Abstract

The recent boom in house prices in many countries during the COVID-19 pandemic and the possibility of household financial distress are of concern among some central banks. We revisit the empirical modelling of house prices and household debt with a policy-oriented perspective using Norwegian data over the last four decades within the cointegrated VAR model. Our findings suggest, in line with previous work, a long-run mutually reinforcing relationship between these financial magnitudes, and thus the potential for the build-up of financial instabilities and spillover effects to the real economy. Applying a policy control analysis, we find that both house prices and debt are controllable magnitudes to some pre-specified target levels through the mortgage interest rate, which enables the central bank to reduce large fluctuations and bubble tendencies in the housing market. The present control analysis thus provides some useful policy implications from empirically relevant representations of two important financial factors entering the decision process of the policy maker.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The substantial deregulation of housing markets in the 1980s enhanced the exposures from imbalances in these markets to the real economy in many countries. The role of the housing market in the real economy depends inter alia on the transmissions of wealth effects to private consumption, see e.g. Aron et al. (2012) and Mian et al. (2013), the interactions with the credit market and the households’ access to mortgage credit, see e.g. Fitzpatrick and McQuinn (2007) and Gimeno and Martinez-Carrascal (2010), and the residential investments of entrepreneurs, see e.g. Leamer (2015) and Aastveit et al. (2019). For an overview of main transmission channels from the housing market to the real economy of monetary policy, see e.g. Boivin et al. (2011).

Over the past three decades, there are several examples in which imbalances in the housing market have substantially affected the real economy. The banking crisis in Norway that took place in a 5 years period from 1988 is a clear example where a collapse in house prices was followed by a long-lived recession in the real economy and more than a doubling of the unemployment rate, see Moe et al. (2004) and Eitrheim et al. (2016, chapter 14). The global financial crisis in 2008 with a significant bust in house prices in many countries and a subsequent deep downturn in the world economy is another example emphasising the spillovers from the housing market to the real economy, see e.g. Mian et al. (2013). Recently, a house price boom was experienced in many economies during the COVID-19 pandemic and some central bankers worry about financial distress among households and thereby the possibility of amplifying effects on the ongoing real economic downturn.Footnote 1 As an example, the actual Norwegian house prices were, according to a bubble index developed by the Housing Lab at Oslo Metropolitan University, overvalued by as much as 25% compared to their underlying fundamental prices in 2021. The same bubble index shows that actual Norwegian house prices were overvalued by around 7% on average in the 2-years period before the global financial crisis and by around 12% on average in the years 2017 and 2018.Footnote 2

Against this background, the monetary authorities’ ability to contribute to a more stable development in financial magnitudes, including house prices and household debt, is potentially important in reducing fluctuations in the real economy. The question then is whether the authorities can influence the housing market, say by means of the key policy rate, in order to stabilise both house prices and household debt as a part of stabilising inflation and GDP growth. We investigate this question empirically using a control analysis within the context of a cointegrated VAR model and Norwegian data over the last four decades. The question of empirical controllability may not after all be obvious from the authorities point of view given the literature showing that changes in the fundamentals cannot account for the large fluctuations in house prices in many countries, see e.g. Bolt et al. (2019) and the references therein. We therefore believe it is worthwhile to show quantitatively whether house prices and household debt are controllable variables by analyzing real-life time series data.

As in many other countries, Norway has an independent central bank. During the last two decades, from 2001, the monetary policy in Norway has been geared to stabilising inflation. The monetary policy shall also contribute to high and stable production and employment and counteract the build-up of financial imbalances. In its decisions on the key policy rate, Norges Bank often monitors the development in house prices and household credit to assess the status of the financial stability conditions, see e.g. Bank (2021). Since housing wealth constitutes the main part of households’ total wealth, the home-ownership rate is around 80% and the share of floating interest rates on mortgage to households is close to 95% in Norway, fluctuations in house prices, debt and interest rates usually translate into corresponding changes in private consumption, see Boug et al. (2021).Footnote 3 The central bank’s ability to control house prices and household debt is therefore essential for the wealth effects on consumption, and thereby on GDP.

The empirical literature on the housing market, and in particular on the fundamental drivers of house prices, is overwhelming, see Duca et al. (2021) for a recent and comprehensive overview. The Norwegian housing market has been studied in Bjørnland and Jacobsen (2010), Anundsen and Jansen (2013), Robstad (2018) and Anundsen (2019, 2021) among others. The econometric approaches, sample periods and data sets vary across these studies. Applying a structural VAR in GDP, inflation, domestic and foreign interest rates, the real exchange rate and the real house prices for the period from 1983 to 2006, Bjørnland and Jacobsen (2010) find that house prices react immediately and strongly to a temporary monetary policy shock of a one percentage point increase in the interest rate. After about 10 years, house prices are reduced by approximately 1.5% due to the monetary policy shock. Robstad (2018) extends the analysis in Bjørnland and Jacobsen (2010) by including household credit in real terms as an extra variable in the model. Overall, this study covering the period from 1994 to 2013 supports the findings in Bjørnland and Jacobsen (2010), while the household credit response to a monetary policy shock is relatively modest. By way of contrast, Anundsen and Jansen (2013) find a mutual long-run dependency between real house prices and debt over the period from 1985 to 2008 in the context of a partial cointegrated VAR which also includes household real disposable income, housing stock and the real after-tax interest rate. Anundsen and Jansen (2013) show that a permanent increase in the interest rate of one percentage point leads to a decrease in house prices of about 10% in the long run when the housing stock is fixed. Likewise, by linking real house prices to household real disposable income (per capita), the housing stock (per capita) and the real after-tax interest rate in a cointegrated VAR covering the period from 1986 to 1999, Anundsen (2019) finds a somewhat higher long-run negative house price response with respect to the interest rate of about 14%.Footnote 4

In this paper, we revisit the empirical modelling of house prices and debt in Anundsen and Jansen (2013) with a policy-oriented perspective. Our contribution is threefold. First, we set up a theoretical model similar to Anundsen and Jansen (2013), but extend the data set by one decade and model house prices, debt, disposable income, the housing stock and the interest rate jointly using a full cointegrated VAR. Applying likelihood-based methods, we identify two cointegrating relationships which are interpreted as a long-run house price relation and a debt relation similar to those in Anundsen and Jansen (2013). In particular, due to the mutual long-run dependency between house prices and debt, we find that a permanent increase in the interest rate of one percentage point leads to a decrease in house prices of about 15% when the housing stock is fixed. Hence, extending the sample period by 10 years after the financial crisis seems to suggest an increase in the long-run responsiveness of house prices to changes in the interest rate by around 5 percentage points compared to Anundsen and Jansen (2013). However, we show by means of recursive estimation that our estimate of the long-run interest rate effect is fairly stable over a substantial period of time since the mid-1990s. We therefore believe that the higher interest rate effect compared to Anundsen and Jansen (2013) simply reflects the difference in model specifications.

Then, we calculate the so-called persistence profiles for the two cointegrating vectors, relying on the methods in Pesaran and Shin (1996), to provide estimates of the speed with which the housing market returns to its equilibrium state after a system-wide shock. As pointed out by Pesaran and Shin (1996), the persistence profile approach is invariant to the way shocks in the underlying cointegrated VAR are orthogonalized, which is not true of the traditional impulse response analysis using a structural VAR. We find that around 80% and 90% of the adjustments towards equilibrium after a system-wide shock are made after 6 years in the cases of the house price relation and the debt relation, respectively. The slow speed of adjustment may be attributed to costly information gathering of housing opportunities in the market and government-imposed restrictions on housing trade by inter alia lending criteria based on payment-to-income ratios. Nevertheless, the fact that both cointegrating relationships eventually converge to zero provides further evidence that the house price relation and the debt relation indeed represent cointegrating relationships in line with the theory.

Finally, we apply the control analysis of non-stationary time series, as originally proposed by Johansen and Juselius (2001), see also Kurita (2018), to analyse whether the interest rate (real after-tax) can be used as an instrument in controlling house prices and debt within the cointegrated VAR model. Our control analysis thus addresses cointegration properties among non-stationary time series, an issue which is neglected in existing studies of the Norwegian housing market using a standard-type impulse response analysis of monetary policy based on a structural VAR. We are, of course, fully aware that the real after-tax interest rate cannot be treated as an explicit policy instrument by Norges Bank in the real world. However, Hungnes (2015) shows that a long-run one-to-one relationship exists between the money market rate, which is closely related to the key policy rate, and the interest rate on mortgage credit. Hence, the key policy rate in our modelling framework works implicitly through both components of the real interest rate; the nominal interest rate on household loans and the inflation rate. We demonstrate that both house prices and debt are controllable magnitudes to some pre-specified target levels through the real after-tax interest rate, which enables the central bank to reduce large fluctuations and bubble tendencies in the housing market. The present control analysis thus provides some useful policy implications from empirically relevant representations of two important financial factors entering the decision process of Norges Bank.

