Abstract

As an instrument to minimize carbon leakage, the effects and feasibility of Carbon Border Adjustments Mechanism (CBAM) will depend on multiple design options. While the EU has committed to introducing CBAM as part of its green climate deal, pursuing climate efforts to successfully limit global warming requires a collective implementation involving major emitters China and the US. This paper quantifies the distributional impacts of a joint CBAM implementation of in a climate alliance or a club of the EU, the US, and China. Differing from a myriad of studies that focus on unilateral CBAM, this analysis emphasizes collective implications on leakage, sectoral competitiveness, and welfare by projecting climate neutrality relative to current policies and climate targets. Our findings confirm that coalition reduces leakage, improves production on energy-intensive industries, and increases club’s welfare relative to a non-CBAM and a unilateral implementation. These are in contrast with some unilateral analytical studies, especially for the US. It is further proof of the potential of CBAM as collective instruments to facilitate mitigation and trade competitiveness.

Similar content being viewed by others

1 Introduction

As a pioneer in global climate mitigation, the European Union (EU) has been taking more serious action in regards to the policy initiative of the European Green Deal (European Commission 2019), aiming to reach carbon neutrality by 2050 (European Parliament 2019). In achieving this, the EU Commission has initiated the Carbon Border Adjustment Mechanism (CBAM) to support transition to stop free allowances and in long term to reduce the risk of carbon leakage and ensure competitive price (European Commission 2019). CBAM can be imposed either as import tariffs for certain goods that imported to the EU or export rebates for the EU export. In early 2021, the EU Parliament expressed its support, and the first legislative proposal was released on July 14, 2021, as part of the Fit for 55 legislative packages (European Commission 2021b, c).

On the other hand, the EU’s strong commitment and its unilateral move are still subject to caveats. EU contributions as an economic union are still limited to making meaningful differences in global emissions targets without equal effort from the major emitters such as China and the US. A coordinated multilateral action shall be considered since domestic reductions in emissions are likely counter-balance by emissions outside the EU (Condon and Ignaciuk 2013; Clora and Yu 2022). In addition to this, the carbon cost discrepancy has been expanding dramatically in the EU ETS sectors, indicating a higher growing burden on the European industries compared to other regions (Mathieu 2021).

A climate alliance or club has been a long-discussed approach to global warming, as a study proposed by Nordhaus (2015). Aligning acclimate club with CBAM is feasible as participating countries could manage emissions at a stringent level and coordinate tariffs on imports to solve the leakage and burden sharing issue (Branger and Quirion 2014; Böhringer et al. 2021). The EU legislative proposal opens this opportunity to coordinate with the affected regions that motivates to form a climate club, which includes the opportunity for agreements with China and the USFootnote 1 since both have also committed to a more stringent climate approach to reach climate neutrality.

With the US, the EU, and China accounting for 61% of the global gross domestic product and 43% of goods imports, forming a climate club has geopolitical advantages. A tripartite deal also supports China’s green revolution with no extra cost on the export (Li and Zhang 2012) and fits with the US’s strategy on China’s technology and intellectual property (Tagliapietra and Wolff 2021). A collective CBAM implementation involving the EU, China, and the US is critical to achieve universal abatement commitments from others. China and the US are net gainers from unilateral mitigations, but these net gains are bolstered by universal climate abatement (Perdana and Tyers 2020). An import tariff in CBAM increases production costs and acts as a punitive instrument that alter countries’ decisions to join and change other countries’ dominant strategy from free riding. As the cost of reducing emissions falls, the cost of joining the club will decline, so China and the US’ decisions to form a coalition and implement CBAM alongside the EU is a decisive factor for others countries to follow (Helm et al. 2012; Böhringer et al. 2016).

This paper aims to assess the distributional impacts of the climate club of the EU, China, and the US imposing the CBAM. Despite studies measuring the implication of CBAM, none specifically focused on analyzing the impacts when a border tariff protection is implemented amongst a climate club consisting the EU, the US, and China.Footnote 2 Though the impacts of unilateral policy are measurable, the magnitude of the resulting leakage will depend on the current climate policies, implementing countries, and sectoral coverage. Unlike previous studies, we start the analysis from the current policy and climate targets for these regions, then move to their latest climate neutrality targets. CBAM is then introduced under this neutrality framework and being assessed for its potentials of CBAM to reduce emissions leakage, sectoral competitiveness, and their distributional allocations in each region or as a club. Scenario development also involves sectoral analysis, the basis and the adjustment tariff target in order to improve the global-cost effectiveness.

Our analysis confirms that collective implementation reduces leakage and improves productivity especially in energy-intensive industries (EII). The collective implementation also improves welfare relative to a non-CBAM and or unilateral implementation, where welfare contribution from trade is stronger for the US than for the EU or China. The following section discusses the current literature of CBAM, the critical aspect and the implications. A modelling approach is addressed in Sect. 3, and Sect. 4 elaborates the scenario development, numerical results and analysis. Results are concluded in Sect. 5.

2 Literature review

In general, studies investigating CBAM report impacts due to changes in production output (Babiker and Rutherford 2005; Mattoo et al. 2009; Böhringer et al. 2010; Winchester et al. 2011). Three aspects emerge from these prior analyses. The first is CBAM's impact on reducing leakage and improving overall cost effective if it is unilaterally implemented. The second aspect is whether CBAM limits the negative effect on the production of EII. And if it creates negative terms of trade effects that impact the welfare (Gros 2009).

The coalition scenario created to address the leakage channels will determine how effectively CBAM reduces leakage (Branger and Quirion 2014). Most studies that focus on the EU as a unilateral region or as a central player in the coalition, confirm that CBAM reduces leakage (Elliott et al. 2010; Böhringer et al. 2012c; Bednar-Friedl et al. 2012; Perdana and Vielle 2022) despite the significance and the magnitude of the reported results not always being in agreement. In contrast, the analysis centralizing on the US finds no significant evidence for leakage. McKibbin et al. (2016) finds non-positive leakage in the unilateral implementation of the carbon tax in the US. Implementing carbon tax lowers growth in the US and slows down the global economies. It further results in declining in global emissions. Policy scenarios with a CBAM tax on imports with the baseline reflecting current policies also find no evidence of leakage (McKibbin et al. 2012).

The leakage effect may also differ between macro and sectoral levels. Kuik and Hofkes (2010) and Antimiani et al. (2013) confirm a modest reduction effect in the EU macro-levels. Nonetheless, the sectoral rate of EII’s leakage such as in the iron and steel industry may be reduced significantly. Böhringer et al. (2012a) discovers that production losses fall from 2.8 to 1% compared to the reference case, implying carbon border adjustment’s competence in protecting the competitiveness of energy intensives industries in abating regions.

