Abstract

With financial technology (FinTech) emerging as a pivotal force driving business model innovation and reshaping market competitiveness, its potential contribution to sustainability has garnered widespread attention. Drawing on carbon emissions data at the county level from 2011 to 2017 in China, alongside information on the FinTech companies, this study reveals that FinTech significantly reduces regional carbon emissions intensity. This effect is particularly pronounced in developed regions and metropolitan cities. These findings withstand rigorous scrutiny, including the application of instrumental variable strategies, controlling for financial attributes, and robustness checks altering model specifications. Mechanism analysis indicates that FinTech fosters optimization and upgrading of industrial structure and promotes the development of the ICT industry, while simultaneously driving down the proportion of coal in electricity generation and per unit GDP energy consumption, and increasing the proportion of new energy generation, thereby enhancing overall energy efficiency. The evidence presented herein supports the role of FinTech in enhancing Nationally Determined Contributions and achieving the objectives of the Paris Agreement.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Since the twentieth century, global carbon emissions have increased significantly, especially since 1970, with a growth of approximately 90% in carbon dioxide emissions. In 2022, carbon dioxide emissions from energy combustion and industrial processes increased by 0.9%, reaching an unprecedented level exceeding 3.68 billion tons, primarily attributed to emerging economies, notably China. The lockdown measures during the COVID-19 pandemic resulted in delayed recovery, further exacerbating the unchecked growth trend of greenhouse gas emissions. In 2023, China's emissions accounted for 31% of global carbon dioxide emissions, marking a 4% increase from the previous year. Coal, oil, and natural gas emissions rose by 3.3%, 9.9%, and 6.5%, respectively, surpassing pre-pandemic levels. Considering the ambitious economic goals outlined in China's "14th Five-Year Plan," there is limited room for further growth in carbon emissions by 2025. China has staunchly committed to reaching its peak carbon emissions by 2030 and achieving carbon neutrality by 2060.

Emerging digital technologies and financial innovations are fostering grassroots responses to escalating environmental challenges (Buchak et al. 2018). Ant Group, China's largest financial technology (FinTech) platform, launched the Ant Forest program in August 2016, incentivizing users to engage in activities aimed at reducing carbon emissions to earn green energy points. Alipay collaborates with local non-governmental organizations for conservation efforts or tree planting, matching contributions from users. According to the United Nations climate report, the program has planted over 100 million real trees in China's northwest region, engaging over 500 million users, representing a novel approach to addressing environmental challenges (Zhang et al. 2021).Footnote 1

In the rapidly evolving field of FinTech, the integrated application of cutting-edge technologies such as artificial intelligence-generated content, blockchain, big data, and cloud computing is accelerating the deep integration of financial services and technological innovation. According to KPMG data, in the first quarter of 2021, global equity financing projects in the FinTech industry increased by 246.2% year-on-year, with disclosed financing amounts increasing by 317.6%, exceeding $21.69 billion. Driven by technological innovation, supportive regulatory environments, and a vast base of digitally adept consumers, China's FinTech industry has become one of the largest and most dynamic sectors globally. In the first quarter of 2021, the total financing amount in China's FinTech sector reached $10 billion, ranking at the forefront in terms of both quantity and amount. From 2016 to 2020, China's FinTech market maintained a growth rate of about 10%, reaching an overall market size of 542.3 billion yuan in 2022. According to the Prospective Industry Research Institute, it is projected that the market size of China's FinTech industry will grow at a compound annual growth rate of approximately 17% in the coming years, exceeding 1.39 trillion yuan by 2028.

Furthermore, breakthroughs in technologies such as big data, cloud computing, distributed computing, and blockchain are driving a wave of financial innovation, activating resources and facilitating efficient allocation among entities facing financing challenges (Guo et al. 2021). FinTech has the capability to mitigate moral hazards between financial institutions and companies, reduce adverse selection, and promote the flow of resources toward high-quality companies demonstrating preferences for clean technologies and green patents (Schiemann and Sakhel 2019). It is expected that FinTech will streamline and redirect financial resources toward areas led by environmentally conscious companies and investors, facilitating continuous optimization and enhancement of internal structures within technology-intensive enterprises, accelerating the transition of regional energy structures toward renewable and cleaner energy sources. The improved allocation of resources and transformation of energy structures hold significant potential for substantially reducing carbon emission intensity (Wu 2022).

A pertinent question arises: can the development of FinTech effectively reduce regional carbon emission intensity, and if so, what are its potential mechanisms? This paper represents one of the initial attempts to analyze the impact of FinTech development on the reduction of regional carbon emission intensity. The scarcity of research in this area may be partly explained by the challenges in appropriately measuring the level of FinTech development. This study employs the total count of FinTech companies within specific years in cities as a quantified measure of FinTech development, laying the foundation for examining the causal relationship between FinTech development and the reduction of regional carbon emission intensity. This measurement method is inspired by the distribution of FinTech companies, including arrangements for cooperation with external FinTech entities and the establishment of FinTech departments or subsidiaries. Given the transition to a market economy, the former is often a primary consideration. Therefore, regions with a higher number of FinTech companies are more likely to witness cooperation between traditional enterprises and FinTech entities. The quantity of FinTech companies serves as a direct and comprehensive indicator reflecting local FinTech development.

This study is expected to contribute to existing literature in several aspects. Firstly, it utilizes satellite imagery of China's counties to obtain samples of carbon emission intensity, departing from traditional methods relying on carbon emissions volume. Additionally, the study compiles county-level panel data, incorporating economic factors from CEIC and CSMAR databases, which are considered more capable of capturing regional heterogeneity compared to provincial or prefecture-level data. Secondly, this paper focuses on studying the impact of FinTech development on carbon emission intensity, enriching the research findings on the environmental impact of FinTech. Thirdly, this study employs robust methods such as instrumental variable regression, changes in FinTech indicators, controlling for other financial attributes, and altering model specifications to enhance the reliability of the research results. Fourthly, this study examines the mechanisms through which the development of financial technology influences carbon emission intensity. The results indicate that reducing distortions in industrial structure, accelerating industrial structural upgrading, transitioning from traditional energy sources, and enhancing energy efficiency constitute the potential and crucial mechanisms within this context.

The remainder of this paper is organized as follows: Section 2 reviews literature and presents the hypotheses based on theoretical analysis. Section 3 describes the data and introduces the variables used in the study. Section 4 reports the empirical results. Section 5 delves into several mechanisms. Section 6 presents robustness checks, and the final section concludes the study.

2 Literature review and conceptual analysis

2.1 Literature review

The existing body of literature in this field predominantly focuses on various aspects of FinTech. Specifically, prior research has explored different dimensions of FinTech, including its regulatory frameworks (Taylor et al. 2020), business models (Pizzi et al. 2021), and stability risks (Vučinić, 2020), among others, as outlined in Sect. 2.2. However, there has been a noticeable gap in the literature concerning the direct impact of FinTech on carbon emission intensity. This study aims to fill this void by delving into the relationship between FinTech development and the reduction of carbon emission intensity.