The rest of the paper is organised as follows: Sect. 2 outlines the theoretical background, Sect. 3 presents the data, Sect. 4 reports the findings from the cointegration analysis and Sect. 5 examines the empirical controllability of house prices and debt and conducts the policy simulation study. Section 6 provides some conclusions.

2 Theoretical background

In this section, we present an economic model for the interaction between house prices and debt, which serves as an impetus for the study of the Norwegian data. We follow Anundsen and Jansen (2013) in the formulation of the model, which is presented here as a simplified linear version so as to be able to directly test the validity of theoretical long-run economic relationships in the empirical framework in Sect. 4.

A commonly used theory for the fundamental drivers of house prices is the life-cycle model of housing where a representative agent maximises lifetime utility with respect to consumption of housing goods and other goods, see e.g. Meen (2002), Muellbauer and Murphy (1997, 2008) and Anundsen (2019). Augmenting this model with the presence of a credit market constraint faced by the agent, Anundsen and Jansen (2013) derive the equilibrium condition from the underlying maximisation problem as

where \(\mu _{h}/\mu _{c}\) is the marginal rate of substitution between housing and a composite consumption good, \(P_{t}\) is real house prices, \(R_{t}\) is the real after-tax interest rate, \(\delta _{t}\) is the depreciation rate of housing, \(E\varDelta P_{t+1}/P_{t}\) is the expected real rate of capital gain and \(\lambda _{t}\) is the shadow price of the credit constraint relative to the marginal utility of consumption, \(\mu _{c}\). The right hand side of (1) is, due to the credit market constraint, an extended version of the standard definition of the real housing user cost of capital. A common definition of \(R_{t}=(1-\varUpsilon _{t})I_{t}-\varDelta CPI_{t}/CPI_{t-1}\), where \(\varUpsilon _{t}\) is the rate of tax relief on mortgage interest payments, \(I_{t}\) is the nominal interest rate on mortgage credit and \(\varDelta CPI_{t}/CPI_{t-1}\) is the actual consumer price index inflation rate, is used as an operational measure for the direct real user cost of capital in (1).Footnote 5 Because the housing market also consists of rental housing, market efficiency requires the following condition to be fulfilled in equilibrium:

where \(Q_{t}\) denotes the real imputed rental price of housing services. It is common practice to interpret (2), either with or without a credit market constraint, as an inverted housing stock demand function. Also, simplified log-linearised versions of (2) are typically the basis for studies that explore house price determination, see e.g. Anundsen (2019) and the references therein. Assuming in line with Anundsen and Jansen (2013) that \(Q_{t}\), which is unobservable, is proportional to households’ real disposable income, \(Y_{t}\), and the real housing stock, \(K_{t}\), we may write (2) as

where \(\theta _{y}\) and \(\theta _{k}\) are expected to be non-negative coefficients. In order to operationalise (3) further, Anundsen and Jansen (2013) assume that (i) the depreciation rate of housing is constant in accordance with the National Accounts, (ii) the expected real rate of capital gain is captured, in line with Abraham and Hendershott (1996) and Gallin (2006), by lags of house price changes in the VAR model and (iii) the households’ real debt, \(D_{t}\), approximates the unobservable \(\lambda _{t} /\mu _{c}\) term. The latter assumption implies that \(\lambda _{t}\) may cointegrate with \(D_{t}\), \(Y_{t}\), \(K_{t}\) and \(R_{t}\). Hence, we may have two independent cointegrating vectors when the latent variable representing credit constraints (\(\lambda _{t}\)) is included in (3).Footnote 6 However, the number of cointegrating vectors may be reduced by one when the latent variable is not included in our analysis, giving rise to the possibility of one cointegrating vector consisting of only observable variables. A log-linearised version of such a cointegrating vector, augmented with a stochastic disequilibrium error \(\upsilon _{t}\), can then be written as

where lowercase letters indicate that the variables, except the interest rate, are log-transformed, \(c_{p}\) is a constant, the coefficient \(\theta _{d}\) is expected to be non-negative and the sign of \(\theta _{R}\) is theoretically ambiguous as the substitution effect between consumption of housing and other consumer goods underlying the life-cycle model may be either positive or negative.Footnote 7 This log-linearised equation embodies a static long-run equilibrium which determines the market clearing house prices for any given level of the housing stock. Hence, (4) can be seen as a candidate for a cointegrating combination between the observable variables \(P_{t}, D_{t}, Y_{t}, K_{t}\) and \(R_{t}\). We are therefore justified in the empirical analysis of the Norwegian data in exploring the possibility that

where I(j) denotes j-th order of integration, so that I(0) implies a stationary process.

Finally, Anundsen and Jansen (2013), inspired by Fitzpatrick and McQuinn (2007) among others, supplement the model for house prices with an equilibrium condition for \(D_{t}\), the log-linearised version of which can be presented as

where \(c_{d}\) is a constant, \(\nu _{t}\) is a stochastic error term and \(\phi _{p}\), \(\phi _{y}\), \(\phi _{k}\) and \(\phi _{R}\) are all expected to be non-negative.Footnote 8 Equation (6) defines households’ real debt as a function of real house prices, real disposable income, the housing stock and the real after-tax interest rate. Accordingly, banks may agree to provide more mortgage loans if households have more collateral, higher income or face lower interest expenses on mortgage credit. These arguments are consistent with the requirements for residential mortgage loans inherent in the Norwegian regulation of lending practices by banks and other financial institutions.Footnote 9 Again, (6) is subject to cointegration analysis, in which we investigate whether or not

Equations (5) and (7) together show the potential two-way link between house prices and debt in the housing market. Higher house prices give rise to more credit needed to finance a given housing purchase. Since higher house prices feed into increased value of households collateral, and thus their borrowing possibilities, banks may be willing to provide more loans to households. Increased borrowing by households is then likely to stimulate the house prices which eventually may provide a significant financial accelerator mechanism in the housing market. For this reason, central banks commonly monitor the development in both house prices and debt closely and maybe raise the interest rate in order to dampen the existence of a financial accelerator. As seen from (5) and (7), an increase in the real after-tax interest rate is likely to put downward pressure on both house prices and debt when the housing market is out of equilibrium.

Since we have a set of two candidates for the underlying long-run relationships, there are several directions conceivable in the cointegration analysis. If test statistics indicate a single cointegrating combination, for example, we will then find it important to check whether the relationship can be interpreted as the empirical counterpart of either (5) or (7). In this case, the sign of the coefficient for \(k_{t}\) and also for \(R_{t}\) if positive will play critical roles in the identification of (5) or (7), since they are opposite in these candidate long-run conditions. The revealed structure of adjustment towards a long-run relationship will also shed some light on the identification problem, see Johansen and Juselius (1994).

If the tests show evidence for two cointegrating combinations, as in Anundsen and Jansen (2013), we will have to explore various coefficient restrictions in such a way that the empirical relationships can be identified and interpreted as (5) and (7) together. We note that neither (5) nor (7) is distinguishable in a system of equations as they stand, since no identifying restrictions are pre-imposed on the coefficients at this stage. The arguments so far lead us to consider a vector of variables, \(X_{t}\), defined as

which is to be modelled as a full VAR as a point of departure for the cointegration analysis instead of a partial VAR employed from the outset by Anundsen and Jansen (2013). We thus assign importance to the fact that all the variables in \(X_{t}\ \)are inherently endogenous in an overall macroeconomic system. By opting for a full system if feasible in the empirical analysis, we follow the procedure recommended by Juselius (2006, p. 198) when estimating the long-run parameters of interest. Adopting the joint-model framework is also advantageous in that we can naturally estimate a long-run impact matrix required for the subsequent cointegrated VAR-based control analysis. Such an analysis enables us to examine the controllability of policy target variables through instrument variables and allows us to conduct various policy simulations. Further details will be provided in Sect. 5. Having established the theoretical background for the empirical analysis, we now turn to an overview of the data with particular attention to any observed relationships between \(p_{t},d_{t},y_{t},k_{t}\) and \(R_{t}\) and their time series properties.

