Abstract

We consider consumption taxes in a model of endogenous Cournot versus Bertrand competition. It is argued that when the choice of unit versus ad valorem taxes affects longer-term decisions beyond the customary price or quantity decisions, the mix of the two taxes co-determines market conduct. This gives ad valorem taxes an anti-competitive effect that harms ad valorem taxes’ efficiency in comparison with unit taxes. We show that a mix of the taxes—or a unit tax alone if we compare one or the other of the taxes—is sometimes welfare superior on account of consumer-price and tax revenue effects. A practical implication of our findings is that pass-through rates are only sometimes useful guides for policy. In fact, we show when the proper response to demand for higher revenue is a higher unit tax rate and a lower ad valorem tax rate.

Similar content being viewed by others

Notes

Vetter (2017) uses this idea to discuss pricing and endogenous market conduct when an upstream monopolist supplies an input to downstream duopoly firms.

Another exception arises when the two taxes are compared in general equilibrium settings. Grazzini (2006) shows that per-unit taxation might welfare-dominate ad valorem taxes when one takes into account the effect on non-taxed goods. Blackorby and Murty (2007, 2013), analyzing taxes in monopoly, show that unit and ad valorem taxes are identical in a qualified way.

As explained in Maggi (1996), the result in the following Proposition 1 relies on the product differentiation that gives well-behaved residual demand functions defined over prices. This observation also shows that the limiting cases of monopoly and perfect competition are ill defined in the current setting.

We assume that capacity is set before taxes. Another possibility is to assume that taxes are set in a first stage, followed by capacity in a second stage and price in a third stage. In parallel to Grout (1984) the timing of taxes is important when taxes affect the real cost of capital.

Notice that the duopoly model we use is restrictive. For example, we use that, under the same marginal cost, the Bertrand price falls short of the Cournot price. This is not always so in a more general setting. See for example Häckner (2000).

Some straightforward calculations show that the Laffer curve has a positive slope for the Bertrand outcome when \(ab>2\omega \), and \(ab>2\left( {1+b} \right) \psi \) for the Cournot outcome.

Notice that the discontinuity in the marginal cost works a commitment. Firms’ choice of capacity makes sure that there is no un-utilized capacity that in turn implies that firms will not deviate to a lower price.

A referee suggests that, in general, we think of unit and ad valorem taxes in the market for final goods as well as in the market for inputs. Under the assumption that tax rates are the same in the two markets, Eq. (3) is modified to \(\theta _c \left( {\tau , t} \right) =c\left( {\tau , t} \right) +\left( {2+b} \right) ^{-1}b^{2}\left( {\left( {1-\tau } \right) a-\left( {z\left( {\tau , t} \right) +c\left( {\tau , t} \right) +t} \right) } \right) \). Hence, the elasticity rates are \(\partial \theta _c \left( {\tau , t} \right) /\partial \tau \tau /\theta _c \left( {\tau , t} \right) =\left( {c_\tau -\left( {2+b} \right) ^{-1}b^{2}\left( {a+z_\tau +c_\tau } \right) } \right) \tau /\theta _c \left( {\tau , t} \right) \), where \(c_\tau >0\) and \(z_\tau >0\) are partial derivatives with respect to tax rates. Similarly, \(\partial \theta _c \left( {\tau , t} \right) /\partial tt/\theta _c \left( {\tau , t} \right) =\left( {c_t -\left( {2+b} \right) ^{-1}b^{2}\left( {z_t +c_t } \right) } \right) t/\theta _c \left( {\tau , t} \right) \). As in the text we have \(\partial \theta _c \left( {0,t} \right) /\partial \tau \tau /\theta _c \left( {0,t} \right) <0 \)and \(\partial \theta _c \left( {\tau , t} \right) /\partial tt/\theta _c \left( {\tau , t} \right) =0\). Therefore, a change away from pure unit taxation towards ad valorem taxation still implies that competition might change from Bertrand to Cournot.

