Abstract

In the context of the Covid-19 pandemic, we evaluate the effects of vaccines and virus variants on epidemiological and macroeconomic outcomes by means of Monte Carlo simulations of a macroeconomic-epidemiological agent-based model calibrated using data from the Lombardy region of Italy. From simulations we infer that vaccination plays the role of a mitigating factor, reducing the frequency and the amplitude of contagion waves and significantly improving macroeconomic performance with respect to a scenario without vaccination. The emergence of a variant, on the other hand, plays the role of an accelerating factor, leading to a deterioration of both epidemiological and macroeconomic outcomes and partly negating the beneficial impacts of the vaccine. A new and improved vaccine in turn can redress the situation. Vaccinations and variants, therefore, can be conceived of as drivers of an intertwined cycle impacting both epidemiological and macroeconomic developments.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since late 2020, two crucial V-words have changed the dynamics of Covid-19: Vaccines and variants. The introduction of vaccines has raised the hopes of ending the pandemic once and for all but this optimistic belief has been thrown into doubt by the emergence of variants. While it is well known that changes in public health – due, for instance, to a new disease or a new drug – can have remarkable repercussions on economic activity (Pritchett and Summers 2001), health economists generally focus on their micro-economic or sectoral effects in the long run, in particular on education provision, productivity, saving and investment (Bloom and Canning 2000, 2008).

In this paper we take a broader perspective and focus on the short to medium run. Our goal is to assess the effects of Covid-19 vaccines and variants on the macroeconomy, i.e., on GDP and other aggregate variables over a limited time span, i.e., at business cycle frequencies as Covid-19 has, in fact, also had an impact on the amplitude and duration of business fluctuations.

The economy-wide consequences of a change in public health have generally been explored by means of Computable General Equilibrium (CGE) models. Using this approach (Smith et al. 2005) assess the macroeconomic effects of anti-microbial resistance; Keogh-Brown et al. (2010) examine the potential macro economic cost of a modern epidemic; Smith et al. (2009) explore how vaccines affect the macroeconomic impact of influenza in the UK. We adopt a different approach, developing an integrated agent based macro-epidemiological framework consisting of a macroeconomic sub-model and an epidemiological network-based compartmental Susceptible, Infectious, Recovered (SIR) sub-model.

Agent based models (ABM) are more granular and more flexible than CGE models. First, by construction ABMs keep track of the behaviour of a large number of interacting agents (households, firms) instead of only a few sectors. Second, the behaviour of each (bounded rational) agent is described by “rules of thumb” which are not necessarily optimal. Finally, market transactions are carried out at prices which are not necessarily market clearing. Market disequilibrium phenomena such as rationing of demand or involuntary accumulation of inventories are pervasive and lead to adaptive adjustment of economic decisions (see Dawid and Delli Gatti (2018)). Aggregate variables such as GDP, consumption etc. are computed “from the bottom up", i.e. summing individual quantities across agents.

We also apply this granular approach to the SIR component of our model. We track contagion along the networks of contacts of each agent both in the workplace and during leisure time. The dynamics of each epidemiological group are therefore micro-simulated instead of being postulated as aggregate laws of motion as in canonical SIR models. With this framework we contribute to a small but growing literature on joint economic and epidemiological dynamics in agent-based settings (e.g. Mellacher 2020; Basurto et al. 2022).

In our macro-epidemiological ABM, the epidemic impacts the labour market (because workers become sick), the market for goods (because households consume less), the healthcare sector (because sick people with serious symptoms must be hospitalized) and public finance (because transfers for sick pay increase while tax revenue declines). These developments negatively affect GDP, causing a slump. Non-pharmaceutical interventions such as a government-mandated lockdown exacerbate the recession in the short run by forcing firms to shut down. The contraction of macroeconomic activity, in turn, feeds back on the epidemiological scenario by reducing the speed of contagion.

From simulations of our ABM we obtain a rich set of results on the effects of vaccination. First of all, as expected, the vaccine significantly contributes to containing contagion and saving lives, even if it is not 100% effective at preventing infection and serious disease. Regardless of the prioritisation strategy, in fact, the cumulative number of infections and of deaths is substantially lower than in the absence of a vaccine.

As to vaccination strategies (priority given to the old vs. priority given to the young and economically active), the literature suggests a potential trade-off between minimizing infections by vaccinating the young first and minimizing fatalities by prioritizing the elderly (Forslid and Herzing 2021; Gollier 2021; Babus et al. 2021; Glover et al. 2022; Brotherhood and Santos 2022). Saad-Roy et al. (2020) find that the impact of vaccines is strongly dependent on the efficacy of the vaccine and the response of the immune system. According to Matrajt et al. (2021), the optimal prioritization strategy depends on vaccine efficacy; in order to minimize deaths, when vaccine efficacy is relatively low, it is optimal to allocate vaccines to the old first. On the contrary, when vaccine efficacy is high, priority should be given to younger age groups.

In terms of the number of infections, the performance of different vaccination strategies does not differ starkly in our simulations: the magnitude of the reduction in the number of cases is broadly similar across different strategies. On the contrary, the ranking of strategies in terms of cumulative fatalities is clear: the vaccination strategy aimed at prioritizing the old – i.e., the agents with higher exposure to the risk of dying – allows to save a remarkably higher number of lives (at the cost of a slightly higher number of infections).

In addition, we find that the vaccine reduces both the frequency and amplitude of the waves of infections and fatalities. The epidemiological effect of vaccination that our simulations reveal, therefore, is a significant mitigation of the cyclical dynamics of infections and deaths.

One relevant issue connected to the discussion of vaccination strategies is the vaccination of children; to the extent that infected children play an important role in spreading the disease (see e.g. Gaythorpe et al. (2021) and Silverberg et al. (2022) for reviews of the evidence on the role of children in the SARS-CoV2 pandemic), vaccination may be a sensible approach not only to protect children at risk of serious disease but also to reduce the transmission of the virus from children to adults. While our model does not explicitly consider children as a separate age group, our results suggest that priority should be given to old agents in all contexts. At the same time, however, we also conduct a separate simulation experiment showing that when a significant share of agents remains unvaccinated, epidemiological outcomes deteriorate strongly, suggesting that the maximisation of vaccination rates (potentially including that of children) should be a key policy goal.

As to the macroeconomic effects of vaccination, regardless of prioritisation strategy the vaccine has a significant and persistent positive impact on GDP driven by the increase of consumption that follows from the lower number of infections and fatalities. The decline in infections reduces the perceived risk of contagion, weakens the incentives for social distancing and boosts consumption. The decline of deaths means that the old who survive thanks to the vaccine contribute to consumption while in the absence of vaccination they (and their consumption demand) were “removed” from the economy. We do not find significant differences in macroeconomic outcomes between vaccination strategies, i.e. the prioritisation of young workers does not translate into an aggregate economic gain, relative to prioritization of the old.

We then turn to variants. We assume that variants alter the epidemiological scenario by reducing the effectiveness of the original vaccine in preventing infections and/or serious symptoms and by increasing the transmissibility of the disease. Simulations show that a variant with these features replaces the original virus rapidly and yields a sequence of subsequent waves of contagion. This increase in infections also leads to an increase in deaths, particularly when the variant also reduces the vaccine’s efficacy at preventing serious symptoms (cf. Bernal et al. 2021; Hoffmann et al. 2021; Wall et al. 2021). The economy experiences a sequence of oscillations of GDP which impacts also on government debt as a share of GDP. Variants hence act as an accelerator, leading to an increase in the frequency and amplitude of waves of contagion and of fluctuations in macroeconomic activity, partly offsetting the positive effects of the original vaccine.Footnote 1 If the vaccine is adapted to the variant, the amplitude of these waves is mitigated.

The paper is structured as follows. In Section 2 we present a synthetic overview of the model. We provide a detailed description of the model in Appendices A and B. Section 3 presents the epidemiological and macroeconomic dynamics of an epidemic scenario with no vaccine which we use as a benchmark to evaluate the effects of vaccination. The macroeconomic calibration underlying this scenario is discussed in Appendix C. The effects of vaccination are presented in Sections 4, while 5 introduces the emergence and spread of variants. Section 6 discusses the case in which a share of agents remains unvaccinated. Section 7 concludes. Appendix D contains additional simulation experiments and sensitivity analyses. Appendix E contains all parameter values for the macroeconomic and epidemiological sub-models.

