Abstract

In this paper, we present a refreshed version of the original model proposed by Gabszewicz and Vial (J Econ Theory 4:381–400, 1972) and we use their main example to review the main theoretical issues related to the notion of Cournot-Walras equilibrium. We compute, in the Gabszewicz and Vial main example, two different Cournot-Walras equilibria associated with different normalization rules. Moreover, in the same example, we compute a Utility-Cournot-Walras equilibrium as defined by Grodal (in: Allen (ed) Economics in a changing world, Macmillan, London, 1996) and we show that it coincides with the unique Walras equilibrium. Furthermore, using a proposition proved by Grodal (1996), we build a normalization rule with respect to which there is a Cournot-Walras equilibrium that coincides with the Utility-Cournot-Walras equilibrium and hence with the unique Walras equilibrium. To the best of our knowledge, this example provides the first case of Cournotian duopolistic firms being Walrasian in a production economy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Fifty years ago, Gabszewicz and Vial (1972) proposed a pathbreaking analysis of oligopolistic interaction à la Cournot among firms in a general equilibrium framework, where they introduced the concept of Cournot-Walras equilibrium. In this celebrated contribution, they lucidly recognized the main theoretical issues raised by their own concept: The dependence of the Cournot-Walras equilibrium on the rule chosen to normalize prices and the possible lack of rationality of the maximization of monetary profits as a decision criterion for the firms. These issues, together with some other more technical problems concerning the very existence of a Cournot-Walras equilibrium, were discussed in a conspicuous literature inspired by their seminal article, which is summarized in several surveys (see Mas-Colell (1982); Hart (1985); Bonanno (1990), among others).

In this paper, we present a refreshed version of the original model proposed by Gabszewicz and Vial (1972) and provide a systematic treatment of the two fundamental issues mentioned above, concerning price normalization and firms’ rationality criteria, in the framework of their main example (see p. 385). On the basis of our analysis, we are able to exhibit an unprecedented case: Cournotian duopolistic firms may be Walrasian.

In our analysis, we largely borrow from Grodal (1996): First of all, we use her notion of a normalized price function – i.e., a function that results from the composition of a normalization rule and a price selection – to re-define the very concept of Cournot-Walras equilibrium.

Gabszewicz and Vial (1972) did not explicitly specify a normalization rule in their general model. Nevertheless, in their main example they introduced a specific rule, which normalizes the prices of an exchange economy using the feasible production plans determining its intermediate initial endowments. They used this normalization rule to compute a Cournot-Walras equilibrium for a two consumers, two firms, and two goods specification of their model.

Here, in our definition of a Cournot-Walras equilibrium, we base the construction of the notion of a normalized price function on the definition of a type of normalization rules which takes inspiration from the one used by Gabszewicz and Vial in their example and encompasses it. At the same time, this type of normalization rules generalizes a different type of normalization rules, formally introduced by Grodal (1996), which depend only on prices, allowing them to depend also on the quantities produced by firms. We call à la Gabszewicz and Vial those normalization rules that satisfy the requirements of our generalization, while we call à la Grodal those normalization rules which belong to the type introduced by this author. In Sect. 2, we formally establish the general relationship between the two types of rules.

After re-considering the notion of a Cournot-Walras equilibrium and proposing a slightly amended version of Gabszewicz and Vial’s main example, we compute, in the same basic structure, a Cournot-Walras equilibrium, using a normalization rule à la Grodal, that maps prices from the unit simplex into itself. Since this equilibrium differs from that computed by Gabszewicz and Vial on the basis of their normalization rule, the result represents a first explicit case of the dependence of the original Gabszewicz and Vial’s Cournot-Walras equilibrium on the normalization rule in their main example.

Gabszewicz and Vial (1972) also reported an argument proposed in verbal terms by a referee of their original paper concerning firms’ rationality criteria (see p. 395). We develop here that argument, providing a result that, to the best of our knowledge, can be considered as a first formal counterexample to the idea, present in the literature, that profit maximization is a rationality criterion for firms’ owners in a general equilibrium model with oligopolistic interaction à la Cournot (see, among others, Grodal (1996)).

Finally, still in the structure of Gabszewicz and Vial’s main example, we compute a Utility-Cournot-Walras equilibrium – a notion introduced by Grodal (1996) – and we show that it coincides with the unique Walras equilibrium of the economy. Moreover, using a proposition proved by Grodal (1996), we build a normalization rule à la Grodal with respect to which there is a Cournot-Walras equilibrium that coincides with the Utility-Cournot-Walras equilibrium and hence with the unique Walras equilibrium.

Codognato et al. (2015), Busetto et al. (2020), and Busetto et al. (2021) exhibited some cases in which atomic Cournotian traders may be Walrasian in pure exchange economies but, as far as we know, our result, obtained in the basic setup of the Gabszewicz and Vial example, provides the first case of Cournotian duopolistic firms being Walrasian in a production economy.

We review the critical issues raised by Gabszewicz and Vial’s seminal analysis in Sect. 4 within the same structure of a production economy studied by these authors in their main example. Being aware of those theoretical problems, Gabszewicz and Vial (1972) themselves anticipated: “[...] Some readers could accordingly be tempted to reject our theory as a whole; but they should be aware that they would simultaneously reject the whole theory of imperfect competition in partial analysis” (see p. 400).

Nevertheless, partial equilibrium analysis à la Cournot is not embodied into a monolithic theory, but it consists of a variety of models designed to capture relevant features of the markets under consideration. Consequently, it seems to us that the main lesson we can draw from our review of the fundamental theoretical questions raised by the general equilibrium analysis à la Cournot introduced by Gabszewicz and Vial (1972) is represented by the fact that they showed its limits as a monolithic theory. These limits have been emphasized during a fifty-year long debate which led to a theoretical impasse, preventing the development of a variety of models with production aimed at grasping different configurations of market interrelations which could be considered as a general equilibrium counterpart of the variety of Cournotian models in a partial equilibrium analysis.

In the last section of this work, we shall have a look at some very recent developments of the theory of oligopoly à la Cournot in a general equilibrium analysis, which claim to overcome the impasse of this theory for production economies.

The paper is organized as follows. In Sect. 2, we introduce the mathematical model and we define the notion of Cournot-Walras equilibrium introducing the notion of normalized price function. In Sect. 3, we compute two different Cournot-Walras equilibria in the structure of Gabszewicz and Vial’s main example. In Sect. 4, we discuss, through further results, the main issues related to the notion of Cournot-Walras equilibrium for economies with production. In Sect. 5, we draw some conclusions and we suggest some further lines of research.

2 Mathematical model

We present here a refreshed version of the mathematical model proposed by Gabszewicz and Vial (1972), where we explicitly specify the notion of a normalization rule, generalizing that proposed by Grodal (1996), to define the concept of Cournot-Walras equilibrium.

We consider a production economy with n consumers i, \(i=1,\ldots ,n\), m firms j, \(j=1,\ldots ,m\), and l consumption goods, \(h=1,\ldots ,l\).

Each consumer \(i=1,\ldots ,n\) is characterized by a consumption set \(R^l_+\), an initial endowment vector \(\omega _i \in R^l_+\), with \(\omega _i \gg 0\), a share \(\theta _{ij}\) in the production of firm j, such that \(\sum _{i=1}^n\theta _{ij}=1\), for each firm \(j=1,\ldots m\), and a rational, continuous, strongly monotone, and strictly convex preference relation \(\succsim _i\), defined on \(R^l_+\). A consumption bundle of consumer i is a vector \(x_i \in R^l_+\).

Each firm \(j=1,\ldots ,m\) is characterized by a compact and convex production set \(G_j \subset R^l_+\). A feasible production plan of firm j is a vector \(y_j \in G_j\).

A price vector is a vector \(p \in \Delta\), where \(\Delta\) is the unit simplex.

An allocation is a n-tuple of consumption bundles \((x_1,\ldots ,x_n)\) and a m-tuple of feasible production plans \((y_1,\ldots ,y_m)\) such that \(\sum _{i=1}^nx_i=\sum _{i=1}^n\omega _i+\sum _{j=1}^my_j\).

Given feasible production plans \((y_1,\ldots ,y_m)\), the intermediate endowment of consumer i is \(\omega _i+\sum _{j=1}^m\theta _{ij}y_j\).

