Abstract

This research investigates the spillovers of global liquidity to Asia–Pacific countries, focusing on the contradictory effects of policy-driven liquidity created by monetary stances in advanced economies and market-driven liquidity generated by the private banking sector. Our findings stand in sharp contrast to previous studies, showing that shifts in macro-financial indicators in Asia–Pacific economies are predominantly influenced by market-driven shocks rather than those of policy-driven liquidity. Specifically, liquidity shocks associated with surges in cross-border credit flows, especially those denominated in US dollars, drive up asset prices and have boosting effects on inflation and economic output. A positive shock to market liquidity also results in an appreciation pressure on domestic currencies and a short-term rise in interest rates. However, excess liquidity shocks caused by the Bank of Japan’s adjustments in shadow short rates and balance sheets have a negative effect on inflation and bring about temporary depreciation pressure on Asian currencies. Surprisingly, we find that Asian responses to financial easing associated with the Fed’s monetary policy change are not well-pronounced.

Similar content being viewed by others

1 Introduction

The COVID-19 outbreak plunged the world economy into the sharpest downturn ever since the Great Depression. In response to the recession outlook and the challenges associated with the prolonged pandemic, macroeconomic stimulus packages were implemented in many countries worldwide. Central banks in advanced economies (AEs) such as the Federal Reserve (Fed), the European Central Bank (ECB), the Bank of England (BoE) and the Bank of Japan (BoJ), introduced extensive monetary responses, including aggressive policy rate cuts, large-scale asset purchase schemes, and broad-based credit support for firms and households. These responses aim to prevent liquidity strains that could lead to market freeze, financial distress, and insolvency of firms, with negative implications for economic growth. However, the post-Covid cost-of-living crisis, exacerbated by surging energy and fuel prices and related supply chain disruption following the Ukraine invasion in 2022, has necessitated that the Fed and other major central banks raise interest rates and unwind the stimulus programmes to curb the inflationary pressure (IMF 2023). This economic context has reignited the ongoing debate on the dynamics of liquidity transmission across borders, as AEs’ monetary policies are established as key drivers of global liquidity (Avdjiev et al. 2020). The literature shows that global liquidity, during periods of both surplus and scarcity, has various implications for the financial stability of emerging market economies (EMEs). On the one hand, surges in global liquidity boost output growth and stock prices in developing countries through capital inflows, resulting in lower funding costs that enhance competitiveness and improve the current account balance (Choi et al. 2017). On the other hand, abundant liquidity may lead to the accumulation of official reserves and inflows into equity portfolios in recipient countries, contributing to excessive credit growth and exerting appreciation pressure on exchange rates and asset prices (Psalida and Sun 2011). In contrast, global liquidity shortages may trigger disruption in financial markets, and in a more severe scenario, and could dampen investors’ appetite for risk, ultimately resulting in the malfunctioning of market mechanisms (Landau 2011).

Global liquidity is broadly defined as the availability of funds for the purchases of goods and services on a global scale (Eickmeier et al. 2014). There is no single variable that adequately captures the global liquidity condition. Instead, it is typically explained and measured using various approaches, generally composed of three elements: (i) policy-driven liquidity, which results from changes in monetary policies in AEs; (ii) market-driven liquidity, determined by the traditional banking sector and conditions in the financial markets; (iii) risk averseness, reflected in investors’ willingness to take financial risks (Choi et al. 2017). Most economists use the term “global liquidity” to refer to the stance of monetary policy in major currency areas. Central banks supply official liquidity through both conventional and unconventional monetary policies, including emergency liquidity assistance during periods of stress. The implementation of unconventional monetary policy such as quantitative easing (QE) or large-scale asset purchases (LSAP) significantly increases the central bank's balance sheet size, thereby providing a substantial amount of liquidity to the financial system (Avdjiev et al. 2020). However, global liquidity is not solely created by central banks; financial institutions can also generate market liquidity through their cross-border operations (Landau 2011). Domanski et al. (2011) argue that market liquidity, also known as private liquidity, often dominates official liquidity in the world of high capital mobility, fostering cross-border spillovers as financial institutions provide liquidity both domestically and internationally. Tillmann (2017) adds that changes in investors' attitudes toward risk also drive global liquidity, as increased risk aversion prompts international investors to repatriate their funds, leading to a reduction in available liquidity for EMEs. The 2007–2008 global financial crisis (GFC) provides a vivid example of the strong interactions between risk aversion and a spike in liquidity drain.

The study of monetary policy and global liquidity spillovers gained momentum after the GFC. Numerous studies have explored the impact of the US expansionary monetary policy and global liquidity spillovers on EMEs. However, the empirical results have been diverse and, at times, inconsistent (Anaya et al. 2017; Belke et al. 2013; Choi et al. 2017; Djigbenou-Kre and Park 2016; Honda et al. 2013; Kapetanios et al. 2012; Psalida and Sun 2011; Sousa and Zaghini 2007; Sun 2015; Tillmann et al. 2019). It appears that the nature of transmission depends on many factors, such as the relative efficacy of transmission channels. Different financial systems, characterized by varying degrees of development and integrations, may react differently to the same monetary or financial impulse (Landau 2011), and the most effective policy responses can vary depending on the nature of spillovers (Georgiadis and Jarocinski 2023). This study revisits the paradox of global liquidity spillovers, with a special focus on the Asia–Pacific region, one of the world’s most dynamic economic growth hubs. This region is particularly vulnerable to global liquidity shocks due to its historical experience with regional crisis. While our approach is closely related to the work of Anaya et al. (2017), Choi et al. (2017) and Tillmann et al. (2019), we aim to provide unique contributions to the existing literature.

First, this study sheds light on the heterogeneous effects of policy-driven and market-driven global liquidity. Although the literature on global liquidity spillovers is extensive, studies often focus either on AEs’ monetary policies or international credit aggregates. Domanski et al. (2011) argue that the measure of global liquidity should encompass changes in both official and private liquidity, as well as the financial easing in the global financial market. According to Landau (2011), during stable times and particularly in periods of economic growth, the supply of liquidity is primarily determined by international banks' activities in securities markets and cross-border lending. However, during crises, liquidity injection is largely influenced by monetary policy actions. There exists an active interplay between official and private liquidity components, challenging policy initiatives and effective interventions. However, empirical evidence regarding the heterogeneous effects of these two distinct types of liquidity shocks remains limited. To the best of our knowledge, our study is among the few that empirically estimate the contradictory effects of policy- versus market-driven global liquidity, taking into account their dynamic interactions in Asia–Pacific economies.