3 Overview of data

The empirical analysis is based on quarterly, seasonally unadjusted data, published by Statistics Norway, that span the period 1982q1–2018q4. We measure the real house prices, \(p_{t}\), by the overall price index for residential buildings in the second-hand market; the household real debt, \(d_{t}\), by the total amount of outstanding gross household debt at the end of the quarter; and the household real disposable income, \(y_{t}\), by the disposable income excluding dividend payments. All of these variables in nominal terms are adjusted by the consumption deflator in the National Accounts. The real housing stock in fixed 2018-prices, \(k_{t}\), measures the total stock of housing at the end of the quarter and is in the National Accounts calculated by means of the perpetual inventory method. Finally, we measure the real after-tax interest rate, \(R_{t}\), by the average nominal interest rate paid by households on loans in private financial institutions net of the rate of tax relief and adjusted by the fourth-quarter ratio of the consumer price index.Footnote 10

Our chosen sample period is justified on several grounds. As described in Krogh (2010), the housing and capital markets were heavily regulated during the 1970s and early 1980s, which likely prevented the existence of a self-reinforcing relationship between house prices and credit. The housing market regulations, both with regard to quantities and prices, ended during the first half of 1982. The period of liberalisation of the credit markets took place in several steps between 1982 and 1985 to allow for competition among lending institutions in the household segment. As a result, an incipient boom in the real estate market was evident during the deregulation period, which was made possible through credit expansion to households combined with high marginal rates of tax relief on mortgages. We therefore argue that a self-reinforcing relationship between house prices and household debt was appearing during the deregulation period, and choose 1982q1 as the effective starting point for estimation purposes. Noticeably, our conclusions from the cointegration analysis in Sect. 4 remain intact with different choices of starting date during the deregulation period. Since 2018q4 is the data end point in our analysis, we extend the sample period in Anundsen and Jansen (2013) by 10 years or by a total of 40 quarterly observations. We do not include the years of the COVID-19 pandemic as the National Accounts figures are only preliminary and subject to later revisions.

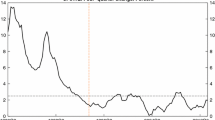

Real house prices (\(p_{t}\), panel a), household real debt (\(d_{t}\), panel a), real disposable income (\(y_{t}\), panel b), real housing stock (\(k_{t}\), panel c) and real after-tax interest rate (\(R_{t}\), panel d). Notes: Sample period: 1982q1–2018q4. The household real debt matches mean and range to the real house prices. Source: Statistics Norway

Figure 1 shows the time series \(X_{t}\) over the selected sample period. We observe that the aforementioned boom in the real estate market initiated by the deregulation period was followed by a huge drop in the real house prices (panel a) during the banking crisis in Norway between 1988 and 1993. After the banking crisis, the real house prices have increased almost steadily until 2018, only interrupted by a significant, but short-lived, fall in the aftermath of the financial crisis in 2008. Much the same picture can be said about the development in the household real debt, suggesting a close interdependency between \(p_{t}\) and \(d_{t}\) during the sample period. We also notice that the upward trending behaviour from the mid 1990s of both the real house prices and the household real debt is associated with increasing real disposable income (panel b) and real housing stock (panel c). These similarities in the trending behaviour of \(p_{t}\), \(d_{t}\), \(y_{t}\) and \(k_{t}\) may indicate the presence of co-trending among these time series, such that inclusion of a linear deterministic trend in the underlying VAR model of the cointegration analysis may not be necessary. The real after-tax interest rate (panel d) for its part reached a historically high level in the early 1990s in the wake of the huge boom in the real estate market. Since then the real after-tax interest rate has shown a downward trend and has reached negative levels as in the early 1980s by the end of the sample period, see Fig. 8 in “Appendix A” for the underlying movements in the components of \(R_{t}\). Hence, it seems to be a negative association between \(R_{t}\) and \(p_{t}\) and between \(R_{t}\) and \(d_{t}\) in accordance with the predictions from the theory outlined in Sect. 2.

The fact that the time series, overall, exhibit a clear trending behaviour with no apparent mean-reversion property suggests that \(X_{t}\) is a vector of non-stationary, I(1), time series. In addition, plotting the time series properties of \(\varDelta X_{t}=(\varDelta p_{t},\varDelta d_{t},\varDelta y_{y},\varDelta k_{t},\varDelta R_{t})'\), the first difference of the variables may be judged to be stationary, I(0), see Fig. 9 in “Appendix A”. Admittedly, \(\varDelta k_{t}\sim I(0)\) may be questionable as some persistence in the series is apparent around the middle of the sample period. However, based on a battery of Augmented Dickey–Fuller tests, albeit such tests are only indicative as pointed out by inter alia Juselius (2006, p. 297), \(X_{t}\) may be regarded as I(1), see Table 6 in “Appendix A”.Footnote 11 Therefore, we shall in line with Anundsen and Jansen (2013) treat \(X_{t}\) as I(1), such that a reduced rank VAR is a candidate as an empirical model.

4 Cointegration analysis

In this section, we carry out a multivariate cointegration analysis within the context of Johansen (1988, 1991, 1995).Footnote 12 First, we apply the trace test for cointegrating rank determination based on an estimated full VAR in \(X_{t}\). Then, we use likelihood ratio tests for various restrictions on the estimated cointegrating vectors in order to find a theory-consistent long-run structure between house prices and debt. Finally, we examine the persistence profiles of the estimated cointegrating vectors by means of Pesaran and Shin (1996) to shed light on the speed of adjustment towards equilibrium after a system-wide shock on the underlying cointegrated VAR.

4.1 Rank determination

As opposed to Anundsen and Jansen (2013), who worked with a partial VAR where the real housing stock and the real after-tax interest rate were conditioned upon from the outset, our point of departure is a p-dimensional unrestricted VAR of order k expressed as

where \(p=5\) is the number of variables in \(X_{t}\), \(\varPi _{1},\ldots ,\varPi _{k}\) are autoregressive coefficients, \(\vartheta \) represents a vector of constant terms, \(\rho _0\) includes coefficients of a linear deterministic trend t, \(\delta \) includes coefficients of seasonal dummies \(D_{t}\), \(\varepsilon _{k+1},\ldots ,\varepsilon _{T}\) are independent Gaussian innovations with expectation zero and variance-covariance matrix \(\varOmega \) and T is the total number of observations (excluding lags). The initial observations \(X_{-k+1},\ldots ,X_{0}\) are kept fixed. Under the assumption that \(X_{t}\) is I(1), the presence of cointegration implies \(1\le r \le p-1 = 4\), where r denotes the rank or the number of cointegrating vectors of the impact matrix \(\varPi =\varPi _{1}+\cdots +\varPi _{k}-I\). The null hypothesis of r cointegrating vectors can be formulated as \(H_{0}\): \(\varPi =\alpha \beta ^{\prime }\), where \(\alpha \) and \(\beta \) are matrices of adjustment coefficients and cointegration coefficients, respectively, and \(\beta ^{\prime }X_{t}\) comprises r cointegrating linear combinations. For future reference, we write the equilibrium correction form of (8), the cointegrated VAR (CVAR), as

where the linear trend is restricted to lie within the cointegrating space, \(\rho = \alpha \rho _0\), thereby addressing the observed trending behaviour and possibly co-trending behaviour in the time series, and the deterministic components (constant terms and seasonal dummies) are unrestricted in (9). The parameters of the model are \(\alpha ,\beta \in \textbf{R}^{p\times r}\) for \(r<p\), \(\varGamma _{i}\in \textbf{R}^{p\times p}\), \(\vartheta \in \textbf{R}^{p}\), \(\rho \in \textbf{R}^{r}\) and \(\delta \in \textbf{R}^{p\times 3}\); all of them vary freely. The variance-covariance matrix \(\varOmega \in \textbf{R}^{p\times p}\) is positive definite.

Cheung and Lai (1993) point out that the trace test is rather sensitive to under- parametrization and not so to over-parametrization in the lag length of the VAR. According to both Akaike’s information criterion, likelihood ratio tests of sequential model reduction and misspecification tests of the residuals, the VAR in our case should include six lags (\(k=6\)) as the premise for the cointegration analysis. Otherwise with fewer lags, the VAR suffers from severe autocorrelation in the residuals, particularly in the equations for the real house prices and the real housing stock. Also, the sixth lag of \(p_{t}, d_{t}\) and \(k_{t}\) are all strongly significant in the model. We notice that nine dummy variables being 1 in 1986q1, 1987q1, 1987q3, 1995q4, 2002q3, 2003q1, 2003q2, 2008q4 and 2015q2, and 0 otherwise, are added unrestrictedly to the VAR(6). The decision to include these dummy variables was made by the statistical criterion of residuals exceeding 2.5 standard errors. The dummy variables may be associated with the abnormal upswing in the real estate market in 1986 and 1987, the revisions of household disposable income in the National Accounts in 1995, 2002 and 2015,.Footnote 13 the substantial fluctuations in electricity prices, and hence in the consumption deflator, in 2003, and the financial crisis in 2008. We emphasise that using the dummy variables for large outliers does not alter the conclusions from the cointegration analysis. In addition, the cointegration rank determination conducted below is not much sensitive when using VAR(5) instead of VAR(6). However, using VAR(3) or VAR(2) with severe autocorrelation in the residuals, the rank determination becomes more sensitive in our case. These findings coincide with the point by Cheung and Lai (1993) about the sensitivity of the trace test. We therefore argue that a well-specified VAR(6) should be used rather than a under-parameterised VAR(3) or VAR(2) in the cointegration analysis.

