Abstract

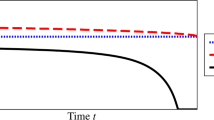

We consider an optimal investment problem to maximize expected utility of the terminal wealth, in an illiquid market with search frictions and transaction costs. In the market model, an investor’s attempt of transaction is successful only at arrival times of a Poisson process, and the investor pays proportional transaction costs when the transaction is successful. We characterize the no-trade region describing the optimal trading strategy. Our asymptotic analysis implies that the effects of the transaction costs are more pronounced (more widening effect of the no-trade region and more diminishing effect of the value function) in the market with less search frictions.

Similar content being viewed by others

Notes

Here, perfect liquidity assumption means that assets can be traded in any quantity and at any moment in time, without any transaction costs.

To be more specific, let \(0<\lambda _1<\lambda _2\) and consider two markets \({\mathcal {M}}_1\) and \({\mathcal {M}}_2\) with search friction parameters \(\lambda _1\) and \(\lambda _2\), respectively. In words, \({\mathcal {M}}_2\) has less search frictions than \({\mathcal {M}}_1\). Our result implies that if we increase the transaction costs, the widening speed of the no-trade region in \({\mathcal {M}}_2\) is faster than that in \({\mathcal {M}}_1\). Similarly, if we increase the transaction costs, the diminishing speed of the optimal value in \({\mathcal {M}}_2\) is faster than that in \({\mathcal {M}}_1\).

Therefore, bigger \(\lambda \) implies more frequent trading opportunities (less search frictions), on average.

Indeed, for \(s>t\) and \(A=\{ W^{(1)}_{t}<0, W^{(0)}_{t} \ge 0\}\) (or \(A=\{W^{(1)}_{t} \ge 0, W^{(0)}_{t}<0\}\)), we observe that \({{\mathbb {P}}}(W_s<0 \, | \,A) \ge {{\mathbb {P}}}(P_t=P_s \text { and } W_s<0 \, | \, A)>0\).

To check this, let \(\tau _n:=\inf \{ t\ge 0: P_t=n\}\) and \(\tau _0=0\). For \(\tau _n\le t<\tau _{n+1}\), the dynamics (2.3) produce \(W_t=W_{\tau _n}^{(0)} e^{r(t-\tau _n)} +W_{\tau _n}^{(1)} e^{(\mu -\frac{\sigma ^2}{2})(t-\tau _n)+\sigma (B_t-B_{\tau _n})}\). If \(W_{\tau _n-}>0, W_{\tau _n-}^{(0)}\ge 0, W_{\tau _n-}^{(1)}\ge 0\) and (2.4) are satisfied, then \(W_{\tau _n}>0, W_{\tau _n}^{(0)}\ge 0\) and \(W_{\tau _n}^{(1)}\ge 0\) hold. By this way, we can inductively show that \(W_{\tau _n}>0, W_{\tau _n}^{(0)}\ge 0\) and \(W_{\tau _n}^{(1)}\ge 0\) for all n, almost surely. Now the expression of \(W_t\) above implies that \(W_t>0\) for all \(t\ge 0\), almost surely.

The inequality (3.15) becomes strict on the event \(\left\{ \omega \in \Omega : \exists t\in [0,T] \text { such that }\Delta P_t(\omega )=1 \text { and }{\hat{M}}_t^0(\omega ) \hat{M}_t^1(\omega )<0\right\} \).

