Abstract

Licensing is one of the main channels for technology transfer from foreign-owned multinational enterprises (MNEs) to domestic plants. This transfer, occurring within and across industries, results in technology spillovers that may affect both intra- and interindustry productivity. Intellectual property rights (IPR) legislation may increase (or reduce) this effect. Using Chilean plant-level data for the 2001–2007 period and an exogenous variation from an IPR reform in 2005, we explore whether or not IPR affects the spillover effects of licensing on productivity. We find that stronger IPR reduces backward spillovers but increases forward spillovers. Moreover, the IPR legislation effect is stronger on firms that are on average smaller, and have low productivity. Our results are robust not only to a series of definitions of IPR, licensing, and productivity, but also to a set of different specifications.

Similar content being viewed by others

Notes

For a survey on spillover effects, see Görg and Greenaway (2004).

For more examples, see www.franquicia.cl/nacionales.html.

For further information, see Instituto Nacional de Propiedad Industrial (www.inapi.cl).

This could present a problem if the majority of firms have more than one plant; however, as noted by Pavcnik (2002), using a previous version of this dataset, approximately 90% have a single plant. For the 2001–2007 period, this figure is approximately 89%.

The covered industries are, in terms of ISIC (Rev.3) codes, 17, 18, 19, 20, 21, 22, 24, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34, 35, and 36. The ISIC (Rev.3) codes of the manufacturing sector range from 15 to 36. Industries 16 (tobacco) and 23 (coke, refined petroleum products, and nuclear fuel) have no observations in the dataset.

Although there may be a loss of information, in this case the number of observations lost is not large (approximately 6 percent of the original dataset). When estimating a model using fixed effects, these fixed effects will capture all the inherited characteristics of a firm that do not change over time. Thus, a change in industry or region would invalidate the interpretation of the results.

The entire methodology for constructing the two-digit deflators can be obtained from https://www.ine.cl/estadisticas/economia/industria-manufacturera/estructura-de-la-industria.

An excellent survey of TFP estimation can be found in Van Beveren (2012).

Table 12 in “Appendix B” presents results for the main specification using different TFP methods

The formula used by the Fraser Institute is based on the index presented by the World Economic Forum in its Global Competitiveness Report. The formula used is \(EFWi = [(GCRi - 1)/6] * 10\).

An alternative definition of horizontal spillovers uses license payments instead of purchases of licenses of the focal firm. We have tested our results with this definition and the results remain valid.

The average exchange rate in 2003 was 691.54 pesos per US dollar.

This can be seen in Table 13 in the columns listing observations used per method.

For a more detailed discussion, see (Cameron and Trivedi 2005).

The other estimation methods have been calculated and are available from the corresponding author upon request.

Here the assumption is that this imitative capacity is not high enough to create bias. Still, this could be checked by introducing an interaction term of the spillover effects with skilled labour, as in Damijan et al. (2013).

Since there could be an issue with overidentification, we present in “Appendix A” the correspondent tests that support a correct identification of the models.

To make this claim, the dummy IPR and the Fraser Institute measures should be considered interaction terms that reflect the difference between before and after the reform. However, this is not a difference-in-difference estimation, since the changes IPR law affect each firm in the same way.

We conducted a Kolmogorov–Smirnov test between backward and forward spillovers.

The decision to split the sample into quartiles makes it possible to estimate the model. If the division were into smaller bins, there would not be enough observations in each group for the estimation.

For ease of exposition, we will only include one variable that represents labour, although in this study, we use skilled and unskilled labour as two different inputs. Since it is estimated as a function of investment and capital, it is possible to estimate it even for firms that have zero capital.

Recall that in the LP methodology; investment is replaced by intermediate inputs.

References

Ackerberg DA, Caves K, Frazer G (2015) Identification properties of recent production function estimators. Econometrica 83(6):2411–2451

Aitken BJ, Harrison AE (1999) Do domestic firms benefit from direct foreign investment? Evidence from venezuela. Am Econ Rev 89(3):605–618

Alfaro L, Chanda A, Kalemli-Ozcan S, Sayek S (2010) Does foreign direct investment promote growth? Exploring the role of financial markets on linkages. J Dev Econ 91(2):242–256

Amann E, Virmani S (2015) Foreign direct investment and reverse technology spillovers. OECD J Econ Stud 2014(1):129–153

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arnold JM (2005) Productivity estimation at the plant level: a practical guide. Unpublished manuscript, 27

Bettig RV (2018) Copyrighting culture: the political economy of intellectual property. Routledge, Abingdon

Blalock G, Gertler PJ (2008) Welfare gains from foreign direct investment through technology transfer to local suppliers. J Int Econ 74(2):402–421

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Branstetter L, Fisman R, Foley CF, Saggi K (2007) Intellectual property rights, imitation, and foreign direct investment: theory and evidence. Technical report, National Bureau of Economic Research

