Abstract

The recent flattening of the Phillips curve has stimulated new empirical research and theoretical discussions regarding the nonlinear nature of the changes in the parameters. The objective of the present paper is twofold: to detect the relevant type of the implied nonlinearity and look for some general model capable of generating a Phillips curve mimicking the empirical one. We find evidence of a convex US price Phillips curve, from 1961 q1 to 2019 q4, assessed both by piecewise and threshold models. The result presents some degree of novelty regarding the role of supply shocks and model-specific convexities; in addition, it supports the use of a regime-switching macro system. The latter accomplishes three tasks. It can generate a Phillips curve resembling its empirical counterparts; it creates a medium-run endogenous cycle where unemployment is not a NAIRU; finally, it opens new perspectives on economic policy issues.

Similar content being viewed by others

1 Introduction

The debate on the Phillips curve, present in the economic literature since its inception, has fluctuated in intensity depending on the conditions of the economy and the theoretical paradigms prevailing. Since the Great Recession it has witnessed a renewed interest, largely driven by a further weakening of the response of the US price inflation to the labour market tightening, during the last recovery. As this missing inflation followed a missing disinflation period, when the slack abruptly increased but inflation did not fall as much as expected, the possible breakdown of the Phillips curve became a topical issue both for economic research and policy making.Footnote 1

Figure 1 sets the scene by drawing the price Phillips curve and the dynamics of inflation and unemployment gap. Figure 1a shows the well-known outward movement of the Phillips curve from the sixties through the eighties, its subsequent leftward translation and initial flattening, between the mid eighties and the nineties, and the final downward shifting and further flattening in the last 25 years.Footnote 2 Figure 1b depicts the unemployment gap, using the US Congressional Budget Office natural rate of unemployment as a measure of business cycle and overlays the dynamics of core inflation; again, the mid nineties appear as boundary years: the relationship between the change in inflation and unemployment gap that is visible until then, appears to break down in the second part of the period. The picture also conveys that episodes of very tight labour market are more frequent in the first half of the period. Similarly, Hooper et al. (2019) show that since the late eighties the unemployment gap has been less often below -1, relative to the previous three decades and suggest that this can also be ascribed to the Central Bank effort of avoiding events of overheated economy.Footnote 3

The long-lasting stability of inflation that characterises the last 25 years raised various theoretical and policy concerns. Carlaw and Lipsey (2012) argue that as a wide range of unemployment rates is compatible with a stable inflation, the flattening of the curve is inconsistent with the strict natural rate hypothesis and, more generally, is at odds with the implications of ergodic equilibrium theories. On the contrary, it supports path-dependent historical models according to which, in the medium term, the economy evolves along a non-stationary path (Lipsey 2016). In addition, as Central Bank credibility increased and inflation expectations came to anchor to the target rate, the evidence in support of the accelerationist view (Friedman 1968) largely declined. In the empirical Phillips curves the weight on past relative to target inflation, which had approached 1 in favour of the former, thus determining the real economic activity to affect the change of inflation, decreased while the role of target inflation on inflation expectations rose. As (Blanchard 2018) recently stated “We appear to have returned ... to a relation between the unemployment rate and the rate of inflation, rather than between the unemployment rate and the rate of change in the rate of inflation” (p.99).

While changes in slope and inflation persistence became clear through the decades, Phillips curve nonlinearities across the business cycles, that is asymmetries in the response of inflation to low vs high rates of unemployment or economic activity, were already present in the original estimated regressions (Phillips 1958; Lipsey 1960). Though relatively disregarded in the earlier debate, interest in Phillips curve nonlinearities has been revived in the recent years. Granger and Jeon (2011) use a convenient approximation for nonlinearities based on Kalman filter to reconsider the original Phillips curve models through different periods and countries. They find that the basic relationship accounted for by Phillips continues to be nonlinear and that the causation from unemployment to inflation is stronger in nonlinear models with respect to linear ones, a result which feeds back to relevant theoretic issues.

Nonlinearities in the Phillips curve and their relevance for the conduct of monetary policy have been explicitly recognized by policy makers. In a speech delivered at the Federal Reserve Bank of Boston, Janel Yellen referred to the Phillips curve convexity and its effects on unemployment level and variability, and the role played by downward wage rigidities (Yellen 2007). More recently, in Sintra, Jerome Powell, while accounting for the slope of the Phillips curve, hinted to nonlinear inflationary effects, which could emerge in presence of very tight labor markets (Powell 2018).

The Phillips curve nonlinearity has various policy implications. The immediate one is that the same policy action has different real effects depending on the phase of the cycle: stronger effects in slack periods and weaker ones in tight periods when most of the action is absorbed by prices (Clark et al. 1996; Macklem 1997). Moreover, the effectiveness of contractionary policies in reducing inflation would be greater than what expected on the basis of a linear model; analogously, in periods of high unemployment, expansionary policies would be less inflationary than expected (Gross and Semmler 2019). In this sense, more vibrant policies could be adopted to revive a feeble economy. More specific policy implications depend on the theoretical underpinning of nonlinearities; if they are ascribable to capacity constraints, in line with (Phillips 1958) and with recent results by Boehm and Pandalai-Nayar (2020),Footnote 4 then a relevant implication is a preemptive monetary policy, as delaying actions aimed at containing inflationary pressures would exacerbate the business cycle and lower the average output level (Macklem 1997; Laxton et al. 1999). On the contrary, in the case of costly price adjustments due to menu costs or contracts of duration inversely related to inflation, the Phillips curve would be steeper for high levels of inflation and almost flat for low inflation levels, as in this case firm price changes are muted (Ball and Mankiw 1995; Dupasquier and Ricketts 1998). This would imply that the Phillips curve slope relates to the inflation level rather than to the output gap and monetary policy can enjoy a longer reaction time during low inflation periods than during high inflation periods. Quite the opposite, if firms would use low prices to undercut competitors, as in the monopolistically competitive model, the result would be a concave Phillips curve, a case rarely detected empirically.Footnote 5

Nonlinearities in the Phillips curve can therefore be of various degrees, taking the form of convexities or even concavities and could entail discontinuities in correspondence to specific thresholds. We address these points again in the empirical section where we allow sufficiently flexible specifications.