In addition to the FinTech aspect, scholars have conducted comprehensive investigations into the factors influencing regional carbon emission intensity. Notably, economic factors such as GDP growth and GDP per capita play a pivotal role in this context. The well-established Environmental Kuznets Curve (EKC) theory has been instrumental in understanding the dynamic relationship between economic growth and environmental concerns, including carbon emission (Grossman and Krueger 1991). This relationship is inherently influenced by the different stages of development that countries find themselves in (Dogan and Seker 2016).

Existing studies have demonstrated that changes in industrial structure significantly impact carbon emission intensity (Daly 1996). The influence of population growth on carbon emissions has also garnered attention, albeit with differing perspectives. Malthusians argue that population growth leads to increased energy demand, thereby deteriorating the environment. Conversely, Boserupians posit that population growth fosters technological advancement, improves living standards, and ultimately reduces carbon emissions (Bogue 1982).

Moreover, technological advancements, particularly in Research and Development (R&D) and Information and Communication Technology (ICT) sectors, have been recognized for their potential in reducing carbon emissions (Salahuddin et al. 2016) Wu (2023) Sustainable growth through industrial robot diffusion: quas), utilizing paired data on industrial robot installations, concludes that industrial robots significantly drive economic growth and aid in carbon emission reduction, thus promoting sustainable development. These factors collectively contribute to a comprehensive understanding of how technology mitigates carbon emissions.

Numerous studies have delved into the micro-level carbon emission behaviors. Schulze (2002) underscores the pivotal role of human behavior in influencing carbon emissions. In this regard, research indicates that choices such as extending education duration and enhancing human capital are associated with clean production practices, surpassing the significance of physical capital (Fleisher et al. 2010; Wu et al. 2023a). Furthermore, Wu et al. (2023c) argue that zombie enterprises constitute one of the root causes hindering the reduction of carbon intensity in China. Other assessments of carbon emission factors include fiscal expenditures (Chen et al. 2016), firms' trade and export activities (Fang et al. 2019), international direct investment (Malik et al. 2020), and regional composition of transportation (Chang et al. 2019). Additionally, some studies delve into evaluating the impact of environmental policies on carbon emissions.

In summary, while there is an abundance of research exploring the determinants of carbon intensity, there has been a notable absence of scholarly attention to the impact of regional FinTech development on carbon intensity and an examination of the underlying mechanisms. Given the rapid pace of technological innovations in China, which has provided fertile ground for the swift expansion of FinTech, it is crucial to explore how FinTech can significantly contribute to promoting environmental sustainability. Despite the potential, the literature in this domain remains limited, necessitating further discussion and research to comprehensively understand this emerging field.

2.2 Conceptual analysis

FinTech has the potential to exert both direct and indirect causal effects on reducing carbon emissions intensity. Specifically: There exist intricate interrelations among finance, technology, and industrial structure. FinTech has the capacity to facilitate the optimization and upgrading of industrial structures, thereby diminishing the presence of high-carbon-emission industries. It enhances the prominence of ICT, consequently augmenting the carbon efficiency of the economy. Traditionally, due to moral hazards and the prevalence of adverse selection, venture capitalists have been hesitant to invest in clean technology firms, given their substantially high development costs. Banks and other financial institutions have traditionally favored tangible assets as collateral for loans, rendering it challenging to identify companies with potential in clean technology (Stiglitz and Weiss 1981). Particularly in emerging economies, where the financial intermediation sector is still in its nascent stages, such as in China, there is a tendency to allocate resources to State-Owned Enterprises (SOEs) rather than to Small and Medium-sized Enterprises (SMEs) exhibiting higher growth rates (Zhang et al. 2024). Consequently, stricter credit constraints are more likely to mismatch with lower environmental performance (Tian and Lin 2019). This phenomenon arises from lower total factor productivity due to financing constraints (Hsieh and Klenow 2009), ultimately resulting in companies lacking adequate cash flows to invest in environmental technologies.

FinTech has alleviated the difficulty and cost for innovative enterprises, particularly those in ICT and green technology sectors, to access funds by offering more flexible and diverse financing methods such as online crowdfunding and blockchain financing. These enterprises often focus on developing technology solutions that enhance energy efficiency and reduce carbon emissions, such as smart grids, energy management systems, and electric transportation. The novel financing channels provided by FinTech enable these innovative projects to more easily secure seed capital and growth funding, facilitating a quicker transition from conceptualization to implementation and accelerating the pace and scale of technological innovation (Chen et al. 2019). Moreover, FinTech not only directly influences the flow of funds but also indirectly promotes the proliferation of low-carbon lifestyles such as remote work and smart logistics by supporting the development of the ICT industry. Under the auspices of FinTech, technologies such as cloud computing, big data, and artificial intelligence have experienced rapid advancement, forming the bedrock for efficient remote work environments (Fernández et al. 2018). Concurrently, smart logistics significantly reduces energy consumption and carbon emissions in the logistics sector by optimizing delivery routes and enhancing transportation efficiency. Real-time data monitoring and analysis empower enterprises to optimize production plans and resource allocation, thereby reducing unnecessary energy consumption and material wastage (Nguyen et al. 2020).

Simultaneously, leveraging FinTech, investors can comprehensively monitor and analyze various entities providing financial services, even directly scrutinizing real-time feedback and sentiment about financial entities on social media platforms. This aids them in identifying potential fraudulent activities or risk signals, enabling timely adjustments to investment strategies (Schiemann and Sakhel 2019; Yang et al. 2022). Consequently, investing in green energy projects or through green financial products such as green bonds and green funds becomes more accessible. The availability of such funds is crucial for investors to identify and invest in enterprises and projects with commendable Environmental, Social, and Governance (ESG) performance, thus propelling sustainable development and carbon reduction. In recent years, ESG funds in the Asia–Pacific region, led by China and Japan, have experienced rapid growth. As of the end of the second quarter of 2021, the assets under management of ESG funds in China and Japan reached $24.9 trillion and $26.8 trillion, respectively, marking year-on-year growth of 126% and 496%. This growth can be attributed to the development of FinTech, which provides investors with more extensive and precise ESG information and evaluation tools. These investment activities not only enhance public awareness of sustainability and environmental protection but also directly drive the broader application of green technology. The development of FinTech and the ICT industry provides necessary technical support and platforms for these green technologies, such as promoting energy efficiency through smart applications and optimizing resource allocation through data analysis (Zhou et al. 2022).

