Abstract

We apply standard evolutionary dynamics to study trader participation in three competing market formats —call market (CM), posted offer (PO) and decentralized market (DM). In our framework, heterogeneous buyers and sellers seek to transact a homogeneous good, which can be done by allocating their time among three different market formats. Our results show that (i) the final participation of traders in the CM is much higher, (ii) the PO can coexist with the CM, (iii) the DM unravels when competing against CM and (iv) the DM can coexist with the PO, depending on the initial participation conditions. Thus, we demonstrate that agent-based micro-simulations coupled with replication dynamics can reproduce most of the previously known theoretical results and have the potential to investigate other commonly used hybrid auction protocols.

Similar content being viewed by others

Notes

Stability refers to trader participation in different market formats in the long-run. In other words, we examine the survival of different market formats in an interactive setting.

Garbade (2012) elaborates on the evolution of posted offer in the primary market of Treasury securities. Notice that there is only one seller (the Treasury) in this market. Our approach assumes a large number of sellers and buyers who can costlessly choose to participate in different market formats.

Klutti (1997), extending the previous work of Lu and McAfee, compares auction to a directed search PO format and concludes that the two are equivalent.

Davis and Korenok (2009) discovered that equilibrium predictions can emerge more quickly in a continuous framework. In order to add a continuous framework to the environment, the authors shortened the time allowed for decisions.

The PO was not observed as an equilibrium market format in Kirchsteiger et al. (2005), who studied the formation of market formats in the laboratory. In their environment, traders had the option to reveal information to some traders (from either side of the market). They found that offers are typically directed to all traders on the other side of the market and to none of the traders on the same side of the market.

We present our results of the three format analysis in Appendix C. These results do not add to the discussion beyond the two competing format scenario, and only serve to confirm that the DM is unstable when the CM format is present, and that the PO can coexist with other formats.

In order to ensure the best possible format of DM, we test two DM specifications (but omit for brevity) against centralized formats: (i) the random pair matching DM and (ii) the matching market DM as specified by Kugler et al. (2006), where buyers and sellers are sorted, so that the highest cost seller is matched with the highest value buyer, provided that the cost does not exceed the value. The latter approach is meant to increase the transaction volume in the DM, which it does but at the expense of the trader surplus. Not surprisingly, our results indicate that random pair matching performs better when competing against CM.

Lu and McAfee (1996) also adopt the assumption that payoff advantage is the force that drives the preference of one format over others, when analyzing auctions over bargaining. We specify that the evolutionary dynamics in this example follow replicator dynamics, one of the most studied dynamics in literature.

Our dynamics can be interpreted as each agent representing a subpopulation and then applying the usual imitation (Schlag 1999, for example) process to each subpopulation. An alternative interpretation is the same as when replicator dynamics are applied to a monomorphic population (or in our case, subpopulation of one).

We extend the model to include three competing formats in Appendix C, however the results of the two format environment are sufficient to understand the existing dynamics.

For example, Fano et al. (2013) use a genetic algorithm, and Alós-Ferrer and Kirchsteiger (2015) assume learning rules, where every period a randomly selected trader is allowed to revise his market choice. We use replicator dynamics to model format choice. Anufriev et al. (2013) and Arifovic and Ledyard (2007) apply reinforcement learning, where traders select their strategies not only on the basis of actual performance, but also counterfactual performance.

We use the term almost continuous because we discretize time in order to numerically solve the ODE. This technique is standard in mathematical packages. For a more technical discussion, see Iserles (2009).

This result is easily derived since the marginal trader does not increase the mark-up/mark-down in the CM. However, this assumption does not hold in other formats. The simulations performed for a single format help confirm whether the dynamic system approaches the theoretical predictions for a single market, or deviates from it.

Recall that high surplus traders are defined as high (low) value (cost) buyers (sellers).

We can express the ODE system for three competing markets that governs the evolution of the state variables x (participation at CM) and y (participation at PO) as

$$\begin{array}{@{}rcl@{}} \dot{x} &=& x \cdot y \cdot (\pi_{CM}-\pi_{PO}) + x \cdot (1-x-y) \cdot (\pi_{CM}-\pi_{DM}) \\ \dot{y} &=& y \cdot x \cdot (\pi_{PO}-\pi_{CM})+y \cdot (1-x-y) \cdot (\pi_{PO}-\pi_{DM}) \end{array} $$where 1 − x − y is the participation in DM.

We also allow the DM to be the preferred format, with the following time allocation: DM - 95 percent, PO - four percent and CM - one percent. Our conclusions do not change. Appendix CC presents the results for the first case, discussed in the main text.