Second, we assess the effectiveness of both asset-price and traditional bank-lending channels of monetary transmission by incorporating various endogenous macro-financial variables, including economic growth, inflation, interest rates, foreign exchange rates, and stock prices. To do this, we employ the panel vector autoregression with exogeneous driving forces (PVARX) within a generalized method of moments (GMM) framework. This methodological approach not only accommodates plausible interdependencies among endogenous variables but also accounts for synchronous and lag-induced effects resulting from exogenous shocks. The analyzed period of 22 years (from 2000 to 2022) encompass several stages in international monetary and global liquidity conditions: before the GFC (2000–2007), unconventional policies during the GFC and European debt crisis (2008–2013), and the shift toward policy normalization in the US (2014–2017), the slight divergence in monetary policies in AEs during uncertain economic conditions (2018–2019), and the COVID-19 pandemic (2020–2022). Therefore, the findings of this study may have significant policy implications for authorities in Asia–Pacific countries when dealing with external shocks.

The roadmap to the remainder of this paper is as follows: Section 2 reviews the literature on global liquidity spillovers to EMEs. Section 3 explains the model specification, the dataset, and provides a description of variables. Section 4 presents the estimated results and discusses the main findings regarding the heterogeneous effects of policy-driven versus market-driven liquidity on Asia–Pacific countries. Finally, Sect. 5 concludes the study with relevant policy remarks.

2 Literature review on global liquidity spillovers to EMEs

Global liquidity and its spillover effects have been central to international policy debates and a challenging research issue over the last few decades. The literature consistently shows that global monetary shocks, originating from either global monetary policy or global credit supply, have emerged as the primary external source of macroeconomic fluctuations and a "monetary tsunami" in developing countries (Barrot et al. 2018). However, the effects are not uniform across every economy and region, and they depend on global financial conditions, domestic economic fundamentals, and policy responses. For instance, many EMEs, such as Korea and Brazil, utilize foreign exchange reserves to mitigate foreign currency funding pressures resulting from monetary shocks (Domanski et al. 2011).

Central banks’ policies play a pivotal role in shaping the magnitude and nature of liquidity spillovers. The expansionary monetary policies adopted by major central banks worldwide in response to the GFC and the subsequent recession triggered a surge in global liquidity (Belke et al. 2013). The abundant liquidity resulting from the implementation of QEs in AEs has been notably observed to spread to EMEs, generating stimulative effects on economic output and equity valuation. However, these gains are counterbalanced by the potential threats of currency appreciation pressure and excessively inflated asset prices (Choi et al. 2017). Choi et al. (2017) also demonstrate that countries with inflation-targeting (IT) frameworks experience less pronounced volatility in the behavior of macro-financial variables to global liquidity shocks compared to non-IT countries. Studying the international transmission of monetary policy with a focus on foreign liquidity, Sousa and Zaghini (2008) reveal that shocks to global liquidity play a significant role in explaining price and output fluctuations in the euro area. He and McCauley (2013) conduct an empirical analysis of the monetary policies of major economies toward Northeast Asian countries such as China, Hong Kong and Korea. They identify the price and quantity channels of monetary shocks, finding that low interest rates in major currencies lead to more favorable financing conditions, resulting in domestic currency appreciation and encouraging firms to borrow in foreign currency. Sun (2015) analyses the transmission of global liquidity to ASEAN-5 and finds that the changing financial landscape associated with fluctuations in global liquidity contributed to increased risks to financial stability in Indonesia, Malaysia, Philippines, Singapore and Thailand. Lee and Choi (2010) explore the linkages between global and domestic monetary gaps and estimate their effects on output, inflation, and net saving rates using panel data for 20 Asian countries from 1980 to 2008. They find that AEs’ expansionary monetary policies persistently boost output growth and inflation in emerging Asian markets. Investigating the response of key macroeconomic and financial variables of Asian countries during the period 2004–2015, Tillmann (2017) shows that positive shocks to global liquidity led to a domestic economic boom, a surge in asset prices, and upward pressure on exchange rates. In a recent paper, Tillmann et al. (2019) find that the regime shift in monetary policy through conventional or unconventional instruments in the USA has different effects on EMEs, with tightening monetary policy shocks having a stronger influence than easing ones. Kolasa and Wesołowski (2020) provide additional evidence to support this asymmetric effect. Accordingly, conventional monetary easing in a large economy positively affects output in other countries, while QE undermines international competitiveness and depresses aggregate output.

While many studies emphasize the role of the monetary policy stance in AEs as a driver of global liquidity, another strand of literature focuses on the availability of ample and low-cost funding in global financial markets (Bruno and Shin 2015). Eickmeier et al. (2014) delve into the concept of global liquidity using a factor model, discovering that global liquidity conditions are primarily shaped by three fundamental common factors: global monetary policy, global credit supply and global credit demand. Cross-border credit flows expanded significantly during periods of expansionary monetary policy, while periods of decreasing international credit flows indicate tighter financial conditions (Cerutti et al. 2017). By aggregating bank-to-bank cross-border credit flows across countries as a measure of global liquidity, Cesa‐Bianchi et al. (2015) recognize that the effects of global liquidity shock on house prices, consumption and the current account were significantly stronger in EMEs than in AEs. Choi et al. (2017) are among the very few studies that evaluate the impacts of both policy-driven and market-driven liquidity on EMEs. They find that policy-driven global liquidity is more important in explaining the movements in EMEs’ variables (except the current account) than market-driven global liquidity.

In conclusion, the literature extensively documents that AEs are the primary drivers of global liquidity shocks. However, the overall ease of financing depends on the actions of both the public sector and private financial institutions (Domanski et al. 2011). Therefore, focusing solely on a specific facet of global liquidity may fail to provide a comprehensive assessment of its overall condition, thereby hindering the implementation of effective policy responses. While there is a substantial body of literature examining the spillovers of global liquidity to EMEs, there is still limited studies that analyze the heterogeneous effects of policy- and market-driven liquidity, considering their dynamic interactions. Furthermore, despite extensive evidence demonstrating the association between fluctuations in global liquidity and the volatility of capital flows to EMEs, along with negative implications for financial stability, the effects of global liquidity shocks vary across countries and regions, possibly due to different underlying mechanisms. Economic fundamentals, financial openness, and policy responses (e.g., the accumulation and use of foreign reserves) are considered critical drivers of the underlying heterogeneity in their reactions to external monetary shocks. This paper contributes to the literature by revisiting the spillovers of global liquidity to Asia–Pacific countries from 2000 to 2022, a period that encompasses different stages in international monetary stances and market turbulence. Importantly, our results diverge from those of Choi et al. (2017), showing that Asian economies are more vulnerable to market-driven liquidity rather than policy-driven liquidity. The findings from this study carry important implications for policymakers as well as financial market participants.