2 An overview of the model

2.1 The environment

The model is a variant of the ABM presented in Delli Gatti and Reissl (2022). The economy we analyze is populated by households, firms, the banking system and the public sector. The unit of time for the macroeconomic sub-model is a month. The epidemiological sub-model instead runs at the frequency of one week, with every month containing four weeks. In what follows, the subscript t indicates a month while the subscript \(\tau \) indicates a week.

There are \(N_{H}\) households which fall into two categories: \(N_{W}\) workers and \(N_{F}\) firm owners. For simplicity we assume that only workers can become ill. There are \(N_{F}\) firms which fall into three categories: \(N_{F}^{k}\) producers of capital goods (K-firms), \(N_{F}^{b}\) producers of basic (or essential) consumption goods (B-firms) and \(N_{F}^l\) producers of non essential or luxury consumption goods (L-firms). The set of all consumption goods producers (C-firms) is the union of the sets of B-firms and L-firms, denoted \(N^{c}_{F}\). The number of active firms may change over time due to entry and exit but never exceeds \(N_{F}\). The banking system is represented by a single bank, collectively owned by firm owners.

2.2 The macroeconomic sub-model

In this section we succinctly describe the macroeconomic sub-model. A more detailed description is given in Appendix A.

2.2.1 Households

A household indexed with \(h\in (1,N_{W})\) is a worker. If alive, workers can be either economically active or inactive. Chiefly for epidemiological purposes, the population of workers is divided into three age groups: young, middle-aged and old. For simplicity agents do not age, i.e. they remain in the age-group to which they are initially assigned. All old agents are assumed to be retired and hence economically inactive. All young and middle-aged agents are initially economically active and constitute the labor force (either employed or unemployed). When an economically active worker falls ill they become economically inactive until their illness ends.Footnote 2

Each economically active worker supplies 1 unit of labor inelastically. If employed, they receive a uniform wage and pay a fraction of this wage to the Government. If unemployed, they receive an unemployment subsidy. Workers who fall ill receive sick-pay. Retired workers receive pensions.

A household indexed with \(h=N_{W}+f\) is the owner of the f-th firm, \(f=1,2,...,N_{F}\). The income of this household consists of dividends, which are equal to a fraction of the after-tax profit of the firm owned by that household. The firm pays out dividends only if profits are positive. Moreover, the firm owners are assumed to jointly own the bank and consequently each receives an equal share of the dividends distributed by the bank. In addition, all households receive interest income on deposits held at the bank, which represent the only financial asset owned by households.

A household’s consumption budget is given by a weighted average of past disposable incomes and a fraction of its financial wealth (deposits). The fraction of the consumption budget allocated to B-goods depends on the relative price of B-goods and L-goods. The consumer shops first at B-firms and then at L-firms. The consumer visits two B-firms: the “go-to” supplier and a randomly drawn potential new shopping partner. If the price charged by the former is lower than or equal to that of the latter they will first buy from the go-to supplier and resort to the new seller only if the consumption budget devoted to B-goods is not completely exhausted with the first purchase. Otherwise, they will switch to the new partner (and reverse the order of purchase) with a probability which is increasing with the price set by the go-to partner relative to that of the potential new partner. If the consumer switches to the new partner, the latter becomes their new go-to supplier. The market protocol for L-goods follows the same rules as that for B-goods.

2.2.2 Firms

B-firms and L-firms are consumption goods producers (C-firms for short) and follow the same behavioural rules. An active firm indexed with \(f\in (1,N^{c}_{F})\) has market power and sets its individual price and desired production under uncertainty.

Two rules of thumb govern price changes and quantity changes respectively. Excess demand and the relative price \(\frac{P_{f,t}}{P_{t}}\) – where \(P_t\) is an aggregator of the prices set by C-firms – dictate the direction of price adjustment: the firm will increase (reduce) the price next period if it has registered excess demand (supply) and has underpriced (overpriced) the good in the current period. Otherwise it will leave the price unchanged. The magnitude of price adjustments is stochastic. Both the direction and the magnitude of quantity adjustment are determined by excess demand. The firm will increase production next period if it has registered excess demand (in the form of a fringe of unsatisfied consumers) in the current period; it will downsize production if it has registered excess supply (i.e., involuntary inventory accumulation).

Technology is represented by a Leontief production function the arguments of which are capital and labor. Both labour and capital productivity are constant, meaning that the model does not feature long-term growth. Once a decision has been taken on desired output, a firm determines how much capital and labor it needs to reach that level of activity. If actual capital is greater than the capital requirement, the rate of capacity utilization will be smaller than one. If actual employment is smaller than the labor requirement, the firm will post vacancies. If the opposite holds true the firm will fire workers. If actual capital is smaller than the capital requirement, the former will be utilized at full capacity but desired output will not be reached and production will be scaled back.

We assume that a C-firm may carry out investment in any given period with a probability \(\pi ^{k}<1\). In order to determine its investment demand, the firm calculates a target capital stock based on past utilisation and a target utilisation rate, also taking into account the depreciation of capital and the probability of investing. It invests in capital goods so as to reach this target capital stock, visiting the market for K-goods. The market protocol for this market follows the same rules as those for B-goods and L-goods.

The price adjustment rule for capital goods producers is the same as that of C-firms. The quantity adjustment rule departs from the one adopted by C-firms to take into account the assumption that K-goods are durable and therefore storable. Hence inventories of capital goods carried over from the past can be used to face actual demand. We assume that K-firms are endowed with a linear production function with labor as the only input. Once the price-quantity configuration has been set, a K-firm may post vacancies or fire workers in order to fulfil labor requirements.

Unemployed workers visit a subset of firms chosen at random. Once an unemployed worker finds a firm with an unfilled vacancy a match occurs. The uniform nominal wage is set on the basis of labor market conditions captured by the distance between the current unemployment rate and a threshold unemployment rate. Whenever the unemployment rate is above (below) the threshold the wage will decrease (increase).

2.2.3 The banking system

Firms register a financing gap when outlays (to pay for wages and, in the case of C-firms, capital goods) are greater than their available liquidity in the form of accumulated bank deposits. Firms which cannot self-finance their costs demand bank loans.

The bank sets the interest rate on loans and the quantity of credit supplied to firms. The interest rate on loans is set adding a mark up (external finance premium) on the risk free interest rate. The external finance premium, in turn, is increasing with the borrower’s leverage. Moreover, the bank determines a maximum amount it is willing to lend to a given borrower, again based on that borrower’s leverage. This means that a firm may be credit rationed and therefore forced to scale down production and/or investment. In every period, borrowers repay a fraction of their outstanding loans.

Households and firms hold deposits at the bank. The interest rate on deposits is a fraction of the fixed risk free interest rate which coincides with the interest rate on Government bonds. If the bank’s profit at the end of a period is positive, it pays a fraction of its after-tax profit as a dividend, which is divided up equally among all firm owners.

2.2.4 The public sector

The public sector collects taxes on wage income and profits and provides transfers in the form of unemployment subsidies, sick-pay and pensions, all of which are given by fractions of the current nominal wage. Government expenditure consists of public provision of healthcare services. In case of a public sector deficit, the Government issues bonds. We assume that all issued bonds are purchased by the bank at a fixed interest rate.

2.2.5 Demand and supply of healthcare

Government expenditure on healthcare (in real terms) is given by a constant fraction of full employment output, calculated using the initial labor force. We assume that the government uses this amount to spend on the output of both K-firms and C-firms. The goods thus purchased are converted one-for-one into a supply of healthcare.Footnote 3

Even in the absence of an epidemic, a worker may become ill with some probability in any period, but such illness is neither potentially lethal nor infectious to others. As long as an agent is ill, they generate a demand for healthcare which is increasing with their age. If the remaining supply of healthcare in a given period is insufficient to accommodate the agent’s demand, they join a randomised queue to receive treatment. In the case of an epidemic, agents who contract the epidemic disease and develop serious symptoms will also demand healthcare, making it more likely that demand will exceed supply.