Finally, the presence of nonlinearities reinforce once more the challenge, to all paradigms, of accounting for changes in the values of a model parameters. At one extreme, the strictly microfounded New Classical approach, coupled with the Rational Expectation Hypothesis (REH), led to the conclusions that parameters have a particularly robust stability (Ljungqvist and Sargent 2004) and that business cycles have substantially been tamed (Lucas 1987); within this framework the Phillips curve has come to be regarded as a largely archaeological stylized fact (Hall and Sargent 2018). Although the DSGE approach has deeply questioned and largely softened these conclusions, the evidence of the empirical Phillips curve contrasts with the benchmark New Keynesian model and seems to imply a flexible inflation targeting (Blanchard 2016). At the other extreme, frameworks that do not consider microfoundation as a sine qua non for economic analysis, recognize the existence of complex forces underlying parameter changes, ranging from interactions to aggregations and endogeneous technological changes; still, these considerations do not appear sufficient to deal with the dynamic implications of parameter changes.

The present paper contributes to the recent debate on the Phillips curve nonlinearities, adding to the empirical and theoretical literature. From the empirical point of view, it investigates the types and degree of nonlinearities in the US PCE core inflation from 1961 q1 to 2019 q4. Specifically, by using three different empirical specifications, we contrast the linear model with an inherently convex one, based on the log-transformation of the unemployment gap, and with two more flexible specifications, based on piecewise linear regressions and threshold models. The latter allow to test the type of nonlinearity, whether concavity or convexity and threshold models also provide an estimated value of the unemployment gap in correspondence of which the slope of the Phillips curve changes. As it will be clear in the empirical section, this turns out to be half percentage point higher than the zero level assumed in the piecewise linear regressions. In addition, the empirical model accounts for supply shocks, namely, the dynamics of relative import prices and that of trade flows, and in both cases potential asymmetric effects are allowed across the cycle.

On the basis of the empirical results, which clearly support convexities and discontinuities, the paper then adds to the theoretical debate by suggesting a model of the Phillips curve based upon a regime switching and embedded in a concise dynamic macro system. As shown by Ferri et al. (2001), the regime-switching approach is capable of tempering accelerations in the dynamics with the overall stability of the system and in so doing it can generate endogenous cycles along with Phillips curves of different shapes. The model is a stylized medium-run growth model compatible with structural changes in evolving economies; moreover, it accounts for the role of monetary policy and the interaction between aggregate demand and supply (Fazzari et al. 2020; Ferri et al. 2019).

The structure of the paper is the following. Section 2 briefly reviews the existing empirical evidence on the Phillips curve nonlinearities for the US, paying particular attention to models estimated on quarterly PCE core inflation data; a dedicated subsection introduces the empirical specification and compares the econometric results of linear and nonlinear models. Section 3 sets forth the model of the Phillips curve embedded in a nonlinear dynamic system; the latter, consonant with evolutionary forces, is based upon a switching behaviour and is capable of offering a business cycle perspective. Section 4 characterizes the regimes and Section 5 illustrates the overall dynamics obtained by means of simulations. Section 6 shows how the Phillips curve can be generated within the model and Section 7 discusses policy issues. Section 8 tests the robustness of the results and introduces learning expectations. Section 9 concludes.

2 Empirical evidence on nonlinearities

As anticipated in the previous section, nonlinearities in the Phillips curve can be ascribed to capacity constraints and convex supply curves as well as to firm price decisions. Further rationales are provided by the link between wage and price inflation; hence strategic labor market factors, like downward wage rigidity, differences in trade union power across the cycle, shifting composition of the labor force in a recessionary or stagnant economy (Daly and Hobijn 2014), as well as structural changes due to the retirement of high-wage baby boomers and the entry of lower-wage workers (Daly et al. 2016) have been considered. Analogously, union power decline and globalization have been called into the picture for relieving inflationary pressure. Indeed, the decline of union powerFootnote 6 is partly connected to globalization as higher competition has increased the elasticity of labour demand and weakened the ability of unions to bargain higher wages (Stansbury and Summers 2020). More generally, since foreign prices are largely unrelated to the US economy stance, their increased weight in US final prices, due to globalization, is consistent with the increased disconnection between US slack and inflation (Gordon 2013; Obstfeld 2020). The effect of globalization through a higher competition is instead unclear: although competition has lowered the markup, the responsiveness of the latter to foreign competition might also have declined (Obstfeld 2020).

Finally, the changing slope of the Phillips curve throughout the decades has been crucially associated with the conduct of the monetary policy, which underwent significant changes in time. After driving inflation down from the high levels of the eighties, most Central Banks, starting from the early nineties, came to adopt successful inflation targeting policies, thus stabilizing inflations around the target rates.

From the empirical point view, piecewise linear as well as threshold models have been used to detect nonlinearities in the Phillips curve.Footnote 7 While the former allow the slope to differ between negative and positive unemployment gaps, the attractiveness of threshold regression models is that they treat the threshold parameter as unknown. Table 1 reports the estimated slope coefficients in a few recent papers that use quarterly US PCE core inflation and consider a relatively long period of time.Footnote 8 The slope is always found to be negative and significant in linear, piecewise and log-transformed models (top panel of Table 1). As expected, in the linear regressions the magnitude of the coefficient is close to zero if the time period excludes the pre-nineties decades. The spline model captures significantly different slopes between negative and positive unemployment gaps and in the latter case the estimated coefficient is almost 10 times lower in magnitude.Footnote 9 The log-transformed model is inherently nonlinear and allows the asymmetry to enhance with the divergence of the rate of unemployment from the natural rate; nonetheless, using the data of the period considered, the estimated nonlinearity is weaker than in the piecewise regression.Footnote 10 Moving to threshold models, for the period 1961 q1-2002 q4, Barnes and Olivei (2003) find two thresholds and a significant slope coefficient of -0.29 for values of the unemployment gap above the highest or below the lowest threshold. For values of the unemployment gap ranging between the two thresholds, the tradeoff between inflation and unemployment is not statistically significant. Adopting the same methodology but stretching the time period to 2007 q4 (Peach et al. 2011), the slope coefficient remains statistically significant only in the two outer regions defined by the thresholds but it lowers in magnitude. On an even more recent time period, 1968 q4-2016 q3, the threshold reduces to one, in correspondence of a positive and relatively large unemployment gap (Doser et al. 2017); below the threshold the slope coefficient is negative and significant (-0.21) and above it is positive but only marginally different from zero.