3 Methodologies and data

This paper employs the PVARX model within the GMM framework to analyze the transmission of global liquidity to eight Asia–Pacific countries: Hong Kong, Indonesia, Korea, Malaysia, Philippines, Singapore, Thailand and Vietnam. The focus on this group of countries is attributable to their geographical proximity and shared economic and cultural dynamics. These nations experienced and were significantly affected by the Asian crisis in 1997. However, they demonstrated a remarkable recovery, undergoing rapid economic growth and industrialization in recent decades, and have been the fastest growing and most dynamic in the world (Glick and Spiegel 2015). Due to its historical crisis and swift transformation, they are highly exposed and vulnerable to global liquidity shocks and have a strong potential and need for regional coordination and cooperation on liquidity management. We assume that exogenous shocks in global liquidity led to necessary adjustments in macro-financial variables of Asia–Pacific economies. However, these adjustments do not have contemporaneous effects on international monetary conditions. This assumption enables us to capture the nature of small open economies where the country-specific shock is too small to Granger cause a significant adjustment in AEs (Tillmann et al. 2019). Furthermore, there exists a dynamic interaction between global liquidity shocks resulting from major central banks’ policy actions and those stemming from cross-border banking operations (Bruno and Shin 2015). However, their effects on economic and financial environments of Asia–Pacific region differ and may even be contradictory. These features of global liquidity spillovers and the panel properties will be addressed using the conditionally homogeneous PVARX model developed by Georgiadis (2012), which is incorporated into the GMM framework by Abrigo and Love (2016).

In order to derive the source and propagation of exogenous global liquidity shocks, we model the lead–lag interaction of policy- and market-driven liquidity in a VAR framework. The standard representation of VAR model is defined as:

where vector Zt contains three variables representing policy-driven liquidity (PDLt), market-driven liquidity (MDLt) and the third component of risk aversion (RAt), which is assumed to act as propagation mechanism between PDLt and MDLt. \(\beta \;{\text{is}}\;{\text{a}}\;m \times 1\) vector of constants, \({C}_{p}\) is a \(m\times m\) matrix of coefficients, and \({\vartheta }_{t}\) is a \(m\times 1\) vector of i.i.d. reduced form shocks.

Following (Jarociński 2010), we assume that structural shocks are orthogonal. This implies that the covariance matrix of the VAR residuals contains information regarding the coefficients of the simultaneous relationships among endogenous variables. Only shocks (\({\vartheta }_{t})\) from \({{\text{PDL}}}_{t}\) and \({{\text{MDL}}}_{t}\) were obtained and included as exogeneous driving factors in PVARX model. We identify these shocks under the assumption that policy-driven and market-driven liquidity do not respond immediately to the risk aversion shock.

The baseline PVARX model can be formulated as follows:

where \({Y}_{it}\) is a \(\left(G\times 1\right)\) vector of endogenous variables capturing different macro-financial metrics of country i at time t with i = 1,…, N and t = 1,…, T; l is the lag length of endogenous variables; \({A}_{1}, {A}_{2\cdots },{A}_{l}\) is a \(\left(G\times G\right)\) matrix of coefficients capturing the lagged effects of endogenous variables. \(\vartheta ({Z)}_{t-q}\) is a vector of exogeneous global liquidity shocks that are included contemporaneously (i.e. q = 0) and with q lags ((i.e. q > 0), and \(B_{q}\) is a vector containing their corresponding coefficients (i.e. the response of endogenous variable to exogenous variable). Finally, \({\mu }_{i}\) captures country-specific fixed effects, and \({\varepsilon }_{it}\) denotes the error terms which are assumed to have the following characteristics:

For identification, global liquidity shocks contained in \(\vartheta ({Z)}_{t-q}\) are assumed to be independent of individual shocks \({\varepsilon }_{it}.\) This PVARX setup is based on Abrigo and Love (2016), assuming that the cross-sectional units share the same underlying data generating process, with the reduced form parameters \({A}_{1}, {A}_{2\cdots },{A}_{l}\) and \({B}_{q}\) to be common among them. Systematic cross-sectional heterogeneity is modeled as panel-specific fixed effects. These assumptions are valid for our study, as the investigated countries in our data sample share similar structural characteristics in terms of economic dynamics and financial integration (Bank 2017; Das et al. 2013). Therefore, they are assumed to respond in a comparable way to external and common shocks, despite the variation in economic and financial development. The fixed effects can account for idiosyncratic factors influencing each country’s responses. Moreover, our focus is evaluating the effects of two sources of external liquidity shocks rather than comparing economic mechanisms across cross-sectional units (countries). Additionally, having common reduced form parameters \({A}_{1}, {A}_{2\cdots },{A}_{l}\) and \({B}_{q}\) across countries allows for a concise representation of relationships between variables. This shared structure can make the estimation process more efficient, especially when dealing with a small data sample. Models that allow heterogeneous and time-varying dynamics in the parameters are computationally intensive, requiring large amounts of data but are unable to attain efficiency gain by leveraging common features in the dynamics of endogenous variables across cross-sectional units (Georgiadis 2012).

The parameters in PVARX shown in Eq. (2) may be estimated jointly with the fixed effects or, alternatively, with ordinary least squares (OLS) but with the fixed effects removed after some transformation on the variables. However, the presence of lagged dependent variables in the right-hand side of the system of equations may lead to biased estimates even with large N (Nickell 1981). Following Abrigo and Love (2016), we estimate PVARX using GMM with the Helmert forward mean-differencing transformation that controls for country fixed effects while preserving the orthogonality between the endogenous variables and their lags. We use 2 lags of dependent variables as instruments for GMM estimation and rely on J-statistics to check the validity of the instrument set. GMM provides consistent estimates of the PVARX parameters even for a panel with large N and small T.