In contrast, McKibbin et al. (2018) study discovers potential declines in export when quantifying the economic and environmental impact of carbon taxation in the US in the presence of a CBAM. Imposing CBAM tends to produce lower net exports than the carbon taxes alone. It raises the value of the dollar relative to other currencies, thus lowering exports more than imports. This finding is consistent with standard results in the international trade literature on the effects of import tariffs and export subsidies on real exchange rates, yet often overlooked in the discussion of domestic carbon policy.

On the other hand, China has been chiefly seen as a vital target country of CBAM. Among the few qualitative analyses, Li and Zhang's initial study (2012) ensures CBAM will result in relocations of outputs across regions and countries. Although, when compared to a unilateral tax, CBAM would be a costly and inefficient policy instrument to reduce emissions, it could function as a coercion strategy. This coercion strategy might significantly influence China’s motivation to impose carbon tariffs. China is a large economy and energy consumer that is very open to international trade. Looking ahead, the Chinese government considers potential interactions between China and other economies when designing tax reforms (Lin and Li 2012). Seeing the interaction between the US and the EU that tends to be confrontational, China may impose a carbon tax to give an equal game to play, or it may not. A simulation study of China’s imposing carbon tax against American carbon tariffs results in fluctuation in China's GDP and greatly impacts high-carbon industries (Zhu et al. 2020).

From these current literature, three things can be concluded. First, a unilateral CBAM implementation between the EU and the US will likely lead to opposite results; effective for the EU but contradictory to the US. Second, the non-existing literature on China implementation in CBAM should be a priority in further research. And third, an assessment of the collective implementation of CBAM between these major emitters is important to project the effect on global leakage, sectoral competitiveness, and welfare in each region. Implementing CBAM would change the pay-offs in climate negotiation and be an incentive for abating their emissions.

The projected impacts of unilateral implementation policy are well known (Felder and Rutherford 1993), but the relative magnitude of resulting leakages, competitiveness level, and welfare impacts if countries move collectively remains an empirical question, which all depends on the policies in place, the implementing countries, and the affected sectors. This paper aims to address this empirical question. It focuses on scrutinizing the impact of CBAM on the EU, the US, and China collectively as a club, based on the current climate policies and targets. A carbon neutral commitment is the conditional factor to join the climate club for collective CBAM, which have been all indicated by the EU, China and the US.

The analysis will prove a hypothesis of ineffective CBAM of a small coalition by Antimiani et al. (2013). The notion of a coalition was introduced by Buchanan (1965) and then up-scaled by Nordhaus (2015) by positing climate as a public goods. Increasing tariffs unilaterally increases leakage (Jakob et al. 2013), but leakage is still likely to occur in a limited coverage coalition and consequently offset emissions reduced by the coalition (Veenendaal and Manders 2008). A small coalition still causes a reallocation of emission reductions; thus, this is also not effective in reducing leakage. Furthermore, the implementation should be directed towards a global solution rather than a domestically oriented point of view. In addition to this, widening the scope of the coalition could avoid abuse of pure protectionists, which could lead to retaliatory tit for tat trade wars.

For competitiveness analysis, Weitzel et al. (2012) argues that the EU has the strongest incentives followed by the US, to increase carbon-based border tax prices across regions once a coalition is formed. Strategic use for the terms of trade is more substantial than environmental use for reducing carbon emissions. Böhringer et al. (2017) claim that protective measures in CBAM increase the comparative advantage and competitiveness, but may reduce output value due to negative Income Effect (IE) should the coalition be formed. Reduction in output value should also be the center of analysis of collective CBAM implementation. Sub-global abatement inevitably induces changes in trade, comparative advantage, and competitiveness and arguably affects the coalition welfare.

3 The GEMINI-E3 model

The vast majority of research around CBAM is built on the Computable General Equilibrium (CGE) models, where carbon leakage and distributive allocation between sectors could adequately be assessed. The CGE is widely adaptable to address the economic impact of climate-change mitigation policies and the level of ambition required to reach the commitments. The multi-sectoral calibration and dynamic global scope encompass international trade and emissions and adequately address the impacts in terms of allocation of production, international trade and emissions of Greenhouses Gases (GHGs). For simulations and analytical purposes, this study uses the latest modification of GEMINI-E3 based on the study by Bernard and Vielle (2008). The model incorporates multi-country, multi-sector, recursive computable general equilibrium model that assumes of total flexibility in both macroeconomic markets such as capital and international trade markets (with endogenously driven associated prices being the real rate of interest and the real exchange rate) and microeconomic or sector markets (goods, factors of production, etc.).

The current version is built on the GTAP 10 data base (Aguiar et al. 2019) with the year 2014 as the reference year. For analytical purposes, the regional aggregation of this version covers the EU, the US, China and the rests of the world which is represented by eight countries and regions. The number of sectors is limited to 11 for a tractable and acceptable computation time. GEMINI-E3 is recursive dynamic, with backward looking (adaptive) expectations.

For each sector, the model computes the demand of its production based on of household consumption, government consumption, exports, investment and intermediate uses. Total demand is then divided between domestic production and imports using the Armington assumption (Armington 1969), which assumes that domestic and imported goods are not perfectly homogenous.

Production technologies are described by a nested Constant Elasticity of Substitution (CES) functions. Simulations use the endogenously carbon price for the CBAM tariff, not a stylized unilateral carbon pricing, to tackle the possibility of endogenously decreasing supply elasticities and sharply increasing marginal leakage rates for large coalitions as indicated by Boeters and Bollen (2012). This technique avoids an overestimation of industrial output loss and underestimation the increase in the CO2 embodied in imports that affect the accuracy of efficiency of border carbon adjustments at reducing leakage (Caron 2012).

GEMINI-E3 calibrates GHG emissions (CO2 and non-CO2) from policy databases of countries to sectoral level of aggregation. This feature enables the imposition of CBAM, either as an import tariff or export subsidy, and estimates its impacts, especially for leakage and decomposition. The way the carbon contents are computed in GEMINI-E3 is detailed in Appendix B.2

In all the scenario preformed in this paper, we assume that the government’s deficit or surplus is fixed. When a CBAM is implemented, the revenue collected will be redistributed to households as lump sum transfer.