It is widely acknowledged that energy consumption from fossil fuels constitutes the primary source of carbon emissions (Khan et al. 2020; Jiang et al. 2024). The correlation between the proportion of coal-related energy and carbon emissions is highly significant in both the short and long term (Salahuddin et al. 2018). However, emerging technologies such as the Internet of Things, big data, digital platforms, and other FinTech solutions can play a pivotal role in driving energy structural transformation and enhancing efficiency. The development of FinTech has provided convenient channels for the proliferation of green financial products, leading to rapid growth in the global green finance market. Through green finance and investment, FinTech accelerates the transition from fossil fuels to renewable energy sources. Crowdfunding, blockchain, and other FinTech tools offer new financing avenues for renewable energy projects, particularly for small-scale and decentralized projects that may struggle to secure funding within traditional financial systems (Buchak et al. 2018). This not only increases the proportion of new energy sources such as solar and wind power generation but also accelerates the innovation and dissemination of low-carbon technologies by enhancing fund availability and reducing financing costs (Chen et al. 2019). For instance, the sharp increase in global installed capacity of solar and wind energy over the past decade is largely attributable to the advancements made by FinTech in fund matching, risk assessment, and project management. These technological innovations lower the startup and operational costs of renewable energy projects, making renewable energy increasingly competitive and driving down the proportion of high-carbon energy sources such as coal in the energy structure, while simultaneously boosting the proportion of new energy generation (Croutzet and Dabbous 2021). Finally, the development of FinTech also promotes advancements in policy and regulatory frameworks, providing a more favorable policy environment for renewable energy projects. Governments and regulatory bodies, by observing the development of FinTech and its impact on the renewable energy sector, have gradually introduced a series of policy measures to support renewable energy development, such as tax incentives, subsidy policies, and quota systems (Croutzet and Dabbous 2021; Allen et al. 2021). These policies further stimulate investment and development in renewable energy projects.

In alignment with the arguments presented above, I have formulated the following hypotheses:

H1: FinTech development is capable of reducing carbon emission intensity.

H2: FinTech development can mitigate the distortion of industrial structure and expedite the upgrading of industrial structure, subsequently leading to a reduction in carbon emission intensity.

H3: FinTech development has the potential to decrease carbon emission intensity by facilitating the transformation of energy structures and enhancing energy efficiency.

3 Empirical design

3.1 FinTech measurement

While the literature extensively covers FinTech, research on constructing FinTech indicators remains limited. I draw inspiration from the method proposed by Song et al. (2021), utilizing the quantity of FinTech companies at the city level as a proxy. According to the Financial Stability Board, FinTech represents a range of financial innovations propelled by technological advancements, including big data, cloud computing, distributed computing, machine learning, artificial intelligence, and blockchain. This study conducted a comprehensive search on China's largest commercial inquiry platform, "Tianyancha," using the aforementioned keywords. The platform covers operational information of over 230 million Chinese companies, facilitating access to companies relevant to FinTech.

Several criteria were employed to obtain information on FinTech-related companies. Firstly, companies not containing these keywords in their names or business scopes were excluded to prevent coincidental character matching. Additionally, only samples in normal operational status with a lifespan exceeding one year were retained, consistent with the approach of Song et al. (2021). Furthermore, pseudo FinTech-related companies not employing emerging technologies in financial activities were excluded. To achieve this, fuzzy matching using regular expressions was conducted, with keywords including "insurance," "credit," "clearing," and "payment," consistent with the classification of FinTech activities by the Basel Committee on Banking Supervision (BCBS). Finally, companies containing negative terms such as "not involved," "not participating," or "excluded from business" were excluded. Subsequently, the quantity of FinTech companies in specific cities for specific years was logarithmically transformed to measure the level of FinTech development in that region, with higher numerical values indicating higher levels of FinTech development.

3.2 Model setting

The effect of FinTech development on carbon intensity can be estimated as follows:

The dynamic panel model with lag terms of the explained variables \(\phi \left( {L \cdot {\text{CO}}2/{\text{GDP}}} \right)\) is introduced as the consideration of intertemporal effect of carbon emission:

in which CO2/GDPi,t represents the carbon intensity of county i in year t, expressed in logarithmic form. FinTechj,t-1 denotes the logarithmized count of FinTech companies, indicating the level of FinTech development in city j in the year preceding t − 1. The coefficient β captures the impact of FinTech development on the carbon emission intensity of counties.

The model includes control variables, whose selection is drawn from various reference sources (Wu et al. 2023b). These factors comprise linear and quadratic terms of GDP per capita (GDPP and GDPP2), year-end residence population (POP), non-agricultural value added/GDP (IND), foreign direct investment/GDP (FDI), education expenditure/GDP (EDU), fiscal expenditure/GDP (FIS), financial intermediation output/GDP (FIN), and scientific R&D services output/GDP (TECH) at the city level. The model also incorporates total trade/GDP (OPEN), and transportation structure from the first principal components of railway, highway, and airline mileage at the province level (TRANS). Xi,j,t-1 represents the set of lagged one-period control variables. In the benchmark regression and heterogeneous analysis focusing on the direct impact of FinTech development on carbon intensity, I incorporate the count of non-local FinTech firms within a 200-km radius of the city (FinTech200) as a control variable, aiming to mitigate potential spillover effects (Song et al. 2021). The detailed information about their definitions and descriptive statistics see Table 1 in Section 3.3. Moreover, the model controls for \(\mathop \sum \limits_{i} \mu_{i} {\text{County}}_{i}\) and \(\mathop \sum \limits_{t} \mu_{t} {\text{Year}}_{t}\), representing county fixed and year fixed effects, respectively, to eliminate the influence of county-specific and year-specific features.

3.3 Data description

To assess the impact of FinTech development on carbon emissions reduction, this study utilizes a sample comprising China’s counties, constructing a panel dataset spanning from 2011 to 2017. Control variables are sourced from various official publications, including them China Statistical Yearbooks, China County Statistical Yearbooks, China Environmental Yearbooks, China Energy Statistical Yearbooks, and China Industrial Statistical Yearbooks covering the period from 2011 to 2017.

Our method of measuring carbon dioxide emissions differs methodologically from existing literature. Data are obtained from Chen et al. (2020), who employed a Particle Swarm Optimization-Back Propagation (PSO-BP) algorithm to coordinate the proportions of DMSP/OLS and NPP/VIIRS satellite images, estimating carbon emissions at the county level in China. Subsequently, I associate these data with the annual GDP of each county to derive carbon emission intensity (CO2/GDP). Given the relatively small magnitude and right-skewed distribution of CO2/GDP values, I employ a logarithmic transformation to ensure the robustness of the analysis.

To ensure consistency in carbon emissions, I calculate the carbon emissions of each province by multiplying the electricity consumption, coal consumption, and oil consumption of each province by the corresponding carbon conversion coefficients, following the regulations outlined in the documents of the National Development and Reform Commission of China regarding the method and parameter selection for carbon dioxide emission reduction estimation. Additionally, I compare these results with some bottom-up methods, such as the energy balance sheet approach. Our data exhibit a high degree of consistency with these methods, strengthening our analysis.

Figures 1 and 2 depict the trends and distributions of the number of FinTech companies and carbon emission intensity, respectively. Figure 1 illustrates a gradual increase in the number of FinTech companies from 2011 to 2017, while carbon emission intensity demonstrates a declining trend over time. This dual-axis chart suggests a potential correlation between the growth of FinTech companies and the improvement of CO2 emission efficiency observed during the study period. Figure 2 displays a substantial number of observations, wherein higher CO2/GDP ratios are associated with lower levels of FinTech, and as FinTech levels increase, the CO2/GDP ratio tends to decrease. Trend lines calculated from data points clearly indicate an overall decline in the CO2/GDP ratio with the growth of FinTech, indicating a negative correlation between the level of FinTech development and economic environmental efficiency. In the subsequent sections, I will employ rigorous econometric tools to further investigate this relationship. Additionally, Table 1 provides definitions and descriptive statistics for the main variables.