Brüggemann J, Crosetto P, Meub L, Bizer K (2016) Intellectual property rights hinder sequential innovation. experimental evidence. Res Policy 45(10):2054–2068

Cameron AC, Trivedi PK (2005) Microeconometrics: methods and applications. Cambridge University Press, Cambridge

Damijan JP, Rojec M, Majcen B, Knell M (2013) Impact of firm heterogeneity on direct and spillover effects of fdi: micro-evidence from ten transition countries. J Comp Econ 41(3):895–922

Demena BA, van Bergeijk PA (2017) A meta-analysis of fdi and productivity spillovers in developing countries. J Econ Surv 31(2):546–571

Demena BA, van Bergeijk PA (2019) Observing fdi spillover transmission channels: evidence from firms in uganda. Third World Quarterly, pages 1–22

Foellmi R, Grossmann SH, Kohler A (2018) A dynamic north-south model of demand-induced product cycles. J Int Econ 110:63–86

Görg H, Greenaway D (2004) Much ado about nothing? Do domestic firms really benefit from foreign direct investment? World Bank Res Obs 19(2):171–197

Ha YJ, Giroud A (2015) Competence-creating subsidiaries and fdi technology spillovers. Int Bus Rev 24(4):605–614

Henderson DJ, Parmeter CF (2015) Applied nonparametric econometrics. Cambridge University Press, Cambridge

Javorcik BS (2004) Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. Am Econ Rev 94(3):605–627

Javorcik BS, Lo Turco A, Maggioni D (2018) New and improved: does fdi boost production complexity in host countries? Econ J 128(614):2507–2537

Javorcik BS, Spatareanu M (2008) To share or not to share: does local participation matter for spillovers from foreign direct investment? J Dev Econ 85(1–2):194–217

Jude C (2016) Technology spillovers from fdi. Evidence on the intensity of different spillover channels. World Econ 39(12):1947–1973

Keller W, Yeaple SR (2009) Multinational enterprises, international trade, and productivity growth: firm-level evidence from the united states. Rev Econ Stat 91(4):821–831

Krugman P (1979) A model of innovation, technology transfer, and the world distribution of income. J Polit Econ 87(2):253–266

Lai EL-C (1998) International intellectual property rights protection and the rate of product innovation. J Dev Econ 55(1):133–153

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70(2):317–341

Lopez RA (2008) Foreign technology licensing, productivity, and spillovers. World Dev 36(4):560–574

Lu Y, Tao Z, Zhu L (2017) Identifying fdi spillovers. J Int Econ 107:75–90

Montalvo JG, Yafeh Y (1994) A microeconometric analysis of technology transfer: the case of licensing agreements of japanese firms. Int J Ind Org 12(2):227–244

Moulton BR et al (1990) An illustration of a pitfall in estimating the effects of aggregate variables on micro unit. Rev Econ Stat 72(2):334–338

Naghavi A (2007) Strategic intellectual property rights policy and north-south technology transfer. Rev World Econ 143(1):55–78

Newman C, Rand J, Talbot T, Tarp F (2015) Technology transfers, foreign investment and productivity spillovers. Eur Econ Rev 76:168–187

Newman C, Rand J, Tarp F, Trifkovic N (2018) The transmission of socially responsible behaviour through international trade. Eur Econ Rev 101:250–267

Olley GS, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econ J Econ Soc 1263–1297

Pavcnik N (2002) Trade liberalization, exit, and productivity improvements: evidence from chilean plants. Rev Econ Stud 69(1):245–276

Rojec M, Knell M (2018) Why is there a lack of evidence on knowledge spillovers from foreign direct investment? J Econ Surv 32(3):579–612

Saravia A, Canavire-Bacarreza GJ, Rios-Avila F (2017) Intellectual property rights, foreign direct investment and economic freedom. Glob Econ J 13(1)

Syverson C (2011) What determines productivity? J Econ Lit 49(2):326–365

Van Beveren I (2012) Total factor productivity estimation: a practical review. J Econ Surv 26(1):98–128

Yang G, Maskus KE (2001) Intellectual property rights, licensing, and innovation in an endogenous product-cycle model. J Int Econ 53(1):169–187

Zanello G, Fu X, Mohnen P, Ventresca M (2016) The creation and diffusion of innovation in developing countries: a systematic literature review. J Econ Surv 30(5):884–912

Acknowledgements

We would like to thank Keith Maskus, Wolfgang Keller, Scott Savage, and Thibault Fally for their invaluable advice. We would also like to thank the editor, two anonymous referees, and Joze Damijan and Ricardo Lopez for their helpful comments. Felipe Bedoya-Maya provided superb research assistance. The findings, interpretations, and conclusions expressed in this document do not necessarily reflect the views of the World Bank, the Executive Directors of the World Bank or the governments they represent.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interests.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

A. Appendix I: robustness

See Tables 5, 6, 7, 8, 9 and 10.

