Abstract

This study applies factor-augmented vector autoregressive models to investigate the effect of the European Central Bank’s (ECB) conventional monetary policy on the real economy. More specifically, the study examines how unanticipated changes in the ECB’s policy rate have affected unemployment rate and industrial production. The effect of monetary policy on unemployment rate and industrial production is estimated to be strong and statistically significant using the data from January 1999 to July 2017 or from the pre-crisis period. However, after the beginning of the crisis the responses weaken drastically and become sometimes statistically insignificant, indicating that the effect of the ECB’s conventional monetary policy became weaker after the financial crisis. This finding is extremely interesting because one could presume either weaker or stronger effect based on economic theory. Additionally, the previous studies that have analysed the possible changes in the monetary policy effectiveness in the euro area have not found any changes (e.g. Bagzibagli in Empir Econ 47(3):781–823, 2014; Von Borstel et al. in Int J Money Finance 68:386–402, 2016).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The financial crisis of 2008 was followed by a remarkable decline in nominal interest rates globally. In the euro area, the European Central Bank (ECB) lowered its policy rate first from 4.25 to 1.00. After dawning economic recovery and accelerating inflation, the rate was raised to 1.50 where it stayed only a little while before it was declined to zero after the escalation of the European debt crisis.

There is a great amount of literature concerning, for example the optimal monetary policy in zero lower bound (ZLB) or the effects of unconventional monetary policy in ZLB. However, there are surprisingly few papers that investigate the effect of conventional monetary policy when nominal rates are close to zero. According to Keynes (1936), the effectiveness of monetary policy diminishes as nominal interest rates approach to zero. That is, there are nonlinearities present.

In this research, I investigate the effect of the ECB’s conventional monetary policy on the real economy. Specifically, I examine whether the effect has been weaker during the low interest rate period. The euro area is particularly interesting subject of research because the policy rates have been both raised and declined during the low rates period. To analyse the possible change in the effectiveness of monetary policy, I apply factor-augmented vector autoregressive models (FAVAR models) proposed by Bernanke et al. (2005). FAVAR models have many advantages compared to traditional VAR models. The main advantage is that a large amount of information can be included in the model. Traditional VAR models typically include no more than six to eight variables because the number of parameters to be estimated increases rapidly too high. FAVAR models include typically dozens or even hundreds of variables. It is, therefore, possible to estimate the effect of monetary policy on a large number of macroeconomic variables. In addition, the large information set makes identification of monetary policy shock more reliable as central banks observe literally hundreds of time series in reality.

The results of this study can be summarised as follows. The effect of conventional monetary policy on the real economy is found to be in line with the previous studies. Yet, the effect of conventional monetary policy weakened drastically or came even impotent after the ECB’s policy rate was lowered to 1.00 in May 2009. The results contradict the earlier literature concerning the effects of the ECB’s conventional monetary policy (Bagzibagli 2014; Von Borstel et al. 2016). The results are consistent, for example, with the results by Cenesizoglu et al. (2018) and Liu et al. (2019). They find similar kind of results in the USA.

Thus, the most important contribution of this article is to find evidence of the impact of the ECB’s conventional monetary policy, which contradicts the previous literature. On the other hand, the results support evidence from the USA. The paper investigates, in addition, the effects during the pre-crisis period. The effects before the crisis are found to be similar to those of Bagzibagli (2014). This further strengthens the argument that the effects probably changed after the crisis. More broadly, the paper contributes to the literature concerning the time variation in the effects of macroeconomic shocks (e.g. Cogley and Sargent 2005; Primiceri 2005; Boivin et al. 2010; Korobilis 2013; Mumtaz and Zanetti 2015).

In the light of economic theory, the results can be seen either expected or surprising. There are at least three reasons to presume that the effect of conventional monetary policy has been weaker in the euro area after the financial crisis. However, the same three matters can be used as arguments for a stronger impact.