References

Akian, M., Menaldi, J., Sulem, A.: On an investment-consumption model with transaction costs. SIAM J. Control. Optim. 34, 329–364 (1996)

Almgren, R., Chriss, N.: Optimal execution of portfolio transactions. J. Risk 3, 5–40 (2001)

Ang, A., Papanikolaou, D., Westerfield, M.M.: Portfolio choice with illiquid assets. Manag. Sci. 60, 2737–2761 (2014)

Back, K.: Insider trading in continuous time. Rev. Financ. Stud. 5, 387–409 (1992)

Bayraktar, E., Dolinskyi, L., Dolinsky, Y.: Extended weak convergence and utility maximisation with proportional transaction costs. Financ. Stochast. 24, 1013–1034 (2020)

Bertsekas, D.P., Shreve, S.: Stochastic optimal control: the discrete-time case (2004)

Bichuch, M., Guasoni, P.: Investing with liquid and illiquid assets. Math. Financ. 28, 119–152 (2018)

Bichuch, M., Shreve, S.E.: Utility maximization trading two futures with transaction costs. SIAM J. Financ. Math. 4, 26–85 (2013)

Chen, X., Dai, M.: Characterization of optimal strategy for multiasset investment and consumption with transaction costs. SIAM J. Financ. Math. 4, 857–883 (2013)

Choi, J.: Asymptotic analysis for Merton’s problem with transaction costs in power utility case. Stochastics 86, 803–816 (2014)

Choi, J.H.: Optimal consumption and investment with liquid and illiquid assets. Math. Financ. 30, 621–663 (2020)

Choi, J.H., Larsen, K., Seppi, D.J.: Information and trading targets in a dynamic market equilibrium. J. Financ. Econ. 132, 22–49 (2019)

Cretarola, A., Gozzi, F., Pham, H., Tankov, P.: Optimal consumption policies in illiquid markets. Financ. Stochast. 15, 85–115 (2011)

Czichowsky, C., Muhle-Karbe, J., Schachermayer, W.: Transaction costs, shadow prices, and duality in discrete time. SIAM J. Financ. Math. 5, 258–277 (2014)

Czichowsky, C., Schachermayer, W., et al.: Duality theory for portfolio optimisation under transaction costs. Ann. Appl. Probab. 26, 1888–1941 (2016)

Dai, M., Jin, H., Liu, H.: Illiquidity, position limits, and optimal investment for mutual funds. J. Econ. Theory 146, 1598–1630 (2011)

Dai, M., Li, P., Liu, H., Wang, Y.: Portfolio choice with market closure and implications for liquidity premia. Manag. Sci. 62, 368–386 (2016)

Dai, M., Yi, F.: Finite-horizon optimal investment with transaction costs: a parabolic double obstacle problem. J. Differ. Equ. 246, 1445–1469 (2009)

Davis, M.H.A., Norman, A.R.: Portfolio selection with transaction costs. Math. Oper. Res. 15, 676–713 (1990)

Foster, D., Viswanathan, S.: Strategic trading with asymmetrically informed traders and long-lived information. J. Financ. Quant. Anal. 29, 499–518 (1994)

Foucault, T., Kadan, O., Kandel, E.: Limit order book as a market for liquidity. Rev. Financ. Stud. 18, 1171–1217 (2005)

Gassiat, P., Gozzi, F., Pham, H.: Investment/consumption problem in illiquid markets with regime-switching. SIAM J. Control. Optim. 52, 1761–1786 (2014)

Gatheral, J., Schied, A.: Optimal trade execution under geometric brownian motion in the almgren and chriss framework. Int. J. Theor. Appl. Financ. 14, 353–368 (2011)

Gerhold, S., Guasoni, P., Muhle-Karbe, J., Schachermayer, W.: Transaction costs, trading volume, and the liquidity premium. Financ. Stoch. 18, 1–37 (2014)

Gerhold, S., Muhle-Karbe, J., Schachermayer, W.: Asymptotics and duality for the Davis and Norman problem. Stochastics 84, 625–641 (2012)

Guilbaud, F., Pham, H.: Optimal high-frequency trading with limit and market orders. Quant. Financ. 13, 79–94 (2013)

Hobson, D., Tse, A.S.L., Zhu, Y.: A multi-asset investment and consumption problem with transaction costs. Financ. Stochast. 23, 641–676 (2019)

Hugonnier, J., Kramkov, D.: Optimal investment with random endowments in incomplete markets. Ann. Appl. Probab. 14, 845–864 (2004)

