Abstract

The paper estimates dynamic effects of pandemics on GDP per capita with local projections, controlling for the effects of wars and weather conditions, using a novel dataset that covers 33 countries and stretches back to the thirteenth century. On average, pandemics are found to have prolonged and highly statistically significant effects on GDP per capita—a pandemic killing 1% of the population tends to increase GDP per capita by approx. 0.3% after about 20 years. The study of a more detailed dataset available for the UK reveals that this results mainly from an increase in per capita land and a disproportionate impact of pandemics on low-productivity workers, while monetary expansion, institutional change and innovation could also play some role. At the same time, the effects of pandemics are found to vary with scale and across time and countries, with positive effects present following the Black Death and the Spanish flu pandemics, especially in Northern Europe. This suggests that only the largest and most unexpected pandemics have a positive impact on income.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The COVID-19 pandemic has reignited interest in the study of macroeconomic effects of epidemics. Will the effects of the pandemic be short-lasting, with the economy returning to its pre-crisis trend sooner or (just a bit) later, or will they last much longer, with GDP remaining depressed for many years or even decades to come? Perhaps history can help us answer this question to some degree—despite all the differences in the level of economic, organisational and healthcare development between the present and the past.

From a theoretical viewpoint, pandemics may have had either a positive or negative impact on GDP per capita. On the one hand, they decreased the denominator, i.e. the population size, which could have led to an increase in the standard of living in Malthusian subsistence societies (Malthus 1798). In a more sophisticated economy, they also tended to increase the capital labour ratio, rising labour productivity and per capita income, in line with the neoclassical growth model (Solow 1956). Average productivity and incomes would also increase if pandemics disproportionally affected individuals who exhibited lower than average productivity, e.g. the elderly. A large catastrophic event like a pandemic may have also disturbed economic and power structures, perhaps leading to positive structural and institutional changes and technological innovation, in the spirit of Schumpeterian creative destruction (Schumpeter 1942).

On the other hand, in the short run pandemics were likely to raise uncertainty and induce precautionary saving, lowering investment and consumption even without lockdowns and quarantines. The level of risk aversion may as well have increased in a more permanent manner as economic agents would fear the repetition of a catastrophe, in a mechanism similar to Bayesian updating (Kozlowski et al. 2020). At the same time, lower population density following a pandemic could have led to a decline in market economy activities (surplus production and trade) in a longer run due to lower effects of scale and higher transportation and transaction costs.

The identification of GDP per capita effects of pandemics is therefore an empirical question. To answer it, data on the size of epidemics and pandemicsFootnote 1 (in terms of percentage of population killed by each pandemic) are assembled for a panel of 33 countries between 1252 and 2016. This is a novelty—previous literature (e.g. Jordà et al. 2020; Ma et al. 2020) used binary variables as the measure of pandemics. Since pandemics are not necessarily fully exogenous—the historical evidence suggests they might have been fostered by wars, droughts and poor living conditions—data on tree ring growth (to control for weather conditions) and incidence of wars is also gathered. Other than avoiding a potential omitted variable bias, this allows me to compare the GDP effects of pandemics with those of wars and weather conditions.

After combining the gathered data with GDP per capita estimates from the Maddison Project Database, local projections in the spirit of Jordà (2005) with adjustments proposed by Teulings and Zubanov (2014) are run to estimate the impulse response functions of GDP per capita to pandemics, as well as wars and weather conditions. On average, pandemics are found to have a prolonged, highly statistically significant and somewhat delayed effect on GDP per capita, with a pandemic resulting in the death of 1% of population increasing GDP per capita by a maximum of 0.3%, this peak effect appearing after almost 20 years. Importantly, taking into account the size of the pandemics does have an influence on the results. When a binary pandemic variable is used instead, the effect is larger, but disappears in the long run.Footnote 2

At the same time, the effects of pandemics differ from those of war and weather conditions. The incidence of a war and one standard deviation increase in tree ring growth are estimated to depress GDP by about 1% and 0.5%, respectively, with the impacts dying out after 10–15 years.

In order to dig deeper into the mechanics of the baseline results, the responses of several other macroeconomic variables are studied using the data available for the UK. The increase in GDP per capita is found to stem from a larger decline in population than in GDP. Per capita income is supported by an increase in per capita land, raising per capita output in agriculture, in line with the Malthusian mechanism. However, labour productivity goes up by more than the rise in per capita land could explain. This effect takes only a few years to reach full force, suggesting that pandemics disproportionately affect low-productivity workers. Indeed, evidence suggests that for most of the diseases studied, mortality rates rise with age. The effect is somewhat delayed, as in the very short run the effects of increases in per capita land and average labour productivity are likely to be offset by the negative impact of pandemic-related disruptions in economic activity and uncertainty.

Per capita real money and prices are also found to go up following a pandemic, suggesting that monetary expansion could also play a role in the short-run increase in per capita incomes. Finally, since the post-pandemic increase in labour productivity is sustained into longer run, the results suggest that pandemics generate institutional improvements and innovation.

It is also examined whether the effects of pandemics differ with scale and across time and countries. Pandemics are found to have a positive impact on GDP per capita in the first, medieval part of the sample, dominated by the Black Death, and the latter part of the sample, dominated by the Spanish flu. A similar pattern emerges when the effects of pandemics are allowed to differ with size—pandemics of similar scale as the Black Death and the Spanish flu (death tolls of approx. 40% and 1–2%, respectively) raise GDP per capita. This suggests that only the largest and/or least anticipated pandemics, such as the Black Death or the Spanish flu, have a potential to induce institutional change or innovation and raise per capita output in the long run. Admittedly, though, in the case of Spanish flu these estimates might be confounded by the post-World War I recovery.

Finally, when countries are studied separately, it appears that pandemics have a positive impact on GDP per capita in Northern Europe (UK, France, Netherlands, Sweden, and Poland), while in the South (Italy, Spain, Portugal) their effect is neutral or negative, supporting the hypothesis that the Black Death led to positive structural and institutional change in the North (such as enclosure), but not in the South (Pamuk 2007; Voigtländer and Voth 2013; Prados De La Escosura and Rodríguez-Caballero 2020).

The qualitative conclusions of the study are largely robust to various adjustments in the model specification, controlling for cross-sectional dependence, alternative ways of accounting for nonlinearity and the use of mean group estimator, though quantitative results and the persistence of the estimated effects into the long run differ in some cases.

Related literature This paper is related primarily to empirical studies on the economic consequences of pandemics. The most closely related paper is Jordà et al. (2020), in which local projections are used to estimate the impact of pandemics (and wars) on interest rates and other macroeconomic variables, including GDP per capita, over a similar time frame. Their approach and data are much more limited, however—they do not use panel data, cover only the most (in)famous pandemics and wars, do not study the heterogeneity of effects across time, scale of a pandemic and countries, and neither control for weather conditions, include time trends, nor control for future shocks via the Teulings–Zubanov adjustment. While they study the effects on variables other than GDP (interest rates and wages), they do not look at per capita land, labour productivity or money supply. Finally, pandemics are represented by a binary variable. They find that the effects of pandemics are positive, but much larger than in this paper—GDP per capita in the UK is found to be almost 10% higher 40 years after a pandemic.

Focusing on more recent events and aiming at drawing conclusions relevant for the current COVID-19 crisis, Ma et al. (2020) use local projections and panel regressions to investigate the macroeconomic effects of the much smaller, but more recent post-World War 2 pandemics. Similar to Jordà et al. (2020), pandemics are represented by a binary variable, though various levels of epidemic severity are differentiated. However, they focus on the short-run effects and neither employ the Teulings–Zubanov adjustment nor study the heterogeneity of effects across time and countries. Epidemics are found to depress GDP by almost 3% at the outbreak, with the effect not fully dying out within 5 years.

A couple of other papers study the short-run effects of the Spanish flu pandemic in given countries, investigating the relationship between regional pandemic incidence and economic outcomes (Brainerd and Siegler 2003; Karlsson et al. 2014; Barro et al. 2020). The results of these studies range from highly negative to positive impacts on GDP per capita.