2.2.6 Entry and exit

The epidemic disease may lead to the death of workers. If a worker dies, their assets are written off, and they may be replaced in each future period by a young worker with a constant probability. During the epidemic the population of living workers can hence temporarily be smaller than \(N_W\).

If a firms’ equity becomes negative, it is assumed to go bankrupt and exit.Footnote 4 The exiting firm may then be replaced by a new firm operating in the same sector, with a probability that is increasing with the average profit rate in the sector in question. The new firm receives any fixed capital remaining from the bankrupt firm and receives an injection of liquidity from the owner of latter, who becomes the owner of the new firm. The bank’s equity may become negative due to persistent loan defaults. If this is the case, a bail-in procedure is applied: all firm-owners (who collectively own the bank) make a transfer to the bank until its equity becomes positive.

2.3 The epidemiological sub-model

In this section we briefly describe the epidemiological sub-model. A more detailed outline can be found in Appendix B.

2.3.1 The taxonomy of epidemiological groups

The epidemic is characterised by the outbreak of an infectious disease which spreads from one subject to the others through contagion. At a certain point during the model simulation, a small number of workers are exogenously infected with the epidemic disease and may then spread it to the rest of the population.

Infected agents can be either non-symptomatic or symptomatic. The former are infected agents who do not have symptoms or develop only mild symptoms. In this case the infection can be detected only if the agent is subjected to a random test. Detected non-symptomatic infected agents are quarantined and therefore cannot spread the disease. By assumption, all symptomatic infected agents develop serious symptoms and are detected with certainty. The disease is hence spread only by infected agents who develop mild or no symptoms and remain undetected. For simplicity, we assume that the infected remain contagious for the entire duration of the illness.

The probability to develop serious symptoms is increasing with age. All agents whose infection is detected become inactive and will not have social contacts for the duration of the disease. Only people developing serious symptoms are hospitalized, i.e., they express demand for healthcare services. Non-symptomatic infected agents recover with certainty after a certain number of weeks while those who develop serious symptoms may either recover or die.

2.3.2 Contagion

Contagion takes place in three networks: the workplace (employment network), the marketplace (shopping network) and social relations (social network). Each employed worker is linked to all co-workers in the firm for which they work. If a worker is infectious, they can spread the disease to their (susceptible) co-workers.

In addition, all workers are nodes in the shopping network. A certain number of households shop at a given C-firm. If one of these buyers is infectious, they may spread the disease to other households shopping at the same firm. We list all possible connections between the customers of a given firm in a given period and assume that a fixed share of those encounters actually take place (not all customers visit the firm at the same time).

Each worker also has a set of social connections consisting of family and close friends. The total number of social connections is a (very small) fraction of the maximum number of possible undirected connections between workers. While the shopping and employment networks evolve dynamically as agents’ employers and the firms at which they shop change over time, the social network is assumed to be static.

We assume that each agent meets all their connected agents in every week. The set of potential new infections is constructed by randomly drawing one infected and one susceptible agent from the set of all connections. We assume that a fraction (the basic transmission rate) of the number of connections in week \(\tau \) which involves exactly one infected and one susceptible agent may lead to a new infection. By assumption, the different types of connections have different probabilities of being drawn, being highest for social connections, second highest for workplace connections and lowest for market connections. The basic transmission rate is assumed to be seasonal, being higher during autumn and winter months in the Northern hemisphere (October to April) and lower during late spring and summer (May to September).

Each of these potential new infections leads to an actual new infection with a baseline probability equal to 1, but this probability may be reduced if i) one or both agents involved in the respective connection engages in social distancing as described in Section 3 and/or ii) if the susceptible agent is vaccinated as described in Section 4.

2.3.3 Recovery, death, re-infection

Infected but non-symptomatic agents recover with certainty, while infected agents with serious symptoms may either recover or die. For any infected individual, the duration of the disease is stochastic, being drawn from a distribution with finite support. Agents with serious symptoms may die in each period in which they are infected, with a probability which increases with age and with excess demand for healthcare. The supply of healthcare services which seriously ill agents actually receive depends on the rate of “capacity utilization" of the healthcare system. In the epidemic scenario, in fact, the demand for healthcare services may rapidly come to exceed the supply.Footnote 5

When the healthcare system becomes overburdened, the demand for healthcare is rationed and an agent who develops serious symptoms may be forced to join a randomised queue. If the seriously ill agent has not died after the duration of the disease, they will recover. We assume that both the effect of age and of excess demand for healthcare on the probability of dying decrease over time until they reach a lower bound as the healthcare system is partly able to adapt to dealing with the novel disease even in the absence of a vaccine (e.g. through the use of existing or new medicines other than vaccines, or simply through increased experience in treating the new disease (Ledford 2020).

Recovered agents who became economically inactive due to the disease will re-enter the labor force as unemployed workers and look for a job. Each recovered agent becomes immune to the epidemic disease (‘natural’ or post-infection immunity) for a number of periods given by a draw from a normal distribution.Footnote 6 Once the drawn number of weeks has passed, the recovered agent becomes susceptible again.

3 The baseline epidemic scenario

To construct a baseline scenario against which the effect of a vaccine will be evaluated, we begin by calibrating the macroeconomic sub-model on a situation of Normal Times, i.e., in the absence of an epidemic. For this purpose we obtain macroeconomic data for real GDP, consumption, gross fixed capital formation and employment for the Lombardy region of Italy from 1995 to 2017 and follow the same calibration approach as Delli Gatti and Reissl (2022), setting parameter values such that the macroeconomic sub-model replicates a set of moments calculated from these data as closely as possible. The calibration procedure is described in more detail in Appendix C. The resulting parameter values can be found in Table 4 in Appendix E. Starting from the calibrated macroeconomic sub-model, we construct and analyse the baseline Epidemic scenario (EP), characterized by spreading of the epidemic disease in the absence of vaccines and variants. In what follows, we denote with \(t_{E}\) the month and \(\tau _{E}\) the week in which the epidemic begins.

3.1 Epidemic dynamics

The epidemic is imposed on the model by exogenously changing the status of a small number of agents from susceptible to infected in \(\tau _E\), after which the epidemic disease spreads endogenously as described in Section 2.3 and Appendix B. In the scenario we consider, two features may mitigate the spread of the disease: the adoption of voluntary/spontaneous social distancing by private agents, and the implementation of a one-off government-mandated lockdown. Government healthcare expenditure remains fixed; Appendix D contains a simulation experiment analysing the results of an increase in healthcare expenditure in the EP scenario.

Social distancing is described by a binary choice model. The probability that an agent will engage in social distancing is increasing in the number of currently infected and detected individuals (relative to a fixed threshold value) and the share of other agents who are already distancing, and decreasing in the perceived cost of social distancing. Every time an agent engages in social distancing, three effects occur. Firstly an encounter between a susceptible and an infected individual – which would otherwise lead to an infection with certainty – does so only with probability \(1-\beta \) if one of the agents is distancing and \(1-2\beta \) if both agents are. Secondly, the number of social and shopping connections decreases linearly up to a lower bound as the share of distancing agents increases. Thirdly, desired consumption of B-goods of an agent engaged in social distancing receives a positive shock, while their desired consumption of L-goods receives a larger negative shock. Social distancing hence leads to both a decrease in overall consumption demand and a change in its composition. The magnitude of both shocks declines over time down to a lower bound while the agent remains in distancing mode. When the agent decides to cease social distancing according to the binary choice model described above, the shocks are removed from their desired consumption. If, at a later point, the agent decides to engage in social distancing once again (because infection numbers have increased again), the shocks to their desired consumption are applied again at their previous (reduced) value. The modelling of social distancing is described in more detail in Appendix B.1.

