Abstract

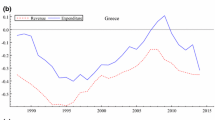

There is a growing literature documenting that the persistence of time series may change over time, and as a consequence, shifts in the long-run equilibrium of macroeconomic variables are expected. An important example is the significant increase in public debt in certain periods of time due to increases in government expenditures which are not matched by revenue counterparts. In this paper, new residual-based Wald-type tests are proposed which are designed to detect segmented cointegration, i.e., subsamples during which equilibrium relations exist. We derive the asymptotic properties of the tests, tabulate critical values for models with different deterministic components, and show by simulations that the tests display good finite sample performance in many relevant setups. Our empirical application provides a thorough examination of the main components of US governments’ budgets at two administrative levels (Federal, and State and Local) and concludes that until Bill Clinton’s presidency government budgets components never moved together.

Similar content being viewed by others

Change history

27 December 2021

A Correction to this paper has been published: https://doi.org/10.1007/s00181-021-02187-0

Notes

From the OMB: “The Federal Government has used the unified or consolidated budget concept as the foundation for its budgetary analysis and presentation since the 1969 Budget. The basic guidelines for the unified budget were presented in the Report of the President’s Commission on Budget Concepts (October 1967). The Commission recommended the budget include all Federal fiscal activities unless there were exceptionally persuasive reasons for exclusion." The BEA splits the data in two different excel files, one prior and one after 1969, so we took the one with the most recent period. We tried with data starting in 1947Q1 but obtained some in-congruent results.

In 2016, 44%, 13%, and 35%, respectively, from the Federal government current receipts.

In 2016, 17%, 47%, and 29%, respectively, from the State and Local government current receipts.

In 2016, 24%, 64%, and 11%, respectively, from the Federal government current expenditures, and 65%, 27%, and 8% from the State and Local government current expenditures.

In 2016, 79% is consumption expenditures and 21% is gross investment for Federal, and 83% and 17%, respectively, for State and Local.

In 2016, 59% is for national defense and 41% for nondefense.

References

Andrews DWK, Kim J-Y (2006) Tests for cointegration breakdown over a short time period. J Bus Econ Stat 24(4):379–394

Ang A, Bekaert G (2002) Regime switches in interest rates. J Bus Econ Stat 20:163–182

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66:47–78

Banerjee A, Lumsdaine RL, Stock JH (1992) Recursive and sequential tests of the unit-root and trend-break hypotheses: theory and international evidence. J Bus Econ Stat 10(3):271–287

Breitung J (2002) Nonparametric tests for unit roots and cointegration. J Econom 108(2):343–363

Camarero M, Carrion-i Silvestre JL, Tamarit C (2015) The relationship between debt level and fiscal sustainability in organization for economic cooperation and development countries. Econ Inq 53:129–149

Chang Y, Park JY (2002) On the asymptotics of adf tests for unit roots. Econom Rev 21(4):431–447

Chen P-F (2016) Us fiscal sustainability and the causality relationship between government expenditures and revenues: a new approach based on quantile cointegration. Fisc Stud 37:301–320

Chu C-SJ, Stinchcombe M, White H (1996) Monitoring structural change. Econometrica 64(5):1045–1065

Davidson J, Monticini A (2010) Tests for cointegration with structural breaks based on subsamples. Comput Stat Data Anal 54(11):2498–2511

Elliott G, Rothenberg T, Stock J (1996) Efficient tests for an autoregressive unit root. Econometrica. 64(4):813–836

Engle RF, Granger CWJ (1987) Cointegration and error correction: representations, estimation and testing. Econometrica 55:251–276

Gregory AW, Hansen BE (1996) Practitioners corner: tests for cointegration in models with regime and trend shifts. Oxford Bull Econ Stat 58(3):555–560

Gregory AW, Hansen BE (1996) Residual-based tests for cointegration in models with regime shifts. J Econom 70(1):99–126

Hansen BE (1992) Tests for parameter instability in regressions with i(1) processes. J Bus Econ Stat 10:321–335

Harvey DI, Leybourne SJ, Taylor AMR (2006) Modified tests for a change in persistence. J Econom 134:441–469

Hassler U, Meller B (2014) Detecting multiple breaks in long memory the case of us inflation. Empir Econ 46(2):653–680