The national trends of FinTech companies and carbon emission intensity from 2011–2017. Notes: The horizontal axis represents time. The left vertical axis displays the number of FinTech companies, depicted with blue bar graphs. The right vertical axis represents the ratio of carbon dioxide emissions to GDP, measured in tons per thousand RMB, depicted with a red line graph

The scatter and dispersion of FinTech companies and carbon emission intensity. Notes: The horizontal axis represents the level of FinTech development, while the vertical axis represents the ratio of carbon dioxide emissions to GDP. The blue dots in the graph represent specific data points, illustrating a large number of observations. The solid red line in the graph represents the fitted values, indicating the trend line calculated from the data points

4 Empirical results

4.1 Baseline results

Based on Eqs. (1) and (2), I derive the benchmark estimates, presented in Table 2, with each column representing a distinct regression specification. Columns (1) through (4) employ a static panel regression, while columns (5) and (6) utilize a dynamic panel model incorporating lagged terms. In column (1), the explanatory variables consist solely of FinTech and FinTech200, alongside year fixed effects. Column (2) extends upon column (1) by incorporating county fixed effects into the model.

Subsequently, in columns (3) and (4), I incorporate control variables at the city and province levels, respectively, on top of those introduced in Column (2). It's worth noting that previous research by Wang et al. (2021) and Ulucak (2021) have indicated that carbon emissions follow a dynamic process, and including lag terms of CO2/GDP in the regression can effectively account for the influence of other unobservable factors. In accordance with the modeling approach outlined in Yan et al. (2016), columns (5) and (6) introduce the first-order autoregressive (AR(1)) and second-order autoregressive (AR(2)) terms of carbon intensity. The latter regression involves carbon emissions divided by industrial value added as the dependent variable.

Columns 1 through 4 of Table 2 consistently exhibit negative coefficients for FinTech, with statistical significance at least at the 10% level. Even after accounting for lagged terms of CO2/GDP, columns 5 and 6 indicate that the impact of FinTech remains statistically significant at levels exceeding 10%. This validates Hypothesis 1 proposed in this paper. Specifically, taking the estimation from the fourth column as an example, a 1% increase in the number of FinTech companies during the sample period is associated with an approximately 0.0038% reduction in regional carbon intensity. Expanding this result further, although the baseline number of FinTech companies nationwide during the sample period is relatively small, it has grown rapidly from 1549 to 4370, marking an increase of 182.117%. Therefore, the cumulative reduction in carbon intensity attributable to FinTech from 2011 to 2017 is estimated at 0.692%. According to official Chinese statistics, China's carbon intensity decreased by 48.4% from 2005 to 2020, equivalent to an average annual change of 3.23%. Extrapolating from the estimation results of this study, the reduction in China's annual carbon intensity from 2011 to 2017 attributed to FinTech development is estimated at 3.57% (0.692% / (3.23% × 6)). This estimation is relatively conservative as the indicator primarily represents the quantity of FinTech companies rather than their impact throughout the entire industry chain. Nonetheless, it is evident that FinTech has a notable mitigating effect on carbon intensity.

4.2 Endogeneity test

The potential endogeneity issues can introduce biases into our estimations. This stems from the intricate causal pathways between urban FinTech and carbon emissions intensity. For instance, industries with high-carbon emissions can necessitate more financial services to support their operations, thus the carbon emissions intensity could potentially influence the development of urban FinTech in reverse. Furthermore, regions with high-carbon emissions intensity can lean toward adopting FinTech to compensate for deficiencies in traditional industries, rather than the adoption of FinTech leading to a reduction in carbon emissions. Therefore, to accurately assess the impact of urban FinTech on carbon emissions intensity, it is imperative to consider these complex causal pathways. Hence, this paper employs an FinTech strategy to address the endogeneity issues associated with carbon emissions and the development of FinTech. The IV approach aims to mitigate potential issues such as "bad controls" bias resulting from omitted variables (Heutel and Ruhm 2016), measurement errors, or any underlying reverse causality (e.g., FinTech firms responding to the high-carbon emissions generated by traditional industry structures and large energy-intensive sectors).

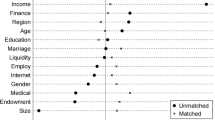

To address endogeneity concerns, this paper employs an IV strategy. I select two instrumental variables: the construction process of the first instrumental variable (IV1) is as follows: firstly, I conduct principal component analysis on the per capita number of post offices, fixed-line telephones, and postal and telecommunications services volume for each city in 1984, extracting the first principal component as a comprehensive measure of early-stage information infrastructure level; then, I multiply this composite indicator by the first lagged term of the national number of FinTech companies (Kliber et al. 2021; Sun and You 2023; Lu et al. 2023). The rationale for selecting this instrumental variable is twofold: 1) Relevance: the early diffusion of fixed-line telephones and post offices influences the development and spread of the Internet, and digital technologies such as mobile internet are crucial foundations for the development of FinTech. Thus, the level of early-stage information infrastructure is closely related to the current level of FinTech development. 2) Exogeneity: with the advancement of communication technology, the impact of early-stage information infrastructure such as fixed-line telephones and post offices on modern business operations has significantly diminished, especially the level in 1984 can be considered as a deep-seated foundation for the development of FinTech but has no direct relationship with current carbon emissions intensity, thereby meeting the exclusion restriction. Multiplying the first lagged term of the national number of FinTech companies by the cross-sectional indicators is to introduce time-varying factors into the instrumental variable, aligning it with the nature of panel data.

Our second IV involves the spherical distance to Hangzhou multiplied by the lagged one-period national count of FinTech companies, a method widely employed in similar studies (Fu and Huang, 2018; Zhang et al. 2020; Hong et al. 2020). The rationale for selecting this IV is as follows: (1) Relevance: as the home to Alibaba Group, Hangzhou represents the epicenter of China's FinTech industry. In accordance with the theories of innovation diffusion and agglomeration economics, cities near Hangzhou are more likely to benefit from spillover effects of FinTech, as the distribution of FinTech firm within each city is influenced by geographical and spatial factors associated with Hangzhou. Additionally, although Hangzhou holds significance in the FinTech industry, it is not a first-tier city in China, proximity to which does not necessarily imply a higher income level, as might be the case with Beijing or Shenzhen. (2) Exogeneity: geographical distance is a naturally given constant, remaining unchanged over time. Furthermore, I interact this distance with the annual level of national FinTech development to create IV2. This approach further strengthens the effectiveness of our IV strategy. (3) The count of national FinTech companies captures the evolving trends over time.

