Abstract

In this paper, we study the optimal tax policy in a differential oligopoly game where the competing firms share the access to a productive renewable resource. We show that, in a Feedback Nash Equilibrium of the game, a linear Markov tax, imposed on the output, and specified as an affine function of the available resource stock, leads the competing firms to produce the socially optimal quantities over time, thus overcoming the dynamic interplay between the tragedy of the commons and the firms’ market power. The optimal tax turns out to be independent from the resource stock in a monopoly, and it cannot be defined in a duopoly.

Similar content being viewed by others

Notes

Loosely speaking, we consider as a common property regime any situation in which multiple agents are assigned the same rights of usage of the resource. More precisely, as stated by Sun and Liu (2017), “according to the traditional concept of property, owners enjoy a complementary bundle of rights over their property, including the right to use the property and the right to exclude others from it. The tragedy of commons refers to perfect substitutability of concurrent possession of a property right”.

In brief, Fujiwara (2008) shows that, in steady-state, “duopoly can be more anti-competitive than monopoly”, both for the linear and a non-linear FNE. The latter, anyway, constitutes an unstable equilibrium, as shown by Lambertini and Mantovani (2016). A comparison between Cournot and Bertrand competition in a model with product differentiation is carried out by Colombo and Labrecciosa (2015).

Fujiwara (2011) and Benchekroun et al. (2014) study an asymmetric competition among efficient and inefficient firms, with different production costs; Lambertini and Mantovani (2014) analyze the possibility of resource exhaustion; Benchekroun and Gaudet (2015) focus on the effects of a merger of a subset of firms.

However, in a similar model, Benchekroun and Chaudhuri (2011) show that such a policy can induce stable cartelization, which in turn diminishes the welfare gain from environmental regulation.

In a similar framework, there are a few contributions about natural resources. See, for instance, Daubanes (2008), who focuses on an exhaustible resource, such as fossil fuels, while dealing, as the previously mentioned papers, with the first-best policy in a differential oligopoly game with pollutant emissions.

In the logistic model \(F(x)=\delta x(x_M-x)\). This model is often employed in natural resource economics [see, e.g., Hartwick and Olewiler (1998)], but, since it is non-linear, it does not lead to explicit closed-form solutions in our framework.

Given this specification, \(T_i>(<)0\) corresponds to a tax (resp., a subsidy).

In the remainder, F(x) always stands for the instantaneous resource stock growth in absence of exploitation defined in equation (1).

Therefore, by definition, FNE are subgame perfect Nash equilibria. For more formal definitions of differential games, related information structures, strategies and equilibrium concepts, see Basar and Olsder (1999).

The requirement \(\delta >2A\) is stronger than the analogous assumption imposed in Benchekroun (2008).

Obviously, in what follows we ignore the specific cases \(x_0\in \{x^*_1,x^*_2\}\), since it is trivial to see that in these cases the socially optimal production plan consists in the endless repetition of the perfect competition quantity and, by definition, the resource stock level does not change over time.

By relaxing our requirement \(\delta >2A\), in particular by imposing, as in Benchekroun (2008), \(\delta >\frac{2A(1+N^2)}{(1+N)^2}\), only \(x^{(N)}_{\infty ,1}\) obtains as the steady-state resource stock level for \(\delta <\frac{2AN}{1+N}\).

As a result, the resource is never depleted. It is worth mentioning that, by relaxing Assumption (A), in a linear quadratic framework, Lambertini and Mantovani (2014) focus on the possibility of the resource exhaustion.

Nevertheless, as we have seen, for low values of the resource stock firms voluntarily do not exploit it, since in this model the rent associated with an additional unit of resource stock is very big for low resource stock values. This does not hold true in models where players maximize a consumption-based utility function, if the marginal utility of consumption tends to infinity when consumption tends to zero, as in Dockner and Sorger (1996).

Clearly, this is not true anymore when the production is subsidized, as we will see in the next section.

It is worth stressing that the coexistence of multiple steady-state values with different basins of attraction, whose presence and relevance have been recently investigated in the studies of common-pool resources embedded in ecological systems [see, e.g., Crépin and Lindahl (2009)], arises due to the non-linearity of the considered resource stock dynamic, which is piecewise-linear.