In addition to voluntary social distancing, there may also be a one-off government mandated lockdown. We assume that the lockdown is imposed when the number of detected weekly new infections reaches an exogenous threshold and remains in force for 12 weeks unless new infections decrease below another threshold prior to this. The lockdown has a range of effects. A fraction of L-firms are closed entirely and cease production for the duration of the lockdown such that no workplace encounters take place at those firms. All firms which remain open move into ‘smart-working’ mode in which only a fraction of workplace encounters take place there. In addition, an upper bound is placed on the number of social and shopping connections which persist during the lockdown and the lockdown lowers agents’ perceived cost of keeping the social distance, making it more likely that an agent will engage in social distancing. Finally, we assume that the lockdown is associated with an increased effort to detect infections. Accordingly, once the lockdown begins, the probability of detecting an infected asymptomatic agent becomes a function of the number of cases detected in the previous week. A more detailed description of the lockdown in the model can be found in Appendix B.2.

Our simulated lockdown is designed to mimic, in a stylised way, the policies implemented by the Italian government starting in March 2020 which, in addition to restrictions of contacts and mobility, also involved the temporary closure of economic activities considered “inessential”, including in manufacturing and non-customer-facing services. A second, ‘softer’ set of regionally differentiated lockdown measures was implemented in late 2020 to combat the second wave (cf. Reissl et al. 2022; Ferraresi et al. 2023). Since the objective of this paper is to examine the impact of vaccines and variants rather than lockdowns, we do not model this second set of lockdown measures. We assume, however, that agents may continue to engage in voluntary social distancing. The EP scenario can hence be considered to mimic the actual institutional setting in Lombardy up to the start of the second wave, and a counterfactual scenario from that point onward. Epidemiological parameters are calibrated such that the model is able to reproduce the actual numbers of infections and deaths observed in that region until the onset of the second wave.

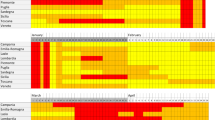

In Fig. 1 we show the simulated epidemic curves at weekly frequency. We run the model 100 times with different seeds and compute the mean of the simulated data for each period along with 95% confidence intervals. The top left panel shows the number of cumulative detected infections while the top right panel shows the flow of newly detected infections, with week zero being the beginning of the epidemic \(\tau _{E}\). The bottom panels show the same curves for deaths. In all cases, the numbers have been scaled by a factor of \(\frac{1}{0.003}\) in order to transform simulated data from our model with a population of 30000 workers into equivalents for Lombardy which has a population of around 10 million.

The adoption of mandated lockdown measures is able to break the first wave of the epidemic at a relatively low level of contagion compared to later waves. Lagged adjustment of social and workplace connections following the lockdown as well as the remaining effects of voluntary social distancing are then able to contain new infections at a low level for some time until gradual relaxation together with the assumed seasonality of the base transmission rate lead to the emergence of a second wave. Since we assume that there is no second lockdown, and since the number of people who have acquired natural immunity through infection is quite low (due to the first lockdown), this second wave is more severe than the first.Footnote 7

Figure 2 compares the empirical dynamics of cumulative detected infections and per-week detected infections in Lombardy to the simulated epidemic curves for the first year of the epidemic, beginning in calendar week 9 of 2020 (the first week of March; denoted as week zero in the diagram). Overall, the model does a good job at reproducing both cumulative and newly detected infections throughout the first wave, although slightly under-estimates the number of infections taking place between the first and second waves. The model also correctly reproduces the timing of the outbreak of the second wave. Once the second wave has started, simulated infections peak at a higher level than in the empirical data as we do not model the second set of lockdown measures.

Figure 3 compares the simulated and empirical numbers of cumulative deaths for the same time-period as that shown in Fig. 2. The model does a good job at reproducing the cumulative number of deaths at the end of the first wave. During the first and particularly during the second wave, however, simulated deaths increase prior to their empirical counterparts. This is due to the fact that in the model, a patient who develops serious symptoms is as likely to die during the first week in which they are ill as in the last, whereas in the real world, fatalities due to Covid-19 can take place considerable time after the contraction of the disease.

3.2 The macroeconomic effects of the epidemic

In this sub-section, we briefly examine the macroeconomic effects of the epidemic scenario described above. As outlined previously, we run the model 100 times with different seeds. For a given run r, for each macroeconomic variable in levels – say x – we compute the percent deviation of the variable in the EP scenario from the scenario of Normal times (NT), i.e. in the absence of an epidemic: \(\hat{x}^{r}_{t}=(x^{r,EP}_t-x^{r,NT}_t)/x^{r,NT}_t\). We then compute the mean of these percent deviations across 100 runs, \(\hat{x}_{t}\). For variables which are already expressed in percent terms (government debt to GDP ratio and the default rate) – say y – we compute the absolute deviation \(\Delta y^{r}_{t}=y^{r, EP}_t-y^{r,NT}_t\) and the mean of the absolute deviations \(\Delta y_t\). The time series of these means are plotted in Fig. 4 (along with 95% confidence intervals). Month zero is the first month of the epidemic \(t_E\).

By assumption, during the lockdown one third of all L-firms are shut down and cease to produce. This large supply shock is immediately reflected in the aggregate data, leading to a sharp decline in GDP during the lockdown interval. In addition, firms which are forced to close are unable to sell the output they have already produced. Operating costs already incurred are not matched by revenues, which suddenly drop. This liquidity shortfall is the source of the spike in the default rate during the lockdown recession.

In the same interval, there is also a sharp decrease in consumption, partly driven by social distancing and partly by the reduced availability of L-goods. The demand for capital goods falls even more sharply. The reduction in the supply of L-goods – being stronger than the decline in the demand of these goods due to social distancing – leads to an increase in the price of L-goods relative to B-goods and to an increase in the general price level.

At the end of the lockdown, consumption, investment and GDP bounce back but do not regain the levels of Normal Times. The default rate, on the contrary, goes back to normal. The recovery, however, is short lived. As shown above, in the EP scenario the second wave of the epidemic ends up being more severe than the first. Due to the high number of infections during the second wave, there is hence a second large shock to consumption which leads to a renewed decline in GDP, consumption and investment. The second recession begins approximately at month 10 and reaches a trough around month 15.

After the second wave GDP recovers slowly. It takes four years for GDP to reach the level of Normal Times (around month 50). Consumption and investment follow a similar trajectory. GDP, consumption and investment also overshoot the level of NT for some months in the second half of the simulation time span. This overshooting is due to the adaptive rules which characterize agents’ behaviour in the model. Investment in particular overshoots the baseline quite strongly due to firms rebuilding capacity lost during the previous recession. In addition, the rule of thumb which firms use to make their investment decision leads them to over-react to both positive and negative changes in capacity utilisation. Eventually, GDP returns to a level slightly below the baseline, the disease having become endemic.

Initially, the large increase in public outlays due to unemployment benefits and sick pay, coupled with a strong decline in GDP and tax revenue, leads to a sizable increase of the government debt to GDP ratio. The ratio decreases sharply once the lockdown ends but then trends upward again when the second wave begins and only slowly decreases thereafter.

4 Vaccination

In this section we address the economic and epidemiological impacts of vaccination in the absence of variants of the virus. We take the EP scenario outlined and analysed above as the baseline against which the effects of vaccination are assessed.

In the vaccination scenario we assume that 11 months after the outbreak of the epidemic (roughly corresponding to the actual start of the vaccination campaign in Italy), a vaccine against the epidemic disease becomes available. Vaccination has two separate effects in our model. Firstly, a vaccinated individual is less susceptible to infection (Vaccine Effectiveness of type 1): the probability that a meeting between an infected and a susceptible individual will result in an infection is reduced by \(VE_{1}=0.8\) if the susceptible individual is vaccinated. Secondly, vaccination reduces the vulnerability to serious disease (Vaccine Effectiveness of type 2): if a vaccinated individual is infected, the probability that they develop serious symptoms (which may eventually lead to death) is decreased by \(VE_{2}=0.95\). We assume that the vaccine immediately unfolds the above-described effects in a vaccinated individual for a number of weeks (vaccine-induced immunity) drawn from a normal distributionFootnote 8 after which the individual becomes as susceptible to infection and serious disease as they were previously and needs to be vaccinated again.

Vaccination campaigns in the model are continuous (i.e. they also feature re-vaccination) and are characterised by a coverage rate as well as a prioritization rule. We assume that the coverage rate, i.e., the share of the initial population which can be vaccinated in each week, starts at a low level (0.01) and then increases linearly by 0.001 in each week until reaching a level of 0.05. In each week, a number of eligible (susceptible, recovered and undetected infected) individuals corresponding to the coverage rate times the initial population are drawn randomly for vaccination according to probabilities defining the prioritization strategy. In the simulations shown below, we explore three prioritization strategies:

-

1.