2.1 Empirical specification and econometric results

The empirical specification of the Phillips curve presented below comprises the three main ingredients of the so-called triangle model (Gordon 2013): inertia, demand and supply; the presence of both inflation expectations and lagged inflation makes it also partly consistent with the hybrid Phillips curve (Galí and Gertler 1999), which is part of the curve long microfoundation process. The original theoretical formulation of the Phillips curve, based on the idea of nominal rigidities due to staggered contracts à la (Taylor 1980), though sufficient to obtain monetary policy non-neutrality, did not include any inflation persistence of its own. As underlined by Fuhrer and Moore (1995) this result, by implying disinflation to be costless, was in stark contrast with the facts. One way to impart persistence to inflation is to assume a contracting rule based on real wage (Fuhrer and Moore 1995); as shown by Roberts (1997) the same result can be obtained by keeping to the sticky price model and adding imperfectly rational expectations.Footnote 11 In both cases a forward-looking component of inflation is thereby included in the Phillips curve, in addition to past inflation.Footnote 12Galí and Gertler (1999) put forward some empirical shortcomings of this new specification, especially on quarterly data, and on the basis of (Calvo 1983) random price adjustment model and explicitly accounting for the role of marginal costs, derive a new Phillips curve where current inflation depends on marginal costs, which replace output gap, and expected future inflation. By allowing a fraction of firms to be backward looking and set prices equal to the average past price level, Galí and Gertler finally provide an estimable ‘hybrid’ Phillips curve where coefficients are explicit functions of the model parameters.Footnote 13 While the use of marginal cost as slack variable raises problems of endogeneity (Gordon 2013), the inclusion of both expected inflation and a few lags of inflation has become usual practice in the empirical analysis of the Phillips curve.

We investigate the price Phillips curve nonlinearity on US quarterly data, from 1961 q1 to 2019 q4, and compare linear, log-transformed unemployment gap, piecewise linear and threshold models. The linear and non-linear regressions are based on the standard specification reviewed above which includes a measure of slack, past and expected inflation, and measures of supply shocks:

where π is the annualized PCE core inflation,Footnote 14Ugap is the slack measure, πe are long-term inflation expectations from Michigan consumers survey,Footnote 15χ and ξ capture globalization and measure the annualized rate of growth of the ratio of import price index to PCE price index (χ) and the (change of) the intensity of trade computed as the sum of exports and imports to GDP (ξ); they are both lagged to allow sufficient time to feed into domestic inflation (Gordon 2013). We follow Hooper et al. (2019) and include seven lags of past inflationFootnote 16 and the price homogeneity constraint \({\sum }_{s=1}^{7} \gamma _{s}+\beta _{1}=1\). The slack measure Ugap is alternatively defined as the difference between the rate of unemployment and the natural rate, i.e. the unemployment gap (U − U∗) or as the log of the ratio, log(U/U∗). In the first case the model is linear and in the latter one is inherently nonlinear, as it explicitly introduces a convexity through the log function; the log-transformed model overcomes some limit of the traditional linear model (Carlaw and Lipsey 2012; Hooper et al. 2019), though it does not allow the necessary flexibility to capture different degrees of convexity or concavity.

The piecewise model allows the slope to vary between positive and negative unemployment gaps; in addition we also allow for the role supply shocks to vary across the cycle.

where dpos is a dummy equal 1 if Ugap is positive.

Figure 2 show the evolution of the main variables used in the estimation and Table 8 in the Appendix reports the descriptive statistics.

The linear, log-transformed and piecewise specification results are compared in Table 2. In all specifications the slope is negative and significant, and RMSEs decline by moving from the linear to the nonlinear specifications. In the linear regression the magnitude of the tradeoff is small, indicating that an unemployment gap of -1%(+ 1%) increases annual inflation by 0.13%(-0.13%); the slope is robust to the inclusion of international supply shocks (column 2), a result also found in the log-transformed and piecewise specifications. At this regard notice that an increase in trade intensity (ξ) reduces inflation, consistently with the idea that competition from globalization lowers the markup, whereas a rise in relative import prices (χ) rises inflation.

In the log-transformed specification (columns 3 and 4), the slope of the Phillips curve, computed at the average value of U, is -0.81/6=-0.13, similar to the linear model; however, using the average values of the rate of unemployment in correspondence of positive and negative unemployment gaps, the slope, in absolute value, drops to -0.116 when the unemployment gap is positive and rises to -0.172 in tight labour markets.

The final columns of Table 2 report the piecewise regression results; they make clear that the small coefficient found in the linear specification is actually the result of a relatively strong tradeoff (-0.3) when the unemployment gap is negative and a coefficient not significantly different from zero when the unemployment gap is positive, thus suggesting a convexity.Footnote 17 When international supply shocks are also allowed to vary through the cycle, (column 7) they both tend to reduce inflation during slacks while in periods of tight labour market only the growth of relative import prices (χ) exerts an inflationary push. This is consistent with the expected unambiguous role of foreign prices as opposed to foreign competition, on domestic inflation (Obstfeld 2020). Finally, the coefficient of inflation persistence (the sum of all past inflation coefficients) is rather stable throughout the specifications and around 0.8 vs 0.2 for inflation expectations, similarly to what found by Hooper et al. (2019).

A different way to test for nonlinearities is to use threshold models. In addition to allowing the coefficients to differ across the regions identified by the threshold variable, the values of the threshold are also unknown and estimated. The empirical model with m thresholds and m + 1 regions is defined as follows:

where x is a vector of covariates containing the lagged values of the dependent variables and inflation expectations, so that the linear constraint can be imposed, and δ is the vector of region invariant parameters; z is the vector of variables with region-specific coefficients, i.e. the unemployment gap and the globalization-related supply shocks previously defined and βj is the corresponding coefficient vector. I is an indicator of the j regions defined on the basis of the threshold values λj and threshold variable Ugap defined as (U − U∗). The threshold values are estimated by minimizing the SSR obtained for all tentative thresholds, and the optimal number of thresholds is based on the Bayesian Information Criteria (BIC). Conditional least squares are used to estimate the parameters of the threshold regression.

Table 3 reports the results. Column (1) and column (2) differ for the inclusion of the supply shock factors. In both specifications the optimal number of thresholds is one; the threshold value declines from 1.83 in column (1) to 0.517 (equivalent to a rate of unemployment of 6.2% using the period average U∗) once the supply shock factors are included in the model;Footnote 18 the introduction of globalization-related factors enhances the tradeoff both below and above the threshold. Again, the change in trade intensity (ξ) is largely insignificant whereas the ratio of import prices (χ) is relevant and exerts a stronger effects when the unemployment gap is below the threshold. In the final specification (column 2), the estimated tradeoff is negative and significant in both regions although below the threshold its magnitude is six times higher, in absolute value (-0.60 vs -0.10). Relative to the corresponding piecewise linear results, the estimated slope is therefore twice as steep in tight labour markets and negative and significant even during slacks.

