Abstract

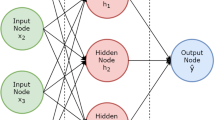

Financial analysis of the stock market using the historical data is the exigent demand in business and academia. This work explores the efficiency of three deep learning (Dl) techniques, namely Bayesian regularization (BE), Levenberg–Marquardt (lM), and scaled conjugate gradient (SCG), for training nonlinear autoregressive artificial neural networks (NARX) for predicting specifically the closing price of the Egyptian Stock Exchange indices (EGX-30, EGX-30-Capped, EGX-50-EWI, EGX-70, EGX-100, and NIlE). An empirical comparison is established among the experimented prediction models considering all techniques for the time horizon of 1 day, 3 days, 5 days, 7 days, 5 days and 30 days in advance, applying on all the datasets used in this study. For performance evaluation, statistical measures such as mean squared error (MSE) and correlation R are used. From the simulation result, it can be clearly suggested that BR outperforms other models for short-term prediction especially for 3 days ahead. On the other hand, lM generates better prediction accuracy than BR- and SCG-based models for long-term prediction, especially for 7-day prediction.

Similar content being viewed by others

References

Das SR, Mishra D, Rout M (2019) Stock market prediction using firefly algorithm with evolutionary framework optimized feature reduction for oselm method. Expert Syst Appl X 4:100016

Jin Z, Yang Y, Liu Y (2019) Stock closing price prediction based on sentiment analysis and LSTM. Neural Comput Appl p 1–17

Armano G, Marchesi M, Murru A (2005) A hybrid genetic-neural architecture for stock indexes forecasting. Inf Sci 170(1):3–33

Mishra S, Padhy S (2019) An efficient portfolio construction model using stock price predicted by support vector regression. In: The North American Journal of Economics and Finance, p 101027

Tkáč M, Verner R (2016) Artificial neural networks in business: two decades of research. Appl Soft Comput 38:788–804

Esfahanipour A, Aghamiri W (2010) Adapted neuro-fuzzy inference system on indirect approach tsk fuzzy rule base for stock market analysis. Expert Syst Appl 37(7):4742–4748

Sadaei HJ, Enayatifar R, lee MH, Mahmud M (2016) A hybrid model based on differential fuzzy logic relationships and imperialist competitive algorithm for stock market forecasting. Appl Soft Comput 40:132–149

Shi L, Teng Z, Wang L, Zhang Y, Binder A (2018) Deepclue: visual interpretation of text-based deep stock prediction. IEEE Trans Knowl Data Eng 31(6):1094–1108

Bai Y, Jin X, Wang X, Su T, Kong J, Lu Y (2019) Compound autoregressive network for prediction of multivariate time series. Complexity, 2019

Sheremetov I, Cosultchi A, Martínez-Muñoz J, Gonzalez-Sánchez A, Jiménez-Aquino MA (2014) Data-driven forecasting of naturally fractured reservoirs based on nonlinear autoregressive neural networks with exogenous input. J Petrol Sci Eng 123:106–119

Wunsch A, liesch T, Broda S (2018) Forecasting groundwater levels using nonlinear autoregressive networks with exogenous input (NARX). J Hydrol 567:743–758

louzazni M, Mosalam H, Khouya A (2020) A non-linear auto-regressive exogenous method to forecast the photovoltaic power output. Sustain Energy Technol Assess 38:100670

Delcroix B, le Ny J, Bernier M, Azam M, Qu B, Venne J-S (2020) Autoregressive neural networks with exogenous variables for indoor temperature prediction in buildings. In: Building Simulation, pp 1–14. Springer

Zhou F, Alsaid A, Blommer M, Curry R, Swaminathan R, Kochhar D, Talamonti W, Tijerina L, Lei B (2020) Driver fatigue transition prediction in highly automated driving using physiological features. In: Expert Systems with Applications, p 113204

Saadon A, Abdullah J, Muhammad NS, Ariffin J (2020) Development of riverbank erosion rate predictor for natural channels using NARX-QR factorization model: a case study of Sg. Bernam, Selangor, Malaysia. Neural Comput Appl pp. 1–11

Kumar J, Saxena D, Singh AK, Mohan A (2020) Biphase adaptive learning-based neural network model for cloud datacenter workload forecasting. Soft Comput, pp 1–18

Yu P, Yan X (2019) Stock price prediction based on deep neural networks. Neural Comput Appl, pp 1–20

Das D, Sadiq AS, Mirjalili S, Noraziah A (2017) Hybrid clustering-gwo-narx neural network technique in predicting stock price. In: Journal of Physics: Conference Series, volume 892, page 012018. IOP Publishing,

Matkovskyy R, Bouraoui T (2019) Application of neural networks to short time series composite indexes: evidence from the nonlinear autoregressive with exogenous inputs (narx) model. J Quant Econ 17(2):433–446

Araújo RdeA, Nedjah N, Oliveira A lI, Silvio Rdel (2019) A deep increasing–decreasing-linear neural network for financial time series prediction. Neurocomputing 347:59–81