We assume that \(t_0 \epsilon {\Phi }\) defined by \(\theta _c \left( {0,t_0 } \right) =\theta \) and \(\tau _0 \epsilon {\Phi }\) defined by \(\theta _c \left( {\tau _0,0} \right) \) are both strictly positive. This amounts to \(a>z+c+b^{-2}\left( {2+b} \right) \left( {\theta -c} \right) .\)

When in-house versus external production explains the increased marginal costs, it is conceivable that \(\theta \) is unrelated to c. As noted by a referee we expect that \(\theta \) is, in general, a function of c. In this situation, we would have a critical value of c rather than of \(\theta \), given by \(\theta \left( {c\left( {\tau , t} \right) } \right) =c\left( {\tau , t} \right) +\left( {2+b} \right) ^{-1}b^{2}\left( {\left( {1-\tau } \right) a-\left( {z+c\left( {\tau , t} \right) +t} \right) } \right) .\)

If competition were fixed being either of the Cournot or Bertrand type, pass through is defined for all \(t>0\) and \(0<\tau <1\) and it is easy to see that the ranking follows the one in Häckner and Herzing [2016, equations (11) and (12)].

To see this solve \(\bar{p}^{b}=\left( {2-b} \right) ^{-1}\left( {\left( {1-b} \right) a+\omega } \right) \) for \(\tilde{t} =\left( {2-b} \right) \bar{p}^{b}-\left( {1-b} \right) a-z-\theta \). Next use \(t_{\Phi } \ge t_{\bar{p}^{b}} \) to arrive at the expression in the text.

This utilizes that there is Bertrand competition under the equal-price pairs \(\left( {0,t_\epsilon ^*} \right) \) and \(\left( {\tau _{\Phi }^*, t_{\Phi }^*} \right) \) and that tax revenue goes up, when market conduct is exogenous, with a move towards ad valorem taxation.

References

Anderson SP, de Palma A, Kreider B (2001) The efficiency of indirect taxes under imperfect competition. J Public Econ 81(2):231–251

Blackorby C, Murty S (2007) Unit versus ad valorem taxes: monopoly in general equilibrium. J Public Econ 91(3–4):817–822

Blackorby C, Murty S (2013) Unit versus ad valorem taxes: the private ownership of monopoly in general equilibrium. J Public Econ Theory 15(4):547–579

Delipalla S, Keen M (1992) The comparison between ad valorem and specific taxation under imperfect competition. J Public Econ 49(3):351–367

Dixit AK (1979) A model of duopoly suggesting a theory of entry barriers. Bell J Econ 10(1):10–32

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67(3):297–308

Grazzini L (2006) A note on ad valorem and per unit taxation in an oligopoly model. J Econ 89(1):59–74

Grout P (1984) Investment and wage in the absence of binding contracts: a Nash bargaining approach. Econometrica 52(2):449–460

Häckner J (2000) A note on price and quantity competition in differentiated oligopolies. J Econ Theory 93(2):233–239

Häckner J, Herzing M (2016) Welfare effects of taxation in oligopolistic markets. J Econ Theory 163(2):141–166

Hamilton SF (2009) Excise taxes with multiproduct transactions. Am Econ Rev 99(1):458–471

Lapan HE, Hennessy DA (2011) Unit versus ad valorem taxes in multiproduct oligopoly. J Public Econ Theory 13(1):125–138

Lindh T (1992) The inconsistency of consistent conjecture: coming back to Cournot. J Econ Behav Organ 18(1):69–90

Maggi G (1996) Strategic trade policy with endogenous mode of competition. Am Econ Rev 86(1):237–258

Milgrom P, Roberts J (1990) The economics of modern manufacturing: technology, strategy, and organization. Am Econ Rev 80(3):511–528

Salant SW, Shaffer G (1999) Unequal treatment of identical agents in Cournot equilibrium. Am Econ Rev 89(3):585–604

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. RAND J Econ 15(4):546–554

Suits DB, Musgrave RA (1953) Ad valorem and unit taxes compared. Q J Econ 67(4):598–604

Vetter H (2014) Ad valorem versus unit taxes in oligopoly and endogenous market conduct. Public Financ Rev 42(4):532–551

Vetter H (2017) Pricing and market conduct in a vertical relationship. J Econ (forthcoming)

Wang XH, Zhao J (2009) On the efficiency of indirect taxes in differentiated oligopolies with asymmetric costs. J Econ 96(3):223–239

Weyl EG, Fabinger M (2013) Pass-through as an economic tool: principles of incidence under imperfect competition. J Polit Econ 121(3):528–583

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

The proof uses the following Lemma.