Given feasible production plans \((y_1,\ldots ,y_m)\), an equilibrium allocation relative to \((y_1,\ldots ,y_m)\) is a n-tuple of consumption bundles \((x_1,\ldots ,x_n)\) such that \(\sum _{i=1}^nx_i=\sum _{i=1}^n(\omega _i+\sum _{j=1}^m\theta _{ij}y_j)\).

A n-tuple of consumption bundles \((x_1,\ldots ,x_n)\) and a m-tuple of feasible production plans \((y_1,\ldots ,y_m)\) such that \((x_1,\ldots ,x_n)\) is an equilibrium allocation relative to \((y_1,\ldots ,y_m)\) is an allocation as \(\sum _{i=1}^nx_i=\sum _{i=1}^n(\omega _i+\sum _{j=1}^m\theta _{ij}y_j)=\sum _{i=1}^n\omega _i+\sum _{j=1}^m\sum _{i=1}^n\theta _{ij}y_j= \sum _{i=1}^n\omega _i+\sum _{j=1}^my_j\).

Given feasible production plans \((y_1,\ldots ,y_m)\), a Walras equilibrium relative to \((y_1,\ldots ,y_m)\) is a pair \((p, (x_1,\ldots ,x_n))\) consisting of a price vector \(p \in \Delta\) and an equilibrium allocation \((x_1,\ldots ,x_n)\) relative to \((y_1,\ldots ,y_m)\) such that \(x_i \succsim _i x_i^{\prime }\), for each \(x_i^{\prime }\) such that \(px_i^{\prime } \le p\omega _i+p\sum _{j=1}^m\theta _{ij}y_j\), for each consumer \(i=1,\ldots ,n\).

Given feasible production plans \((y_1,\ldots ,y_m)\), there exists a Walras equilibrium \((p, (x_1,\ldots ,x_n))\) relative to \((y_1,\ldots ,y_m)\) as \(\succsim _i\) is rational, continuous, strongly monotone, and strictly convex, for each consumer \(i=1,\ldots ,n\).

A price correspondence is a correspondence \(\pi\) defined on \(\prod _{j=1}^mG_j\) with values in \(\Delta\) such that, for all feasible production plans \((y_1,\ldots ,y_m)\), \((p, (x_1,\ldots ,x_n))\) is a Walras equilibrium relative to \((y_1,\ldots ,y_m)\), for some \(p \in \pi (y_1,\ldots ,y_m)\) and for some equilibrium allocation \((x_1,\ldots ,x_n)\).

A price selection is a function p defined on \(\prod _{j=1}^mG_j\) with values in \(\Delta\) such that \(p(y_1,\ldots ,y_m) \in \pi (y_1,\ldots ,y_m),\) for all feasible production plans \((y_1,\ldots ,y_m)\).

A normalization rule à la Gabszewicz and Vial is a function \(\alpha\) defined on \(\prod _{j=1}^mG_j \times \Delta\) with values in \(R^l_+ \setminus \{0\}\) such that \(\alpha (y_1,\ldots ,y_m,p)=\sum _{h=1}^l\alpha _h(y_1,\ldots ,y_m,p)p\), for all feasible production plans \((y_1,\ldots ,y_m)\) and for each \(p \in \Delta\).Footnote 1

A normalization rule à la Gabszewicz and Vial is a normalization rule à la Grodal if and only if \(\alpha (y_1,\ldots ,y_m,p)=\alpha (y_1^{\prime },\ldots ,y_m^{\prime },p)\), for all feasible production plans \((y_1,\ldots ,y_m)\) and \((y_1^{\prime },\ldots ,y_m^{\prime })\) and for each \(p \in \Delta\) (see Grodal (1996)).

Given a price selection p and a normalization rule à la Gabszewicz and Vial \(\alpha\), a normalized price function is a function \(p^{\alpha }\) defined on \(\prod _{j=1}^mG_j\) with values in \(R^l_+ \setminus \{0\}\) such that \(p^{\alpha }(y_1,\ldots ,y_m)=\alpha (y_1,\ldots ,y_m,p(y_1,\ldots ,y_m))\), for all feasible production plans \((y_1,\ldots ,y_m)\).

Given a normalized price function \(p^{\alpha }\), the profit function of firm j is the function \(p^{\alpha }(y_1,\ldots ,y_m)y_j\), for all feasible production plans \((y_1,\ldots ,y_m)\).

Given a normalized price function \(p^{\alpha }\), a m-tuple of feasible production plans \((y^{*}_1,\ldots ,y^{*}_m)\) is a Cournot equilibrium for \(p^{\alpha }\) if

for each \(y_j \in G_j\) and for each firm \(j=1,\ldots ,m\).

A Cournot-Walras equilibrium is a triplet \((p^{\alpha },(x^{*}_1,\ldots ,x^{*}_n),(y^{*}_1,\ldots ,y^{*}_m))\) consisting of a normalized price function \(p^{\alpha }\), a m-tuple of feasible production plans \((y^{*}_1,\ldots ,y^{*}_m)\), and an equilibrium allocation \((x^{*}_1,\ldots ,x^{*}_n)\) relative to \((y_1^{*}\ldots ,y^{*}_m)\) such that the pair \((p^{\alpha }(y^{*}_1,\ldots ,y^{*}_m),(x^{*}_1,\ldots ,x^{*}_n))\) is a Walras equilibrium relative to \((y^{*}_1,\ldots ,y^{*}_m)\) and \((y^{*}_1,\ldots ,y^{*}_m)\) is a Cournot equilibrium for \(p^{\alpha }\).

A Walras equilibrium of the production economy is a triplet \((\hat{p},( \hat{x}_1,\ldots ,\hat{x}_n),(\hat{y}_1,\ldots ,\hat{y}_m))\) consisting of a price vector \(\hat{p} \in \Delta\), a m-tuple of feasible production plans \((\hat{y}_1,\ldots ,\hat{y}_m)\), and an equilibrium allocation \((\hat{x}_1,\ldots ,\hat{x}_n)\) relative to \((\hat{y}_1,\ldots ,\hat{y}_m)\) such that the pair \((\hat{p},(\hat{x}_1,\ldots ,\hat{x}_n))\) is a Walras equilibrium relative to \((\hat{y}_1,\ldots ,\hat{y}_m)\) and \(\hat{p}y_j\) achieves its maximum on \(G_j\) in \(\hat{y}_j\), for each firm \(j=1,\ldots ,m\).

3 Cournot-Walras equilibrium and normalization rules

In order to illustrate the fundamental concepts introduced in their paper, Gabszewicz and Vial (1972) considered a first example - the main one of their paper - which constitutes a particularization of the model of a production economy introduced in the previous section. In this example, they used a specific normalization rule belonging to the type we have called à la Gabszewicz and Vial.

Here, we present a more articulated example, in which we first re-propose a slightly amended version of their result. Then, within the same structure of a production economy introduced by those authors, we compute a different Cournot-Walras equilibrium, using a type of normalization rule à la Grodal. This result provides an explicit evidence of the dependence of the original Gabszewicz and Vial’s Cournot-Walras equilibrium on the normalization rule.

