Abstract

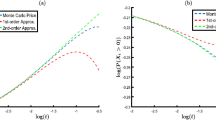

We consider a local volatility model, with volatility taking two possible values, depending on the value of the underlying with respect to a fixed threshold. When the threshold is taken at the money, we establish exact pricing formulas for European call options and compute short-time asymptotics of the implied volatility surface. We derive an exact formula for the at-the-money implied volatility skew which explodes as \(T^{-1/2}\), reproducing the empirical steep short end of the smile. This behaviour is a consequence of the singularity of the local volatility at the money. Finally, we look at continuous, non-differentiable versions of such a model. We still find, in simulations, exploding implied skews.

Similar content being viewed by others

References

Abate, J., Choudhury, G.L., Whitt, W.: An introduction to numerical transform inversion and its application to probability models. In: Grassmann, W.K. (ed.) Computational Probability, pp. 257–323. Springer, Boston (2000)

Alòs, E., León, J.A., Vives, J.: On the short-time behavior of the implied volatility for jump-diffusion models with stochastic volatility. Finance Stoch. 11, 571–589 (2007)

Bayer, C., Friz, P.K., Gatheral, J.: Pricing under rough volatility. Quant. Finance 16, 887–904 (2016)

Bayer, C., Friz, P.K., Gulisashvili, A., Horvath, B., Stemper, B.: Short-time near-the-money skew in rough fractional volatility models. Quant. Finance 19, 779–798 (2019)

Berestycki, H., Busca, J., Florent, I.: Asymptotics and calibration of local volatility models. Quant. Finance 2, 61–69 (2002)

Bodurtha, J., Jermakyan, M.: Nonparametric estimation of an implied volatility surface. J. Comput. Finance 2(4), 29–60 (1999)

Breiman, L.: Probability. Classics in Applied Mathematics, vol. 7. Society for Industrial and Applied Mathematics (SIAM), Philadelphia (1992)

Caravenna, F., Corbetta, J.: The asymptotic smile of a multiscaling stochastic volatility model. Stoch. Process. Appl. 128, 1034–1071 (2018)

Chen, C.W.S., So, M.K.P., Liu, F.-C.: A review of threshold time series models in finance. Stat. Interface 4, 167–181 (2011)

Chi, Z., Dong, F., Wong, H.Y.: Option pricing with threshold mean reversion. J. Futures Mark. 37, 107–131 (2017)

Decamps, M., Goovaerts, M., Schoutens, W.: Self exciting threshold interest rates models. Int. J. Theor. Appl. Finance 9, 1093–1122 (2006)

Dereudre, D., Mazzonetto, S., Roelly, S.: Exact simulation of Brownian diffusions with drift admitting jumps. SIAM J. Sci. Comput. 39, A711–A740 (2017)

Dupire, B.: Pricing with a smile. Risk 7(1), 18–20 (1994)

Engelmann, B., Koster, F., Oeltz, D.: Calibration of the Heston stochastic local volatility model: a finite volume scheme. Preprint (2011). Available online at http://ssrn.com/abstract=1823769

Étoré, P.: On random walk simulation of one-dimensional diffusion processes with discontinuous coefficients. Electron. J. Probab. 11, 249–275 (2006)

Étoré, P., Martinez, M.: Exact simulation for solutions of one-dimensional stochastic differential equations with discontinuous drift. ESAIM Probab. Stat. 18, 686–702 (2014)

Figueroa-López, J.E., Olafsson, S.: Short-time asymptotics for the implied volatility skew under a stochastic volatility model with Lévy jumps. Finance Stoch. 20, 973–1020 (2016)

Friz, P.K., Gerhold, S., Yor, M.: How to make Dupire’s local volatility work with jumps. Quant. Finance 14, 1327–1331 (2014)

Fukasawa, M.: Normalization for implied volatility. Preprint (2010). Available online at https://arxiv.org/abs/1008.5055