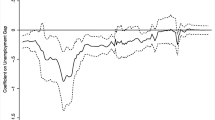

Figure 3 draws the estimated slopes of the Phillips curve in the three main models.

On the whole, considering the period 1961-2019 and PCE core inflation, we can conclude that convexities have been detected in all the models and specifications used. The degree of convexity however, is model-specific and at this regard threshold models are those estimating a comparatively higher degree of nonlinearity. In this case, according to our results, inflation rises by 1.2 p.p. in correspondence to an unemployment gap of -2 p.p. and declines by 0.2 p.p. in correspondence of an unemployment gap of + 2 p.p., ceteris paribus. We also find that the extent of nonlinearity is biased if international supply shocks are not controlled for and, of these, relative import prices are more important than trade intensity measures. Finally, we find that the value of the coefficient of inflation persistence is relatively stable throughout the specifications and the relative weights on past vs expected inflation are 0.8 : 0.2.

3 A medium-run regime-switching model

The empirical finding of a convex Phillips curve, obtained by methods based upon a piecewise approach and strengthened by a threshold technique, opens the way to the consideration of a regime-switching model. Its purpose is threefold: (i) generate a Phillips curve with properties similar to the empirical counterparts; (ii) identify the different mechanisms generating the results; (iii) shed new light on economic policy issues.

The resulting macro model operates in a medium-run perspective, defined as a period “long enough to encompass the possibility of major or deep depression cycles” (Minsky 1982, p. 258), and can only be solved by simulations. In the present analysis, the medium-run has five specific structural characteristics:

-

It is longer than the traditional business cycle.

-

In such an interval of time, dynamics cannot be reasonably assumed to be driven only by exogenous forces, but some endogenous mechanism is to be looked for.

-

Investments play a particular role, being both a source of aggregate demand and a vehicle for capital growth.

-

Two regimes are assumed, a stagnating one and an expansionary one.

-

In each regime, expectations are anchored, though at different values, as explained below.

In line with the literature and the results obtained in the empirical section, the Phillips curve is assumed to differ across two regimes, the good state and the bad state, in terms of slope, inflation persistence and inflation expectations. Equations 4 and 5 illustrate the two regimes; notice that expectations (π∗) are anchored to two different levels, and that persistence (β1) is absent in the bad state.

Bad state: slack labour market

Good state: tight labour market

Regarding the threshold separating the two regimes, we are considering a particular value of the rate of unemployment uth.Footnote 19 When u < uth the good state is prevailing and vice-versa; as the threshold is crossed, new parameters become operative. To generalize the results, a stochastic threshold will be considered in Section 8.

3.1 The macro model

The successive step consists in putting the Phillips curve equation into a broader macro dynamic model. The latter is based upon the dynamic interaction between aggregate demand and an endogenous supply, along the lines of (Fazzari et al. 2020). The model accounts for the monetary policy and its transmission mechanism, it is nonlinear and expressed in intensive form, i.e. the variables are divided by last period output, Yt− 1. Finally, it generates endogenous dynamics capable of reproducing Phillips curves of different slopes and intercepts; as intercepts and slopes can change in both regimes, the overall Phillips curve can then take different forms.

The model consists of the following equations:

where the variables are detailed in Table 4, subscript j = 1,2 identifies the regime, subscript 0 stands for steady state, while superscript ∗ means that the variable is exogenously fixed.

In order to make the explanation easier, the system is considered into three blocks of equations. The first block refers to expectations; in particular, those in the price (6a) are anchored to the target rate of inflation credibly pursued by the Central Bank following a rule à la Taylor (6c); notice that the Central Bank operates in different ways according to the prevailing regime.Footnote 20 The real rate of interest is determined accordingly by Eq. 6d. Growth expectations (6b) are specified as an adaptive process; in Section 8 a learning process will replace this formulation. The steady state values of expectations are equal to g0j which are determined by \(g_{j}^{*}\) in Eq. 6h; it follows that f0j in Eq. 6i are to be endogenized.

The second block of equations refers to aggregate demand. In particular, Eqs. 6f and 6h represent consumption in non durable and durable goods, respectively. Both equations include unemployment. It is worth stressing that the rate of unemployment interacts with an autonomous component in Eq. 6h; while the presence of the latter is well known in the literature, the inclusion of unemployment in a Keynesian consumption function has been criticized because of the high correlation between Y and u. However, this conventional wisdom neglects the impact that the downsizing of the welfare system has had on the rules of the game. In particular, the inclusion of rate of unemployment helps considering two phenomena: it allows to introduce heterogeneity into the analysis, as employed and unemployed are characterized by different propensities to consume (see Kaplan and Violante 2018); it stands for a proxy of uncertainty characterizing non insurable incomes, a point stressed by Carroll (1992), Malley and Moutos (1996), and Palley (2019). Equation 6e shows the evolution of the capital/output ratio derived from the accumulation equation; it depends on depreciation and last period investment. Equation 6g introduces the investment function that plays different roles: i) it replaces depreciation (δ); ii) it accounts for steady state growth in desired capacity and iii) at least partially, it tries to close the gap between actual and desired capacity, where ν∗ is the optimal capital output.Footnote 21 This process of adjustment depends (negatively) on the real rate of interest.

The final block refers to supply equations that determine the rate of unemployment and the rate of growth of potential supply, i.e Harrod’s natural rate of growth. In this perspective, the rate of growth of labor supply gNst (6j) and productivity τt (6k) are endogenously determined and contribute to define the rate of unemployment, expressed in Eq. 6m, where gNt is the rate of growth of labor demand, determined in Eq. 6l. Finally, (6n) expresses the rate of the growth of potential output ratio.

Given the autonomous component of consumption f∗, price expectation π∗ and the expected-optimal capital output ratio ν∗, the system refers to 14 unknowns: πt, Egt, Rt, rt, ct, νt, it, ft, gt, τt,gNst, gNt, ut and \({g_{t}^{s}}\) inserted into 14 equations. The nonlinear nature of the model suggests to refer to simulations. In order to make this task easier, the model has been expressed as a recursive process.