Example

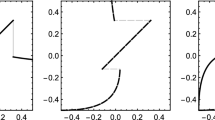

Consider a production economy, where \(i=2\), \(j=2\), \(l=2\), \(\omega _1=(0,0)\), \(\omega _2=(0,0)\), \(\theta _{11}=1\), \(\theta _{12}=0\), \(\theta _{21}=0\), \(\theta _{22}=1\), \(\succsim _1\) is represented by the utility function \(u_1(x_{11},x_{21})=x_{11}^{\frac{1}{4}}x_{21}^{\frac{3}{4}}\), \(\succsim _2\) is represented by the utility function \(u_2(x_{12},x_{22})=x_{12}^{\frac{3}{4}}x_{22}^{\frac{1}{4}}\), \(G_1=\{y_1=(y_{11},y_{21}):\,0 \le y_{11} \le 2,\, 0 \le y_{21} \le 8,\, 2y_{11}+y_{21} \le 10\}\), \(G_2=\{y_2=(y_{12},y_{22}):\,0 \le y_{12} \le 8,\, 0 \le y_{22} \le 2,\, y_{12}+2y_{22} \le 10\}\). Moreover, consider the functions \(\beta (y_1,y_2,p)=p\) and \(\gamma (y_1,y_2,p)=\frac{3y_{11}+y_{12}+y_{21}+3y_{22}}{D}p\), where \(D=(y_{21}+3y_{22})(y_{11}+y_{12})+(3y_{11}+y_{12})(y_{21}+y_{22})\), for all feasible production plans \((y_1,y_2)\) and for each \(p \in \Delta\). Then, the triplet \((\hat{p},(\hat{x}_1,\hat{x}_2),(\hat{y}_1,\hat{y}_2))\), where \(\hat{p}=\left(\frac{1}{2},\frac{1}{2}\right)\), \((\hat{x}_1,\hat{x}_2)=\left(\left(\frac{9}{4},\frac{27}{4}\right),\left(\frac{27}{4},\frac{9}{4}\right)\right)\), \((\hat{y}_1,\hat{y}_2)=((1,8),(8,1))\), is the unique Walras equilibrium of the production economy; the function p, where \(p(y_1,y_2)=\left(\frac{y_{21}+3y_{22}}{3y_{11}+y_{12}+y_{21}+3y_{22}},\frac{3y_{11}+y_{12}}{3y_{11}+y_{12}+y_{21}+3y_{22}}\right)\), for all feasible production plans \((y_1,y_2)\), is the unique price selection; \(\beta\) is a normalization rule à la Grodal and the triplet \((p^{\beta },(x^{*}_1,x^{*}_2),(y^{*}_1,y^{*}_2)),\) where \(p^{\beta }(y_1,y_2)=\left(\frac{y_{21}+3y_{22}}{3y_{11}+y_{12}+y_{21}+3y_{22}},\frac{3y_{11}+y_{12}}{3y_{11}+y_{12}+y_{21}+3y_{22}}\right)\), for all feasible production plans \((y_1,y_2)\), \((x^{*}_1,x^{*}_2)=\left(\left(\frac{35}{17},\frac{105}{17}\right),\left(\frac{105}{17},\frac{35}{17}\right)\right)\), \((y^{*}_1,y^{*}_2)=\left(\left(\frac{30}{17},\frac{110}{17}\right),\left(\frac{110}{17},\frac{30}{17}\right)\right)\), is a Cournot-Walras equilibrium; \(\gamma\) is a normalization rule à la Gabszewicz and Vial and the triplet \((p^{\gamma },(x^{**}_1,x^{**}_2),(y^{**}_1,y^{**}_2))\), where \(p^{\gamma }(y_1,y_2)=\left(\frac{y_{21}+3y_{22}}{D},\frac{3y_{11}+y_{12}}{D}\right)\), for all feasible production plans \((y_1,y_2)\), \((x^{**}_1,x^{**}_2)=((2,6),(6,2))\), \((y^{**}_1,y^{**}_2)=((2,6),(6,2))\), is a Cournot-Walras equilibrium.

Proof

Given feasible production plans \((y_1,y_2)\), the demand function of consumer 1 is

and the demand function of consumer 2 is

The triplet \((\hat{p},(\hat{x}_1,\hat{x}_2),(\hat{y}_1,\hat{y}_2))\), where \(\hat{p}=\left(\frac{1}{2},\frac{1}{2}\right)\), \((\hat{x}_1,\hat{x}_2)=\left(\left(\frac{9}{4},\frac{27}{4}\right),\left(\frac{27}{4},\frac{9}{4}\right)\right)\), \((\hat{y}_1,\hat{y}_2)=((1,8),(8,1))\), is a Walras equilibrium of the production economy as

\(\hat{p} \hat{y}_1=\frac{1}{2}y_{11}+\frac{1}{2}y_{21}\) achieves its maximum on \(G_1\) in \(\hat{y}_1=(1,8)\), and \(\hat{p} \hat{y}_2=\frac{1}{2}y_{12}+\frac{1}{2}y_{22}\) achieves its maximum on \(G_2\) in \(\hat{y}_2=(8,1)\). We now show that the triplet \((\hat{p},(\hat{x}_1,\hat{x}_2),(\hat{y}_1,\hat{y}_2))\) is the unique Walras equilibrium of the production economy. Suppose that there exists a triplet \((\tilde{p},(\tilde{x}_1,\tilde{x}_2),(\tilde{y}_1,\tilde{y}_2)) \ne (\hat{p},(\hat{x}_1,\hat{x}_2),(\hat{y}_1,\hat{y}_2))\) which is a Walras equilibrium of the production economy. Suppose that \(\frac{\tilde{p}_1}{\tilde{p}_2} \ge 2\). Then, it is straightforward to verify that \(\tilde{y}_1=(t2+(1-t),t6+(1-t)8)\), for some \(t \in [0,1]\) and \(\tilde{y}_2=(8,1)\). But then, we have that

a contradiction. Suppose that \(\frac{\tilde{p}_1}{\tilde{p}_2} \le \frac{1}{2}\). Then, it is straightforward to verify that \(\tilde{y}_1=(1,8)\) and \(\tilde{y}_2=(t6+(1-t)8,t2+(1-t))\), for some \(t \in [0,1]\). But then, we have that

a contradiction. Therefore, we must have that \(\frac{1}{2}<\frac{\tilde{p}_1}{\tilde{p}_2}<2\). Then, it is immediate to check that \(\tilde{y}_1=(1,8)\) and \(\tilde{y}_2=(8,1)\) and that \(\tilde{p}=\left(\frac{1}{2},\frac{1}{2}\right)\) is the only solution to the equation

But then, we have that \((\tilde{p},(\tilde{x}_1,\tilde{x}_2),(\tilde{y}_1,\tilde{y}_2))=(\hat{p},(\hat{x}_1,\hat{x}_2),(\hat{y}_1,\hat{y}_2))\), a contradiction. Therefore, the triplet \((\hat{p},(\hat{x}_1,\hat{x}_2),(\hat{y}_1,\hat{y}_2))\) is the unique Walras equilibrium of the production economy. The function p, where \(p(y_1,y_2)=\left(\frac{y_{21}+3y_{22}}{3y_{11}+y_{12}+y_{21}+3y_{22}},\frac{3y_{11}+y_{12}}{3y_{11}+y_{12}+y_{21}+3y_{22}}\right)\), is the unique price selection as \(p(y_1,y_2)\) is the unique solution to the system of equations

and

for all feasible production plans \((y_1,y_2)\). Consider the function \(\beta (y_1,y_2,p)=p\). \(\beta\) is a normalization rule à la Gabszewicz and Vial as \(\beta (y_1,y_2,p)=\sum _{h=1}^2\beta _h(y_1,y_2,p)p\), for all feasible production plans \((y_1,y_2)\) and for each \(p \in \Delta\). Moreover, it is a normalization rule à la Grodal as \(\beta (y_1,y_2,p)=\beta (y_1^{\prime },y_2^{\prime },p)\), for all feasible production plans \((y_1,y_2)\) and \((y_1^{\prime },y_2^{\prime })\) and for each \(p \in \Delta\). Consider the triplet \((p^{\beta },(x^{*}_1,x^{*}_2),(y^{*}_1,y^{*}_2))\), where \(p^{\beta }(y_1,y_2)=\left(\frac{y_{21}+3y_{22}}{3y_{11}+y_{12}+y_{21}+3y_{22}},\frac{3y_{11}+y_{12}}{3y_{11}+y_{12}+y_{21}+3y_{22}}\right)\), for all feasible production plans \((y_1,y_2)\), \((x^{*}_1,x^{*}_2)=\left(\left(\frac{35}{17},\frac{105}{17}\right),\left(\frac{105}{17},\frac{35}{17}\right)\right)\), \((y^{*}_1,y^{*}_2)=\left(\left(\frac{30}{17},\frac{110}{17}\right),\left(\frac{110}{17},\frac{30}{17}\right)\right)\). \(p^{\beta }\) is a normalized price function as

for all feasible production plans \((y_1,y_2)\). Let \(p^{\beta *}=(p^{\beta }(y^{*}_1,y^{*}_2))=\left(\frac{1}{2},\frac{1}{2}\right)\). The pair \((p^{\beta *},(x^{*}_1,x^{*}_2))\) is a Walras equilibrium relative to \((y^{*}_1,y^{*}_2)\) as

and

The profit function of firm 1, given the feasible production plan of firm 2, \(y^{*}_2\), is