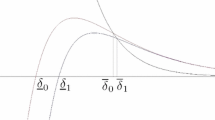

Notice that, for every \(N\ge 2\), \(x^{(N)}_{\infty ,1}<{\bar{x}}_1\): the steady-state resource stock reached under the unregulated competition for any \(x_0<x^{(N)}_{\infty ,2}\) is so low that a benevolent planner endowed with that amount of resource would not produce at all.

Specifically, \(Q(0)>Q^*(0)\iff x_0<\frac{A[2\delta (N^2 + N - 1) - r(N^2 + 2N - 1)]}{\delta (2\delta - r)(N^2- 1)}\), this threshold being higher than \({\bar{x}}^{(N)}_2\).

However, we stress that Assumption (A), for given values of the discount rate and of the resource growth rate, imposes an upper bound on the number of firms we can consider in the model, implying in particular that we cannot examine the limit case of perfect competition (\(N\rightarrow \infty \)). In particular, we must have: \(N<\sqrt{\frac{2\delta }{r}-1}\).

In summary, the author finds that for a certain range of x values, an increase in \(\delta \) induces the firms to hasten the resource extraction even beyond the increase in the natural accumulation of the resource, and this causes a lower stock in steady-state. The term voracity effect was introduced by Tornell and Lane (1996, 1999) in the framework of an economic growth model.

We compared \(x^*_1\) with the stable equilibrium point \(x^{(N)}_{\infty ,1}\), disregarding the unstable point \(x^{(N)}_{\infty ,2}\). As for the role of \(\delta \) in a short-run comparison among the two models, it is just the case to notice that the result \(\displaystyle \frac{\partial {\hat{x}}}{\partial \delta }<0\) is a trivial consequence of the fact that, beyond \({\hat{x}}\), when \(\delta \) increases, the oligopolists keep producing the Cournot output, while the benevolent planner would increase its production.

As we will see at the end of the next subsection, along the equilibrium path of any subgame \(\varGamma _{\alpha ,\beta }(t_0,x_0\ge \frac{A}{\delta })\), a state-independent Markov tax actually constitutes the first-best policy, as it happens in the monopoly case.

Formally, considering per-firm outputs in both cases: \(\frac{2\delta - r}{N}-\frac{(N + 1)(2\delta - r)}{2N^2}=\frac{(N - 1)(2\delta - r)}{2N^2}\). We already noticed that the slope of the monopolist’s strategy coincides with the one of the welfare-maximizing solution.

The subscript C stands for Cournot.

Recall that, in this case, it also holds true that \(x(t)\ge \frac{A}{\delta }\) for all t.

Given the concavity of the objective function, the first order conditions are also sufficient for an optimal control.

Trivially, if \(x<{\bar{x}}_1\), then the benevolent planner would not produce anything until this threshold is reached, then case (i) obtains.

A similar approach was also followed by Colombo and Labrecciosa (2013b) in a model with a private property resource.

Since the expression to be maximized is strictly concave in the decision variable \(q_i\).

Recall that, under Assumption (A): \(\frac{A}{\delta }<\frac{1}{2}\), hence \(F(x)=\delta x\).

It is just the case to mention that we only focused on the slope of the firms’ strategy, which only depends on \(\alpha \), since the non-homogeneous term of the firms’ strategy can always be equated, for a given \(\alpha \) value, to the corresponding term of the welfare-maximizing strategy, by choosing properly the value for \(\beta \).

References

Akao KI (2008) Tax schemes in a class of differential games. Econ Theory 35(1):155–174

Agrawal A, Chhatre A, Hardin R (2008) Changing governance of the world’s forests. Science 320(5882):1460–1462

Amacher GS (1997) The design of forest taxation: a synthesis with new directions. Silva Fennica 31(1):101–119

Basar T, Olsder GJ (1999) Dynamic noncooperative game theory, 2nd edn. SIAM, New York

Benchekroun H, Van Long N (1998) Efficiency inducing taxation for polluting oligopolists. J Public Econ 70(2):325–342

Benchekroun H, Van Long N (2002) On the multiplicity of efficiency-inducing tax rules. Econ Lett 76(3):331–336