Thus, the above-mentioned papers seem to suggest that the pre-twentieth-century pandemics had a largely positive impact on GDP per capita, while the impact of more recent events (post-WW2 and to some extent the Spanish flu) was negative. This paper does not fully corroborate this conclusion, finding positive GDP per capita effects both in the medieval times and early twentieth century, though admittedly, the comparability with the literature studying the post-WW2 period is limited given the low number and scale of the post-WW2 epidemics included in the dataset.Footnote 3

The paper is also related to the literature on the pre-industrial economic growth in Europe, which debates whether per capita growth took place before 1750 (Jones 2000; Goldstone 2002, 2019; Broadberry and Wallis 2017), in particular in England and the Netherlands (Broadberry 2013; de Pleijt and van Zanden 2019), pointing to the Black Death, overseas expansion and wars as potential sources of structural changes and growth (Pamuk 2007; Voigtländer and Voth 2013; de Pleijt and van Zanden 2016; O’Brien 2018; Jedwab et al. 2019; Prados De La Escosura and Rodríguez-Caballero 2020). Since the effects of pandemics are found to be prolonged and positive in Northern Europe, but not so much in the South of the continent, the results of this paper support the view that pandemics played a role in spurring pre-industrial growth and the “Little Divergence” between the North Sea Area and the rest of Europe. The opposite is true for wars, for which no long-run effects are identified.

The contribution of this paper is thus a thorough study of short-run and longer-run effects of pandemics on per capita income, the drivers of these effects and their heterogeneity across time, pandemic size and countries, using a large sample of countries and controlling for wars and weather.

While the results of this paper should not be accepted at face value when relating to COVID-19 due to the obvious differences in the economic, organisational and healthcare structure with the pre-twentieth century world, they could be regarded as a reason for optimism that the long-run effects of the pandemic might not be as disastrous as sometimes anticipated, and certainly not as disastrous as in the case of financial crises (Jordà et al. 2013; Reinhart and Rogoff 2014).

The paper is structured as follows: Sect. 2 describes the data, while Sect. 3 discusses the empirical framework. In Sect. 4, the baseline results are presented. Section 5 describes the impact of pandemics on other macroeconomic variables, studying the UK data, while Sect. 6 presents the results accounting for nonlinearities with respect to pandemic size and time as well as heterogeneity across countries. Section 7 provides robustness checks. Finally, Sect. 8 discusses the limitations of the study and Sect. 9 concludes.

2 Data

The dataset covers 33 countriesFootnote 4 over the period of 1252 to 2016.Footnote 5 Only countries with continuous estimates of GDP per capita starting before World War I are included so that the Spanish flu pandemic is covered.Footnote 6

Pandemics are expressed in terms of the percentage of population that died from a given disease in a given year. Death toll estimates are more common than infection estimates and are more likely to reflect the relative social and economic costs of a pandemic event. While these estimates might be imprecise and often vary across sources, they are preferable to a binary variable describing pandemic incidence that effectively gives equal weights to very different events. Nevertheless, the results obtained with the binary variable are also reported for comparison purposes.

Data on the incidence of pandemics and their death tolls are gathered from a large variety of sources—see "Appendix Section 10.1.1" for more details. Death estimates are divided by population estimates from the Maddison Project Database (interpolated when necessary). All disease-generated spikes in death rates are studied as long as they are significant enough (the death rate of 0.1% of population per year is the usually applied threshold, though it is lifted for some recent events where death tolls were significant in absolute terms) and documented (i.e. estimates of death tolls exist). This means that both epidemics (i.e. events constrained to a region or country) and pandemics (spreading to multiple countries or continents) are studied. For simplicity and brevity, the terms “epidemics” and “pandemics” are used interchangeably throughout the paper. Endemic diseases are included only in the years of notable spikes in deaths. When pandemics are reported to have lasted for several years, the death toll is spread evenly over time, unless data suggests otherwise. The binary variable describing pandemic incidence additionally includes events that seem to be significant, but for which no death toll estimates are available.

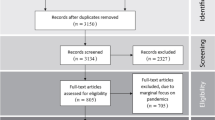

Data on the size of pandemics is presented in Fig. 1.

GDP per capita data comes primarily from the 2018 version of the Maddison Project Database (Bolt et al. 2018).Footnote 7 As I am interested in GDP growth over time, rather than the comparison of relative GDP per capita levels across countries, the 2011 PPP benchmark series is used. Data for the Netherlands and the UK is projected backwards with estimates for Holland and England, respectively, assuming a constant relation of income levels between these regions and entire countries. Data for Italy are extended with estimates for North and Central Italy from Malanima (2011) in the same fashion. For Spain, recent estimates by Prados de la Escosura et al. (2020) are used.

Since the incidence of pandemics is not necessarily fully exogenous, the inclusion of control variables may be warranted. In particular, historical evidence suggests that pandemics are often associated with wars. Looting, devastation, sieges, the resulting poor nutrition, as well as large concentration and movement of troops are conducive to disease outbreaks and support their spread. For example, diseases are considered to be the main cause for the huge decline of population in Germany during the Thirty Years War (Outram 2001), plagues swept through Central and Eastern Europe during the Great Northern War (Kroll and Kruger 2006), typhus killed a large chunk of Napoleon’s Grande Armée during the invasion of Russia (Conlon 2014), while one of the most deadly pandemics in history—the Spanish flu—broke out at the end of World War I.

Thus, to control for a potential impact of wars on pandemics, data on war incidence, expressed as a binary variable, are gathered from a very large number of sources—see "Appendix Section 10.1.2" for details. Included are conflicts that either caused major destruction of physical capital and/or disruption of social and economic activity, or required a substantial military effort from a given country, i.e. a substantial part of its military force was used and actively engaged in warfare. Countries that did not exist as independent entities at the time of conflicts are reported to have taken part in a war if warfare had taken place on their territory or the population of the country had participated in the conflict by being drafted into the military in significant numbers.

Weather is another factor that can potentially affect outbreaks and spread of pandemics. Long periods of drought may facilitate spread of diseases by causing poor nutrition and thus weaker immunity of both humans and disease transmitters. On the other hand, transmitters of some diseases (e.g. mosquitoes) benefit from wet weather conditions. Therefore, long periods of drought followed by wet conditions might be particularly dangerous as they combine abundant populations of transmitters with weaker human immunity—some historical evidence suggests this could have been the reason why the 1545–1548 cocoliztli epidemic in Mexico was so deadly (Acuña-Soto et al. 2002).

To proxy for the effects of weather, data on tree ring growth are used. Tree growth is clearly associated with weather conditions—in fact, temperature, precipitation and drought indices are reconstructed from tree ring data when more direct measures are not available (e.g. Briffa et al. 2004; Cook et al. 2004; Yang et al. 2014a, b). At the same time, tree ring data are available for a larger number of countries over longer time periods than the reconstructed data on temperature, weather and droughts.

Tree ring data are gathered from the NOAA Paleoclimatology database and expressed in terms of the standardised growth index, computed according to the standard chronology method. When several locations are available for a given country, one of them is picked, taking into account time coverage and proximity in distance and altitude to most densely populated areas. For details on the data sources, see "Appendix Section 10.1.3". Tree ring data are not available for Cuba and Malaysia, shrinking the sample to 31 countries.

Cross-correlation plots (Fig. 2) suggest that pandemics are weakly, but statistically significantly, positively correlated with contemporaneous and past wars (up to 8 years back). The correlation between tree rings and pandemics is negative and strongest at 20–30 year lag, thus bad weather conditions seem to increase the likelihood of a pandemic outbreak. The relationship is not statistically significant, however.

3 Empirical framework

3.1 Local projections

Local projections in the spirit of Jordà (2005) are used to estimate the impulse response function (IRF) of GDP per capita to pandemics (as well as wars and weather conditions) over the 40-year horizon. This method entails estimating conditional forecast regressions for various IRF horizons h, which in the simplest case can be written as follows:

where \({y}_{t}\) is the dependent variable, and \({d}_{t}\) is an exogenous shock for which the impulse response is computed. The impulse response function is made of the coefficients \({\beta }^{h}\):

In the context of this paper, local projections have several advantages over IRFs computed from vector autoregressive (VAR) models and analytical IRFs obtained from single equation autoregressive distributed lag (ARDL) models:

-

Local projections are more robust to model misspecification, non-stationarity and autocorrelation, especially at longer horizons (Jordà 2005; Teulings and Zubanov 2014; Plagborg-Møller and Wolf 2020; Montiel Olea and Plagborg-Møller 2021);

-

Local projections are more flexible—lags and nonlinearities can be added in a straightforward mannerFootnote 8;

-

Comparing to VAR models, local projections are easier to estimate in a panel data setup.