With some abuse of notation, we denote by \(f_1^{\beta }\) a function defined on \(R^2_+\) such that \(f_1^{\beta }(y_1)=p^{\beta }(y_1,y^{*}_2)y_1\). \(f_1^{\beta }\) is strictly increasing in \(y_{11}\) and \(y_{21}\) as it is straightforward to verify that \(\frac{\partial f_1^{\beta }(y_1,y^{*}_2)}{\partial y_{11}}>0\) and \(\frac{\partial f_1^{\beta }(y_1,y^{*}_2)}{\partial y_{21}}>0\), for each \(y_1 \in R^2_+\). Moreover, it is also possible to compute the determinant of the bordered Hessian of \(f_1^{\beta }\) and verify that

for each \(y_1 \in R^2_+\). Then, the function \(f_1^{\beta }\) is strictly quasi-concave on \(G_1\). At \((y^{*}_{11},y^{*}_{21})=\left(\frac{30}{17},\frac{110}{17}\right)\), \(\lambda ^{*}_1=\lambda ^{*}_2=0\), and \(\lambda ^{*}_3=\frac{2}{5}\), the Kuhn-Tucker conditions for the maximization of the function \(f_1^{\beta }\) on \(G_1\), which reduce to

are satisfied as \(\frac{\partial f_1^{\beta }(y^{*}_1,y^{*}_2)}{\partial y_{11}}=\frac{4}{5}\) and \(\frac{\partial f_1(^{\beta }y^{*}_1,y^{*}_2)}{\partial y_{21}}=\frac{2}{5}\). Then, \((y^{*}_{11},y^{*}_{21})\) is the unique feasible production plan which maximizes \(f_1^{\beta }\) on \(G_1\) as \(f_1\) is strictly quasi-concave. The profit function of firm 2, given the feasible production plan of firm 1, \(y^{*}_1\), is

With some abuse of notation, we denote by \(f_2^{\beta }\) a function defined on \(R^2_+\) such that \(f_2^{\beta }(y_2)=p^{\beta }(y^{*}_1,y_2)y_2\). Then, by using, mutatis mutandis, the previous argument, it is straightforward to verify that \((y^{*}_{12},y^{*}_{22})\) is the unique feasible production plan which maximizes \(f_2^{\beta }\) on \(G_2\). Therefore, the triplet \((p^{\beta },(x^{*}_1,x^{*}_2),(y^{*}_1,y^{*}_2))\) is a Cournot-Walras equilibrium. Consider the function \(\gamma (y_1,y_2,p)=\frac{y_{21}+3y_{22}+3y_{11}+y_{12}}{D}p\). \(\gamma\) is a normalization rule à la Gabszewicz and Vial as \(\gamma (y_1,y_2,p)=\left(\sum _{h=1}^2\frac{y_{21}+3y_{22}+3y_{11}+y_{12}}{D}p_h\right)p=\sum _{h=1}^2\gamma _h(y_1,y_2,p)p,\) for all feasible production plans \((y_1,y_2)\) and for each \(p \in \Delta\). Consider the triplet \((p^{\gamma },(x^{**}_1,x^{**}_2),(y^{**}_1,y^{**}_2))\), where \(p^{\gamma }(y_1,y_2)=\left(\frac{y_{21}+3y_{22}}{D},\frac{3y_{11}+y_{12}}{D}\right)\), for all feasible production plans \((y_1,y_2)\), \((x^{**}_1,x^{**}_2)=((2,6),(6,2))\), \((y^{**}_1,y^{**}_2)=((2,6),(6,2))\). \(p^{\gamma }\) is a normalized price function as

for all feasible production plans \((y_1,y_2)\). Let \(p^{\gamma **}=(p^{\gamma }(y^{**}_1,y^{**}_2))=\left(\frac{1}{16},\frac{1}{16}\right)\). The pair \((p^{\gamma **},(x^{**}_1,x^{**}_2))\) is a Walras equilibrium relative to \((y^{**}_1,y^{**}_2)\) as

and

The profit function of firm 1, given the feasible production plan of firm 2, \(y^{**}_2\), is

With some abuse of notation, we denote by \(f_1^{\gamma }\) a function defined on \(R^2_+\) such that \(f_1^{\gamma }(y_1)=p^{\gamma }(y_1,y^{**}_2)y_1\). \(f_1^{\gamma }\) is strictly increasing in \(y_{11}\) and \(y_{21}\) as it is straightforward to verify that \(\frac{\partial f_1^{\gamma }(y_1,y^{**}_2)}{\partial y_{11}}>0\) and \(\frac{\partial f_1^{\gamma }(y_1,y^{**}_2)}{\partial y_{21}}>0\), for each \(y_1 \in R^2_+\). Moreover, it is also possible to compute the determinant of the bordered Hessian of \(f_1^{\gamma }\) and verify that

for each \(y_1 \in R^2_+\). Then, the function \(f_1^{\gamma }\) is strictly quasi-concave on \(G_1\). At \((y^{**}_{11},y^{**}_{21})=(2,6)\), \(\lambda ^{**}_1=\lambda ^{**}_3=\frac{1}{48}\), and \(\lambda ^{**}_3=0\), the Kuhn-Tucker conditions for the maximization of the function \(f_1^{\gamma }\) on \(G_1\), which reduce to

are satisfied as \(\frac{\partial f_1^{\gamma }(y^{**}_1,y^{**}_2)}{\partial y_{11}}=\frac{3}{48}\) and \(\frac{\partial f_1^{\gamma }(y^{**}_1,y^{**}_2)}{\partial y_{21}}=\frac{1}{48}\). Then, \((y^{**}_{11},y^{**}_{21})\) is the unique feasible production plan which maximizes \(f_1^{\gamma }\) on \(G_1\) as \(f_1^{\gamma }\) is strictly quasi-concave. The profit function of firm 2, given the feasible production plan of firm 1, \(y^{**}_1\), is

With some abuse of notation, we denote by \(f_2^{\gamma }\) a function defined on \(R^2_+\) such that \(f_2^{\gamma }(y_2)=p^{\gamma }(y^{**}_1,y_2)y_2\). Then, by using, mutatis mutandis, the previous argument, it is straightforward to verify that \((y^{**}_{12},y^{**}_{22})\) is the unique feasible production plan which maximizes \(f_2^{\gamma }\) on \(G_2\). Therefore, the triplet \((p^{\gamma },(x^{**}_1,x^{**}_2),(y^{**}_1,y^{**}_2))\) is a Cournot-Walras equilibrium. \(\square\)

4 Discussion of the model and the example

The Example in Sect. 3 compares two different Cournot-Walras equilibria, obtained on the basis of two different types of normalization rules. The first one re-proposes the specific rule introduced by Gabszewicz and Vial (1972) in their main example, which normalizes the prices of an exchange economy using the feasible production plans determining its intermediate initial endowments. This normalization rule, of the type à la Gabszewicz and Vial, constitutes a generalization of the other one, à la Grodal, depending only on prices. The distinction between these two kinds of normalization rules was recognized by Dierker and Grodal (1986). As is well-known, these authors developed some examples on the non-existence of a Cournot-Walras equilibrium, proposing the following comment: “It should be remarked that we do not allow the normalization to depend on the production plans but only on relative price” (see p. 168). On the other hand, the fact that price normalization also depends on production plans is consistent with what observed by Gabszewicz and Vial (1972) themselves: “[...] the price system only defines a direction in the commodity space: this information is not sufficient to specify how the influence that the firms exert on this direction can affect their monetary profits. For the competitive equilibrium concept, one has not to worry about this specification since, by assumption, the firms do not exert any influence on the direction of prices. Such a specification is needed, however, if the profit criterion is incorporated into the model” (see p. 400). The role of normalization in the determination and the existence of a Cournot-Walras equilibrium was considered by Dierker and Grodal (1986), Böhm (1994), Ginsburgh (1994), Dierker and Grodal (1999), Ritzberger (2007), among others. In particular, Ginsburgh (1994) considered an example of a production economy with two goods where each good is produced by a monopolist and he showed that a change in the normalization rules leads to different Cournot-Walras equilibria with different welfare properties.

