties. J Regional Sci. https://doi.org/10.1111/jors.12540

Acknowledgements

The author would like to thank the editor Thomas Brenner and three anonymous referees for their helpful comments and suggestions. The usual disclaimer applies.

Funding

There is no funding used for this paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of Interests

There are not any conflicts of interest or any competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yilmazkuday, H. COVID-19 and housing prices: evidence from U.S. county-level data. Rev Reg Res 43, 241–263 (2023). https://doi.org/10.1007/s10037-023-00187-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10037-023-00187-4