Prioritization by age (PA) in which the probability of being drawn increases exponentially with age.

-

2.

Prioritization of workers (PW) in which the probability of being drawn is exponentially higher for economically active agents than for inactive (retired ones).

-

3.

Randomized Vaccination (RV) in which the probability is equal for every agent.

For the moment, we assume that all agents accept to get vaccinated when they receive an offer. The modelling of vaccine effects and vaccination strategies is described in more detail in Appendix B.3. Model simulations show that vaccination reduces both infections and fatalities and therefore the duration and amplitude of the output loss due to the epidemic, and the resulting public sector deficit and debt. Our framework, however, allows to go beyond these intuitive results and gain additional insights about the effects of alternative vaccination strategies both at the macro level – in terms of aggregate health and economic outcomes – and at the meso level, by comparing the number of infections and fatalities between age groups.

Figure 5 compares the simulated epidemic curves in the three vaccination cum prioritization scenarios to the baseline given by the Epidemic scenario (EP) presented in Section 3. As in the previous experiments, we run the model 100 times with different random seeds and compute the mean values with \(95\%\) confidence intervals for each time period. We consider a time window consisting of 100 weeks starting from the beginning of the vaccination campaign, denoting with \(t_{VC}\) the month and \(\tau _{VC}\) the week in which vaccination begins. Period zero in Fig. 5 corresponds to \(\tau _{VC}\). The top left panel shows the cumulative number of (detected) infected individuals (computed from the beginning of the epidemic) which occur with and without the vaccine. The top right panel shows the weekly flow of newly detected infections. The bottom panels show cumulative and new deaths respectively. Since vaccination started well after the end of the first wave in Italy, the waves shown in the right panel are the (latter part of the) second wave and subsequent ones.

The vaccine significantly contributes to reducing the number of infections. At the same time, the differences in infection numbers between prioritization strategies are not large; regardless of the strategy, once the campaign begins detected infections quickly diverge in almost identical fashion from those recorded in the absence of vaccination, with the gap between cumulative detected infections with and without the vaccine widening over time. As shown in the top right panel, the vaccine roll-out slightly accelerates the decline of the flow of new infections per week as the second wave dies down. In the absence of a vaccine, there are also multiple subsequent waves, albeit much less pronounced than the second one. With the vaccine, in the time window considered we observe only wavelets of negligible amplitude and frequency. This is because the vaccine-induced immunity is not complete, thus leaving vaccinated agents partially exposed to the risk of infection. In the end the vaccine acts as a mitigating factor on epidemiological fluctuations, leading to a reduction of the frequency and amplitude of subsequent waves of contagion.

As expected, the decline in the number of infections coupled with the vaccine’s ability to prevent serious disease also triggers a significant reduction in fatalities, as shown in the bottom panels of Fig. 5. The ranking of prioritisation strategies in decreasing order of number of cumulative fatalities is clear. The best performing strategy along this dimension consists in vaccinating the old first. Interestingly, random vaccination performs better than the strategy based on economic activity. Regardless of the prioritisation strategy adopted, less than one year after the start of the vaccination campaign the number of deceased individuals stabilizes while it continues to grow in the absence of a vaccine. As shown in the bottom right panel, in the presence of vaccination the flow of new deaths rapidly converges closely to zero via dampening oscillations and remains almost flat at zero thereafter while there are multiple additional waves of fatalities in the absence of a vaccine.

In order to assess the difference in the epidemic dynamics across vaccination strategies, Table 1 takes a snapshot of the epidemiological situation after the first year of the vaccination campaign. It shows the total number of deaths and detected infections (averaged across simulations) which occur during the first year of the vaccination campaignFootnote 9 under different priority rules, for the whole population and by age groups. First and foremost the table confirms that, independently of the prioritization strategy, vaccination leads to a sizable improvement in the epidemiological situation. Comparing the numbers in the absence of a vaccine with their counterparts under all vaccination strategies, we observe a large reduction in the number of detected cases, and an even more dramatic one in the death toll in all cases.

From the same table we infer that prioritization by age group allows to save more lives (with respect to PW and RV) – in particular among the old – while allowing for a slightly higher number of infections compared to the other vaccination strategies. On the other hand, prioritization by economic activity leads to slightly lower infections – in particular among the young and the middle aged – but higher fatalities. Contrary to old and inactive agents who meet only with social and marketplace connections, employed workers also interact with colleagues. Therefore, a vaccination strategy aimed at prioritizing workers, by protecting individuals with greater connectivity, reduces the overall level of contagion but at the same time leaves the elderly, i.e., the subjects with the highest likelihood of developing serious symptoms, more exposed to the risk of dying.

The macroeconomic effects of vaccination are shown in the upper panels of Fig. 6. We run the model 100 times with different seeds for each vaccination strategy and in every simulation month we calculate the mean deviation from the EP scenario (along with confidence intervals), as described in Section 3, for GDP and the government debt to GDP ratio. These time-series are plotted in the upper panels of Fig. 6, with month zero being the first month of vaccination. To illustrate the relationship with the epidemiological situation, in the lower panels we also report the average % deviations of cumulative deaths and detected infections under vaccination from the EP scenario at weekly frequency for the same time horizon as in the top panels. Week zero is the first week of vaccination.

As already illustrated, the introduction of the vaccine leads to a sizable improvement of the epidemiological situation; cumulative fatalities and detected infections decline steadily relative to the epidemic scenario without vaccine. In parallel, the introduction of the vaccine leads to a considerable improvement of macroeconomic performance, with monthly GDP increasing significantly soon after the introduction of vaccination and eventually settling at a per-period improvement relative to the EP scenario of between 1 and 2 percent. This is essentially due to the positive impact on consumption and aggregate demand resulting from the reduced number of infections and deaths brought about by the diffusion of vaccine-induced immunity. The lower number of infections reduces the prevalence of social distancing and the magnitude of the associated (negative) consumption shock. In addition, the lower number of deaths results in higher aggregate consumption because the old who survive due to the vaccine contribute to aggregate demand while in the EP scenario they (and their consumption demand) were at least temporarily “removed” from the economy. The upper right panel shows a steady and sizable decline of government debt as a fraction of GDP relative to the EP scenario. At the end of the time-window depicted, this ratio is approximately 6% lower than in the epidemic scenario without vaccines. This is essentially due to the boost received by GDP and therefore to the increase of the denominator. Importantly, the figure shows that there are no statistically significant differences in economic outcomes between vaccination strategies, i.e. the prioritisation of economically active agents in vaccination does not appear to translate into an aggregate economic gain, relative to other strategies. In this sense, there is no trade-off between epidemiological and economic outcomes in choosing a vaccination strategy.

5 Variants

Vaccination is certainly crucial but may not be sufficient to eradicate a viral epidemic, especially since viruses may mutate rapidly. Mutations that make a virus capable of escaping antibodies survive and spread across the population, becoming “variants of concern” (Zimmer 2021). A sequence of variants of SARS-CoV-2 has emerged around the world over the course of the Covid-19 pandemic. The most important variants of concern for Italy have been Alpha (B.1.1.7) detected in September 2020 in the United Kingdom, Delta (B.1.617) identified in December 2020 in India and Omicron (B.1.1.529) detected in South Africa in November 2021.