The total emissions leakage for a country is equal to the emission change by sectors and household consumption. Other critical features of GEMINI-E3 including its GHG emissions, leakage decomposition and methods of welfare assessments, are detailed in the Appendices A and C.Footnote 3

4 Scenario development, numerical result and analysis

4.1 Current policies implemented in the club

The scenario design of current policies follows the CD-Links policies database, documented in McCollum et al. (2018) and Roelfsema et al. (2020), along with International Energy Agency (2020) to ensure a more updated complementary climate-development policy until the year 2030. The assumptions on demography, GDP, energy prices and technology costs follow our previous work on the H2020 Paris-Reinforce project, detailed in Giarola et al. (2021) and Sognnaes et al. (2021). This scenario includes a subset of the high-impact policies collected and analyzed for the period 2015 to 2030. For robustness, the scenario will be projected until 2040 to fit the undefined climate policies post-2030 and the feasibility of policy implementation due to technological and sectoral granularity in the model. All relevant policies are listed in the Table A.13 of Appendix.

Particularly for the EU, the reference scenario uses still targets in 2030 climate and Energy Framework of the −43% emissions decrease with respect to 2005 for ETS and the −30% for non-ETS emissions. These two carbons’ prices are then assumed to grow in line with GDP per capita rates until 2040.Footnote 4 Table 1 shows keys performance indicators for the selected regions in the year 2020. The current policies scenario results in GHG emissions as described in Fig. 1.

Around 16% of the world production of energy-intensive goods are traded among countries),Footnote 5 and the exchange of these goods amounts to 7′515 billion of US$Footnote 6by 2040 (Table 2). The club represents 46% of the exports and 44% of the imports. As expected, China is not only a net exporter to the US and the EU, but also is a net importer from the other regions.

4.2 Climate policies implemented in the club

The climate policies scenario integrates the new targets recently decided by the alliance as elaborated in the previous subsection. In line with the EU’s new target to cut GHG emissions by at least 55% from 1990’s levels, we follow the proposal of the EC’s impact assessment report (European Commission 2020) to increase the targets to −65% for ETS sectors and to −40% for Effort Sharing Regulation (ESR) sectors by year 2030 with respect to 2005 levels.

In the US, even if the commitments defined by the Biden administration have not been specified in detail, we assume that the existing regional cap-and-trade programs already implemented into the electricity generation sectorFootnote 7 will be extended to other states and merged (Hibbard et al. 2018). We also assume that the US EII will participate into the US ETS market. For China, our climate policy scenario sets no specific targets for their ETS sectors, since the trading market has not been escalated to the national level. National abatement targets are adjusted linearly to achieve net-zero emissions by the targeted year. The abatement target for China is 100% in 2060, with national abatement targets linearly adjusted (25% of 2020 in 2030, 50% in 2040, and 75% in 2050) to reach this net zero emissions target. Table 3 lists these new targets.

In this scenario, we implement the GHG and CO2 targets in the club with unilateral CO2 prices. In the EU, an ETS price and a GHG tax (applied on the ESR sectors) are implemented simultaneously, followed by the assumption of a fully auctioned quota in the ETS sector. A similar protocol is used for the US. With no precise definition of the climate policy, especially for ETS markets (Li et al. 2019; Yan et al. 2020), we assume that a uniform carbon price is implemented in China. Table 4 shows the results of CO2 prices.

Integrating the “Fit for 55” package results in a higher EU ETS price, which is now equal to 131 US$ in 2040.Footnote 8 The CO2 price applied in the EU ESR sectors reach 3353 US$ showing the stringency of the emissions reduction in these sectors, especially in the transportation and in non- CO2 GHG emissions. In the US, both the ETS and the CO2 price will emerge in the year 2030.The ETS reaches 275 US$ in 2040 with increasing pressure now placed on other sectors, raising the CO2 prices to 1080 US$ in 2040.Footnote 9 For comparison, China’s CO2 price is relatively the same compared to the EU and the US. Despite being lower than predicted in a recent study by Yuan et al. (2021) with an estimated 99 US$ in 2030, our projected CO2 price is consistent with similar simulations for China using CGE models (Cao et al. 2021).

Table 5 shows the impact of these unilateral carbon prices on CO2 emissions. Global CO2 emissions decrease by 10.1 GT CO2 or 23%, whereas global GHG emissions are reduced by 12.4 Gt CO2-eq or 20% by 2040. As can be expected, GHG emissions increase in all regions beyond the club. The leakage rate is equal to 4.8%.

The EII production fall range between 4.8 and 12.2%, whereas amongst non- alliance member, production increase occurs mainly in Russia (+ 22.9%), followed by the Middle East (+ 12.5%) due to the specialization of these regions in energy-intensive industries. The world GDP slightly decreases by 1.1%, due to the depressive impact of the climate policy within the club. Outside the coalition, GDP increases; however, the welfare measure gives a different picture where all regions are negatively affected. The US, EU and China suffer from negative welfare changes due to the GHG taxation. And others, mainly energy-exporting countries, have revenue loss from energy exports.

Positive change in GHG emissions in all regions beyond the club indicates the occurrence of leakage. To distinguish the contribution from EII, we use a different approach for leakage decomposition. It starts from the leakage related to production changes without considering the emission changes induced by relative price changes (mainly the decrease of international fossil energy prices). For EII, we decompose this component as related to change in global reallocation (i.e. trade) and the one linked to domestic demand. It is then followed by decomposition related to the component of aggregated production change for non-EII sectors and consumptions. The residual is called “other general equilibrium effects”, which is mainly driven by reduced international fossil energy prices. Figure 2 shows the leakage decomposition in these four components.Footnote 10

At the worldwide level, the price component (“OGE” in Fig. 2), the non- EII component, and the EII component related to trade account for around one- third of leakage. At the regional level, we find many more disparities according to national conditions. Leakage related to EII (blue bars in Figure) dominates in the Middle East, India and Brazil. The decrease of international fossil energy prices induces a CO2 emission decrease in India. A lower international natural gas prices generates the substitution of domestic coal by imported natural gas in Indian electricity generation, which decreases CO2 emissions in this sector.

The international trade of EII goods falls by 16% at the worldwide level. Exports from the club decrease by 30%, but imports from the Club remain un- changed except for China (Table 6).