Abrigo and Love (2016) propose the following transformed PVARX model based on Eq. (2):

If the original value is defined as \({x}_{it},\) the first difference (FD) transformation is \({x}_{it}^{*}={x}_{it}-{x}_{it-1}\), while the forward orthogonal deviation implies \({x}_{it}^{*}={(x}_{it}-\overline{{x }_{it}})\sqrt{{T}_{it}/({T}_{it}+1)}\) where \({T}_{it}\) represent the number of available future observations for panel i at time t, and \(\overline{{x }_{it}}\) is the mean value of all available future observations.

We verify the robustness of PVARX-GMM estimates by assessing the eigenvalue stability condition and conducting the impulse response functions (IRFs) to analyze the dynamic response of endogenous variables to global liquidity shocks. Since our focus is exclusively on the endogenous responses to exogenous shocks, the PVARX framework becomes a useful representation of data dynamics, free from any imposed identifying assumptions. Consequently, we avoid the arbitrary nature inherent in numerous identification schemes employed in the existing literature.

3.1 Global liquidity variables

We distinguish between two sources of global liquidity: policy-driven liquidity (or official liquidity) caused by AEs’ monetary policies and market-driven liquidity (or private liquidity) generated by the global banking system.

The monetary policy stance of major countries is proxied by the US shadow-fed funds rate, developed by Wu and Xia 2016 from an estimated term structure model, and by changes in the size of the Fed’s balance sheets. The literature has demonstrated that US monetary policy serves as an effective gauge of global financial conditions (Cerutti et al. 2017). Since the 2007–2008 GFC, federal funds rates have reached their effective lower bound, leading major central banks to rely on unconventional policy tools like QE to influence the economy. Consequently, policy and short-term money market rates no longer adequately reflect liquidity conditions. In these “zero-lower bound” environments, the shadow rate has been widely used to measure the stance of monetary policy and the Fed’s easing (Krippner 2013; Wu and Xia 2016). In addition, LSAPs have expanded the Fed’s balance sheet, resulting in abundant global liquidity (Tillmann 2016). Therefore, we include another proxy, changes in the Fed's balance sheet, to reflect exogenous innovations in unconventional monetary policy and the central banks’ adjustments to the state of the economy (Anaya et al. 2017). These two proxies represent price-based and quantity-based measures of global liquidity created by AEs’ policy stance. It is important to note the differing nature of these two proxies used to measure policy-driven global liquidity. An increase in the Fed’s asset size represents expansionary monetary policy and results in a surge in global liquidity, whereas an increase in the shadow-fed funds rate is associated with a tightened monetary policy and a decrease in global liquidity. To ensure consistency in conveying policy-driven liquidity, we convert the shock to the shadow-fed funds rate into a negative shock by multiplying it by minus one (− 1). For comparison purposes, we also analyze global liquidity shock generated by the BoJ’s monetary policy by including changes in the BOJ’s asset size and the Japan shadow short rate estimated and provided by (Krippner 2016)Footnote 1 via the website www.ljkmfa.com.

The market-driven global liquidity, also known as private liquidity, is proxied by the BIS’s global liquidity indicator (GLI). This indicator is estimated based on changes in cross-border bank credit flows from AEs to EMEs. The GLI tracks credit provided by BIS-reporting banks in AEs to non-bank borrowers in EMEs. This coverage includes both loans extended by banks and funding obtained from global bond markets through the issuance of international debt securities. As detailed in the BIS’s document explaining the GLI methodology,Footnote 2 financial institutions play a critical role in providing market liquidity to securities markets and funding borrowers through their trading and lending activities. This indicator relies on national data and BIS international banking and financial statistics. The country grouping used in BIS statistical commentaries align with the classification in the BIS Annual Economic Report. These groupings comprise: (1) AEs: Australia, Canada, Denmark, the euro area and small European economies, Iceland, Japan, New Zealand, Norway, Sweden, Switzerland, the United Kingdom, the United States and the overseas and dependent territories of these AEs; (2) EMEs: Algeria, Argentina, Brazil, Chile, China, Colombia, Czechia, Hong Kong SAR, Hungary, India, Indonesia, Israel, Korea, Kuwait, Malaysia, Mexico, Morocco, Peru, the Philippines, Poland, Romania, Russia, Saudi Arabia, Singapore, South Africa, Thailand, Turkey, the United Arab Emirates and Vietnam. The BIS has estimated total credit to non-bank borrowers denominated in 3 different currencies: USD, Euro and Yen. Given the dominant position of USD in cross-border lending (Bruno and Shin 2015) and the significant role of Japanese banks in providing credit to Asia (Cerutti et al. 2017), we have included credit flows denominated in both USD and Yen.

Risk aversion that is included as a mechanism between policy- and market-driven liquidity is proxied by the Chicago Board Options Exchange's CBOE Volatility Index (VIX). The VIX is widely used measure of stock market’s expectation of short-term volatility, based on S&P 500 index option. Additionally, VIX is considered a risk-based measure of global liquidity since global liquidity is influenced by conditions in the global financial system (Domanski et al. 2011). However, this study does not incorporate VIX as the third source of exogeneous global liquidity shock in PVARX setup because risk aversion is influenced by a multitude of factors beyond liquidity risks, such as credit and counterparty risks. It is indeed challenging to disentangle these factors from the risk premium (Gefang et al. 2011; Helwege et al. 2014; Schwarz 2019).

3.2 Endogenous variables

The selection of macro-financial variables for Asia–Pacific countries is based on extensive literature, highlighting that the effects of monetary shocks are transmitted to the real economy through various channels (Belke et al. 2010; Brana et al. 2012; Kim 2001; Mishkin 1995; Shah and Kundu 2023; Sousa and Zaghini 2008). Specifically, Mishkin (1995) identified four primary channels: interest rate, exchange rate, asset price and the credit channel. Therefore, we include the following variables: stock prices, foreign exchange rates (FOREX), short-term interest rates (IRR), inflation (CPI) and real GDP growth rates (GDP). This set of domestic variables allows us to assess the effectiveness of both traditional bank lending and asset-price channels.

