Abstract

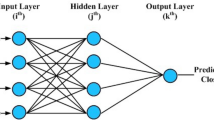

Based on the basic principles of system dynamics, the mathematic description for the stock market evolution which is a typical complicated dynamic system is provided. And according to this mathematic description, a new hybrid intelligent method based on multi-layer feed-forward neural network (MFNN) which is the most widely used neural network and new improved black hole algorithm (IBHA) which is a new nature-inspired metaheuristic algorithm is proposed to model the stock market. In this new hybrid intelligent method, the new IBHA whose structure is simple and which can be implemented easily, and the modified back propagation algorithm have been used to optimize the architectural and algorithmic parameters of MFNN simultaneously. This new method is applied to model two data groups of Shanghai stock market in 2015.9–2018.8 of China to show that the computing results of the new method coincide well with the real data and that the forecasting precision is highly accurate in these cases. At last, the new method has been applied to model seven other stock market data sets and compared with five state-of-the-art hybrid algorithms proposed in previous studies. The results show that the performance of the new method (including modeling effect and efficiency) has been demonstrated to be satisfactory by using for different problem settings and market situations and it is also easy to be implemented.

Similar content being viewed by others

Data availability

I declared that materials described in the manuscript, including all relevant raw data, will be freely available to any scientist wishing to use them for non-commercial purposes, without breaching participant confidentiality.

Code availability

Not applicable.

References

Abualigah L, Diabat A, Sumari P, Gandomi AH (2021a) Applications, deployments, and integration of internet of drones (IoD): a review. IEEE Sensors J 21:25532–25546

Abualigah L, Diabat A, Mirjalili S, Elaziz MA, Gandomi AH (2021b) The arithmetic optimization algorithm. Comput Methods Appl Mech Eng 376:113609

Abualigah L, Yousri D, Elaziz MA, Ewees AA, Al-qaness MAA, Gandomi AH (2021c) Aquila optimizer: a novel meta-heuristic optimization algorithm. Comput Ind Eng 157:107250

Abualigah L, Elaziz MA, Sumari P, Geem ZW, Gandomi AH (2022) Reptile Search Algorithm (RSA): a nature-inspired meta-heuristic optimizer. Expert Syst Appl 191:116158

Aghaei MA, Fard MM, Abbassi NM (2014) An integrated system based on fuzzy genetic algorithm and neural networks for stock price forecasting. Int J Qual Reliab Manag 31(3):281–292

Alexander V, Nataliia V, Olena V, Yevgeniy B, Dmytro P (2019) A novel ensemble neuro-fuzzy model for financial time series forecasting. Data 4:126

Anand C (2021) Comparison of stock price prediction models using pre-trained neural networks. J Ubiquitous Comput Commun Technol 3(2):122–134

Arqub OA (2017) Adaptation of reproducing kernel algorithm for solving fuzzy Fredholm–Volterra integrodifferential equations. Neural Comput Appl 28:1591–1610

Arqub OA, Al-Smadi M (2020) Fuzzy conformable fractional differential equations: novel extended approach and new numerical solutions. Soft Comput 24:12501–12522

Arqub OA, AL-Smadi M, Momani S, Hayat T (2016) Numerical solutions of fuzzy differential equations using reproducing kernel Hilbert space method. Soft Comput 20:3283–3302

Arqub OA, AL-Smadi M, Momani S, Hayat T (2017) Application of reproducing kernel algorithm for solving second-order, two-point fuzzy boundary value problems. Soft Comput 21:7191–7206

Asadi S, Hadavandi E, Mehmanpazir F, Nakhostin MM (2012) Hybridization of evolutionary Levenberg–Marquardt neural networks and data pre-processing for stock market prediction. Knowl-Based Syst 35:245–258

Atsalakis G, Valavanis K (2013) Surveying stock market forecasting techniques—part I: conventional methods. In: Zopounidis C (ed) Computation optimization in economics and finance research compendium. Nova Science Publishers Inc, New York, pp 49–104

Banik S, Khodadad Khan AFM, Anwer M (2014) Hybrid machine learning technique for forecasting Dhaka Stock Market timing decisions. Comput Intell Neurosci 2014:318524

Bao ZG, Wei Q, Zhou TY, Jiang X, Watanabe T (2021) Predicting stock high price using forecast error with recurrent neural network. Appl Math Nonlinear Sci 6(1):283–292