This observation is related to the problem of the maximization of monetary profits as a decision criterion for the firms. It is well known that, under perfect competition, the consumers unanimously agree on the maximization of monetary profits of the firms they own as shareholders, which is, therefore, their only rational decision criterion (see, for instance, DeAngelo (1981)). The problem of the rationality of the maximization of monetary profits as a decision for the firms in the model of Gabszewicz and Vial (1972) was raised by a referee of their original article which they reported as follows: “Consider a firm owned by many consumers, all of whom are identical. Given the strategies of the other firms in the economy, this firm chooses an output vector so as to maximize the wealth of each of its consumers. However, it is possible that this firm could choose a different strategy which would result in slightly lower wealth, but in a much lower price of some particular commodity which is greatly “desired” by the owners of the firm. Thus this alternative strategy might yield greater “real income” to the firms owners” (see p. 395).

We use now the same structure of a production economy as that considered in the Example of Sect. 3 to show that the maximization of monetary profit may not be a well-founded rationality criterion for the firms in Gabszewicz and Vial’s model.

Example

[Continued]. Consider the production economy specified above. Moreover, consider the normalized price function \(p^{\beta }\) and the feasible production plan of firm 2, \(y^{*}_2=\left(\frac{110}{17},\frac{30}{17}\right)\). Then, the maximization of the profit function \(p^{\beta }(y_1,y^{*}_2)y_1\) is not a rational decision criterion for firm 1.

Proof

From the previous results, we have that \(y^{*}_1=\left(\frac{30}{17},\frac{110}{17}\right)\) is the unique feasible production plan which maximizes the profit function of firm 1, \(p^{\beta }(y_1,y^{*}_2)y_1\), on \(G_1\) and that the pair \((p^{\beta *},(x^{*}_1,x^{*}_2))\) where \(p^{\beta *}=(p^{\beta }(y^{*}_1,y^{*}_2))=\left(\frac{1}{2},\frac{1}{2}\right)\) and \((x^{*}_1,x^{*}_2)=\left(\left(\frac{35}{17},\frac{105}{17}\right), \left(\frac{105}{17},\frac{35}{17}\right)\right)\) is a Walras equilibrium relative to \((y^{*}_1,y^{*}_2)\). Consider the feasible production plan of firm 1, \({\bar{y}}_1=(1,8)\). The pair \(({\bar{p}}^{\beta },({\bar{x}}_1,{\bar{x}}_2))\) where \({\bar{p}}^{\beta }=(p^{\beta }({\bar{y}}_1,y^{*}_2))=\left(\frac{226}{387},\frac{161}{387}\right)\) and \(({\bar{x}}_1,{\bar{x}}_2)=\left(\left(\frac{757}{452},\frac{2271}{322}\right), \left(\frac{44535}{7684},\frac{14845}{5474}\right)\right)\) is a Walras equilibrium relative to \(({\bar{y}}_1,y^{*}_2)\) as

and

Then, the maximization of the profit function \(p^{\beta }(y_1,y^{*}_2)y_1\) is not a rational decision criterion for firm 1 as

\(\square\)The result is consistent with the case described by the referee quoted by Gabszewicz and Vial (1972). Indeed, consumer 1 can be considered as representative of many identical consumers. Given the feasible production plan of firm 2, \(y^{*}_2\), the wealth of these consumers is lower at the feasible production plan \({\bar{y}}_1\) than at the feasible production plan \(y^{*}_1\) which is the unique maximum point of the profit function of firm 1. However, the price of good 2, which is “greatly desired” by the owners of firm 1, is also lower at the feasible production plan \({\bar{y}}_1\) than at the feasible production plan \(y^{*}_1\) as

Thus, as anticipated by the referee, the feasible production plan \({\bar{y}}_1\) yields greater “real income” to the owners of the firm measured in terms of a greater utility level.

From the counterexample to their analysis raised by the quoted referee’s report, Gabszewicz and Vial (1972) drew the conclusion that their “[...] analysis may not apply if firms are “owned” by “similar” consumers who have agreed beforehand on some unanimous preference ordering” (see p. 396). However, some years later Dierker and Grodal (1986) argued that, when each firm is owned by exactly one consumer, the analysis of Gabszewicz and Vial (1972) can be “amended” by replacing the maximization of the indirect utility of each consumer-owner instead of profit maximization as a decision criterion for the firms. They sketched a model of this particular configuration of the analysis proposed by Gabszewicz and Vial (1972) and of their alternative behavioral assumption which was generalized by Grodal (1996) who explicitly introduced the notion of Utility-Cournot-Walras equilibrium as the appropriate equilibrium concept in this framework. We now define the notion of Utility-Cournot-Walras equilibrium in the particular configuration of the Gabszewicz and Vial model considered by Dierker and Grodal (1986) and Grodal (1996).

Consider the production economy introduced in Sect. 2.

We assume that \(n=m\), i.e., that the number of consumers is equal to the number of firms and that, for each consumer \(i=1,\ldots ,n\), \(\theta _{ij}=1\), if \(i=j\), and \(\theta _{ij}=0\), if \(i \ne j\), for each firm \(j=1,\ldots ,n\), i.e., each firm is owned by only one consumer.

There exists a continuous utility function \(u_i\) which represents the preference relation \(\succsim _i\) as \(\succsim _i\) is rational and continuous, for each consumer i.

Given feasible production plans \((y_1,\ldots ,y_n)\), the demand function \(x_i(p, p(\omega _i+y_i))\) is well defined as \(\succsim _i\) is rational, continuous, strongly monotone, and strictly convex, for each consumer i.

Given a price selection p, the indirect utility function of the owner of firm i is the function \(v_i(p(y_1,\ldots ,y_n),p(y_1,\ldots ,y_n)(\omega _i+y_i))=u_i(x_i(p(y_1,\ldots ,y_n), p(y_1,\ldots ,y_n)(\omega _i+y_i)))\), for all feasible production plans \((y_1,\ldots ,y_n)\).

Since the indirect utility of the owner of firm i is homogeneous of degree zero in prices, it only depends on the price selection p but not on the normalization rule.

Given a price selection p, a n-tuple of feasible production plans \((\check{y}_1,\ldots ,\check{y}_n)\) is a Utility-Cournot equilibrium for p if

for each \(y_j \in G_j\) and for each consumer \(i=1,\ldots ,n\).

A Utility-Cournot-Walras equilibrium is a triplet \((p,(\check{x}_1,\ldots ,\check{x}_n),(\check{y}_1,\ldots ,\check{y}_n))\) consisting of a price selection p, a n-tuple of feasible production plans \((\check{y}_1,\ldots ,\check{y}_n)\), and an equilibrium allocation \((\check{x}_1,\ldots ,\check{x}_n)\) relative to \((\check{y}_1\ldots ,\check{y}_n)\) such that the pair \((p(\check{y}_1,\ldots ,\check{y}_n),(\check{x}_1,\ldots ,\check{x}_n))\) is a Walras equilibrium relative to \((\check{y}_1,\ldots ,\check{y}_n)\) and \((\check{y}_1,\ldots ,\check{y}_n)\) is a Utility-Cournot equilibrium for p.

We can now compute a Utility-Cournot-Walras equilibrium in the same basic framework of a production economy considered in the Example in Sect. 3.

Example

[Continued]. Consider the production economy specified above. Then, the triplet \(( p,(\check{x}_1,\check{x}_2),(\check{y}_1,\check{y}_2))\), where \(p(y_1,y_2)=\left(\frac{y_{21}+3y_{22}}{3y_{11}+y_{12}+y_{21}+3y_{22}},\frac{3y_{11}+y_{12}}{3y_{11}+y_{12}+y_{21}+3y_{22}}\right)\), for all feasible production plans \((y_1,y_2)\), \((\check{x}_1,\check{x}_2)=\left(\left(\frac{9}{4},\frac{27}{4}\right), \left(\frac{27}{4},\frac{9}{4}\right)\right)\), \((\check{y}_1,\check{y}_2)=((1,8),(8,1))\), is a Utility-Cournot-Walras equilibrium.

