Abstract

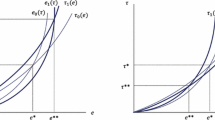

The conflicting views that agents and voters have about redistributive taxation have been broadly studied. The literature has focused on situations where the counterfactual outcomes that would have occurred had other actions been chosen are observable or point identified. I analyze this problem from an econometric standpoint, in a context of ambiguity. The extent to which individuals are responsible for their own fate is partially identified. Agents have partial knowledge of the relative importance of effort in the generation of income inequality and, therefore, the magnitude of the incentive costs. I present a simple model of redistribution and show that multiple equilibria might arise even in the presence of ambiguity: One where the rate of redistribution is high, agents are pessimistic, and exert low effort (Pessimism/Welfare State), and another where the redistribution tax rate is low, agents are optimistic, and exert high effort (Optimism/Laissez Faire).

Similar content being viewed by others

Data availability

The data used in this paper is publicly available and can be downloaded using the links in Appendix A.

Notes

See, e.g. Di Tella and MacCulloch (2009) and the references therein.

See AGS and Alesina and Glaeser (2004) for comprehensive reviews of the literature.

Using the law of iterated expectations and \(y\in \{y_0,y_1\}\):

$$\begin{aligned} \begin{aligned} \beta&:= \mathbb {E}[y_j(e_H)],\\&=\mathbb {E}[y_j(e_j)|e_j=e_H]\mathbb {P}(e_j=e_H)+\mathbb {E}[y_j(e_j)|e_j \ne e_H]\mathbb {P}(e_j \ne e_H),\\&\in [\underbrace{\mathbb {E}[y_j(e_j)|e_j=e_H]\mathbb {P}(e_j=e_H)+y_0\mathbb {P}(e_j \ne e_H)}_{\beta _L},\underbrace{\mathbb {E}[y_j(e_j)|e_j=e_H]\mathbb {P}(e_j=e_H)+y_1\mathbb {P}(e_j \ne e_H)}_{\beta _U}]. \end{aligned} \end{aligned}$$An alternative approach would be to solve the model using the Hurwicz criterion without introducing the cognitive technology and treating \(\lambda\) as an exogenous parameter that is drawn from some distribution. The conclusions from the following section still hold, but the degree of pessimism, \(\lambda\), is exogenous.

I call this period 0 to emphasize that this decision may or may not be conscious.

As explained below, if the median voter is always extremely pessimistic, then the optimal effort is always zero, as in the maximin criterion, regardless of the tax and the redistribution.

A natural question that might arise is whether the main result of the paper—the possibility of multiple equilibria—can also be obtained using other criteria, such as the ones discussed in the introduction and concluding remarks. I hypothesize that the answer is “yes” if the optimal effort solution is fractional, although one might have to make some simplifying technical assumptions, such as the ones in the paper. However, I have only proved Proposition 1 under the criteria discussed in this section.

Downloaded from Enrico Tabellini’s webpage available at (accessed on April 21, 2022): https://didattica.unibocconi.it/mypage/index.php?IdUte=48805 &idr=4273. File name: 60panel_26maj.dta.

Downloaded from the World Values Survey’s webpage available at (accessed on April 21, 2022): https://www.worldvaluessurvey.org/WVSEVStrend.jsp and https://search.gesis.org/research_data/ZA7503?doi=10.4232/1.13736. File names: WVS.dta and EVS.dta, respectively, under datasets on the webpages.

References

Alesina A, Angeletos G-M (2005a) Corruption, inequality, and fairness. J Monetary Econ 52(7):1227–1244. https://www.jstor.org/stable/1209137

Alesina A, Angeletos G-M (2005b) Fairness and redistribution. Am Econ Rev 95(4):960–980. https://doi.org/10.1257/0002828054825655

Alesina A, Glaeser E (2004) Fighting poverty in the US and Europe: a world of difference. Oxford University Press

Alesina A, Glaeser E, Sacerdote B (2001) Why Doesn’t the United States Have a European-Style Welfare State? Brookings Papers Econ. Activity. 2001(2):187–254. https://doi.org/10.1016/j.jmoneco.2005.05.003