Table 1 displays a battery of misspecification tests for the VAR(6). Although the debt-equation still has significant, but not very strong, ARCH-effects and non-normality in the residuals, we judge the model to be well-specified and thus to be a valid statistical representation of the data. Generally speaking, cointegration analysis is quite robust against ARCH-effects, according to Hansen and Rahbek (1998), and non-normality caused by excess kurtosis, according to Gonzalo (1994). Based on the VAR(6) model, we now turn to the cointegration rank determination of the impact matrix \(\varPi =\alpha \beta ^{\prime }\) in (9). Table 2 reports trace test statistics for a sequence of null hypotheses of the rank order r. We conclude that \(r=0\) can be rejected at the 1% significance level, whereas \(r=2\) can be accepted at the 5% significance level. Evidence of two cointegrating vectors may be supportive of a self-reinforcing relationship between real house prices and household real debt. We next examine the underlying long-run structure of the two cointegrating vectors relying on the theoretical set-up in Sect. 2.

4.2 Long-run structure

Having established that \(r=2\), we need to exactly identify the two cointegrating vectors before testing overidentifying restrictions in order to reveal the underlying long-run structure between \(p_{t}\) and \(d_{t}\). For this purpose, we write out the cointegrating part of (9) as

and set \(\beta _{p,1}=1\), \(\beta _{d,2}=1\), \(\beta _{R,1}=0\) and \(\beta _{y,2}=0\) as the identification scheme, which is motivated by the findings in Anundsen and Jansen (2013, Table 4, panel 5). In particular, \(\beta _{p,1}=1\) and \(\beta _{d,2}=1\) normalise the first and second cointegrating vector on \(p_{t}\) and \(d_{t}\), respectively. The restriction \(\beta _{R,1}= 0\) may be justified by the notion that the effects of interest rates feed into house prices through disposable income and through the cost of financing households’ debt. Likewise, the restriction \(\beta _{y,2}=0\) may be motivated by the notion that the effects of disposable income on household debt work through a self-reinforcing relationship between house prices and debt. Table 3 displays the estimates of \(\alpha \), \(\beta \) and \(\rho \) given the chosen identification scheme.

Overall, the unrestricted estimates of the cointegration coefficients and the adjustment coefficients are in accordance with the underlying theory. In particular, the evidence of significant feedback effects with respect to \(p_{t}\) and \(d_{t}\), and less so with respect to \(y_{t}\), \(k_{t}\) and \(R_{t}\), points to assigning importance to the roles of \(p_{t}\) and \(d_{t}\) in the long-run relationships. Moreover, the estimates of \(\beta _{d,1}\), \(\beta _{y,1}\), \(\beta _{p,2}\) and \(\beta _{R,2}\) are all strongly significant with signs as expected from the theory. We do notice that the signs of the estimates of \(\beta _{k,1}\) and \(\beta _{k,2}\) contradict the theory underlying the chosen identification scheme. An alternative identification scheme would be to replace \(\beta _{y,2}=0\) with \(\beta _{k,2}=0\). However, this scheme yields estimated signs of \(\beta _{k,1}\), \(\beta _{y,2}\) and \(\beta _{R,2}\) that contradict the theory and that \(\hat{\alpha }_{p,1}>0\) and \(\hat{\alpha }_{p,2}>0\). Accordingly, we judge the identification scheme in Table 3 as a satisfactory point of departure for testing overidentifying restrictions on the two cointegrating vectors.Footnote 14

After stepwise testing of various theory-consistent restrictions by means of likelihood ratio tests, both individually and jointly, we end up with the estimates of \(\alpha \), \(\beta \) and \(\rho \) reported in Table 4. The hypothesis of the joint restrictions is not rejected at the 5% significance level according to a likelihood ratio test statistic of \(\chi ^{2}(11)=12.78\) with a p-value of 0.31. We observe that the imposed restrictions in Table 4, except the one related to \(\beta _{k,1}\), do not change the remaining estimates of \(\alpha \) and \(\beta \) much compared to those in Table 3. A preliminary restriction of \(\beta _{k,2}=0\) produces a likelihood ratio test statistic of \(\chi ^{2}(1)=1.53\) with a p-value of 0.22 and theory-consistent cointegrating vectors where \(\beta _{k,1}\) now is significantly negative. In addition, the preliminary joint restrictions of \(\beta _{k,2}=0\) and \(\rho _{1}=\rho _{2}=0\) provide a likelihood ratio test statistic of \(\chi ^{2}(3)=4.06\) with a p-value of 0.26 and still a significantly negative estimate of \(\beta _{k,1}\). The results from these preliminary tests thus justify that the real housing stock is excludable from the second cointegrating vector and that the linear trend is excludable from both vectors. The evidence for \(\rho _{1}=\rho _{2}=0\) may reflect a dominant property of co-trending between \(p_{t}\), \(d_{t}\), \(y_{t}\) and \(k_{t}\) over the sample period, as addressed in Sect. 3. The stepwise testing of restrictions on \(\beta \) further justifies the additional two restrictions of \(\beta _{p,2}=1\) and \(\beta _{k,1}=-\beta _{y,1}\) according to a likelihood ratio statistics of \(\chi ^{2}(5)=5.38\) with a p-value of 0.37. Finally, imposing the additional six restrictions of \(\alpha _{d,1}=\alpha _{y,1}=\alpha _{y,2}=\alpha _{k,1}=\alpha _{k,2}=\alpha _{R,1}=0\) produces our preferred empirical long-run structure reported in Table 4.Footnote 15 Notably, the zero restrictions on \(\alpha \) associated with \(y_{t}\) and \(k_{t}\) imply that these two variables are weakly exogenous for the parameters of interest \(\beta \), see Engle et al. (1983).

We are now able to interpret the empirical long-run structure between real house prices and household real debt in light of the theory. The estimates in Table 4 imply the following two restricted cointegrating vectors along with standard errors in parentheses:

All estimated coefficients have their expected signs and are significant at the 5% level. The cointegrating linkages in (11) and (12) are consistent with (4) and (6) in Sect. 2, and are thus interpretable as long-run equations for \(p_{t}\) and \(d_{t}\), respectively. In particular, the estimated demand elasticity of income in (11), \(-(\beta _{y,1}/\beta _{k,1}\)), is equal to unity and matches what Anundsen (2019, 2021) finds on data for Nordic countries including Norway and Meen (2001) and Anundsen (2015) find on data for the US. Our findings also support the hypothesis of a long-run mutual dependency or a self-reinforcing relationship between \(p_{t}\) and \(d_{t}\) as the former enters the equation for the latter and vice versa. Although there is no direct linkage between real house prices and the real after-tax interest rate in (11), an increased interest rate still causes house prices to fall through the self-reinforcing relationship between \(p_{t}\) and \(d_{t}\). Similarly, due to the mutual dependency between \(p_{t}\) and \(d_{t}\), household debt will respond positively to an increase in disposable income. Hence, both house prices and debt are linked to income, the housing stock and the real after-tax interest rate in the long run in accordance with the findings in Anundsen and Jansen (2013).

However, by combining (11) and (12), we find that the reduced form long-run elasticities of house prices with respect to income and the housing stock are around 4% compared to around 7% and 9%, respectively, in Anundsen and Jansen (2013). Moreover, our estimates of the reduced form long-run (semi) elasticity of house prices with respect to the real after-tax interest rate is around 15% compared to around 10% in Anundsen and Jansen (2013). Accordingly, extending the sample period by 10 years after the financial crisis seems to suggest an increase in the long-run responsiveness of house prices to changes in the interest rate by around 5 percentage points. One may then ask if our model is subject to a structural break in the interest rate sensitivity in recent years due to inter alia greater indebtedness among Norwegian households and/or more sluggish adjustments of housing supply. From Fig. 2, we observe that the recursive estimates of the real after-tax interest rate effect in Table 4 appear to be fairly stable around the full-sample estimate of 8.13 over a substantial period of time since the mid-1990s. There is only a temporal dip around 2010. We therefore believe that the higher real after-tax interest rate effect compared to Anundsen and Jansen (2013) simply reflects the difference in model specifications. Our model is a full system whereas the model in Anundsen and Jansen (2013) is a partial system without any testing of weak exogeneity of the real after-tax interest rate. As such, we may have succeeded in revealing the underlying true and stable parameter value, around 8.13, in comparison with the preceding partial system. Our findings imply a large interest rate effect on house prices and may reflect that the majority of households’ loans in Norway are floating-rate mortgages.