Bebarta DK, Das TK, Chowdhary LC, Gao XZ (2021) An intelligent hybrid system for forecasting stock and forex trading signals using optimized recurrent FLANN and case-based reasoning. Int J Comput Intell Syst 14(1):1763–1772

Berradi Z, Lazaar M (2019) Integration of principal component analysis and recurrent neural network to forecast the stock price of Casablanca Stock Exchange. Procedia Computer Science 148:55–61

Billah M, Waheed S, Hanifa A (2015) Predicting closing stock price using artificial neural network and adaptive neuro fuzzy inference system (ANFIS): the case of the Dhaka Stock Exchange. Int J Comput Appl 129(11):1–5

Bouchekara HREH (2013) Optimal design of electromagnetic devices using a black-hole-based optimization technique. IEEE Trans Magn 49(12):5709–5714

Chang V, Li TY, Zeng ZY (2019) Towards an improved Adaboost algorithmic method for computational financial analysis. J Parallel Distrib Comput 134:219–232

Chen MS (1995) Stock market analysis method. Anhui People Press, Hefei ((in Chinese))

Chen YJ, Chen YM, Tsao ST, Hsieh SF (2018) A novel technical analysis-based method for stock market forecasting. Soft Comput 22(4):1295–1312

Chen YX, Lin WW, Wang JZ (2019) A Dual-attention-based stock price trend prediction model with dual features. IEEE Access 7:2946223

Choudhury S, Ghosh S, Bhattacharya A, Fernandes KJ, Tiwari MK (2014) A real time clustering and SVM based price-volatility prediction for optimal trading strategy. Neurocomputing 131(131):419–426

Churing Y (1995) Backpropagation, theory, architecture and applications. Lawrence Erbaum Publishers, New York

Dash R, Dash PK (2016) Efficient stock price prediction using a self evolving recurrent neuro-fuzzy inference system optimized through a modified differential harmony search technique. Expert Syst Appl 52:75–90

Ding SF, Li H, Su CY, Yu JZ, Jin FX (2013) Evolutionary artificial neural networks: a review. Artif Intell Rev 39:251–260

Fang J, Xi YG (1997) Neural network design based on evolutionary programming. Artif Intell Eng 11:155–161

Gao W (2017) Investigating the critical slip surface of soil slope based on an improved black hole algorithm. Soils Found 57:988–1001

Gao W, Yin ZX (2011) Modern intelligent bionics algorithm and its applications. Science Press, Beijing ((in Chinese))

Gao W, Ge MM, Chen DL, Wang X (2016a) Back analysis for rock model surrounding underground roadways in coal mine based on black hole algorithm. Eng Comput 32(4):675–689

Gao W, Wang X, Dai S, Chen DL (2016b) Study on stability of high embankment slope based on black hole algorithm. Environ Earth Sci 75(20):1381

Guidolin M, Timmermann A (2006) An econometric model of nonlinear dynamics in the joint distribution of stock and bond returns. J Appl Economet 21(1):1–22

Hafezia R, Shahrabi J, Hadavandi E (2015) A bat-neural network multi-agent system (BNNMAS) for stock price prediction: case study of DAX stock price. Appl Soft Comput 29:196–210

Hatamlou A (2013) Black hole: a new heuristic optimization approach for data clustering. Inf Sci 222:175–184

Hatamlou A (2018) Solving travelling salesman problem using black hole algorithm. Soft Comput 22:8167–8175

Hiremath GS (2014) Indian Stock Market—an empirical analysis of informational efficiency. Springer, New Delhi

Hirschleifer D, Subrahmanyam A, Titman S (2006) Feedback and the success of irrational investors. J Financ Econ 81:311–338

Hsieh TJ, Hsiao HF, Yeh WC (2011) Forecasting stock markets using wavelet transforms and recurrent neural networks: an integrated system based on artificial bee colony algorithm. Appl Soft Comput 11:2510–2525

Hsu CM (2011) A hybrid procedure for stock price prediction by integrating self-organizing map and genetic programming. Expert Syst Appl 38:14026–14036

Ifebanjo TM, Ogunleye OM, Abiodun TN, Adebiyi AA (2017) Soft computing approaches to stock forecasting: a survey. Global J Eng Sci Res Manag 4(5):107–131

Jacek ZM (1992) Introduction to artificial neural systems. West Publishing Company, St. Paul

