Abstract

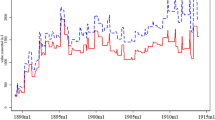

The effects of the Great Depression (GD, 1929–1936) on the Italian banking system were worse than those of the Great Recession (GR, 2007–2014), in terms of loan and deposit contraction and of bank failures. When the GD hit the Italian economy in 1929–1930, regulatory restrictions on bank activity were mild, whereas a stricter regulatory framework was in force at the beginning of the GR and notably included bank supervision, capital requirements and deposit insurance. We test the effectiveness of the modern institutional setting by comparing lending policies in the two crises using micro data on bank balance sheets. We find that in the GR banks with higher pre-crisis capital ratios were able to expand lending more than undercapitalized banks, whereas in the GD there were no differences between high and low-capitalized banks.

Similar content being viewed by others

Notes

Data for the entire banking system are based on De Bonis et al. (2012), and integrated for the most recent period with banking statistics published by the Bank of Italy. They include also the Cassa Depositi e Prestiti, which is classified among monetary financial institutions in current statistics. Data for joint-stock banks during the GD are based on Cotula et al. (1996) and Natoli et al. (2016)

In real terms, because of the deflation registered in the GD, deposits of the entire banking system actually increased (15%), although less than during the GR; instead, for joint-stock banks the contraction of deposits is confirmed also in real terms (−7%).

Statistics include both compulsory administrative liquidations and voluntary bank closures. Banks which were likely to fail but received public aid are not included.

The difference is even larger than shown in the graphs since mutual cooperative banks are excluded from the GD figure (because of the lack of data) and included in the GR.

Deposits of failed banks during the GD are underestimated because the lack of balance sheets data for some of those banks.

The creation of new banks was also influenced by the bankruptcy of “Banca Italiana di Sconto” which held 14% of Italian total assets (see Sraffa 1922).

The capital requirements imposed by law cannot be exactly replicated within the Historical Archive of Credit in Italy (Molteni and Pellegrino 2021). However, we can broadly state that in 1925 the constraint would have been binding only for 5% of joint-stock banks and, given that their median deposit-to-asset ratio was around 45%, it corresponded to a capital-to-asset ratio below 2.5%.

Supervision audits and inspections were carried out by local directors of the branches of the Bank of Italy: the supervisory reports were sent to the central administration of the Bank of Italy in Rome which in turn prepared a summary for the Ministry of Finance (Molteni 2021a). As already pointed out, final decisions were taken by the Ministry of Finance.

Notwithstanding the mild implementation of the 1926 banking law, the new regulation was successful in driving the attention of the Government to the safeguarding of savings (De Cecco 1986) and in favoring the consolidation process that led to the drop in the number of banks. The rationale of this process was to eliminate extremely small and undercapitalized banks and to reduce competitive pressures, perceived as drivers of instability.

Deflation was particularly detrimental for a confederation of banks, the so-called “Catholic banks,” which entered a serious crisis. Some of them officially failed after the spread of the GD, but the roots of their bankruptcies were well ahead. Their crisis was also affected by the failure of Banco di Roma and by the loss of political support.

Molteni and Pellegrino (2021) partially disagree with this hypothesis, suggesting that actually the Bank of Italy refused to help banks that were insolvent. Indeed, thanks to the information gathered through its supervisory activity, the central bank was able to act as a Lender of Last Resort, distinguishing illiquid from insolvent banks.

The national central banks of the Eurosystem can provide central bank money to solvent but temporarily illiquid credit institutions through the emergency liquidity assistance (ELA).

Information on how to access the database is available on the website of the Bank of Italy, in the Historical Statistics section.

There were relevant constraints in their investment strategies (Pantaleoni 1924).

Our definition of deposits also includes correspondent current accounts, because most of business deposits were included in this item. Moreover, household deposits were classified sometimes among correspondent current accounts because of a more beneficial tax treatment (Molteni and Pellegrino 2021).

Molteni (2021a) collects information from balance sheets gathered for supervisory purposes, which report more detailed data than public ones (e.g., distinction between time and demand deposits, or between public bonds and industrial shares). However, the supervision balance sheets are not available for all banks and for all the years under investigation. Other details on this issue can be found in Molteni and Pellegrino (2021).

According to current harmonized bank statistics, non-performing loans are included within total loans. This is coherent with GD data because, as already said, the balance sheets for the GD do not provide separate evidence for the entire period of analysis on non-performing loans, which are included among total loans.