Recursive estimates of \(\beta _{R,2}\ \)inTable 4. Notes: Sample period: 1996q1–2018q4 after initialisation of observations for recursive estimation

The estimated adjustment coefficients for \(p_{t}\) in Table 4 are \(-0.24\) (t-value of \(-5.93\)) and \(-0.08 \) (t-value of \(-5.86\)), which imply that house prices adjust steadily to deviations from its equilibrium as well as to deviations from household debt equilibrium. The single estimated adjustment coefficient for \(d_{t}\), on the other hand, is \(-0.02\) (t-value of \(-3.67\)), and indicates that household debt only reacts to its disequilibrium errors. These findings are also in line with those in Anundsen and Jansen (2013). Finally, as opposed to disposable income and the housing stock, the real after-tax interest rate is not weakly exogenous with respect to the coefficients in the long-run equation for household debt. That said, the feedback effects with respect to \(R_{t}\) are relatively weak since \(\hat{\alpha }_{R,2}=-0.01\) (t-value of \(-2.75\)). Thus, the evidence for relatively strong and highly significant feedback effects with respect to \(p_{t}\) and \(d_{t}\) makes the normalising of the two cointegrating vectors on these variables justifiable.

Estimates of equilibrium correction terms based on the VAR(6). Notes: Sample period: 1982q1–2018q4. The first equilibrium correction term (panel a), \(eqcm_{1,t}=p_{t}-0.65d_{t}-1.49y_{t}+1.49k_{t}\), and the second equilibrium correction term (panel b), \(eqcm_{2,t}=d_{t}-p_{t}+8.13R_{t}\), are based on (11) and (12), respectively

Figure 3 shows the two equilibrium correction terms, \(eqcm_{1,t}\) and \(eqcm_{2,t}\) based on (11) and (12), over the sample period. The two equilibrium correction terms are clearly mean-reverting stationary series from the mid-1990s. The mean-reversion property is, however, relatively slow during the aforementioned banking crises.Footnote 16 We may argue that the self-reinforcing effects between house prices and household debt were particularly strong during the banking crises due to the steady increase in the unemployment rate from 2.6% in 1987 to a record-high 6.5% in 1993 and the associated increased uncertainty about the prospects for the households’ economy. Intuitively, it may be the case that such a big and persistent shock to the system causes the huge disequilibrium in the two cointegrating vectors and thus that mean-reversion takes longer time during the banking crisis. Nevertheless, Augmented Dickey–Fuller tests reveal that \(eqcm_{1,t}\) (borderline case) and \(eqcm_{2,t}\) are stationary time series at the 5% level during the entire sample period.

4.3 Persistence profiles

Given the evidence of relatively slow mean-reversion property during the banking crisis, it is of interest to provide estimates of the speed with which the housing market returns to its equilibrium state after a system-wide shock on the two cointegrating vectors. For this purpose, we estimate the so-called persistence profiles for the two cointegrating vectors, as originally proposed by Pesaran and Shin (1996).

The scaled persistence profile of the effect of a system-wide shock on the j-th cointegrating relationship is in our case defined as

for \(j=1,2\) and \(n=0,1, 2,\ldots \) and where the \(p \times p\) matrix \(A_{n}\) is the coefficient matrix for the residual vector lagged n periods in a Granger representation form of the cointegrated VAR in (9).Footnote 17 The value of the persistence profile is equal to unity on impact as \(A_0=I_p\), but tends to zero as n, the horizon of the profile, approaches infinity under the assumption that \(\beta _{j}\) is a cointegrating vector. As such, \(h(\beta '_{j}X_{t},n)\) as a function of n provides insightful information on the speed of adjustment towards equilibrium after a system-wide shock on the cointegrating relationship, \(\beta '_{j}X_{t}\).

We use the econometric package Microfit in order to estimate the persistence profiles. To do so, we re-estimate the long-run structure in Table 4 with no restrictions on \(\alpha \) since Microfit does not allow for such restrictions when generating the persistence profiles. However, we retain the same restrictions imposed on \(\beta \) and \(\rho \). Table 5 displays the estimates of \(\alpha \), \(\beta \) and \(\rho \), while recalling that the five imposed restrictions on \(\beta \) and \(\rho \) are justified by a likelihood ratio statistics of \(\chi ^{2}(5)=5.38\) with a p-value of 0.37. A comparison of Tables 4 and 5 shows that the estimates, overall, are of the same magnitudes, which further confirms the validity of imposing the additional six restrictions on \(\alpha \) in Table 4. The comparison also indicates that the persistence profiles based on Table 5 will be approximately the same as those based on Table 4.

Estimates of persistence profiles based on the VAR(6). Notes: The first cointegrating vector (panel a), \(\hat{\beta }^{\prime }_{1}X_{t}=\begin{pmatrix}1 &{} -0.63 &{} -1.65 &{} 1.65 &{} 0\\ \end{pmatrix}X_{t}\), and the second cointegrating vector (panel b), \(\hat{\beta }^{\prime }_{2}X_{t}=\begin{pmatrix}-1 &{} 1 &{} 0 &{} 0 &{} 11.63\\ \end{pmatrix}X_{t}\), are the house price relation and the debt relation, respectively, based on Table 5. \(n=0,1,\ldots ,50\)

Figure 4 displays the estimates of the scaled persistence profiles for the two cointegrating relationships, the house price relation (\(\hat{\beta }^{\prime }_{1}X_{t}\)) in panel a and the debt relation (\(\hat{\beta }^{\prime }_{2}X_{t}\)) in panel b, estimated by means of (13). The estimates of the persistence profiles clearly show that both the house price relation and the debt relation converge to zero, but quite slowly. About 80% and 90% of the adjustments towards equilibrium after a system-wide shock are made after 6 years in the cases of the house price relation and the debt relation, respectively. Although completely different markets and not comparable as such, it is interesting that the estimates of the persistence profile for the UK purchasing power parity (PPP) relation in Pesaran and Shin (1996) give a similar picture of the speed of adjustment. Johansen and Juselius (1992), who also study the PPP relation for the UK, point out that “Whatever the true case, there can hardly be any doubt that if the PPP holds as a long-run relation, the speed of adjustment has to be very slow due to costly information gathering, product heterogeneity, government-imposed barriers to trade, etc.” Likewise, if the house price and debt relations are cointegrating vectors, the slow speed of adjustment may be attributed to costly information gathering of housing opportunities in the market and government-imposed restrictions on housing trade by inter alia lending criteria based on payment-to-income ratios. Because the estimates of both persistence profiles eventually converge to zero provides further evidence that both the house price relation and the debt relation indeed represent cointegrating relationships restricted by the theory. We refer to “Appendix B” for additional analyses of the cointegrating relationships between house prices and debt. Our findings from the cointegration analysis set the stage for the subsequent control analysis of house prices and debt in the context of Johansen and Juselius (2001).

5 Controllability of house prices and debt

In this section, we explore the controllability of \(d_{t}\) and \(p_{t}\) in the cointegrated VAR model by following Johansen and Juselius (2001).Footnote 18 We first check the empirical validity of a controllability condition and then proceed to a simulation study using a set of parameter estimates with a view to drawing useful policy implications. A brief review of the control theory is provided in “Appendix C”.

5.1 Analysis of empirical controllability

As reviewed in “Appendix C”, the objective of economic policy in the context of Johansen and Juselius (2001) is to render a non-stationary target variable stationary with its mean equal to a pre-specified target level by making use of a policy instrument variable. If the policy is effective, the target variable is judged to be under control in the sense that it moves around the target level with no upward or downward trending features. In other words, the target variable has been turned, as a result of policy actions, into a stationary series with no widening deviations from the given target level. The target level itself can be chosen by econometricians, as long as the level is judged to be realistic according to the corresponding actual data. This control theory thus allows us to draw useful policy implications from a class of non-stationary data in a flexible manner, which is not feasible in conventional policy analysis.