However, Jordà (2005) local projections are biased if the shocks of interest reappear over the forecasting horizon (Teulings and Zubanov 2014). This can be corrected for by including shocks that take place between time t + 1 and t + h in the regressions.

Moreover, if the variable of interest is not (fully) exogenous, control variables that are correlated with it (and the dependent variable) should be added to the regression in order to single out the exogenous component of the variation. However, even if the variable of interest is exogenous, the inclusion of control variables and lags of a dependent variable improves the efficiency of the IRF estimates (Jordà et al. 2020).

3.2 Non-stationarity of GDP per capita

An important issue that needs to be resolved is the non-stationarity of the dependent variable—log GDP per capitaFootnote 9 (Fig. 3, Table 1 column 1). Since lags of the dependent variable are included in the specification, the easiest solution—using the first difference estimator—is not feasible as in a dynamic panel data setting, this estimator is biased and inconsistent (Sarafidis and Wansbeek 2012).

An alternative is to account for the structural shifts in trend GDP growth. With this aim, a common piecewise linear time trend is included in the regressions, with structural breaks in 1815 (the Congress of Vienna, i.e. the end of Napoleonic wars), 1945 (the end of World War II) and 1973 (the first oil shock). These dates reflect both important historical events and changes in the slope of log mean GDP per capita trend, as visible in Fig. 3. After accounting for the common trend, the log GDP per capita series passes the IPS and Fisher panel unit root tests (Table 1).

The advantage of a common trend lies in simplicity and efficiency. The introduction of country-specific piecewise linear trends significantly raises the number of explanatory variables to be estimated. As a result, it is no longer possible to use robust standard errors (which is important in this case—see the next subsection for an explanation), introduce nonlinearities into the specification or conduct many of the robustness checks. On the other hand, if one removes the country-specific trends before estimating the model, e.g. by using the Christiano-Fitzgerald filter, the medium- and long-run effects of pandemics are likely to vanish with the trend.

In any case, the alternative ways of dealing with non-stationarity are considered in the Sect. 7.2.

3.3 Baseline specification

All the above considered, the following set of regressions is estimated for \(h=0, 1, \dots ,40\):

where \({y}_{i,t}\) is log GDP per capita for country \(i\) at time \(t\), \({\mu }_{i}\) is a country fixed effect, \({P}_{i,t}\) is the percentage of people killed by a pandemic in country \(i\) at time \(t\), \({\mathrm{war}}_{i,t}\) is a dummy variable equal to 1 if a conflict takes place in country \(i\) at time \(t\), \({\mathrm{tr}}_{i,t}\) is the tree ring standardised growth index in country \(i\) at time \(t\); \({\mathrm{vienna}}_{t}\), \({ww2}_{t}\) and \({\mathrm{oil}}_{t}\) are dummies equal to 1 since 1815, 1945 and 1973, respectively, and 0 before, while \({\varepsilon }_{i,t}\) is an idiosyncratic error term. The last 3 terms before the error term reflect the Teulings–Zubanov adjustment, i.e., these are the shocks that take place between time \(t+1\) and \(t+h\).

The impulse response of log GDP per capita to a pandemic that killed 1% of the population is defined as follows:

Impulse responses to wars and changes in tree ring growth are constructed analogically, i.e. \(\mathrm{IRF}\_\mathrm{war}\left(h\right)= {\theta }_{0}^{h}\) and \(\mathrm{IRF}\_\mathrm{tr}\left(h\right)= {\vartheta }_{0}^{h}\).

Lags of log GDP per capita and the pandemic, war and tree ring variables are included in the specification in order to control for the potential endogeneity of pandemics and improve the model fit and thus estimate efficiency. Since information criteria point to widely different optimal number of lags (AIC suggests 3 lags, BIC 2 lags and adjusted R-squared as much as 29), 10 lags of each of the variables are included in the baseline specification. Alternative numbers of lags are considered in the subsection 7.1.

Equation 3 is estimated with the fixed effects estimator. Even though this estimator is biased in a dynamic panel setting (Nickell 1981), the downward bias on the lagged dependent variable coefficient is diminishing with increasing time dimension of the panel, and thus can be safely ignored in the sample which covers 765 years.

Conditional forecasts of the type considered here suffer from serial correlation since the forecast error follows a moving average process (Teulings and Zubanov 2014). Therefore, standard errors are corrected for heteroskedasticity and autocorrelation using the approach of Driscoll and Kraay (1998).

4 Baseline results

The response of GDP per capita to a pandemic that kills 1% of the population in a given year, obtained from the baseline specification, is presented in Fig. 4.

In the short run, positive and negative effects of pandemics on per capita income seem to roughly cancel each other out. After several years, positive effects, associated i.a. with higher per capita land and capital, begin to dominate. In the second decade following the pandemic, GDP per capita is about 0.25% higher, with the peak effect of 0.28% after 18 years. Afterwards, the effects partially dissipate, but remain positive and statistically significant even after 40 years. Thus, pandemics seem to have a positive impact on GDP per capita in the long run, perhaps because they induce positive institutional changes. The driving factors behind these results are studied in more detail in the following section.

Importantly, taking into account the size of the pandemics does have an influence on the results. When a binary variable is used as the main variable of interest, as in Jordà et al. (2020), both the shape of the impulse response function and the size of the effect differ (Fig. 5). The effect peaks after 10 years instead of almost 20 and disappears after about 20 years, with no statistically significant impact in the longer run. Quantitatively, the effect is larger than in the baseline specification—GDP per capita is higher by as much as 3% 10 years after the pandemic.Footnote 10 It is also worth noting that Jordà et al. (2020) find an even larger effect—GDP per capita raises by as much as 10% after 40 years.Footnote 11

Having said that, the main qualitative conclusion remains unchanged when the binary pandemic variable is used—pandemics continue to have a positive impact on GDP per capita.

The effects of pandemics are very different than those of wars and weather conditions (Fig. 6). A war depresses GDP per capita by about 1% on impact and the effect gradually fades away over the next 10 years. Wars destroy capital while killing a smaller part of the population than pandemics. In line with the neoclassical growth model, this negative impact on capital labour ratio, together with other disruptive effects of wars, generates a negative response of GDP per capita. At the same time, wars—unlike pandemics—have no statistically significant effect on GDP per capita in the long run, contradicting the claims that they were one of the drivers of growth in pre-industrial Europe (Voigtländer and Voth 2013; O’Brien 2018).

In turn, one standard deviation increase in tree ring growth has a borderline significant, negative impact on GDP per capita that persists over the first decade, peaks at 0.5% after 11 years and fades away soon afterwards. These results are somewhat counterintuitive as weather conditions that are conducive to tree growth have a negative and quite persistent impact on per capita income. Perhaps weather conditions that support tree growth are not necessarily conducive to crop growth, especially in the case of excessively wet conditions.

5 Impact on other variables

In order to investigate the mechanics of the baseline results in more detail, the impact of pandemics on other macroeconomic variables is studied using the Bank of England’s “A millenium of macroeconomic data” for the UK. This dataset includes numerous continuous annual time series, many of which go back to 1270 or even 1086.

The impact on population, absolute real GDP, arable land per capita, GDP per hour worked, real wages, real money supply per capita, CPI and per capita value added in agriculture, industry and services are studied in order to check whether the post-pandemic increase in GDP per capita:

-

results from a (persistent) decline in population or an increase in GDP,

-

is supported by an increase in per capita land,

-

is associated with an increase in labour productivity that—if outstrips effects of higher per capita land—likely stems from pandemics disproportionately affecting low-productivity workers (if true in the short run) or/and productivity-enhancing innovation/structural change (if true in the long run), e.g. resulting from wage pressure—if wages increase more than labour productivity,

-

is supported (in the short run) by monetary expansion,

-

results from a structural move from less productive (agriculture) to more productive (industry) sectors.