4.3 CBAM integration

CBAM could be implemented by a border charge on imports, a border rebate for exports, or full border adjustment. The tendency, however, goes to implementation of CBAM as a border charge on import for less complexities (Mehling and Ritz 2020) and its consistency with the World Trade Organisation (WTO) rules (Evans et al. 2021). Implementing CBAM as an export subsidy may violate international trade law for its conditional upon exportation classified as a prohibited subsidy under the Agreement on Subsidies and Countervailing Measures (Holzer 2014). Following Cosbey et al. (2019), there are three following categories or scopes of calculating emissions contents in CBAM. Carbon contents could be based on either direct emission from fuel combustion within the sector boundary (Scope 1), direct emissions plus the CO2 content of electricity consumed by the sector or indirect emissions associated with energy use (Scope 2), or direct emissions and any indirect production-related emissions including all the CO2 content of intermediate consumption by the sector (Scope 3). Computing the CO2 content with Scope 1 is the simplest, while complexity grows with Scope 2, and 3. Methodologies for calculating these emission contents are detailed in the Appendix.

As legal issue might be prohibitive to a collective implementation of CBAM (Böhringer et al. 2012b), the system is thus more likely to comply with international law characterized by low rates and limited coverage. This brings to the likelihood that the potentials of CBAM go with scope 1 or 2 rather than scope 3, since the carbon content for compensation at the border includes indirect emissions associated with intermediate non-fossil inputs that are less likely to comply with WTO. The global cost-effectiveness of unilateral climate policy is also degraded rather than improved by a more complicated and detailed system in scope 3 (Böhringer et al. 2017). From environmental policy perspectives, the tariff is too high and fails to acknowledge a key behavioral response to redirect output in other markets. For comparative analysis, scenario development in this paper will evaluate CBAM, in all scopes and measure the impact on leakage, competitiveness and welfare indicators.

The analysis includes only CO2 contents for CBAM to avoid complexity and to keep the robustness of estimated results. We consider it as the limitation of our study, as CBAM should correspond to GHG emissions covered by Annex I to the EU ETS (European Commission 2021c) in Directive 2003/87/EC, including nitrous oxide (N2O) and perfluorocarbons (PFCs). Initial work to model non-CO2 emissions is done by Clora et al. (2021) using GTAP 10 non-CO2 database, with a shorter projection frame of 2030. This is clearly a matter for our future work.

The final aspect in implementing CBAM is the technique, whether the carbon contents will be based on the best available technology in abating countries or unregulated countries outside the club (Antimiani et al. 2013). The chosen technique is critical, especially if CBAM is applied as an import tariff. We follow the assessment by Ismer and Neuhoff (2007) to use domestic emissions of the exporting countries and to impose CBAM equal to projected carbon price of the importing countries (members of the club). Tons of carbon from domestic or international sources are subject to similar treatment consistent with WTO rules.

4.3.1 Determining industries candidate for CBAM

Following most literature focused on EII (i.e. industries where energy consumption represents a significant share of production costs), a holistic sectoral assessment to evaluate the gain in implementing CBAM is critical. As the first step in developing a climate policy scenario with CBAM, we analyze the impacts of implementation of CBAM as import tax for electricity generation, agriculture, EII, and other goods & services. The scenario runs using the direct emissions from fuel combustion within the sector boundary, or “scope 1” for CBAM implemented in all regulated countries in the club. Results are significant only for EII, where CBAM reduces the leakage effect and protects domestic productions (Fig. 3). The production change on other goods & services is non-negligible, but to include this sector in the CBAM is impractical for the heterogeneity of goods aggregated in this sector. Further analyses on the following sections particularise to the EII.

4.3.2 Determining CO2 content that must be used (scopes)

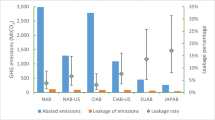

In determining the basis of the CO2 content in collective CBAM, the second step compares the implication of CBAM as an import tax using scopes 1, 2 and 3. The results of the three scenarios are reported in Fig. 4 for collective CBAM. Switching from scopes 1 to 2 significantly reduces leakage from 180 to 284 Mt CO2 and increases EII’s production from 253 to 450 million US$. The gain of scope 3 to scope 2 is much more limited, where leakages are reduced to 315 Mt CO2 and EII production only reach 527 million US$. Scope 3 also has the particularity of raising practical problems of implementation due to its complexities. Following this rationality, further analysis focuses on scope 2 on CBAM implementation.

4.3.3 Implementation of CBAM on EII with scope 2

The implementation of a CBAM decreases the leakage rate and limits production loss amongst countries of the club. CBAM also improves the welfare for club members but not for non-members, following the loss of production in energy-intensive products. Moving from unilateral (Table 7) to collective implementation of CBAM further reduces leakage, increases the competitiveness of EII and provides higher welfare improvement, proving the effectiveness of coalition to attain CBAM objective. Production change of EII in China has slightly declined by joining the club, indicating a slight competitiveness loss by the US and EU products in the global market. However, this is insignificant, as welfare change in China is still higher by collective implementation in the club.

Welfare decomposition shown in Table 8 reveals that implementing CBAM improves regions gains from trade (GTT), which justifies increasing competitiveness and net negative deadweight loss (DWL). The US’s trade effect on welfare is more substantial, yet lower DWL gives more dominant effects for both the EU and China. These findings prove that implementing CBAM, either unilateral or collectively, will positively impact US EII trade competitiveness. Further, these indicate that strategic use of the terms of trade is more substantial for the US, for the more robust incentives to increase the carbon tax by joining the coalition. These findings are still relevant to Weitzel et al. (2012), although the most robust incentives happen in the US instead of the EU. These also highlight the importance of constructing the simulation based on current (and updated), instead of assuming of no climate policies taken, affect simulations results’ robustness. In the absence of CBAM, the deadweight loss is higher in the EU than in the US and China due to more stringent abatement targets. When CBAM is implemented, the DWL is significantly reduced by revenue gained from import tax (Felbermayr et al. 2015).

In terms of export, CBAM reduces more of EII exports products. Table 9 shows more distortion in exports for the EU, US and China than the absence of CBAM (Table 6). Protective measures in CBAM may increase comparative advantages and competitiveness, but reduce the output value due to the negative Income Effect. Reduction of the output value is quite significant for EII because of considerable declines in the import of energy-intensive intermediate goods that reduce production. We assess that this factor is more justifiable than the effects of import tariffs on exchange rates as suggested by McKibbins. As the coalition grows, the effects of import tariffs on exchange rates will become less significant, as the value of local currencies of club members will appreciate.

4.3.4 Full implementation of CBAM–import tariff and export subsidies

The analysis expands once collective CBAM is complemented with an export subsidy, in addition to an import tariff (full implementation). Figure 5 compares leakage, competitiveness, and welfare change effects between the import tariff and the full implementation. The latter gives slightly higher leakage reduction, more EII production, and insignificant differences in welfare change. Export decomposition in Table 10 also reveals minor differences than with import tariffs. Subsidies cause no significant improvements in export reductions, validating the stronger impact of negative Income Effects of a higher cost of intermediate goods that reduces the output.

