Abstract

Surveys of the costs of inputs assigned to pollution abatement (Stated Costs) have been the principal method used to estimate pollution abatement costs. While surveys have been widely used, problems with these surveys may adversely affect their ability to accurately measure pollution abatement costs. In this paper, we propose a method that does not depend on surveys of input costs. Instead, a nonparametric cost function that models the joint production of good and bad outputs is used to identify the cost of inputs assigned to pollution abatement (Revealed Costs). The increased input costs when the bad output is not freely disposable compared to input costs when the bad output is freely disposable constitute our estimate of the revealed cost of pollution abatement. Our model is illustrated using data from coal-fired electric power plants in the United States for 2000–2005.

Similar content being viewed by others

Data availability

The LP problems are solved using GAMS/MINOS. The GAMS programs are available from the corresponding author upon request. (See footnote 17).

Code availability

The data are available from the corresponding author upon request. (See footnote 17).

Notes

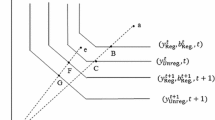

Throughout this paper, “unregulated technology” is short-hand terminology we adopt when the bad output is treated as freely disposable, while “regulated technology” is our short-hand for when the bad output is treated as not freely disposable.

Weak disposability was introduced by Shephard (1970).

At the present time, the authors are unaware of any paper deriving the theoretical framework that allows incorporating the case when the bad output is not freely disposable into a parametric (e.g., translog, quadratic) cost function.

Färe et al. (2013) offer a diferent perspective on modeling a bad output by specifying a good output production sub-technology and an end-of-pipe abatement sub-technology within a network model, while Färe et al. (2017) compares the the effects of different pollution abatement strategies found by the network model with the the effects found by the reduced form joint production model.

Pollution abatement does not eliminate the undesirable byproducts of good output production. However, it can reduce the threat to human health posed by undesirable byproducts by transforming them from one media (air) to another media (solid waste). Baumgärtner et al. (2001), Førsund (2009), and Murty et al. (2012) discuss the implications of the material balance perspective of production models.

When modeling the environmental technology, we assume b is an output—not an input.

The subscript U for P and x in Eq. (1) denotes the unregulated technology. While the xkn values are observations and xU,n are variables, their units are identical. In Eq. (2), the subscript R for P and x denotes the regulated technology. Once again the xkn values are observations and xR,n are variables, while their units are identical.

By adding this constraint to the LP problem: \( \sum\nolimits_{{k = 1}}^{K} {z_{k} { \leqq }1} \), non-increasing returns to scale (NIRS) is modeled for the unregulated technology (1) and the regulated technology (2). Färe and Grosskopf (1983) and Färe et al. (1986) specified models of the regulated technology with variable returns to scale (VRS). By specifying constant returns to scale, we avoid needing to discuss scale effects on PAC, which simplifies the presentation of the models.

For additional properties, see Färe and Primont (1995).

The objective functions of the LP problems specified in Eqs. (3) and (4) sum over the 5 inputs—capital, labor, coal, oil, and natural gas, where capital is quasi-fixed. This notation is adopted because it allows an easier transition when modifying the objective function for the LP problem specified in (Eq. 6) when fuel heterogeneity is incorporated into the model.

Except for the intensity variables (\({z}_{k}\)) a subscript k or k′ indicates a fixed value or data. In the cost function of the regulated technology (Eq. 4), the left-hand side of the constraints with summations include sample data on y, b, and x. Therefore, an input is a variable when only R,n appears in its subscript.

Some capital—the quasi-fixed input—will be assigned to pollution abatement if the plant installs an end-of-pipe (e.g., flue gas desulfurization system). Capital is less likely to be assigned to pollution abetment if a plant adopts a fuel switching abatement strategy. Bostian et al. (2022) use data from Swedish pulp and paper firms to investigate the issue of optimal abatement mix.

Appendix B provides additional information about the effect of introducing intra-fuel heterogeneity into the analysis.

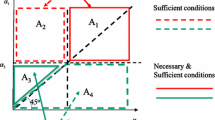

Following Pizer and Kopp (2005), PAC can also be defined by the joint production model as: \( {\text{PAC}} = C_{R} (y_{{k^{\prime}}} ,b_{{k^{\prime}}} ,r_{{k^{\prime}}} ,x_{{k^{\prime}1}} ) - ~C_{U} (y_{{k^{\prime}}} ,b_{{k^{\prime}}} ,r_{{k^{\prime}}} ,x_{{k^{\prime}1}} ) \). One advantage of defining PAC as a ratio in Eq. (9) is it simplifies comparisons of the relative magnitudes of plant abatement costs.