4 Characterizing the regime

The steady state values of the model are easily obtainable. The Harrodian steady state (the so called warranted rate) is driven by g∗ in the equation of durable consumption, while the target inflation rate of the Central Bank fixes the steady state value of inflation.

Table 5 illustrates the quantitative properties of the two regimes, which are at the root of the simulations.

It follows that the bad state is characterized by low growth, high unemployment, and low inflation, while the good state has the opposite properties.

The final step consists in identifying the switching parameters and therefore the switching equations. Both switching and fixed parameters are shown in Table 6.

Notice that we have tried to minimize the number of changing parameters and that these changes are not irreversible because the economy switches from one regime into the other. The parameters of the price Phillips curve are in lines with the results of the empirical section and the remaining are, more generally, in line with empirical estimates as discussed in Fazzari et al. (2020).

5 The dynamics of the model

In carrying out the simulations, the values of the steady states and of the parameters indicated in Tables 5 and 6 have been used. Simulations have been run for 1000 periods, even though in some pictures a smaller interval of values may be indicated. It is also worth stressing that three constraints have been made operative:

-

Rt > 0;

-

ut > 0;

-

[ν∗(1 + Egt)2 − (1 + Egt)νt] > 0;

The first constraint is the zero-bound on the rate of interest, well known in the monetary policy literature. The second constraint, referring to the rate of unemployment, can be considered as a dual of a ceiling. Finally, the last one refers to the investment equation and sets a floor to this variable. These constraints do not determine the existence of fluctuations but they rather have an impact on their amplitude. The dynamics are illustrated in Fig. 4.

Some points are worth stressing. First of all, the dynamics of the model is persistent. In the present case, the number of observations n is equal to 100, but it holds also for n= 1000. In the second case, the dynamics are endogenous. In fact, the steady state value is disturbed by a random shock that only lasts one period. Thirdly, the dynamics is different in the two regimes. Finally, the variables shown represent the framework in which the Phillips curve is generated (consumption and investment are been omitted because they are highly correlated with g).

6 Generating the Phillips curve

The ensuing Phillips curve derived from the simulation of the model is shown in Fig. 5, where also the rate of inflation has been represented. Some points are worth stressing. The first is that the threshold, which is equal to a rate of unemployment equal to 0.07, is within the range of values found in the empirical analysis and consistent with the econometric literature. The second is that the Phillips curve appears to be clearly distinct in the two regimes. The one referring to high unemployment mimics a situation similar to that of the Great Recession, which, mutatis mutandis, replicated that of the Great Depression. Thirdly, it is worth underlying that no runaway situation is generated, in spite of the fact that each regime is not necessarily stable. Finally, with different values of the parameters possible situations of deflation can be generated.

7 Policy implications

Table 7 contains a series of information relative to the impact of three kinds of parameter changes. In a preliminary way, it is important to underline that they witness the robustness of the model. In fact, dynamics remain the same, implying that fluctuations maintain both persistence and boundedness. However, significant changes in other aspects are worth stressing. The first experiment consists in increasing the slope of the price equation in the good state (Table 7, column 2). What is relevant to stress is that if one fits a simple Phillips curve in the data it turns out that the ex-post value of this slope (ϕ1) has increased with respect to the benchmark value. This implies that the price equation generates the empirical Phillips curve. While this is obvious, the problem is to understand how the overall pattern of the model impacts on this result. At this regard, a first aspect to be underlined is that in the present model the equilibrium rate of unemployment is not a NAIRU (Lang et al. 2020). In fact, it is equal to:

In other words, the rate of unemployment is the variable that allows the natural rate of growth (i.e. the aggregate supply) to equal aggregate demand in equilibrium. Differently from the neo-classical literature, the parameter ϕ1 has no impact on u0. However, it has an impact on the empirical Phillips curve, conditioned on the working of the model and on the values of the other parameters.

A first hint on how the overall model affects the result can be derived from the second experiment, which concerns policy (Table 7, column 3). Suppose that the monetary authorities reject a regime-switching model and put forward a Taylor rule which is entirely based upon the values of the good state.Footnote 22 Two results and a caveat are to be underlined. The overall rate of growth is lower with respect to the benchmark, while the rate of unemployment is higher, a result consistent with the long-standing view according to which the use of a linear monetary policy rule when the underlying world is convex, reduces output growth (Laxton et al. 1999). Indeed, the experiment also implies a lower ϕ1, i.e. the policy impacts on the Phillips curve, but this has nothing to do with the Lucas critique. This influence does not occur necessarily through expectations but through the abandonment of a ‘partial equilibrium’ view of the Phillips curve. In fact, once it is conceived as a system result and not only as a labor market phenomenon, all the markets may have an impact, as will emerge from the third experiment. However, before discussing this experiment, a caveat is to be faced. The impact of monetary policy depends, inter alia, on the presence of monetary mechanisms of transmission. In the present model they are too simplistic in the sense that they work only indirectly on the real rate of interest that impacts on the adjustment of investment. If more room is devoted to the monetary and financial variables the impact would be certainly greater (Ferri et al. 2019). Let us finally consider the last experiment, where the value of ξ1, the parameters affecting the speed of adjustment of investment rises with respect to the benchmark (Table 7, column 4). To our purposes, it is important to observe that the implied value of ϕ1 changes in a remarkable way.

The lessons that can be learned from these experiments is the presence of a stone guest represented by the regime switching, which may alter the results obtained by models without such regimes. On this point, more will be said in the next Section.

8 A learning mechanism

The results of the model are robust to the changes in the three kinds of parameters examined in the previous Section. However, the robustness extends to other aspects. In fact, the co-presence of accelerations, discontinuities and global stability are robust both to changes in the values of the parameters and to the values of the threshold. There remains the problem of the abruptness of changes when the model reaches the threshold. Natura non facit saltus seems to be behind the repulsion of this state of affairs. There are many ways to soften this discontinuity (Ferri 2011). In what follows, two strategies are suggested. The first one consists in introducing a stochastic threshold, which can be specified in the following way: uth + 𝜖t where 𝜖t is a normal stochastic variable of the type (0,σ). The second strategy adds a learning in the process of expectations of the rate of growth. In particular, we assume that agents do not have a complete knowledge of the model and therefore use simple rules to forecast the future output growth.Footnote 23 We suppose that there are heterogeneous beliefs and that, as in De Grauwe (2011), the agents can be either optimistic or pessimistic.Footnote 24 The optimists’ forecast is given by the following relationship:

If ξ = 1 they expect that the steady state rate of growth of the good regime is always prevailing. On the other hand, the pessimists forecast a smaller rate:

where η < |1| because it can be negative, and g01, is the steady state rate of growth in the bad state previously used. The market forecast is obtained as a weighted average of these two forecasts:

where αopt,t + αpess,t = 1. Following (Brock and Hommes 1997), a selection mechanism is introduced such that agents compute the forecast performance by referring to the mean squared forecasting error:

where χ represents geometrically declining weights. The proportions of agents are determined à la (Brock and Hommes 1997):

where γ measures the intensity of choice. These formulae indicate that those that had a success in the past will convince more people to follow them in the future. By using the same parameters underlying Fig. 5, referring to a stochastic process marked by \(N \sim (0, \sigma =0.10)\) and making use of a Monte Carlo simulations (repeated n = 100), one obtains Fig. 6.