Benchekroun H (2003) Unilateral production restrictions in a dynamic duopoly. J Econ Theory 111(2):214–239

Benchekroun H (2008) Comparative dynamics in a productive resource oligopoly. J Econ Theory 138(1):237–261

Benchekroun H, Chaudhuri AR (2011) Environmental policy and stable collusion: the case of a dynamic polluting oligopoly. J Econ Dyn Control 35(4):479–490

Benchekroun H, Gaudet G, Lohoues H (2014) Some effects of asymmetries in a common pool natural resource oligopoly. Strateg Behav Environ 4(3):213–235

Benchekroun H, Gaudet G (2015) On the effects of mergers on equilibrium outcomes in a common property renewable resource oligopoly. J Econ Dyn Control 52:209–223

Clemhout S, Wan HY (1985) Dynamic common property resources and environmental problems. J Optim Theory Appl 46(4):471–481

Colombo L, Labrecciosa P (2013a) Oligopoly exploitation of a private property productive resource. J Econ Dyn Control 37(4):838–853

Colombo L, Labrecciosa P (2013b) On the convergence to the Cournot equilibrium in a productive resource oligopoly. J Math Econ 49(6):441–445

Colombo L, Labrecciosa P (2015) On the Markovian efficiency of Bertrand and Cournot equilibria. J Econ Theory 155:332–358

Crépin AS, Lindahl T (2009) Grazing games: sharing common property resources with complex dynamics. Environ Resour Econ 44:29–46

Daubanes J (2008) Fossil fuels supplied by oligopolies: on optimal taxation and rent capture. Econ Bull 17(13):1–11

Dockner E, Sorger G (1996) Existence and properties of equilibria for a dynamic game on productive resources. J Econ Theory 71:209–227

Dockner H, Jorgensen S, Van Long N, Sorger G (2000) Differential games in economics and management sciences. Cambridge University Press, Cambridge

Dutta PK, Sundaram RK (1993b) How different can strategic models be? J Econ Theory 60:42–61

Fujiwara K (2008) Duopoly can be more anti-competitive than monopoly. Econ Lett 101(3):217–219

Fujiwara K (2011) Losses from competition in a dynamic game model of a renewable resource oligopoly. Resour Energy Econ 33(1):1–11

Grilli L, Bisceglia M (2017a) A differential game in a duopoly with Instantaneous Incentives. Decis Econ Fin 40(1):317–333

Grilli L, Bisceglia M (2017b) A duopoly with common renewable resource and incentives. Int Game Theory Rev 19(4):1750018

Hartwick JM, Olewiler ND (1998) The economics of natural resource use. Addison Wesley Longman, Reading

Hotelling H (1931) The economics of exhaustible resources. J Polit Econ 39(2):137–175

Karp L, Livernois J (1992) On efficiency-inducing taxation for a nonrenewable resource monopolist. J Public Econ 49:219–239

Kossioris G, Plexousakis M, Xepapadeas A, de Zeeuw A (2011) On the optimal taxation of common-pool resources. J Econ Dyn Control 35(11):1868–1879

Koskela E, Ollikainen M (2001) Forest taxation and rotation age under private amenity valuation: new results. J Environ Econ Manag 42(3):374–384

Lambertini L, Mantovani A (2014) Feedback equilibria in a dynamic renewable resource oligopoly: pre-emption, voracity and exhaustion. J Econ Dyn Control 47:115–122

Lambertini L, Mantovani A (2016) On the (in) stability of nonlinear feedback solutions in a dynamic duopoly with renewable resource exploitation. Econ Lett 143:9–12

Menezes FM, Pereira J (2017) Emissions abatement R&D: dynamic competition in supply schedules. J Public Econ Theory 19(4):841–859

Rowat C (2007) Non-linear strategies in a linear quadratic differential game. J Econ Dyn Control 31(10):3179–3202

Sun CH, Liu CJ (2017) The combination of two tragedies: commons and anticommons tragedies. J Econ 122(1):29–43

Tornell A, Lane P (1996) Power, growth, and the voracity effect. J Econ Growth 1(2):213–241