First, the effect of monetary policy may be weaker when nominal interest rates are low. One reason for this is the speculative demand for money as was proposed by Keynes (1936). In addition, low interest rates may have a negative impact on banks’ profits (e.g. Borio et al. 2017). This in turn may reduce loan supply and weaken the effectiveness of expansionary monetary policy (Borio and Gambacorta 2017). Additionally, lowering policy rates to unforeseen levels may be seen as “Delphic”, meaning that market participants believe that the central bank has lowered the rates because it expects economic situation to worsen in the future (see Campbell et al. 2012). Nevertheless, there are reasons to believe that monetary policy could have been very effective when nominal rates have been low. There is evidence that the natural rate of interest has declined considerably (e.g. Holston et al. 2017). If the natural rate was very low as the ECB raised its policy rate from 1.00 to 1.50 in 2011, one might expect that this hike would have had a more negative effect on the real economy than during previous years when the natural rate was probably higher.

Second, the problems of asymmetric information typically worsen during crisis periods (e.g. Mishkin 1990). Bernanke (1983), for example, proposes that increasing uncertainty makes people await more information and postpone investment decisions. The real economy, therefore, does not respond to monetary policy as in normal times. This proposition is supported by the results of Aastveit et al. (2013). On the other hand, Mishkin (2009) argues that the effect of monetary policy could actually be stronger during crisis periods because then its effect on risk premia is stronger.

Third, the financial intermediation was impaired in the euro area after the financial crisis. As the financial intermediaries play a crucial role in the transmission of monetary policy, one could think that broken banking system would weaken the effect of monetary policy (e.g. Diamond 1984). However, the bank lending channel of monetary policy might be especially strong when banking sector is weak because an increase in asymmetric information may increase the sensitivity of lending supply to changes in monetary policy (e.g. Albertazzi et al. 2016; Holton and McCann 2017).

When it comes to the empirical research concerning the euro area, there are few papers that investigate the possible change in the effectiveness of conventional monetary policy. Bagzibagli (2014) applies FAVAR models to examine whether the transmission of conventional monetary policy changed during the financial crisis. He concludes that the transmission has probably not changed as the impulse response functions are very similar before and after the beginning of the crisis. The problem in this study is the short data. Bagzibagli’s (2014) last observation is in the end of 2011. Thus, the study does not concern the period during which the ECB’s policy rate has been low for a long period of time.

Another interesting research is made by Von Borstel et al. (2016). They investigate whether the monetary policy transmission to nominal interest rates changed after the financial crisis using FAVAR models. According to their results, the effect of conventional monetary policy on interest rates remained roughly the same. However, they do not analyse the possible change in the responses of real variables such as unemployment and industrial production.

The remainder of the paper is as follows. Section 2 represents the FAVAR model. Section 3 describes the data. Section 4 analyses the results. Section 5 concludes.

2 Model

The model closely follows Bernanke et al. (2005). Let \(Y_{t}\) denote \(Mx1\) vector containing observable variables. Typically, \(Y_{t}\) contains the policy instrument of the central bank and possibly some other economic variables that are assumed to be observable. Let \(F_{t}\) denote \(Kx1\) vector that contains unobservable factors that represent abstract phenomena such as economic activity or confidence. These phenomena are impossible to observe through some single indicator. Together vectors \(Y_{t}\) and \(F_{t}\) form the following model:

where \(\varTheta^{*} \left( L \right)\) is a matrix of finite lag polynomials. The number of lags in the model is \(d\), so the lag polynomials are order \(d - 1\). The symbol \(v_{t}\) denotes a vector containing error terms that are assumed to have mean zero and covariance matrix \(Q\). Equation (1) is referred as a FAVAR model. The model cannot be estimated directly because the factors \(F_{t}\) are unobservable. However, these factors can be estimated from a large number of relevant time series. These time series are denoted by the \(Nx1\) vector \(X_{t}\). The time series \(X_{t}\) also contain the variables in \(Y_{t}\). The relation between these time series, factors \(F_{t}\) and the observable variables \(Y_{t}\) is summarised by the equation:

where the matrix \(\lambda^{f}\) is \(NxK\) and the matrix \(\lambda^{y}\) is \(NxM\). The matrix \(\lambda^{f}\) contains so-called factor loadings. In factor analysis, it is typical to use some rotation to make it easier to interpret the results. Here, the factor loadings are just unrestricted regression coefficients that are estimated after the estimation of factors. Similar method is used by Von Borstel et al. (2016). The vector \(e_{t}\) is \(Nx1\) that contains error terms that are assumed to be mean zero but may display some small degree of cross-correlation.

