Abstract

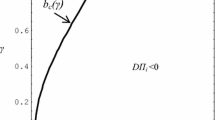

This paper analyzes decentralized wage bargaining in a unionized oligopoly industry. The novel features of the proposed model are that firms are subject to incomplete information concerning their cost and that wages may signal firms’ private information. The potential for signaling exerts an upward shift on the equilibrium wage profile which mitigates the externality that has been shown to weaken unions’ bargaining power in decentralized wage bargaining.

Similar content being viewed by others

Notes

In detail, in 2012 the highest bonus of 8.251€ was paid by Audi, followed by 7.650€ (BMW), 7.600€ (Porsche), 7.500€ (Volkswagen), and 4.100€ (Daimler). In 2014 the bonuses were: 8.200€ (Porsche), 8.140€ (BMW), 6.900€ (Audi), 6.200€ (Volkswagen), 2.541€ (Daimler).

However, even in countries like Germany, bargaining at the industry level is frequently supplemented by bargaining at the firm level, where bonuses are negotiated.

In the US the Taft-Hartley Act outlawed the “closed shop” in 1947, but permits the “union shop”, except in those states that have passed right-to-work laws. In a “union shop” unions may require that those who are employed become members of the union. This is the case when the union is sufficiently strong.

For simplicity of exposition, we ignore severance payments to unemployment members.

Suppose firm-union coalitions base their outputs decision on their respective opportunity costs. These opportunity costs are \((c_1,c_2):=(\theta _1+\delta , \theta _2+\delta )\). Then, the most favorable case for monopoly is the profile \(\theta _1=\alpha , \theta _2=0\) or vice versa. The above condition assures that even in that most favorable case for monopoly, both equilibrium outputs are positive.

While this procedure proves existence of a unique symmetric separating equilibrium it does not exclude existence of pooling equilibria. Typically, signaling games have both separating and pooling equilibria. However, pooling equilibria, if they exist at all, are typically eliminated by standard equilibrium refinements such as the “intuitive criterion” (Cho and Kreps 1987).

For convenience we denote partial derivatives, such as \(\partial N / \partial z\), by \(\partial _z N\).

In optimization theory, this property of the function \(\log N\) is known as the pseudo-concavity.

This excludes probability distribution that exhibit a high concentration on low values. It is satisfied for most typically employed distributions (including the uniform distribution for which \(\bar{\theta }= \alpha / 2\)), and it holds for the family of truncations of \(F\), \(G(\theta ): [d,\alpha ] \rightarrow [0,1], G_d(\theta ):= (F(\theta )-F(d))/(\alpha -d)\), provided \(0<d<\alpha \) is sufficiently large.

See, for example Kreps and Scheinkman (1983), who showed that the equilibrium outcome of a complex Bertrand market game in which firms choose their capacity before they engage in price competition, is equivalent to the equilibrium outcome of a simple Cournot market game.

References

Cho IK, Kreps D (1987) Signaling games and stable equilibria. Q J Econ 102:179–221

Corneo G (1995) National wage bargaining in an internationally integrated product market. Eur J Polit Econ 11:503–520

Das Varma G (2003) Bidding for a process innovation under alternative modes of competition. Int J Ind Organ 21:15–37

Davidson C (1988) Multiunit bargaining in oligopolistic industries. J Labor Econ 6:397–422

Ding W, Fan C, Wolfstetter E (2013) Horizontal mergers with synergies: Cash- vs. profit-share auctions. Int J Ind Organ 31:382–391

Dowrick S (1989) Union-oligopoly bargaining. Econ J 99:1123–1142

Goeree J (2003) Bidding for the future: signaling in auctions with an aftermarket. J Econ Theory 108:345–364

Hall R, Lilien D (1979) Efficient wage bargains under uncertain supply and demand. Am Econ Rev 69:868–879

Haucap J, Pauly U, Wey C (2007) A cartel analysis of the German labor institutions and its implications for labor market reform. J Inst Theor Econ 163:503–516

Horn H, Wolinski A (1988) Bilateral monopolies and incentives for merger. RAND J Econ 19:408–419

Jehiel P, Moldovanu B (2000) Auctions with downstream interaction among buyers. RAND J Econ 31:768–791

Kreps DM, Scheinkman JA (1983) Quantity precommitment and Bertrand competition yield Cournot outcomes. Bell J Econ 14:326–337

Leontief W (1946) The pure theory of the guaranteed annual wage contract. J Polit Econ 56:76–79

Mas-Colell A, Whinston M, Green J (1995) Microeconomic theory. Oxford University Press, Oxford

McDonald I, Solow R (1981) Wage bargaining and employment. Am Econ Rev 71:896–908

Milgrom P, Roberts J (1982) Limit pricing and entry under incomplete information: a general equilibrium analysis. Econometrica 50:443–459

Mukherjee A, Suetrong K (2010) Unionisation structure and outward foreign investment. Working paper, University of Nottingham

Myerson RB (1979) Incentive compatibility and the bargaining problem. Econometrica 47:61–73

Nash J (1950) The bargaining problem. Econometrica 18:155–162

Oswald A (1982) The microeconomic theory of the trade union. Econ J 92:576–595

Pal R, Saha B (2008) Union-oligopoly bargaining and entry deterrence: a reassessment of limit pricing. J Econ 95:121–147

Rubinstein A (1982) Perfect equilibrium in a bargaining game. Econometrica 50:97–109

Vannetelbosch V (1997) Wage bargaining with incomplete information in an unionized Cournot oligopoly. Eur J Polit Econ 13:353–374

Acknowledgments

I would like to thank the editor, two anonymous referees, Anja Schöttner, and Elmar Wolfstetter for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendix: Supplement to the proof of Proposition 3

Appendix: Supplement to the proof of Proposition 3

Here we show that, evaluated at \(z=\theta , w=w_B\), one has \(\partial _z \log N<0\), and thus \(\partial _z N<0\), for all \(\theta \), assuming that \(\bar{\theta }\ge \frac{2}{11} \alpha \). The proof is prepared by two auxiliary results:

(1) Observe that, evaluated at \(z=\theta , w=w_B\),

(2) Therefore, evaluated at \(z=\theta , w=w_B\),

Hence, evaluated at \(z=\theta , w=w_B\),

There, the first inequality is based on Jensen’s Inequality concerning a continuous variation of the random variable \(\theta _2\) for the convex function \((\cdot )^2\), and the last inequality follows from the fact that \(w_B(\theta )-\delta < 2 E(L)\), as shown in (35) above.

Rights and permissions

About this article

Cite this article

Ding, W. Decentralized union-oligopoly bargaining when wages signal strength. J Econ 114, 239–254 (2015). https://doi.org/10.1007/s00712-014-0401-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-014-0401-9