All the time series used go back to at least 1270 and end in 2016, with the exception of data on arable land that ends in 1871. The time series are described in more detail in "Appendix Section 10.1.5".

The econometric specification is essentially the same as in the baseline specification, with a given variable of interest replacing GDP per capita and the model run for time series rather than panel data, i.e. country-specific fixed effects and subscripts are dropped:

where \({y}_{t+h}\) is the variable of interest (in logs). The results remain largely the same if real money supply per capita and detrended measure of crop yields (an alternative proxy for weather) are included as additional control variables (results not reported).

Responses of GDP per capita, absolute GDP and population to a pandemic shock resulting in the death of 1% of the population are compared in Fig. 7. GDP per capita increases as population shrinks more than GDP. Both GDP and population decline persistently, remaining depressed after 40 years. These results indicate that higher per capita income is likely to—at least partially—result from higher per capita land and capital stocks following a pandemic.

It is also worth noting that the response of GDP per capita is quite similar for the UK as for the full panel of countries, making the results for the UK relatively representative for the full sample.

In line with expectations, per capita land increases following a pandemic (Fig. 8), though by less than the decline in population would suggest as some of the land stops being cultivated. The 0.6% rise in per capita land, assuming a standard Cobb–Douglas production function with a textbook land-capital share of 1/3, leads to an increase in per capita output by 0.2%. However, the estimated increase in GDP per capita is larger (close to 0.5% at peak) and labour productivity, measured by GDP per hour worked, rises by even more (over 0.8% at peak).

This suggests that an increase in land per capita is only a part of the story. Given that the increase in labour productivity reaches its peak only after a few years, the most plausible explanation is that pandemics disproportionately affect low-productivity workers (sick, elderly). The effect is not exactly immediate, as in the very short run labour productivity is likely to be depressed by the ongoing pandemic reducing mobility and increasing uncertainty.

Indeed, evidence shows that for most of the diseases included in the sample, mortality rates increase with age (see, for example, DeWitte 2010 for plague, Adhikari et al. 2018 for typhus, Phelphs et al. 2018 for cholera and Soler et al. 2009 for yellow fever). On top of that, waterborne cholera tends to spread in low-income neighbourhoods characterised by poor sanitation. Only smallpox, with highest mortality rates among children, and to some extent the Spanish flu, with unusually high mortality rates among young adults (see e.g. Gagnon et al. 2013), diverge from this pattern.

If this is indeed the case, the positive impact of pandemics on labour productivity should dissipate over time, and over the first 20 years it seems to be doing just that. Later productivity is again trending slightly upwards, suggesting that other factors (innovation, structural change) may play a role.

The responses of per capita output in agriculture, industry and services to a pandemic shock (Fig. 9) fit well into the above-proposed story. Per capita output increases in all sectors almost instantly, in line with the hypothesis that pandemics tend to disproportionately affect low-productivity workers, increasing labour productivity. At the same time, output in agriculture increases more than in industry and services, confirming the importance of the rise in per capita land. After about 20 years the initial positive impact on output in industry and services dissipates, but later on output begins to trend upwards once again, especially in industry, confirming that some innovative forces may be at play.

This innovative drive may to some extent stem from wage pressure. Following a pandemic, wages initially follow or even lag a bit behind labour productivity (Fig. 8). However, after 30 years they begin to outpace productivity, which may prompt entrepreneurs to substitute labour with capital or look for other ways to improve productive processes.

Finally, the positive reaction of GDP per capita to a pandemic shock may be supported—at least in the short run—by monetary expansion. Real money supply per capita increases, generating some inflation (Fig. 10). The gradual and persistent character of the increase in money supply suggests that this is not merely a by-product of the fall in population given steady coin supply, but more of a policy decision—i.e. governments resort to coin debasement following pandemics.

Summing up, an increase in per capita land and labour productivity—the latter likely stemming from pandemics disproportionately affecting low-productivity workers—are the most important source of the increase in GDP per capita following a pandemic. Monetary expansion—in the short run—and innovation—in the long run—could also play some role.

6 Heterogeneity with respect to time, pandemic size and across countries

6.1 Variation over time

The effects of pandemics may differ over time with i.a. changing economic structures and healthcare practices. So may the effects of war and weather, as the character of warfare changes and the share of agriculture in GDP diminishes. To test these hypotheses, the sample is divided into 3 subperiods: the medieval period (pre-1500), the early modern period (1500–1815) and the period of sustained economic growth (post-1815). Such a division makes sense not only from a historical and economic perspective, but also from the point of view of history of pandemics—the first subperiod covers the beginning of the second plague pandemic (the Black Death and first recurrences of plague), the second one covers the later—less deadly—period of this plague pandemic, while during the third subperiod the importance of plague has dissipated.

Nevertheless, alternative ways of investigating whether the effects of pandemics vary over time—the rolling window regression and a specification with polynomial terms of time interacted with the pandemic variable—are reported in Appendices B.2 and B.3.

The impulse responses estimated separately for the 3 sample subperiods are presented in Fig. 11.

GDP per capita effects of medieval pandemics are positive and very similar to baseline estimates. In the early modern period this positive effect disappears—if anything, pandemics have a borderline significant negative effect on GDP per capita, but only after almost 30 years. After 1815 the estimates turn positive and significant once again, except on impact, when the effect is negative—in line with what Ma et al. 2020 find for the post-WWII epidemics. The positive medium- and long-run effects are, however, an order of magnitude larger than in medieval times—a pandemic resulting in the death of 1% of population raises GDP per capita by as much as 5%.

The difference in estimates between the medieval and early modern periods can be rationalised. The Black Death was the first pandemic of that kind and magnitude in several hundred years. As such, both the “mechanical” effects on income per capita and the potential for inducing (positive) structural change were large. After 1500, plague was a recurring phenomenon and its potential for inducing creative destruction was likely exhausted. Moreover, quarantines began to be put in place, which likely limited economic activity in the short term.

Looking closer at the post-1815 sample, it becomes evident that the results are driven by the Spanish flu pandemic—the largest pandemic in this subperiod that took place at the end of World War I. While wars are controlled for, this is done with a binary variable, and thus economic costs of wars are assumed to be equal. With the economic costs of WWI clearly larger than average, the model seems to be attributing the post-war recovery to the effects of the Spanish flu.

6.2 Nonlinearity with respect to pandemic size

The baseline specification assumes that the effects of pandemics are proportional. This might be a strong assumption, however—while small events are likely to have limited effects, especially in the longer run, large events might cause structural and institutional shifts, leading to pronounced effects in the long run.

Therefore, an alternative specification investigates whether the effects of pandemics on GDP per capita depend on the size of a pandemic. For this purpose, up to the fourth-order polynomial terms of the pandemic variable at time \(t\) are added to the regressions:

which results in the following expression for the impulse response function:

Cubic form of the impulse response function gives enough flexibility to cover various forms of nonlinearity. The results obtained from a specification with fewer (up to third order) polynomial terms are presented in "Appendix Section 10.2.4".

The impulse responses obtained from the specification which allows for nonlinearity with respect to the pandemic size are shown in Fig. 12.

The impulse responses from the nonlinear specification are largely consistent with the results obtained for the sample subperiods. Both the largest (40% death toll) and the smallest pandemics (1–2% death toll) have a positive impact on GDP per capita in the medium run, picking up the effects of the Black Death and the Spanish flu, respectively. The peak effect appears somewhat earlier (after about 10 years) than in the baseline specification, though, and after over 20 years the impact of pandemics turns negative. The effects of mid-sized pandemics are a mirror image—negative in the first decade and positive after more than 20 years.