Herrera AM, Pesavento E (2005) The decline in US output volatility: structural changes and inventory investment. J Bus Econ Stat 23(4):462–472

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12:231–254

Kejriwal M, Perron P (2010) Testing for multiple structural changes in cointegrated regression models. J Bus Econ Stat 28:503–522

Kejriwal M, Perron P (2012) A note on estimating a structural change in persistence. Econ Lett 117(3):932–935

Kejriwal M, Perron P, Zhou J (2013) Wald tests for detecting multiple structural changes in persistence. Econom Theor 29(2):289–323

Kim J-Y (2000) Detection of change in persistence of a linear time series. J Econom 95:97–116

Kim J-Y (2003) Inference on segmented cointegration. Econom Theor 19:620–639

Leybourne S, Taylor A, Kim T (2007) Cusum of squares-based tests for a change in persistence. J Time Ser Anal 28:408–433

Lütkepohl H, Saikkonen P, Trenkler C (2003) Comparison of tests for the cointegrating rank of a VAR process with a structural shift. J Econom 113(2):201–229

Mahdavia S, Westerlund J (2011) Fiscal stringency and fiscal sustainability: panel evidence from the American state and local governments. J Policy Model 33:953–969

Martin G (2000) Us deficit sustainability: a new approach based on multiple endogenous breaks. J Appl Econom 15:83–105

Martins LF, Rodrigues PMM (2014) Testing for persistence change in fractionally integrated models: an application to world inflation rates. Comput Stat Data Anal 76:502–522

Ng S, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power. Econometrica 69(6):1519–1554

Nguyen TD, Suardi S, Chua CL (2017) The behavior of us public debt and deficits during the global financial crisis. Contemp Econ Policy 35:201–215

Park JY, Phillips PCB (1988) Statistical inference in regressions with integrated processes: part 1. Econom Theor 4(3):468–497

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica 57(6):1361–1401

Perron P (2005) Dealing with structural breaks. Boston University-Department of Economics-Working Papers Series WP2005-017. Boston University, Department of Economics

Perron P, Ng S (1996) Useful modifications to some unit root tests with dependent errors and their local asymptotic properties. Rev Econ Stud 63:435–463

Perron P, Qu Z (2006) “Estimating restricted structural change models.” J Econ 134:373–399

Perron P, Rodriguez G (2016) Residuals-based tests for cointegration with gls detrended data. Econom J 19:84–111

Perron P, Vogelsang TJ (1992) Testing for a unit root in a time series with a changing mean: Corrections and extensions. J Bus Econ Stat 10(4):467–470

Phillips PCB, Hansen BE (1990) Statistical inference in instrumental variable regressions with i(1) processes. Rev Econ Stud 57:99–125

Phillips PCB, Ouliaris S (1990) Asymptotic properties of residual based tests for cointegration. Econometrica 58(1):165–193

Phillips PCB, Park JY (1988) Asymptotic equivalence of ordinary least squares and generalized least squares in regressions with integrated regressors. J Am Stat Assoc 83:111–115

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Qu Z (2007) Searching for cointegration in a dynamic system. Econom J 10(3):580–604 (10)

Quintos CE, Phillips PCB (1993) Parameter constancy in cointegrating regressions. Empir Econ 18:675–706

Rodrigues P, Sibbertsen P, Voges M (2019) Testing for breaks in the cointegrating relationship: on the stability of government bond markets’ equilibrium. Working paper No 12, Banco de Portugal

Saunoris JW (2015) The dynamics of the revenue- expenditure nexus: evidence from us state government finances. Public Finance Rev 43(1):108–134

Sibbertsen P, Kruse R (2009) Testing for a break in persistence under long-range dependencies. J Time Ser Anal 30(3):263–285

Siklos PL, Granger CWJ (1997) Regime-sensitive cointegration with an application to interest-rate parity. Macroecon Dyn 1(3):640–657

Stock J, Watson M (1996) Evidence on structural instability in macroeconomic time series relations. J Bus Econ Stat 14:11–30

Wagner M, Wied D (2017) Consistent monitoring of cointegrating relation- ships: the us housing market and the subprime crisis. J Time Ser Anal 38(6):960–980

Zivot E, Andrews D (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 10(3):251–70