We utilize quarterly data spanning from 2000-Q1 to 2022-Q4, sourced from various databases including IMF-IFS, Fred-economic data, BIS’s global liquidity statistics and Bloomberg terminal. Table 1 provides the definitions of variables employed in Eqs. (1) and (2), while Table 2 summarizes their descriptive statistics. To meet the stationary requirement of VAR and PVARX models, we transformed the variables into logarithmic or percentage changes, except for interest rates and VIX. The overall mean of IRR of 7.092 corresponds to 7.092%. For the set of macro-financial variables (GDP, CPI, IRR, FOREX and SP), which are cross-country data, we report statistics of the overall sample (N = 712 country-time observations), between groups (n = 8 countries) and within groups (T = 89 quarters starting from 2000Q2 to 2022Q4).

To provide an overall perspective on the evaluation of global liquidity throughout the analyzed period, we present key metrics for global credit supply and global monetary policy in Figs. 1 and 2. Figure 1 illustrates that the total USD-denominated credit from AEs to EMEs’ non-bank borrowers exhibit a consistent upward trend, starting at USD bn. 947 in 2000 and reaching USD bn. 5155 in 2022. However, the annual percentage change reveals fluctuations, marked by a significant decrease in 2009 following the outbreak of the GFC. The lower panel of Fig. 1 shows the evolution of yen-denominated credit flows, which displays similar behavior but with a higher degree of volatility compared to USD-denominated flows. Figure 2 describes policy-driven liquidity conditions, captured by the Fed’s balance sheet and interest rate policy. The data in the left panel demonstrate the growth of Fed’s total assets over time. The Fed’s balance sheets expanded significantly since 2009 but experienced a slight contraction in 2013 when the Fed announced its “taper tantrum” reducing the pace of asset purchases and the amount of money injected into the economy. The right panel of Fig. 2 presents the shadow-fed funds rate, which exhibited a sharp downward trajectory following the outbreak of the GFC and the subsequent aggressive policy rate cuts, dipping into negative values from 2010 to 2016.

Source: Bloomberg Terminal & Wu and Xia (2016)’s data: https://sites.google.com/view/jingcynthiawu/shadow-rates

Fed’s total assets and shadow funds rate by Wu and Xia (2016).

4 Heterogeneous effects of policy- and market-driven liquidity to Asia–Pacific countries

Our empirical analysis consists of two steps. First, we obtain shocks from policy- and market-driven liquidity, assuming a lead–lag interaction between them, using the VAR model (Eq. 1) with Cholesky decomposition. We assume that the risk version shock does not impact market-driven nor policy-driven liquidity. Our assumption about the interaction between market-driven and policy-driven liquidity is grounded in the traditional money multiplier concept. According to Domanski et al. (2011), central banks create official liquidity by setting the risk-free interest rate and the amount of funds available to the payment system, which subsequently serves as the cornerstone for the creation of private liquidity. However, during crisis periods, private liquidity often dissipates, leading global liquidity to condense into its official constituent. Additionally, private capital flows may contribute to the accumulation of foreign exchange reserves, thereby increasing official liquidity and further promoting financial easing. In the second step, we incorporate both sources of global liquidity shocks, obtained from VAR estimated in the first step, as exogeneous variables into the PVARX model. The reactions of macro-financial metrics are derived from IRFs based on PVARX estimation assuming the following ordering of the Cholesky decomposition for endogenous variables to identify shocks: \({\text{GDP}} \to {\text{CPI}} \to {\text{IRR}} \to {\text{FOREX}} \to {\text{SP}}\). Our primary interest lies in the impact of exogeneous global monetary shocks on the economic output of Asia–Pacific countries, while the other variables represent different transmission mechanisms discussed in the literature on monetary policy spillovers. Stock prices are typically very sensitive to news and tend to react quickly to contemporaneous changes in all other variables, whereas exchange rates, interest rates, and CPI may be influenced by interventions by local central banks. In both steps, we employ Hannan–Quinn information criteria (HQC) and Schwarz information criteria (SBIC) to select the lag order, which suggest one-to-two lags for VAR and two lags for PVARX. Global liquidity shocks enter the PVARX model with one contemporaneous and two lagged terms.

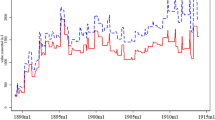

Figure 3 plots the history of each of the shocks obtained from VAR model expressed in Eq. 1. The shocks to USssr and JPssr are highly correlated, exhibiting significant variability during the periods of 2007–2008 and 2011–2014. This was marked by a substantial decline in both US and Japanese interest rates due to the GFC. The GFC prompted major central banks to implement QE and unconventional measures to support their respective economies and financial systems. The BoJ's balance sheet residuals experienced notable movements during the first unconventional policy period from 2001Q1 to 2006Q1, while the GFC was the primary factor causing pronounced fluctuations in the Fed's total assets. The GLIjp shock exhibited heightened volatility during the timeframe from 2013 to 2021, primarily influenced by events such as the taper tantrum in 2013 and the Abenomics policy spanning from 2013 to 2019. Additionally, the COVID-19 pandemic in 2020 also contributed to increased volatility. The pandemic triggered a worldwide economic downturn, surging risk aversion, and leading to a reduction in Japan's current account surplus and capital outflows.

The estimated global liquidity shocks over time. Notes Nshock_USssr and Nshock_JPssr denote negative shocks to USssr and JPssr, respectively. Estimated shocks were obtained from VAR model expressed in Eq. (1). USssr, JPssr, Fedasset and JPasset are proxies of policy-driven liquidity, GLIus and GLIjp represent market-driven liquidity proxies

Figure 4 depicts the average responses of Asia–Pacific macro-financial variables to both sources of exogenous shocks over a 10-quarter period (equivalent to 2.5 years). Confidence bands at 95% level are estimated using 200 Monte Carlo simulations. The IRFs clearly indicate that effects of policy- and market-driven liquidities are not uniform. Specifically, market-driven liquidity shocks lead to significant adjustments in all macro-financial variables, including SP, FOREX, IRR, CPI and GDP. Stock prices exhibit a positive association with market liquidity, rising by more than 0.5 percentage points immediately after the shock. This upward effect on stock returns aligns with existing literature highlighting the crucial role of capital inflows associated with excess liquidity in driving up asset prices in EMEs (Anaya et al. 2017; Brana et al. 2012; Gupta et al. 2017). However, this effect is observed in Asian countries in the short run, within a single period. Surges in cross-border credit also exert appreciation pressure on domestic currencies, as evident from the immediate drop of FOREX series by more than 0.2 percentage points. Additionally, we observe a slight increase in interest rates, possibly due to exchange rates pressures. A stronger local currency reduces the competitiveness of domestic industries relying on exports. To counteract this, central banks might intervene by purchasing foreign currencies, affecting the money supply and interest rates. However, the upward effect on IRR is significant only for the first period, as its temporary adjustment may be offset by international monetary policy cooperations (i.e., Asian central banks may align their policy rate cuts with those of AEs). A positive shock in cross-border credit also stimulates inflation and economic output for more than one period, eventually returning to the initial levels. Conversely, official liquidity shocks generated by the Fed’s policy adjustments significantly affect only stock prices, evidenced by an immediate 2-percentage-point jump in SP, followed by a sharp reversal. These effects of both sources of global liquidity on stock prices underscore the strong interconnection between monetary conditions and financial market sentiment, highlighting the importance of the risk-taking channel of monetary policy (Borio and Zhu 2012).