Notice that the introduction of a stochastic threshold along with the operation of a learning mechanism have softened the discontinuities caused by the threshold, without altering the structural properties of the model

9 Concluding remarks

The flattening of the Phillips curve has stimulated new theoretical discussions on its nonlinear nature, along with a methodological deepening concerning both the measurement and the implications of the changeability of its parameters. The story of the changing Phillips curve has been told many times. Tobin (1972) used the title of a Pirandello’s famous novel “One, no one and hundred thousand” as a metaphor of the changing nature of the Phillips curve, which can assume different forms and play different roles according to the circumstances.

In the present paper, we first test for nonlinearities in the US price Phillips curve from 1961 q1 to 2019 q4 using log-transformed, stepwise and threshold models. All the nonlinear specifications adopted clearly support convexity and are all preferable to a linear specification in terms of RMSE. However, the extent of estimated convexity is model specific and responsive to the inclusion of supply shocks. Regarding the latter, consistently with the theory, we find that relative import prices exert a stronger inflationary pressure than changes in trade flows and that such pressure is also relatively more intense in booms. Regarding the empirical specification, we find that the estimated degree of convexity increases moving from the log-transformed model to the piecewise and the threshold model. In the latter the optimal threshold is in correspondence to a positive unemployment gap (0.517) and the estimated slope is six times as steep below the threshold than above it. With respect to the piecewise and log-transformed models, the difference in the slope of the estimated Phillips curve is especially stark below the threshold, suggesting that the choice of the model can itself carry policy implications specifically in periods of tight labour market.

Based on the relevance of empirical nonlinearities, a regime switching model grounded upon dynamic interactions between aggregate demand and supply and compatible with structural changes is then suggested. We show that the model is capable of generating Phillips curves akin to those found in the econometric analyses and at the same it prevents runaway situations from occurring; in other words, while each regime may be unstable, the overall system is globally stable.

These results, which stress the relevance of nonlinearity and convexity in economics studied from the perspective of the Phillips curve, can be extended from both the empirical and the theoretical point of view. From the empirical point of view, the description of the links between the price Phillips curve and the set of macroeconomic variables considered in the model could be illustrated using a VAR (Del Negro et al. 2020). From the analytical point of view, three changes are to be put forward. First of all, a structural approach linking wage, price, productivity and income distribution must be introduced. Secondly, the presence of monetary and financial aspects must be strengthened in order to better assess the role of policies (Ferri et al. 2019). Finally, some sort of evolutionary learning must be faced, in keeping with the evolutionary nature of the underlying process of growth.

Code Availability

On request.

Notes

A flatter Phillps curve implies a larger sacrifice ratio, hence the need for more extreme policy measures and could challenge the Central Banks inflation targeting strategy. Among others, former ECB Vice President Costâncio in his speech at Jackson Hole (Costâncio 2015) explicitly recognizes the consequences of a weakened output-inflation trade-off on the sacrifice ratio and the role of strongly anchored expectations to mitigate the related difficulties. In a recent speech, FED Vice Chair Clarida also considers pros and cons of a flatter Phillips curve (Clarida 2019).

The specific measures of inflation and slack used in empirical Phillips curves do not explain the flattening. Robustness checks performed using CPI (consumption price index) vs PCE (personal consumption expenditures), headline vs core inflation (Ball and Mazumder 2011; Doser et al. 2017), short run vs long run unemployment rate (Kiley 2015; Albuquerque and Baumann 2017) as well as different measures of inflation expectations (Doser et al. 2017) and (Fu 2020) largely confirmed the flattening of the slope.

Hooper et al. (2019) argue that this generates a positive correlation between unemployment gaps and inflation and biases the slope coefficient towards zero. Indeed, using MSA (Metropolitan Statistical Area) data instead of national ones, the same authors find that the variability of the unemployment gap increases and the estimated slope coefficient is also higher in absolute value, consistent with MSA data being exogenous to national monetary policy. Similarly, the account of heterogeneity across products also produces a stronger tradeoff (Stock and Watson 2019), recently confirmed by Del Negro et al. (2020). See also the recent review in The Economist (2020).

On the convexity of the supply curve and its effects on the potency of monetary policy see also the initial evidence reported by Evans (1986).

On concavity of the Phillips curve see for example (Eisner 1997; Stiglitz 1997). Dupasquier and Ricketts (1998) use a model that nests several types of nonlinearities and conclude that it is difficult to precisely distinguish among them. On a similar vein, see also Huh et al. (2009). Finally, see Dupasquier and Ricketts (1998) for a thorough review of the microfoundations of the Phillips curve.

By 2019 union membership had dropped to 6% from around 25% in the early seventies and the wage premium reduced by almost 30% since the early eighties (Stansbury and Summers 2020)

According to the results reported in Table 1, the slope estimated in the piecewise model is -0.049 when the unemployment gap is positive and -0.423 when negative.

Considering the average level of the natural rate of 5.5 in the period 1961q1-2018q2, a negative unemployment gap of -2 p.p. the log-transformed model would imply, ceteris paribus, an effect on inflation of -0.913⋅log(3.5/5.5)= 0.412 while a positive unemployment gap of 2 p.p. would imply an effect of -0.913⋅log(7.5/5.5)=-0.283. Notice that, at the same values of unemployment gap, the spline model implies an effect on inflation of 0.846 and -0.098, respectively, i.e. a higher nonlinearity.

Roberts (1997) shows that, empirically, the sticky inflation model suggested by Fuhrer and Moore is outperformed by a model with less than perfectly rational expectations.

Starting from Phelps (1967), the presence of expected inflation in the Phillips curve is central to theoretical models and policy making.