Acknowledgements

We thank the Editor Robert Kunst, and two anonymous referees for their helpful and constructive comments on an earlier version of this paper. Martins gratefully acknowledges financial support from the Portuguese Science Foundation (FCT) through project UID/GES/00315/2020 and Rodrigues through projects PTDC/EGE-ECO/28924/2017, and (UID/ECO/00124/2013, UID/ECO/00124/2019 and Social Sciences DataLab, LISBOA-01-0145-FEDER-022209), POR Lisboa (LISBOA-01-0145-FEDER-007722, LISBOA-01-0145-FEDER-022209) and POR Norte (LISBOA-01-0145-FEDER-022209)

Funding

Martins gratefully acknowledges financial support from the Portuguese Science Foundation (FCT) through project UID/GES/00315/2020 and Rodrigues through projects PTDC/EGE-ECO/28924/2017, and (UID/ECO/00124/2013, UID/ECO/00124/2019 and Social Sciences DataLab, LISBOA-01-0145-FEDER-022209), POR Lisboa (LISBOA-01-0145-FEDER-007722, LISBOA-01-0145-FEDER-022209) and POR Norte (LISBOA-01-0145-FEDER-022209).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest:

Luis F. Martins declares that he has no conflict of interest. Paulo M. M. Rodrigues declares that he has no conflict of interest.

Ethical approval:

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original online version of this article was revised: The affiliation “CIMS, University of Surrey, Guildford, UK” was incorrectly tagged to the author “Paulo M. M. Rodrigues”. It should have been tagged to the author “Luis F. Martins”

Supplementary Information

Below is the link to the electronic supplementary material.

Technical appendix

Technical appendix

1.1 Preliminary results

Considering \(\xi _{t}\) as defined in Assumption 1 and \( \varepsilon _{0}=0\), the following standard multivariate FCLT can be stated,

where \(\mathbf {W}\left( r\right) :=\left( W_{1}\left( r\right) ,\mathbf {W}_{ \mathbf {2}}\left( r\right) ^{\prime }\right) ^{\prime },\) \(W_{1}\left( r\right) \) is a standard Wiener process, \(\mathbf {W}_{\mathbf {2}}\left( r\right) \) is a K vector of standard Wiener processes and \(\mathbf {\Omega } :=\left( \begin{array}{cc} \omega _{yy} &{} \omega _{xy}^{\prime } \\ \omega _{xy} &{} \mathbf {\Omega }_{\mathbf {x}\mathbf {x}} \end{array} \right) .\) Thus, \(T^{-1/2}\varepsilon _{\left[ rT\right] }\Rightarrow \omega _{11\cdot 2}{}^{1/2}W_{11\cdot 2}\left( r\right) ,\) where \(\omega _{11\cdot 2}:=\omega _{yy}-\omega _{xy}^{\prime }\mathbf {\Omega }_{\mathbf {x}\mathbf {x} }^{-1}\omega _{xy}\) and \(W_{11\cdot 2}\left( r\right) :=W_{1}\left( r\right) +\left( \frac{R^{2}}{1-R^{2}}\right) ^{1/2}\mathbf {W}_{2}\left( r\right) ,\) is a scalar Wiener process, \(\mathbf {W}_{2 }\left( r\right) :=K^{-1/2}\sum _{i=1}^{K}W_{i}\left( r\right) ,\) K is the number of exogenous regressors considered in (2.1), and \(R^{2}=\Lambda '\Lambda \) with \(\Lambda =\Omega _{\mathbf {x}\mathbf {x}}^{-1/2}\omega _{xy}\omega _{yy}^{-1/2}\) and \(0 \le R^{2} \le 1\); see e.g., Perron and Rodriguez (2016).