Proof

Consider the triplet \(( p,(\check{x}_1,\check{x}_2),(\check{y}_1,\check{y}_2))\), where \(p(y_1,y_2)=\left(\frac{y_{21}+3y_{22}}{3y_{11}+y_{12}+y_{21}+3y_{22}},\frac{3y_{11}+y_{12}}{3y_{11}+y_{12}+y_{21}+3y_{22}}\right)\), for all feasible production plans \((y_1,y_2)\), \((\check{x}_1,\check{x}_2)=\left(\left(\frac{9}{4},\frac{27}{4}\right), \left(\frac{27}{4},\frac{9}{4}\right)\right)\), \((\check{y}_1,\check{y}_2)=((1,8),(8,1))\). p is the unique price selection by the previous argument. Let \(\check{p}=p(\check{y}_1,\check{y}_2)=(\frac{1}{2},\frac{1}{2})\). The pair \((\check{p},(\check{x}_1,\check{x}_2))\) is a Walras equilibrium relative to \((\check{y}_1,\check{y}_2)\) as

and

The indirect utility function of consumer 1, given the feasible production plan on firm 2, \(\check{y}_2\), is

With some abuse of notation, let \({\bar{v}}_1\) denote a function defined on \(R^2_+\) such that \({\bar{v}}_1(y_1)=v_1(p(y_1,\check{y}_2),p(y_1,\check{y}_2)y_1))\). \({\bar{v}}_1\) is strictly increasing in \(y_{11}\) and \(y_{21}\) as it is straightforward to verify that \(\frac{\partial {\bar{v}}_1(y_1,\check{y}_2)}{\partial y_{11}}>0\) and \(\frac{\partial {\bar{v}}_1(y_1,\check{y}_2)}{\partial y_{21}}>0\), for each \(y_1 \in R^2_+\). Moreover, it is also possible to compute the determinant of the bordered Hessian of \({\bar{v}}_1\) and verify that

for each \(y_1 \in R^2_+\). Then, the function \({\bar{v}}_1\) is strictly quasi-concave on \(G_1\). At \((\check{y}_{11},\check{y}_{21})=(1,8)\), \(\check{\lambda }_1=0\), \(\check{\lambda }_2=\frac{19}{352}(3)^{\frac{3}{4}}\), and \(\check{\lambda }_3=\frac{59}{352}(3)^{\frac{3}{4}}\), the Kuhn-Tucker conditions for the maximization of the function \({\bar{v}}_1\) on \(G_1\), which reduce to

are satisfied as \(\frac{\partial {\bar{v}}_1(\check{y}_1,\check{y}_2)}{\partial y_{11}}=\frac{59}{176}(3)^{\frac{3}{4}}\) and \(\frac{\partial {\bar{v}}_1(\check{y}_1,\check{y}_2)}{\partial y_{21}}=\frac{39}{176}(3)^{\frac{3}{4}}\). Then, \((\check{y}_{11},\check{y}_{21})\) is the unique feasible production plan which maximizes \({\bar{v}}_1\) on \(G_1\) as \({\bar{v}}_1\) is strictly quasi-concave. The indirect utility function of consumer 2, given the feasible production plan on firm 1, \(\check{y}_1\), is

With some abuse of notation, let \({\bar{v}}_2\) denote a function defined on \(R^2_+\) such that \({\bar{v}}_2(y_2)=v_2(p(\check{y}_1,y_2),p(\check{y}_1, y_2)y_2))\). Then, by using, mutatis mutandis, the previous argument, it is straightforward to verify that \((\check{y}_{12},\check{y}_{22})\) is the unique feasible production plan which maximizes \({\bar{v}}_2\) on \(G_2\). Hence, the triplet \(( p,(\check{x}_1,\check{x}_2),(\check{y}_1,\check{y}_2))\) is a Utility-Cournot-Walras equilibrium. \(\square\)

The Utility-Cournot-Walras equilibrium \(( p,(\check{x}_1,\check{x}_2),(\check{y}_1,\check{y}_2))\) coincides with the unique Walras equilibrium \((\hat{p},(\hat{x}_1,\hat{x}_2),(\hat{y}_1,\hat{y}_2))\) as \(\hat{p}=p(\check{y}_1,\check{y}_2)\), \((\hat{x}_1,\hat{x}_2)=(\check{x}_1,\check{x}_2)\), and \((\hat{y}_1,\hat{y}_2)=(\check{y}_1,\check{y}_2)\).

Gabszewicz and Vial (1972) argued, without providing a proof, that the unique Walras equilibrium of their main example “[...] is not a Cournot-Walras equilibrium” (see p. 387). However, adapting the proof of Proposition 1 in Grodal (1996) to our version of their example, we shall show that there exists a normalization rule à la Grodal that determines a Cournot-Walras equilibrium which coincides with the Utility-Cournot-Walras equilibrium \(( p,(\check{x}_1,\check{x}_2),(\check{y}_1,\check{y}_2))\) and hence with the unique Walras equilibrium \((\hat{p},(\hat{x}_1,\hat{x}_2),(\hat{y}_1,\hat{y}_2))\).

According to Grodal (1996), given a continuous price selection p, the feasible production plans \(({\bar{y}}_1,\ldots ,{\bar{y}}_m)\) are said to be p-dominated if, for a firm j, there exists a feasible production plan \(y^{\prime }_j \in Y_j\) such that \(p({\bar{y}}_1,\ldots ,y^{\prime }_j,\ldots ,{\bar{y}}_m)=p({\bar{y}}_1,\ldots ,{\bar{y}}_j,\ldots ,{\bar{y}}_m)\) and \(p({\bar{y}}_1,\ldots ,y^{\prime }_j,\ldots ,{\bar{y}}_m)y^{\prime }_j>p({\bar{y}}_1,\ldots ,{\bar{y}}_j,\ldots ,{\bar{y}}_m){\bar{y}}_j\). It is immediate to verify that a price selection p and feasible production plans \(({\bar{y}}_1,\ldots ,{\bar{y}}_m)\) which are p-dominated cannot belong to a triplet which is a Cournot-Walras equilibrium or a Utility-Cournot-Walras equilibrium.

We now apply to our basic framework the argument of Proposition 1 in Grodal (1996).

Example

[Continued]. Consider the production economy specified above. Moreover, consider the Utility-Cournot-Walras equilibrium \(( p,(\check{x}_1,\check{x}_2), (\check{y}_1,\check{y}_2))\). Then, there exists a normalization rule à la Grodal \(\theta\) such that the triplet \(( p^{\theta },(\check{x}_1,\check{x}_2),(\check{y}_1,\check{y}_2))\) is a Cournot-Walras equilibrium.