We now replace Wu and Xia (2016)’s shadow-fed funds rate with Krippner (2016)’s short-term shadow rate and re-estimate the PVARX model. The IRFs are obtained and presented in Fig. 5. Overall, the effects of market-driven liquidity, as captured by GLIus, are highly consistent with those presented in Fig. 3. However, the effects of shocks to US short-term shadow rate (USssr) turn out to be insignificant. In Fig. 6, we display the IRFs to shocks in Fed assets (i.e., a quantity measure of global liquidity). Similar to what is shown in Figs. 4 and 5, all macro-financial variables exhibit significant reactions to a positive shock in USD-denominated cross-border credit flows. This leads to an increase in stock prices, interest rates, inflation, and economic output, but a decrease in FOREX rates. Conversely, shocks to the Fed’s balance sheet adjustments do not appear to have a considerable influence, which diverges from previous literature that emphasized the large and significant Fed’s policy spillovers to the rest of the world. One plausible explanation is that most impactful policy changes in our sample were communicated in advance, rather than arriving as unexpected shifts in the short-term policy direction and that different Fed’s policy measures may yield different impacts (Georgiadis and Jarocinski 2023). It appears that Asia–Pacific economies are more vulnerable to market-driven liquidity rather that policy-driven liquidity, as all macro-financial metrics were affected by foreign liquidity shocks generated by the global banking system. However, the impact of global liquidity on Asia–Pacific region is relatively short-lived, losing statistical significance within 1–2 quarters. Our empirical results seem to contradict those of Choi et al. (2017), who emphasized the dominant role of policy-driven liquidity over market-driven liquidity in terms of impacts on EMEs. These contrasting results may be attributed to the specific economic structure and financial dynamics of the Asia–Pacific region. Most countries in this region are export-oriented and heavily integrated into the global supply chain, making them highly susceptible to fluctuations to external economic conditions. Additionally, the historical regional crisis in 1997 contributes to their vulnerability to market-driven liquidity shocks, which often result from sudden changes in investor sentiment, risk appetite and capital flows. In contrast, coordinated central bank actions and international monetary policy cooperation may mitigate the impacts of policy-driven liquidity.

We extend our analysis to estimate the effects of global liquidity shocks stemming from the BoJ’s monetary policy and yen-denominated cross-border credit flows. This extension is motivated by the critical role of the Japanese banking system in Asian markets. We use proxies for policy-driven liquidity, including changes in the BOJ’s balance sheets (JPasset) and the shadow short rate (JPssr), which was estimated and provided by Krippner (2016) using yield curve data spanning both unconventional and conventional monetary policy periods. Figures 7 and 8 illustrate the IRFs in response to exogenous market liquidity shocks originating from international credit supply denominated in yen and the policy shocks proxied by JPasset and JPssr, respectively. However, we observe significant effects of market-driven liquidity primarily on foreign exchange rates and inflation. The reactions of FOREX and CPI to GLIjp are quite similar to those of GLIus, although the magnitude of these effects differ. Specifically, surges in cross-border credit exert upward pressure on domestic currencies, leading to a decrease in FOREX by more than 0.05 percentage points. Simultaneously, those shocks boost CPI, with the boosting effects persisting for 3 periods. In contrast, excess liquidity shocks resulting from BoJ’s adjustments in the shadow short rate yield a negative effect on inflation, while BoJ’s balance sheet changes temporarily depreciate Asian currencies. The temporary downward effect on Asian currencies can be attributed to shifts in market sentiment. When BoJ injects excess liquidity through QEs, the Japanese yen depreciates against the US dollar. A stronger US dollar subsequently impacts exchange rates in Asia–Pacific countries. Overall, regarding the effects of shocks in BoJ’s monetary policy, it appears that the exchange and interest rate channels appear to be more effective compared to the asset price channel.

The robustness of the results is checked with two alternative specifications. First, we change the ordering of endogenous variables in PVARX. Overall, changing the Cholesky ordering of endogenous variables does not result in significant changes in the adjustment of endogenous variables to global liquidity shocks when compared to the baseline models. Second, we investigate whether our empirical results are influenced by the Covid shock. We re-estimate the PVARX model using a subsample from 2000 to 2019, excluding the period from 2020 to 2022 when the world experienced a severe social–economic disruption due to the pandemic that originated in China in December 2019. The IRFs obtained for the non-Covid period align closely with those of the entire sample, affirming the robustness of our findings.

5 Conclusions

Global liquidity spillovers have garnered significant research attention and policy debates over the past decades. However, the failure to distinguish between the effects of policy-driven and market-driven global liquidity may lead to misinterpretations in empirical studies and hinder effective policy interventions. In this paper, we estimate the heterogeneous effects of these two components of global liquidity on eight Asia–Pacific countries from 2000 to 2022, encompassing various stages of international monetary stances and market volatility.

Using a panel VAR model with external driving forces within the GMM framework, we find that Asia–Pacific economies are more susceptible to shocks from market-driven liquidity rather than those stemming from policy-driven liquidity. Although this result contradicts previous studies, it reflects the regional specific characteristics. The impulse responses obtained from the PVARX-GMM estimates suggest that a positive shock in cross-border credit flows, especially those denominated in USD, boosts asset prices, inflation, and output, while also exerting appreciation pressure on exchange rates. Additionally, there is a temporary upward adjustment in short-term interest rates following the same shock. However, shocks to the shadow-fed fund rate significantly impact only stock prices, which surge by 2 percentage points immediately after the shock and subsequently reverse sharply. Interestingly, we observe that adjustments in the BoJ’s monetary policy have a dominant impact compared to policy actions taken by the Fed in terms of their effects on Asia–Pacific macro-financial indicators. Excess liquidity shocks resulting from BoJ’s shadow short rate and balance sheet adjustments yield a negative effect on inflation and a temporary depreciation pressure on Asian currencies. In contrast, similar shocks resulting from changes in the Fed’s monetary policy do not significantly trigger responses in Asian economies. Regarding the relative efficacy of transmission mechanisms, exchange rates and interest rates appear to be more effective than asset prices in transmitting monetary policy shocks. However, all channels actively transmit shocks from market-driven liquidity.