When it comes to the estimation of the FAVAR model, there are basically two different methods. The first one is one-step Bayesian method and the second one is two-step method that applies principal component analysis. Bernanke et al. (2005) find the methods equally good. Thus, I apply computationally easier two-step method. In the first step, the factors \(F_{t}\) are estimated using principal component analysis. In the second step, \(F_{t}\) in Eq. (1) is replaced by the estimate \(\hat{F}_{t}\). Thereafter, Eq. (1) is estimated using OLS.

It is assumed that the time series \(X_{t}\) can be divided into fast-moving and slow-moving variables. The fast-moving variables are assumed to respond contemporaneously to unanticipated changes in monetary policy. The slow-moving variables are assumed not to respond to monetary policy shocks during the same period. In practice, fast-moving variables are assumed to be, for example, asset prices and the slow-moving variables are mainly real variables like industrial production and unemployment rate.

The first step has two stages. In the first stage, principal components are estimated both from the slow-moving variables and from all of the variables. Principal component analysis is applied to correlation matrix as the variables have different scales. Another possibility would be covariance matrix. The first \(K\) principal components estimated from all the time series are denoted by the \(Kx1\) vector \(\hat{C}\left( {F_{t} , Y_{t} } \right)\), and the first \(K\) principal components of the slow-moving variables are denoted by the \(Kx1\) vector \(\hat{C}^{*} \left( {F_{t} } \right)\). In the second stage of the first step, the effect of the observable variables \(Y_{t}\) is purged from the principal components \(\hat{C}\left( {F_{t} , Y_{t} } \right)\). This is carried out by estimating the equation:

where \(a_{k}\) is the regression coefficient of the \(k\)th slow-moving principal component, \(b_{k}\) is a vector containing the regression coefficients of the observable variables \(Y_{t}\) and \(u_{kt}\) is an error term. That is to say, each principal component estimated from all the time series \(X_{t}\) is explained by the corresponding slow-moving principal component and by all the observable variables \(Y_{t}\). The equation is estimated for all the \(K\) principal components using OLS. Thereafter, it is straightforward to calculate the estimate for the vector of factors \(F_{t}\):

In the second step, \(F_{t}\) in Eq. (1) is replaced by the estimate \(\hat{F}_{t}\) and the equation is estimated using OLS like a standard VAR model.

In further analysis, the effect of monetary policy is investigated by examining impulse response functions. The impulse response functions can be calculated for FAVAR models like for VAR models. The monetary policy shock is identified using Cholesky decomposition. Cholesky decomposition is chosen as many other identification strategies require some of the factors to be identified as specific economic concepts like output gap. In the baseline model, the ECB’s policy rate (MRO) is ordered last which means that the ECB’s total assets/liabilities, inflation and all the factors are assumed to have a contemporaneous effect on the MRO. The total assets/liabilities is ordered second last and inflation third last. The FAVAR model can be written in structural form:

where \(A\) is a matrix of coefficients, \(\varPsi^{*} \left( L \right)\) is a matrix of finite lag polynomials and \(\varepsilon_{t}\) is the vector of structural shocks. The equation can also be represented in a vector moving average form:

where \(\varPsi \left( L \right)^{ - 1}\) is a matrix of infinite lag polynomials. The impulse response functions for all the time series \(X_{t}\) can be calculated as:

The estimates for \(\lambda^{f}\) and \(\lambda^{y}\) are obtained by estimating Eq. (2) using OLS. To demonstrate the uncertainty of the estimates, confidence intervals are estimated following the method proposed by Yamamoto (2012). The method takes into account the uncertainty related to the estimation of factors.

3 Data

The data are mainly from Eurostat and the ECB. Other sources are MSCI, the Bank of Japan, OECD and the Bureau of Labor Statistics. The data include 90 monthly time series from January 1999 to July 2017. All the variables, their source and possible transformation are listed in “Appendix A”. Most of the variables are seasonally adjusted.