Lemma

To find the way firm i reacts to the price charged by firm j, define \(q^{i}=a-bp^{j}-\hbox {X}^{i}\left( {p^{j},k^{i}} \right) ,\) with \(q^{i}=k^{i}\). That is, \({\mathrm{X}}\left( {p^{j},k^{i}} \right) \) is \(p^{i}\) so that firm i produces exactly at its capacity, \(k^{i},\) given \(p^{j}.\) Now, let \(R^{i}\left( {p^{j},k^{i}} \right) \) be the reaction function of firm i. We have:

Proof of Lemma

Now, \({\mathrm{X}}\left( {p^{j},k^{i}} \right) <r^{i}\left( {p^{j},z+t} \right) \) means that firm i sets a price where the marginal revenue curve cuts the marginal cost curve given by \(z+t.\) In this situation Eq. (1) defines the reaction function:

By analogy, when \({\mathrm{X}}^{i}\left( {p^{j},k^{i}} \right) <r^{i}\left( {p^{j},z+\theta +t} \right) ,\) firm \(i^{\prime }\)s marginal revenue curve cuts the marginal cost curve given by \(z+\theta +t\) and the reaction function is:

Here firm i produces beyond capacity. Finally, in the intermediate case, firm \(i^{\prime }\)s marginal revenue curve cuts the marginal cost curve where marginal costs jump from \(z+t\) to \(z+\theta +t.\) That is, the firm ideally sets a price that results in production at the capacity limit. Clearly, it can charge a higher price and produce less, or it can charge a lower price and sell more. That is, \(r^{i}\left( {p^{j},z+\theta +t} \right)>{\mathrm{X}}^{i}\left( {p^{j},k^{i}} \right) >r^{i}\left( {p^{j},z+t} \right) .\) In this situation, the firm sets a price given by \({\mathrm{X}}\left( {p^{j},k^{i}} \right) ,\) hence the reaction function is:

Proof of Proposition 1

In the second stage, firms’ capacities are given, and the Bertrand response functions are the solutions to \(argmax_{p^{i}} \left( {\left( {1-\tau } \right) p^{i}-x^{i}} \right) q^{i}\), where the marginal cost is \(x^{i}=z+t\) when \(q^{i}\le k^{i}\) and \(x^{i}=z+\theta +t\) when \(q^{i}>k^{i}\). We have:

Equation (7) defines firm i’s best response to the price charged by firm j. To determine the reaction function, define \({\mathrm{X}}\left( {p^{j},k^{i}} \right) \) as the combination of the price set by firm j and the capacity that happens to equalize the output of firm i to its capacity. Formally \(k^{i}=a-bp^{j}-{\Phi }^{i}\left( {p^{j},k^{i}} \right) \). Under this definition firm i charges a price that implies production below capacity when \({\mathrm{X}}\left( {p^{j},k^{i}} \right) <r^{i}\left( {p^{j},z+t} \right) \). In this situation, the reaction function of firm i is given by Eq. (7) with \(x^{i}=z+t\). Similarly, when \({\mathrm{X}}^{i}\left( {p^{j},k^{i}} \right) >r^{i}\left( {p^{j},z+\theta +t} \right) ,\) the firm operates beyond capacity and the reaction function is defined by the best response function in Eq. (7) where \(x^{i}=z+t+\theta \). Finally, when \(r^{i}\left( {p^{j},z+\theta +t} \right)>{\mathrm{X}}^{i}\left( {p^{j},k^{i}} \right) >r^{i}\left( {p^{j},z+t} \right) \) firm i produces at its capacity constraint and the reaction function is \(a+bp^{j}-k^{i}\).Footnote 16