The study’s findings hold significance both theoretically and in practical contexts. First, traditional economic theories focus on the global aggregates of broad money as a measure of global liquidity condition. The paper contributes theoretically by emphasizing the importance of distinguishing between liquidity spillovers originating from policy decisions in AEs and those resulting from market dynamics, particularly private banking sector activities. This finding implies that it is critical to distinguish between official and private liquidity, as they represent different market conditions and may create contradictory effects on EMEs. However, these two components of global liquidity closely interact (Domanski et al. 2011), and they should be considered together in international monetary model, whether in times of crisis or during normal times. Second, the paper challenges conventional wisdom by highlighting contradictory effects of liquidity shocks. Instead of policy-driven liquidity being the dominant factor, the study finds that market-driven shocks play a more substantial role in influencing macro-financial indicators in the Asia–Pacific economies. This challenges existing theoretical framework and calls for a revaluation of the drivers behind economic shifts in the region. It highlights that the source of the liquidity shocks is crucial in assessing their impact on regional economies. Market liquidity, driven by private sector, depends on the willingness of financial institutions to take on risk. Therefore, it can either dampen or amplify policy-driven liquidity. Third, in theory, international monetary spillovers can be explained via two transmission mechanisms: trade and financial channels. Under international capital mobility, financial channel works through capital flows and exchange rates, which determine the relative valuation of financial assets denominated in different currencies (Ca’Zorzi et al. 2020). Our study emphasizes the role of cross-border credit flows, particularly those denominated in US dollars, in triggering liquidity shocks and subsequently influencing asset prices, interest rate, inflation, and economic output in Asia–Pacific countries. This result aligns with structural models and previous literature featuring international monetary policy spillovers transmitted through financial channels centering on global risk’ aversion (Akinci and Queralto 2018). Fourth, the relative importance of monetary transmission mechanism differs depending on the source of the liquidity shocks. All asset price and traditional bank lending channels actively transmit shocks from market-driven liquidity; however, exchange rates and interest rates are more effective in transmitting policy-driven liquidity shocks associated with BoJ’s monetary adjustments.

From policy perspectives, the paper suggests that market-driven liquidity shocks can lead to appreciation pressure on domestic currencies and a short-term rise in interest rates. Policymakers need to be cognizant of these dynamics when formulating exchange rate and interest rate policies. It highlights the importance of adopting a flexible approach to navigate through short-term fluctuations in response to market-driven liquidity shocks. An intriguing aspect of the paper is the unexpected finding that Asian responses to financial easing associated with changes in the Fed's monetary policy are not pronounced. This suggests a nuanced relationship between the Asia–Pacific region and the Fed's monetary policy changes, contrary to expectations. However, our findings that excess liquidity shocks stemming from the BoJ's adjustments in shadow short rates and balance sheets have negative effects on inflation and temporarily depreciate Asian currencies. These findings suggest that there might be a need for improved global monetary policy coordination. Understanding the varying responses to different types of liquidity shocks can inform international efforts to mitigate potential spillover effects and enhance global financial stability. Additionally, the contributions of unconventional monetary policy shocks to macro-financial adjustments in EMEs differ significantly in the short-run and long-run. Potential effects of an exit plan of monetary expansion and the transmission to a "new normal" economy should also be considered through scenario analysis. Finally, the international transmission of monetary policy and global liquidity in EMEs depends on various factors, including fundamentals, foreign-exchange regimes, the degree of capital mobility and financial integration, and the flexibility of domestic monetary policies in response to external shocks. Future research should address these factors within a broader context.

Data availability

The data supporting the findings of this study are available from the corresponding author upon request.

Notes

While the shadow rates estimated by Wu and Xia (2016) have been widely used in measuring monetary policy stance in AEs, they are only available for the USA, Euro-area and the UK.

See the methodology for GLI by BIS from https://www.bis.org/statistics/gli/gli_methodology.pdf

References

Abrigo MR, Love I (2016) Estimation of panel vector autoregression in Stata. Stata J 16(3):778–804. https://doi.org/10.1177/1536867X1601600314

Akinci O, Queralto A (2018) Exchange rate dynamics and monetary spillovers with imperfect financial markets. SSRN Electron J. https://doi.org/10.2139/ssrn.3395526

Anaya P, Hachula M, Offermanns CJ (2017) Spillovers of US unconventional monetary policy to emerging markets: the role of capital flows. J Int Money Financ 73:275–295

Avdjiev S, Gambacorta L, Goldberg LS, Schiaffi S (2020) The shifting drivers of global liquidity. J Int Econ 125:103324. https://doi.org/10.1016/j.jinteco.2020.103324

Bank W (2017) East Asia and Pacific Economic Update, April 2017: Sustaining Resilience. World Bank

Barrot L-D, Calderón C, Servén L (2018) Openness, specialization, and the external vulnerability of developing countries. J Dev Econ 134:310–328. https://doi.org/10.1016/j.jdeveco.2018.05.015

Belke A, Orth W, Setzer R (2010) Liquidity and the dynamic pattern of asset price adjustment: a global view. J Bank Financ 34(8):1933–1945

Belke A, Bordon IG, Volz U (2013) Effects of global liquidity on commodity and food prices. World Dev 44:31–43. https://doi.org/10.1016/j.worlddev.2012.12.009

Borio C, Zhu H (2012) Capital regulation, risk-taking and monetary policy: a missing link in the transmission mechanism? J Financ Stab 8(4):236–251. https://doi.org/10.1016/j.jfs.2011.12.003

Brana S, Djigbenou M-L, Prat S (2012) Global excess liquidity and asset prices in emerging countries: a PVAR approach. Emerg Mark Rev 13(3):256–267

Bruno V, Shin HS (2015) Cross-border banking and global liquidity. Rev Econ Stud 82(2):535–564. https://doi.org/10.1093/restud/rdu042