Galí and Gertler find that the forward looking behaviour is the dominant one and that the coefficient on lagged inflation is small and further inflation lags are not much informative. On the contrary, they reckon that the cyclical behaviour of the marginal costs is a promising venue to explain the slow response of inflation to output.

PCE core inflation excludes food and energy prices and thus excludes supply shocks due to these components (Ball and Mazumder 2011); it is FED preferred measure of inflation: FOMC focuses on PCE inflation in its quarterly economic projections and also states its longer-run inflation goal in terms of headline PCE. It is also largely used empirically.

Michigan survey of consumers, even if referred to CPI is found to be more effective than professional forecaster in the Phillips curve estimation (Doser et al. 2017; Coibion and Gorodnichenko 2015). The Michigan series starts from 1978; we extend it back to 1961 using a VAR on PCE inflation and CPI inflation, both computed as quarter over corresponding quarter in the previous year. See Fig. 7 in the A. Details are available upon request.

Lags should be sufficient to obtain white noise residuals. In the empirical literature lags number vary but main results are not meaningfully affected by this choice as very long lags are not usually statistically significant (Hooper et al. 2019).

In this case the slope coefficient is the sum of the two coefficients. In all specifications this sum is not statistically different from zero.

It is worth stressing that, while ν∗ refers to contemporaneous value of K and Y, the steady state value of ν, i.e. ν0, must take into consideration that the intensive form is expressed in terms of a lagged value of Y.

We thank an anonimous Referee for suggesting this policy experiment.

This formulation is well known in finance. Dieci and He (2018) name it HAM i.e. Heterogeneous Agent Model.

References

Albuquerque B, Baumann U (2017) Will US inflation awake from the dead? The role of slack and non-linearities in the Phillips curve. J Policy Model 39(2):247–271

Ball L, Mankiw NG (1995) Relative-price changes as aggregate supply shocks. Q J Econ 110(1):161–193

Ball L, Mazumder S (2011) Inflation dynamics and the great recession. Brook Pap Econ Act 42(1 (Spring)):337–405

Barnes M, Olivei G (2003) Inside and outside bounds: threshold estimates of the Phillips curve. N Engl Econ Rev pp 3–18

Blanchard O (2016) The Phillips Curve: Back to the ’60s? Am Econ Rev 106(5):31–34

Blanchard O (2018) Should we reject the natural rate hypothesis? J Econ Perspect 32(1):97–120

Boehm C, Pandalai-Nayar N (2020) Convex supply curves. Working Paper 26829, National Bureau of Economic Research

Brock WA, Hommes CH (1997) A rational route to randomness. Econometrica 65(5):1059–1095

Calvo GA (1983) Staggered prices in a utility-maximizing framework. J Monet Econ 12(3):383–398

Carlaw K, Lipsey R (2012) Does history matter? Empirical analysis of evolutionary versus stationary equilibrium views of the economy. J Evol Econ 22:735–766

Carroll C (1992) The buffer-stock theory of saving: Some macroeconomic evidence. Brook Pap Econ Act 23(2):61–156

Clarida RH (2019) The Federal Rserve’s review of its monetary policy strategy, tools, and communication practices. Speech delivered at the conference: A Hot Economy: Sustainability and Trade-Offs a Fed Listens event sponsored by the Federal Reserve Bank of San Francisco, San Francisco, California

Clark P, Laxton D, Rose D (1996) Asymmetry in the U.S. output-inflation nexus. Staff Pap Int Monet Fund 43(1):216–251

Coibion O, Gorodnichenko Y (2015) Is the Phillips curve alive and well after all? Inflation expectations and the missing disinflation. Ame Econ J Macroecon 7(1):197–232

Coibion O, Gorodnichenko Y, Kamdar R (2018) The Formation of Expectations, Inflation, and the Phillips Curve. J Econ Lit 56(4):1447–91

Costâncio V. (2015) Understanding inflation dynamics and monetary policy. Jackson Hole economic policy symposium, Federal reserve bank of Kansas city

Daly MC, Hobijn B (2014) Downward nominal wage rigidities bend the Phillips curve. J Money Credit Bank 46(S2):51–93

Daly MC, Hobijn B, Pyle B (2016) What’s up with wage growth? FRBSF Econ Lett

De Grauwe P (2011) Animal spirits and monetary policy. Econ Theory 47(2):423–457

Del Negro M, Lenza M, Primiceri GE, Tambalotti A (2020) What’s up with the Phillips curve? Brook Pap Econ Act Conf Draft pp 1–75

Dieci R, He X-Z (2018) Heterogeneous agent models in finance. In: Hommes J, Baron BL (eds) Handbook of computational economics, chapter 4. Elsevier, Amsterdam, pp 257–328

Donayre L, Panovska I (2016) Nonlinearities in the U.S. wage Phillips curve. J Macroecon 48(C):19–43

Doser A, Nunes R, Rao N, Sheremirov V (2017) Inflation expectations and nonlinearities in the Phillips curve. Working Papers 17-11, Federal Reserve Bank of Boston

Dosi G, Egidi M (1991) Substantive and procedural uncertainty: An exploration of economic behaviours in changing environments. J Evol Econ 1 (2):145–68

Dosi G, Napoletano M, Roventini A, Stiglitz J, Treibich T (2020) Rational heuristics? Expectations and behaviors in evolving economies with heterogeneous interacting agents. Working Paper 26922, National Bureau of Economic Research

Dupasquier C, Ricketts N (1998) Non-linearities in the output-inflation relationship: Some empirical results for Canada, Staff working papers, Bank of Canada

Eisner R (1997) New view of the NAIRU. In: Davidson P, Kregel J (eds) Improving the global economy. Edward Elgar Publishing, Northampton

Evans P (1986) Does the potency of monetary policy vary with capacity utilization? Carn-Roch Conf Ser Public Policy 24(1):303–331

Fazzari SM, Ferri P, Variato AM (2020) Demand-led growth and accommodating supply. Camb J Econ 44(3):583–605

Ferri P (2011) Macroeconomics of growth cycles and financial instability. Edward Elgar Publishing, Northampton

Ferri P, Cristini A, Variato AM (2019) Growth, unemployment and heterogeneity. J Econ Interac Coord 14(3):573–593

Ferri P, Greenberg E, Day RH (2001) The Phillips curve, regime switching, and the NAIRU. J Econ Behav Organ 46(1):23–37