Our analysis begins with conducting the Durbin–Wu–Hausman test. The p value associated with the Durbin–Wu–Hausman test statistic is 0.000, indicating potential endogeneity issues with the "FinTech" index in the baseline model. To address this endogeneity problem, I adopt the 2SLS regression method incorporating instrumental variables. The results are presented in Table 3. Specifically, the first and fourth columns, respectively, display the first-stage regression results using IV1 and IV2. The second and fifth columns present the results of the second-stage regression. Considering the potential endogeneity of control variables, I adhere to the methodology outlined by Lu et al. (2019), employing the product of the control variables' pre-sample inception values and the temporal trend as novel control measures. This strategy is employed because the inception values remain predetermined and uninfluenced by other model variables, thereby obviating contemporaneous correlation between control variables and other model elements. Subsequently, lagging the variables by one period ensures the attenuation of correlation between the control variables and the error term, thus enhancing the model's robustness. The second-stage estimation results based on the new control variables for both IVs are presented in the third and sixth columns. The first-stage results indicate that the coefficient of the instrumental variables is significant at the 5% level, suggesting a positive correlation between the level of early-stage information infrastructure and the overall level of FinTech in the region. Furthermore, the presence of major digital financial centers such as Hangzhou and their spillover effects effectively influence the distribution of FinTech companies outside Hangzhou, further confirming the relevance assumption of the instrumental variables. The second-stage regression results consistently show a negative coefficient associated with FinTech, significant at the 5% level or above. This indicates that even after mitigating potential endogeneity, the conclusion of this study remains robust: FinTech significantly reduces the carbon emissions intensity of the region. Additionally, I conducted tests to address the weak instrumental variable problem. The Anderson-Rubin-Wald test rejects the null hypothesis of weak IV, indicating the absence of a weak instrumental variable problem. In conclusion, considering the endogeneity tests conducted, our hypothesis continues to be supported by the evidence provided in this paper.

4.3 Heterogeneity

Heterogeneity analysis plays a pivotal role in guiding policymakers as they formulate pertinent FinTech development strategies and policies. In Table 4, I undertake various heterogeneity analyses to discern the nuanced impact of FinTech development on the reduction of regional carbon emission intensity across diverse regions and city rankings.

To begin, it is imperative to acknowledge the pronounced regional economic disparities within China, with the eastern region being the most developed and the western region lagging behind significantly (Cao et al. 2014). Consequently, I categorize counties into three groups: eastern, central, and western, adhering to the classification criteria set forth by China's National Bureau of Statistics. In Table 4, columns (1) through (3), a stark disparity among these groups becomes evident. FinTech development exerts discernible effects solely on the eastern and central regions, with negligible impact on the western region. Notably, the central region experiences the most pronounced influence, followed by the eastern region. This heterogeneity can potentially be attributed to the rapid concurrent growth in both economic activity and carbon emissions in the western region during a period of expansive negative decoupling. Additionally, several western provinces continue to be dominated by traditional resource-based industries, posing substantial challenges for FinTech development companies primarily engaged in the service sector.

Consideration of resource allocation in China is intricately tied to political hierarchy, which primarily manifests in varying degrees across cities. To elucidate this aspect, I classify counties into three distinct groups based on their city rankings: first-tier, second-tier, and others. City ranking is assessed based on the 2020 City Commercial Charm Ranking, widely regarded as the definitive indicator for Chinese investors to assess a city's developmental prospects. As delineated in Table 4, columns (4) through (6), counties situated within first-tier Chinese cities exhibit a heightened receptivity to FinTech development's impact on carbon emission intensity. This heightened responsiveness can be attributed to these cities' transition toward an economic structure centered on the service industry. Moreover, their establishment of a sophisticated modern operational infrastructure proves instrumental in enabling FinTech companies to effectively contribute to carbon reduction efforts.

5 Mechanisms analysis

5.1 Industrial optimizing and upgrading

The distortion of the industrial structure emerges as a pivotal factor contributing to low energy efficiency. FinTech development expedites the evolution of the industrial landscape, channeling resources toward technology-intensive and capital-intensive sectors, notably the service industry. This shift leads to the creation of higher value-added products for a given level of carbon emissions (Deng et al, 2019). Simultaneously, research reveals that the ICT industry contributes significantly to carbon emission reduction, primarily through non-physical means such as video conferencing and telecommuting (Amri et al. 2019).

I construct the industrial Theil Index (TL), defined as \( TL_{j,t} = \mathop \sum \limits_{n = 1}^{3} \left( {\frac{{Y_{n,j,t} }}{{Y_{j,t} }}} \right)\ln \left( {\frac{{Y_{n,j,t} }}{{L_{n,j,t} }}/\frac{{Y_{j,t} }}{{L_{j,t} }}} \right)\), to quantify the rationality of each city's industrial structure. Here, Y represents the value added, and L represents the corresponding number of employees. \(n\) includes the first, second, and third industries. Additionally, I extract the first principal component from the number of fixed telephone end-users, mobile phone end-users, and Internet broadband access users employing the Entropy Weight Method. The results in columns 1 and 3 of Table 5 indicate that distortions in industrial structure are the underlying reason for the inability of carbon emission intensity to decline, with the lag in ICT development, or in other words, the solidification of traditional industrial structures, significantly contributing to higher carbon emission intensity. And columns 2 and 4 of the table reveal that the advancement of FinTech optimizes industrial structures and markedly propels the growth of the ICT sector. These findings suggest that the development of financial technology influences regional carbon emission intensity by prompting the rationalization of industrial structures and fostering the expansion of the ICT sector. These findings lend support to Hypothesis 2.

5.2 Energy structure and efficiency

Many researchers assert that the distortion of China's energy structure is a significant contributor to the continuous increase in energy consumption and carbon emissions (Shen and Lin 2021; Chang et al. 2021). When the marginal return on the energy factor does not align with energy prices, a substantial number of production factors become trapped within traditional capacities. This impedes the transition from high-pollution and energy-intensive sectors to cleaner industries and the adoption of green technologies. As demonstrated in Table 6, FinTech development has a discernible impact, prompting capital to gravitate toward environmentally friendly companies and modern sectors. This, in turn, encourages micro-entities to phase out extensive production capacities and invest in more efficient equipment.

At the provincial level, I establish three key energy structure and efficiency indices:

-

1.

Proportion of traditional energy to total: Denoted as \({\text{CoalRatio}}_{k,t} = 1 - \mathop \sum \limits_{m = 1}^{7} E_{m} \cdot {\text{Coal}}_{m,k,t} /\left( {\mathop \sum \limits_{m = 1}^{7} E_{m} \cdot {\text{Coal}}_{m,k,t} + \mathop \sum \limits_{n = 1}^{12} E_{n} \cdot {\text{NonCoal}}_{n,k,t} } \right)\), n comprises 12 low-carbon sources, such as natural gas and liquefied petroleum gas. m represents a specific type of fossil fuel. \({\text{Coal}}_{m,k,t}\) and \({\text{NonCoal}}_{n,k,t}\) represent specific fossil fuel and non-fossil fuel energy sources in province k during year t, respectively. Em and En, as derived from Jiang et al. (2019), signify the conversion coefficients for energy consumption of fossil fuels and non-fossil fuels, respectively.

-

2.