In other words, the unregulated technology produces the same level of the good output as the regulated technology at an equal or lower cost.

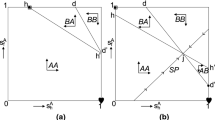

Appendix C uses isoquants and isocost lines to depict the unregulated technology and regulated technology, and provide a visual representation of the nonparametric cost functions used to define PAC.

Because labor is a homogeneous input, its price, \({\mathrm{r}}_{{\mathrm{k}}^{\mathrm{^{\prime}}}2}\), is identical for the regulated and unregulated technologies that model intra-fuel heterogeneity. The summation in Eq. (11) from 3 to 5 calculates the cost of coal, oil, and natural gas (n = 3, 4, 5).

The LP problems are solved using GAMS/MINOS. The GAMS programs, data, and appendices are available from the corresponding author upon request.

The FERC Form 1 survey collects information on the Distribution of Wages and Salaries associated with electric power generation by private utilities (page 354) for the following categories of operation and maintenance activities: (1) production, (2) transmission, (3) distribution, (4) customer accounts, (5) customer service and informational, (6) sales, and (7) administrative and general. However, after 2001 the FERC Form 1 survey ceased collecting data on the number of regular full-time employees, part-time and temporary employees, and total Electric Department Employees (page 323). Therefore, it is not possible to use FERC Form 1 data to calculate the average wage/salary for utility employees.

Fuels other than coal, oil, and natural gas (e.g., petroleum coke, blast furnace gas, coal-oil mixture, fuel oil #2, methanol, propane, wood and wood waste, and refuse, bagasse and other nonwood waste) are consumed by some plants. Plants whose consumption of fuels other than coal, oil, and natural gas represent more than 0.0001 percent of its total fuel consumption (in Btu) are excluded. Consumption of fuels other than coal, oil, and natural gas that constitute less than 0.0001 percent of a plant’s fuel consumption are ignored.

Annual reports published by the Federal Power Commission and the Energy Information Administration are the source of data on the cost of plant and equipment for years prior to 1981. The cost of plant and equipment data for 1981–1997 is provided by the Utility Data Institute (1999). Finally, data for (1) the cost of plant and equipment and (2) employment collected by the FERC Form 1 for 1998–2005 and EIA-423 for 1998–2003 are downloaded from their respective websites.

While the FERC Form 1 and EIA 412 surveys collect data on the historical cost of plant and equipment, neither collects data on investment expenditures. As a result, changes in the value of plant and equipment reflect the value of additional plant and equipment plus the value of retired plant and equipment. Following Yaisawarng & Klein (1994, p. 453, footnote 30) and Carlson et al. (2000, p. 1322), we assume changes in Cost of Plant reflect net investment (NI). Using the Handy-Whitman Index (HWI) (see Whitman, Requardt & Associates, LLP 2012), we then convert the historical cost of plant data to constant dollar values. The net constant dollar capital stock (CS) for year n is calculated in the following manner:

\(\quad \quad CS_{n} = \sum\limits_{t = 1}^{n} {\frac{{NI_{t} }}{{HWI_{t} }}} .\)

In the first year of its operation, the net investment of a power plant is equivalent to the total value of its plant and equipment.

For some states, confidentiality issues result in the most disaggregated NAICS code available varying from year-to-year. In those cases, we use the most disaggregated code available for each year. When state data are unavailable for NAICS 221112, 22111, and 2211 for 2001–2004, we interpolate wage rates using NAICS 2211. If data are missing for 2000 or 2005, we use the wage rates of a contiguous state. As a result, 2000-2005 wage rates for Alabama plants use Tennessee data, 2000-2003 wage rates for the North Dakota plant are from Montana, and 2000 wage rates for South Carolina plants use North Carolina data.

When checking the GAMS solutions an inconsistency emerged for selected LP problems. For some LP problems, although all intensity variables for a fuel constraint are nil, the fuel consumption variable on the right-hand side of the constraint is either positive or negative. After an investigation, we identified the default value of 1.0E-06 for the GAMS Feasibility Tolerance parameter as the source of the problem. When we increased the value of the Feasibility Tolerance to 1.0E-04, the inconsistencies previously described disappeared. Further investigation confirmed changing the Feasibility Tolerance has no effect on the results presented in this paper.