Fukasawa, M.: Asymptotic analysis for stochastic volatility: martingale expansion. Finance Stoch. 15, 635–654 (2011)

Fukasawa, M.: Short-time at-the-money skew and rough fractional volatility. Quant. Finance 17, 189–198 (2017)

Gairat, A., Shcherbakov, V.: Density of skew Brownian motion and its functionals with application in finance. Math. Finance 27, 1069–1088 (2017)

Gatheral, J.: The Volatility Surface: A Practitioner’s Guide. Wiley, New York (2011)

Gatheral, J., Hsu, E.P., Laurence, P., Ouyang, C., Wang, T.-H.: Asymptotics of implied volatility in local volatility models. Math. Finance 22, 591–620 (2012)

Gerhold, S., Gülüm, I.C., Pinter, A.: Small-maturity asymptotics for the at-the-money implied volatility slope in Lévy models. Appl. Math. Finance 23, 135–157 (2016)

Guyon, J.: Path-dependent volatility. Risk Mag. 2014, 52–58 (2014)

Guyon, J., Henry-Labordère, P.: The smile calibration problem solved. Preprint (2011). Available online at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1885032

Gyöngy, I.: Mimicking the one-dimensional marginal distributions of processes having an Ito differential. Probab. Theory Relat. Fields 71, 501–516 (1986)

Itô, K., McKean, H.P. Jr.: Diffusion Processes and Their Sample Paths, 2nd edn. Springer, Berlin (1974)

Kasahara, Y.: Tauberian theorems of exponential type. J. Math. Kyoto Univ. 18, 209–219 (1978)

Keilson, J., Wellner, J.A.: Oscillating Brownian motion. J. Appl. Probab. 15, 300–310 (1978)

Le Gall, J.-F.: One-dimensional stochastic differential equations involving the local times of the unknown process. In: Truman, A., Williams, D. (eds.) Stochastic Analysis and Applications, Swansea, 1983. Lecture Notes in Math., vol. 1095, pp. 51–82. Springer, Berlin (1984)

Lee, R.W.: Implied volatility: statics, dynamics, and probabilistic interpretation. In: Baeza-Yates, R., et al. (eds.) Recent Advances in Applied Probability, pp. 241–268. Springer, New York (2005)

Lejay, A.: On the constructions of the skew Brownian motion. Probab. Surv. 3, 413–466 (2006)

Lejay, A., Lenôtre, L., Pichot, G.: One-dimensional skew diffusions: explicit expressions of densities and resolvent kernel. Research Report (2015). Available online at https://hal.inria.fr/hal-01194187v2/

Lejay, A., Martinez, M.: A scheme for simulating one-dimensional diffusion processes with discontinuous coefficients. Ann. Appl. Probab. 16, 107–139 (2006)

Lejay, A., Pichot, G.: Simulating diffusion processes in discontinuous media. J. Comput. Phys. 231, 7299–7314 (2012)

Lejay, A., Pigato, P.: Statistical estimation of the oscillating Brownian motion. Bernoulli 24, 3568–3602 (2018)

Lejay, A., Pigato, P.: A threshold model for local volatility: evidence of leverage and mean reversion effects on historical data. Int. J. Theor. Appl. Finance 22(04), 1–24 (2019)

Linetsky, V., Mendoza, R.: The constant elasticity of variance model. In: Cont, R. (ed.) Encyclopedia of Quantitative Finance, pp. 328–334. Wiley, Chichester (2010)

Lipton, A.: The vol smile problem. Risk Mag. 2002, 61–65 (2002)

Lipton, A.: Oscillating Bachelier and Black–Scholes formulas. In: Lipton, A. (ed.) Financial Engineering—Selected Works of Alexander Lipton, pp. 371–394. World Scientific, Singapore (2018)

Lipton, A., Sepp, A.: Filling the gaps. Risk Mag. 2011, 66–71 (2011)

