Abstract

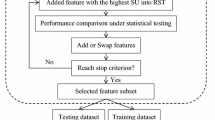

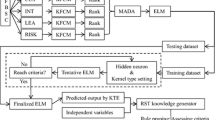

This study proposes a novel technique by extending balanced scorecards with risk management considerations (i.e., risk metrics and insolvency risk) for corporate operating performance assessment and then establishes a fusion mechanism that incorporates hybrid filter-wrapper subset selection (HFW), random vector functional-link network (RVFLN), and ant colony optimization (ACO) for operating performance forecasting. The study executes HFW, which preserves the advantages of wrapper approaches, but prevents paying its tremendous computational cost, in order to determine the essential features for forecasting model construction. With the merits of rapid learning speed and no extra inherent parameters needed to be tuned, RVFLN helps establish the forecasting model. However, RVFLN has demonstrated that its superior forecasting performance comes with the challenge of being unable to represent the inherent decision logic for humans to comprehend. To cope with this task, the study conducts ACO so as to extract the inherent knowledge from RVFLN and represents it in human-readable format. If the extracted knowledge is not comprehensive for decision makers, then they will not be able to interpret and verify it. In this circumstance, the decision makers probably will not trust enough the extracted knowledge and be prone to making unreliable judgments more easily. The introduced mechanism herein is examined by real cases and poses superior forecasting quality under numerous examinations. It is a promising alternative for corporate operating performance forecasting.

Similar content being viewed by others

References

Ahn H (2001) Applying the balanced scorecard concept: an experience report. Long Range Plan 34:441–461

Barakat N, Diederich J (2005) Eclectic rule-extraction from support vector machines. Int J Comput Intell 2:59–62

Barakat N, Bradley AP (2010) Rule extraction from support vector machines: a review. Neurocomputing 74:178–190

Bacciu D (2015) Unsupervised feature selection for sensor time-series in pervasive computing applications. Neural Comput Appl. doi:10.1007/s00521-015-1924-x

Bartlett PL (1998) The sample complexity of pattern classification with neural networks: the size of the weights is more important than the size of the network. IEEE Trans Inf Theory 44:525–536

Bermejo P, Gámez JA, Puerta JM (2011) A GRASP algorithm for fast hybrid (filter-wrapper) feature subset selection in high-dimensional datasets. Pattern Recogn Lett 32:701–711

Cao J, Lin Z, Huang GB (2012) Self-adaptive evolutionary extreme learning machine. Neural Process Lett 36:285–305

Chiang CY, Lin B (2009) An integration of balanced scorecards and data envelopment analysis for firm’s benchmarking management. Total Qual Manag Bus 20:1153–1172

Davis S, Albright T (2004) An investigation of the effect of the balanced scorecard implementation on financial performance. Manag Acc Res 15:135–153

Dash M, Liu H (1997) Feature selection for classification. Intell Data Anal 1:131–156

Dai W, Liu Q, Chai T (2015) Particle size estimate of grinding processes using random vector functional link networks with improved robustness. Neurocomputing 169:361–372

Dessler G (2000) Human resource management, 8th edn. Prentice Hall, New Jersey

Delis MD, Hasan I, Tsionas EG (2014) The risk of financial intermediaries. J Bank Financ 44:1–12

Demsar J (2006) Statistical comparisons of classifiers over multiple data sets. J Mach Learn Res 7:1–30

Eilat H, Golany B, Shtub A (2008) R&D project evaluation: an intergrade DEA and Balanced Scorecard approach. Omega 36:895–912

Friedman M (1974) Explanation and scientific understanding. J Philos 71:5–19

Flores MJ, Gámez JA (2005) Breeding value classification in Manchego sheep: a study of attribute selection and construction. Lect Notes Comput Sci 3682:1338–1346

Gallant S (1988) Connectionist expert system. Commun ACM 31:152–169

Geng R, Bose I, Chen X (2015) Prediction of financial distress: an empirical study of listed Chinese companies using data mining. Eur J Oper Res 241:236–247