6.3 Heterogeneity across countries

The baseline specification also assumes that the effects of pandemics on GDP per capita are uniform across countries. However, variations in the levels of development, institutions, economic structures, etc., might cause the effects of pandemics to differ across jurisdictions. To test whether cross-country heterogeneity has an impact on the results, the mean group estimator is used, i.e. the baseline specification is estimated for each country separately and these individual country estimates are then averaged (Pesaran and Smith 1995). In order to make sure that each of the country-specific regressions is estimated on a large enough sample, only countries with samples that cover at least 400 years are retained when this estimation procedure is used.Footnote 12 Since this sample covers only European countries, a separate regression is run for the rest of the world to test whether the effects of pandemics remain the same also outside of Europe. Finally, the estimates for the individual countries are also investigated to check whether the patterns of results differ among regions and specific countries.

The impulse response function estimated with the mean group estimator for the group of 8 countries with long time series is presented in Fig. 13.

Mean group estimation for long-sample countries: response of GDP per capita to a pandemic resulting in the death of 1% of the population in a given year. Shaded area is a 90% confidence band around response estimates. Long-sample countries are countries with at least 400 observations: Spain, France, UK, Italy, Netherlands, Poland, Portugal, and Sweden

Qualitative conclusions remain the same—pandemics have a positive impact on GDP per capita, which in this case is borderline significant over the first 20 years following a pandemic. Quantitatively, the effect is estimated to be larger than in the baseline specification—following a pandemic resulting in the death of 1% of the population, GDP per capita rises by more than 2% at peak. The impulse response function drops massively after about 25 years, but this fall is driven by one country—the Netherlands, where GDP per capita plummeted during World War II, about 25 years after the Spanish flu pandemic—and thus is not statistically significant.

Looking at estimates for specific countries ("Appendix Section 10.2.1"), impulse responses are similar to the baseline estimate in the UK and France, largely positive in Poland, Sweden (except for the first decade following a pandemic) and the Netherlands (barring the third decade), close to zero in Italy and largely negative in Spain and Portugal. Thus, pandemics tend to have positive impact on GDP per capita in Northern Europe, while in the South the effects are neutral or negative.

This probably reflects the fact that pandemics led to positive institutional changes (such as enclosure) in the North, while in the South, perhaps due to differences in economic structures, such a positive impact did not materialise. Hence, these results confirm the hypothesis that pandemics played a role in spurring the “Little Divergence” between the North Sea region and the rest of Europe before the industrial revolution (Pamuk 2007; Voigtländer and Voth 2013; Prados De La Escosura and Rodríguez-Caballero 2020).

The above analysis is conducted only for selected European countries. However, the rest of world differed from Europe not only in terms of culture, institutions, scientific knowledge and the level of economic interconnectedness across countries, but also in terms of diseases—while in Europe plague caused the most deadly pandemics, in the New World smallpox played a more important role. Moreover, Acemoglu et al. (2001) claim that in the New World, diseases discouraged settlement and led to the creation of highly persistent, extractive institutions that limited future economic growth. For all these reasons, the effects of pandemics could be different—potentially negative—outside of Europe.

To test this hypothesis, the sample is divided between Europe (including Central and Eastern Europe; 18 countries) and the rest of the world (15 countries; all of them but Japan used to be colonies). The impulse responses to pandemics in these subsamples are shown in Fig. 14.

The impulse response for Europe is virtually identical to the baseline, which is not very surprising given that almost 80% of the observations come from the Old Continent. In the rest of the world, the IRF is qualitatively similar—pandemics have a persistent, positive impact on GDP per capita. Thus, there is no evidence of the negative feedback loop between diseases and institutions as claimed by Acemoglu et al. (2001). The peak effect comes somewhat later (after 25 years) and is significantly larger (about 2%), though, and the impact of pandemics disappears in the long run, suggesting that in the New World pandemics were less conducive to positive structural and institutional change than in (Northern) Europe.

7 Robustness checks

For brevity, only selected robustness checks pertaining to the baseline estimates are reported in this section. The remaining robustness checks, including those of the specifications with time-varying and nonlinear effects of pandemics as well as cross-country heterogeneity, are presented in "Appendix Section 10.2".

7.1 Specification adjustments

As the first robustness check, the baseline specification is modified by removing either the piecewise time trend, the control variables or the Teulings–Zubanov adjustment (shocks that take place between time t + 1 and t + h), either increasing (to 30) or decreasing (to 3) the number of lags of all explanatory variablesFootnote 13 and adding time fixed effects. The impulse response functions resulting from these robustness checks are presented in Fig. 15.

Only the addition of time fixed effects has a substantial influence on the results. While the initial response is positive and similar to the baseline, after almost 20 years it turns negative and stays there till the end of the IRF interval. This negative response in longer run is not statistically significant, however. This result is not that surprising given that time fixed effects cancel out any common cross-country trends. As argued earlier, only large, cross-country events may matter in the long run—and in this case their effects are likely to be captured by time fixed effects. At the same time, positive country-specific (dependent on the size of the pandemic) effects on land per capita and labour productivity continue to increase GDP per capita in the shorter run. Very similar results are obtained for the specification with common correlated effects (see Sect. 7.3), which eliminates common trends in a somewhat similar manner.

Other modifications have limited effects on the results. Over the first 20 years, differences among specifications are negligible. Later on, some divergence begins to appear, but the shape of the IRF and qualitative conclusions remain unchanged.

7.2 Alternative approaches to non-stationarity of GDP per capita

Three alternative approaches to dealing with non-stationarity of the log GDP per capita series are considered: the first difference estimator, the inclusion of country-specific piecewise linear time trends (with the same structural breaks as in the baseline specification), and detrending the log GDP per capita series with the Christiano–Fitzgerald filter (Christiano and Fitzgerald 2003). In the latter case, the structural shift and time trend variables are dropped from the specification, the asymmetric filter is used and the maximum period of oscillation is set to 100 years in order to retain as much long-run variability as possible.

The impulse responses resulting from these alternative approaches to non-stationarity of GDP per capita are presented in Fig. 16.

The inclusion of country-specific trends has very little impact on the results, easing the concerns that the baseline results might be driven by country-specific deviations from the common trend. The shape of the first-difference IRF is also very similar, though the effects are somewhat more volatile over time, which is to be expected with this estimator.

To the contrary, when the CF filter is used, the IRF moves downwards, with positive but more limited GDP per capita effects up to 20 years following the pandemic and negative effects afterwards. The medium- and long-run impact of pandemics found in the baseline specification thus seems to be captured by the CF trend, even though the maximum oscillation period is set to 100 years.Footnote 14

7.3 Cross-sectional dependence

Error terms may be correlated across countries due to common technological developments and, especially later on in the sample, trade linkages. The effects of pandemics may also spill over to other countries even if the disease does not, not only via trade linkages, but also as a result of higher uncertainty. Using tests based on Breusch and Pagan’s LM statistic, scaled LM statistic and Pesaran’s CD statistic (Breusch and Pagan 1980; Pesaran 2004), the null of no cross-sectional dependence in the baseline specification is rejected at any conventional significance level.

Cross-sectional dependence deems the fixed effects estimator inconsistent (Phillips and Sul 2007). The most straightforward way of solving this issue is via the common correlated effects (CCE) estimator developed by Pesaran (2006) that boils down to augmenting the specification with cross-sectional averages of dependent and independent variables. Even though this estimator was developed for static panels, Chudik and Pesaran (2015) and Everaert and De Groote (2016) demonstrate that it performs well for dynamic panels if T is large and a sufficient number of lags of cross-sectional averages is included in the specification. The CCE estimator is available in two versions: pooled and mean group, the latter allowing for cross-country heterogeneity in model parameters.

To test whether cross-sectional dependence has an impact on the results, the pooled version of the CCE estimator is used. The pooled estimator is preferred given a relatively large number of explanatory variables (driven mostly by the Teulings–Zubanov adjustment). This does not constitute a problem, however, as Pesaran (2006) shows that the pooled estimator performs well even if parameters are in fact heterogeneous. Cross-country averages of all explanatory variables and their lags are included in the specification. Given the baseline specification includes 10 lags of explanatory variables, the number of lags of cross-sectional averages is likely to be sufficient in such a case.

The response of GDP per capita to a country-specific pandemic shock is presented in the left panel of Fig. 17.

Similar to the baseline specification, GDP per capita does not react on impact and increases in the medium run, though the peak effect appears earlier, after less than 10 years, and is not statistically significant at a 10% level. However, after 20 years the effects turn negative, in contrast to the baseline results.