Tornell A, Lane P (1999) The voracity effect. Am Econ Rev 89(1):22–46

Van Long N (2011) Dynamic games in the economics of natural resources: a survey. Dyn Games Appl 1(1):115–148

Yanase A (2006) Dynamic voluntary provision of public goods and optimal steady-state subsidies. J Public Econ Theory 8(1):171–179

Acknowledgements

The author deeply thanks Hassan Benchekroun, Roberto Cellini, Luca Colombo, Luca Grilli, Paola Labrecciosa and Santiago Rubio for many helpful comments, and Guiomar Martin-Herran for her kind invitation to present this paper at the 18th ISDG (International Symposium on Dynamic Games and Applications, Grenoble, France, July 9–12, 2018). This version has benefited from comments and suggestions from the Editor and two anonymous referees.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Proof of Proposition 1

In order to get the solution of the optimal control problem in feedback form, we adopt the dynamic programming approach. The Hamilton-Jacobi-Bellman (henceforth, HJB) equation is given by:

where \(V(x)\in C^1\) is the unknown (current) value function. The transversality condition is: \(\displaystyle \lim \nolimits _{t\rightarrow \infty } e^{-rt}V(x)=0\), hence it is automatically satisfied by any bounded value function.

In what follows, we show that the value function for the considered problem is given by:

where the values for \({\bar{x}}_1\) and \({\bar{x}}_2\) are given in Proposition 1 and

with:

The FOC for a maximum point of the right hand side of the HJB equation is:Footnote 29

In words, the socially optimal production is the perfect competition quantity minus \(\frac{\partial V}{\partial x}\), which represents the rent associated with an additional unit of resource stock.

For our guess-function, it results:

Therefore, this rent is decreasing w.r.t. x, it tends to infinity when the stock approaches zero and it is zero for large values of the resource stock.

First of all, we must prove that the function V(x) is continuously differentiable. Clearly this holds true for every \(x\in [0,{\bar{x}}_1)\cup ({\bar{x}}_1,{\bar{x}}_2)\cup ({\bar{x}}_2,+\infty )\). Here we prove that V(x) is also continuously differentiable at \(x={\bar{x}}_1\) and \(x={\bar{x}}_2\).

First we check that V(x) is continuous at \(x={\bar{x}}_1\) and \(x={\bar{x}}_2\):

As far as differentiability is concerned, it amounts to check the continuity of the function \(\displaystyle \frac{\partial V}{\partial x}\) at \(x={\bar{x}}_1\) and \(x={\bar{x}}_2\). It is easy to find:

Lastly, it can be easily proved that the considered function V(x) actually solves our optimal control problem. Indeed, for \(x>{\bar{x}}_1\), the HJB equation admits the interior solution \(Q^*(x)=A-\frac{\partial V}{\partial x}\), which, by considering Eq. (10), yields the linear feedback solution (for \(x>{\bar{x}}_1\)) given in Eq. (4). For \(x\le {\bar{x}}_1\), the HJB admits the corner solution \(Q^*(x)=0\). It can be easily checked that the function V(x) specified in (8) satisfies the differential equation obtained after substituting \(Q^*(x)\), as specified in (4), into the HJB equation.

Proof of Corollary 1

The steady-state values of the resource stock are the solutions of the (algebraic) equation: \(F(x)-Q^*(x)=0\). We must consider three cases:Footnote 30

- (i)

For \({\bar{x}}_1\le x<\min \displaystyle \left( \frac{1}{2},{\bar{x}}_2\right) ={\bar{x}}_2\): \(F(x)=\delta x, Q^*(x)=(2\delta -r)x-\frac{A(\delta -r)}{\delta }\) and \(x^*_1=\frac{A}{\delta }\). As far as the stability of the equilibrium point is concerned, we have: \(F(x)-Q^*(x)>0\), hence the resource stock equilibrium trajectory (monotonically) converges to \(x^*_1\) for every initial value \(x_0<{\bar{x}}_2=x^*_1\).

- (ii)

For \({\bar{x}}_2<x<\frac{1}{2}\): \(F(x)=\delta x, Q^*(x)=A\) and, again, we get \(x^*_1=\frac{A}{\delta }\). Again it holds \(F(x)-Q^*(x)>0\), but here this means that the basin of attraction of \(x^*_1\) does not contain any initial value \({\bar{x}}_2<x_0<\frac{1}{2}\).