In order to apply the non-stationary control theory to our data, we first need to select policy instrument and target variables from the variable set \(X_{t}=(p_{t},d_{t},y_{t},k_{t},R_{t})^{\prime }\). The selection of \(R_{t}\) as a policy instrument is justifiable, given the variable set \(X_{t}\), on the grounds that a long-run one-to-one relationship exists between the money market rate, which is closely related to the key policy rate by Norges Bank, and the interest rate on mortgage credit, see Hungnes (2015). Hence, we assume here that the key policy rate works implicitly in our model through both components of the real after-tax interest rate; the nominal interest rate on household loans and the inflation rate. Although the purpose of monetary policy depends on the economies and times which are to be studied, it is generally the case that asset prices belong to a class of important target variables in the implementation of monetary policy. This reasoning allows us to pick out \(p_{t}\ \)and\(\ d_{t}\) as policy target variables in the study of the Norwegian housing market.

Bearing in mind Tinbergen’s principle for effective economic policy (see “Appendix C” for further details), we thus specify a class of selection vectors as

combined with

so that

According to the condition in (19) in “Appendix C”, the controllability of \(p_{t}\) and \(d_{t}\ \)by using \(R_{t}\) as a policy instrument is guaranteed by

respectively. These conditions should be tested separately, according to Tinbergen’s principle. See Paruolo (1997) for further details of inference on the C matrix involved in (14). In terms of consistency with the economic theory outlined in Sect. 2, we find it necessary to verify not solely (14), but also

so that each of stabilising policies is judged to be effective.

Let us get back to the empirical analysis of the Norwegian time series data. We have already confirmed that the cointegrating rank is two, or \(r=2\), which enables us to obtain the maximum likelihood estimates of the model’s parameters using reduced rank regression. The estimated impact matrix is

in which each figure in parentheses denotes a standard error. The figures in italics on the upper right corner of the matrix, \(\hat{C}_{15}\ \)and\(\ \hat{C}_{25}\), correspond to \(b^{(p_{t})\prime }\hat{C}a\ \)and\(\ b^{(d_{t})\prime }\hat{C}a\), respectively. Both of the estimates are judged to be significantly negative at the 5% level, so that the conditions in (15) are empirically satisfied and we can argue for the effectiveness of monetary stabilisation policy concerning \(p_{t}\ \)and \(d_{t} \). Figure 5 records a set of recursive estimates for \(b^{(p_{t})\prime }\hat{C}a\ \)and\(\ b^{(d_{t})\prime }\hat{C}a\), indicating some fluctuations, but the estimates are negative and significant in most cases over the last decade of the sample period. As shown in (21) in “Appendix C”, the inverses of these two coefficients play critical roles in the feedback mechanism required for the stability of the controlled system. We will assess this mechanism quantitatively by using the method of data-based simulation in Sect. 5.2.

As a possible caveat, we should recall that \(R_{t}\) was not judged to be weakly exogenous for the cointegrating parameters; the rejection of weak exogeneity implies the absence of super exogeneity, a property which is required in the context of policy analysis to counteract the Lucas critique, see Lucas (1976) and Engle et al. (1983) for further details. Although our analysis may be subject to this type of criticism, we assign importance to the fact that all of the conditions in (14) and (15) are empirically satisfied, thereby justifying the conduct of a policy simulation study in the context of Johansen and Juselius (2001).

5.2 Simulation study and policy implications

The finding of empirical controllability of \(p_{t}\) and \(d_{t}\) leads us to a class of policy simulation studies using the data-based parameter estimates. For this purpose, we follow Johansen and Juselius (2001) and set up a dynamic system, see (24) and (25) in “Appendix C”, in which a set of restricted estimates \(\hat{\alpha }\ \)and\(\ \hat{\beta }\ \)obtained in Sect. 4 is used. For the derivation of the impact matrix to be used in the control rule, the orthogonal complements, \(\hat{\alpha } _{\perp }\) and \(\hat{\beta }_{\perp }\), are calculated as the null spaces of \(\hat{\alpha }\ \)and\(\ \hat{\beta },\) respectively, and \({\varGamma }\ \)is estimated by regression given \(\hat{\alpha }\ \)and\(\ \hat{\beta }\).

Since the target levels of \(p_{t}\) and \(d_{t}\), denoted by \(b^{(p_{t})*}\) and \(b^{(d_{t})*}\), are indeterminate yet in the system, it is necessary to specify them according to the actual observations for the two variables. As mentioned at the beginning of Sect. 5.1, we can choose a set of target levels as long as they are judged to be realistic according to the corresponding actual data. We formulate a scenario on the assumption that the policy maker aims to stabilise each policy target variable around its relatively low values over the sample period. It should be noted here that \((b^{(d_{t})\prime }\hat{C}a)^{-1}\ \)has turned out to be smaller than \((b^{(p_{t})\prime }\hat{C}a)^{-1}\) in absolute value, as shown in Sect. 5.1. This implies that the magnitude of intervention \(\upsilon _{t}\ \)in the underlying control rule for \(d_{t}\ \)is smaller than that for \(p_{t}\), given the same deviations from the target level and the steady state for the two variables, see (20) in “Appendix C” for the grounds for this reasoning. Taking this finding into account, we should select a rather conservative value for \(b^{(d_{t})*}\), so that the element of intervention associated with deviations from the target level, or \((b^{(d_{t})\prime }\hat{C}a)^{-1}[b^{(d_{t})\prime }(X_{t}^{\text {new}}-\hat{\gamma }t)-b^{(d_{t})*}]\), will be amplified by a class of greater deviations from \(b^{(d_{t})*}\), hence leading to a simulation figure in which policy effects are more distinguishable. After a process of trial and error, we arrive at the conclusion that the following is a reasonable selection of target levels given the actual observations: \(b^{(p_{t})*}=-1.08\ \)and\(\ b^{(d_{t})*}=13.3\).

First, we focus on the control of \(p_{t}\) by treating \(R_{t}\) as a policy instrument. Figure 6 (panel a) records the series of \(R_{t}\), together with those of \(R_{t}^{\text {ctr}}\) given the target value \(b^{(p_{t})*}\). It is evident that \(R_{t}^{\text {ctr}}\) has risen significantly since the mid of the sample period and stayed at a higher level than that of \(R_{t}\). This distinguishing feature is interpreted as a policy response, driven by the underlying control rule, for the objective of achieving the selected target level \(b^{(p_{t})*}\). The behaviour of \(p_{t}^{\text {new}}\), as shown in Fig. 6 (panel b), appears to be relatively stabilised compared to \(p_{t}\), in that the flattening of \(p_{t}^{\text {new}}\) is observed around the middle of the sample period. This feature is clearly attributable to a rise in \(R_{t}^{\text {ctr}}\), a reflection of the evidence for controllability \(b^{(p_{t})\prime }\hat{C}a<0\) revealed in Sect. 5.1. Similarly, \(d_{t}^{\text {new}}\) in Fig. 6 (panel c) has been damped down in a manner similar to \(p_{t}^{\text {new}}\), suggesting the presence of significant influences from the spike of \(R_{t}^{\text {ctr}}\). Lastly, Fig. 6 (panel d) displays a de-trended version of \(p_{t}^{\text {new}}\); its mean-reverting characteristics are fairly obvious as compared with \(p_{t}^{\text {new}}\) in Fig. 6 (panel b). The mean of this de-trended series is judged to correspond to \(b^{(p_{t})*}\) as a result of effective control policy.

Next, controlling \(d_{t}\ \)by utilising the policy instrument \(R_{t}\) is considered. Figure 7 has the same structure as Fig. 6, apart from the fact that \(d_{t}\ \)is the policy target variable aiming at the target level \(b^{(d_{t})*}\). According to Fig. 7 (panel a), \(R_{t}^{\text {ctr}}\ \)has increased significantly in the first half and second half of the sample period. This behaviour can be recognised as a policy reaction towards the attainment of the target level. Figure 7 (panel b) shows, as expected, that the behaviour of \(d_{t}^{\text {new}}\) appears to be more stable than that of \(d_{t}\), in that the bumps of the original series have been removed by the increase of \(R_{t}^{\text {ctr}}\). Similarly, Fig. 7 (panel c) depicts the series \(p_{t}^{\text {new}}\), which also seems to be stabilised by \(R_{t}^{\text {ctr}}\). In terms of the attainment of the target level, Fig. 7 (panel d) is noteworthy in that the de-trended series of \(d_{t}^{\text {new}}\) exhibits mean-reverting features around \(b^{(d_{t})*}\).