Proportion of new energy generation: \({\text{NewPower}}_{k,t}\) is calculated as \(\left( {{\text{Total}}_{k,t} - {\text{Thermal}}_{k,t} } \right)/{\text{Total}}_{k,t}\). where \({\text{Total}}_{k,t}\) and \({\text{Thermal}}_{k,t}\) display the total power generation and thermal power generation in year t of province k. This formulation reflects the predominant use of new energy sources in power generation and the significance of thermal power within traditional energy sources (Wang et al. 2019).

-

3.

Energy consumption change rate per GDP: Represented as \(\Delta {\text{Eff}}_{k,t} = \left[ {\left( {{\text{Ene}}_{k,t} /{\text{GDP}}_{k,t} } \right) - \left( {{\text{Ene}}_{k,t - 1} /{\text{GDP}}_{k,t - 1} } \right)} \right]/\left( {{\text{Ene}}_{k,t - 1} /{\text{GDP}}_{k,t - 1} } \right)\), this index measures the difference in energy consumption per GDP over two consecutive years.

The above data are mainly from China Statistical Yearbook, China Energy Statistical Yearbook, China Low Carbon Yearbook, and China Industrial Statistical Yearbook. At both short-term and macroscopic levels, the calorific value and categorization of energy sources are stable due to their intrinsic chemical and physical properties, like the carbon-hydrogen ratio. Despite advancements in energy technologies, the fundamental characteristics of energy sources and their extraction and utilization methods remain consistent. Additionally, energy trading practices and standardized measurement criteria, including classifications like renewable vs. non-renewable and fossil vs. non-fossil fuels, ensure uniformity across regions. These standards, supported by research, official publications, and global acceptance, help minimize measurement errors and biases (Clarke et al., 2022; IEA 2023).

The consistent findings of our study unequivocally demonstrate that advancements in financial technology significantly reduce the proportion of traditional energy within the overall energy mix, lower per unit GDP energy consumption, and increase the share of renewable energy generation. Specifically, as depicted in Table 6, columns (1), (3), and (5), the utilization of traditional energy, technological obsolescence (manifested by high per unit GDP energy consumption), and the low proportion of renewable energy generation are key reasons why regional carbon emission intensity struggles to decline. Column (2) indicates that the contribution of FinTech development to carbon emission reduction is achieved through diminishing reliance on traditional energy sources. Simultaneously, columns (4) and (6) demonstrate that progress in financial technology leads to a decrease in the proportion of renewable energy generation and energy consumption intensity, providing policymakers with invaluable insights. In conclusion, our study concludes that one of the mechanisms through which the development of financial technology ultimately reduces regional carbon intensity is by fostering a transition in regional energy structures and enhancing energy efficiency. Hypothesis 3 of this paper is confirmed.

6 More robustness checks

6.1 Alternative measures of FinTech

Our discussion has underscored the significant impact of FinTech development on the reduction of carbon emission intensity. Nevertheless, the FinTech index used thus far only considers the number of companies, and therefore, I have taken steps to address this limitation: (1) I initially employed the non-logarithmized count of FinTech companies, denoted as FinTech1, as a robustness check to assess whether the logarithmic transformation in the baseline specification significantly influenced the model results. (2) To provide a more comprehensive perspective, I introduce additional variables to supplement the FinTech development analysis. Firstly, I utilize the proportion of total registered capital of FinTech companies relative to local gross domestic product as a proxy for local FinTech development (referred to as FinTech2). (3) In recognition of the importance of media attention, I gauge the degree of local media focus on FinTech development by counting the number of pages containing hot words related to FinTech in Baidu News, a dominant Chinese search engine. Specifically, I use the search query “City Name” + “FinTech-related keywords” each year to quantify media coverage and reflect FinTech development (referred to as FinTech3). (4) I also incorporate the "Depth of Digital Finance" subindex from China's Digital Inclusive Finance Index, compiled by the Financial Center at Peking University, as another proxy variable for FinTech development (referred to as FinTech4). Following the incorporation of these supplementary variables to represent FinTech development, our findings remain consistent with those presented in Table 7.

6.2 Control finance attribution

While the empirical findings in the preceding sections suggest that the level of development in FinTech can significantly facilitate the reduction of regional carbon intensity, it is possible that this conclusion may be driven by the spontaneous innovation of local financial institutions rather than the actual "empowerment" of FinTech. To mitigate the potential impact of the self-initiated innovation of financial institutions on total factor productivity, this study further incorporates the following variables into the baseline model for each city annually: (1) the number of branches of commercial banks (Branch), and (2) the logarithm of patent applications submitted by financial institutions (Patent). These variables aim to control for the innovative capacity of prefectural-level financial institutions. The coefficients presented in Table 8 continue to affirm the significant role of FinTech development in reducing carbon intensity, even after accounting for potential confounding factors associated with regional financial institutions. This further enhances the credibility and robustness of our baseline regression results.

6.3 More regression specifications

I enhance the robustness of our baseline conclusions by altering the specifications of econometric models. Initially, given the non-negative nature of carbon emission/GDP, I employ Tobit and Poisson models for estimation. Subsequently, I introduce a binary dummy variable indicating whether local carbon intensity exceeds its mean level, followed by estimation using Logit, Probit, and cumulative log odds function (Cloglog) models. Finally, I explore the nonlinear relationship between FinTech and carbon emission intensity by incorporating the quadratic term of FinTech into the model. The estimation results are presented in Table 9. Table 9 indicates that regardless of the regression model utilized, the research findings consistently affirm that the development of FinTech significantly facilitates the reduction of regional carbon emission intensity. This conformity with the core hypothesis underscores the robustness and reliability of our conclusions.

7 Conclusion

The urgency of reducing carbon emission intensity has gained prominence on the agendas of various countries. Notably, China, as the world's largest developing nation, stands as a significant contributor, accounting for 31.8% of global carbon emissions in 2023. The ambitious targets of peaking carbon emissions by 2030 and achieving carbon neutrality by 2060 present formidable challenges. Meanwhile, the rapid advancement of information technology has catalyzed the convergence of finance and technology, giving rise to a plethora of innovative FinTech solutions. These technological advancements have ushered in sweeping and comprehensive changes in economic activities and environmental strategies. The central question at hand is whether the development of FinTech offers a viable pathway to reduce carbon emission intensity.

Distinguishing itself from the extensive body of prior research, this paper takes the pioneering step of addressing this question. I aim to provide answers by rigorously estimating and evaluating the impact of FinTech development on the reduction of regional carbon emission intensity. In our empirical analysis, I utilized the number of FinTech companies in each city to gauge the level of FinTech development. I combined these data with carbon emission data at the county level, spanning the years from 2011 to 2017. Specifically, our findings suggest that a 1% increase in the number of FinTech companies correlates with a reduction in regional carbon intensity by approximately 0.0038% of the mean, and the cumulative reduction attributable to FinTech from 2011 to 2017 is estimated at 0.692%.

After rigorous analysis addressing potential endogeneity issues, I have determined that the impact of FinTech on reducing carbon emission intensity remains persistent and statistically significant. This conclusion is robust and withstands various robustness tests. Our mechanism analysis reveals that regional FinTech development plays a crucial role in promoting energy efficiency and digital transformation. It drives the optimization and upgrading of industrial structure, directing resources toward the ICT industry. Simultaneously, regional energy structure undergoes optimization, evidenced by the decline in coal's share in electricity generation and per unit GDP energy consumption, along with the increase in the proportion of renewable energy generation, thereby enhancing overall energy efficiency. It is noteworthy that this impact is more pronounced in developed regions and metropolitan cities.