This impulse response does not show the whole picture, however. In the CCE specification, the impact of pandemics on GDP per capita shows up not only in the pandemic variable, but also in its cross-section average. The latter may be interpreted as a common shock that reflects the impact of large cross-border pandemics as well as their spillover effects. The impulse response to a common shock is reported in the right panel of Fig. 17.

The response to a common shock is largely neutral over the first 15 years following a pandemic, but positive afterwards. Putting the two impulse responses together, it seems that countries more affected by a given pandemic (or affected by a country-specific epidemic) have higher GDP per capita in the medium run—likely due to a mechanical impact on per capita land and capital and higher average labour productivity, with pandemics disproportionately affecting low-productivity workers. In the longer run, GDP per capita increases across the board, likely reflecting positive institutional and technological developments following large pandemics. At the same time, countries more affected by large pandemics seem to benefit less in the long run, while country-specific epidemics do not lead to any positive long-run developments.

The responses to country-specific and common pandemic shocks can be added for a comparison with the IRF obtained from baseline specification, bearing in mind the differences in interpretation.Footnote 15 Such a sum lines up quite well with the baseline estimate, though the effects over the first 15 years following the pandemic are somewhat smaller while being somewhat larger after 25 to 35 years (Fig. 18).

Hence, the regressions that account for cross-sectional dependence confirm that the effects of pandemics on GDP per capita are on average positive, but differ across large, cross-border events and smaller, country-specific epidemics, with only the former supporting positive structural changes in the long run.

8 Caveats

There are numerous caveats to the results presented above. First and foremost, there are many potential issues with the data. The pandemic death tolls are often no more than rough estimates, frequently limited to certain cities or regions. Population estimates, to which the pandemic death tolls are related to obtain the main variable of interest, are also quite tentative prior to the nineteenth century. At the same time, they are quite sparse; therefore, interpolation is often used to obtain an estimate for a given year. In the eras of wars and pandemics, these interpolations might be quite imprecise.

Other variables also suffer from data issues. Historical GDP per capita estimates are relatively reliable for benchmark years (though still very imprecise compared to modern national accounts data), but the in-between continuous estimates are much more tentative.Footnote 16 They are based on population interpolations, and hence do not account for large shifts in population due to pandemics and wars; in practice, they are constructed for specific regions or even cities, and hence may be heavily influenced by local factors.

The data on tree rings are plagued with similar issues as the GDP per capita data. These are estimates for a particular place, sometimes—when no better location is available—from not a very central region, not necessarily representative for a given country as a whole. Moreover, observations are derived from various tree species, and thus are not entirely comparable between each other. The quality of the data is not constant over time, as early observations tend to be derived from fewer trees, leading to higher variation in tree ring growth. Finally, tree ring growth is not a perfect proxy for agricultural conditions, as weather conditions that are conducive to tree growth are not necessarily conducive to crop growth.

Finally, the scale of armed conflicts is not taken into account. The losses in both population and capital stocks varied wildly across wars. At the same time, the scale of conflicts is likely to be correlated with the likelihood of disease outbreak, and thus bias the estimates of the effects of pandemics. The results of regressions with time-varying effects or cross-country heterogeneity suggest that this is indeed an issue around the World Wars.

Econometrically, all these data issues are likely to cause a measurement error in both the dependent and independent variables. As a result, parameter (IRF) estimates are likely to be biased towards zero and standard errors are likely to be inflated. Both issues make it more difficult to obtain statistically significant results. However, if the measurement error is not random, then the results may be biased in another direction.

Omitted variables are another potential issue. The economic consequences of a pandemic might depend not only on its death toll, but also—as we have seen recently—on containment measures, whether it is a more local or nationwide event, infectiousness of the disease and its death rate, duration of the pandemic etc. There are also other variables that might be correlated with the likelihood of a pandemic outbreak and GDP per capita, e.g. hygiene practices, which are likely to have varied not only over time, but also across countries, affecting pandemic outbreak and spread. Another such variable is trade linkages, which could have been conducive to pandemic spread, while increasing per capita income.

9 Discussion and conclusion

The paper finds that on average, pandemics have a positive effect on GDP per capita. On impact, GDP falls in line with population and GDP per capita does not change, with the impact of pandemic-related disruptions to economic activity and uncertainty likely balancing out with increasing land per capita. After a few years GDP per capita begins to increase, with the peak effect appearing after 10 to 20 years. The results for the UK show that this rise stems mainly from an increase in per capita land and higher mortality rates among low-productivity workers, which raises average labour productivity. Positive impact persists even after 40 years, suggesting that pandemics seem to lead to institutional improvements and innovation.

Quantitatively, the effects are rather limited—at peak, GDP per capita increases by less than 0.3% following a pandemic that kills 1% of the population. Thus, the absolute level of GDP falls, as the decline in population is larger than an increase in GDP per capita.

A closer examination of the results across time, countries and pandemic sizes shows that the baseline responses are driven by 2 events—the Black Death and the Spanish flu. The former had a robustly positive impact on GDP per capita in the medium and long run of the size similar to the baseline estimates. The latter is estimated to have had an order of magnitude larger impact, though this estimate is likely to be confounded by the post-WWI recovery. Other pandemics seem to have had a broadly neutral impact on GDP per capita.

It seems that large and unanticipated events, such as the Black Death and perhaps the Spanish flu,Footnote 17 led to significant increases in per capita land and capital and average labour productivity that cannot be missed by—admittedly tentative—historical GDP per capita estimates. In the longer run, these large events led to structural changes that created more growth-friendly institutions. Especially the Black Death, the first large plague pandemic in several hundred years, had a significant impact on power structures and economic organisation of the society. The rise in wages increased the demand for urban products, spurring city growth (Voigtländer and Voth 2013). The increase in the amount of land per person started the process of enclosure and a gradual demise of the growth-unfriendly feudal system.

Smaller and easier to anticipate pandemics, on the one hand, generated small enough effects in the short and medium run that could go undetected in the estimates of historical GDP, and on the other hand, did not lead to substantial structural shifts. Over time, society adapted to recurring plague pandemics, and even if population losses were significant, they did not manage to shake up the established order.

The effects of pandemics differ from those of war and weather, the latter being proxied with tree rings. Both wars and higher tree ring growth depress GDP per capita in the first 10–15 years, with no long-run effects. Having said that, the negative effect of higher tree ring growth and its persistence 10–15 years afterwards is somewhat puzzling.

Are the results of this paper in any way relevant in the context of the COVID-19 pandemic? COVID-19 significantly differs from the pandemics studied in this paper as its effects stem mostly from restrictions imposed on social and economic activity, while in the past the impacts were related mostly to population losses. Studies focusing on post-WW2 pandemics (such as Ma et al. 2020) are clearly more relevant when one aims to study particularly the short-run effects of COVID-19. However, this paper could be regarded as an optimistic indication that unlike e.g. financial crises, pandemics are unlikely to have negative effects in the long run. Quite to the contrary, these effects could be positive if COVID-19 speeds up innovation and structural changes related to, e.g. remote work, automation, or e-commerce.

Going forward, more work is to be done on the data front, including the coverage of additional countries and a further selection of sources to make the data more comparable across time and countries. This relates not only to the pandemic variable, but also controls. It would also be desirable to scale the war variable in a similar fashion as the pandemic variable, either by casualties or the number of engaged troops. This would help especially in the study of pandemics that happened around the World Wars. On the top of that, accounting for various other characteristics of pandemics other than the death toll, such as regional distribution and time scope, infectiousness, death rates, and containment measures, would definitely help to obtain more accurate and nuanced estimates of the economic consequences of pandemics. Finally, it would be interesting to study the spillover effects of pandemics across countries in more detail.

Data availability

Data are available on the author’s website: https://sites.google.com/view/maciej-stefanski/pandemic-dataset.

Code availability

Code is available upon request.

Notes

The paper studies all significant and documented disease-generated spikes in death rates, whether they have regional or national impact (and thus they can be referred to as epidemics) or they spread over multiple countries or continents (and hence can be termed as pandemics). For simplicity and brevity, the terms “epidemics” and “pandemics” are used interchangeably throughout the paper. For a more detailed definition of studied epidemic events, see the data section.