Based on the firm’s reaction function we can see how taxes have a direct effect when the reaction function is given by \(r^{i}\left( {p^{j},x^{i}} \right) \). It is easy to check that firm i sets a higher price in response to the price of firm j as tax rates go up. Equation (7) also shows that unit and ad valorem taxes are quantitatively different. When the unit tax rate increases at the margin, the effect on the price charged by firm i, given the price set by firm j, is \(\left. {\partial p^{i}/\partial t} \right| _{p^{j}} =1/2\left( {1-\tau } \right) ^{-1}\). For a marginal increase in the ad valorem tax rate, the effect is \(\left. {\partial p^{i}/\partial \tau } \right| _{p^{j}} =1/2\left( {1-\tau } \right) ^{-2}x^{i}\). Hence, the ad valorem tax rate’s price effect at the margin becomes more pronounced when the ad valorem tax rate is already high. There is a second effect of taxes. Clearly, the \({\mathrm{X}}^{i}\left( {p^{j},k^{i}} \right) \)-function is not affected by the tax firms pay. Nevertheless, changes in the tax rates have an effect through changes in the reaction-function’s domain because taxes affect firm i’s best response function. That is, in the condition \(r^{i}\left( {p^{j},z+\theta +t} \right)>{\mathrm{X}}^{i}\left( {p^{j},k^{i}} \right) >r^{i}\left( {p^{j},z+t} \right) ,\) changes in the taxes affect the \(r^{i}\)-functions.

Because the introduction of taxes does not change the fact that the reaction-functions’ slopes lie in the range \(\left[ {0,1} \right] \), Proposition 1 in Maggi (1996) establishes an equilibrium in pure strategies. More precisely, let \(p^{c}\left( \psi \right) \), \(\psi =\left( {1-\tau } \right) ^{-1}\left( {z+c+t} \right) \) be the Cournot price under a marginal cost of \(z+c+t\) and \(q^{c}\left( \psi \right) \) the corresponding firm-output:

Similarly, \(p^{b}\left( \omega \right) \), \(\omega =\left( {1-\tau } \right) ^{-1}\left( {z+\theta +t} \right) \), is the Bertrand price under a marginal cost of \(z+t+\theta \) and \(q^{b}\left( \omega \right) \) the corresponding firm-output:

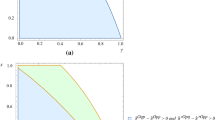

If we define \(\theta _c \) by \(p^{b}\left( \omega \right) =p^{c}\left( \psi \right) \), the Cournot outcome survives when \(\theta >\theta _c \). When \(\theta \le \theta _c \), the outcome is that of a Bertrand duopoly where firms have a marginal cost equal to \(z+\theta +t.\)

Proof of Lemma 1

Because \(\theta =\theta _c \left( {0,t_m } \right) \) defines \(t_m \), it follows that any unit tax rate below \(t_m \) sustains Bertrand equilibrium. Next, consider the solution of \(\theta =\theta _c \left( {\tau _m, 0} \right) \). This defines the ad valorem tax rate where a slight increase changes market conduct from Bertrand to Cournot conduct. Thus, any \(\tau \le \tau _m \) sustains the Bertrand equilibrium. Define \(t_l \) by \(z+\theta +t_l =\left( {1-\tau _m } \right) ^{-1}\left( {z+\theta } \right) \). Clearly, when the unit tax rate satisfies \(z+\theta +t=\left( {1-\tau } \right) ^{-1}\left( {z+\theta } \right) \), \(\tau <\tau _m, \) a pure unit tax system as well as a pure ad valorem tax system sustains Bertrand equilibrium. To the contrary, take any unit tax rate satisfying \(t>t_l \) and define the ad valorem tax rate by \(\left( {1-\tau } \right) ^{-1}\left( {z+\theta } \right) =z+\theta +t\). By construction, this defines ad valorem tax rates bounded from below by \(\tau _m, \) proving the claim.

Proof of Proposition 2

By Lemma 1, the price is \(p^{c}\left( {\psi _{\tilde{\tau }, 0} } \right) \) under the ad valorem tax-only policy with a tax rate of \(\tilde{\tau } \), and \(p^{b}\left( {\omega _{0,\tilde{t} } } \right) \) under the unit tax-only policy. Thus, the tax change’s effect on price is unambiguously positive so that \(p^{b}\left( {\omega _{0,\tilde{t} } } \right) <p^{c}\left( {\psi _{\tilde{\tau }, 0} } \right) \).