Ca’Zorzi M, Dedola L, Georgiadis G, Jarocinski M, Stracca L, Strasser G (2020) Monetary policy and its transmission in a globalised world

Cerutti E, Claessens S, Ratnovski L (2017) Global liquidity and cross-border bank flows. Econ Policy 32(89):81–125. https://doi.org/10.1093/epolic/eiw018

Cesa-Bianchi A, Cespedes LF, Rebucci A (2015) Global liquidity, house prices, and the macroeconomy: evidence from advanced and emerging economies. J Money, Credit Bank 47(S1):301–335. https://doi.org/10.1111/jmcb.12204

Choi WG, Kang T, Kim G-Y, Lee B (2017) Global liquidity transmission to emerging market economies, and their policy responses. J Int Econ 109:153–166. https://doi.org/10.1016/j.jinteco.2017.08.001

Das SB, Menon J, Severino RC, Shrestha OL (2013) The ASEAN economic community: a work in progress (vol. 14). Institute of Southeast Asian Studies

Djigbenou-Kre M-L, Park H (2016) The effects of global liquidity on global imbalances. Int Rev Econ Financ 42:1–12

Domanski D, Fender I, McGuire P (2011) Assessing global liquidity. BIS Quarterly Review. https://ssrn.com/abstract=1971208

Eickmeier S, Gambacorta L, Hofmann B (2014) Understanding global liquidity. Eur Econ Rev 68:1–18. https://doi.org/10.1016/j.euroecorev.2014.01.015

Gefang D, Koop G, Potter SM (2011) Understanding liquidity and credit risks in the financial crisis. J Empir Financ 18(5):903–914

Georgiadis G, Jarocinski M (2023) Global spillovers from multi-dimensional US monetary policy. ECB Working Paper Series No 2881. https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2881~a2c5c8070a.en.pdf?2b1e4e1086b6dab3280a0feba0de5e6e

Georgiadis G (2012) The panel conditionally homogenous vector-autoregressive model. Available at SSRN 2031494. https://doi.org/10.2139/ssrn.2031494

Glick R, Spiegel MM (2015) Policy challenges in a diverging global economy: conference summary (Asia Economic Policy Conference, Issue). https://www.frbsf.org/economic-research/events/2015/november/2015-asia-economic-policy-conference/

Gupta P, Masetti O, Rosenblatt D (2017) Should emerging markets worry about US monetary policy announcements? World Bank Policy Research Working p (8100)

He D, McCauley RN (2013) Transmitting global liquidity to East Asia: policy rates, bond yields, currencies and dollar credit. Bank for International Settlements

Helwege J, Huang J-Z, Wang Y (2014) Liquidity effects in corporate bond spreads. J Bank Financ 45:105–116

Honda Y, Kuroki Y, Tachibana M (2013) An injection of base money at zero interest rates: empirical evidence from the Japanese experience 2001–2006. Jpn J Monet Financ Econ 1(1):1–24

IMF (2023, Oct 2023) World Economic Outlook 2023: navigating global divergences. IMF Library, Oct 2023. https://www.elibrary.imf.org/display/book/9798400235801/9798400235801.xml

Jarociński M (2010) Responses to monetary policy shocks in the east and the west of Europe: a comparison. J Appl Econom 25(5):833–868. https://doi.org/10.1002/jae.1082

Kapetanios G, Mumtaz H, Stevens I, Theodoridis K (2012) Assessing the economy-wide effects of quantitative easing. Econ J. https://doi.org/10.1111/j.1468-0297.2012.02555.x

Kim S (2001) International transmission of US monetary policy shocks: evidence from VAR’s. J Monet Econ 48(2):339–372. https://doi.org/10.1016/S0304-3932(01)00080-0

Kolasa M, Wesołowski G (2020) International spillovers of quantitative easing. J Int Econ 126:103330

Krippner L (2013) Measuring the stance of monetary policy in zero lower bound environments. Econ Lett 118(1):135–138. https://doi.org/10.1016/j.econlet.2012.10.011

Krippner L (2016) Documentation for measures of monetary policy. Reserve Bank of New Zealand. Wellington, New Zealand. https://www.ljkmfa.com/

Landau J (2011) Global liquidity-concept, measurement and policy implications. CGFS Pap 45:1–33

Lee MIH, Choi WG (2010) Monetary transmission of global imbalances in Asian countries. International Monetary Fund

Mishkin FS (1995) Symposium on the monetary transmission mechanism. J Econ Perspect 9(4):3–10

Nickell S (1981) Biases in dynamic models with fixed effects. Econom J Econom Soc. https://doi.org/10.2307/1911408

Psalida MLE, Sun T (2011) Does G-4 liquidity spill over? International Monetary Fund

Schwarz K (2019) Mind the gap: disentangling credit and liquidity in risk spreads. Rev Financ 23(3):557–597

Shah AI, Kundu S (2023) Asymmetric effects of monetary policy: evidence from India. Empir Econ. https://doi.org/10.1007/s00181-023-02453-3

Sousa JM, Zaghini A (2007) Global monetary policy shocks in the G5: A SVAR approach. J Int Finan Markets Inst Money 17(5):403–419

Sousa J, Zaghini A (2008) Monetary policy shocks in the euro area and global liquidity spillovers. Int J Financ Econ 13(3):205–218. https://doi.org/10.1002/ijfe.320

Sun T (2015) The impact of global liquidity on financial landscapes and risks in the ASEAN-5 Countries. International Monetary Fund

Tillmann P (2016) Unconventional monetary policy and the spillovers to emerging markets. J Int Money Financ 66:136–156. https://doi.org/10.1016/j.jimonfin.2015.12.010

Tillmann P, Kim GY, Park H (2019) The spillover effects of US monetary policy on emerging market economies. Int J Financ Econ 24(3):1313–1332. https://doi.org/10.1002/ijfe.1720

Tillmann P (2017) Global Liquidity and the Impact on SEACEN Economies. Res Stud

Wu JC, Xia FD (2016) Measuring the macroeconomic impact of monetary policy at the zero lower bound. J Money, Credit Bank 48(2–3):253–291. https://doi.org/10.1111/jmcb.12300

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors hereby confirm that there are no conflicts of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Le, C., Nguyen, H. & Vo, D. Global liquidity spillovers in the Asia–Pacific region: policy-driven versus market-driven effects. Empir Econ (2024). https://doi.org/10.1007/s00181-024-02573-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s00181-024-02573-4