In order to examine the effects of virus mutations, we model two variants of the original disease. We assume that both variants feature a sizable increase in the basic transmission rate relative to the original virus and that the seasonality of the transmission rate is less pronounced for the variants.Footnote 10 and that they both reduce the effectiveness of social distancing in preventing infections by \(75\%\). The variants differ only in their ability to circumvent the effectiveness of the vaccine against the original virus, which is a centrally important characteristic in determining the ability of a vaccine to become dominant and exacerbate epidemiological dynamics in a setting in which a vaccine is available (cf. Bernal et al. 2021; Hoffmann et al. 2021; Wall et al. 2021). While both of the variants we simulate reduce the vaccine’s effectiveness at preventing infection to the same degree (namely \(20\%\)), the first variant, \(VR_{1}\), leaves the original vaccine’s effectiveness in preventing serious disease unchanged while the second, \(VR_{2}\), reduces the latter by \(20\%\). We assume in parallel that the vaccine may be adapted over time to be as effective against the variant as the original vaccine was against the original virus, in which case agents need to be re-vaccinated with the new vaccine. Accordingly, we examine four scenarios:

-

Variant 1 and original vaccine (VR1-OV)

-

Variant 1 and new vaccine (VR1-NV)

-

Variant 2 and original vaccine (VR2-OV)

-

Variant 2 and new vaccine (VR2-NV)

A variant is introduced in the model by assuming that a few weeks before the start of the original vaccination campaign, a small number of highly connected undetected infected individuals have their infection status exogenously changed from the original virus to the variant, which they then spread among their network of contacts.Footnote 11 Appendix B.4 describes the modelling of the variants in more detail, also illustrating the process of diffusion; in all cases, the variant quickly comes to supplant the original virus, soon accounting for 100% of new infections.

Figure 7 summarises the epidemiological and macroeconomic impacts of Variant 1 relative to the epidemic scenario with the original vaccine prioritized according to age (PA). We plot both the VR1-OV and VR1-NV scenarios with deviations from the PA scenario calculated as in Fig. 6. Period 0 is the start of the vaccination campaign.

The emergence of Variant 1 leads to a significant increase in the number of detected infections, particularly in the absence of an improved vaccine. In scenario VR1-NV the new vaccine by assumption becomes available 6 months after the emergence of the variant. Once available, the new vaccine is first administered to any agents who are completely unvaccinated and subsequently to those who had previously received the old vaccine; this new vaccine is partly able to mitigate the increase in infections relative to the PA scenario.

As explained previously, variant 1 by assumption does not reduce the original vaccine’s effectiveness at preventing serious disease. Despite this, the variant leads to a significant increase in fatalities driven purely by the higher number of infections, particularly those occurring in the early stages of the variant’s circulation. As a consequence, the improved vaccine is only partly able to mitigate the increase in fatalities due to variant 1, with the difference between the two scenarios not being statistically significant in this case. The top left panel demonstrates that variant 1 also has a sizable detrimental effect on macroeconomic outcomes. In the absence of an improved vaccine, GDP shows a persistent negative deviation from the PA scenario which oscillates in synchronisation with the magnified waves of infections driven by the variant, with the per-period loss exceeding \(2\%\) in some periods. At the same time, the government debt to GDP ratio increases substantially over time. Since the effect on macroeconomic outcomes is chiefly driven by the negative impact of higher infection numbers of consumption, the introduction of an improved vaccine can partly mitigate the deterioration.

Figure 8 shows the scenarios involving Variant 2, which undermines both dimensions of vaccine effectiveness (on the probability of infection and on the probability of serious symptoms). The increase in infection numbers is similar to that shown in Fig. 7 due to the identical characteristics of the variants with regard to transmissibility. By reducing the vaccine’s ability to prevent serious symptoms, however, variant 2 leads to an increase in the death toll which is even more substantial than that caused by variant 1. This can be mitigated only if the healthcare sector is able to swiftly produce and distribute a new and more effective vaccine. Due to the increased number of deaths, the detrimental economic impact of variant 2 is also slightly larger than that of variant 1, with the maximum per-period loss in GDP being slightly higher if no new vaccine becomes available.

Overall, the analysis hence shows that virus variants can act as a strong accelerating factor in the epidemiological and macroeconomic dynamics, being able to partly negate the beneficial effects of a vaccine against the original virus. In addition, these variants also lead to considerable macroeconomic losses. The detrimental effects of a variant on both epidemiological and macroeconomic outcomes may however in turn be mitigated if a new and improved vaccine becomes available.

6 The impacts of unvaccinated agents

All scenarios involving vaccines shown up to this point were conducted under the assumption that, once a vaccine becomes available, every agent accepts to be vaccinated as soon as they receive an offer. In the case of the Covid-19 pandemic most countries which have undertaken major vaccine rollouts, however, have experienced difficulty in approaching a vaccination rate anywhere close to 1 even once sufficient doses for everyone had become available. We use our model to examine how simulation results differ when an increasing share of agents remains unvaccinated. In particular, we re-run the scenario of Variant 2 without improved vaccine (VR2-OV) for a total of ten times. In each batch of 100 runs, we increase the share of agents who refuse the vaccine from the baseline of 0 up to 100% in steps of size 10%, with those agents refusing the vaccine being randomly chosen from the population.

The results of the experiments are summarised as boxplots in Fig. 9, with the numbers on the horizontal axes representing the percentage of unvaccinated agents. The top left panel shows the percentage gain/loss in GDP generated over the first 3 years of the vaccination campaign relative to the case of zero unvaccinated agents. The top right panel plots the percentage difference in the public debt to GDP ratio 3 years after the beginning of the vaccination campaign relative to the case of zero vaccinated agents. The bottom panels show the percentage changes in cumulative deaths and infections relative to the case of zero unvaccinated agents 3 years after the beginning of the campaign.

As one might expect, an increasing share of unvaccinated agents has a rather drastic impact on epidemiological outcomes, with cumulative detected infections but especially cumulative deaths three years into the vaccination campaign increasing very strongly with the share of unvaccinated agents. The presence of unvaccinated agents however also has a sizable negative effect on economic outcomes, leading to significantly lower values of GDP and large increases in the public debt to GDP ratio especially when the share of unvaccinated agents is high.

7 Conclusion

Using macro-epidemiological agent-based model calibrated on the Lombardy region of Italy, this paper explored the epidemiological and macroeconomic effects of vaccines and virus variants in the context of the Covid-19 pandemic.

As expected, the availability of a vaccine strongly slows down the pace of the epidemic in our model and in particular is able to save a large number of lives, acting as a significant mitigating factor of the cyclical dynamics of infections and deaths. At the same time, the lower numbers of infections and fatalities under vaccination also translate into a substantial economic gain in the form of a positive impact on GDP. Different vaccination strategies do not differ greatly in terms of epidemiological and macroeconomic results, but a strategy prioritizing old agents for vaccination emerges as the best choice for minimising the number of deaths. Importantly, the choice of vaccination strategy in our model does not imply an economic trade-off, in that a prioritization of economically active agents does not lead to significantly better economic outcomes than other strategies.

The emergence of a variant of the original virus, by contrast, plays the role of an accelerating factor, counteracting the mitigating effects of the vaccine on epidemiological dynamics and also leading to a substantial economic loss. These adverse developments can in turn be addressed by the introduction of a new and improved vaccine. The emergence and diffusion of new and more transmissible variants counteracted by new and improved vaccines may come to represent the new normal in the future.

Finally, the presence of a share of agents refusing the vaccine predictably leads to a sizable deterioration in epidemiological outcomes, but the model in addition shows that the associated economic losses may also be quite substantial.

Notes

Mellacher (2022) uses a detailed epidemiological agent-based model to study the emergence and diffusion of mutations. The macroeconomic impact of these, however, is not explored.

In normal times, illness always ends with recovery, during an epidemic it may end either with recovery or with death.

Appendix D presents an experiment showing the effects of an increase in healthcare expenditure during an epidemic.

If a firm’s liquidity is negative but its equity is positive, it receives a transfer from the firm owner up to the financial wealth of the latter. If the firm’s liquidity is still negative after the transfer, the bank takes a loss equal to the negative balance and the firm’s deposit becomes zero, but the firm does not exit.

The most straightforward example of this phenomenon is the limited availability of beds in Intensive Care Units and equipment such as ventilators, particularly in the early stages of the pandemic.

In the baseline epidemic scenario the mean of this distribution – i.e., the average duration of natural immunity – is 52 weeks. In Appendix D.2 we experiment with varying durations of natural immunity.

As shown in Appendix D, an increase in healthcare expenditure has no significant effect on the number of infections, but considerably reduces the number of deaths resulting from this scenario.

As in the case of natural immunity we assume that the mean of this distribution – i.e., the average vaccine-induced immunity – is 52 weeks. In Appendix D.3 we experiment with varying durations of vaccine-induced immunity.