Some studies, for example Soares (2013), use disaggregated quarterly data to increase the information set. However, disaggregation is always somewhat uncertain. In addition, many quarterly series are published with a considerable lag. Thus, it is not very realistic to assume that these data are always part of the ECB’s governing council’s information set as the council conducts monetary policy.

When it comes to the euro area as an entity, one needs to consider what the euro area actually is. In 1999, the euro area consisted of 11 countries, but the number of countries has increased to 19. It would be best to consider only the original countries. Unfortunately, the data are rarely available to this set of countries. The majority of the variables are, therefore, calculated for the current euro area (see “Appendix A”). However, this is hardly a problem in this analysis as the eight countries that joined the euro after 1999 joined quite early (Greece 2001, Slovenia 2007, Cyprus 2008, Malta 2008, Slovakia 2009, Estonia 2011, Latvia 2014, Lithuania 2015).

4 Results

4.1 The estimation of factors and model specification

Figure 1 shows the total variance explained by the first 10 principal components that are estimated from all the 90 variables. The first principal component explains 24 per cent of the total variance. Together all the 10 principal components explain 75 per cent of the total variation in the 90 variables. It is not unambiguous how many principal components should be used in the FAVAR model. Every principal component adds more information to the model, but on the other hand the idea of principal component analysis is to reduce the dimensions of the data.

There are some techniques to evaluate the optimal number of principal components. I apply two information criteria (IC1 and IC2) proposed by Bai and Ng (2002). In addition, I estimate the FAVAR model using many different specifications and evaluate the goodness of these models using traditional information criteria used in the VAR literature (AIC, FPE, SC and HQ). Some examples of the results are shown in Table 1. In all the models, I assume that the observable variables, \(Y_{t}\), are inflation (HICP, YoY, %), the change in the natural logarithm of the total assets/liabilities of the Eurosystem and the MRO. The Eurosystem’s total assets/liabilities are included to control unconventional monetary policy. Inflation is included as it is the main objective variable of the ECB and a key determinant of the stance of monetary policy. The models are estimated using the whole data from January 1999 to July 2017. All the models include constant and deterministic trend.

Based on these results, I use the FAVAR model with 5 factors and 3 lags as a baseline model when evaluating the effect of monetary policy using the whole data. As I analyse the possible time variation using only 99–120 observations, I use the model with 3 factors and 3 lags (baseline 2). The number of parameters might otherwise be too large for such a small sample. Nevertheless, I test the robustness of the results using different number of factors and lags.

4.2 The effect of conventional monetary policy on real variables

Figure 2 shows the impulse response functions of unemployment rate and industrial production to a 0.25 percentage points shock to the MRO (some more responses are shown in “Appendix B”). The estimated model includes the MRO, the ECB’s total assets/liabilities, inflation, 5 factors, 3 lags, constant and linear trend. The impulse response functions are in line with previous research (e.g. Soares 2013; Bagzibagli 2014). The 0.25 percentage points shock to the MRO increases unemployment 0.11 percentage points. The reaction peaks after about 2 years. The shock has a negative impact on industrial production. The reaction is at its deepest 1.2 per cent after nearly 2 years.

The effects are quite robust to changes in the number of lags or factors (see “Appendix G”). The inclusion of trend term is not important either (see “Appendix E”). The assumed order of the observable variables is not the key driver of the results either (see “Appendices D and F”). The results are also robust to exclusion of the ECB’s total assets/liabilities (see “Appendix C”). The results suggest that the model produces reasonable outcomes that are in line with previous findings. The model is, therefore, a good starting point for analysing whether the effects of monetary policy have changed after the drastic decline in nominal interest rates.

4.3 The effect might have changed

Figure 3 shows the impulse response functions that are estimated using pre-crisis and post-crisis data. The beginning of the crisis is assumed to be in July 2007. The same definition was used by Bagzibagli (2014) who notes that stock market peaked then. Now, the FAVAR model includes only 3 factors and 3 lags. The shock is again 0.25 percentage points.