Medvedev, A., Scaillet, O.: Approximation and calibration of short-term implied volatilities under jump-diffusion stochastic volatility. Rev. Financ. Stud. 20, 427–459 (2007)

Mijatović, A., Tankov, P.: A new look at short-term implied volatility in asset price models with jumps. Math. Finance 26, 149–183 (2016)

Mota, P.P., Esquível, M.L.: On a continuous time stock price model with regime switching, delay, and threshold. Quant. Finance 14, 1479–1488 (2014)

Neuman, E., Rosenbaum, M.: Fractional Brownian motion with zero Hurst parameter: a rough volatility viewpoint. Electron. Commun. Probab. 23, 1–12 (2018)

Ng, E.W., Geller, M.: A table of integrals of the error functions. J. Res. Natl. Bur. Stand. 73B(1), 1–20 (1969)

Pai, J., Pedersen, H.: Threshold models of the term structure of interest rate. In: Joint Day Proceedings Volume of the XXXth International ASTIN Colloquium/9th International AFIR Colloquium, Tokyo, Japan, pp. 387–400 (1999)

Piterbarg, V.: Markovian projection method for volatility calibration. Risk Mag. 2007, 84–89 (2007)

Puri, P., Kythe, P.K.: Some inverse Laplace transforms of exponential form. Z. Angew. Math. Phys. 39(2), 150–156 (1988)

Rogers, L.C.G., Diffusions, D.W.: Markov Processes and Martingales, vol 2: Itô Calculus, 2nd edn. Cambridge University Press, Cambridge (2000)

Rossello, D.: Arbitrage in skew Brownian motion models. Insur. Math. Econ. 50, 50–56 (2012)

Tong, H.: Threshold Models in Nonlinear Time Series Analysis. Lecture Notes in Statistics, vol. 21. Springer, New York (1983)

Van der Stoepc, A.W., Grzelak, L.A., Oosterlee, C.W.: The Heston stochastic-local volatility model: efficient Monte Carlo simulation. Int. J. Theor. Appl. Finance 17(07), 1–30 (2014)

Yan, S.: Jump risk, stock returns and slope of implied volatility smile. J. Financ. Econ. 99, 216–233 (2011)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The author gratefully acknowledges financial support from ERC via Grant CoG-683164.

The author is grateful to Peter K. Friz, Masaaki Fukasawa and Antoine Lejay for discussion and useful comments and to two anonymous reviewers for their suggestions.

Appendix: Auxiliary computations

Appendix: Auxiliary computations

Lemma A.1

Recall\(G\)in (2.5) and\(Z\)in (3.8). For all\(b,c \in \mathbb{R}\), \(t>0\), we have the limit

Proof

From the definition of \(G\), we get

Since \(\lim _{a\downarrow 0}\sin (a\sqrt{z})=0\), the integrable factors multiplying the \(\sin (\cdot )\) function give a vanishing contribution in the limit due to dominated convergence. So we get

In case \(b=c\), the second integral in (A.1) vanishes and

We suppose now that \(b> c\) and compute the limit for \(a\downarrow 0\) of the second integral. We have

With the change of variables \(c+z=u\), we have

and

Now,

and

Therefore,

Recalling also (A.3), we have

Suppose now \(c>b\). In this case, it is not clear from (2.5) that \(G\) is a real function. For this choice of parameters, \(G\) can be rewritten with standard manipulations as

In this form, one can see that \(G\) is a real function. Completely analogous computations can be made starting from (A.5). One can show that

and

From (A.2), (A.6) and (A.7) (it clearly does not matter if the lower integration bound in the first integral is 0 or \(c-b\)), we get

Therefore, the statement holds for all \(b,c,t\). □

Rights and permissions

About this article

Cite this article

Pigato, P. Extreme at-the-money skew in a local volatility model. Finance Stoch 23, 827–859 (2019). https://doi.org/10.1007/s00780-019-00406-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-019-00406-2