In the left panels of Fig. 5 we show the cumulative numbers of detected infections and fatalities since the beginning of the epidemic. The numbers in Table 1 are not comparable with those used to produce the figures, since the former do not include detected infected or deceased prior to the beginning of the vaccination campaign.

Numerically, the transmission rate of the original virus is 0.07 in the period October to April and 0.04 between May and September. We assume that the transmission rate of any variant is 0.105 (October to April) and 0.095 (May to September). The difference in transmission rates between seasons therefore shrinks from 0.03 to 0.01 in the presence of a variant.

We model the emergence of a variant as an exogenous shock to the epidemiological scenario with vaccination. In more sophisticated epidemiological agent-based models such as Mellacher (2022), the emergence of variants is endogenous. While the endogenous emergence of variants is undoubtedly an appealing feature of a macro-epidemiological model, the exogeneity assumption is justified in our context because of the focus on a single region, Lombardy, within the context of a worldwide pandemic (indeed, all relevant variants of the SARS-COV2 virus discovered to date are held to have originated outside of Lombardy). Our modelling choice allows to better track the consequences of the variant, which is clearly identified as an exogenous shock with a pre-determined timing in the simulated model.

This is the desired allocation of the consumption budget to B-goods and L-goods. If the household’s consumption budget turns out to be larger than available liquidity (deposits inherited from the past plus current income) the desired allocation will be infeasible. In this case we assume that the consumer will first spend up to \(c^b C_{h,t}\) on B-goods and then allocate any remaining liquidity to the consumption of luxury goods.

In symbols: \(c^b=\dfrac{N_F^b}{N^c_F}\dfrac{P^l_{t-1}}{P^b_{t-1}}\) where \(N_F^c=N_F^b+N_F^l\) is the cardinality of the set of C-firms (the union of B-firms and L-firms) while \(P^{b}\) (resp: \(P^{l}\)) is an aggregator of the individual B-prices (L-prices). If the relative price is 1, i.e., if on average B-firms charge the same price as L-firms, the fraction of the consumption budget allocated to B-firms is \(\frac{N_F^b}{N^c_F}\), i.e., it is equal to the fraction of B-firms in the population of C-firms.

For the specification of f(.) see Assenza et al. (2015).

The firm can also be illiquid. If a firm’s liquidity (bank deposit) is smaller than zero at the end of the period but its equity is positive, it receives a transfer from the firm owner to make up the negative balance. If the firm’s liquidity is then still negative, the bank takes a loss equal to the negative balance and the firm’s deposit become zero. However, the illiquid firm does not exit the economy.

The f-th firm receives demand from the public sector equal to the fraction \(\frac{R_f}{\sum _{f=1}^{N_F}R_f}\) where \(R_f\) represents the firm’s revenue. If, after the first round of expenditure, the government has been unable to spend the entire amount G, the remaining demand is redistributed between those firms which still have goods available until the exact amount G has been spent.

Since agents in the model can be infected multiple times with the epidemic disease, provided that they recover in-between, and given that dead agents can be replaced by newly born ones, it makes sense to define the stocks of currently recovered and dead agents as distinct from cumulative values.

Appendix D contains a sensitivity analysis on the mean value 52.

The number of connections, however, has a lower bound given by the exogenous share of connections which take place during the lockdown, described below.

Expected demand for each previously open L-firm is set to the minimum between the mean production of open L-firms in last period and that firm’s own production in last period. Re-opening L-firms’ expected demand is set to equal the mean production of open L-firms in the previous period. Firms’ expectations regarding capacity utilisation are adjusted in line with this.

Epidemiologists distinguish between the effectiveness and the efficacy of a vaccine. Efficacy is the capability of the vaccine to reduce the risk (of being infected or getting serious symptoms or transmitting the disease) in clinical trials before the vaccine roll out, while effectiveness is the capability of the vaccine to reduce the risk in the population at large after the vaccine roll-out. In principle efficacy can be different from effectiveness. For the sake of parsimony, we do not model the production and clinical testing of the vaccine; hence we are interested in vaccine effectiveness. Evidence gathered from the massive vaccination roll-out against SARS-CoV-2 in Israel, however, suggests that effectiveness is close to efficacy (Dagan et al. 2021).

The shares of agents (in each age class) who develop serious symptoms are denoted with \(\pi ^h_z; z=y,m,o\). The numerical values of these parameters can be found in Table 5. Agents who are newly born during the simulation fall in the category of young people.

As to \(VE_1\), in December 2020, a study on the effects of the Moderna vaccine found that vaccination implied a lower risk of (symptomatic) Covid-19 of 94%. As to \(VE_2\), the efficacy of Moderna in reducing the risk of hospitalisation was estimated to be 89% (CDC 2020). A study of the vaccination campaign in Israel between December 2020 and February 2021 by the Clalit Institute for Research found that two doses of Pfizer vaccine reduced cases by 94% and the risk of severe Covid-19 symptoms by 92% (Wise (2021)). On March 22 2021 a report on clinical trials of the AstraZeneca vaccine in the US showed a vaccine efficacy of type 1 of 76% (85% in adults aged 65 years and older) and of type 2 of 100% (AstraZeneca 2021). Vaccines were designed to mitigate the spread of the original virus but they have been effective also against the alpha and delta variants. The omicron variant has substantially reduced \(VE_1\) but not \(VE_2\). As to \(VE_3\), it appears reasonable to set the transmissibility of the virus by vaccinated individuals to the same level of that of non-vaccinated individuals (Franco-Paredes 2022).

Appendix D contains a sensitivity analysis this value.

In the PA scenario, the probability an agent of age a of being drawn for vaccination increases exponentially with a: \(\pi _v^a=\dfrac{\exp (a)}{\sum _a \exp (a)}\) with \(a=1,2,3\) for young, middle aged and old respectively. Since all the old are inactive by assumption – the labor force consisting only of young and middle aged agents – in PW the probabilities are given by \(\pi _v^{in}=\dfrac{\exp (1)}{\exp (1)+\exp (3)}\) for the inactive (old) and by \(\pi _v^{ac}=\dfrac{\exp (3)}{\exp (1)+\exp (3)}\) for the active (young and middle-aged actives have the same probability of being drawn for vaccination).

We follow the same calibration methodology used for the original ABC model presented in Delli Gatti and Reissl (2022). Since the current model differs from ABC both in terms of the number of agents and some behavioural assumptions, the results of this calibration procedure are also somewhat different.

References

Assenza T, Delli Gatti D, Grazzini J (2015) Emergent dynamics of a macroeconomic agent based model with capital and credit. Journal of Economic Dynamics & Control 50:5–28. https://doi.org/10.1016/j.jedc.2014.07.001

AstraZeneca (2021) “AZD1222 US Phase III primary analysis confirms safety and efficacy”. AZ Press Release 25 March 2021, https://tinyurl.com/3fakkaxx

Babus A, Das S, Lee S (2021) “The optimal allocation of covid 19 vaccines”. CEPR Discussion Paper 15329

Baskozos G, Galanis G, Guilmi CD (2020) “Social distancing and contagion in a discrete choice model of COVID-19”. Centre for Applied Macroeconomic Analysis - Australian National University 35

Basurto A, Dawid H, Harting P, Hepp J, Kohlweyer D (2022) How to design virus containment polices? A joint analysis of economic and epidemic dynamics under the COVID-19 pandemic. Journal of Economic Interaction and Coordination advance access. https://doi.org/10.1007/s11403-022-00369-2

Bernal J, Andrews N, Gower C, Gallagher E, Simmons R, Thelwall S, Ramsay M et al (2021) “Effectiveness of covid-19 vaccines against the B.1.617.2 variant. New England Journal of Medicine 385:585–594. https://doi.org/10.1056/NEJMoa2108891

Bernanke B, Gertler M, G S (1996) The financial accelerator and the flight to quality. The Review of Economics and Statistics 78:1–15. https://doi.org/10.2307/2109844

Bloom DE, Canning D (2000) The health and wealth of nations. Science 287:1207–1209. https://doi.org/10.1126/science.287.5456.1207

Bloom DE, Canning D (2008) “Population health and economic growth”. World Bank Commission on Growth and Development Working Paper 24