Long run is defined as the IRF horizon, i.e. 40 years after the pandemic. Throughout the paper, “on impact” refers to the year of the pandemic outbreak (time 0), “short run” to the first few (≤ 5) years following the pandemic, and “medium run” to the period 10–20 years after the pandemic, when the peak effect usually appears.

See "Appendix Section 10.2.6" for a more detailed discussion of this issue.

Argentina, Australia, Austria, Belgium, Canada, Switzerland, Chile, Cuba, Germany, Denmark, Spain, Finland, France, UK, Greece, Indonesia, India, Italy, Japan, Mexico, Malaysia, Netherlands, Norway, New Zealand, Peru, Philippines, Poland, Portugal, Romania, Russia, Sweden, USA, and South Africa.

Data on pandemics and wars are available over the whole 1252–2016 period, while the coverage of tree ring and GDP per capita data is limited. See "Appendix Section 10.1" for details.

Not all such countries are included, however—Bolivia, Brazil, Colombia, Ecuador, Korea, Sri Lanka, Panama, Singapore, Taiwan, Uruguay and Venezuela all have continuous GDP per capita estimates starting before 1914 (though, with the exception of Venezuela, no earlier than 1870), but are not covered.

The 2020 edition of the database has been published recently, but it does not include any important new time series. The main modification is the change back to the 1990 PPP benchmark, which does not have any effect on pre-1950 growth estimates and thus should not substantially influence the results in this paper.

Increasing the number of lags is limiting degrees of freedom much faster in VAR models than in local projections, while making the computation of IRFs much more cumbersome in ARDL models.

Though it should also be noted that Montiel Olea and Plagborg-Møller 2021 find local projections to be robust to non-stationarity.

The numbers from the baseline and the binary variable specifications are not directly comparable, but taking into account that an average pandemic killed about 1.2% of population per year, and there are almost twice as few (169 to 308) pandemic events as observations with positive pandemic size (since only the first year of the pandemic is denoted in the binary variable case), it is clear that the binary variable specification points to significantly larger effects of pandemics than the baseline specification.

They study only the UK, do not include any trends and cover a limited set of pandemics, which probably explains the difference.

Spain, France, UK, Italy, Netherlands, Poland, Portugal, and Sweden. The results for the full sample are reported in "Appendix Section 10.2.5".

3 lags are optimal according to the AIC information criterion, while 30 is the maximum number of lags considered (and optimal according to adjusted R2).

When the maximum period of oscillation is increased further, the CF trend stops to capture well the post-1815 developments in trend growth and thus loses any potential advantage over the piecewise linear trend.

The sum of CCE IRFs shows a reaction of GDP per capita to a pandemic that killed 1% of population in each of the countries in the sample, while the baseline IRF does not consider what happens abroad.

See, for example, Malinowski and van Zanden (2017) for details on the construction of historical GDP per capita estimates.

While the death toll of the Spanish flu (1–2%) was not very large in the context of the whole sample, it has been the largest pandemic of the last 150 years with one of the highest death tolls in absolute terms. Thus, it can be regarded as a large event.

The 2020 edition of the database has been published recently, but it does not include important new time series. The main modification is the change back to the 1990 PPP benchmark, which does not have any effect on pre-1950 growth estimates and thus should not substantially influence the results of this paper.

In the baseline specification, if one country has 400 observations and the other 100, the one with more observations has effectively 4 times as much influence on the results as the one with fewer observations. Using mean group estimator, they are of equal importance. For short sample countries, observations are on average more recent than for long sample countries. Therefore, more recent observations have a relatively larger weight in the mean group estimator than in the baseline specification.

References

Aberth J (2013) From the brink of the apocalypse: confronting famine, war, plague and death in the later middle ages. Routledge, London

Acemoglu D, Johnson S, Robinson JA (2001) The colonial origins of comparative development: an empirical investigation. Am Econ Rev 91(5):1369–1401

Acuña-Soto R, Romero LC, Maguire JH (2000) Large epidemics of hemorrhagic fevers in Mexico 1545–1815. Am J Trop Med Hyg 62(6):733–739

Acuña-Soto R, Stahle DW, Cleaveland MK, Therrell MD (2002) Megadrought and megadeath in 16th century Mexico. Emerg Infect Dis 8(4):360

Adhikari S, Poudel RS, Shrestha S, Lamichhane P (2018) Predictors of mortality in scrub typhus infection requiring intensive care admission in Tertiary Healthcare Centre of Nepal. Interdiscip Perspect Infect Dis 2018:1–6

Alchon SA (2003) A pest in the land: new world epidemics in a global perspective. UNM Press, Albuquerque

Alexander JT (2002) Bubonic plague in early modern Russia: public health and urban disaster. Oxford University Press, Oxford

Åman M (1990) Spanska sjukan: den svenska epidemin 1918–1920 och dess internationella bakgrund. Studia Historica Upsaliensia 160

Ansart S, Pelat C, Boelle PY, Carrat F, Flahault A, Valleron AJ (2009) Mortality burden of the 1918–1919 influenza pandemic in Europe. Influenza Other Respir Viruses 3(3):99–106

Appleby AB (1980) Epidemics and famine in the little ice age. J Interdiscip History 10(4):643–663

Arnold D (1993) Colonizing the body: state medicine and epidemic disease in nineteenth-century India. University of California Press, Berkeley

Arnold D (2019) Dearth and the modern empire: the 1918–19 influenza epidemic in India. Trans R Hist Soc 29:181–200

Barro RJ, Ursúa JF, Weng J (2020) The coronavirus and the great influenza pandemic: lessons from the “Spanish Flu” for the coronavirus’s potential effects on mortality and economic activity. NBER working paper, 26866

Barry JM (2004) The site of origin of the 1918 influenza pandemic and its public health implications. J Transl Med 2(1):1–4

Barua D, Greenough WB III (1992) Cholera: current topics in infectious disease. Springer, Berlin

Beardslee GW (2000) The 1832 cholera epidemic in New York State. Early Am Rev 4(1)

bei der Wieden B (1999) Die Entwicklung der Pommerschen Bevölkerung, 1701 bis 1918. Veröffentlichungen der Historischen Kommission für Pommern (vol 33). Forschungen zur Pommerschen Geschichte (vol 5). Böhlau

Beloch KJ (1937) Bevölkerungsgeschichte Italiens: Grundlagen: die Bevölkerung Siziliens und des Königreichs Neapel. De Gruyter

Benedictow OJ (2004) The black death, 1346–1353: the complete history. Boydell & Brewer, Woodbridge

Bergeron G (1872) Des Caractères Généraux des Affections Catarrhales Aiguës. Adrien-Delahaye

Biraben JN (1976) Les Hommes et la Peste en France et Dans les Pays Européens et Méditerranéens, Les Hommes Face à la Peste: Civilisations et Sociétés. Mouton, Berlin

Bohn R (1989) Das Handelshaus Donner in Visby und der gotländische Außenhandel im 18. Jahrhundert. Quellen und Darstellungen zur hansischen Geschichte. 33. Böhlau

Bolt J, Inklaar R, de Jong H, van Zanden J (2018) Rebasing ‘Maddison’: new income comparisons and the shape of long-run economic development. GGDC Research Memorandum, Groningen, p 174

Bowling WK (1866) Cholera, as it appeared in Nashville in 1849, 1850, 1854 and 1866. University Book and Job Office, Medical College, WHF Ligon, Nashville

Brainerd E, Siegler MV (2003) The economic effects of the 1918 influenza epidemic

Bray RS (2004) Armies of pestilence: the impact of disease on history. James Clarke & Co, Cambridge

Brecke P (1999) Violent conflicts 1400 AD to the present in different regions of the World. 1999 Meeting of the Peace Science Society

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Briffa KR, Osborn TJ, Schweingruber FH (2004) Large-scale temperature inferences from tree rings: a review. Glob Planet Change 40(1–2):11–26

Broadberry S, Wallis JJ (2017) Growing, shrinking, and long run economic performance: historical perspectives on economic development. NBER working paper, 23343