On these ground, I put forward these policy implications:

Firstly, to actualize the emission reduction objectives delineated in the Paris Agreement, it is imperative for governments to stimulate FinTech enterprises to conceive and promulgate green financial products and solutions, such as carbon credits, green bonds, and investments centered on renewable energies. Against the backdrop of a just transition, governments should ardently advocate for FinTech initiatives catering to energy-intensive industries, underrepresented regions, and remote areas, ensuring holistic economic progression. It is beneficial to galvanize participation from the private sector. By leveraging Public–Private Partnership models, specialized funds or projects can be initiated to buttress the research, development, and dissemination of low-carbon technologies.

Secondly, under the aegis of the United Nations Framework Convention on Climate Change, it is propitious to inaugurate transnational FinTech cooperative networks, aiming at the diffusion of efficacious practices and resolutions. A concerted effort should be exerted to catalyze collaboration between various local governments and underrepresented areas, harnessing FinTech to usher in an array of economic opportunities and resources. The establishment of cross-border data hubs and research entities would expedite the global application of FinTech solutions.

Thirdly, a global competition, juxtaposing FinTech with climate initiatives, should be staged to incite widespread participation and innovation. Dedicated research and development funding is necessary to back endeavors aimed at carbon emission abatement across specific industries and sectors. In tandem with international entities, merit-based reward systems can be designed to accolade corporations and individuals who have made stellar contributions on the global stage.

Fourthly, engagement with international financial institutions and regulatory bodies is pivotal for drafting and periodically refining international norms pertinent to FinTech and climate endeavors. It is quintessential to guarantee consumer data integrity and privacy, while ensuring equity and transparency in the FinTech evolution. Training and guidance should be dispensed to FinTech entities, equipping them with a comprehensive understanding and adherence to the ESG standards, culminating in genuine sustainable development.

This study makes a valuable attempt to explore the relationship between FinTech and carbon emission reduction. However, several limitations persist: (1) The sample data utilized in this study covers the period from 2011 to 2017, spanning merely seven years. Given that FinTech is a rapidly emerging industry in recent years, its impact on carbon emissions may exhibit certain lag effects. The relatively short sample period might fail to fully capture these long-term effects. Acquiring panel data with a more extensive time span in the future would be advantageous for analysis. (2) This paper primarily examines the relationship between FinTech development and carbon emission intensity at the regional level. However, the micro-mechanisms through which FinTech influences carbon emissions are more likely to manifest at the enterprise level, for instance, how FinTech development affects the ease of financing, technological innovation, and clean production of enterprises. The lack of micro-level enterprise data hampers an in-depth analysis of these mechanisms. (3) Climate change is a global issue, and addressing it requires concerted efforts from the international community. Conclusions drawn solely from Chinese data might offer limited guidance for coordinating global climate governance. Different countries exhibit significant disparities in FinTech development, economic development stages, industrial structures, energy compositions, and environmental regulatory strengths. Hence, the external validity of the research findings to other countries, especially developed ones, warrants further validation. (4) The COVID-19 pandemic has altered traditional lifestyles and production methods, further underscoring the importance of the digital economy and FinTech. Post-pandemic, various countries have launched large-scale green recovery plans, such as the "European Green Deal." These new developments present both opportunities and challenges for FinTech's support of low-carbon transitions, deserving subsequent research attention. In summary, this study contributes to the exploration of FinTech's role in carbon emission reduction. However, constrained by data and methodologies, the robustness and generalizability of the research conclusions require further enhancement. Future research should endeavor to validate and expand upon the findings of this study from diverse perspectives, utilizing a variety of data and methodologies.

Notes

See Alipay Ant Forest: Using Digital Technologies to Scale up Climate Action | China, United Nations Climate Change (2019), https://unfccc.int/climate-action/momentum-for-change/planetary-health/alipay-ant-forest.

References

Allen F, Gu X, Jagtiani J (2021) A survey of fintech research and policy discussion. Rev Corp Finance 1:259–339

Amri F, Zaied YB Lahouel BB (2019) ICT, total factor productivity, and carbon dioxide emissions in Tunisia.Technol Forecast Soc Change 146:212–217

Bogue DJ (1982) Review of population and technological change: A study of long-term trends., by E. Boserup. American J Sociolo 88(2):461–463

Buchak G, Matvos G, Piskorski T, Seru A (2018) Fintech, regulatory arbitrage, and the rise of shadow banks. J Fin Econo 130(3):453–483

Cao S, Lv Y, Zheng H, Wang X. (2014) Challenges facing China’s unbalanced urbanization strategy, Land Use Policy 39:412-415.

Chang CT, Yang CH, Lin TP (2019) Carbon dioxide emissions evaluations and mitigations in the building and traffic sectors in Taichung metropolitan area, Taiwan. J Clean Product 230:1241–1255

Chang Q, Zhou Y, Liu G, Wang D, Zhang X. (2021) How does government intervention affect the formation of zombie firms? Economic. Modelling 94:768-779.

Chen J, Cheng S, Song M, Wang J (2016) Interregional differences of coal carbon dioxide emissions in China. Energy Policy 96:1–13

Chen MA, Wu Q, Yang B (2019) How valuable is FinTech innovation? Rev Financ Stud 32(5):2062–2106

Chen J, Gao M, Cheng S, Hou W, Song M, Liu X, Shan Y (2020) County-level CO2 emissions and sequestration in China during 1997–2017.Scientific data 7(1):391.

Clarke L, Wei Y-M, De La Vega Navarro A, Garg A, Hahmann AN, Khennas S, Azevedo IML, Löschel A, Singh AK, Steg L, Strbac G, Wada K (2022) Energy Systems. In: Shukla PR, Skea J, Slade R, Al Khourdajie A, van Diemen R, McCollum D, Pathak M, Some S, Vyas P, Fradera R, Belkacemi M, Hasija A, Lisboa G, Luz S, Malley J (eds) IPCC, 2022: Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge. https://doi.org/10.1017/9781009157926.008

Croutzet A, Dabbous A (2021) Do FinTech trigger renewable energy use? Evidence from OECD countries. Renew Energy 179:1608–1617

Daly HE (1996) Beyond growth: the economics of sustainable development. Beacon Press, Boston

Deng X, Huang Z, Cheng X (2019) FinTech and sustainable development: evidence from China based on P2P data. Sustainability 11(22):6434

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sustain Energy Rev 60:1074–1085

Fang J, Gozgor G, Lu Z, Wu W (2019) Effects of the export product quality on carbon dioxide emissions: evidence from developing economies. Environ Sci Pollut Res 26(12):12181–12193

Fernández YF, López MF, Blanco BO (2018) Innovation for sustainability: the impact of RandD spending on Carbon emission. J Clean Prod 172:3459–3467

Fleisher B, Li H, Zhao MQ (2010) Human capital, economic growth, and regional inequality in China. J Dev Econ 92(2):215–231