Under \(H_{0}:c_{j}=0\) and \(\gamma _{j}=0,\) for all j, considering \( \widehat{\mathbf {b}}^{\prime }:=\left( 1,-\widehat{\mathbf {\ }\varvec{ \beta }}^{\prime }\right) ,\) where \(\widehat{\varvec{\beta }}\) is the OLS estimate of \(\varvec{\beta }\) in (2.1) and \(\widehat{ \varvec{\beta }}^{\prime }\mathbf {x}_{t}=e_{t},\) it follows that \(\widehat{\mathbf {b}}\rightarrow \mathbf {b},\) where \(\mathbf {b}:=\left( 1,- \varvec{\beta }^{\prime }\right) \). Furthermore,

where \(\mathbf {B}\left( r\right) :=\left[ B_{1}\left( r\right) _{1\times 1}, \text { } \mathbf {B}_{2}\left( r\right) _{K \times 1}\right] ^{\prime }\) is a \((K+1)\times 1\) vector Brownian motion with covariance matrix \(\mathbf {\Omega }=\Omega _{0}+\Omega _{1}+\Omega _{1}^{\prime }.\)

To remove the nuisance parameters present in the distributions of the test statistics, consider \(\mathbf {\Omega }:=\mathbf {LL}^{\prime },\) where \(\mathbf {L}:=\left( \begin{array}{cc} l_{11} &{} 0 \\ l_{21} &{} \mathbf {L}_{22} \end{array} \right) \) with \(l_{11}:=\left( \omega _{yy}-\omega _{xy}^{\prime }\mathbf { \Omega }_{\mathbf {xx}}^{-1}\omega _{xy}\right) ^{1/2};\) \(l_{21}:=\mathbf { \Omega }_{\mathbf {xx}}^{-1/2}\omega _{xy};\) and \(\mathbf {L}_{22}:=\mathbf {\Omega }_{\mathbf {xx}}^{1/2}\) (see Phillips and Ouliaris 1990). Moreover, define

where \(\mathbf {W}(r)\) is a vector of standard Brownian motions. Then,

Furthermore, \(\mathbf {B}\left( r\right) =\mathbf {L}^{\prime }\mathbf {W} \left( r\right) ;\) \(\mathbf {Lb}=l_{11}\kappa ;\) \(\mathbf {b}^{\prime }\mathbf { \Omega b}=\omega _{11\cdot 2}\kappa ^{\prime }\kappa ;\) \(\mathbf {b}^{\prime } \mathbf {B}\left( r\right) =l_{11}Q\left( r\right) ;\) \(\mathbf {b}^{\prime }\left( \int _{0}^{1}\mathbf {B}d\mathbf {B}^{\prime }\right) \mathbf {b}=\omega _{11\cdot 2}\left( \int _{0}^{1}Q(r)dQ(r)^{\prime }\right) ,\) and \(\mathbf {b} ^{\prime }\mathbf {Ab}=a_{11\cdot 2}=\omega _{11\cdot 2}\int _{0}^{1}Q(r)^{2}\) so that \(\left( 1,-a_{\mathbf {x}y}^{\prime }\mathbf {A}_{\mathbf {xx} }^{-1}\right) =\mathbf {b}^{\prime }.\)

1.2 Proof of Theorem 1

Considering Assumption 1 under the null hypothesis of no cointegration, \(\varepsilon _{t}=\varepsilon _{t-1}+\nu _{t}\) with \(\nu _{t}\) white noise, the test regression we consider is:

where \(e_{t}\) are the full sample LS residuals from (2.1). For the sake of simplicity and with no loss of generality, we consider the case of a test regression with no deterministics; however, this will be generalized below.

Recall that the residual-based Wald test for \(H_{1A}\) (which corresponds to the case where the first regime is I(1)) is,

where \(\tau :=\left( \tau _{1},\ldots ,\tau _{m^{*}}\right) \) with \(\tau _{j}:=T_{j}/T\) and the number of changes is fixed, \(m=m^{*}.\) Thus, under \(H_{0}:\gamma _{j}=0,\) \(j=1,\ldots ,m+1,\) it follows from (A.1) that

where \(\xi _{t}:=(\varepsilon _{t},\mathbf {u}_{t}^{\prime })^{\prime }.\) Moreover, under the alternative hypothesis and for \(m^{*}\) fixed and even,

Noting that \(\sum _{j=0}^{m^{*}/2}\sum _{t=T_{2j}+1}^{T_{2j+1}}\left( \Delta e_{t}\right) ^{2}=\sum _{t=1}^{T}\left( \Delta e_{t}\right) ^{2}-\sum _{j=1}^{m^{*}/2}\sum _{t=T_{2j-1}+1}^{T_{2j}}\left( \Delta e_{t}\right) ^{2},\) it follows that