Janeček, K., Shreve, S.E.: Asymptotic analysis for optimal investment and consumption with transaction costs. Financ. Stochast. 8, 181–206 (2004)

Karatzas, I., Lehoczky, J.P., Shreve, S.E.: Optimal portfolio and consumption decisions for a “small investor’’ on a finite horizon. SIAM J. Control. Optim. 25, 1557–1586 (1987)

Karatzas, I., Lehoczky, J.P., Shreve, S.E., Xu, G.L.: Martingale and duality methods for utility maximization in an incomplete market. SIAM J. Control. Optim. 29, 702–730 (1991)

Karatzas, I., Shreve, S.: Brownian Motion and Stochastic Calculus. Graduate Texts in Mathematics, Springer, New York (2014)

Karatzas, I., Žitković, G.: Optimal consumption from investment and random endowment in incomplete semimartingale markets. Ann. Probab. 31, 1821–1858 (2003)

Kramkov, D., Schachermayer, W.: The asymptotic elasticity of utility functions and optimal investment in incomplete markets. Ann. Appl. Probab. 9, 904–950 (1999)

Krylov, N., Society, A.M.: Lectures on Elliptic and Parabolic Equations in Holder Spaces. Graduate studies in mathematics. American Mathematical Society (1996)

Kühn, C., Stroh, M.: Optimal portfolios of a small investor in a limit order market: a shadow price approach. Math. Financ. Econ. 3, 45–72 (2010)

Kyle, A.S.: Continuous auctions and insider trading. Econometrica 53, 1315–1335 (1985)

Liu, H.: Optimal consumption and investment with transaction costs and multiple risky assets. J. Financ. 59, 289–338 (2004)

Magill, M.J.P., Constantinides, G.M.: Portfolio selection with transactions costs. J. Econ. Theory 13, 245–263 (1976)

Matsumoto, K.: Optimal portfolio of low liquid assets with a log-utility function. Financ. Stochast. 10, 121–145 (2006)

Merton, R.C.: Lifetime portfolio selection under uncertainty: the continuous-time case. Rev. Econ. Stat. 51, 247–257 (1969)

Merton, R.C.: Optimum consumption and portfolio rules in a continuous-time model. J. Econ. Theory 3, 373–413 (1971)

Muthuraman, K., Kumar, S.: Multidimensional portfolio optimization with proportional transaction costs. Math. Financ. 16, 301–335 (2006)

Pham, H., Tankov, P.: A model of optimal consumption under liquidity risk with random trading times. Math. Financ. 18, 613–627 (2008)

Possamaï, D., Soner, H.M., Touzi, N.: Homogenization and asymptotics for small transaction costs: the multidimensional case. Commun. Partial Differ. Equ. 40, 2005–2046 (2015)

Predoiu, S., Shaikhet, G., Shreve, S.: Optimal execution in a general one-sided limit-order book. SIAM J. Financ. Math. 2, 183–212 (2011)

Robert, E., Robert, F., Jeffrey, R.: Measuring and modeling execution cost and risk. J. Portf. Manag. 38, 14–28 (2012)

Rogers, L.C.G.: The relaxed investor and parameter uncertainty. Finance Stochast. 5, 131–154 (2001)

Rogers, L.C.G., Zane, O.: A Simple Model of Liquidity Effects, pp. 161–176. Springer, Berlin (2002)

Roşu, I.: A dynamic model of the limit order book. Rev. Financ. Stud. 22, 4601–4641 (2009)

Shreve, S.E., Soner, H.M.: Optimal investment and consumption with transaction costs. Ann. Appl. Probab. 4, 609–692 (1994)

Yakov, A., Mendelson, H., Pederson, L.H.: Liquidity and asset prices. Found. Trends Financ. 1, 1–96 (2005)

Funding

This work was supported by the National Research Foundation of Korea (NRF) Grant funded by the Korea government (MSIT) (No. 2019R1A5A1028324, No. 2020R1C1C1A01014142, and No. 2021R1I1A1A01050679).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no competing interests to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A. Proof of Lemma 3.1

Since the parabolic type PDE (3.2) is not uniformly elliptic, we change variable as \(x=h(z):=\frac{e^z}{1+e^{z}}\) and consider the PDE for v(t, h(z)).

