Abstract

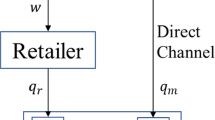

Incorporating an exclusive dealing extension into Cournot competition, we analyze the multiproduct downstream firms’ choice of organizational form between the unitary form (U-form) for corporate incentive and the multidivisional form (M-form) for divisional incentive. The U-form in the managerial delegation for downstream firms is a dominant strategy under partial and binding exclusive dealings, while the M-form for downstream firms is a dominant strategy under non-binding exclusive dealing. If the degree of interbrand competition is sufficiently large when comparing the two forms in equilibrium, social welfare and consumer surplus within the U-form under partial exclusive dealing are greater than those within the M-form under non-binding exclusive dealing, and vice versa. When decentralized bargaining is allowed, (i) strategic delegation is redundant and (ii) regardless of the channel structure, one downstream firm chooses the M-form and the other the U-form, except for a small intermediate substitutability range.

Similar content being viewed by others

Notes

The pioneering works of strategic delegation are Vickers (1985), Fershtman and Judd (1987) and Sklivas (1987) among others. Later studies extend these basic models to explicitly model the endogenous choice of delegation in a duopoly (see Lambertini 2017, chapter 5) for excellent survey of divisionalization and vertical relations). Recently, Pan and D., Lee and K. Choi, (2020) demonstrated theoretical approach to clarify how firms’ delegation incentives are affected by consumers’ heterogeneity in willingness to pay.

Park (2002) investigates strategic delegation among vertically related firms in where each firm produces a single homogeneous good. Consequently, the strategic value of delegation contracts disappears, and managerial downstream firms behave like owner-managed firms.

This is equivalent to the implicit assumption of the model that relates to the view of trading with a non-exclusive distribution contract.

For example, the Boeing selects General Electric as the exclusive engine supplier for Boeing 777X in 1999. See “GE Unit Lands Exclusive Boeing Pact For Developing Commercial Jet Engine,” Wall Street Journal, 1999; July 8.

Evidently, Boeing’s supply chain is globally spread and includes component and technology providers, which one supposes are best-in-class. Boeing moves up in the supply chain to a role as an assembler and integrator, rather than doing all work itself. Airbus has partnered with multiple companies in its tier-organized supplier base, who participate as risk-sharing partners in the program. Embraer has developed its E-jet series in close cooperation with 16 risk-sharing partners and 22 main suppliers.

More specifically, “Toyota has a two supplier policy: \(\ldots\) there must always be at least two suppliers for each category of component. \(\ldots\) Guaranteeing the supplier that it will continue to make the part throughout the life of the model helps to protect any specific investment the suppliers makes (Milgrom and Roberts 1992; p. 567)”.

Polasky (1992) showed that with linear demand and costless divisionalization, there is no equilibrium as firms wish continually to expand their number of divisions.

See also Corchon and Gonzalez-Maestre (2000) for the case of concave demand functions.

Even though we adopt \(p_i=1 - q_{ik}-\alpha q_{il} - d(q_{jk}+\alpha q_{jl})\) where \(\alpha\) measures the degree of intrabrand competition between downstream firms’ goods, we have exactly the same results. Thus, for the simplicity, we employ simple demand function with \(\alpha =1\). The detailed derivations are available from the author on request.

For example, this implies that the productivity of one unit of input j, when provided by supplier A, is the same as the productivity of this input when provided by supplier B.

Even if the supplier decides to form unitary or multidivision and other timing is still sustained, the results are not changed. That is, \(S_k^{MM}-S_k^{UM}=\frac{2d(1-c)^2 (2 + d)\Theta _2}{ (1+ d) \Psi _{MU}^2\Psi _{MM}^2}>0\) and \(S_k^{UU}-S_k^{MU}=\frac{-d(1-c)^2\Theta _3}{ 1600(1+d) \Psi _{MU}^2}<0\).

When suppliers decides to form unitary or multidivision and other timing is still sustained in the case of which managers maximize profits, the results are as follows: \(\underline{S}_k^{MM}-\underline{S}_k^{UM}=\frac{2 (3 - d) d (2 + d)^2 (15 + 15 d + 4 d^2)}{(1 + d) (3 + d)^2 (3 +2 d)^2 (15 + 7 d)^2}> 0,\) \(\underline{S}_k^{UU}-\underline{S}_k^{MU}=\frac{-8 d (405+18 d -180 d^2 - 49 d^3)}{81 (1 + d) (3 + d)^2 (15 +7 d)^2}< 0\) and \(\underline{S}_k^{UU}-\underline{S}_k^{MM}=\frac{2 d^2 (63 + 63 d + 16 d^2)}{81(1 + d) (3 + d)^2 (3 + 2 d)^2}>0\).

Implicit to the model is the view that, given two suppliers and two downstream firms, and all are assumed to be active, then each supplier only supplies one downstream firm and each contracting pair has information in equilibrium as analyzed by Chang (1992) and Dobson and Waterson (1996a). Even with the asymmetric exclusive dealing including upward or downward exclusive dealing, the analysis of such contracts proves to be very complex with very messy calculations compared with the relatively straightforward analysis of contracts in equilibrium (see Dobson and Waterson 1996a, footnotes 5 and 9).