5 Conclusion

Carbon Border Adjustments (CBAM) have been formally introduced as part of the EU Green Climate Deal to reach its commitment to carbon neutrality by 2050 and increase the competitiveness of the EU’s energy-intensive industries. While pursuing climate efforts to limit global warming requires a collective implementation, the EU’s commitment to implement CBAM by 2025 should also impact other countries, including China and the US. On the other hand, China has also declared its commitment to reach carbon neutrality by 2060, and the US’ new administration has started to take more serious action towards climate abatement. This paper begins from a hypothetical standpoint and explores whether CBAM should be implemented collectively by the world’s most significant emissions contributors, namely the EU, China, and the US. As an instrument to minimize carbon leakage, the effects and feasibility of CBAM will depend on multiple design options. Differing from a myriad of studies that focus on unilateral CBAM, this paper analyzes the distributional impacts of joint implementation of CBAM, and emphasizes collective implications on leakage, sectoral competitiveness, and welfare by projecting climate neutrality relative to current policies and climate targets.

There are four findings concluded from the analysis. First, stringent climate ambitions in the EU, China, and the US result in positive GHG emissions change in all other regions, confirming the leakage. But the decomposition shows no such dominant channel of leakage between the energy market or reallocation of productions. But leakage caused by reallocating production from EII is significant in Brazil, Russia and Middle East.

Second, the implementation of CBAM has to be applied only in EII in order to be effective in reducing leakage effects and protecting domestic productions. Its impact on other sectors remains insignificant. In determining the basis of the CO2 content in CBAM, switching from a direct carbon content basis (scope 1) to include the electricity consumption (scope 2) significantly reduces leakage and increases EII production. These findings contradict the recent EC proposal on CBAM, which calculates based only on direct CO2 emissions (Scope 1) for both EII and electricity generation (European Commission 2021c). Extending the scenario to include indirect emissions contents (scope 3) results in an insignificant reduction in leakage and production improvement. Following these results, compatibility with WTO rules, and complexities of implementation, means that adoption of scope 2 is likely to result in far more effective impacts of CBAM.

Third, a coalition reduces more leakages, improves production on energy- intensive industries, and increases club’s welfare relative to a non-CBAM and or unilateral implementation. Switching from unilateral to collective implementation of CBAM results in more leakage reduction, confirming the effectiveness of CBAM in a bigger coalition. Production of EII goods escalates in the EU and the US, but slightly reduces in China due to trade competition. Gains on trade improves welfare for the US, while the negative deadweight loss of revenue gained from import tax is more dominant for the EU and China.

Fourth, CBAM reduces further EII product exports. CBAM may increase the comparative advantage and competitiveness, but reduces the output value due to the negative Income Effect of post-import tariff on imported intermediate goods. This caused is more significant than the implication of exchange rates suggested by several studies. Switching into full implementation of CBAM by adding the export subsidies results in no further significant effects on leakage reduction but slightly improves production with no change in welfare.

Finally, the significant impacts of CBAM on aggregated EII emphasizes the importance of scrutinizing the impacts on each type of these energy industries. However, representing full disaggregated EII requires detailed inclusion of non- CO2 gas, as well as necessitates extending three methodologies of imposing CBAM based on emissions contents. In addition to this, mapping the source of non-CO2 to different classifications of energy industries (should this sector be disaggregated) is complex and requires secondary feedbacks for data robustness. This remains a limitation of this current work and should be regarded in further research.

Data availability

An excel sheet that includes the numerical results will be provided once the paper is accepted, uploaded on a Zenodo space.

Notes

Antony J. Blinken, Secretary of State, February 19, 2021: The United States Officially Rejoins the Paris Agreement. US Department of State. https://www.state.gov/the-united-states.

We acknowledge that the US has a current free trade agreement with Mexico and Canada (USMCA, which can detract joining from the coalition. However, we assess that a climate club including the US is feasible, given the current proposal from congressional Democrats for import tax based on carbon content (see: https://www.bloomberg.com/news/articles/2021-07-14/democrats-propose-tax-on-carbonintensive-imports-in-budget-deal) and possibility to amend the current agreement to extend to environmental modules (see: https://www.iatp.org/trade-agreements-achieve-climate-ambitions).

This can also be found on the webpage of the H2020 Paris-Reinforce project. See https://paris-reinforce.eu/i2am-paris/models

This treatment distinguishes between the definition of current and climate policies scenarios in our analysis, with the latter incorporating carbon neutral targets in 2050-2060 and the adjusted abatement target in precedent years.

Without considering intra-trade within the European Union and other aggregated regions.

In the paper, all the US$ values refer to US$ of the year 2014.

Such as the Regional Greenhouse Gas Initiative or the California cap and trade initiative.

With the previous target, the EU Reference Scenario projected the ETS price to be approximately 80 Euro per ton of CO2 in 2040 (European Commission 2021a).

Leakage decompositions are detailed in the Appendix C.

References

Aguiar A, Chepeliev M, Corong EL, McDougall R, Van Der Mensbrugghe D (2019) The GTAP data base: version 10. J Glob Econ Anal 4(1):1–27

Antimiani A, Costantini V, Martini C, Salvatici L, Tommasino MC (2013) Assessing alternative solutions to carbon leakage. Energy Econ 36:299–311

Armington PS (1969) A theory of demand for products distinguished by place of production. Staff Papers 16(1):159–178

Babiker MH, Rutherford TF (2005) The economic effects of border measures in subglobal climate agreements. Energy J. https://doi.org/10.5547/ISSN0195-6574-EJ-Vol26-No4-6

Bednar-Friedl B, Schinko T, Steininger KW (2012) The relevance of process emissions for carbon leakage: a comparison of unilateral climate policy options with and without border carbon adjustment. Energy Econ 34:S168–S180

Bernard A, Vielle M (2008) GEMINI-E3, a general equilibrium model of international–national interactions between economy, energy and the environment. CMS 5(3):173–206

Bistline J, Abhyankar N, Blanford G, Clarke L, Fakhry R, McJeon H, Zhao A (2022) Actions for reducing US emissions at least 50% by 2030. Science 376(6596):922–924

Boeters S, Bollen J (2012) Fossil fuel supply, leakage and the effectiveness of border measures in climate policy. Energy Econ 34:S181–S189