Let \(L^{1q}\) (\(L^{3q}\)) be the amount of loans of the first (third) quartile of the distribution. Similarly, let \(K^{1q}\) (\(K^{3q}\)) be the capital ratio of the first (third) quartile of the distribution. The overall effect can be obtained in this way:

$$\begin{aligned} \mathrm{ln}(L^{3q}) - \mathrm{ln}(L^{1q})= & {} {\hat{\beta }} K^{3q} - {\hat{\beta }} K^{1q} \\ \mathrm{ln}\bigg (\frac{L^{3q}}{L^{1q}}\bigg )= & {} {\hat{\beta }} (K^{3q} - K^{1q}) \\ \frac{L^{3q}}{L^{1q}}= & {} exp(1.558 \cdot (0.107-0.056)) = 1.083 \end{aligned}$$The figure is obtained by multiplying the interquartile range 0.107–0.056 by the estimated coefficient 0.2034 and taking the exponential, which gives 1%.

The estimation was also carried out on a 5-year rolling window for robustness purposes with no significant differences in terms of the following regression results reported in Table 4.

For brevity, in the following description of the results sometimes we refer to this indicator variable as “Z-score.”

The threshold was derived as \(-0.3255 + 3.4307K \ge 0 \rightarrow K^* \ge 0.3255/3.4307 \rightarrow K^* \ge 9.5\%\).

A 2-year pre-crisis period is particularly convenient for the GD because of the lack of observations in 1926.

References

Aiginger K (2010) The Great Recession versus the Great Depression: stylized facts on siblings that were given different foster parents. In: Economics discussion papers 2010-9, Kiel Institute for the World Economy (IfW)

Baffigi A (2011) Italian national accounts, 1861–2011. Economic History Working Papers 18, Bank of Italy

Beltratti A, Stulz RM (2012) The credit crisis around the globe: why did some banks perform better? J Financ Econ 105(1):1–17

Berger AN, Bouwman CH (2013) How does capital affect bank performance during financial crises? J Financ Econ 109(1):146–176

Bernanke B (2013) The crisis as a classic financial panic. In Remarks at the fourteenth Jacques Polak annual research conference, Washington D.C. IMF

Bofondi M, Carpinelli L, Sette E (2013) Credit supply during a sovereign debt crisis. Temi di discussione (Economic working papers) 909, Bank of Italy, Economic Research and International Relations Area

Bonaccorsi di Patti E, Sette E (2016) Did the securitization market freeze affect bank lending during the financial crisis? Evidence from a credit register. J Financ Intermed 25(C):54–76

Boyd J, Graham S (1986) Risk, regulation, and bank holding company expansion into nonbanking. Q. Rev. 10(Spring):2–17

Budnik KB, Affinito M, Barbic G, Ben Hadj S, Chretien E, Dewachter H, Gonzalez CI, Hu J, Jantunen L, Jimborean R, et al (2019) The benefits and costs of adjusting bank capitalisation: evidence from euro area countries. ECB Working Paper Series 2261, European Central Bank

Cingano F, Manaresi F, Sette E (2016) Does credit crunch investment down? New evidence on the real effects of the bank-lending channel. Rev Financ Stud 29(10):2737–2773

Ciocca P, Toniolo G (1984) Industry and finance in Italy 1919–1940. J Eur Econ Hist 13(2):113–136

Cotula F, Raganelli T, Sannucci V, Alieri S, Cerrito E (1996) I bilanci delle aziende di credito 1890-1936. Laterza, Roma-Bari. (Collana storica della Banca d’Italia-Statistiche)

De Bonis R, Farabullini F, Rocchelli M, Salvio A (2012) A quantitative look at the Italian banking system: evidence from a new dataset since 1861. Economic History Working Papers 26, Bank of Italy, Economic Research and International Relations Area

De Bonis R, Marinelli G, Vercelli F (2018) Playing yo-yo with bank competition: new evidence from 1890 to 2014. Explor Econ Hist 67(C):134–151

De Cecco M (1986) La protezione del risparmio nelle forme finanziarie fasciste. Riv di Storia Econ 3(2):237–241

Fratianni M, Giri F (2017) The tale of two great crises. J Econ Dyn Control 81(C):5–31

Gaiotti E (2013) Credit availability and investment: lessons from the“great recession". Eur Econ Rev 59(C):212–227