We obtain that \(\Pi _k^{UU*}-\Pi _k^{MM*}=\frac{2 d(1-c)^2 (80 + 71 d + 16 d^2)}{25 (1 + d)^2 (5 + 2 d)^2}>0.\)

When suppliers decides to form unitary or multidivision and other timing is still sustained, the results are changed. That is, \(\hat{S}_k^{MM}-\hat{S}_k^{UM}=\frac{d(1-c)^2(12+3d-2d^2)\Theta _{10}}{2(1+d) \hat{\Psi }_{MU}^2\hat{\Psi }_{MM}^2}> 0\). However, if \(d<d^s\equiv 0.202603\) and \(d>d^p\equiv 0.761933\), we have \(\hat{S}_k^{UU}-\hat{S}_k^{MU}=\frac{-2d(1-c)^2\Theta _{11}}{(14 - 9 d)^2 (1 + d) \hat{\Psi }_{MU}^2}<0\), and vice versa if \(d\in (d^s,d^p)\).

When manufactures decide to form unitary or multidivision and other timing is still sustained in the case of which managers maximize profits, the results are conversely held. That is, \(\ \tilde{S}_k^{MM}- \tilde{S}_k^{UM}=\frac{d(1-c)^2 (648 - 972 d + 1044 d^2 - 405 d^3 + 54 d^4 - 11 d^5 + 2 d^6)}{2 (6- d)^2 (3- d)^2 (2- d)^2 (1 + d) (3 + d) (3 +2 d)}> 0,\) \(\tilde{S}_k^{UU}- \tilde{S}_k^{MU}=\frac{-2 d (1-c)^2(18- 18 d+ 11 d^2- 2 d^3)}{3 (6- d)^2 (2- d)^2 (1 + d) (3 + d)}<0\) and \(\tilde{S}_k^{MM}- \tilde{S}_k^{UU}=\frac{d(1-c)^2 (36- 45 d+ 37 d^2 -10 d^3)}{6 (3- d)^2 (2-d)^2 (1 + d) (3 + 2 d)}>0\).

It is easy to check that \(\overline{SW}^{UU}-\overline{SW}^{MM}=\frac{8d (1-c)^2(90 + 102 d - 54 d^2 -75 d^3 + 2 d^4 + 14 d^5 + 2 d^6)}{(5-d) (1 + d) (15+ 12 d - 6 d^2 -4 d^3)^2}>0\), \(\overline{\Pi }_k^{UU}+\overline{S}_k^{UU}-(\overline{\Pi }_k^{MM}+\overline{S}_k^{MM})=\frac{8 d(1-c)^2 (450 + 300 d - 468 d^2 - 205 d^3 + 165 d^4 + 36 d^5 - 20 d^6) }{(5- d) (1 + d) (15+ 12 d - 6 d^2-4 d^3)^2}>0\) and \(\overline{CS}^{UU}-\overline{CS}^{MM}=\frac{16d^2(1-c)^2 (2-d^2)(30 + 24 d - 14 d^2 - 8 d^3 + d^4)}{(5-d) (1 + d) (15+ 12 d - 6 d^2 -4 d^3)^2}>0\).

As in previous section with linear input contract, we can obtain that \(\frac{{\partial} \overline{w}_{ik}}{{\partial} \overline{\theta }_i}>0, \frac{{\partial} \overline{w}_{ik}}{{\partial} \overline{\beta }_{ik}}>0, \frac{{\partial} \overline{f}_{ik}}{{\partial} \overline{\theta }_i}<0, \frac{{\partial} \overline{f}_{ik}}{{\partial}\overline{\beta }_{ik}}<0\).

References

Barcena-Ruiz JC, Espinosa MP (1999) Should multiproduct firms provide divisional or corporate incentives? Int J Ind Organ 17:751–764. https://doi.org/10.1016/S0167-7187(97)00060-X

Baye MR, Crocker KJ, Ju J (1996a) Divisionalization and franchising incentives with integral competing units. Econ Lett 50:429–435. https://doi.org/10.1016/0165-1765(95)00779-2

Baye MR, Crocker KJ, Ju J (1996b) Divisionalization, franchising, and divesture incentives in oligopoly. Am Econ Rev 86:223–236

Beelaerts van Blokland WWA, Verhagen WJC, Santema SC (2008) The effects of co-innovation on the value-time curve: a quantitative study on product level. J Bus Mark Manag 2:5–24. https://doi.org/10.1007/s12087-007-0020-7

Chandler AD Jr (1969) Strategy and structure: chapters in the history of the American industrial enterprise. MIT Press, Cambridge

Chang M (1992) Exclusive dealing contracts in a successive duopoly with side payments. South Econ J 59:180–193. https://doi.org/10.2307/1060524

Corchon L (1991) Oligopolistic competition among groups. Econ Lett 36:1–3. https://doi.org/10.1016/0165-1765(91)90045-M

