Abstract

A parcimonious long term model is proposed for a mining industry. Knowing the dynamics of the global reserve, the strategy of each production unit consists of an optimal control problem with two controls, first the flux invested into prospection and the building of new extraction facilities, second the production rate. In turn, the dynamics of the global reserve depends on the individual strategies of the producers, so the models leads to an equilibrium, which is described by low dimensional systems of partial differential equations. The dimensionality depends on the number of technologies that a mining producer can choose. In some cases, the systems may be reduced to a Hamilton–Jacobi equation which is degenerate at the boundary and whose right hand side may blow up at the boundary. A mathematical analysis is supplied. Then numerical simulations for models with one or two technologies are described. In particular, a numerical calibration of the model in order to fit the historical data is carried out.

Similar content being viewed by others

References

Achdou, Y., Buera, F.J., Lasry, J.-M., Lions, P.-L., Moll, B.: Partial differential equation models in macroeconomics. Philos. Trans. R. Soc. A 372(2028) (2014)

Achdou, Y., Lasry, J.-M., Lions, P.-L., Scheinkman, J.: work in progress

Bardi, M., Capuzzo-Dolcetta, I.: Optimal control and viscosity solutions of Hamilton-Jacobi-Bellman equations, Systems & Control: Foundations & Applications, Birkhäuser Boston Inc., Boston, MA, 1997, With appendices by Maurizio Falcone and Pierpaolo Soravia

Capuzzo-Dolcetta, I., Lions, P.-L.: Hamilton-Jacobi equations with state constraints. Trans. Am. Math. Soc. 318(2), 643–683 (1990)

Cardaliaguet, P., Delarue, F., Lasry, J.-M., Lions, P.-L.: The master equation and the convergence problem in mean field games, arXiv preprint arXiv:1509.02505 (2015)

Guéant, O., Lasry, J.-M., Lions, P.-L.: Mean field games and applications, Paris-Princeton Lectures on Mathematical Finance 2010, Lecture Notes in Math., vol. 2003, pp. 205–266. Springer, Berlin (2011). MR 2762362

Krusell, P., Smith, A.A.: Income and wealth heterogeneity in the macroeconomy. J. Polit. Econ. 106(5), 867–896 (1998)

Lachapelle, A., Lasry, J.-M., Lehalle, C.-A., Lions, P.-L.: Efficiency of the price formation process in presence of high frequency participants: a mean field game analysis. Math. Financ. Econ. 1–40 (2013)

Lasry, J.-M., Lions, P.-L.: Nonlinear elliptic equations with singular boundary conditions and stochastic control with state constraints. I. The model problem. Math. Ann. 283(4), 583–630 (1989)

Lasry, J.-M., Lions, P.-L.: Jeux à champ moyen. I. Le cas stationnaire. C. R. Math. Acad. Sci. Paris 343(9), 619–625 (2006)

Lasry, J.-M., Lions, P.-L.: Jeux à champ moyen. II. Horizon fini et contrôle optimal. C. R. Math. Acad. Sci. Paris 343(10), 679–684 (2006)

Lasry, J.-M., Lions, P.-L.: Mean field games. Jpn. J. Math. 2(1), 229–260 (2007)

Lions, P.L.: Generalized solutions of Hamilton-Jacobi equations, Research Notes in Mathematics 69. Pitman, Boston (1982)

Lucas Jr., R.E., Prescott, E.C.: Investment under uncertainty. Econometrica 39, 659–681 (1971)

Soner, H.M.: Optimal control with state-space constraint. I. SIAM J. Control Optim. 24(3), 552–561 (1986)

Soner, H.M.: Optimal control with state-space constraint. II. SIAM J. Control Optim. 24(6), 1110–1122 (1986)

Acknowledgments

All the authors acknowledge the support of the Chaire “Finance et développement durable”. The last three authors were partially supported by the Chaire ”Économie, finance et gestion des commodités”. The first author was partially supported by ANR projects ANR-12-MONU-0013 and ANR-16-CE40-0015-01.