Gethsiyal Augasta M, Kathirvalavakumar T (2012) A new discretization algorithm based on range coefficient of dispersion and skewness for neural networks classifier. Appl Soft Comput 12:619–625

Guyon I, Elisseeff A (2003) An introduction to variable and feature selection. J Mach Learn Res 3:1157–1182

Hornik K, Stinchcombe M, White H (1989) Multilayered feed forward networks are universal approximators. Neural Netw 2:359–366

Huang GB, Zhu QY, Siew CK (2006) Extreme learning machine: theory and applications. Neurocomputing 70:489–501

Huang GB, Li MB, Chen L, Siew CK (2008) Incremental extreme learning machine with fully complex hidden nodes. Neurocomputing 71:76–583

Huang GB, Wang DH, Lan Y (2011) Extreme learning machines: a survey. Int J Mach Learn Cybern 2:107–122

Huang GB (2015) What are extreme learning machines? Filling the gap between Frank Rosenblatt’s dream and John von Neumann’s puzzle. Cogn Comput 7:263–278

Huang GB, Bai Z, Kasun LLC, Vong CM (2015) Local receptive fields based extreme learning machine. IEEE Comput Intell Mag 10:18–29

Hsu YS, Lin SJ (2014) An emerging hybrid mechanism for information disclosure forecasting. Int J Mach Learn Cybern. doi:10.1007/s13042-014-0295-4

Igelnik B, Pao Y (1995) Stochastic choice of basis functions in adaptive function approximation and the functional-link net. IEEE Trans Neural Netw 6:1320–1329

Jia J, Yang N, Zhang C, Yue A, Yang J, Zhu D (2013) Object-oriented feature selection of high spatial resolution images using an improved Relief algorithm. Math Comput Model 58:619–626

Jung C, Shen Y, Juao L (2015) Learning to rank with ensemble ranking SVM. Neural Process Lett 42:703–714

Kaplan RS, Norton DP (1996) Using the balanced scorecard as a strategic management system. Harv Bus Rev 74:75–85

Lichman M (2013) UCI machine learning repository. http://archive.ics.uci.edu/ml. University of California, School of Information and Computer Science, Irvine, CA

Ljung L, Glad T (1994) On global identifiability of arbitrary model parametrizations. Automatica 30:265–276

Lin WY (2015) A novel 3D fruit fly optimization algorithm and its applications in economics. Neural Comput Appl. doi:10.1007/s00521-015-1942-8

Lin SJ, Chen TF (2016) Multi-agent architecture for corporate operating performance assessment. Neural Process Lett 43:115–132

Martens D, Baesens B, Gestel TV, Vanthienen J (2006) Comprehensible credit scoring models using rule extraction from support vector machines. Eur J Oper Res 183:1466–1476

Martens D, Baesens B, Gestel TV (2009) Decompositional rule extraction from support vector machines by active learning. IEEE Trans Knowl Data Eng 21:177–190

Markowitz H (1952) Portfolio selection. J Finance 7:77–91

Martínez-Villena JM, Rosado-Muñoz A, Soria-Olivas E (2014) Hardware implementation methods in random vector functional-link networks. Appl Intell 41:184–195

Mitchell DW (1982) The effects of interest-bearing required reserves on bank portfolio riskiness. J Finance Quant Anal 17:209–216

Miller C, Cardinal LB (1994) Strategic planning and firm performance: a synthesis of more than two decades of research. Acad Manag J 37:16–49

Nakariyakul S, Casasent DP (2009) An improvement on floating search algorithms for feature subset selection. Pattern Recogn 42:1932–1940

Othman R, Domil AKA, Senik ZC, Abdullah NL, Hamzah N (2006) A case study of balanced scorecard implementation in a Malaysian company. J Asia Pacific Bus 7:55–72

Özşen S (2013) Classification of sleep stages using class-dependent sequential feature selection and artificial neural network. Neural Comput Appl 23:1239–1250

Pietruszkiewicz W (2008) Dynamical systems and nonlinear Kalman filtering applied in classification. 7th IEEE international conference on cybernetic intelligent systems, 9-10 Sept, London, 1–6