Fu QZ, Huang YP (2018) The heterogeneous impact of digital Finance on rural financial demand: evidence from China Household Finance survey and Peking University digital inclusive finance index. J Financ Res 461:68–84

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement, NBER Working Paper No. 3914, National Bureau of Economic Research, Cambridge, MA

Guo Q, Chen S, Zeng X (2021) Does fintech narrow the gender wage gap? evidence from China. Chin World Econ 29(4):142–166

Heutel G, Ruhm CJ (2016) Air pollution and procyclical mortality. J Assoc Environ Resour Econ 3(3):667–706

Hong CY, Lu X, Pan J (2020) Fintech adoption and household risk-taking, NBER Working Paper No. 28063, National Bureau of Economic Research, Cambridge, MA

Hsieh CT, Klenow PJ (2009) Misallocation and manufacturing TFP in China and India. Q J Econ 124(4):1403–1448

IEA (2023) World Energy Outlook 2023, IEA, Paris https://www.iea.org/reports/world-energy-outlook-2023, Licence: CC BY 4.0 (report); CC BY NC SA 4.0 (Annex A)

Jiang T, Huang S, Yang J (2019) Structural carbon emissions from industry and energy systems in China: an input-output analysis. J Clean Product 240:118116

Jiang L, Yang Y, Wu Q, Yang L, Yang Z (2024) Hotter days, dirtier air: the impact of extreme heat on energy and pollution intensity in China. Energy Econ 130:107291

Khan H, Khan I, Binh TT (2020) The heterogeneity of renewable energy consumption, carbon emission and financial development in the globe: a panel quantile regression approach. Energy Rep 6:859–867

Kliber A, Będowska-Sójka B, Rutkowska A, Świerczyńska K (2021) Triggers and obstacles to the development of the FinTech sector in Poland. Risks 9(2):30

Lu Y, Wang J, Zhu L (2019) Place-based policies, creation, and agglomeration economies: evidence from China’s economic zone program. Am Econ J Econ Pol 11(3):325–360

Lu L, Liu P, Yu J, Shi X (2023) Digital inclusive finance and energy transition towards carbon neutrality: evidence from Chinese firms. Energy Econ 127:107059

Malik MY, Latif K, Khan Z, Butt HD, Hussain M, Nadeem MA (2020) Symmetric and asymmetric impact of oil price, FDI and economic growth on carbon emission in Pakistan: evidence from ARDL and non-linear ARDL approach. Sci Total Environ 726:138421

Nguyen TT, Pham TAT, Tram HTX (2020) Role of information and communication technologies and innovation in driving carbon emissions and economic growth in selected G-20 countries. J Environ Manag 261:110162

Pizzi S, Corbo L, Caputo A (2021) Fintech and SMEs sustainable business models: Reflections and considerations for a circular economy. J Clean Prod 281:125217

Salahuddin M, Alam K, Ozturk I (2016) The effects of Internet usage and economic growth on Carbon emission in OECD countries: a panel investigation. Renew Sustain Energy Rev 62:1226–1235

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on Carbon emission in Kuwait. Renew Sustain Energy Rev 81:2002–2010

Schiemann F, Sakhel A (2019) Carbon disclosure, contextual factors, and information asymmetry: the case of physical risk reporting. Eur Account Rev 28(4):791–818

Schulze PC (2002) I= PBAT. Ecol Econ 40(2):149–150

Song M, Zhou P, Si H (2021) Financial technology and enterprise total factor productivity—Perspective of “enabling” and credit rationing. China Ind Econ 4:138–155

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Sun Y, You X (2023) Do digital inclusive finance, innovation, and entrepreneurship activities stimulate vitality of the urban economy? Empirical evidence from the Yangtze River Delta, China. Technol Soc 72:102200

Taylor MCR, Wilson C, Holttinen E, Morozova A (2020) Institutional arrangements for Fintech regulation and supervision. International Monetary Fund, Washington, DC

Tian P, Lin B (2019) Impact of financing constraints on firm’s environmental performance: evidence from China with survey data. J Clean Prod 217:432–439

Ulucak R (2021) Renewable energy, technological innovation and the environment: a novel dynamic auto-regressive distributive lag simulation. Renew Sustain Energy Rev 150:111433

Vučinić M (2020) Fintech and financial stability potential influence of fintech on financial stability, risks and benefits. J Central Bank Theory Pract 9(2):43–66

Wang Y, Song J, Yang W, Dong L, Duan H (2019) Unveiling the driving mechanism of air pollutant emissions from thermal power generation in China: a provincial-level spatiotemporal analysis. Resour Conserv Recycl 151:104447

Wang WZ, Liu LC, Liao H, Wei YM (2021) Impacts of urbanization on carbon emissions: an empirical analysis from OECD countries. Energy Policy 151:112171

Wu Q (2022) Price and scale effects of China’s carbon emission trading system pilots on emission reduction. J Environ Manag 314:115054

Wu Q (2023) Sustainable growth through industrial robot diffusion: quasi-experimental evidence from a Bartik shift-share design. Econ Trans Inst Change 5:96

Wu Q, Sun Z, Jiang L, Jiang L (2023a) “Bottom-up” abatement on climate from the “top-down” design: lessons learned from China’s low-carbon city pilot policy. Empir Econ 5:1–35

Wu Q, Sun Z, Jiang L (2023b) Why does education matter in climate action? Evidence and mechanisms from China’s higher education expansion in the late 1990s. Appl Econ 5:1–21

Wu Q, Chang S, Bai C, Wei W (2023c) How do zombie enterprises hinder climate change action plans in China? Energy Econ 124:106854

Yan CL, Li T, Lan W (2016) Financial development, innovation and carbon dioxide emissions. J Financ Res 427(1):14–30

Yang Z, Wu Q, Venkatachalam K, Li Y, Xu B, Trojovský P (2022) Topic identification and sentiment trends in Weibo and WeChat content related to intellectual property in China. Technol Forecast Soc Chang 184:121980

Zhang X, Tan Y, Hu Z, Wang C, Wan G (2020) The trickle-down effect of fintech development: from the perspective of urbanization. Chin World Econ 28(1):23–40

Zhang Y, Chen J, Han Y, Qian M, Guo X, Chen R, Chen Y (2021) The contribution of Fintech to sustainable development in the digital age: ant Forest and land restoration in China. Land Use Policy 103:105306

Zhang Z, Zhang W, Wu Q, Liu J, Jiang L (2024) Climate Adaptation through Trade: evidence and Mechanism from Heatwaves on Firms’ Imports. China Econ Rev 2:102133

Zhou G, Zhu J, Luo S (2022) The impact of fintech innovation on green growth in China: mediating effect of green finance. Ecol Econ 193:107308

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The author declares no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wu, Q. From bits to emissions: how FinTech benefits climate resilience?. Empir Econ (2024). https://doi.org/10.1007/s00181-024-02609-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s00181-024-02609-9

Keywords

- FinTech

- Carbon emission intensity

- Industrial optimizing and upgrading

- Energy structure and efficiency

- Climate change

- Sustainable development