Benabou R, Ok EA (2001) Social mobility and the demand for redistribution: the POUM hypothesis. Q J Econ 116(2):447–487. https://doi.org/10.1162/00335530151144078

Benabou R, Tirole J (2006) Belief in a just world and redistributive politics. Q J Econ 121(2):699–746. https://doi.org/10.1162/qjec.2006.121.2.699

Bossaerts P, Ghirardato P, Guarnaschelli S, Zame WR (2010) Ambiguity in asset markets: theory and experiment. Rev Financial Stud 23(4):1325–1359

Choquet G (1954) Theory of capacities. Ann de l’institut Fourier 5:131–295

Corneo G, Grüner HP (2002) Individual preferences for political redistribution. J Publ Econ 83(1):83–107. https://doi.org/10.1016/S0047-2727(00)00172-9

Cunha F, Heckman JJ (2010) Investing in Our Young People. NBER Working Paper 16201, National Bureau of Economic Research. https://doi.org/10.3386/w16201

Di Tella R, Galiani S, Schargrodsky E (2007) The formation of beliefs: evidence from the allocation of land titles to squatters. Q J Econ 122(1):209–241. https://doi.org/10.1162/qjec.122.1.209

Di Tella R, MacCulloch R (2009) Why Doesn’t capitalism flow to poor countries? Brookings Papers Econ Activity 2009(1):285–321

Ellsberg D (1961) Risk, ambiguity, and the Savage axioms. Q J Econ 643–669. https://doi.org/10.2307/1884324

Fong C (2001) Social preferences, self-interest, and the demand for redistribution. J Publ Econ 82(2):225–246. https://doi.org/10.1016/S0047-2727(00)00141-9

Fong C (2004) Which beliefs matter for redistributive politics? Target-specific versus general beliefs about the causes of income. Unpublished manuscript. Available at (accessed April 29, 2022): http://www.pubchoicesoc.org:80/papers/fong.pdf

Ghirardato P, Maccheroni F, Marinacci M (2004) Differentiating ambiguity and ambiguity attitude. J Econ Theory 118(2):133–173

Gilboa I, Schmeidler D (1989) Maxmin expected utility with non-unique prior. J Math Econ 18(2):141–153

Gilboa I, Schmeidler D (1993) Updating Ambiguous Beliefs. J Econ Theory 59(1):33–49

Gul F, Pesendorfer W (2018) Evaluating Ambiguous Random Variables and Updating by Proxy, Working papers. Princeton University. Economics Department

Heckman JJ (2006) Skill formation and the economics of investing in disadvantaged children. Science 312(5782):1900–1902. https://doi.org/10.1126/science.1128898

Hirschman AO, Rothschild M (1973) The changing tolerance for income inequality in the course of economic development: with a mathematical appendix. Q J Econ 87(4):544–566. https://doi.org/10.2307/1882024

Hochschild JL (1981) What’s fair?: American beliefs about distributive justice. Harvard University Press

Hurwicz L (1951) Some specification problems and applications to econometric models. Econometrica 19(3):343–344

Inglehart R (2018) Culture shift in advanced industrial society. Princeton University Press

Keynes JM (1921) A treatise on probability. Macmillan and Company, limited

Knight FH (1921) Risk, uncertainty and profit, vol 31. Houghton Mifflin

Ladd EC, Bowman KH (1998) Attitudes toward economic inequality. AEI Press

Lora E, Olivera M (2004) What makes reforms likely: Political economy determinants of reforms in Latin America. Journal of Applied Economics 7(1):99–135

Manski CF (2004) Social learning from private experiences: the dynamics of the selection problem. Rev Econ Stud 71(2):443–458. https://doi.org/10.1111/0034-6527.00291

Manski CF (2009) Identification for prediction and decision. Harvard University Press

Meltzer AH, Richard SF (1981) A rational theory of the size of government. J Political Econ 89(5):914–927. https://doi.org/10.1086/261013

Persson T, Tabellini G (2005) The economic effects of constitutions. MIT press

Piketty T (1995) Social mobility and redistributive politics. Q J Econ 110(3):551–584. https://doi.org/10.2307/2946692