Chong E, Han C, Park FC (2017) Deep learning networks for stock market analysis and prediction: methodology, data representations, and case studies. Expert Syst Appl 83:187–205

Nayak SC, Misra BB, Behera HS (2017) Artificial chemical reaction optimization of neural networks for efficient prediction of stock market indices. Ain Shams Eng J 8(3):371–390

Pradeepkumar D, Ravi V (2017) Forecasting financial time series volatility using particle swarm optimization trained quantile regression neural network. Appl Soft Comput 58:35–52

Göçken M, Özçalıcı M, Boru A, Dosdoğru AT (2019) Stock price prediction using hybrid soft computing models incorporating parameter tuning and input variable selection. Neural Comput Appl 31(2):577–592

Selvamuthu D, Kumar V, Mishra A (2019) Indian stock market prediction using artificial neural networks on tick data. Financial Innovat 5(1):16

Moghaddam AH, Moghaddam MH, Esfandyari M (2016) Stock market index prediction using artificial neural network. J Econ Finance Admin Sci 21(41):89–93

Zahra B, Lazaar M (2019) Integration of principal component analysis and recurrent neural network to forecast the stock price of casablanca stock exchange. Procedia Comput Sci 148:55–61

Zhong X, Enke D (2017) Forecasting daily stock market return using dimensionality reduction. Expert Syst Appl 67:126–139

Patel J, Shah S, Thakkar P, Kotecha K (2015) Predicting stock market index using fusion of machine learning techniques. Expert Syst Appl 42(4):2162–2172

Hushani P (2019) Using autoregressive modelling and machine learning for stock market prediction and trading. In: Third International Congress on Information and Communication Technology, pp 767–774. Springer

labde S, Patel S, Shukla M (2017) Time series regression model for prediction of closing values of the stock using an adaptive narx neural network. Int J Comput Appl 158(10):29–35

Pawar K, Jalem RS, Tiwari V (2019) Stock market price prediction using LSTM RNN. In: Emerging Trends in Expert Applications and Security, pp 493–503. Springer

Bhowmick A, Rahman A, Rahman RM (2019) Performance analysis of different recurrent neural network architectures and classical statistical model for financial forecasting: A case study on dhaka stock exchange. In: Computer Science On-line Conference, pp 277–286. Springer

Kim T, Kim HY (2019) Forecasting stock prices with a feature fusion lstm-cnn model using different representations of the same data. PloS ONE 14(2):e0212320

Cao J, Wang J (2019) Exploration of stock index change prediction model based on the combination of principal component analysis and artificial neural network. Soft Comput, pp 1–10

Naik N, Mohan BR (2019) Study of stock return predictions using recurrent neural networks with LSTM. In: International conference on engineering applications of neural networks, pp 453–459. Springer

Jadhav S, Dange B, Shikalgar S (2018) Prediction of stock market indices by artificial neural networks using forecasting algorithms. In: International conference on intelligent computing and applications, pp 455–464. Springer

Baek Y, Kim HY (2018) Modaugnet: A new forecasting framework for stock market index value with an overfitting prevention lstm module and a prediction lstm module. Expert Syst Appl 113:457–480

Pang X, Zhou Y, Wang P, Lin W, Chang V (2018) An innovative neural network approach for stock market prediction. J Supercomput, pp 1–21

Hu H, Tang L, Zhang S, Wang H (2018) Predicting the direction of stock markets using optimized neural networks with google trends. Neurocomputing 285:188–195

Hiransha M, Gopalakrishnan EA, Menon VK, Soman KP (2018) Nse stock market prediction using deep-learning models. Procedia Comput Sci 132:1351–1362

Shen G, Tan Q, Zhang H, Zeng P, Jianjun X (2018) Deep learning with gated recurrent unit networks for financial sequence predictions. Procedia Comput Sci 131:895–903

Balaji AJ, Ram DSH, Nair BB (2018) Applicability of deep learning models for stock price forecasting an empirical study on bankex data. Procedia Comput Sci 143:947–953

Qiu M, Song Y, Akagi F (2016) Application of artificial neural network for the prediction of stock market returns: the case of the japanese stock market. Chaos Solitons Fractals 85:1–7

Jin L, Li S, Hu B (2017) Rnn models for dynamic matrix inversion: a control-theoretical perspective. IEEE Trans Ind Inf 14(1):189–199

Lin T-N, Giles CL, Horne BG, Kung S-Y (1997) A delay damage model selection algorithm for narx neural networks. IEEE Trans Signal Process 45(11):2719–2730

lipu MSH, Hannan MA, Hussain A, Saad MHM, Ayob A, Blaabjerg F (2018) State of charge estimation for lithium-ion battery using recurrent narx neural network model based lighting search algorithm. IEEE Access 6:28150–28161

Haykin S (1994) Neural networks: a comprehensive foundation. Prentice Hall PTR, Upper Saddle River