The results of the simulation-based study are consistent with the evidence for controllability in the estimated C matrix in Sect. 5.1. We can therefore argue that the policy maker is capable of achieving the pre-specified target levels for \(p_{t}\ \)and\(\ d_{t}\) through the instrument \(R_{t}\). Overall, our findings suggest that monetary policy may be effective in reducing large fluctuations and bubble tendencies in the housing market. For further references, we provide in “Appendix D” a set of additional simulation figures which adopt target levels different from those used in Figs. 6 and 7. By checking all the figures, we can argue that, although the simulation paths vary according to the pre-selected target levels, they share the same feature that each of them has been stabilised around its given target level. We thus conclude that the simulation study, overall, is not sensitive to the selection of target levels.

6 Conclusions

We have revisited the empirical modelling of house prices and household debt in Norway with a policy-oriented perspective. Our point of departure has been an operational representation of the life-cycle model of housing in which equilibrium real house prices are determined by households’ real disposable income, household real debt, the housing stock and the real after-tax interest rate on mortgage credit. To account for a self-reinforcing mechanism between house prices and debt, typically observed in the Norwegian housing market, this representation is augmented by an equilibrium real debt relationship with real house prices as one of the key determinants in the long run.

We have then confronted the theoretical set-up empirically over the last four decades by means of a full cointegrated VAR in real house prices, real disposable income, household real debt, the housing stock and the real after-tax interest rate. Our findings suggest the existence of two cointegrating relationships which, we argue, can be interpreted as long-run relations for house prices and debt with mutual dependency between them. More specifically, we find that a permanent increase in the interest rate of one percentage point leads to a long-run decrease in house prices of about 15% when the housing stock is fixed. The existence of the two cointegrating relationships is reinforced by means of estimated persistence profiles which eventually converge to zero, albeit quite slowly, after a system-wide shock. We argue that the slow speed of adjustment may be attributed to costly information gathering of housing opportunities in the Norwegian market and government-imposed restrictions on housing trade by inter alia lending criteria based on payment-to-income ratios. Finally, we have demonstrated by means of a control analysis of the cointegrated VAR that both house prices and debt are controllable magnitudes to some pre-specified target levels through the interest rate. These findings suggest that Norges Bank to some extent is capable of reducing large fluctuations and bubble tendencies in the housing market, which from a monetary policy perspective is potentially important when trying to prevent spillover effects from financial instabilities to the real economy.

We have not in this paper, given our information set, pursued a standard-type impulse response analysis of monetary policy based on a structural VAR. However, we believe that the present study provides theoretically understandable and empirically relevant representations of house prices and debt which are two financial magnitudes entering the decision process of Norges Bank. We should emphasise that our modelling framework has assumed that credit constraints faced by households are reflected in their prevailing debt over time. An alternative approach, following e.g. Aron et al. (2012) and Chauvin and Muellbauer (2018), would be to derive a time series that reflects the process of the latent variable representing credit constraints and then replace this latent variable in our modelling framework with its observable equivalent. We leave the alternative approach together with addressing variations in property taxes, which may improve the empirical specifications of house prices and debt, for future research.

Notes

See also Anundsen (2021).

The assumption that actual inflation is equal to expected inflation may not be appropriate when constructing the real after-tax interest rate. However, Boug et al. (2017) find that forward-looking models of CPI-inflation are at odds with Norwegian data.

\(R_{t}\) is not log-transformed in the empirical analysis as this variable can take negative numbers during the sample period.

Anundsen and Jansen (2013) also included housing turnover as an additional explanatory variable in the equilibrium condition for \(D_{t}\). We assume here that effects from changes in sales turnover are reflected in both house prices and debt.

See “Appendix A” for further details on data descriptions and sources.

These tests show that \(\varDelta d_{t}\sim I(0)\) is a borderline case at conventional significance levels. Anundsen (2019, 2021) also treats the real house prices, the real disposable income, the housing stock and the real after-tax interest rate as I(1)-series in his analyses of the Norwegian housing market.

See Helliesen et al (2021, “Appendix A”) for an overview of benchmark revisions in the Norwegian National Accounts.

It turned out difficult using other identification schemes, for instance replacing \(\beta _{y,2}=0\) with \(\beta _{p,2}=\beta _{k,2}\) as in Anundsen and Jansen (2013), to find reasonable cointegrating vectors in line with the theory. Using the data set and codes in that study, available at http://www.andre-anundsen.com, shows that \(\hat{\beta }_{R,1}\) is not statistically different from zero and that \(\hat{\beta }_{y,2}\) has the wrong sign in the exactly identified cointegrating vectors in Anundsen and Jansen (2013, Table 4). These two coefficients are thus set to zero in their final empirical long-run structure between \(p_{t}\) and \(d_{t}\), which we as mentioned echo in our identification scheme.

These additional zero restrictions on \(\alpha \) are also individually not rejected according to \(\chi ^{2}(6)\).

Applying the data set used in Anundsen and Jansen (2013), reveals similar mean-reversion properties of the two equilibrium correction terms in that study, cf. Table 4, panel 5.

By pre-multiplying the Granger representation form of the cointegrated VAR with one of the two cointegrating vectors, we have \(\beta _j^{\prime } X_t = \textbf{E}\left[ \beta _j^{\prime }X_t\right] +\beta _j^{\prime }\sum _{n=0}^{\infty }A_n \varepsilon _{t-n}\), see Pesaran and Shin (1996) for details.

The econometric analysis in this section was carried out by means of an Ox code available from the authors upon request.

Note that two observations are lost in the estimation due to VAR(8) with a starting point of 1984q1. Both the misspecification tests statistics and the rank tests statistics are hardly affected by two less observations at the beginning of the sample period in the case of VAR(6).

Specifically, we let the logarithm of the nominal interest rate lagged one quarter enter restrictedly in the VAR(6), whereas the first difference of the logarithm of the nominal interest rate and its five lags enter unrestrictedly.

Note that using \(CPI_{t}/CPI_{t-4}\) is equivalent to using \(CPI_{t}/CPI_{t-4}-1\) as a conditioning variable.

The t-value becomes \(-2.46\) by means of a similar exercise in which the quarterly growth rate in the consumer price index replaces the fourth difference ratio of the consumer price index in the partial VAR(6).

References

Aastveit K, Anundsen AK, Herstad EI (2019) Residential investment and recession predictability. Int J Forecast 35:1790–1799

Abraham JM, Hendershott PH (1996) Bubbles in metropolitan housing markets. J Hous Res 7:191–207

Anundsen AK (2015) Econometric regime shifts and the US subprime bubble. J Appl Economet 30(1):145–169

Anundsen AK (2019) Detecting imbalances in house prices: What goes up must come down? Scand J Econ 121:1587–1619

Anundsen AK (2021) House price bubbles in Nordic countries? Nord Econ Policy Rev 2021:13–42

Anundsen AK, Jansen ES (2013) Self-reinforcing effects between housing prices and credit. J Hous Econ 22:192–212

Aron J, Duca J, Muellbauer J, Murata K, Murphy A (2012) Credit, housing collateral, and consumption: evidence from Japan, the U.K., and the U.S. Rev Income Wealth 58:397–423

Bjørnland HC, Jacobsen DH (2010) The role of house prices in the monetary policy transmission mechanism in small open economies. J Financ Stab 6:218–229

Boivin JB, Kiley MT, Mishkin FS (2011) Chapter 8: How has the monetary transmission mechanism evolved over time? In: Friedman B, Woodford M (eds) Handbook of monetary economics. Elsevier

Bolt W, Demertzia M, Diks C, Hommes C, van der Leij M (2019) Identifying booms and bust in house prices under heterogenous expectations. J Econ Dyn Control 103:234–259

Boug P, Cappelen Å, Swensen AR (2017) Inflation dynamics in a small open economy. Scand J Econ 119(4):1010–1039

Boug P, Cappelen Å, Jansen ES, Swensen AR (2021) The consumption Euler equation or the Keynesian consumption function? Oxford Bull Econ Stat 83(1):252–272

Chauvin V, Muellbauer J (2018) Consumption, household portfolios and the housing market in France. Econ Stat 500:151–178

Cheung Y-W, Lai KS (1993) Finite-sample sizes of Johansen’s likelihood ratio tests for cointegration. Oxford Bull Econ Stat 55:313–328

Doornik JA (1998) Approximations to the asymptotic distribution of cointegration tests. J Econ Surv 12:573–593

Doornik JA (2003) Asymptotic tables for cointegration tests based on the Gamma-distribution approximation, accompanying note to Doornik (1998)

Doornik JA, Hendry DF (2018) Modelling dynamic systems using PcGive 15 volume II/OxMetrics 8. Timberlake Consultants Ltd, London