Romer T (1975) Individual welfare, majority voting, and the properties of a linear income tax. J Publ Econ 4(2):163–185

Savage LJ (1954) The foundations of statistics. John Wiley & Sons

Schmeidler D (1989) Subjective probability and expected utility without additivity. Econometrica 57(3):571–587

Stokes SC (2001) Mandates and democracy: Neoliberalism by surprise in Latin America. Cambridge University Press

Wald A (1950) Statistical decision functions. Wiley, New York

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I especially thank Charles F. Manski and Dale T. Mortensen for many helpful suggestions. I thank Ann Atwater and Yuchen Zhu for excellent research assistance. I am particularly grateful to the managing editor, Francois Maniquet, the associate editor, Avidit Acharya, and two anonymous referees for insightful comments and suggestions. This paper combines two previously unpublished working papers, “Redistributive Politics in a Context of Ambiguity” and “Optimal Labor Decisions under Partial Knowledge of Effort”. The opinions expressed in this article reflect only the author’s views and in no way bind the institutions to which he is affiliated.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendices

Appendix

A Data

This data appendix describes the data sources and variables used in Fig. 1, Social Spending and Belief that Luck Determines Income.

1.1 Social spending data

The dataset was obtained from Persson and Tabellini (2005),Footnote 12 for the period 1960-1998. The variable used is SSW, which is defined in Persson and Tabellini’s data appendix as:

Social spending. Consolidated central government expenditures on social services and welfare as a percentage of GDP as reported in the IMF GFS Yearbook divided by GDP and multiplied by 100. Source: IMF - GFS Yearbook 2000 and IMF-IFS CD-Rom.

1.2 Survey data

The dataset was obtained from the World Values Survey (WVS),Footnote 13 for the period 1981–1997. The question used corresponds to E040, where responders were asked whether they agree (higher value) or disagree (lower value) with the statement that: “Hard work doesn’t generally bring success.” Specifically, the variable is constructed as follows.

Belief that luck determines income. Average responses by country to the WVS question:

Now I’d like you to tell me your views on various issues. How would you place your views on this scale? 1 means you disagree completely with the statement there; 10 means you agree completely with the statement there; and if your views fall somewhere in between, you can choose any number in between. “In the long run, hard work usually brings a better life” vs. “Hard work doesn’t generally bring success—it’s more a matter of luck and connections:

1: In the long run, hard work usually brings a better life.

2: \(\dots\)

\(\vdots\)

9: \(\dots\)

10: Hard work doesn’t generally bring success—it’s more a matter of luck and connections.

The WVS data in Fig. 1 correspond to the average E040 responses by country divided by 10.

B Proofs

1.1 B.1 Maximin criterion

Proof optimal effort Maximin Criterion

The agent acts as if \(\beta =\beta _L\) and solves:

Assumption 1 implies that \(\beta _L<\alpha\) and, thus, the solution to the previous problem is trivially solved by setting \(\delta _{MMin}^*=0\). \(\square\)

Proof that effort does not depend on tax Maximin Criterion

The agent’s welfare under Maximin criterion is given by:

where the last equality is obtained by replacing the maximin solution \(\delta _{MMin}^*=0\).

Then:

\(\square\)

1.2 B.2 Maximax Criterion

Proof optimal effort Maximax Criterion

Now the agent sets \(\beta =\beta _U\) and solves:

Assumption 1 implies that \(\beta _U>\alpha\). Therefore, the maximax solution is \(\delta _{MMax}^*=1\). \(\square\)

Proof that effort does not depend on tax Maximax Criterion

The agent’s welfare under Maximax criterion is given by:

where the last equality is obtained by replacing the maximin solution \(\delta _{MMax}^*=1\) and \(\bar{Y}=\alpha +\left( \beta _{U}-\alpha \right)\).

Then:

\(\square\)

1.3 B.3 Hurwicz Criterion

Proof optimal effort Hurwicz Criterion

According to this criterion the agent solves the following problem:

where \(\bar{\beta }_{\lambda }:= \lambda _j\beta _L+(1-\lambda _j)\beta _U\).