References

Alós-Ferrer C, Kirchsteiger G, Walzl M (2010) On the evolution of market institutions: the platform design paradox. Econ J 120(543):215–243

Alós-Ferrer C, Kirchsteiger G (2015) Learning and market clearing: theory and experiments. Economic Theory 60(2):203–241

Anufriev M, Arifovic J, Ledyard J, Panchenko V (2013) Efficiency of continuous double auctions under individual evolutionary learning with full or limited information. J Evol Econ 23(3):539–573

Arifovic J, Ledyard J (2007) Call market book information and efficiency. J Econ Dyn Control 31(6):1971–2000

Björnerstedt J, Weibull J (1996) Nash equilibrium and evolution by imitation. In: Arrow K, Colombatto E (eds) The rational foundations of economic behaviour. Macmillan

Brock WA, Hommes CH (1997) A rational route to randomness. Econometrica:1059–1095

Brock WA, Hommes CH (1998) Heterogeneous beliefs and routes to chaos in a simple asset pricing model. J Econ Dyn Control 22(8):1235–1274

Campbell J, LaMaster S, Smith V, Van B (1991) Off-floor trading, disintegration, and the bid-ask spread in experimental markets. J Bus 64:495–522

Cervone R, Galavotti S, LiCalzi M (2009) Symmetric equilibria in double auctions with markdown buyers and markup sellers. In: Hernandez C, Posada M, Lopez-Paredes A (eds) Artificial Economics. Springer, pp 81–92

Davis D, Holt CA (1993) Experimental economics. Princeton University Press, Princeton N.J

Davis D, Korenok O (2009) Posted-Offer Markets in near continuous time: an experimental investigation. Econ Inq 47:446–466

Einav L, Kuchler T, Levin JD, Sundaresan N (2013) Learning from seller experiments in online markets. NBER Working Paper No. 17385

Fano S, LiCalzi M, Pellizzari P (2013) Convergence of outcomes and evolution of strategic behavior in double auction. J Evol Econ 23(3):513–538

Friedman D (1991) Evolutionary games in economics. Econometrica 59 (3):637–666

Friedman D (1993) The double auction market institution: a survey. In: Friedman D, Rust J (eds) The double action market. Addison-vesley, pp 3–25

Friedman D, Rich CS (1998) The matching market : a laboratory investigation. Am Econ Rev 88(5):1311–1322

Garbade K (2012) Birth of a market: The U.S. Treasury Securities Market from the Great War to the Great Depression. MIT Press

Gehrig T (1993) Intermediation in search markets. J Econ Manag Strateg 2 (1):97–120

Goldbaum D, Panchenko V (2010) Learning and adaptation’s impact on market efficiency. J Econ Behav Organ 76(3):635–653

Hofbauer J, Sigmund K (1988) The theory of evolution and dynamical systems. Cambridge University Press

Iserles A (2009) A first course in the numerical analysis of differential equations (No. 44). Cambridge University Press

Ketcham J, Smith VL, Williams AW (1984) A comparison of Posted-Offer and Double-Auction pricing institutions. Rev Econ Stud 51(4):595–614

Kirchsteiger G, Niederle M, Potters J (2005) Endogeinizing market institutions: an experimental approach. Eur Econ Rev 49:1827–1853

Klutti K (1997) Equivalence of auctions and posted prices. Games and Economic Behavior 27:106– 113

Kugler T, Neeman Z, Vulkan N (2006) Markets versus negotiations: an experimental investigation. Games and Economic Behavior 56(1):121–134

Lu X, McAfee RP (1996) The evolutionary stability of auctions over bargaining. Games and Economic Behavior 15:228–254

Maynard Smith J, Price G (1973) The logic of animal conflict. Nature 246:15–18

Neeman Z, Vulkan N (2010) Markets versus negotiations: the predominance of centralized markets. The BE Journal of Theoretical Economics:10

Plott CR (1986) Experiments in economics: The implications of Posted-Price institutions. Science 232(4751):732–738

Rust J, Hall G (2003) Middlemen versus market makers: a theory of competitive exchange. J Polit Econ 111(2):353–403

Rustichini A, Satterthwaite MA, Williams SR (1994) Convergence to efficiency in a simple market with incomplete information. Econometrica 62(5):1041–1063

Schlag K (1999) Which one should I imitate? J Math Econ 31:493–522

Smith VL (1982) Markets as economizers of information: experimental examination of the “Hayek hypothesis”. Econ Inq 20:165–179

Surowiecki J (2011) Going, Going, gone: who killed the internet auction? Wired

Taylor PD, Jonker LB (1978) Evolutionary stable strategies and game dynamics. Math Biosci 40:145–156