The impulse responses of unemployment rate and industrial production to a 0.25 percentage points shock to the MRO. The solid line represents the response estimated using data from January 1999 to July 2007. The dashed line represents the response estimated using the data from August 2007 to July 2017. The dotted and dotdashed lines around the impulse response functions represent 95% CI

Industrial production shows no signs of weakened reaction. The magnitudes of the pre- and post-crisis reactions are roughly the same, but after the crisis, industrial production has reacted somewhat faster. Instead, the reaction of unemployment rate becomes statistically insignificant after the crisis.

In July 2007, the MRO was still as high as 4.00 and was even raised to 4.25 in July 2008. Therefore, the period after July 2007 does not represent a period of low interest rates. To examine how the real economy reacted to monetary policy shocks when the policy rate and rates in general were low, I estimate the impulse response functions for unemployment rate and industrial production using the data from May 2009 to July 2017. In July 2009, the sharp decline of the MRO from 4.25 to 1.00 was over. Thereafter, the MRO was both raised and lowered, and it varied between 0.00 and 1.50. Thus, the time interval can be defined as a period of low interest rates.

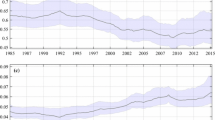

The impulse response functions estimated from the period of low interest rates are shown in Fig. 4. Now, the reaction of unemployment rate is statistically significant but still very uncertain.

The impulse response function of industrial production is instead statistically insignificant.

The insignificant response of unemployment rate (Fig. 3) and industrial production (Fig. 4) is interesting. The FAVAR model was estimated using many different time intervals, and the responses of both variables were robustly statistically significant when the whole data or the pre-crisis period data are used (see “Appendices C, D, E, F, G”). The argument that the responses of industrial production and unemployment rate changed during or after the crisis is supported by multiple robustness tests. The responses are hardly affected when the number or the order of the observed variables is changed or the trend term is excluded (see “Appendices C, D, E, F”). Instead, the reactions vary as the number of lags or factors is changed (see “Appendix H”). For example, reducing the number of factors to 2 makes the response positive. Increasing the number of factors to 4 makes the response negative.

Another issue is the time frame. The last analysis considered only two different periods of time (from July 2007 to July 2017 and from May 2009 to July 2017). What happens if the beginning of the time period was somewhere between July 2007 and May 2009? This is considered in “Appendix I”. The alternative starting periods are January 2008, January 2009 and February 2009. Including the whole year 2008 means that the time span covers also maybe the most dramatic months of the financial crisis. During those months, the MRO was also considerably high. In January 2009, the rate was lowered from 2.5 to 2.0. Using the data from February 2009 onwards excludes this rate cut that potentially dominates the results. The results show that the impulse responses of industrial production remained roughly the same before the low interest rate period that began in May 2009. The impulse response functions of unemployment rate remain about the same in every period. However, the confidence intervals are considerably wider than before the crisis in all the chosen time spans.Footnote 1 The differing behaviour of industrial production and unemployment rate is interesting and difficult to explain theoretically. Nevertheless, the results clearly show that the effect of conventional monetary policy remained hardly the same after the crisis. This conclusion is opposite to the conclusion made by Bagzibagli (2014, p. 798–799): “First of all, there is little sign of any variation in the real activity measurements such as industrial production, investment and employment. The same conclusion applies to real ULC, nominal wages, producer prices, trade, interest rates, stock market and consumer confidence. That is to say, the monetary policy shocks hitting the economy either before or after the crisis periods have almost identical impacts on these macroeconomic and financial indicators.”

5 Conclusions

The results suggest that the transmission of conventional monetary policy to the real economy was weakened after the financial crisis of 2008 in the euro area. The reason for that might be, for example, the low level of nominal interest rates, increased uncertainty or broken banking system. The finding is interesting and policy relevant as the ECB is about to raise its policy rate from zero in some point of time. Conventional monetary policy during low interest rate periods is a surprisingly unknown area which should be examined more—both empirically and theoretically.

The results also support the inclusion of time-varying parameters in FAVAR models (TVP-FAVAR) (e.g. Cogley and Sargent 2005; Primiceri 2005; Korobilis 2013). As the responses of economic variables to shocks vary over time, it is problematic to apply a model with constant parameters.