Böhringer C, Rutherford TF (2002) Carbon abatement and international spillovers. Environ Resource Econ 22(3):391–417

Böhringer C, Fischer C, Rosendahl KE (2010) The global effects of subglobal climate policies. BE J Econ Anal Policy. https://doi.org/10.2202/1935-1682.2583

Böhringer C, Balistreri EJ, Rutherford TF (2012a) The role of border carbon adjustment in unilateral climate policy: overview of an energy modeling forum study (EMF 29). Energy Econ 34:S97–S110

Böhringer C, Bye B, Fæhn T, Rosendahl KE (2012b) Alternative designs for tariffs on embodied carbon: a global cost-effectiveness analysis. Energy Econ 34:S143–S153

Böhringer C, Carbone JC, Rutherford TF (2012c) Unilateral climate policy design: efficiency and equity implications of alternative instruments to reduce carbon leakage. Energy Econ 34:S208–S217

Böhringer C, Carbone JC, Rutherford TF (2016) The strategic value of carbon tariffs. Am Econ J Econ Pol 8(1):28–51

Böhringer C, Garcia-Muros X, Cazcarro I, Arto I (2017) The efficiency cost of protective measures in climate policy. Energy Policy 104:446–454

Böhringer C, Schneider J, Asane-Otoo E (2021) Trade in carbon and carbon tariffs. Environ Resource Econ 78(4):669–708

Branger F, Quirion P (2014) Would border carbon adjustments prevent carbon leakage and heavy industry competitiveness losses? Insights from a meta-analysis of recent economic studies. Ecol Econ 99:29–39

Buchanan JM (1965) An Economic Theory of Clubs. Economica 32(125):1–14

Cao J, Dai H, Li S, Guo C, Ho M, Cai W, Zhang X (2021) The general equilibrium impacts of carbon tax policy in China: a multi-model comparison. Energy Econ 99:105284

Caron J (2012) Estimating carbon leakage and the efficiency of border adjustments in general equilibrium—Does sectoral aggregation matter? Energy Econ 34:S111–S126

Clora F, Yu W, Corong E (2021) Alternative border-carbon-adjustment mechanisms in the European Union and responses: aggregate and within-coalition results (Presented during the 24th Annual Conference on Global Economic Analysis (Virtual Conference)). Purdue University, West Lafayette, IN: Global Trade Analysis Project (GTAP)

Clora F, Yu W (2022) GHG emissions, trade balance, and carbon leakage: Insights from modeling thirty-one European decarbonization pathways towards 2050. Energy Econ 113:106240

Condon M, Ignaciuk A (2013) Border carbon adjustment and international trade: a literature review

Cosbey A, Droege S, Fischer C, Munnings C (2019) Developing guidance for implementing border carbon adjustments: lessons, cautions, and research needs from the literature. Rev Environ Econ Policy 13:3–22

Elliott J, Foster I, Kortum S, Munson T, Perez Cervantes F, Weisbach D (2010) Trade and carbon taxes. Am Econ Rev 100(2):465–469

European Commission. (2019). Communication from the commission to the european parliament, the european council, the council, the european economic and social committee and the committee of the regions. URL https://ec.europa.eu/info/sites/default/ files/european-green-deal-communication_en.pdf

European Commission (2020). Impact assessment report accompanying the document stepping up Europe’s 2030 climate ambition, investing in a climate-neutral future for the benefit of our people. COM/2020/176 final

European Commission (2021a). EU reference scenario 2020

European Commission. (2021b) Summary Report: Public consultation on the Carbon Border Adjustment Mechanism (CBAM). URL https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/12228-EU-Green-Deal-carbon-border-adjustment mechanism-/ public-consultation_en

European Commission. (2021c). Regulation of the European parliament and of the council establishing a carbon border adjustment mechanism

European Parliament. (2019). What is carbon neutrality and how can it be achieved by 2050. https://www.europarl.europa.eu/news/en/headlines/society/20190926STO62270/what-is-carbon-neutrality-and-how-can-it-be-achieved-by-2050

Evans S, Mehling MA, Ritz RA, Sammon P (2021) Border carbon adjustments and industrial competitiveness in a European Green Deal. Climate Policy 21(3):307–317

Felbermayr G, Jung B, Larch M (2015) The welfare consequences of import tariffs: a quantitative perspective. J Int Econ 97(2):295–309

Felder S, Rutherford TF (1993) Unilateral CO2 reductions and carbon leakage: the consequences of international trade in oil and basic materials. J Environ Econ Manag 25(2):162–176

Giarola S, Mittal S, Vielle M, Perdana S, Campagnolo L, Delpiazzo E, van de Ven DJ (2021) Challenges in the harmonisation of global integrated assessment models: a comprehensive methodology to reduce model response heterogeneity. Sci Total Environ 783:146861

Gros D (2009) Global welfare implications of carbon border taxes, vol 315. Ceps, Brussels

Gütschow J, Jeffery L, Gieseke R, Günther A, Gebel R, Stevens D, Rocha M (2019) The PRIMAP-hist national historical emissions time series (1850-2017) (V. 2.1 updated November 2019)

Harrison WJ, Horridge JM, Pearson KR (2000) Decomposing simulation results with respect to exogenous shocks. Comput Econ 15(3):227–249

Helm D, Hepburn C, Ruta G (2012) Trade, climate change, and the political game theory of border carbon adjustments. Oxf Rev Econ Policy 28(2):368–394

Hibbard PJ, Tierney SF, Darling PG, Cullinan S (2018) An expanding carbon cap-and-trade regime? A decade of experience with RGGI charts a path forward. Electr J 31(5):1–8

Hoesly RM, Smith SJ, Feng L, Klimont Z, Janssens-Maenhout G, Pitkanen T, Zhang Q (2018) Historical (1750–2014) anthropogenic emissions of reactive gases and aerosols from the Community Emissions Data System (CEDS). Geosci Model Dev 11(1):369–408

Höglund-Isaksson L, Winiwarter W, Purohit P, Rafaj P, Schöpp W, Klimont Z (2012) EU low carbon roadmap 2050: Potentials and costs for mitigation of non-CO2 greenhouse gas emissions. Energ Strat Rev 1(2):97–108

Holzer K (2014) Carbon-related border adjustment and WTO Law. Edward Elgar, Cheltenham

International Energy Agency (2020) IEA Policy Database 2020. https://www.iea.org/policies. Accessed 11 Nov 2021

Ismer R, Neuhoff K (2007) Border tax adjustment: a feasible way to support stringent emission trading. Eur J Law Econ 24(2):137–164