Friedman M (1968) The role of monetary policy. Am Econ Rev 58(1):1–17

Frydman R, Johansen S, Rahbek A, Tabor M (2019) The Knightian uncertainty hypothesis: Unforeseeable change and Muth’s consistency constraint in modeling aggregate outcomes. Discussion papers 19-02, University of Copenhagen. Department of Economics

Fu B (2020) Is the slope of the Phillips curve time-varying? Evidence from unobserved components models. Econ Model 88(C):320–340

Fuhrer J, Moore G (1995) Inflation persistence. Q J Econ 110 (1):127–159

Galí J, Gambetti L (2019) Has the U.S. wage phillips curve flattened? A semi-structural exploration NBER working papers 25476. National Bureau of Economic Research, Inc

Galí J, Gertler M (1999) Inflation dynamics: A structural econometric analysis. J Monet Econ 44(2):195–222

Gordon RJ (2013) The Phillips curve is alive and well: Inflation and the NAIRU during the slow recovery NBER working papers 19390, National bureau of economic research, Inc

Granger CWJ, Jeon Y (2011) The evolution of the Phillips curve: A modern time series viewpoint. Economica 78(309):51–66

Gross M, Semmler W (2019) Mind the output gap: The disconnect of growth and inflation during recessions and convex phillips curves in the euro area. Oxf Bull Econ Stat 81(4):817–848

Hall RE, Sargent TJ (2018) Short-run and long-run effects of Milton Friedman’s presidential address. J Econ Perspect 32(1):121–134

Hooper P, Mishkin FS, Sufi A (2019) Prospects for inflation in a high pressure economy: Is the Phillips curve dead or is it just hibernating? NBER Working Papers 25792, National bureau of economic research, Inc

Huh H-s, Lee H, Lee N (2009) Nonlinear Phillips curve, nairu and monetary policy rules. Empir Econ 37(1):131–151

Kaplan G, Violante GL (2018) Microeconomic heterogeneity and macroeconomic shocks. J Econ Perspect 32(3):167–194

Kiley MT (2015) An evaluation of the inflationary pressure associated with short- and long-term unemployment. Econ Lett 137(C):5–9

Kumar A, Orrenius MP (2016) A closer look at the Phillips curve using state-level data. What Monetary Policy Can and Cannot Do. J Macroecon 47:84–102

Lang D, Setterfield M, Shikaki I (2020) Is there scientific progress in macroeconomics? The case of the NAIRU. Eur J Econ Econ Policies Interv 17(1):19–38

Laxton D, Rose D, Tambakis D (1999) The U.S. phillips curve: The case for asymmetry. J Econ Dyn Control 23(9):1459–1485

Lipsey R (1960) The relation between unemployment and the rate of change of money wage rates in the United Kingdom, 1862 -1957: A further analysis. Economica 27:496–513

Lipsey R (2016) The Phillips curve and an assumed unique macroeconomic equilibrium in historical context. J Hist Econ Thought 38:415–429

Ljungqvist L, Sargent T (2004) Recursive macroeconomic theory, vol 1, 2nd edn. MIT Press, Cambridge

Lucas RE (1987) Models of business cycles. Basil Blackwell, Oxford

Macklem T (1997) Capacity constraints, price adjustment, and monetary policy. Bank Can Rev 1997(Spring):39–56

Malley J, Moutos T (1996) Unemployment and consumption. Oxf Econ Pap 48(4):584–600

Minsky H (1982) Can “It” happen again? Essays on instability and finance. M.E. Sharpe, New York

Murphy A (2018) The death of the Phillips curve? Working Papers 1801, Federal Reserve Bank of Dallas

Obstfeld M (2020) Global dimensions of U.S. monetary policy. Int J Cent Bank 16(1):73–132

Palley T (2019) The economics of the super-multiplier: A comprehensive treatment with labor markets. Metroeconomica 70(2):325–340

Peach R, Rich RW, Cororaton A (2011) How does slack influence inflation? Curr Issues Econ Finance vol 17

Phelps ES (1967) Phillips curves, expectations of inflation and optimal unemployment over time. Economica 34(135):254–281

Phillips AW (1958) The relation between unemployment and the rate of change of money wage rates in the United Kingdom, 1861-1957. Economica 25 (100):283–299

Powell J (2018) Monetary policy at a time of uncertainty and tight labor markets.Speech at ECB Forum on Central Banking, Sintra, Portugal

Roberts J (1997) Is inflation sticky? J Monet Econ 39(2):173–196

Semmler W, Gross M (2017) Mind the output gap: the disconnect of growth and inflation during recessions and convex Phillips curves in the euro area. Working Paper Series 2004, European Central Bank

St-Cyr R (2018) Non-linarit de la courbe de Phillips: un survol de la littrature. Staff Analytical Notes 2018-3, Bank of Canada

Stansbury A, Summers LH (2020) Declining worker power and American economic performance. Brook Pap Econ Act Conf Draft pp 1–93

Stiglitz J (1997) Reflections on the natural rate hypothesis. J Econ Perspect 11(1):3–10

Stock JH, Watson MW (2019) Slack and Cyclically Sensitive Inflation NBER Working Papers 25987, National Bureau of Economic Research, Inc

Taylor J (1980) Aggregate dynamics and staggered contracts. J Polit Econ 88(1):1–23

The Economist (2020) A flattened curve. August 22

Tobin J (1972) Inflation and unemployment. Am Econ Rev 62 (1):1–18

Tramontana F, Gardini L, Ferri P (2010) The dynamics of the NAIRU model with two switching regimes. J Econ Dyn Control 34(4):681–695

Turner D, Chalaux T, Guillemette Y, Rusticelli E (2019) Insights from OECD Phillips curve equations on recent inflation outcomes. OECD Economics Department Working Papers 1579, OECD Publishing

Yellen J (2007) Implications of behavioral economics for economic policy. Speech delivered at the Panel on: Behavioral Economics and Economic Policy in the Past and Future Federal Reserve Bank of Boston, Boston, Massachusetts

Acknowledgements

We thank the participants to the Post-Keynesian Conference in Bilbao, June 2019, for comments on a previous version of this paper. We also thank two anonymous referees for stimulating suggestions.

Funding

Open access funding provided by Università degli studi di Bergamo within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interests

The authors declare that they have no conflict of interest.

Additional information

Availability of data and material

Data are publicly available in FRED.

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Cristini, A., Ferri, P. Nonlinear models of the Phillips curve. J Evol Econ 31, 1129–1155 (2021). https://doi.org/10.1007/s00191-021-00736-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-021-00736-5