Author information

Authors and Affiliations

Corresponding author

Appendix: A mean field games approach to Lucas–Prescott benevolent planner model

Appendix: A mean field games approach to Lucas–Prescott benevolent planner model

The present mining industry model is reminiscent of the celebrated Lucas–Prescott model, see [14]: let us recall the latter and propose its interpretation in terms of mean field games.

1.1 The Framework

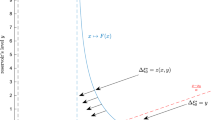

Lucas and Prescott consider a market of production units. The size of a given unit, i.e. the capital owned by the producer is \(k_t\). Each producer can invest in order to improve the production capacity, and therefore increase its capital: the flux of capital generated during dt by an invested flux of \(z_t dt\) is \(k_t \Phi (z_t/k_t) dt\), where the nondecreasing and concave function \(\phi \) measures the impact of the investment: therefore

The price of a unit of capital is fixed by a pricing function:

where \(K_t\) is the aggregate capital and \(X_t\) is an exogeneous parameter standing for the global state of the economy. This parameter is driven by a diffusion process:

hence it represents an aggregate risk, common to all production units.

Each individual firm solves the optimal control problem: maximize

1.2 The Approach Via Mean Field Games

Similarly as in § 2, it is convenient to split the production units in such a way that any production unit corresponds to a unit of capital. Then the aggregate capital \(K_t\) is the number of such production units. The value u of a unit of capital can be expressed as a function of K and X: \(u=u(K,X)\). From the dynamic programming principle, u satisfies

Note the similarity with (7). A first order expansion yields

where the optimal control \(\alpha ^* \) is such that \(\phi '(\alpha ^*) u(K,X)=1\). Then, at the mean field game equilibrium, \(\frac{dK}{dt}= \phi (\alpha ^*)K \). Finally, we obtain the partial differential equation:

or in an equivalent manner

1.3 From (64) to a Hamilton–Jacobi equation

The aim is to find a Hamilton–Jacobi equation of the form

in such a way that if V is a solution to (65), then \(u=\partial _K V\) is a solution to (64). Differentiating (65) with respect to K,

with self-explanatory notations. If \(u=\partial _K V\), this yields

Identifying, we obtain that \(a(X)=\sigma ^2(X) /2\), \(\partial _4 H (K, X, u, \partial _X V)=\mu (X)\), \( \partial _3 H (K, X, u, \partial _X V)= K \Phi (\alpha ^*)\) and \(\partial _K H (K, X, u, \partial _X V) = P(K,X) +\max _{\alpha \ge 0} (\phi (\alpha ) u-\alpha )\). Consider a surplus function s(K, X) such that \(\partial _K s(K,X)=P(K,X)\); we see that a good candidate for the Hamiltonian is

and (65) becomes

which plays the same role as (19), except that no reduced variable as been used in (66). Note that differentiating (66) with respect to X and setting \(w(K,X)=\partial _X V \) yields another partial equation:

1.4 Link of (66) with Lucas–Prescott Benevolent Planner Problem

Hamilton–Jacobi Eq. (66), which has been found via mean field game theory, is also satisfied by the value function of Lucas–Prescott benevolent planner problem. Indeed, Lucas–Prescott benevolent planner problem is as follows:

subject to

and from the dynamic programming principle, V solves (66).

Rights and permissions

About this article

Cite this article

Achdou, Y., Giraud, PN., Lasry, JM. et al. A Long-Term Mathematical Model for Mining Industries. Appl Math Optim 74, 579–618 (2016). https://doi.org/10.1007/s00245-016-9390-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00245-016-9390-0

Keywords

- Heterogeneous agents model

- Mean field games

- Master equation

- Hamilton Jacobi equations

- Viscosity solution

- Model calibration