Abstract

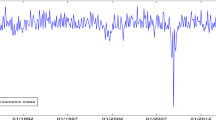

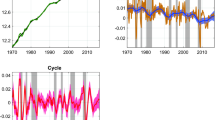

This paper studies the characteristics of financial cycles (credit and house prices) and their interactions with business cycles in Taiwan. We employ multivariate structural time series model to estimate trend and cyclical components in real bank credit, real house prices, and real GDP. We find that financial cycles are roughly twice the length of the business cycles, and house price cycles lead both credit and business cycles. Nevertheless, the estimated length of business and financial cycles in Taiwan is much shorter than those in industrialized economies. We then use machine learning to evaluate the importance of a macroeconomic variable that predicts downturns of financial cycles, by conducting both in-sample fitting and out-of-sample forecasting. Those macrovariables selected by machine learning reflects Taiwan’s close linkage in trades and financial interdependence with other countries such as China and spillover effects from the Fed’s monetary policy.

Similar content being viewed by others

Notes

As for the stock price, it has much a higher degree of synchronization with the business cycle than credit and house price cycles do.

Given the stylized facts of financial cycles for industrialized economies outlined above, however, there is a heterogeneity among these countries. For example, in some cases the financial cycles of Germany are found to be substantially shorter than other European countries. However, the reason for this finding is yet to be clear.

Note that due to data limitation, Pontines (2017) examines GDP and equity prices for Hong Kong, Malaysia, Philippines, and Thailand. House prices were available only for Hong Kong.

Note that due to limit of sample periods for a large number of variables, the estimation starts at 1995Q2.

The list of all 74 variables is omitted here, but is available upon request.

The details for computing the average frequencies \(\lambda _{i}^{G}\) and the average coherences and phase shifts can be referred to the “appendix” of Runstler and Vlekke (2018).

To avoid an overly smooth slope and make sure that the maximum likelihood estimation is able to converge and attain a maximum value, we restrict the values of standard deviations of innovations \(\varepsilon _{t}\), \(\sigma _{\eta }\), and \(\sigma _{\upsilon }\) for both the univariate and multivariate STSM ( Runstler and Vlekke (2018)).

For the purpose of comparison, we also estimate Hodrick–Prescott (HP) filter, frequency-based filter, ARMA spectral analysis, univariate UCM, and univariate STSM to measure financial and business cycles. There are some differences between these methods and the multivariate STSM. As mentioned in Introduction, these alternative methods have obvious shortcomings compared to multivariate STSM. The results are available upon request.

Why are business cycles in Taiwan substantially shorter than those in other industrialized economies? Rand and Tarp (2002) study the nature and characteristics of short-run macroeconomic fluctuations for 15 developing countries, and find that their business cycles are generally shorter than their developed counterparts. They argue that this is because shocks originating in developed countries are important drivers of short-run output fluctuations in developing countries. Taiwan is a highly small open economy, and thus, its economic activity is deeply affected by external shocks from other economies. Monetary policy and business fluctuations from advanced economies and trading partners are the main sources of these external shocks, which makes Taiwan’s business cycles exposed to external shocks and fluctuate more frequently than industrialized economies.

We use the package of eviews to conduct both the BDS test and the distribution test.

Note that we use the package of Business Cycle Dating (BCDating) in R, specifying the minimum length of a cycle and minimum length of a phase of a cycle so that the duration of a complete cycle is close to the average length of cycles identified by the multivariate STSM from last section.

For selecting the number of variables randomly sampled, Breiman (2001) suggests trying the default number \(\sqrt{J}\), half of the default, and twice the default, and pick the best. Liaw and Wiener (2002) point out the results generally do not change dramatically. Even with the number set to be 1, it can generate very good performance for some data.

Usually, a large number of trees are necessary to get stable estimates of variable importance. However, Liaw and Wiener (2002) suggests that even though the variable importance measures may vary for each run of iteration, the ranking of variable importance is quite stable.

Note that China’s industrial production index matters only in the in-sample fitting, but not in out-of-sample forecasting. A possible explanation is that Taiwan’s manufacturers take orders but mainly produce in China for exports. Since exogenous shocks from advanced economies affect both Taiwan and China, the predicting power of China’s industrial production index is weakened in the out-of-sample forecasting, compared to OECD’s leading indicators or US monetary policy.

References

Aikman D, Haldane A, Nelson B. Curbing the credit cycle. Econ J. 2015;125:1072–109.

Berge T. Predicting recessions with leading indicators: model averaging and selection over the business cycle. J Forecast. 2015;34(6):455–71.

Bordo MD, Haubrich JG. Credit crises, money and contractions: an historical view. J Monet Econ. 2010;57:1–18.

Borio C. The financial cycle and macroeconomics: what have we learnt? J Bank Finance. 2014;45(C):182–98.

Breiman L. Random forests. Mach Learn. 2001;45(1):5–32.

Brock WA, Dechert WD, Scheinkman JA, LeBaron B. A test for independence based on the correlation dimension. Econ Rev. 1996;15(C):197–235.

Chen NK. Bank net worth, asset prices and economic activity. J Monet Econ. 2001;48:415–36.

Chen X, Kontonikas A, Montagnoli A. Asset prices, credit and the business cycle. Econ Lett. 2012;117:857–61.