To handle the nonlinear term in the PDE, we first consider the following map \(\phi \) from \(C_b([0,T]\times {{\mathbb {R}}})\) (equipped with the uniform norm) to itself:

where for \((s,z)\in [t,T]\times {{\mathbb {R}}}\),

We observe that for \(f,g \in C_b([0,T]\times {{\mathbb {R}}})\),

where the first inequality is due to the triangular inequality for supremum. Therefore, the map \(\phi \) in (A.1) is a contraction map and there exists a unique \({\hat{u}}\in C_b([0,T]\times {{\mathbb {R}}})\) such that \(\phi ({\hat{u}})={\hat{u}}\), by the Banach fixed point theorem.

Claim: For all \(\delta \in (0,1)\), \(K_{\hat{u}}\in C^{\frac{\delta }{2},\delta }([0,T]\times {{\mathbb {R}}})\).

(Proof of Claim): We first check that \(K_{{\hat{u}}}\) is bounded. Since \(0<h(z)<1\), we observe that

i.e., \(\Vert K_{{\hat{u}}}\Vert _\infty <\infty \). Therefore, to prove the claim, it is enough to check that \(K_{{\hat{u}}}\) is uniformly Lipschitz with respect to z variable and \(\tfrac{1}{2}\)-Hölder continuous with respect to t variable. For \(\Delta >0\), we obtain the following inequalities:

where we used the mean value theorem and the bounds \(0<h<1\) and \(0<h'<1\). We can treat \(\Delta <0\) by the same way, and conclude that \(K_{\hat{u}}\) is uniformly Lipschitz with respect to z.

For \(\Delta >0\), using (A.5) and the mean value theorem, we observe that

where the last inequality is due to

Using \({\hat{u}}= \phi ({\hat{u}})\) and triangular inequality, we obtain

where the generic constant C only depends on the market parameters and \(\Vert {\hat{u}}\Vert _{\infty }\) and the last inequality is due to (A.4) and (A.6). We can treat \(\Delta <0\) by the same way, and conclude that \(K_{{\hat{u}}}\) is \(\tfrac{1}{2}\)-Hölder continuous with respect to t variable. (End of the proof of Claim).

Let \(\delta \in (0,1)\) be fixed. Then, the above claim and Theorem 9.2.3 in [35] ensure that there exists a unique function \(u\in C^{1+\frac{\delta }{2},2+\delta }((0,T)\times {{\mathbb {R}}})\) such that it satisfies the following PDE on \((t,z)\in (0,T)\times {{\mathbb {R}}}\).

Since u admits a unique continuous extension on \([0,T]\times {{\mathbb {R}}}\) (i.e., see chapter 8.5 in [35]), we let \(u\in C^{1+\frac{\delta }{2},2+\delta }([0,T]\times {{\mathbb {R}}})\). By the Feynman-Kac formula (i.e., see Theorem 5.7.6 in [32]), the solution u of the parabolic PDE (A.7) has the stochastic representation \(u=\phi ({\hat{u}})\), where \(\phi \) is defined in (A.1). Since \({\hat{u}}\) is chosen as the unique fixed point of the map \(\phi \), we conclude that \(u={\hat{u}}\).