Gigliobianco A (2012) La crisi bancaria italiana, l’IRI e la Banca d’Italia: 1927–1937. Bank of Italy

Gigliobianco A, Giordano C (2012) Does economic theory matter in shaping banking regulation? A case-study of Italy (1861–1936). Account Econ Law 2(1):1–75

Giordano C, Toniolo G, Zollino F (2017) Long-run trends in Italian productivity. Banca d’Italia Occasional Papers 406, Banca d’Italia

Ivashina V, Scharfstein D (2010) Bank lending during the financial crisis of 2008. J Financ Econ 97(3):319–338

Jiménez G, Lopez JA, Saurina J (2013) How does competition affect bank risk-taking? J Financ Stab 9(2):185–195

Jiménez G, Ongena S, Peydró J-L, Saurina J (2014) Hazardous times for monetary policy: what do twenty-three million bank loans say about the effects of monetary policy on credit risk-taking? Econometrica 82(2):463–505

Koch C, Richardson G, Van Horn P (2016) Bank leverage and regulatory regimes: evidence from the Great Depression and Great Recession. Am Econ Rev 106(5):538–542

Laeven L, Levine R (2009) Bank governance, regulation and risk taking. J Financ Econ 93(2):259–275

Molteni M (2020) Measuring bank failures in interwar Italy: sources and methods for a comparative account. Riv di Storia Econ 37(3):345–398

Molteni M (2021a) Bank failures: what failure? Distress, development, and supervision in Italian banking, 1926–1936. DPhil dissertation in Economic and Social History, University of Oxford

Molteni M (2021b) The distress of italian commercial banks in 1926–1936: a new dataset from banking supervision archives. In: Oxford Economic and social history working papers 194, University of Oxford, Department of Economics

Molteni M, Pellegrino D (2021) Lessons from the early establishment of banking supervision in Italy (1926–1936). In: Economic history working papers 48, Bank of Italy

Natoli S, Piselli P, Triglia I, Vercelli F (2016) Historical archive of credit in Italy. In: Economic history working paper 36, Bank of Italy

Pantaleoni M (1924) Fino a che punto ed entro che limiti, senza frustrare gli scopi e le ragioni della loro esistenza, le Casse di Risparmio possono funzionare da Istituti bancari. In: Atti del Primo Congresso Internazionale del Risparmio, Milano

Rossi S (2015) Conoscenza, innovazione, rilancio dell’economia. In: Lectio magistralis, Pavia. 17 marzo 2015

Schiantarelli F, Stacchini M, Strahan PE (2020) Bank quality, judicial efficiency and borrower runs: loan repayment delays in Italy. J Financ 75(4):2139–2178

Sraffa P (1922) The bank crisis in Italy. Econ J 36(126):178–197

Temin P (2010) The Great Recession and the Great Depression. Technical Report 15645, National Bureau of Economic Research

Toniolo G (1978) Crisi economica e smobilizzo pubblico delle banche miste (1930–34). In: Toniolo G (ed) Industria e banca nella grande crisi. ETAS LIBRI, Milano, pp 1929–1934

Toniolo G (1993) Il profilo economico. In: Guarino G, Toniolo G (eds) La Banca d’Italia e il sistema bancario. Roma-Bari, LaTerza, pp 1919–1936

Toniolo G (1995) Italian banking. In: Feinstein C (ed) Banking, currency and finance in Europe between the two wars. Oxford Clarendon Press, Oxford, pp 1919–1939

Vercelli F (2022) The Italian banking system during the 1907 financial crisis and the role of the Bank of Italy. In: Economic history working paper 49, Bank of Italy

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Giorgio Albareto, Emilia Bonaccorsi di Patti, Luigi Infante, Francesco Marchionne, Matteo Piazza and Zeno Rotondi for very useful suggestions and comments. The opinions expressed and conclusions drawn are those of the authors and do not necessarily reflect the views of the Bank of Italy and of the Eurosystem.

Appendix 1

Appendix 1

See Tables 5, 6, 7, 8, 9, 10, 11, 12, 13 and Figs. 7, 8, 9, 10, 11

Rights and permissions

About this article

Cite this article

De Bonis, R., Marinelli, G. & Vercelli, F. Bank lending in the Great Recession and in the Great Depression. Empir Econ 64, 567–602 (2023). https://doi.org/10.1007/s00181-022-02268-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-022-02268-8