References

Aastveit KA, Natvik GJ, Sola S (2013) Economic uncertainty and the effectiveness of monetary policy. Norges Bank, Oslo

Albertazzi U, Nobili A, Signoretti FM (2016) The bank lending channel of conventional and unconventional monetary policy. Bank of Italy Temi di Discussione. No. 1094

Bagzibagli K (2014) Monetary transmission mechanism and time variation in the Euro area. Empir Econ 47(3):781–823

Bai J, Ng S (2002) Determining the number of factors in approximate factor models. Econometrica 70(1):191–221

Bernanke BS (1983) Irreversibility, uncertainty, and cyclical investment. Q J Econ 98(1):85–106

Bernanke BS, Boivin J, Eliasz P (2005) Measuring the effects of monetary policy: a factor-augmented vector autoregressive (FAVAR) approach. Q J Econ 120(1):387–422

Boivin J, Kiley MT, Mishkin FS (2010) How has the monetary transmission mechanism evolved over time? In: Friedman BM, Woodford M (eds) Handbook of monetary economics, vol 3. Elsevier, Amsterdam, pp 369–422

Borio C, Gambacorta L (2017) Monetary policy and bank lending in a low interest rate environment: diminishing effectiveness? J Macroecon 54:217–231

Borio C, Gambacorta L, Hofmann B (2017) The influence of monetary policy on bank profitability. Int Finance 20(1):48–63

Campbell JR, Evans CL, Fisher JD, Justiniano A, Calomiris CW, Woodford M (2012) Macroeconomic effects of federal reserve forward guidance. Brookings papers on economic activity, pp 1–80

Cenesizoglu T, Larocque D, Normandin M (2018) The conventional monetary policy and term structure of interest rates during the financial crisis. Macroecon Dyn 22(8):2032–2069. https://doi.org/10.1017/S1365100516000997

Cogley T, Sargent TJ (2005) Drifts and volatilities: monetary policies and outcomes in the post WWII US. Rev Econ Dyn 8(2):262–302

Diamond DW (1984) Financial intermediation and delegated monitoring. Rev Econ Stud 51(3):393–414

Holston K, Laubach T, Williams JC (2017) Measuring the natural rate of interest: international trends and determinants. J Int Econ 108:S59–S75

Holton S, McCann F (2017) Sources of the small firm financing premium: evidence from euro area banks. ECB Working Paper. No. 2092

Keynes JM (1936) The general theory of employment, interest and money. Macmillan, London

Korobilis D (2013) Assessing the transmission of monetary policy using time-varying parameter dynamic factor models. Oxf Bull Econ Stat 75(2):157–179

Liu P, Theodoridis K, Mumtaz H, Zanetti F (2019) Changing macroeconomic dynamics at the zero lower bound. J Bus Econ Stat 37(3):391–404. https://doi.org/10.1080/07350015.2017.1350186

Mishkin FS (1990) Asymmetric information and financial crises: a historical perspective. National Bureau of Economic Research w3400

Mishkin FS (2009) Is monetary policy effective during financial crises? Am Econ Rev 99(2):573–577

Mumtaz H, Zanetti F (2015) Labor market dynamics: a time-varying analysis. Oxf Bull Econ Stat 77(3):319–338

Primiceri GE (2005) Time varying structural vector autoregressions and monetary policy. Rev Econ Stud 72(3):821–852

Soares R (2013) Assessing monetary policy in the euro area: a factor-augmented VAR approach. Appl Econ 45(19):2724–2744

Von Borstel J, Eickmeier S, Krippner L (2016) The interest rate pass-through in the euro area during the sovereign debt crisis. J Int Money Finance 68:386–402

Yamamoto Y (2012) Bootstrap inference for impulse response functions. Institute of Economic Research, Hitotsubashi University, Kunitachi

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is based on my master’s thesis: “EKP: n rahapolitiikan vaikutus reaalitalouteen – FAVAR-lähestymistapa”. I am grateful to Hannu Laurila, Essi Jormanainen and the seminar participants at the University of Tampere for helpful comments.

Appendices

Appendix A

In the following table, the description (EA) means the changing euro area and (EA19) the current euro area of 19 countries. The description (SCA) means that the time series is both seasonally and working-day adjusted, the description (SA) means seasonal adjustment, only and the description (NA) means that the series is not seasonally nor working-day adjusted. The description (S) means that the variable is assumed to be slow-moving.