Our next task is to define \(u(t,\pm \infty )\) for \(t\in [0,T]\). Using \(\lim _{z\rightarrow \infty }h(Z_s^{(t,z)})=1\) and \(\lim _{z\rightarrow -\infty }h(Z_s^{(t,z)})=0\) almost surely, we obtain

The above convergence and \(\Vert K_u\Vert _\infty <\infty \) enable us to apply the dominated convergence theorem:

Therefore, we can continuously extend u to \(z=\pm \infty \) and \(u(t,\infty )\) and \(u(t,-\infty )\) are defined by the above limit. We observe that for \(z\in \{ \infty , -\infty \}\), u(t, z) satisfies

where the function h is continuously extended as \(h(\infty ):=1\) and \(h(-\infty ):=0\).

Now we define v as \(v(t,x):=u(t,h^{-1}(x))\) for \((t,x)\in [0,T]\times [0,1]\). Such v is well-defined because \(h:{{\mathbb {R}}}\cup \{ \infty , -\infty \} \rightarrow [0,1]\) is bijective. We observe that for \((t,x)\in (0,T)\times (0,1)\) and \(z=h^{-1}(x)\),

The PDE for u in (A.7) with \({\hat{u}}\) replaced by u and the equalities in (A.10) produce the PDE for v, which is (3.2). Therefore, statement (i) is valid.

To check statement (ii), we observe that \(v(t,0)=u(t,-\infty )\) and \(v(t,1)=u(t,\infty )\). Then, the continuous differentiability of v(t, 0) and v(t, 1) with respect to t is followed by that of \(u(t,-\infty )\) and \(u(t,\infty )\), and (A.9) produces (3.3).

Finally, statement (iii) is a direct consequence of (A.10) and \(u\in C^{1+\frac{\delta }{2},2+\delta }([0,T]\times {{\mathbb {R}}})\).

Appendix B. Proof of Lemma 5.3

(i) When \(\epsilon =0\), Lemma 4.1 and (5.1) produce (5.2).

To prove (5.3), we first check that \(Y_s^{(t,x)}\) in (4.9) safisfies

Then application of Ito’s formula produces that for \((s,x)\in [t,T) \times (0,1)\),

Since \(0<Y_s^{(t,x)}<1\), the local martingale part above is a true martingale and we obtain

where the second equality is from elementary computations using the definition of \(Y_s^{(t,x)}\) in (4.9).

For \(x\in (0,1)\), we observe that

and the above expression is decreasing in x, therefore,

When \(\epsilon =0\), the representation of \(v_x\) in (4.11) becomes

We take derivative with respect to x in the above expression. Then, the mean value theorem and the dominated convergence theorem, together with the inequalities (4.14) and (B.4), allow us to take derivative inside of the expectation and obtain that for \((t,x)\in [0,T)\times (0,1)\),

where the second equality is due to (B.2), and the third equality is from integration by parts. Obviously (B.7) implies that \(v_{xx}^0(t,x)<0\) for \((t,x)\in [0,T)\times (0,1)\).

To conclude (5.3), it only remains to check that \(\lim _{x\uparrow 1} v_{xx}^0(t,x)<0\) and \(\lim _{x\downarrow 0} v_{xx}^0(t,x)<0\). Indeed, (B.3) and (B.4) enable us to apply the dominated convergence theorem to (B.7) and obtain

and we conclude that \(\lim _{x\uparrow 1} v_{xx}^0(t,x)<0\) and \(\lim _{x\downarrow 0} v_{xx}^0(t,x)<0\).

(ii) The SDE for \(Y_s^{(t,x)}\) in (B.1) and \(0<Y_s^{(t,x)}<1\) imply that for \((s,x)\in [t,T) \times (0,1)\),

We divide both sides of (B.8) by \(x(1-x)\) and take derivative with respect to x. Then, we can put the derivative inside of the expectation as in the proof of part (i), and obtain

We rearrange the above equation and use (B.8), (B.5), and (B.7) to obtain

Now we conclude that \(F(t, {\hat{y}}^0(t))<1\) by the following way:

where the first inequality is from the definition of F in (5.4) and the positivity of \(\frac{\partial }{\partial x} Y_s^{(t,x)}\) (see (4.14)), and the equality is due to integration by parts and (B.9), and the last inequality is due to the positivity of \(\frac{\partial }{\partial x} Y_T^{(t,x)}\), \(v_x^0(t,{\hat{y}}^0(t))=0\), and \(v_{xx}^0(t,\hat{y}^0(t))<0\).