Corchon L, Gonzalez-Maestre M (2000) On the competitive effects of divisionalization. Math Soc Sci 39:71–79. https://doi.org/10.1016/S0165-4896(98)00047-X

Cusumano M, Takeishi A (1991) Supplier relations and management: a survey of Japanese, Japanese-transplant, and U. S. auto plants. Strategy Manag J 12:563–588. https://doi.org/10.1002/smj.4250120802

Dobson PW, Waterson M (2007) The competition effects of industry-wide vertical price fixing in bilateral oligopoly. Int J Ind Organ 25:935–962. https://doi.org/10.1016/j.ijindorg.2007.04.004

Dobson PW, Waterson M (1996a) Exclusive trading contracts in successive differentiated duopoly. South Econ J 63:361–377. https://doi.org/10.2307/1061173

Dobson PW, Waterson M (1996b) Product range and interfirm competition. J Econ Manag Strategy 5:313–341. https://doi.org/10.1111/j.1430-9134.1996.00317.x

Fershtman C, Judd KL (1987) Equilibrium incentives in oligopoly. Am Econ Rev 77:927–940

Fumagalli C, Motta M, Claudio C (2018) Exclusionary practices: the economics of monopolisation and abuse of dominance. Cambridge University Press, Cambridge

Gonzalez-Maestre M (2000) Divisionalization and delegation in oligopoly. J Econ Manag Strategy 9:321–338. https://doi.org/10.1111/j.1430-9134.2000.00321.x

Lambertini L (2017) An economic theory of managerial firms. Routledge Press, London

Lambertini L, Pignataro G (2019) On the social (sub)optimality of divisionalization under product differentiation. J Econ 128:225–238. https://doi.org/10.2307/2098494

Lin Y (2006) The dampening-of-competition effect of exclusive dealing. J Ind Econ 39:209–223. https://doi.org/10.2307/2098494

Milgrom P, Roberts J (1992) Economics, organization and management. Prentice Hall, Englewood Cliffs

Moner-Colonques R, Sempere-Monerris JJ, Urbano A (2011) Product line choice in retail duopoly. J Econ Manag Strategy 20:777–802. https://doi.org/10.1111/j.1530-9134.2011.00305.x

Moner-Colonques R, Sempere-Monerris JJ, Urbano A (2004a) The manufacturers’ choice of distribution policy under successive duopoly. South Econ J 70:532–548. https://doi.org/10.2307/4135329

Moner-Colonques R, Sempere-Monerris JJ, Urbano A (2004b) Strategic delegation with multiproduct firms. J Econ Manag Strategy 13:405–427. https://doi.org/10.1111/j.1430-9134.2004.00017.x

Pan C, Lee D, Choi K (2020) Firms’ strategic delegation with heterogeneous consumers. J Econ 131:199–222. https://doi.org/10.1007/s00712-020-00707-7

Park E (2002) Vertical externality and strategic delegation. Manag Decis Econ 23:137–141. https://doi.org/10.1002/mde.1051

Podolny JM, Hansen MT (2020) How Apple is organized for innovation. Harv Bus Rev 87–95

Polasky S (1992) Divide and conquer: on the profitability of forming independent rival divisions. Econ Lett 40:365–371. https://doi.org/10.1016/0165-1765(92)90019-U

Schwartz M, Thompson EA (1986) Divisionalization and entry deterrence. Q J Econ 101:307–321. https://doi.org/10.2307/1891117

Sklivas SD (1987) The strategic choice of managerial incentives. Rand J Econ 18:452–458. https://doi.org/10.2307/2555609

Veendorp ECH (1991) Entry deterrence, divisionalization, and investment decisions. Q J Econ 106:297–307. https://doi.org/10.2307/2937918

Vickers J (1985) Delegation and the theory of the firm. Econ J 95:138–147. https://doi.org/10.2307/2232877

Williamson OE (1975) Markets and hierarchies: analysis and antitrust implications. The Free Press, Mumbai

Ziss S (1998) Divisionalization and product differentiation. Econ Lett 597:133–138. https://doi.org/10.1016/S0165-1765(98)00017-2

Ziss S (1999) Divisionalization and strategic managerial incentives in oligopoly under uncertainty. Int J Ind Organ 17:1163–1187. https://doi.org/10.1016/S0167-7187(98)00019-8

Acknowledgements

We are extremely indebted to the Editor-in-Chief, Giacomo Corneo, and two anonymous referees for their extensive and useful comments, suggestions and remarks that have helped me to improve the quality and clarity of this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Proposition 3

Simple calculations show that in the absence of manipulating the incentives,

Proof of Proposition 4

Simple calculations yield

Proof of Proposition 10

If \(d>d^{\tau }\equiv 0.9 (d<\hat{d}^{\tau }\equiv 0.87)\), we have

and vice versa if \(d<d^{\tau } (d>\hat{d}^{\tau })\). \(\square\)

The constants \(\Theta _0\sim \Theta _{11}\) in the main text

Rights and permissions

About this article

Cite this article

Choi, K. Delegation in multiproduct downstream firms with heterogeneous channels. J Econ 135, 75–102 (2022). https://doi.org/10.1007/s00712-021-00752-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-021-00752-w