Broadberry S (2013) Accounting for the great divergence. Economic history working papers, 184/13

Burchardt J, Meissner RK, Burchardt D (2009) Oddech Śmierci – Zaraza Dżumy w Wielkopolsce i w Poznaniu w Pierwszej Połowie XVIII wieku. Nowiny Lekarskie 78(1):79–84

Byrne JP (2008) Encyclopedia of pestilence, pandemics and plagues. Greenwood Press, Westport

Byrne JP (2012) Encyclopedia of the black death. ABC-CLIO, Santa Barbara

Carbonetti A (2010) Historia de una Epidemia Olvidada: La Pandemia de Gripe Española en la Argentina, 1918–1919. Desacatos 32:159–174

Carey M (1793) A short account of the malignant fever, lately prevalent in Philadelphia: with a statement of the proceedings that took place on the subject in different parts of the United States

Cesana D, Benedictow OJ, Bianucci R (2017) The origin and early spread of the black death in Italy: first evidence of plague victims from 14th-century Liguria (Northern Italy). Anthropol Sci 125(1):15–24

Chandra S, Kuljanin G, Wray J (2012) Mortality from the influenza pandemic of 1918–1919: the case of India. Demography 49(3):857–865

Chisholm H (ed) (1911) Yellow fever. Encyclopædia Britannica, vol 28, 11th edn. Cambridge University Press, Cambridge, pp 910–911

Chowell G, Simonsen L, Flores J, Miller MA, Viboud C (2014) Death patterns during the 1918 influenza pandemic in Chile. Emerg Infect Dis 20(11):1803

Christiano LJ, Fitzgerald TJ (2003) The band pass filter. Int Econ Rev 44(2):435–465

Chudik A, Pesaran MH (2015) Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J Econom 188(2):393–420

Clark WR (2008) Bracing for Armageddon? The science and politics of bioterrorism in America. Oxford University Press, Oxford

Cohn SK (2010) Black death, social and economic impact of the. In: Bjork RE (ed) The Oxford dictionary of the middle ages. Oxford University Press, Oxford

Collins S (1671) The present state of Russia. Newman, London

Conlon JM (2014) The historical impact of epidemic typhus

Cook ND (2004) Demographic collapse: Indian Peru, 1520–1620. Cambridge University Press

Cook ER, Woodhouse CA, Eakin CM, Meko DM, Stahle DW (2004) Long-term aridity changes in the western United States. Science 306(5698):1015–1018

Cook ER, Anchukaitis KJ, Buckley BM, D’Arrigo RD, Jacoby GC, Wright WE (2010) Asian monsoon failure and megadrought during the last millennium. Science 328(5977):486–489

Creighton C (1891) A history of epidemics in Britain, from AD 964 to the extinction of Plague. Cambridge University Press

Cumpston JHL (1914) The history of small-pox in Australia, 1788–1908. AJ Mullett, Melbourne

Daschuk JW (2013) Clearing the plains: disease, politics of starvation, and the loss of aboriginal life. University of Regina Press, Regina

de Pleijt AM, van Zanden JL (2016) Accounting for the “little divergence”: what drove economic growth in pre-industrial Europe, 1300–1800? Eur Rev Econ Hist 20(4):387–409

de Pleijt AM, van Zanden JL (2019) Preindustrial economic growth, ca 1270–1820. In: Diebolt C, Haupert M (eds) Handbook of cliometrics. Springer, Cham, pp 423–438

DeLeo FR, Hinnebusch BJ (2005) A Plague upon the phagocytes. Nat Med 11(9):927–928

Desjardins B (1996) Demographic aspects of the 1702–1703 smallpox epidemic in the St. Lawrence Valley. Can Stud Popul 23:49–67

DeWitte SN (2010) Age patterns of mortality during the black death in London, AD 1349–1350. J Archaeol Sci 37(12):3394–3400

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Stat 80(4):549–560

Duchêne R, Contrucci J (2004) Marseille: 2600 ans d’histoire. Fayard, Paris

Eckert EA (1978) Boundary formation and diffusion of Plague: Swiss epidemics from 1562 to 1669. In: Annales de démographie historique. Société de Démographie Historique, pp 49–80

Erkoreka A (2010) The Spanish influenza pandemic in occidental Europe (1918–1920) and victim age. Influenza Other Respir Viruses 4(2):81–89

Everaert G, De Groote T (2016) Common correlated effects estimation of dynamic panels with cross-sectional dependence. Econom Rev 35(3):428–463

Frandsen KE (2010) The last plague in the Baltic region 1709–1713. Museum Tusculanum Press, Copenhagen

Gagnon A, Miller MS, Hallman SA, Bourbeau R, Herring DA, Earn DJ, Madrenas J (2013) Age-specific mortality during the 1918 influenza pandemic: unravelling the mystery of high young adult mortality. PLoS ONE 8(8):e69586

Gallagher JA (1936) The Irish emigration of 1847 and its Canadian consequences. CCHA Rep 3:43–57

Goldberg J (1996) Introduction. In: Ormrod M, Lindley PG (eds) The black death in England. Stamford, Paul Watkins, pp 1–15

Goldstone JA (2002) Efflorescences and economic growth in World history: rethinking the “rise of the west” and the industrial revolution. J World History 13:323–389

Goldstone JA (2019) Data and dating the great divergence. In: Roy T, Riello G (eds) Global economic history. Bloomsbury, London, pp 38–53

Göse F (2009) Prenzlau im Zeitalter des “Absolutismus” (1648–1806). In: Neitmann K, Schich W (eds) Geschichte der Stadt Prenzlau. Lewiston, Geiger, pp 140–184

Gottfried RS (2010) Black death. Simon and Schuster

Gould GM, Pyle WL (1896) Anomalies and curiosities of medicine. The Julian Press, Houston

Grabowski ML, Kosińska B, Knap JP, Brydak LB (2017) The lethal Spanish influenza pandemic in Poland. Med Sci Monit Int Med J Exp Clin Res 23:4880

Griffiths T (2009) Stockholm: a cultural history. Oxford University Press, Oxford

Hatcher J (2010) The black death: an intimate history. Hachette UK, Paris

Hays JN (2005) Epidemics and pandemics: their impacts on human history. ABC-CLIO, Santa Barbara

Hays JN (2009) The burdens of disease: epidemics and human response in western history. Rutgers University Press, New Brunswick

Helleiner KF (1967) The population of Europe from the black death to the eve of the vital revolution. Camb Econ History Eur 4:1–96

Horrox R (ed) (1994) Fifteenth-century attitudes: perceptions of society in late medieval England. Cambridge University Press, Cambridge

Hosking GA (2001) Russia and the Russians: a history. Harvard University Press, Cambridge

Houston CS, Houston S (2000) The first smallpox epidemic on the Canadian plains: in the fur-traders’ words. Can J Infect Dis 11:112–115

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econom 115(1):53–74

Ionescu ŞX (1974) Bucureştii în Vremea Fanarioţilor. Ed. Dacia

Jackson C (2009) History lessons: the Asian flu pandemic. Br J Gen Pract 59(565):622–623

Jedwab R, Johnson ND, Koyama M (2019) Pandemics, places, and populations: evidence from the black death. CESifo working paper, 7524

Johnson NP, Mueller J (2002) Updating the accounts: global mortality of the 1918–1920 “Spanish” influenza pandemic. Bull History Med 76:105–115

Jones C (1996) Plague and its metaphors in early modern France. Representations 53:97–127

Jones EL (2000) Growth recurring: economic change in World history. University of Michigan Press, Ann Arbor

Jordà Ò (2005) Estimation and inference of impulse responses by local projections. Am Econ Rev 95(1):161–182

Jordà Ò, Schularick M, Taylor AM (2013) When credit bites back. J Money Credit Bank 45(s2):3–28

Jordà Ò, Singh SR, Taylor AM (2020) Longer-run economic consequences of pandemics. NBER working paper, 26934

Jordan EO (1927) Epidemic influenza. A survey. American Medical Association, Chicago

Karlsson G (2020) Iceland’s 1100 years: history of a marginal society. Oxford University Press, Oxford