The tax revenue changes from \(\tilde{\tau } p^{c}\left( {\psi _{\tilde{\tau }, 0} } \right) q^{c}\left( {\psi _{\tilde{\tau }, 0} } \right) \) to \(\tilde{t} q^{b}\left( {\omega _{0,\tilde{t} } } \right) \), and the effect on the tax revenue is beneficial when

Notice that, by symmetry, it follows from the demand function that \(q^{b}\left( {\omega _{0,\tilde{t} } } \right) =q^{c}\left( {\psi _{\tilde{\tau }, 0} } \right) +\left( {1-b} \right) ^{-1}\left( {p^{c}\left( {\psi _{\tilde{\tau }, 0} } \right) -p^{b}\left( {\omega _{\omega _{0,\tilde{t} } } } \right) } \right) \). Therefore, Eq. (10) becomes:

We have to prove that the inequality in Eq. (11) is satisfied. Using the expressions for prices and quantities in Proposition 1, we see that these are all finite as \(b\rightarrow 1\). This also applies to \(\tilde{t} \) and, in consequence for \(\tilde{\tau } \). Hence, the right-hand side grows without an upper bound as \(b\rightarrow 1\), while the left-hand side is finite showing the claim.

Proof of Proposition 3

When the pair of taxes is in \({\Phi }\) we have that:

When taxes are in \(\tilde{\Phi }_{\tilde{t} } \) we know from \(p^{b}\left( {\omega _{\tau , t} } \right) =p^{b}\left( {\omega _{0,\tilde{t} } } \right) \) that:

Collecting (12) and (13) we have:

Now, (14) shows that \(1-\tau >0\) or \(\tau <1\). Next, notice that \(\tau \) is given by:

Thus, \(\tau >0\) when:

We know that \(\tilde{t} <t_m =a-\left( {z+c} \right) -b^{-2}\left( {2+b} \right) \left( {\theta -c} \right) \). Replacing \(t_m \) for \(\tilde{t} \) in the left-hand side of (16), we see that \(a-\left( {z+\theta +\tilde{t} } \right) >a-\left( {z+\theta +\tilde{t} } \right) t_m =b^{-2}\left( {1+b} \right) \left( {2-b} \right) \left( {\theta -c} \right) \) showing that (16) is satisfied.

Proof of Proposition 7

Define \(t_0^*\) by

and \(t_\epsilon ^*\) by:

Lemma 6.1

\(t_0^*\) is in \({\Phi }_- \),that is, \(t_0^*<t_m \) and \(t_\epsilon ^*<t_m \)

Proof

Because \(\left( {\tau ^{*},t^{*}} \right) \) and \(\left( {0,t_m } \right) \), both are in \({\Phi }\) we have [using Eq. (3)] that \(t_m =a\tau ^{*}+t^{*}\). Some re-arranging shows that \(t_0^*<t_m \):

or

or

which is satisfied as Bertrand quantities, \(\left( {1-\tau ^{*}} \right) a-\left( {z+\theta +t^{*}} \right) \), are positive.

Lemma 6.2

When \(t_0^*\) is in \({\Phi }_- \), \(t_\epsilon ^*\) is also in \({\Phi }_- \) for \(\left( {z+c+t_m } \right) \epsilon <\left( {1-\tau ^{*}} \right) \left( {t_m -t_0^*} \right) \)

Proof

Combining (17) and (18) we have:

Solving for \(t_\epsilon ^*\) gives:

Rearranging of \(t_\epsilon ^*<t_m \) gives:

Lemma 6.3

Comparing the tax policies \(\left( {\tau ^{*}+\epsilon ,t^{*}} \right) \) and \(\left( {0,t_\epsilon ^*} \right) \) we have \(p^{b}\left( {\omega _{0,t_\epsilon ^*} } \right) <p^{c}\left( {\psi _{\tau ^{*}+\epsilon ,t^{*}} } \right) \) and tax revenue under \(\left( {0,t_\epsilon ^*} \right) \) exceeds that under \(\left( {\tau ^{*}+\epsilon ,t^{*}} \right) \) for b sufficiently large.

Proof

The tax policy \(\left( {\tau ^{*}+\epsilon ,t^{*}} \right) \) implements Cournot prices and quantities. Thus the price under this policy is \(p^{c}\left( {\psi _{\tau ^{*}+\epsilon ,t^{*}} } \right) \). When the tax policy \(\left( {0,t_\epsilon ^*} \right) \) replaces \(\left( {\tau ^{*}+\epsilon ,t^{*}} \right) \), Lemma 6.2 implies that the price is \(p^{b}\left( {\omega _{0,t_\epsilon ^*} } \right) <p^{c}\left( {\psi _{\tau ^{*}+\epsilon ,t^{*}} } \right) \).