We can check that \(F(t, {\hat{y}}^0(t))>-1\) by the same way as above. (iii) The expression in (4.11) produces

In the above expression, when we take limit as \(\epsilon \downarrow 0\), the inequalities (4.13) and (4.14) enable us to use the dominated convergence theorem to conclude that

The above limit and the continuity of \(v_{x}^0\) imply (5.6).

To prove (5.7), we first observe that for \((t,x)\in [0,T)\times (0,1)\) and \((s,z)\in (t,T)\times (0,1)\), the density function for \(Y_s^{(t,x)}\) is given by

Then, the expression in (4.11) and \(\frac{\partial }{\partial x} Y_s^{(t,x)}=\frac{Y_s^{(t,x)}(1-Y_s^{(t,x)})}{x(1-x)}\) imply that

For \(x\in (0,1)\), direct computations produce

Assumption implies that

Then, (B.11) and (B.13) produce the following:

where the first inequality is due to (B.14), and the first equality is obtained by change of variables as \(\zeta =\ln \left( \frac{z(1-x)}{(1-z)x} \right) \). The second inequality is due to the inequality of arithmetic and geometric means, and the second equality is obtained by direct computations.

By (B.15), we conclude that

and the function \(H:[0,T)\times (0,1) \rightarrow {{\mathbb {R}}}\) given by

is well-defined due to (B.16) and the boundedness \(| L_y^\epsilon |\le \frac{\epsilon }{1-\epsilon }\) in (4.13). Then, (B.15) implies that

Now, let’s check that

Indeed, for \((t,x)\in [0,T)\times (0,1)\),

where the second equality is due to Fubini’s theorem and the fundamental theorem of calculus, and the third equality is from (B.12).

Finally, we conclude (5.7) by the following observation:

where the second inequality is due to (B.18), (B.19), and the continuity of \(v_{xx}^0\).

Appendix C. Proof of Lemma 5.10

(i) Using \(\Gamma \) in (5.25), the equations (B.5) and (B.6) can be written as

We can do the similar argument to obtain representations for \(v_{xxx}^{0}\) and partial derivatives of \(v_x^{0}\) and \(v_{xx}^{0}\) with respect to \(\lambda \), with the observation that \(\Gamma , \Gamma _x, \Gamma _{xx}\) are continuous & bounded maps on \([0,T]\times (0,1)\). The result is summarized as follows:

Using \(Y_t^{(t,x)}=x\), direct computations produce

With (C.3) and (5.24), we apply Lemma D.2 to (C.2) and conclude (5.61).

(ii) The mean value theorem and (5.2) produce

where we specify the dependence on \(\lambda \) for clarity. Since \(\frac{\partial }{\partial \lambda } v_x^{0}\) exists (see (C.2)), the above equality and (5.3) ensure that \({\hat{y}}^{0,\lambda }(t)\) is differentiable with respect to \(\lambda \) and

Observe that the bounds for \(\frac{\partial }{\partial x}Y_t^{(0,x)}\) and \(\frac{Y_t^{(0,x)}-x}{x(1-x)}\) in (4.14) and (B.4) do not depend on the variable x. Therefore, the following convergence is uniform on \(x \in (0,1)\):

Hence, there is a constant \({\tilde{T}}\in (0,T)\) such that \(\Gamma _x(t,x)\le -\frac{\sigma ^2}{2}\) for \((t,x)\in [0,{\tilde{T}}] \times (0,1)\). This observation and the expression of \(v_{xx}\) in (C.2) imply

We obtain \(\Vert \Gamma _{xt} \Vert _\infty <\infty \) by using Ito’s formula with (B.1) and the bounds (4.14) and (B.4). Then, (C.2) and (C.3) imply

This implies that there exists a constant \({\tilde{\Lambda }}\) (may depend on \({\tilde{T}}\)) such that

Using (C.2) and (C.3), we obtain

where the second inequality is due to \(\Vert \Gamma _t \Vert _\infty <\infty \) and (5.24).