- (iii)

For \(x>\frac{1}{2}\): \(F(x)=\delta (1-x), Q^*(x)=A\) and \(x^*_2=1-\frac{A}{\delta }>x^*_1\). In this case we have: \(F(x)-Q^*(x)>(<)0\iff x_0<(>)x^*_2\), hence, by taking into account also the results shown in the previous point, it follows that \(x^*_2\) is asymptotically stable with basin of attraction \((1-\frac{A}{\delta },+\infty )\).

Proof of Proposition 3

For \(\alpha =0\), the solution of the monopolist’s optimal control problem in feedback form is given by:

where:

This result can be obtained by applying to the considered problem the same technique shown in “Appendix A”, or more easily, by considering the results shown in Proposition 2 with \(N=1\) and \(A-\beta \) replacing A, since the considered taxation rule plays the role of a constant marginal cost in the firm’s profit function and the FNE of the differential game, taking into account \(\beta \), for \(N=1\) provides the solution of the single-agent optimal control problem.

By comparing this solution with the welfare-maximizing extraction plan given in Proposition 1, it is trivial to find: \(\beta ^*=-A\).

Proof of Proposition 5

Let us consider a simplified version of the regulated oligopoly game in which, as in Lambertini and Mantovani (2014) \(F(x)=\delta x\) and the non-negativity constraint on the feasible output set are not taken into account.Footnote 31 In the remainder, this game will be denoted with \({\tilde{\varGamma }}_{\alpha ,\beta }(t_0,x_0)\). In this more tractable, fully linear-quadratic framework, we are able to determine the linear FNE of the game, which will turn out to be very helpful in the computation of the first-best tax rule for the subgames \(\varGamma _{\alpha ,\beta }(t_0,x_0<\frac{A}{\delta })\).

In order for the (non-degenerate) linear FNE strategies of these subgames to lead to a positive resource stock in steady-state \(x^\infty _{\alpha ,\beta }\), which also constitutes an asymptotically stable equilibrium point, we must consider tax policies such that \((\alpha ,\beta )\in {\mathscr {P}}_1\cup {\mathscr {P}}_2\), where the (disjoint) sets \({\mathscr {P}}_1\) and \({\mathscr {P}}_2\) are defined as follows:

Roughly speaking if \((\alpha ,\beta )\in {\mathscr {P}}_1\), the public authority imposes a unitary tax which is decreasing with respect to the resource stock, such that the firms are discouraged to choose high production levels when the resource stock is scarce, while production is subsidized when the resource preservation is not a concern. Nevertheless, taking into account only the positivity and the stability of the state variable in steady-state, it is also possible to implement a different kind of tax policy, as far as \((\alpha ,\beta )\in {\mathscr {P}}_2\).

Lemma 1

A symmetric linear FNE of \({\tilde{\varGamma }}_{\alpha ,\beta }(t_0,x_0)\) is given by the N-tuple \(({\tilde{\phi }}_{\alpha ,\beta }(x),\ldots ,{\tilde{\phi }}_{\alpha ,\beta }(x))\), where:

where:

with:

The resource stock in steady-state is given by:

and it constitutes an asymptotically stable equilibrium point.

Proof

In order for \({\tilde{\phi }}_{i,(\alpha ,\beta )}(x)\) to be a stationary equilibrium strategy for player i, \(i\in \{1,\ldots ,N\}\), it is necessary that there exists a (current) value function \({\tilde{V}}_i(x)\), continuously differentiable, such that the following HJB equation for player i is satisfied [see Dockner et al. (2000)]:

where \({\tilde{\phi }}_{-i}\equiv \sum _{j\ne i}{\tilde{\phi }}_j\). The transversality condition is: \(\displaystyle \lim \nolimits _{t\rightarrow \infty } e^{-rt}{\tilde{V}}_i(x)=0\). The first order conditions, which are also sufficient, for the maximum point of the right hand side of the HJB equation are:Footnote 32

Given the symmetrical structure of this linear-quadratic differential game, we look for a symmetric linear FNE, that is we impose: \({\tilde{V}}_1(x)=\ldots ={\tilde{V}}_N(x)\equiv {\tilde{V}}(x)\), \({\tilde{\phi }}_{1,(\alpha ,\beta )}(x)=\ldots {\tilde{\phi }}_{N,(\alpha ,\beta )}(x)\equiv {\tilde{\phi }}_{\alpha ,\beta }(x)\), and we guess a value function of the form:

where \(k_0,k_1,k_2\in {\mathbb {R}}\) have to be determined by using the undetermined coefficient technique.