Wang R (1993) Auctions versus Posted-Price selling. Am Econ Rev 83(3):838–851

Weibull JW (1998) Evolution, rationality and equilibrium in games. Eur Econ Rev 42(3-5):641–649

Zhan W, Friedman D (2007) Markups in double auction markets. J Econ Dyn Control 31(9):2984–3005

Acknowledgments

We are grateful to Dan Friedman for his persistent encouragement and comments, to the audience of our talks at UCSC, Bates College, the 2015 Game Theory Festival, ESA Heidelberg, and to the Advisory Editor and two anonymous referees for their suggestions. We are also indebted to the College of Sciences and Humanities Beowulf Cluster at Ball State University for facilitating the process of running our numerical simulations. The usual caveats apply.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The authors declare that they have no conflict of interest.

Appendices

Appendix A

The simulation of the two-market format is performed in R. The code is available upon request. Here, we include a description of the algorithm.

-

From a uniform distribution [0,1], we draw values for buyers and costs for sellers.

-

The bid/ask functions depend on the values/costs and the mark-up.

-

In the CM, there is a unique price that clears the market. If there is an interval of prices, then we select the mid-point.

-

We compute the profits for each buyer/seller in the CM.

-

In the PO, we compute the ask function for sellers since they are posting prices. The buyers transact based on their true values.

-

We then order the sellers and randomly select a buyer to transact with the first seller (the lowest cost). You can consider this random selection of buyers as a queue.

-

If the buyer’s value is greater than cost, then a trade occurs. The process is then repeated for the second seller, and the next randomly selected buyer.

-

If a trade does not occur, then a new buyer is randomly selected from the pool for a chance to transact with the first seller. This continues until a trade occurs, or there are no buyers left in the queue.

-

We compute the profits for each buyer/seller in the PO.

-

In the DM, we use the bids/ask functions and then randomly pair buyers and sellers.

-

The transaction price in each pair is the mid-point between the bid and ask, provided that the difference is positive. If the ask exceeds the bid, then trade does not occur.

-

We then compute the profits for each buyer/seller in the DM.

-

In the next round, we adjust the mark-ups (mark-downs) as follows: μ t+1 = μ t ±Δ μ .

-

In the CM, a successful trade implies no change in mark-up (mark-down) the following period while an absence of trade indicates a decrease (−) in mark-up (mark-down) the following period for sellers and buyers.

-

In the PO, only sellers adjust mark-ups. However, following a successful trade a seller will increase (+ ) his mark-up, and decrease (−) if unsuccessful.

-

In the DM, behavior is similar to that in the PO, except that the buyers also adjust mark-down. Thus a successful trade will force a trader to increase (+ ) her mark-up and mark-down. The opposite is true for an unsuccessful trade.

-

-

We adjust the market participation as indicated by equation (1).

-

Tradershaveachancetotransactonlywhenparticipationshares (x, 1 − x) are greater than zero. Otherwise, they leave each applicable market until the next round.

-

We move to the next round until the end of period is achieved.

Appendix B

In this section, we present evidence of robustness when the PO and the DM formats compete. We use different values for the initial mark-up (mark-down) and adjustment rate. Recall that the results presented in the paper assume μ 0 = 0.3. Here, we present the results for μ 0 = 0.15, and 0.45. The initial mark-up (mark-down) cannot go beyond 0.49, otherwise the DM will not be a viable option. The mark-up (mark-down) adjustment is studied for the values of Δ μ = 0.01,0.10. We also increase the number of traders on each side of the market from 100 to 500.

Appendix C

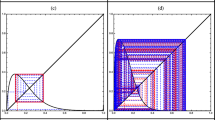

The system of equations for the three market formats is described in footnote 17. We assume that traders have the following initial allocations: (i) PO (95 percent), followed by DM (four percent) and CM (one percent) and (ii) DM (95 percent), followed by PO (four percent) and CM (one percent). We illustrate the solution for the first case at a particular iteration in the graph below. It is clear that the CM gains share early on (see left panel) and that participation in the DM decreases. Following our procedures above, we run 100 simulations and find that the DM vanishes in the long-run while the PO and the CM coexist. The results are the same for case (ii).

Rights and permissions

About this article

Cite this article

Rud, O.A., Rabanal, J.P. Evolution of markets: a simulation with centralized, decentralized and posted offer formats. J Evol Econ 28, 667–689 (2018). https://doi.org/10.1007/s00191-016-0488-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-016-0488-y

Keywords

- Centralized markets

- Decentralized markets

- Decentralized bargaining

- Market design

- Market formation

- Evolutionary dynamics