Proof

Consider the Utility-Cournot-Walras equilibrium \(( p,(\check{x}_1,\check{x}_2),(\check{y}_1,\check{y}_2))\). Clearly, the feasible production plans \((\check{y}_1,\check{y}_2)\) are not p-dominated. Moreover, we have that, at the Utility-Cournot-Walras equilibrium, the profits of both firms are strictly positive as \(\check{p}\check{y}_1=\frac{9}{2}=\check{p}\check{y}_2>0\). Therefore, the assumptions of Proposition 1 in Grodal (1996) are satisfied and we can apply her argument in order to build a normalization rule \(\theta\). Consider firm 1. Let \(Q_1=\{q \in [0,1]:\, p_1(y_1,\check{y}_2)=q, \text{ for } \text{ some } y_1 \in G_1\}\). Then, it is straightforward to show that \(Q_1=\left[\frac{3}{17},\frac{11}{19}\right]\). Let \(\nu _1\) be a function defined on [0, 1] with values in \(R_+\) such that \(\nu _1(q)=-9q+9\), for each \(q \in \left[0,\frac{1}{2}\right)\), and \(\nu _1(q)=9q\), for each \(q \in \left[\frac{1}{2},1\right]\). Then, \(\nu _1(q)\) is continuous. Moreover, we have that \(\nu _1(q) \ge \sup \{qy_{11}+(1-q)y_{21}:\,p_1(y_1,\check{y}_2)=q\}\), for each \(q \in Q_1\), as \(\nu _1(q)=-9q+9 \ge 19q-3=\sup \{qy_{11}+(1-q)y_{21}:\,p_1(y_1,\check{y}_2)=q\}\), for each \(q \in \left[\frac{3}{17},\frac{9}{23}\right]\), \(\nu _1(q)=-9q+9 \ge \frac{-73q^2+71q-6}{q+2}=\sup \{qy_{11}+(1-q)y_{21}:\,p_1(y_1,\check{y}_2)=q\},\) for each \(q \in \left[\frac{9}{23},\frac{1}{2}\right)\), \(\nu _1(q)= 9q \ge \frac{-43q+35}{3}=\sup \{qy_{11}+(1-q)y_{21}:\,p_1(y_1,\check{y}_2)=q\}\), for each \(q \in \left[\frac{1}{2},\frac{11}{19}\right]\), \(\nu _1(\check{p}_1)=\frac{9}{2}=\check{p}\check{y}_1\), and \(\nu _1(q) \ge \frac{9}{2}=\nu _1(\check{p}_1)\), for each \(q \in [0,1]\). Consider firm 2. Let \(Q_2=\{q \in [0,1]:\, p_1(\check{y}_1,y_2)=q, \text{ for } \text{ some } y_2 \in G_2\}\). Then, it is straightforward to show that \(Q_2=\left[\frac{8}{19},\frac{14}{17}\right]\). Let \(\nu _2\) be a function defined on [0, 1] with values in \(R_+\) such that \(\nu _2(q)=-9q+9\), for each \(q \in \left[0,\frac{1}{2}\right)\), and \(\nu _2(q)=9q\), for each \(q \in \left[\frac{1}{2},1\right]\). Then, \(\nu _2(q)\) is continuous. Moreover, we have that \(\nu _2(q) \ge \sup \{qy_{12}+(1-q)y_{22}:\,p_1(\check{y}_1,y_2)=q\}\), for each \(q \in Q_2\), as \(\nu _2(q)=-9q+9 \ge \frac{43q-8}{3}=\sup \{qy_{11}+(1-q)y_{21}:\,p_1(\check{y}_1,y_2)=q\}\), for each \(q \in \left[\frac{8}{19},\frac{1}{2}\right)\), \(\nu _2(q)=9q \ge \frac{-73q^2+75q-8}{3-q}=\sup \{qy_{11}+(1-q)y_{21}:\,p_1(\check{y}_1,y_2)=q\}\), for each \(q \in \left[\frac{1}{2},\frac{14}{23}\right)\), \(\nu _2(q)=9q \ge -19q+16=\sup \{qy_{11}+(1-q)y_{21}:\,p_1(\check{y}_1,y_2)=q\}\), for each \(q \in \left[\frac{14}{23},\frac{14}{17}\right]\), \(\nu _2(\check{p}_1)=\frac{9}{2}=\check{p}\check{y}_2\), and \(\nu _2(q) \ge \frac{9}{2}=\nu _2(\check{p}_1)\), for each \(q \in [0,1]\). Let \(\rho (q)\) be a function defined on [0, 1] with values in \(R_+\) such that \(\rho (q)=q(1-q)\), for each \(q \in [0,1]\). Then, it is immediate to verify that \(\rho\) has a unique maximum in \(q=\frac{1}{2}=\check{p}_1\). Consider the rule \(\theta (y_1,y_2,p)=\frac{\rho (p_1)}{\nu _1(p_1)v\nu _2(p_1)}p\), for all feasible production plans \((y_1,y_2)\) and for each \(p \in \Delta\). \(\theta\) is a normalization rule à la Gabszewicz and Vial as \(\theta (y_1,y_2,p)=\sum _{h=1}^2\theta _h(y_1,y_2,p)p\), for all feasible production plans \((y_1,y_2)\) and for each \(p \in \Delta\). Moreover, it is a normalization rule à la Grodal as \(\theta (y_1,y_2,p)=\theta (y_1^{\prime },y_2^{\prime },p)\), for all feasible production plans \((y_1,y_2)\) and \((y_1^{\prime },y_2^{\prime })\) and for each \(p \in \Delta\). Consider the normalized price function \(p^{\theta }\) such that \(p^{\theta }(y_1,y_2)=\theta (y_1,y_2,p(y_1,y_2))=\frac{\rho (p_1)}{\nu _1(p_1)\nu _2(p_1)}p(y_1,y_2)\), for all feasible production plans \((y_1,y_2)\). We have that

for each \(y_1 \in G_1\), and

for each \(y_2 \in G_2\), as \(\nu _j(\check{p}_1)=\check{p}\check{y}_j\), \(\rho\) has a unique maximum in \(\check{p}_1\), \(\nu _j(q) \ge \nu _j(\check{p}_1)\), for each \(q \in [0,1]\), and \(\nu _j(q) \ge \sup \{qy_{11}+(1-q)y_{21}:\,p_1(y_1,\check{y}_2)=q\}\), for each \(q \in Q_j\), for each firm \(j=1,2\). Therefore, the pair of feasible production plans \((\check{y}_1,\check{y}_2)\) is a Cournot equilibrium for \(p^{\theta }\). Hence, the triplet \(( p^{\theta },(\check{x}_1,\check{x}_2),(\check{y}_1,\check{y}_2))\) is a Cournot-Walras equilibrium. \(\square\)

The Cournot-Walras equilibrium \(( p^{\theta },(\check{x}_1,\check{x}_2),(\check{y}_1,\check{y}_2))\) coincides with the unique Walras equilibrium as \(p^{\theta }(\check{y}_1,\check{y}_2)=\left(\frac{1}{9},\frac{1}{9}\right)=\frac{2}{9}\hat{p}\), \((\hat{x}_1,\hat{x}_2)=(\check{x}_1,\check{x}_2)\), and \((\hat{y}_1,\hat{y}_2)=(\check{y}_1,\check{y}_2)\).

Grodal (1996) did not explicitly consider the dependence of a normalization rule on quantities. Nevertheless, she stated, without providing a proof, the following claim “[...] if we had allowed the price normalization to depend on the production choices of the firms, all production plans \(({\bar{y}}_1,\ldots ,{\bar{y}}_m)\), which give positive profits, can be obtained as Cournot-Walras equilibria” (see p. 12). This claim would imply that any normalization rule à la Gabszewicz and Vial could generate an indeterminacy so dramatic to deprive the Cournot-Walras equilibrium concept of its economic relevance. We leave for further research the proof or the disproof of this claim.

5 Discussion of the literature

The Cournot-Walras approach has shown its major results in the context of pure-exchange economies, where the critical problems concerning price normalization and profit maximization, listed in the previous sections, are radically removed. In particular, the reformulation of the Cournot-Walras equilibrium for exchange economies proposed by Codognato and Gabszewicz (1991) made it possible to overcome those problems, since it does not depend on price normalization and replaces profit maximization with utility maximization. This concept was generalized by Gabszewicz and Michel (1997) by means of a notion of oligopoly equilibrium for exchange economies. The literature which follows these contributions was recast and surveyed by Dickson and Tonin (2021) in the framework of the so-called model of bilateral oligopoly introduced by Gabszewicz and Michel (1997), which consists of a two-commodity exchange economy where each trader holds only one of the two commodities available for trade. In this framework, Codognato et al. (2015), Busetto et al. (2020), and Busetto et al. (2021) provided some examples in which Cournotian traders turn out to behave as if they were Walrasian: They can be viewed as a pure exchange counterpart of the main result of this paper.

Gabszewicz and Vial (1972), referring to the discussion of the indeterminacy generated by normalization rules in their own model argued, in the passage cited in our introduction, that it also concerns partial analysis, and they added: “By a similar argument, it can be shown indeed, that the graph of the classical demand function in the price-quantity coordinates is not invariant on the set of normalization rules of the whole price system on the economy!” (p. 400).

Similarly, Grodal (1996) summarized the negative theoretical consequences of her own indeterminacy proposition as follows: “One should not rely on results which are obtained only by assuming that firms maximize profits with respects to an arbitrary and not justified normalization rule.” (see p. 21). Nevertheless, she immediately extended this caveat to partial equilibrium models with imperfect competition for which “one also needs to exercise a corresponding modesty. [...] the normalization rule should be given special attention in these models also, and should be justified by the economic structure of the model.” (see p. 21).

Dierker and Grodal (1998) stressed the fact that the partial analysis of imperfect competition not only implicitly neglects the dependence of profits on normalization rules but it also overlooks the purchasing power of profits. Indeed, in their footnote 1 they said “It is often argued that money should be used to express profits. However, if money is interpreted as a good or a service playing the role of numéraire, the difficulties associated with the price normalization problem are bound to appear. Thus, some kind of fiat money is needed. However, in an economy with fiat money, there remains the problem that shareholders’ real wealth is not only affected by the amount of money available, but also by its purchasing power. Clearly, the purchasing power of money depends, in general, on the prices resulting form the strategic interaction of firms. Hence, it must be assumed that shareholders’ income is separated form their expenditures, as is common in partial equilibrium models of Industrial Organization[...]” (see p. 154.).