The first-order necessary condition for an interior solution is:

Solving for \(\delta _H\) yields \(\delta _H=a_j(1-\tau )[\bar{\beta }_{\lambda } - \alpha ]\). Thus, the solution is:

The second-order sufficient condition is satisfied because \(\frac{\partial ^2U_j^H(\delta )}{\partial \delta ^2}=-\frac{\partial ^2C_j(\delta )}{\partial \delta ^2}:= -C_j''(\delta )= -\frac{1}{a_j(\lambda )}<0\) by Assumption 3. (The second-order sufficient condition only requires \(C_j(\delta )\) to be convex.) \(\square\)

Proof of interior condition for pessimism rate, \(\lambda\). For \(\overline{\lambda }\), \(\nicefrac {\partial \delta _{H}}{\partial \lambda } < 0\), then \(\overline{\lambda }=\{\lambda : \delta _{H} = a_{j} (1-\tau ) [\lambda \beta _{L} + (1-\lambda )\beta _{U} - \alpha ] = 0\}.\) Then, \(\overline{\lambda }= \frac{\beta _{U} - \alpha }{\beta _{U} - \beta _L} \in (0,1)\). For \(\underline{\lambda }\), let \(\underline{\lambda }^*=\{\lambda : a_{j} (1-\tau ) [\lambda \beta _{L} + (1-\lambda )\beta _{U} - \alpha ] = 1\}\), yielding \(\underline{\lambda }^*= \frac{\beta _{U} - \alpha }{\beta _{U} - \beta _{L}} - \frac{1}{a_{j} (1-\tau )}\lessgtr 0\). Then, \(\underline{\lambda } = \max \{0, \lambda : \underline{\lambda }^*<1\}\). \(\square\)

Proof of Lemma 1

By backwards induction, the optimal level of effort is the value of \(\delta\) that maximizes Eq. (5) because each agent chooses effort optimally using the Hurwicz criterion. Knowing the degree of pessimism, \(\lambda\), and the equilibrium tax rate, \(\tau\), this optimization problem is simplified to Eq. (2) and the optimal level of effort is given by Eq. (3). That is, \({\textrm{arg}\,\textrm{max}}_{\delta \in [0,1]}U_j^{CH}(\lambda ,\delta ,\tau )={\textrm{arg}\,\textrm{max}}_{\delta \in [0,1]}U_j^H(\delta ;\lambda _j)\). Then, Eq. (6) follows from the optimal effort under the Hurwicz criterion. \(\square\)

Proof of Lemma 2

By Lemma 1, the optimal level of effort is given by equation (6). If \((\bar{\beta }_{\lambda }-\alpha )\le 0\), then \(\delta _H\le 0\) and \(\delta _H^*=0\) (corner solution), so \(\frac{\partial \delta _H}{\partial \tau }=0\). If \((\bar{\beta }_{\lambda }-\alpha )>0\), there are two possibilities. If \((\bar{\beta }_{\lambda }-\alpha )\ge \frac{1}{a_j(1-\tau )}\), then \(\delta _H\le 1\) and \(\delta _H^*=1\) (corner solution), so \(\frac{\partial \delta _H}{\partial \tau }=0\). If \(0<(\bar{\beta }_{\lambda }-\alpha )< \frac{1}{a_j(1-\tau )}\), we have an interior solution because \(\delta _H\in (0,1)\) and \(\delta _H^*=\delta _H\). Taking the derivative with respect to the tax rate yields \(\frac{\partial \delta _H}{\partial \tau }=-(\bar{\beta }_{\lambda }-\alpha )<0\). \(\square\)

Proof of Lemma 3

The agent’s welfare is given by Eq. (5):

Maximizing the previous expression with respect to \(\tau\):

where \(G:= [(1-\phi ) a_L (\bar{\beta }_{\lambda _L} - \alpha ) + \phi a_H (\bar{\beta }_{\lambda _H} - \alpha ) ] [(1-\phi )(\bar{\beta }_{\lambda _L} - \alpha ) + \phi (\bar{\beta }_{\lambda _H} - \alpha ) ]\).