As a result, the first order condition can be rewritten as follows:

By substituting this expression into the HJB and by collecting the terms containing \(x^2\), it follows that \(k_2\) must solve the following (algebraic) equation:

from which we obtain two solutions:

with \(\varDelta \) given by Eq. (14). By imposing \(\varDelta >0\) we get:

which results in the first inequality which defines \({\mathscr {P}}_1\) or \({\mathscr {P}}_2\), respectively. By collecting the terms of the HJB [(after having substituted the FOC (18)] containing x, we get that \(k_1\) is the solution of:

By substituting the two obtained \(k_2\) values we get:

By substituting these values into the FOC (18), it is easy to verify that, for \(\alpha =\beta =0\), the solutions \(k_2^{a},k_1^a\) lead to the Cournot static solution, which we disregard since it does not constitute a FNE of the general unregulated oligopoly game for the most interesting cases in which the initial resource stock endowment is not very high. We have thus considered the other pair of solutions (i.e. \(k_2^{b},k_1^b\)) which, for \(\alpha =\beta =0\), coincides with the non-degenerate FNE strategy found in Lambertini and Mantovani (2014).

Given that we are considering a simple linear resource stock dynamic, it follows that the steady-state resource stock solves: \(\delta x=N{\tilde{\phi }}_{\alpha ,\beta }(x)\), which leads to Eq. (15). This value constitutes an asymptotically stable equilibrium if and only if:

By imposing this condition, it turns out that this is verified for \(\alpha <-\frac{2\delta (n-1)+r(n+1)}{2(n-1)}\) or \(\alpha >-\frac{\delta [2\delta -r(N+1)]}{2\delta -rN}\): the latter is implied by the first inequality which defines the set \({\mathscr {P}}_2\), the former is implied by the first inequality which defines the set \({\mathscr {P}}_1\). Therefore equation (19) provides also a sufficient condition for the asymptotically stability of the equilibrium.

Finally, we notice that the steady-state resource stock can be written as:

whose denominator is negative under the stability condition (20). Therefore \(x^\infty _{\alpha ,\beta }>0\iff H_{\alpha ,\beta }<0\), which is verified for \(\beta >A\) and \(\alpha <\frac{r(3N^2+1)-2\delta (N^2+1)}{2(N-1)^2}\), i.e. for every \((\alpha ,\beta )\in {\mathscr {P}}_1\), or for every \((\alpha ,\beta )\in {\mathscr {P}}_2\). \(\square \)

The values for \(\alpha ^*\) and \(\beta ^*\) shown in Proposition 5 are computed by equating the non-degenerate linear strategy of the benevolent planner, given by Proposition 1, with the aggregate output resulting from the linear FNE of the simplified oligopoly game\({\tilde{\varGamma }}_{\alpha ,\beta }(t_0,x_0)\), given in the Lemma. Notice that \((\alpha ^*,\beta ^*)\in {\mathscr {P}}_1\). In what follows, we prove that the affine linear Markov tax with coefficients \(\alpha ^*\) and \(\beta ^*\) leads the considered FNE of the general regulated oligopoly game to coincide with the socially optimal solution for every \(x\in [0,\frac{A}{\delta }]\).