Comparing Table 3 (homogeneous fuels) and Table 5 (heterogeneous fuels) reveals 29 plants have PAC values greater than unity in both tables. Another 23 plants report PAC values greater than unity in Table 3, but unity values in Table 5. In addition, 2 plants report PAC values greater than unity in Table 5, but unity values in Table 3. Finally, 31 plants report PAC values of unity in both Table 3 and Table 5.

References

Ball E, Färe R, Grosskopf S, Zaim O (2005) Accounting for externalities in the measurement of productivity growth: the malmquist cost productivity measure. Struct Change Econ Dyn 16(3):374–394. https://doi.org/10.1016/j.strueco.2004.04.008

Baumgärtner S, Dyckhoff H, Faber M, Proops J, Schiller J (2001) The concept of joint production and ecological economics. Ecol Econ 36(3):365–371. https://doi.org/10.1016/S0921-8009(00)00260-3

Bostian M, Färe R, Grosskopf S, Lundgren T (2022) Prevention or cure? Optimal abatement mix. Environ Econ Policy Studies 24(4):503–531. https://doi.org/10.1007/s10018-021-00335-5

Burtraw D, Krupnick A, Morgenstern R, Pizer W, Shih J-S (2001) Workshop report: pollution abatement costs and expenditures (PACE) survey design for 2000 and beyond. RFF Discussion Paper 01-09. http://www.rff.org/rff/Documents/RFF-DP-01-09.pdf

Carlson C, Burtraw D, Cropper M, Palmer K (2000) Sulfur dioxide control by electric utilities: what are the gains from trade? J Polit Econ 108(6):1292–1326. https://doi.org/10.1086/317681

Cremeans JE (1977) Conceptual and statistical issues in developing environmental measures—recent U.S. experience. Rev Income Wealth 23(2):97–115. https://doi.org/10.1111/j.1475-4991.1977.tb00006.x

Eurostat (2005) Environmental Expenditure Statistics: Industry Data Collection Handbook, Product Code: KS-EC-05-002, Luxembourg: Office for Official Publications of the European Communities. https://ec.europa.eu/eurostat/web/products-manuals-and-guidelines/-/KS-EC-05-002

Färe R, Grosskopf S (1983) Measuring output efficiency. Eur J Oper Res 13:173–179. https://doi.org/10.1016/0377-2217(83)90080-2

Färe R, Primont D (1995) Multi-output production and duality: theory and applications. Kluwer Academic Publishers, Boston

Färe R, Grosskopf S, Pasurka C (1986) Effects on relative efficiency in electric power generation due to environmental controls. Resources Energy 8(2):167–184. https://doi.org/10.1016/0165-0572(86)90016-2

Färe R, Grosskopf S, Pasurka CA (2003) Estimating pollution abatement costs: a comparison of 'stated' and 'revealed' approaches. https://doi.org/10.2139/ssrn.358700

Färe R, Grosskopf S, Pasurka C (2007) Environmental production functions and environmental directional distance functions. Energy 32(7):1055–1066. https://doi.org/10.1016/j.energy.2006.09.005

Färe R, Grosskopf S, Pasurka CA, Weber W (2012) Substitutability among undesirable outputs. Appl Econ 44(1):39–47. https://doi.org/10.1080/00036846.2010.498368

Färe R, Grosskopf S, Pasurka C (2013) Joint production of good and bad outputs with a network application. In: Shogren J (ed) Encyclopedia of energy, natural resource and environmental economic, vol 2. Elsevier Academic Press, Cambridge, pp 109–118. https://doi.org/10.1016/B978-0-12-375067-9.00134-0

Färe R, Grosskopf S, Pasurka C (2016) Technical change and pollution abatement costs. Eur J Operat Res 248(2):715–724. https://doi.org/10.1016/j.ejor.2015.07.040

Färe R, Grosskopf S, Pasurka C (2017) Modeling pollution abatement technologies as a network, chapter 3. In: Azad S, Hernandez F, Ancev T (eds) New directions in productivity measurement and efficiency analysis: counting the environment and natural resources. Edward Elgar, Cheltenham, pp 59–79. https://doi.org/10.4337/9781786432421.00007

Färe R, Grosskopf S, Pasurka C, Shadbegian R (2018) Pollution abatement and employment. Empirical Econ 54(1):259–285. https://doi.org/10.1007/s00181-016-1205-2