In an interior solution:

The second-order sufficient condition is \(\frac{\partial ^2 U_j^{CH}(\lambda ,\delta , \tau ^*)}{\partial \tau ^2}= -5 (\bar{\beta } - \alpha )^2 a_{L}(\lambda ) - 2 \bar{a}(\lambda ) G < 0\) because \(G>0\) and \(a_{L}(\lambda )> 0\). \(\square\)

Proof of Lemma 4

Voters’ preferences over \(\tau\) are single peaked and, thus, the median voter theorem applies. Because \(\phi <\frac{1}{2}\), the equilibrium tax outcome, T, is the optimal desired tax from the disadvantaged group, \(\tau _L^*(\lambda )\). Denote \(\bar{\beta }_{L} = \lambda _{L} \beta _{L} + (1-\lambda _{L}) \beta _{U}\), where \(\lambda _{L}\) is the pessimism rate of disadvantaged agents; similarly, for advantaged agents. The lemma holds trivially if the equilibrium tax rate is 0. If the equilibrium tax rate is interior, then by Lemma 3, \(\tau ^{*} = \frac{1}{3} - \frac{(\bar{\beta }_{L} - \alpha )^2 a_{j}(\lambda )}{3\bar{a}(\lambda ) P}\), where \(P:=a_{L}(\lambda _{L})(1-\phi )^2 (\bar{\beta }_{\lambda _L}-\alpha )^2 + \phi (1-\phi )(a_{L}(\lambda _{L}) + a_{H}(\lambda _{H}))(\bar{\beta }_{\lambda _H} - \alpha ) (\bar{\beta }_{\lambda _L} - \alpha ) + a_{H}(\lambda _{H})\phi ^2 (\bar{\beta }_{\lambda _H} - \alpha )^2\). Then:

Note that:

-

\(A>0\) because \(\bar{a}(\lambda ) > 0\) and \(P>0\).

-

\(B<0\) because \(\beta _{L}- \beta _{U} <0\), \(a'(\lambda )<0\), \(2a_{j}(\lambda )>0, \bar{\beta }_{L}-\alpha > 0\).

Then, \(\frac{\partial T}{\partial \lambda }>0\).

Next, we note that pessimism is decreasing in agents’ cost parameters. Let Assumptions 1, 2, 3 hold and \(\lambda \in (\underline{\lambda },\bar{\lambda })\). Consider the problem of choosing \(\lambda\) in period 0:

Or, after replacing \(\delta _H^*\) and the equilibrium tax rate:

where \(F_j(\lambda ,T):=(1-T)\big [\alpha +\big (\bar{\beta }_{\lambda }- \alpha \big )\delta _H^*\big ]-C_j(\delta _H^*)+T \bar{Y} + M(\lambda )\).

Let \(J_j(\Lambda ,a_{j}):=(1-T)\alpha + \frac{1}{2} (a_{j} + a(-\Lambda )) (1-T)^2(\bar{\gamma }_{\Lambda } - \alpha )^2 + T \bar{Y} + M(-\Lambda )\), where \(\Lambda := - \lambda\), and \(\bar{\gamma }_{\Lambda }:= - \beta _{L} \Lambda + (1+\Lambda )\beta _{U} = \beta _{L} \lambda + (1-\lambda ) \beta _{U} = \bar{\beta }_{\lambda }\).

Then:

Note that:

-

\(C>0\) because \((1-T) \in (0,1)\) and T is increasing in \(\lambda\).

-

\(D>0\) because \(\delta _H^*\in (0,1)\).

Therefore, \(J_j(\Lambda ,a_{j})\) has increasing differences in \((\Lambda ,a_{j})\), and pessimism being decreasing in agents’ cost parameters is established using monotone comparative statics.

Finally, note that the preferred tax rate of the disadvantaged agents is strictly increasing with the pessimism rate. It then follows that disadvantaged agents prefer an interior tax rate.