From (C.4), we obtain the boundedness of \(\left| \lambda ^2 \tfrac{\partial }{\partial \lambda } {\hat{y}}^{0}(t) \right| \):

Therefore, we conclude (5.62).

(iii) The bounds (4.14) and (5.62) enable us to use Leibniz integral rule to obtain

The above expression, together with the bounds (4.14) and (5.62), implies (5.63).

Appendix D. Supplementary Lemmas

Lemma D.1

Let \(F:[0,T]\times [0,1]^2\rightarrow {{\mathbb {R}}}\) be a continuous function. We define \(f:[0,T]\times [0,1]\rightarrow [0,1]\) as

then f is upper semicontinuous (which is obviously Borel-measurable).

Proof

This type of result is well-known (e.g., see p. 153 in [6]), but we give a short proof here for the sake of self-containedness.

Since F is continuous, \( \mathop {\textrm{argmax}}\limits _{y\in [0,1]} F(t,x,y) \) is a nonempty closed subset of [0, 1], so the maximum element of \( \mathop {\textrm{argmax}}\limits _{y\in [0,1]} F(t,x,y) \) exists and f is well-defined. Let \(\{(t_n,x_n)\}_{n\in {{\mathbb {N}}}}\subset [0,T]\times [0,1]\) be a sequence converging to \((t_\infty ,x_\infty )\) such that \(\lim _{n\rightarrow \infty } f(t_n,x_n)\) exists. Then, by definition of f,

We let \(n\rightarrow \infty \) above and using the continuity of F to obtain

This implies that \(\lim _{n\rightarrow \infty } f(t_n,x_n) \in \mathop {\textrm{argmax}}\limits _{y\in [0,1]} F(t_\infty ,x_\infty ,y)\), and the definition of f ensures

Therefore, f is upper semicontinuous. \(\square \)

Lemma D.2

Let \(f(s,x): [0,t] \times (0,1) \rightarrow {{\mathbb {R}}}\) be a continuous function, and \(g(\lambda ): [1,\infty ) \rightarrow (0,1)\) be a function satisfying \(\lim _{\lambda \rightarrow \infty } g(\lambda )=x_\infty \in (0,1)\). Then, for \(\alpha \in \{0,1,2,3,4\}\) and \(t > 0\),

where \(c_0=1\), \(c_1= \frac{\sqrt{\pi }}{2}\), \(c_2= 1\), \(c_3= \frac{3\sqrt{\pi }}{4}\), \(c_4= 2\). Also, there exists a constant C such that

Proof

Let \(\eta >0\) be a given constant. The uniform continuity of f on a compact set containing the point \((0,x_\infty )\), together with \(\lim _{\lambda \rightarrow \infty } g(\lambda )=x_\infty \in (0,1)\), implies that there exists \(\delta >0\) such that

Simple computations and (D.6) produce

Since \(\eta >0\) can be arbitrary small, we conclude (D.4) for the case of \(\alpha =0\). The other cases in (D.4) can be obtained by the same way as above, using the following expressions:

One can easily observe that \(\sup _{x>0} x^{\frac{\alpha }{2}} e^{-x} <\infty \) for \(\alpha \in \{0,1,2,3,4\}\). This observation and the explicit expressions in (D.7) produce the bound (D.5). \(\square \)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Gang, T.U., Choi, J.H. Optimal Investment in an Illiquid Market with Search Frictions and Transaction Costs. Appl Math Optim 88, 3 (2023). https://doi.org/10.1007/s00245-023-09971-7

Accepted:

Published:

DOI: https://doi.org/10.1007/s00245-023-09971-7