Claessens S, Kose MA, Terrones ME. Financial cycles: what? how? when?. In: Richard C, and Francesco G, editors NBER International Seminar on Macroeconomics 2010. Chicago: University of Chicago Press; 2011. p. 303–43.

Claessens S, Kose MA, Terrones ME. How do business and financial cycles interact? J Int Econ. 2012;87(1):178–90.

Dell’Ariccia G, Igan D, Laeven LA. Credit booms and lending standards: evidence from the subprime mortgage market. IMF working papers. 2008.

Drehmann M, Borio C, Tsatsaronis K. Characterising the financial cycle: don’t lose sight of the medium term! BIS working papers, no 380. June 2012.

Duca JV, Muellbauer J, Murphy A. Housing markets and the financial crisis of 2007–2009: lessons for the future. J Financ Stab. 2010;6:203–17.

Duca JV, Muellbauer J, Murphy A. Shifting credit standards and the boom and bust in US house prices. London: CEPR; 2011 (CEPR Discussion paper 8361).

Friedman J, Hastie T, Tibshirani R. The elements of statistical learning, vol. 1. New York: Springer Series in Statistics; 2001.

Grinsted A, Moore JC, Jevrejeva S. Application of the cross wavelet transform and wavelet coherence to geophysical time series. Nonlinear Process Geophys. 2004;11(5/6):561–6.

Hanus L, Vacha L. Growth cycle synchronization of the Visegrad Four and the European Union. Empir Econ. 2020;58:1779–95.

Harding D, Pagan AR. Dissecting the cycle: a methodoligical investigation. J Monet Econ. 2002;49(2):365–81.

Harvey AC, Koopman SJ. Multivariate structural time series models. In: Heij C, Schumacher H, Hanzon B, editors. System dynamics in economic and financial models. New York: Wiley; 1997. p. 269–98.

Iacoviello M. House prices, borrowing constraints and monetary policy in the business cycle. Am Econ Rev. 2005;95(3):739–64.

Jorda O, Schularick M, Taylor A. When credit bites back: leverage, business cycles, and crises. J Money Credit Bank. 2013;45(s2):3–28.

Kiyotaki N, Moore J. Credit cycles. J Political Econ. 1997;105(2):211–48.

Koopman SJ, Lucas A. Business and default cycles for credit risk. J Appl Econ. 2005;20(2):311–23.

Long PM, Servedio RA. Random classification noise defeats all convex potential boosters. Mach Learn. 2009;78(3):287–304.

Liaw A, Wiener M. Classification and regression by random forest. R News. 2002;2:18–22.

Lilliefors HW. On the Kolmogorov–Smirnov test for normality with mean and variance unknown. J Am Stat Assoc. 1967;62:399–402.

Mian AR, Sufi A. The consequences of mortgage credit expansion: evidence from the U.S. mortgage default crisis. Q J Econ. 2009;124:1449–96.

Miranda-Agrippino S, Rey H. US monetary policy and the global financial cycle. NBER working paper. 2019.

Mishkin FS. How should we respond to asset price bubbles? Speech at the Wharton Financial Institutions Center, Philadelphia. 2008.

Murray CJ. Cyclical properties of Baxter–King filtered time series. Rev Econ Stat. 2003;85(2):472–6.

Pan W, Bai H. Propensity score analysis: fundamentals and developments. New York: Guilford Publications; 2015.

Pontines V. The financial cycles in four East Asian economies. Econ Model. 2017;65:51–66.

Raffinot T. Investing through economic cycles with ensemble machine learning algorithms. Working paper. 2017.

Rand J, Tarp F. Business cycles in developing countries: are they different? World Dev. 2002;30(12):2071–88.

Reinhart CM, Rogoff KS. This time is different: eight centuries of financial folly. Princeton: Princeton University Press; 2009.

Rey H. Dilemma not trilemma: The global financial cycle and monetary policy independence. In: Jackson Hole Conference Proceedings, Kansas City Fed. 2013.

Ridgeway G. Generalized boosted models: a guide to the gbm package. Working paper. 2012.

Runstler G. Modelling phase shifts among stochastic cycles. Econ J. 2004;7(1):232–48.

Runstler G, Vlekke M. Business, housing, and credit cycles. Appl Econ. 2018;33:212–26.

Schapire RE. A brief introduction to boosting. In: Proceedings of the Sixteenth International Joint Conference on Artificial Intelligence, p. 1–6. 1999.

Schularick M, Taylor AM. Credit booms gone bust: monetary policy, leverage cycles, and financial crises, 1870–2008. Am Econ Rev. 2012;102(2):1029–61.

Schuler YS, Hiebert P, Peltonen TA. Characterizing financial cycles across europe: one size does not fit all. ECB working paper 1846. 2015.

Thode HC Jr. Testing for normality. New York: Marcel Dekker; 2002.

Torrence C, Compo GP. A practical guide to wavelet analysis. Bull Am Meteorol Soc. 1998;79(1):61–78.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank two anonymous referees for their helpful comments and suggestions. All errors remain ours. Chen also acknowledges the financial support of the Ministry of Science and Technology (107-2410-H-002-018-MY2), Taiwan. Finally, the views expressed herein are those of the authors and do not necessarily reflect the official opinions of Central Bank of the ROC (Taiwan).

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Cheng, HL., Chen, NK. A study of financial cycles and the macroeconomy in Taiwan. Empir Econ 61, 1749–1778 (2021). https://doi.org/10.1007/s00181-020-01926-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-020-01926-z