Let Assumptions 1, 2, and 3 hold, and \(\lambda \in (\underline{\lambda },\bar{\lambda })\). Agent j preferred tax is \(\tau ^{*} = \frac{1}{3} [1 - \frac{(\bar{\beta } - \alpha )^2 a_{j}(\lambda )}{\overline{a(\lambda )} P}]\), where \(P:= a_{L}(\lambda _{L})(1-\phi )^2 (\bar{\beta }_{\lambda _L}-\alpha )^2 + \phi (1-\phi )(a_{L}(\lambda _{L}) + a_{H}(\lambda _H))(\bar{\beta }_{\lambda _H} - \alpha ) (\bar{\beta }_{\lambda _L} - \alpha ) + a_{H}(\lambda _H)\phi ^2 (\bar{\beta }_{\lambda _H} - \alpha )^2\). The disadvantaged agents choose an interior tax rate if \((\bar{\beta }_{L} - \alpha )^2 a_{j}(\lambda ) < \overline{a(\lambda )} P\). Note that \(\overline{a(\lambda )}\) is a weighted average of \(a_{L}(\lambda _{L})\) and \(a_{H}(\lambda _{H})\), where \(\lambda _{H}>\lambda _{L}\), \(\overline{a(\lambda )} > a_{L}(\lambda )\) (decreasing pessimism as a function of cost). Note also that \(a_{H} > a_{L}\) and \((\bar{\beta }_{\lambda _{H}} - \alpha ) > (\bar{\beta }_{\lambda _{L} }- \alpha )\). Then:

by Assumption 3. Then, the result follows because \(P > (\bar{\beta }-\alpha )^2\). \(\square\)

Proof of Lemma 5

As before, the problem of choosing \(\lambda\) in period 0 is:

Or:

where \(F_j(\lambda , T):= (1-T) \alpha + \frac{1}{2} a_{j}(\lambda )(1-T)^2(\bar{\beta }_\lambda - \alpha )^2 + T\bar{Y} + M(\lambda )\).

Then:

-

\(E>0\) because \(a'(\lambda ) < 0\) by Assumption 3 and \(1-T>0\) (interior solution).

-

\(F>0\) because \(\bar{\beta }_{\lambda } - \alpha > 0\).

Therefore, \(F_j(\lambda ,T)\) has increasing differences in \((\lambda ,T)\) and the result follows from monotone comparative statics. \(\square\)

Proof of Lemma 6

It is sufficient to show that \(\exists \ \bar{T}=\tau _L^*(\bar{\lambda }^*_L) \wedge \ \underline{T}=\tau _L^*(\underline{\lambda }^*_L)\) with \(\bar{\lambda }=\bar{\lambda }^*_L>\underline{\lambda }=\underline{\lambda }^*_L\) such that:

Expressions (B.2a) and (B.2c) hold because L-types are optimizing and they are the pivotal group. We know that \(F_H(\bar{\lambda },\bar{T})>F_L(\bar{\lambda },\bar{T})\) because H-types have lower costs than L-types and \(F_L(\bar{\lambda },\bar{T})> F_L(\underline{\lambda },\bar{T})\) (equation B.2a). Using the H-types desired tax for \(\bar{\lambda }^*_H\), \(F_H(\bar{\lambda }^*_H,\bar{\tau }^*)> F_H(\underline{\lambda }^*_H,\bar{\tau }^*)\). Then, \(F_H(\bar{\lambda }^*_H,\bar{T})>F_H(\underline{\lambda }^*_H,\bar{T})\) because of Lemma 4 and because the L-types are the pivotal group. An analogue argument shows that \(F_H(\bar{\lambda }^*_H,\underline{T}>F_H(\underline{\lambda }^*_H,\underline{T})\) holds. Then, the result follows by Lemma 5 because the solution to (B.2), \(\lambda _j^*(T)\), is a continuous function of the equilibrium tax rate, T. \(\square\)

Proof of Proposition 1

We know that \(\tau _L^*(\tilde{\lambda })>\tau _L^*(\hat{\lambda })\) because \(\underline{\lambda }<\hat{\lambda }<\tilde{\lambda }<\bar{\lambda }\). Take \(\tilde{T} \in (\bar{T}=\tau _L^*(\bar{\lambda }),\underline{T}=\tau _L^*(\underline{\lambda }))\). Such a \(\tilde{T}\) exists by continuity. Then, the result follows by Lemmas 2, 4 and 6. \(\square\)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Donna, J.D. Redistributive politics under ambiguity. Soc Choice Welf 62, 583–607 (2024). https://doi.org/10.1007/s00355-023-01500-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-023-01500-3