However, going towards Industrial Organization raises the dilemma conerning prices effects and income effect in partial equilibrium analysis which was first investigated by Vives (1987). It was reconsidered by Hayashi (2013) and formulated in the following terms “Partial equilibrium analysis isolates the market of a particular commodity from the rest of the economy [...]. This presumes that there is no income effect on the commodity under consideration, because otherwise change of consumption of it in general changes expense on the other commodities and this in turn changes the consumer’s willingness to pay for it, meaning that the isolation fails and policy recommendation based on such analysis is misleading. The absence of income effect is usually justified by saying that the commodity is negligibly small compared to the entire set of commodities. Then, however, the consumer does not care for it apparently and the notion of willingness to pay for it does not make sense.” (see p. 280).

Given the growing importance of oligopolistic interaction in interrelated markets reminded above and the theoretical issues reviewed in this paper, we think that further research should move in the shadow line between partial and general equilibrium theory as we believe that some “reasonable” theory is better than no theory at all.

6 Conclusion

In this paper, we have reviewed the main theoretical issues related to the concept of Cournot-Walras equilibrium introduced by Gabszewicz and Vial (1972) using, as a starting point, their own main example. This review has led to a surprising case due to the indeterminacy generated by normalization rules: In the Gabszewicz and Vial model, Cournotian duopolistic firms may be Walrasian.

Recently, Azar and Vives (2021) noticed that “Oligopoly is widespread and allegedly on the rise. Many industries are characterized by oligopolistic conditions, including, but not limited to, the digital ones dominated by GAFAM: Google (now Alphabet), Apple, Facebook, Amazon, and Microsoft. These firms, as well as others, have influence in the aggregate economy” (see p. 1). This observation led these authors to reconsider the general equilibrium analysis à la Cournot introduced by Gabszewicz and Vial (1972) in order to appropriately capture some features of oligopolistic interaction in a model of interrelated markets with a macroeconomic flavor. Their paper, which was motivated by a huge empirical evidence showing an upsurge in oligopoly in the real word economy, might be considered as the initial piece of a parallel upsurge in theoretical general equilibrium models of oligopoly. Azar and Vives (2021) considered particular production economies in which each firm is owned by many heterogeneous shareholders.

Gabszewicz and Vial (1972), after having considered the criticism to profit maximization as a rational criterion for the firms, already observed that their analysis “may not apply if some firms are “owned” by “similar” consumers who have agreed beforehand on some unanimous preference ordering” (see p. 396). We have seen that, in the case where each firm is owned by a consumer, or many identical consumers, both the related problems of price normalization and the rationality of the profit criterion, are ruled out using the notion of Utility-Cournot-Walras equilibrium proposed by Grodal (1996). We have also shown that, due to the indeterminacy result proved by Grodal (1996), there exists a normalization rule such that a Utility-Cournot-Walras equilibrium is also a Cournot-Walras equilibrium at which profit maximization is a rational criterion. This reverses the claim against their own theory formulated by Gabszewicz and Vial (1972) which we have quoted above. In the same paragraph of that quotation, Gabszewicz and Vial (1972) asserted that “if all firms are owned by many “different” consumers, the impossibility of aggregating their various preferences justifies, by default and as a first approximation, the use of monetary profits as an objective for these firms” whereas Grodal (1996) argued that, in this case, given the indeterminacy generated by normalization rules, “[...] there is no natural objective function for the firm” (p. 19).

Azar and Vives (2021) proposed to overcome this theoretical deadlock assuming that, in their specific model, “firm j’s objective function is to maximize a weighted average of the (indirect) utilities of its owners, where the weights are proportional to the numbers of shares. In other words, we suppose that ownership confers control in proportion to the shares owned” (p. 1008). Their proposal is not immune from the criticisms addressed to the so called Drèze criterion (see Drèze (1974)). Indeed, at this stage, Grodal (1996) would object that “If a firm has an objective function which is related to the preferences of its shareholders one might also obtain that markets in shares of firms will be active in equilibrium” (p. 21)...! Demichelis and Ritzberger (2011) followed this suggestion and proposed an approach “[...] to include an analysis of the institutions that regulate investors’ control over firms. This, of course, transcends general equilibrium theory, that is meant to be “institution-free,” as it requires an explicit model of what determines corporate control” (p. 222). The story continued through other papers and could continue in the future.

Notes

We generalize the specific normalization rule proposed by Gabszewicz and Vial (1972) in their examples: It normalizes the prices of an exchange economy by means of the feasible production plans determining its intermediate initial endowments, using the notion of normalization rule introduced by Grodal (1996) “as a function which determines the absolute prices from the relative prices” (see p. 6).

References

Azar J, Vives X (2021) General equilibrium oligopoly and ownership structure. Econometrica 89:999–1048

Böhm V (1994) The foundation of the theory of monopolistic competition revisited. J Econ Theory 63:208–218

Bonanno G (1990) General equilibrium theory with imperfect competition. J Econ Surv 4:297–328

Busetto F, Codognato G, Julien L (2020) Atomic Leontievian Cournotian traders are always Walrasian. Games Econom Behav 122:318–327

Busetto F, Codognato G, Julien L (2021) Atomic Leontievian Walrasian traders are always Cournotian. Econ Lett 207:110043

Codognato G, Gabszewicz JJ (1991) Équilibres de Cournot-Walras dans une économie d’échange. Revue Écono 42:1013–1026

Codognato G, Ghosal S, Tonin S (2015) Atomic Cournotian traders may be Walrasian. J Econ Theory 159:1–14

DeAngelo H (1981) Competition and unanimity. Am Econ Rev 71:18–27

Dickson A, Tonin S (2021) An introduction to imperfect competition via bilateral oligopoly. J Econ 133:103–128

Demichelis S, Ritzberger K (2011) A general equilibrium analysis of corporate control and the stock market. Econ Theor 46:221–254

Dierker H, Grodal B (1986) Nonexistence of Cournot-Walras equilibrium in a general equilibrium model with two oligopolists. In: Hildenbrand W, Mas-Colell A (eds) Contributions to mathematical economics in honor of Gérard Debreu. North-Holland, Amsterdam

Dierker E, Grodal B (1998) Modelling policy issues in a world of imperfect competition. Scand J Econ 100:153–179

Dierker E, Grodal B (1999) The price normalization problem in imperfect competition and the objective of the firm. Econ Theor 14:257–284

Drèze JH (1974) Investment under private ownershp: optimality, equilibrium, and stablity. In: Dréze JH (ed) Allocation under uncertanty: equilibrium and optimality. Wiley, New York

Gabszewicz JJ, Michel P (1997) Oligopoly equilibrium in exchange economies. In: Eaton BC, Harris RG (eds) Trade, technology and economics. Essays in honour of Richard G. Lipsey. Edward Elgar, Cheltenham

Gabszewicz JJ, Vial JP (1972) Oligopoly à la Cournot in a general equilibrium analysis. J Econ Theory 4:381–400

Ginsburgh V (1994) In the Cournot-Walras general equilibrium model, there may be more to gain by changing the numéraire than by eliminating imperfections: a two-good economy example. In: Mercenier J, Srinivisan TN (eds) Applied general equilibrium and economic development. The University of Michigan Press, Ann Arbor

Grodal B (1996) Profit maximization and imperfect competition. In: Allen B (ed) Economics in a changing world. Macmillan, London

Hart O (1985) Imperfect competition in general equilibrium: an overview of recent work. In: Arrow KJ, Honkapohja S (eds) Frontiers of economics. Blackwell, Oxford

Hayashi T (2013) Smallness of a commodity and partial equilibrium analysis. J Econ Theory 148:279–305

Mas-Colell A (1982) The Cournotian foundations of Walrasian equilibrium theory. In: Hildenbrand W (ed) Advances in economic theory. Cambridge University Press, Cambridge

Ritzberger K (2007) Price normalization under imperfect competition. Econ Theor 33:365–368

Vives X (1987) Small income effects: a Marshallian theory of consumer surplus and downward sloping demand. Rev Econ Stud 54:87–103

Funding

Open access funding provided by Università degli Studi di Udine within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Busetto, F., Codognato, G., Pavan, G. et al. Cournotian duopolistic firms may be Walrasian: a case in the Gabszewicz and Vial model. J Econ 140, 121–140 (2023). https://doi.org/10.1007/s00712-023-00830-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-023-00830-1