The HJB equation for player \(i,i\in \{1,\ldots ,N\}\), is Eq. (16), with the considered \(\alpha ^*\) and \(\beta ^*\) values, which must hold with the very same transversality condition.Footnote 33 Given that we are now considering the non-negativity constraint on the output, we guess the following value function:

where the function \({\tilde{V}}(x)\) is the value function we computed for the simplified oligopoly game. By proceeding as in “Appendix A”, it can be proved that the function V(x) is continuously differentiable. Furthermore, for \(x>{\bar{x}}_1\), the HJB Eq. (16) admits the interior solution given by equation (18) for the considered \(\alpha ^*\) and \(\beta ^*\) values, which yields the non-degenerate linear strategy of the benevolent planner. For \(x<{\bar{x}}_1\), the non-negativity constraint on the production is binding, hence the HJB Eq. (16) admits the corner solution \(\phi _{\alpha ^*,\beta ^*}(x)=0\). Summarizing, we have:

It can be easily checked that the function V(x) satisfies the differential equation obtained after substituting \(\phi _{\alpha ^*,\beta ^*}(x)\), as specified above, into the HJB Eq. (16). In other words, we proved that, for every \(x\in [0,\frac{A}{\delta }]\): \(N\phi _{\alpha ^*,\beta ^*}(x)=Q^*(x)\).

Proof of Corollary 4

(a) It is trivial to find: \(\tau ^*(x)=\alpha ^*x+\beta ^*>0\iff x<{\tilde{x}}\), where \({\tilde{x}}\) is given by (7). In steady state: \(\tau ^*(x^*_1)=-\displaystyle \frac{A(\delta N - r)}{(N-2)[\delta (N - 2) + r]}<0\). Furthermore it holds:

We can compute:

implying \({\tilde{x}}<{\hat{x}}\), since \(\tau \) is decreasing w.r.t. x.

(b) Comparative statics provides:

where:

We have:

The last inequality follows since the difference between this threshold and \({\bar{x}}_1\) is given by:

this value being negative, since the denominator is negative and the numerator is positive (because it is increasing in N and positive for \(N=3\)).

With respect to \(\delta \) it results:

where:

We have:

The last inequality follows since the difference between this threshold and \({\bar{x}}_2\) is given by:

this value being negative, since the denominator is negative and the numerator is positive (because it is increasing in N and positive for \(N=3\)).

The duopoly case

Corollary 5

For any value of \(\alpha \) such that \((\alpha ,\beta )\in {\mathscr {P}}_1\) (resp., \((\alpha ,\beta )\in {\mathscr {P}}_2\)) we have:

where the LHS is a decreasing (increasing) function of \(\alpha \). Therefore:

Proof

In a duopoly it holds:

For any \(\alpha \) satisfying the first inequality which defines the set \({\mathscr {P}}_1\), this quantity is (well defined and) negative. It follows that the infimum over \(\alpha \in (-\infty ,-\frac{9(2\delta -r)}{2})\) of the values that \(K_{\alpha }|_{N=2}\) can take is given by:

therefore, in this case: \(\frac{2}{3}K_{\alpha }|_{N=2}>2\delta -r\).

Analogously, for every \(\alpha \) value satisfying the first inequality which defines the set \({\mathscr {P}}_2\), it holds: \(\frac{\partial K_\alpha |_{N=2}}{\partial \alpha }>0\), hence:

therefore, in this case: \(\frac{2}{3}K_{\alpha }|_{N=2}<2\delta -r\). \(\square \)

In a duopoly, when the subsidy per unit of resource decreases (i.e. \(\alpha <0\) increases, still satisfying the first inequality which defines the set \({\mathscr {P}}_1\)), firms have a less aggressive behavior, in the sense that the slope of their non-degenerate linear feedback strategy decreases, nevertheless, in order to achieve the socially-optimal extraction plan, this slope should be lower. If we consider the range of \(\alpha \) values such that \((\alpha ,\beta )\in {\mathscr {P}}_2\), an increase in \(\alpha \) has exactly the opposite effect on the firms’ behavior, nevertheless, given that, as far as only the state-dependent component \(\alpha \) of the tax policy is concerned, production is poorly subsidized or taxed, the marginal effect on the firms’ aggregate production of an increase in the resource stock availability is lower than it would be socially optimal.Footnote 34

Rights and permissions

About this article

Cite this article

Bisceglia, M. Optimal taxation in a common resource oligopoly game. J Econ 129, 1–31 (2020). https://doi.org/10.1007/s00712-019-00662-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-019-00662-y

Keywords

- Tragedy of the commons

- Renewable resource oligopoly

- Differential game

- Optimal tax policy

- Linear Markov tax