Jose AR, Carlos IV, Guillermo FA (2002) Complex dynamics in a simple stock market model. Int J Bifurc Chaos 12(7):1565–1577

Kazem A, Sharifi E, Hussain FK, Saberi M, Hussain OK (2013) Support vector regression with chaos-based firefly algorithm for stock market price forecasting. Appl Soft Comput 13(2):947–958

Kelotra A, Pandey P (2020) Stock market prediction using optimized deep-ConvLSTM model. Big Data 8(1):5–24

Kumar CS (2019) Fusion model of wavelet transform and adaptive neuro fuzzy inference system for stock market prediction. J Ambient Intell Humaniz Comput. https://doi.org/10.1007/s12652-019-01224-2

Kumar K, Gandhmal DP (2021) An intelligent Indian stock market forecasting system using LSTM deep learning. Indones J Electr Eng Comput Sci 21(2):1082–1089

Liu CF, Yeh CY, Lee SJ (2012) Application of type-2 neuro-fuzzy modeling in stock price prediction. Appl Soft Comput 12:1348–1358

Mojtaba S, Hossein J, Mohsen G, Saeed FF (2019) A novel hybrid model for stock price forecasting based on metaheuristics and support vector machine. Data 4:75

Nadia AJ, Mohamad BK (2019) Stock market price prediction system using neural networks and genetic algorithm. J Theor Appl Inf Technol 97(15):4175–4187

Nair V, Hinton GE (2010) Rectified linear units improve restricted Boltzmann machines. In: 27th international conference on machine learning, 21–25 June 2010, Haifa, Israel, pp 807–814

Özgür I, Çelik TB (2017) Stock market prediction performance of neural networks: a literature review. Int J Econ Financ 9(11):100–108

Pathak A, Shetty NP (2019) Indian Stock Market prediction using machine learning and sentiment analysis. Adv Intell Syst Comput 711:595–603

Pring MJ (2002) Technical analysis explained-the successful investor’s guide to spotting investment trends and turning points. Mcgraw-Hill, New York

Sahoo S, Mohanty MN (2020) Stock market price prediction employing artificial neural network optimized by gray wolf optimization. Adv Intell Syst Comput 1030:77–87

Sharifa R, Vinod S (2019) An interpretable neuro-fuzzy approach to stock price forecasting. Soft Comput 23:921–936

Sharma S, Chouhan M (2014) Stock Market Forecasting Techniques: a Survey. Int J Adv Sci Technol 2(3):36–40

Shen KY, Tzeng GH (2015) Combined soft computing model for value stock selection based on fundamental analysis. Appl Soft Comput 37:142–155

Shen W, Guo XP, Wu C, Wu DS (2011) Forecasting stock indices using radial basis function neural networks optimized by artificial fish swarm algorithm. Knowl-Based Syst 24:378–385

Sungkono, SWarnana DD (2018) Black hole algorithm for determining model parameter in self-potential data. J Appl Geophys 148:189–200

Tsay RS (2005) Analysis of financial time series. Wiley series in probability and statistics. Wiley, Hoboken

Vega C (2006) Stock price reaction to public and private information. J Financ Econ 82:103–133

Zhang Y, Wu L (2009) Stock market prediction of S&P 500 via combination of improved BCO approach and BP neural network. Expert Syst Appl 36:8849–8854

Zhou F, Zhou HM, Yang Z, Yang L (2019) EMD2FNN: a strategy combining empirical mode decomposition and factorization machine based neural network for stock market trend prediction. Expert Syst Appl 115:136–151

Funding

No funding was received for conducting this study.

Author information

Authors and Affiliations

Contributions

Conceptualization, Methodology, Manuscript writing, Data curation, and software are all conducted by Wei Gao.

Corresponding author

Ethics declarations

Conflict of interest

The author declares that he has no conflict of interest.

Animal research

Not applicable.

Consent to participate

Not applicable.

Consent to publish

The manuscript should not be submitted to more than one journal for simultaneous consideration. The submitted work should be original and should not have been published elsewhere in any form or language. A single study should not be split up into several parts to increase the quantity of submissions and submitted to various journals or to one journal over time. The author has checked the manuscript and has agreed to the submission.

Plant reproducibility

Not applicable.

Clinical trials registration

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Gao, W. Modeling stock market using new hybrid intelligent method based on MFNN and IBHA. Soft Comput 26, 7317–7337 (2022). https://doi.org/10.1007/s00500-022-06941-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-022-06941-z