B. Appendix II: TFP estimation methods

We follow closely the excellent survey of Van Beveren (2012) regarding TFP estimation which departs from an standard Cobb–Douglas production function with capital, unskilled labour and skilled labour: \(Y_{_{ijrt}}=A_{_{ijrt}}K^{^{\beta _{k}}}_{_{ijrt}}L^{s^{\beta _{ls}}}_{\ _{ijrt}}L^{u^{\beta _{lu}}}_{\ _{ijrt}}\); where \(Y_{ijrt}\) is output of the firm i in sector j and region r at time t; \(K_{ijrt}\) is the capital stock; while \(L^s\) and \(L^u\) are the number of skilled and unskilled workers, respectively. If we apply logarithms our production function becomes: \(TFP_{ijrt}=y_{ijrt}-\beta _kk_{ijrt} -\beta _{ls}l^s_{ijrt}-\beta _{lu}l^u_{ijrt}\).

If we were to estimate this equation using OLS, the main assumption would be that all inputs in the production function are exogenous. However, inputs in the production function are not chosen independently, creating an endogeneity problem. Moreover, selection bias is introduced when, in an unbalanced panel of firms, the decision on allocation of inputs (especially variable inputs) is not independent of the decision to continue operating in the market. Therefore, the estimation technique has to take into account that the estimates are conditional on the survival of the firm. To overcome endogeneity and selection bias, Olley and Pakes (1996) assumes that capital is a fixed input that depends on an investment process. Therefore, capital in period t depends on capital in \(t-1\) and investment \(i_{t-1}\). This timing corrects the endogeneity issue concerning the capital since the decision of capital is taken before the knowledge of the productivity shock. To estimate this, Olley and Pakes (1996) propose a three-step estimation process where the investment of the firm is a monotonically increasing function of productivity and existing capital. If the relationship is monotonically increasing, as explained in Arnold (2005), the investment decision is a function of the productivity and the capital stock.Footnote 26 Thus for the first step, the estimating equation becomes: \(y_{it}=\beta _0+\beta _{l}l_{it} +\phi (i_{it}, k_{it})+\eta _{it}\).

Since the functional form of \(\phi (.)\) is unknown, it can be proxied non-parametrically by a third or fourth-degree polynomial. Thus, in the first stage, both \(\widehat{\beta _l}\) and \(\widehat{\phi }\) can be estimated using regular Ordinary Least Squares (OLS). In the second step, they introduce a correction for the selection bias (exit decision), and in the third step, they recover consistent estimates of \(\beta _l\) and \(\beta _k\). However, the main limitation of this methodology is that there could be a large number of “zero” investment observations (not all firms invest every single period). Thus a considerable amount of information is potentially lost. Since there is a monotonic relation between investment and productivity, all the observations with zero investment must be dropped from the sample, which could imply a significant loss of observations in the dataset (depending on how many firms do not invest). Moreover, since investment is not always positive, Levinsohn and Petrin (2003) proposes using intermediate inputs as a proxy for productivity shocks. As Arnold (2005) points out, typically, there are significantly less zero- observations in intermediate inputs than in investment.

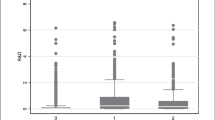

More recently, Ackerberg et al. (2015) have re-examined the estimation methods for production functions. They shed some light on some issues that might hinder the methodology proposed by Olley and Pakes (1996) and Levinsohn and Petrin (2003). They argue that there may be significant problems with the estimation of production functions if the methods mentioned above are used. The most critical issue is collinearity problems that arise in both methods.Footnote 27 The estimation has to be performed using either non-linear least squares or an optimization routine. The OLS and the Olley and Pakes distributions are very asymmetric, while the Levinsohn and Petrin, and the ACF estimators behave more smoothly. Levinsohn and Petrin estimation overestimates TFP compared to the ACF estimator.

Using the Chilean Encuesta Nacional Industrial Anual (ENIA), which is a national representative survey of the manufacturing sector for 2001 – 2007, we follow (Ackerberg et al. 2015) employing the number of skilled and unskilled workers within each establishment to identify \(\beta _{ls}\) and \(\beta _{lu}\) from the production function and electricity consumption as a proxy for investment to identify the function \(\phi (\cdot )\) and thus be able to recover \(\beta _k\).

Table 11 shows summary statistics of different TFP estimators, while Fig. 4 shows the distribution for those estimators. Moreover, Table 13 illustrates the coefficients for the different methods.

In order to check the robustness of the main results of the paper, estimates of Table 2 are depicted in Table 12. As it is shown, the results are qualitatively similar to the ones presented in the main section of the paper (Table 13).

Rights and permissions

About this article

Cite this article

Canavire-Bacarreza, G., Castro Peñarrieta, L. Can licensing induce productivity? Exploring the IPR effect. Empir Econ 61, 549–586 (2021). https://doi.org/10.1007/s00181-020-01880-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-020-01880-w