Abstract

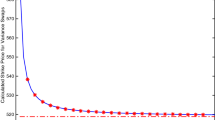

In this paper, we consider the valuation of variance swaps under a modified Heston model with a stochastic mean-reversion level, as a time-dependent mean reversion level for the variance of the Heston volatility model could provide better fit into the term structure of implied volatility and variance swap curve (Byelkina and Levin, in: Sixth World Congress of the Bachelier Finance Society, Toronto 2010; Forde and Jacquier in Appl Math Financ 17:241-259). We present a closed-form pricing formula for discretely sampled variance swaps based on the dimensional reduction technique. The validity of the newly derived formula is demonstrated through the comparison with the Monte Carlo simulation. The influence of introducing the stochastic mean-reversion level on variance swap prices is further investigated with numerical experiments.

Similar content being viewed by others

Data availibility

Data sharing not applicable to this article as no datasets were generated or analyzed during the current study.

References

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81(3):637–654

Broadie M, Jain A (2008) The effect of jumps and discrete sampling on volatility and variance swaps. Int J Theor Appl Financ 11(08):761–797

Byelkina S, Levin A (2010) Implementation and calibration of the extended affine heston model for basket options and volatility derivatives. In: Sixth World Congress of the Bachelier Finance Society, Toronto

Carr P and Madan D (2001) Towards a theory of volatility trading. In: Option Pricing, Interest Rates and Risk Management, Handbooks in Mathematical Finance, pp 458–476

Demeterfi K, Derman E, Kamal M, Zou J (1999) More than you ever wanted to know about volatility swaps. Goldman Sachs Quant Strateg Res Notes 41:1–56

Elliott RJ, Lian G-H (2013) Pricing variance and volatility swaps in a stochastic volatility model with regime switching: discrete observations case. Quant Financ 13(5):687–698

Forde M, Jacquier A (2010) Robust approximations for pricing asian options and volatility swaps under stochastic volatility. Appl Math Financ 17(3):241–259

He X-J, Chen W (2021) A closed-form pricing formula for european options under a new stochastic volatility model with a stochastic long-term mean. Math Financ Econ 15(2):381–396

He X-J, Chen W (2021) Pricing foreign exchange options under a hybrid heston-cox-ingersoll-ross model with regime switching. IMA J Manag Math. https://doi.org/10.1093/imaman/dpab013

He X-J, Lin S (2021) An analytical approximation formula for barrier option prices under the heston model. Comput Econ. https://doi.org/10.1007/s10614-021-10186-7

He X-J, Lin S (2021) A fractional black-scholes model with stochastic volatility and European option pricing. Expert Syst. Appl. 178:114983

Heston SL and Nandi S (2000) Derivatives on volatility: some simple solutions based on observables. Federal Reserve Bank of Atlanta WP, (2000-20)

Karatzas I, Lehoczky JP, Shreve SE (1991) Equilibrium models with singular asset prices. Math Financ 1(3):11–29

Lewis AL (2000) Option valuation under stochastic volatility. Option Valuation under Stochastic Volatility

Little T, Pant V (2001) A finite-difference method for the valuation of variance swaps. J Comput Financ 5(1):81–106

Swishchuk A (2004) Modeling of variance and volatility swaps for financial markets with stochastic volatilities. WILMOTT Mag 2:64–72

Wilmott P, Dewynne J, Howison S (1993) Option pricing: mathematical models and computation. Oxford financial press, Oxford

Zhu S-P, Lian G-H (2011) A closed-form exact solution for pricing variance swaps with stochastic volatility. Math Financ 21(2):233–256

Acknowledgements

This work is supported by the National Natural Science Foundation of China (No. 12101554), the Fundamental Research Funds for Zhejiang Provincial Universities (No. GB202103001), Zhejiang Provincial Natural Science Foundation of China (No. LQ22A010010) and A Project Supported by Scientific Research Fund of Zhejiang Provincial Education Department (No. Y202147703).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Here is the proof of Proposition 2.1.

If we make the transformation of \(\tau _i=t_i-t\) and \(x=\ln (S)\), the PDE system (2.9) can be converted into

By applying the generalized Fourier transform, the PDE system (A-1) can be further transformed into

Here, \(F(\cdot )\) denotes the generalized Fourier transform and \(\bar{U}_i=F(U_i)\). Following He and Chen (2021), we assume that the solution to the PDE system (A-2) takes the form of

Substituting (A-3) into (A-2) yields the following three ordinary differential equations

After working out \(C(\phi ;\tau _i)\), \(D(\phi ;\tau _i)\) and \(E(\phi ;\tau _i)\), the solution to \(U_i(x,v,\theta ,I,\tau _i)\) can be obtained through the inverse Fourier transform as

It is never an easy task to analytically carry out the inverse Fourier transform. Fortunately, with the following two properties of the generalized Fourier transform

and

it is not difficult to find that the pay-off function after the generalized Fourier transform is clearly

Therefore, we can finally arrive at

This has completed the proof.

Appendix B

Here is the proof of Proposition 2.2.

We assume that the solution to the PDE system (2.13)-(2.14) take the form of

and substitute it into the PDE system. Then it is not difficult to obtain

By noticing the fact that Eq. (B-2) should hold for arbitrary v and \(\theta \), we can obtain the following three ordinary equations

It should be mentioned that once we have worked out, D, C and E can be straightforwardly obtained by integrating on both sides of its ODE, respectively, which means that we need to figure out D first. In fact, the ODE governing D can be solved directly with the separation of variables, and thus the result follows. This has completed the proof.

Rights and permissions

About this article

Cite this article

He, XJ., Lin, S. A closed-form pricing formula for variance swaps under a stochastic volatility model with a stochastic mean-reversion level. Soft Comput 26, 3939–3946 (2022). https://doi.org/10.1007/s00500-022-06753-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-022-06753-1