The effect on the tax revenue is beneficial when

Notice that by symmetry, it follows from the demand function that \(q^{b}\left( {\omega _{0,t_\epsilon ^*} } \right) =q^{c}\left( {\psi _{\tau ^{*}+\epsilon ,t^{*}} } \right) +\left( {1-b} \right) ^{-1}\left( {p^{c}\left( {\psi _{\tau ^{*}+\epsilon ,t^{*}} } \right) -p^{b}\left( {\omega _{0,t_\epsilon ^*} } \right) } \right) \). Using this in (25):

Because prices, quantities and taxes are finite for all b-values, we see that the right-hand side grows without an upper bound as \(b\rightarrow 1\) while the left-hand side is finite showing the claim.

Proof of Proposition 6

We first establish that \(\tau _{\Phi }^*<\tau ^{*}+\epsilon \) and \(t_{\Phi }^*>t^{*}\). Notice that \(\left( {\tau ^{*}+\epsilon ,t^{*}} \right) \) as well as \(\left( {\tau _{\Phi }^*, t_{\Phi }^*} \right) \) are in \(\tilde{\Phi }_{t_\epsilon ^*} \) so that \(p^{b}\left( {\omega _{\tau _{\Phi }^*, t_{\Phi }^*} } \right) =p^{b}\left( {\omega _{\tau ^{*}+\epsilon ,t^{*}} } \right) \), or:

Next, because \(\left( {\tau ^{*}+\epsilon ,t^{*}} \right) \) and \(\left( {\tau _{\Phi }^*, t_{\Phi }^*} \right) \) are also in \({\Phi }\) we have:

Using this in (27) we have:

If we set \(t_{\Phi }^*=t^{*}\) the left-hand side is strictly greater than the right-hand side because of \(\epsilon \). The right-hand side is increasing in \(t_{\Phi }^*\) and it follows that \(t_{\Phi }^*>t^{*}\). Because the ad valorem tax rate and the unit tax rate varies inversely along \({\Phi }\), it follows that \(\tau _{\Phi }^*<\tau ^{*}\).

With respect to tax revenue we have \(R_{\tau _{\Phi }^*, t_{\Phi }^*}>R_{0,t_\epsilon ^*}>R_{\tau ^{*}+\epsilon ,t^{*}} >R_{\tau ^{*},t^{*}} \). Therefore, by continuity, there are tax rates, called \(\hat{\tau }\) and \(\hat{t}\), that satisfy \(\tau _{\Phi }^*<\hat{\tau }<\tau ^{*}\) and \(t_{\Phi }^*>\hat{t}>t^{*}\) and \(R_{\hat{\tau }, \hat{t}} =R_{\tau ^{*}+\epsilon ,t^{*}} \).

Evaluating tax changes that keep the Bertrand price intact at \(p^{b}\left( {\omega _{\tau _{\Phi }^*, t_{\Phi }^*} } \right) \) we have \(\left. {dt/d\tau } \right| _{\tilde{\Phi }_{t_\epsilon ^*} } =-\left( {1-\tau _{\Phi }^*} \right) ^{-1}\left( {z+\theta +t_{\Phi }^*} \right) \). On the other hand, the tax changes around \(\left( {\tau _{\Phi }^*, t_{\Phi }^*} \right) \) are restricted to be in \({\Phi }\) so that \(\left. {dt/d\tau } \right| _{\Phi } =-a\). At any meaningful solution we have \(\left. {dt/d\tau } \right| _{\Phi } <\left. {dt/d\tau } \right| _{\tilde{\Phi }_{t_\epsilon ^*} } \) showing that the price goes down as we move from \(\left( {\tau _{\Phi }^*, t_{\Phi }^*} \right) \) to \(\left( {\hat{\tau }, \hat{t}} \right) \).

Rights and permissions

About this article

Cite this article

Vetter, H. Commodity taxes and welfare under endogenous market conduct. J Econ 122, 137–154 (2017). https://doi.org/10.1007/s00712-017-0538-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-017-0538-4