Duca JV, Muellbauer J, Murphy A (2021) What drives house price cycles? International experience and policy issues. J Econ Lit 59(3):773–864

Eitrheim Ø, Klovland JT, Øksendal LF (2016) A monetary history of Norway, 1816–2016. Cambridge University Press, Cambridge

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55:251–276

Engle RF, Hendry DF, Richard JF (1983) Exogeneity. Econometrica 51:277–304

Fitzpatrick T, McQuinn K (2007) House prices and mortgage credit: empirical evidence for Ireland. Manch Sch 75:82–103

Gallin J (2006) The long-run relationship between house prices and income: evidence from local housing markets. Real Estate Econ 34:417–438

Gimeno R, Martinez-Carrascal C (2010) The relationship between house prices and house purchase loans: the Spanish case. J Bank Finance 34:1849–1855

Gonzalo J (1994) Five alternative methods of estimating long-run equilibrium relationships. J Econom 60:203–233

Hansen PR (2005) Granger’s representation theorem: a closed-form expression for I(1) processes. Econom J 8:23–38

Hansen E, Rahbek A (1998) Stationarity and asymptotics of multivariate ARCH time series with application to robustness of cointegration analysis. Department of Theoretical Statistics, University of Copenhagen. Retrieved from http://www.stat.ku.dk/~rahbek/

Harbo I, Johansen S, Nielsen B, Rahbek A (1998) Asymptotic inference on cointegration rank in partial systems. J Bus Econ Stat 16:388–399

Helliesen KH, Hungnes H, Skjerpen T (2021) Revisions in the Norwegian National Accounts: accuracy, unbiasedness and efficiency in preliminary figures. Empir Econ 62:1079–1121

Hungnes H (2015) Testing for co-nonlinearity. Stud Nonlinear Dyn Econom 19:339–353

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12:231–254

Johansen S (1991) Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica 59:1551–1580

Johansen S (1995) Likelihood-based inference in cointegrated vector autoregressive models. Oxford University Press, Oxford

Johansen S (2005) Interpretation of cointegrating coefficients in the cointegrated vector autoregressive model. Oxford Bull Econ Stat 67:93–104

Johansen S, Juselius K (1992) Testing structural hypotheses in a multivariate cointegration analysis of the PPP and UIP for UK. J Econom 53:21l–244

Johansen S, Juselius K (1994) Identification of the long-run and the short-run structure: an application to the ISLM model. J Econom 63:7–36

Johansen S, Juselius K (2001) Controlling inflation in a cointegrated vector autoregressive model with an application to US data. University of Copenhagen, Department of Economics, Discussion Papers 01-03

Juselius K (2006) The cointegrated VAR model: methodology and applications. Oxford University Press, Oxford

Kearl JR (1979) Inflation, mortgages, and housing. J Polit Econ 87(5):1115–1138

Krogh TSH (2010) Credit regulations in Norway, 1970–2008, Report 37/2010, Statistics Norway

Kurita T (2018) A note on potential one-way policy instruments in cointegrated VAR systems. Econ Anal Policy 58:55–59

Leamer EE (2015) Housing really is the business cycle: What survives the lessons of 2008–09? J Money Credit Bank 47:43–50

Lucas R (1976) Econometric policy evaluation: a critique. In: Carnegie-Rochester conference series on public policy, vol 1, pp 19–46. North-Holland

Meen G (2001) Modelling spatial housing markets: theory, analysis and policy. Kluwer Academic Publishers, Boston

Meen G (2002) The time series behavior of house prices: A transatlantic divide? J Hous Econ 11:1–23

Mian A, Rao K, Sufi A (2013) Household balance sheets, consumption, and the economic slump. Quart J Econ 128:1687–1726

Moe TG, Solheim JA, Vale B (eds) (2004) The Norwegian Banking crisis, occational papers, vol 33. Norges Bank, Oslo

Muellbauer J, Murphy A (1997) Booms and busts in the UK housing market. Econ J 107:1701–1727

Muellbauer J, Murphy A (2008) Housing market and the economy: the assessment. Oxf Rev Econ Policy 24:1–33

Norges Bank (2021) Monetary policy report with financial stability assessment 2(21):9–10

Paruolo P (1997) Asymptotic inference on the moving average impact matrix in cointegrated I(1) VAR systems. Econom Theor 18:673–690

Pereira da Silva L (2016) Towards an integrated inflation targeting framework in middle-income countries: a research agenda. In: Keynote speech at the second ECBN policy research conference on “macroprudential instruments and financial cycles”, Ljubljana, 29 September 2016. Retrieved from https://www.bis.org/speeches/sp160929.pdf

Pesaran B, Pesaran MH (2009) Time series econometrics using Microfit 5: a user’s manual. Oxford University Press, Oxford

Pesaran MH, Shin Y (1996) Cointegration and speed of convergence to equilibrium. J Econom 71:117–143

Robstad Ø (2018) House prices, credit and the effect of monetary policy in Norway: evidence from structural VAR models. Empir Econ 54(2):461–483

Tinbergen J (1952) On the theory of economic policy. North-Holland Publishing Company, Amsterdam

Acknowledgements

We are grateful to seminar participants at the Centre for Applied and Theoretical Econometrics at BI Norwegian Business School, Ragnar Nymoen, Victoria Sparrman and Genaro Succarat in particular, for helpful discussions, and to Thomas von Brasch, Ådne Cappelen, Eilev Jansen, Terje Skjerpen, Anders Rygh Swensen and two anonymous referees for useful comments and suggestions on earlier drafts. This study was partly funded by Statistics Norway. Takamitsu Kurita gratefully acknowledges financial support from JSPS KAKENHI 18K01600. The usual disclaimer applies.

Funding

Open access funding provided by Statistics Norway

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Data descriptions and sources

The original data series used in the empirical analysis are all seasonally unadjusted and measured on a quarterly frequency over the period 1982q1–2018q4. Data descriptions and sources are listed below.

- \(p_{ t}\):

-

The log of real house prices measured by the overall price index for residential buildings in the second-hand market and adjusted by the consumption deflator, \(PC_{ t}\), in the National Accounts. Source: Statistics Norway.

- \(d_{ t}\):

-

The log of household real debt measured by the total amount of outstanding gross household debt at the end of the quarter and adjusted by \(PC_{ t}\). Source: Statistics Norway.

- \(y_{ t}\):

-

The log of household real disposable income measured by disposable income excluding dividend payments and adjusted by \(PC_{ t}\). Source: Statistics Norway.

- \(k_{ t}\):

-

The log of total housing stock at the end of the quarter in fixed 2018-prices calculated in the National Accounts by means of the perpetual inventory method. Source: Statistics Norway.

- \(R_{ t}\):

-

The real after-tax interest rate calculated by \(\frac{1+4\times I_{t}\times (1-\varUpsilon _{t})}{CPI_{t}/CPI_{t-4}}-1\), where \(I_{t}\), \(\varUpsilon _{t}\) and \(CPI_{t}\) are the average nominal interest rate (quarterly) paid by households on loans in private financial institutions, the rate of tax relief on mortgage interest payments and the consumer price index for all commodities, respectively. Figure 8 shows the time series of the different components of the real after-tax interest rate. Source: Statistics Norway.

First difference of real house prices (\(\varDelta p_{t}\)), household real debt (\(\varDelta d_{t}\)), real disposable income (\(\varDelta y_{t}\)), real housing stock (\(\varDelta k_{t}\)) and real after-tax interest rate (\(\varDelta R_{t}\)). Notes: Sample period: 1982q1–2018q4. Source: Statistics Norway

The data are available from the authors upon request.

Appendix B: Additional analyses of the cointegrating relationships

As discussed in Sect. 4, the underlying premise for the cointegration analysis should be a sixth-order VAR in \(p_{t}\), \(d_{t}\), \(y_{t}\), \(k_{t}\) and \(R_{t}\). Among the arguments behind this choice of lag length in the VAR is the strong significance of the sixth lag of house price changes that may capture the expected real rate of capital gain. There is, however, evidence in some countries that extrapolative expectations of house price changes are based on a longer period of past appreciation, see e.g. Duca et al. (2021). We have therefore tested the significance of house price changes in a seventh and eighth order VAR in our case. It turns out that both the seventh and eighth lag of \(p_{t}\) and \(d_{t}\), \(y_{t}\), \(k_{t}\) and \(R_{t}\) are, overall, insignificant in the expanded VAR.Footnote 19 Moreover, both Akaike’s information criterion and sequential model reduction tests from VAR(8) to VAR(6) suggest that six lags are enough to render a coherent VAR. For these reasons, we retain six lags in the econometric analysis in Sect. 4.