Førsund FR (2009) Good modelling of bad outputs: pollution and multiple-output production. Int Rev Environ Resour Econ 3:1–38. https://doi.org/10.1561/101.00000021

Granderson G, Prior D (2013) Environmental externalities and regulation constrained cost productivity growth in the US electric utility industry. J Prod Anal 39:243–257. https://doi.org/10.1007/s11123-012-0301-3

Hampf B, Rødseth KL (2019) Environmental efficiency measurement with heterogeneous input quality: a nonparametric analysis of U.S. power plants. Energy Econ 81:610–625. https://doi.org/10.1016/j.eneco.2019.04.031

Kohn RE (1975) Air pollution control: a welfare economic interpretation. D.C. Heath and Company, Lexington

Murty S, Russell RR, Levkoff SB (2012) On modeling pollution-generating technologies. J Environ Econ Manag 64(1):117–135. https://doi.org/10.1016/j.jeem.2012.02.005

Pasurka CA (2008) Pollution abatement and competitiveness: a review of data and analyses. Rev Environ Econ Policy 2:194–218. https://doi.org/10.1093/reep/ren009

Pizer WA, Kopp R (2005) Calculating the costs of environmental regulation. In: Mäler K-G, Vincent JR (eds) Chapter 25 inandbook of environmental economics (economywide and international environmental issues), vol 3. Elsevier, Boston, pp 1307–1351. https://doi.org/10.1016/S1574-0099(05)03025-1

Shephard RW (1970) Theory of cost and production functions. Princeton University Press, Princeton

Shortle J, Willett K (1987) A computable market equilibrium model with markets for transferable discharge permits. Manag Decis Econ 8(4):263–270. https://doi.org/10.1002/mde.4090080402

U.S. Bureau of the Census (2008) Pollution abatement costs and expenditures. Current industrial reports, MA200, U.S. Government Printing Office: Washington, DC. https://www.epa.gov/environmental-economics/pollution-abatement-costs-and-expenditures-2005-survey

U.S. Department of Commerce (2002–2007) County Business Patterns. https://www.census.gov/programs-surveys/cbp/data/datasets.html

U.S. Department of Energy, Energy Informational Administration (2000–2005) Form EIA-412 “Annual Electric Industry Financial Report”. http://www.eia.doe.gov/cneaf/electricity/page/eia412.html

U.S. Department of Energy, Energy Informational Administration (2001–2006) Form EIA-767, “Steam-Electric Plant Operation and Design Report.” http://www.eia.gov/cneaf/electricity/page/eia767/. https://www.eia.gov/electricity/data/eia767/

U.S. Department of Energy, Energy Informational Administration (2022) Form EIA-860, “Electric Generator Report”. https://www.eia.gov/electricity/data/eia860/

U.S. Department of Energy (2002–2007) “Monthly Cost and Quality of Fuels for Electric Power Plants Report”. https://www.eia.gov/electricity/data/eia423/

U.S. Federal Energy Regulatory Commission (2000–2007) “FERC Form No. 1: Annual report of Major Electric Utilities, Licensees and Others”. https://www.ferc.gov/general-information-0/electric-industry-forms/form-1-1-f-3-q-electric-historical-vfp-data

Utility Data Institute (1999) North America electric power data, McGraw-Hill Company

Whitman, Requardt & Associates, LLP (2012) The Handy-Whitman Index of public utility construction costs: trends of construction costs. Bulletin No. 175 (1912 to January 1, 2012), Baltimore, MA

Yaisawarng S, Douglass Klein J (1994) The effects of sulfur dioxide controls on productivity change in the U.S. electric power industry. Rev Econ Stat 76:447–460. https://doi.org/10.2307/2109970

Acknowledgements

We thank David Evans for his assistance with data acquisition, and Curtis Carlson for providing his capital stock and employment data. We also wish to thank Tomeka Williams for helpful comments on an earlier version of this paper presented at the 2019 Annual Conference of the Society for Benefit-Cost Analysis in Washington, DC. In addition, we wish to thank participants at the North American Productivity Workshop XI (June 2020) for their comments.

Funding

Not applicable.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

About this article

Cite this article

Färe, R., Grosskopf, S. & Pasurka, C.A. Revealed pollution abatement costs revisited. Environ Econ Policy Stud 25, 601–629 (2023). https://doi.org/10.1007/s10018-023-00370-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-023-00370-4