Brotherhood L, Santos C (2022) Vaccines and variants: A comment on ‘optimal age-based vaccination and economic mitigation policies for the second phase of the covid-19 pandemic‘. Journal of Economic Dynamics & Control 140:104303. https://doi.org/10.1016/j.jedc.2022.104303

Caiani A, Godin A, Caverzasi E, Gallegati M, Kinsella S, Stiglitz J (2016) Agent based-stock flow consistent macroeconomics: Towards a benchmark model. Journal of Economic Dynamics & Control 69:375–408. https://doi.org/10.1016/j.jedc.2016.06.001

CDC (2020) “Grading of recommendations, assessment, development, and evaluation (grade): moderna covid-19 vaccine”. 20 December 2020. https://www.cdc.gov/vaccines/acip/ recs/grade/covid-19-moderna-vaccine.html

Dagan N, Barda N, Kepten E, Miron O et al (2021) BNT162b2 mRNA Covid-19 Vaccine in a Nationwide Mass Vaccination Setting. New England Journal of Medicine 384:1412–1423. https://doi.org/10.1056/NEJMoa2101765

Dawid H, Delli Gatti D (2018) Agent based macroeconomics. In: Hommes C, LeBaron B (eds) Handbook of computational economics, vol 4. North Holland, Amsterdam, pp 63–156

Delli Gatti D, Gallegati M, Greenwald B, Russo A, Stiglitz J (2010) The financial accelerator in an evolving credit network. Journal of Economic Dynamics & Control 34:1627–1650. https://doi.org/10.1016/j.jedc.2010.06.019

Delli Gatti D, Reissl S (2022) Agent-based covid economics (ABC): Assessing non-pharmaceutical interventions and macro-stabilization policies. Industrial and Corporate Change 31:410–447. https://doi.org/10.1093/icc/dtac002

Ferraresi T, Ghezzi L, Vanni F, Guerini M, Lamperti F, Fagiolo G, Caiani A, Napoletano M, Roventini A, Reissl S (2023) On the economic and health impact of the covid-19 shock on Italian regions: A value-chain approach. Regional Studies, advance access. https://doi.org/10.1080/00343404.2023.2189508

Forslid R, Herzing M (2021) “Whom to vaccinate first -some important trade-offs”. CEPR Discussion Paper, DP15800

Franco-Paredes C (2022) Transmissibility of SARS-CoV-2 among fully vaccinated individuals. The Lancet Infectious Diseases 22:16. https://doi.org/10.1016/S1473-3099(21)00768-4

Gaythorpe K, Bhatia S, Mangal T, Unwin J, Imai N, Cuomo-Dannenburg G, Walters C, Jauneikaite E, Bayley H, Kont M, Mousa A, Whittles L, Riley S, Ferguson N (2021) Children’s role in the COVID-19 pandemic: a systematic review of early surveillance data on susceptibility, severity, and transmissibility. Nature Scientific Reports 11:13903. https://doi.org/10.1038/s41598-021-92500-9

Glover A, Heathcote J, Krueger D (2022) Optimal age-based vaccination and economic mitigation policies for the second phase of the Covid-19 pandemic. Journal of Economic Dynamics Control 140. https://doi.org/10.1016/j.jedc.2022.104306

Gollier C (2021) The welfare cost of vaccine misallocation, delays and nationalism. Journal of Benefit-Cost Analysis 12:199–226. https://doi.org/10.1017/bca.2021.4

Hoffmann M, Hoffmann-Winkler H, Krüger N, Kempf A, Nehlmeier I, Graichen L et al (2021) SARS-CoV2 variant B.1.6167 is resistant to Bamlavinimab and evades antibodies induced by infection and vaccination. Cell Reports 36:109415. https://doi.org/10.1016/j.celrep.2021.109415

Keogh-Brown M, Smith R, Edmunds J, Beutels P (2010) The macroeconomic impact of pandemic influenza: estimates from models of the United Kingdom, France, Belgium and The Netherlands. European Journal of Health Economics 11:543–554. https://doi.org/10.1007/s10198-009-0210-1

Ledford H (2020) “Why do COVID death rates seem to be falling? Nature 587:190–192. https://doi.org/10.1038/d41586-020-03132-4

Matrajt L, Eaton J, Leung T, Brown E (2021) “Vaccine optimization for COVID-19: Who to vaccinate first? Science Advances 7:eabf1374. https://doi.org/10.1126/sciadv.abf1374

Mellacher P (2020) “COVID-Town: An integrated economic-epidemiological agent-based model”. GSC Discussion Paper Series 23

Mellacher P (2022) Endogenous viral mutations, evolutionary selection and containment policy design. Journal of Economic Interaction and Coordination 17:801–825. https://doi.org/10.1007/s11403-021-00344-3

Pritchett L, Summers L (2001) Wealthier is healthier. Journal of Human Resources 31:841–868. https://doi.org/10.2307/146149

Reissl S, Caiani A, Lamperti F, Guerini M, Vanni F, Fagiolo G, Ferraresi T, Ghezzi L, Napoletano M, Roventini A (2022) Assessing the economic impact of lockdowns in Italy: A computational input-output approach. Industrial and Corporate Change 31:358–409. https://doi.org/10.1093/icc/dtac003

Saad-Roy C, Wagner C, Baker R, Morris S et al (2020) Immune life history, vaccination, and the dynamics of SARS-CoV-2 over the next 5 years. Science 370:811–818. https://doi.org/10.1126/science.abd7343

Silverberg S, Zhang B, Li S, Burgert C, Shulha H, Kitchin V, Sauvé L, Sadarangani M (2022) Child transmission of SARS-CoV-2: a systematic review and meta-analysis. BMC Pediatrics 22:172. https://doi.org/10.1186/s12887-022-03175-8

Smith R, Keogh-Brown M, Barnett T, Tait J (2009) The economy-wide impact of pandemic influenza on the UK: a computable general equilibrium modelling experiment. British Medical Journal 339:b4571. https://doi.org/10.1136/bmj.b4571

Smith R, Yago M, Millar M, Coast J (2005) Assessing the macroeconomic impact of a healthcare problem: The application of computable general equilibrium analysis to antimicrobial resistance. Journal of Health Economics 24:1055–1075. https://doi.org/10.1016/j.jhealeco.2005.02.003

Wall E, Wu M, Harvey R, Kelly G, Warchal S, Sawyer C et al (2021) Neutralising antibody activity against SARS-CoV2 VOCs B.1.617.2 and B.1.351 by BNT162b2 vaccination. The Lancet 397:2331–2333. https://doi.org/10.1016/S0140-6736(21)01290-3

Wise J (2021) Covid-19: Pfizer BioNTech vaccine reduced cases by 94% in Israel, shows peer reviewed study. BMJ 372:n567. https://doi.org/10.1136/bmj.n567

Zimmer, K (2021) “A guide to emerging SARS-CoV-2 variants”. The Scientist 26 January, https://www.the-scientist.com/news-opinion/a-guide-to-emerging-sars-cov%-2-variants-68387

Acknowledgements

The majority of the work on this paper was carried out while Severin Reissl was affiliated to IUSS Pavia. This paper is part of a research project promoted by Universitá Cattolica (D3.2) on “The pandemic as a global risk: which strategies against Covid-19?”. We thank the Editor and two Reviewers for their comments and criticisms that led to a considerable improvement in the quality of the paper. We gratefully acknowledge comments received by Federico Bassi, Patrick Mellacher, Marco Pangallo, Oliver Reiter, Andrea Roventini, Gilberto Turati and participants in a seminar at Scuola Superiore Sant’Anna in Pisa and at the following conferences: Workshop on Economics with Heterogeneous Interacting Agents (WEHIA) 2022 in Catania, Computing in Economics and Finance (CEF) 2022 in Dallas, Modelling the economics and epidemiology of Covid-19 in Graz, for insightful comments and discussions. Special thanks to Giulia Gardin for excellent research assistance

Funding

Open access funding provided by Universitá Cattolica del Sacro Cuore within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

The authors state that

\(\bullet \) this manuscript describes original work and is not under consideration for publication in any other journal;