Jakob M, Marschinski R, Hübler M (2013) Between a rock and a hard place: a trade-theory analysis of leakage under production-and consumption-based policies. Environ Resource Econ 56(1):47–72

Kuik O, Hofkes M (2010) Border adjustment for European emissions trading: Competitiveness and carbon leakage. Energy Policy 38(4):1741–1748

Li A, Zhang A (2012) Will carbon motivated border tax adjustments function as a threat? Energy Policy 47:81–90

Li H, Zhang M, Li C, Li M (2019) Study on the spatial correlation structure and synergistic governance development of the haze emission in China. Environ Sci Pollut Res 26(12):12136–12149

Lin B, Li A (2012) Impacts of removing fossil fuel subsidies on China: How large and how to mitigate? Energy 44(1):741–749

Mathieu C (2021) Can the biggest emitters set up a Climate Club? A review of International Carbon Pricing Debates. Études de l’Ifri, Paris

Mattoo A, Subramanian A, Van Der Mensbrugghe D, He J (2009) Reconciling climate change and trade policy. Center for Global Development Working Paper, 189

McCollum DL, Zhou W, Bertram C, De Boer HS, Bosetti V, Busch S, Riahi K (2018) Energy investment needs for fulfilling the Paris agreement and achieving the sustainable development goals. Nature Energy 3(7):589–599

McFarland JR, Fawcett AA, Morris AC, Reilly JM, Wilcoxen PJ (2018) Overview of the EMF 32 study on US carbon tax scenarios. Climate Change Econ 9(01):1840002

McKibbin W, Morris A, Wilcoxen P, Cai Y (2012) The potential role of a carbon tax in US fiscal reform. The Climate and Energy Economics Project. The Brookings Institution, Washington

McKibbin WJ, Morris AC, Wilcoxen PJ (2016) Pricing carbon in the united states: a model-based analysis of power sector only approach. Resour Energy Econ 36:130–150

McKibbin WJ, Morris AC, Wilcoxen PJ, Liu W (2018) The role of border carbon adjustments in a US carbon tax. Climate Change Econ 9(01):1840011

Mehling MA, Ritz RA (2020) Going beyond default intensities in an EU carbon border adjustment mechanism (No. EPRG2026)

Nordhaus W (2015) Climate clubs: Overcoming free-riding in international climate policy. Am Econ Rev 105(4):1339–1370

Perdana S, Tyers R (2020) Global climate change mitigation: strategic incentives. Energy J. https://doi.org/10.5547/01956574.41.3.sper

Perdana S, Vielle M (2022) Making the EU carbon border adjustment mechanism acceptable and climate friendly for least developed countries. Energy Policy 170:113245

Roelfsema M, van Soest HL, Harmsen M, van Vuuren DP, Bertram C, den Elzen M, Vishwanathan SS (2020) Taking stock of national climate policies to evaluate implementation of the Paris Agreement. Nat Commun 11(1):1–12

Sognnaes I, Gambhir A, van de Ven DJ, Nikas A, Anger-Kraavi A, Bui H, Peters GP (2021) A multi-model analysis of long-term emissions and warming implications of current mitigation efforts. Nat Clim Chang 11(12):1055–1062

Tagliapietra S, Wolff GB (2021) Form a climate club: United States, European Union and China. Nature 591:526–528

United Nations Framework Convention on Climate Change (2018). Greenhouse gas inventory data

Veenendaal P, Manders T (2008) Border tax adjustment and the EU-ETS, a quantitative assessment (No. 171). CPB Netherlands Bureau for Economic Policy Analysis

Weitzel M, Hübler M, Peterson S (2012) Fair, optimal or detrimental? Environmental vs. strategic use of border carbon adjustment. Energy Econ 34:S198–S207

Winchester N, Paltsev S, Reilly JM (2011) Will border carbon adjustments work? BE J Econ Anal Policy. https://doi.org/10.2202/1935-1682.2696

Yan Y, Zhang X, Zhang J, Li K (2020) Emissions trading system (ETS) implementation and its collaborative governance effects on air pollution: the China story. Energy Policy 138:111282

Yuan M, Barron AR, Selin N, Picciano P, Metz LE, Reilly J, Jacoby H (2021) Meeting potential new US climate goals

Zhu N, Qian L, Jiang D, Mbroh N (2020) A simulation study of China’s imposing carbon tax against American carbon tariffs. J Clean Prod 243:118467

Acknowledgements

All persons who have made contributions to the work reported in the manuscript, but who do not meet the criteria for authorship, are named in this acknowledgement, and have given us their permissions to be named. The H2020 European Commission Project supports this work “PARIS REINFORCE” under grant agreement No. 820846. The sole responsibility for the content of this paper lies with the authors; the paper does not necessarily reflect the opinions of the European Commission. Thanks to Baptiste Boitier, Sascha Nick, Philippe Thalmann, the EPFL-Leure team for valuable discussions on the topic, and anonymous reviewers for the constructive feedback of this paper.

Funding

Open access funding provided by EPFL Lausanne. The H2020 European Commission Project “PARIS REINFORCE” supports this work under grant agreement No. 820846, as well as the Swiss State Secretariat for Education, Research and Innovation (SERI) Project No. 22.00361 as part of the Horizon Europe European Commission Project “DIAMOND” under Grant Agreement No. 101081179. The sole responsibility for the content of this paper lies with the authors; the paper does not necessarily reflect the opinions of the European Commission.

Author information

Authors and Affiliations

Contributions

Both authors contribute to the conception and design of the study, acquisition of data, and the analysis. Both are also drafting and revising the manuscript. All persons who meet authorship criteria are listed as authors, and all authors certify for full participation in the work to take responsibility for the content in the concept design, analysis, writing or the revision of the manuscript. Each author certifies that this material has not been published before.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that we do not have a competing financial interest that could have been appeared to influence the work reported in this paper.

Ethical approval

The research involved no human participants or animals; thus, compliance with the ethical standard is unnecessary.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Appendix A. Key features of the model–GEMINI-E3

Sectoral disaggregation distinguishes sectors participating in the ETS market from others such as petroleum products, electricity generation, and energy-intensive industries. Energy-intensive industries comprise the iron and steel industries, the chemical industry, the non-ferrous metals industry, the non-metallic minerals products, and the paper and paper products. Three other energy goods are described by the model: coal, crude oil, and natural gas. The remaining five sectors consist of agriculture, land transport, sea transport, air transport, and other goods and services that aggregates all the other sectors.