Buevich A, Sergeev A, Shichkin A, Baglaeva E (2020) A two-step combined algorithm based on NARX neural network and the subsequent prediction of the residues improves prediction accuracy of the greenhouse gases concentrations. Neural Comput Appl 1–11

Møller MF (1990) A scaled conjugate gradient algorithm for fast supervised learning. Aarhus University, Computer Science Department

Aburaed N, Atalla S, Mukhtar H, Al-Saad M, Mansoor W (2019) Scaled conjugate gradient neural network for optimizing indoor positioning system. In: 2019 International Symposium on Networks, Computers and Communications (ISNCC), pp 1–4. IEEE

MacKay DJC (1992) Bayesian interpolation. Neural Comput 4(3):415–447

Jonathon T (2013) A bayesian regularized artificial neural network for stock market forecasting. Expert Syst Appl 40:5501–5506

Taqvi SA, Tufa LD, Zabiri H, Maulud AS, Uddin F (2018) Fault detection in distillation column using NARX neural network. Neural Comput Appl 1–17

Buitrago J, Asfour S (2017) Short-term forecasting of electric loads using nonlinear autoregressive artificial neural networks with exogenous vector inputs. Energies 10(1):40

Demuth H, Beale M, Hagan M (1992) Neural network toolbox. For Use with MATlAB. The MathWorks Inc, 2000

liu G, Wang X (2019) A new metric for individual stock trend prediction. Eng Appl Artif Intell 82:1–12

Orimoloye LO, Sung M-C, Ma T, Johnson JEV (2020) Comparing the effectiveness of deep feedforward neural networks and shallow architectures for predicting stock price indices. Expert Syst Appl 139:112828

levenberg K (1944) A method for the solution of certain non-linear problems in least squares. Q Appl Math 2(2):164–168

Marquardt DW (1963) An algorithm for least-squares estimation of nonlinear parameters. J Soc Ind Appl Math 11(2):431–441

Box GEP, Jenkins GM, Reinsel GC, Ljung GM (2015) Time series analysis: forecasting and control. Wiley, New York

Schmidhuber J (2015) Deep learning in neural networks: an overview. Neural Netw 61:85–117

Tong S, Sun K, Sui S (2017) Observer-based adaptive fuzzy decentralized optimal control design for strict-feedback nonlinear large-scale systems. IEEE Trans Fuzzy Syst 26:569–584

Zhang J, Yin Z, Wang R (2017) Nonlinear dynamic classification of momentary mental workload using physiological features and NARX-model-based least-squares support vector machines. IEEE Trans Hum–Mach Syst 47:536–549

Xiao Z, Jing X, Cheng L (2013) Parameterized convergence bounds for Volterra series expansion of NARX models. IEEE Trans Signal Process 61:5026–5038

Feng F, He X, Wang X, Luo C, Liu Y, Chua TS (2019) Temporal relational ranking for stock prediction. ACM Trans Inf Syst (TOIS) 37:1–30

Zhang L, Aggarwal C, Qi G-J (2017) Stock price prediction via discovering multi-frequency trading patterns. In: Proceedings of the 23rd ACM SIGKDD international conference on knowledge discovery and data mining: 2141–2149

Kara Y, Boyacioglu MA, Baykan ÖK (2011) Predicting direction of stock price index movement using artificial neural networks and support vector machines: the sample of the Istanbul Stock Exchange. Expert Syst Appl 38:5311–5319

Patel J, Shah S, Thakkar P, Kotecha, K (2015) Predicting stock and stock price index movement using trend deterministic data preparation and machine learning techniques. Expert Syst Appl 42:259–268

Wang J, Wang J (2016) Forecasting energy market indices with recurrent neural networks: case study of crude oil price fluctuations. Energy 102:365–374

Cheng F, Fan T, Dandan F, Shanling L (2018) The prediction of oil price turning points with log-periodic power law and multi-population genetic algorithm. Energy Econ 72:341–355

Hatcher WG, Yu W (2018) A survey of deep learning: Platforms, applications and emerging research trends. IEEE Access 6:24411–24432

leCun Y, Bengio Y, Hinton G (2015) Deep learning. Nature 521:436–444

D O’Brien J, Dassios LK, Gleeson JP (2019) Spreading of memes on multiplex networks. New J Phys 21:025001

Ekhtiari A, Dassios L, Liu M, Syron E (2019) A novel approach to model a gas network. Appl Sci 9:1047

Dassios L, O’Keeffe G, Jivkov AP (2018) A mathematical model for elasticity using calculus on discrete manifolds. Math Methods Appl Sci 41:9057–9070

Acknowledgements

The authors would like to thank Minia University for supporting this research. This research is also partially supported by University of Electronic Science and Technology of China (UESTC) and National Natural Science Foundation of China (NSFC) under the Grant No. 61772120.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Houssein, E.H., Dirar, M., Hussain, K. et al. Assess deep learning models for Egyptian exchange prediction using nonlinear artificial neural networks. Neural Comput & Applic 33, 5965–5987 (2021). https://doi.org/10.1007/s00521-020-05374-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-020-05374-9