Parpinelli RS, Lopes HS, Freitas AA (2002) Data mining with an ant colony optimization algorithm. IEEE Trans Evolut Comput 6:321–332

Pao YH, Takefuji Y (1992) Functional-link net computing. IEEE Comput J 25:76–79

Pao Y, Park G, Sobajic D (1994) Learning and generalization characteristics of the random vector functional-link net. Neurocomputing 6:163–168

Pudil P, Novovicova J, Kittler J (1994) Floating search methods in feature selection. Pattern Recogn Lett 15:1119–1125

Rao CR, Mitra SK (1971) Generalized inverse of matrices and its applications. In: Proceedings of the sixth Berkeley symposium on mathematical statistics and probability, vol 1, pp 601–620

Ruiz R, Riquelme JC, Aguilar-Ruiz JS (2006) Incremental wrapper-based gene selection from microarray data for cancer classification. Pattern Recogn 39:2383–2392

Roy AD (1952) Safety first and the holding of assets. Econometrica 20:431–449

Sestito S, Dillon T (1993) Knowledge acquisition of conjunctive rules using multi-layered neural networks. Int J Intell Syst 8:779–805

Shah N (2014) Developing financial distress prediction models using cutting edge recursive partitioning techniques: a study of Australian mining performance. Rev Integr Bus Econ Res 3:103–143

Schalock RL, Bonham GS (2003) Measuring outcomes and managing for results. Eval Program Plan 26:229–235

Schmidt WF, Kraaijveld MA, Duin RPW (1992) Feed forward neural networks with random weights. In: Proceedings of 11th IAPR international conference on pattern recognition methodology and systems, Hague, Netherlands, pp 1–4

Sridharan S, Go S, Zinzow H, Gray A, Gutierrez BM (2007) Analysis of strategic plans to assess planning for sustainability of comprehensive community initiatives. Eval Program Plan 30:105–113

Su CT, Hsu JH (2005) An extended Chi2 algorithm for discretization of real value attributes. IEEE Trans Knowl Data Eng 17:437–441

Thenmozhi M, Sarath Chand G (2015) Forecasting stock returns based on information transmission across global markets using support vector machines. Neural Comput Appl. doi:10.1007/s00521-015-1897-9

Vergara JR, Estévez PA (2014) A review of feature selection methods based on mutual information. Neural Comput Appl 24:175–186

Wanke P, Barros CP, Faria JR (2015) Financial distress drivers in Brazilian banks: a dynamic slacks approach. Eur J Oper Res 240:258–268

Wang J, Wu W, Zurada JM (2012) Computational properties and convergence analysis of BPNN for cyclic and almost cyclic learning with penalty. Neural Netw 33:127–135

Wegner D, Dahmer LV (2004) Tool for performance evaluation in business networks: a methodological proposal. In: Proceedings of the seminar of directors FEA/USP, São Paulo, SP

Wu HY (2012) Constructing a strategy map for banking institutions with key performance indicators of the balanced scorecard. Eval Program Plan 35:303–320

Wu HM, Yin ZH, Sun FC (2006) Application of relief in handwriting recognition. J Comput Appl Math 26:174–176

Zeng Z, Zhang H, Zhang R, Yin C (2015) A novel feature selection method considering feature interaction. Pattern Recogn 48:2656–2666

Zhou P, Yuan M, Wang H, Wang Z, Chai TY (2015) Multivariable dynamic modelling for molten iron quality using online sequential random vector functional-link networks with self-feedback connections. Inf Sci 325:237–255

Acknowledgments

The author would like to thank Ministry of Science and Technology of the Republic of China, Taiwan, for financially supporting this work under Contract No. 104-2410-H-034-023-MY2.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lin, SJ., Hsu, MF. Incorporated risk metrics and hybrid AI techniques for risk management. Neural Comput & Applic 28, 3477–3489 (2017). https://doi.org/10.1007/s00521-016-2253-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-016-2253-4