Household’s behavior consists of three interdependent decisions: (1) labor supply; (2) savings; and (3) consumption of various goods and services. Labor supply and the rate of savings are exogenously driven while the demand in the different commodities has prices of consumption and income (more precisely “spent” income, income after savings) as arguments, and is derived from a nested CES utility function, that is described in this Appendix. The government collects taxes and distributes the resulting revenues to households and firms through transfers and subsidies. Wage is chosen as a numeraire in each region.

1.1.1 Regional and sectoral classifications

Tables A.11 and A.12 provide the regional and sectoral classifications of the version of the GEMINI-E3 model used in this paper.

1.1.2 GHG emissions covered

GHG emissions in GEMINI-E3 is calibrated from the most up-to-date policy databases that cover the country to the sectoral level of disaggregation. Historical inventories for CO2 and methane, are based on Community Emissions Data System (CEDS) detailed in Hoesly et al. (2018). Nitrous oxide is aligned with PRIMAP Dataset (Gütschow et al. 2019), and F gases is calibrated from the U.S. Environmental Protection Agency (Unites States Environmental Protection Agency 2019). The non-CO2 comes from very diverse sources such agriculture, industries, transport, etc., and where emissions and mitigation options must be represented at the bottom-up level. These non-CO2 gases represent 19% of EU28 GHG emissions in 2016 (United Nations Framework Convention on Climate Change 2018). The agriculture sector contributes the most (52%), followed by the waste and waste-water sector (18%) and the energy sector (15%) (Höglund- Isaksson et al. 2012). Non-CO2 GHG emissions included in the EU-ETS are nitrous oxide emissions from adipic and nitric acid production, and perfluoro- carbons emissions from the aluminum industry. In constructing both reference and climate scenarios, abatement for non-CO2 gases are calculated based on the marginal abatement cost.

1.1.3 Assessing welfare cost

Welfare cost of countries are measured through compensating variation of income (CVI) to capture the change in structure of prices, which is the main effects of climate change policies. The cost consists of the domestic component or deadweight loss of taxation (DWL) and the imported component or gains from terms of trade (GTT). The GTT represents spill-over effects due to changes in international prices, mainly from the drop-in fossil energy prices resulting from the decrease in world energy demand. Decomposition of the welfare cost aims to approximate decomposition between domestic and imported cost to obtain a general idea of their relative importance (Harrison et al. 2000; Böhringer and Rutherford 2002). This approach is justified by the fact that the change in prices, in particular the prices of foreign trade, is fairly small. In practice, compensative variation income is first calculated from the results of the model, and the specification and coefficients of the demand function. GTT is then calculated based on the results of the involved scenario using the following equation:

where ∆Pexpi and ∆Pimpi represent changes in the exports and imports prices (for product i), with respect to the reference scenario; and Exporti and Importi represent the levels of exports and imports, respectively, in the reference scenario. Finally, the DWL is the difference between the compensative variation income and the GTT.

1.2 Appendix B. Methodology for calculating emissions contents for CBAM

Computing the CO2 content based on scope 1 is straightforward, it includes only the CO2 emissions emitted by fossil energy combustion by the respective sector. The CO2 content αi for the sector i and region r, is equal to the following equation:

where \({\mathrm{IOV}}_{\mathrm{r}}^{j,i}\) represents the intermediate consumption by sector i in fossil energy j (i.e. coal, petroleum coal, petroleum product, natural gas) in region r, \({\beta }_{\mathrm{R}}^{j}\) the CO2 emissions factor of fossil energy consumption j and \({XD}_{r}^{\mathrm{i}}\) the production level of sector i in region r.

Scope 2 includes not only direct emissions from fuel combustion but also content CO2 content of electricity consumed by sector i, that can be produced domestically or imported. This CO2 called \({\delta }_{r}^{i}\), is therefore equal to the following equation:

In addition, if a country imports electricity produced by a country that is the member of the club, the CO2 emissions of this import must not be taken into account (i.e. \(\delta_{{{\text{r}}\prime }}^{{{\text{elec}},}} = 0\, {\text{if}}\, {\text{r}}\prime \in {\text{the club}})\).

While scope 3 also considers CO2 contents of non-energy intermediate consumption. Therefore, this CO2 content called is \({\mu }_{\mathrm{r}}^{i}\) computed by equation:

If CBAM is implemented as a border charge only, it is assumed that the CO2 contents of goods exported by club are not considered, and \(\mu_{{{\text{r}}\prime }}^{i} = 0\, {\text{if}}\, {\text{r}}\prime \in {\text{the club}}\).

1.3 Appendix C. The algebra of leakage decomposition

As mentioned in the Sect. 2, emissions leakage is linked to several channels, we perform a decomposition analysis to understand the main mechanisms of the emissions leakage for countries that are not part of the coalition. We compute at sector level the leakage that is equal for sector i to its CO2 emissions (called \({\mathrm{CO}}_{2}^{\mathrm{i}}\)) change with respect to the current policies scenario:

The total emissions leakage for a country is equal to the sum of leakage by sector plus the emissions change related to household consumption (denoted \({\mathrm{CO}}_{2}^{\mathrm{H}}\)).

First, we can approximate the emissions that are related only to production change at the sectoral level without considering the emissions change that is induced by relative price changes, like the decrease of fossil energy prices. We compute this term by multiplying the variation of production in percentage (relative to the current policies scenario) to the emissions level of the sector in the current policies scenario.

Variables \(\overline{{\mathrm{Production} }^{i}}\) and \(\overline{{\mathrm{CO} }_{2}^{\mathrm{i}}}\) represent the production level of sector i and its CO2 emissions in the current policies scenario.

For household, the same computation can be done using change in aggregate household consumption:

In a second step, leakage related to production change can be decomposed into two components; one that is related to international trade, i.e. production change coming from change in imports and exports of the goods produced by the sector, and the other related only to domestic demand.

Finally, the residual leakage represents all other general equilibrium effects, which are mainly driven by the decrease of international energy prices and is represented by

Source: Climate Action Tracker (2020); CD LINK (2018). Aggregated Target Based on Weighted Average on Renewable Share of Individual Countries.

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Perdana, S., Vielle, M. Carbon border adjustment mechanism in the transition to net-zero emissions: collective implementation and distributional impacts. Environ Econ Policy Stud 25, 299–329 (2023). https://doi.org/10.1007/s10018-023-00361-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-023-00361-5

Keywords

- Carbon border adjustment mechanism

- Carbon leakage

- Computable general equilibrium model

- Climate club

- International competitiveness