Since

and given that \(\widehat{\gamma }_{2j}=\frac{\sum _{t=T_{2j-1}+1}^{T_{2j}} \left( e_{t-1}-\overline{e}_{2j,-1}\right) \left( \Delta e_{t}-\overline{ \Delta e}_{2j}\right) }{\sum _{t=T_{2j-1}+1}^{T_{2j}}\left( e_{t-1}-\overline{ e}_{2j,-1}\right) ^{2}},\) and

we establish that

Therefore,

where

and

for \(j=1,\ldots ,m^{*}/2\ \)and \(\overline{\Delta \mathbf {X}}_{2j}:=\frac{1}{ T_{2j}-T_{2j-1}}\sum _{t=T_{2j-1}+1}^{T_{2j}}\Delta \overline{\mathbf {X}}_{t}= \overline{\mathbf {\xi }}_{2j},\) with \(\mathbf {X}_{t}:=(y_{t},\) \(\mathbf {x} _{t}^{\prime })^{\prime }\).

Hence, under Assumptions 1 and the null hypothesis of no cointegration it follows that

Note from (A.2) that

Hence, for \(m^{*}\) fixed and even, and assuming \(p_{T}=0,\) it follows that

We can straightforwardly establish from the results in Sect. 1 that

and

Hence, from (A.5) to (A.7), we establish that under joint convergence, for \(m^{*}\) fixed and even,

When \(m^{*}\) is odd, \(F_{A}\left( \tau ,m^{*}\right) :=\frac{\left( T-m^{*}-1\right) \left( SSR_{0}-SSR_{k,m^{*}}\right) }{\left( m^{*}+1\right) SSR_{k,m^{*}}},\) so that there is the correction of \( m^{*}+1\) replacing \(m^{*}\) in the previous expression. By the same token,

and all results in Theorem 1 hold true knowing that \(\mathbf {b}^{\prime } \mathbf {\Omega b}=\omega _{11\cdot 2}\kappa ^{\prime }\kappa \) from Sect. 1 and with \(\xi _{t}\) not autocorrelated, \(\mathbf {\Omega } _{1}=0,\) so that \(\mathbf {\Omega }=\mathbf {\Omega }_{0}\). The distributions become free of nuisance parameters even if we have endogeneity, \(\omega _{xy}\ne 0\). For a single variable, these correspond to the distributions in Kejriwal et al. (2013), as \(Q=W_{1}\equiv W\) and \(\kappa =1.\) The case of \(m^{*}=0 \) (standard cointegration) cannot be obtained from our distributions.

Remark A.1. Note that \(Q\ \)is a scalar and that in general the distribution of these distributions is non-standard and depends on the nuisance parameters \(\Omega _{0},\) \(\Omega _{1}.\) This is still the case even if \(\Omega _{0}\) and \(\Omega _{1}\) are block diagonal. This a is typical feature in limit theory for (non)cointegrating regressions. In this context, we can propose transformations of the statistic which involve consistent estimates of the nuisance parameters (Phillips and Park 1988), or we can try FM-OLS optimal estimation of Phillips and Hansen (1990) which introduces nonparametric corrections in the OLS estimator. \(\diamondsuit \)

For the case of \(\xi _{t}\) autocorrelated, \(\mathbf {\Omega }_{1}\ne 0,\) we present now a correction that eliminates the nuisance parameters and thus keeps the validity of the limit distributions presented above. To correct for the nuisance parameters, consider instead of \(SSR_{A,m^{*}}\) the following corrected sum of squared residuals:

where the scalar correction term \(\widehat{\Upsilon }_{1}\) is defined as,

The statistic considering \(p_{T}=0,\) and \(m^{*}\) even is,

where the second (scalar) correction term, \(\widehat{\Upsilon }_{2}\), in the denominator of (A.10) is,

Hence, for the numerator of (A.10), we observe that

and

Thus, under joint convergence of (A.11) and (A.12), we establish that

as in the case of \(F_{A}\left( \tau ,m^{*}\right) \) with \(\xi _{t}\) not autocorrelated.

Rights and permissions

About this article

Cite this article

Martins, L.F., Rodrigues, P.M.M. Tests for segmented cointegration: an application to US governments budgets. Empir Econ 63, 567–600 (2022). https://doi.org/10.1007/s00181-021-02156-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-021-02156-7