Variable | Transformation | Source |

|---|---|---|

Production (volume) | ||

1. Consumer goods (EA19) (SCA) (S) | Log-difference | Eurostat |

2. Durable consumer goods (EA19) (SCA) (S) | Log-difference | Eurostat |

3. Non-durable consumer goods (EA19) (SCA) (S) | Log-difference | Eurostat |

4. Intermediate goods (EA19) (SCA) (S) | Log-difference | Eurostat |

5. Energy (EA19) (SCA) (S) | Log-difference | Eurostat |

6. Capital goods (EA19) (SCA) (S) | Log-difference | Eurostat |

7. Total excluding construction (EA19) (SCA) (S) | Log-difference | Eurostat |

8. Manufacturing (EA19) (SCA) (S) | Log-difference | Eurostat |

9. Construction (EA19) (SCA) (S) | Log-difference | Eurostat |

Price changes (percentage change year over year) | ||

10. Manufacturing (EA19) (NA) (S) | No transformation | Eurostat |

11. Industry (except construction, sewerage, waste management and remediation activities) (EA19) (NA) (S) | No transformation | Eurostat |

12. Capital goods (EA19) (NA) (S) | No transformation | Eurostat |

13. Intermediate goods (EA19) (NA) (S) | No transformation | Eurostat |

14. All-items HICP (YKHI) (EA) (NA) (S) | No transformation | Eurostat |

15. Food and non-alcoholic beverages (EA) (NA) (S) | No transformation | Eurostat |

16. Alcoholic beverages, tobacco and narcotics (EA) (NA) (S) | No transformation | Eurostat |

17. Clothing and footwear (EA) (NA) (S) | No transformation | Eurostat |

18. Housing, water, electricity, gas and other fuels (EA) (NA) (S) | No transformation | Eurostat |

19. Furnishings, household equipment and routine household maintenance (EA) (NA) (S) | No transformation | Eurostat |

20. Health (EA) (NA) (S) | No transformation | Eurostat |

21. Transport (EA) (NA) (S) | No transformation | Eurostat |

22. Energy and unprocessed food (EA) (NA) (S) | No transformation | Eurostat |

23. Overall index excluding housing, water, electricity, gas and other fuels (EA) (NA) (S) | No transformation | Eurostat |

24. ECB Commodity Price index (EA19) (NA) (S) | No transformation | ECB SDW |

Unemployment | ||

25. Unemployment rate (EA19) (SA) (S) | No transformation | Eurostat |

Exchange rates | ||

26. USD (NA) | Log-difference | Eurostat |

27. JPY (NA) | Log-difference | Eurostat |

28. GBP (NA) | Log-difference | Eurostat |

29. CHF (NA) | Log-difference | Eurostat |

30. RUB (NA) | Log-difference | Eurostat |

31. ECB nominal effective exch. rate of the Euro against euro area-19 countries and the EER-19 group of trading partners (AU, CA, DK, HK, JP, NO, SG, KR, SE, CH, GB, US, BG, CZ, HU, PL, RO, HR and CN) excluding the Euro (EA19) (NA) | Log-difference | ECB SDW |

Confidence | ||

32. Evolution of the current overall order books in retail (EA19) (SA) | No transformation | Eurostat |

33. Employment expectations over the next 3 months in retail (EA19) (SA) | No transformation | Eurostat |

34. Price expectations over the next 3 months in retail (EA19) (SA) | No transformation | Eurostat |

35. Retail confidence indicator (EA19) (SA) | No transformation | Eurostat |

36. Own financial situation over the next 12 months (EA19) (SA) | No transformation | Eurostat |

37. General economic situation over the next 12 months (EA19) (SA) | No transformation | Eurostat |

38. Price trends over the next 12 months (EA19) (SA) | No transformation | Eurostat |

39. Unemployment expectations over the next 12 months (EA19) (SA) | No transformation | Eurostat |

40. Expectation of the demand over the next 3 months in services (EA19) (SA) | No transformation | Eurostat |

41. Expectation of the employment over the next 3 months in services (EA19) (SA) | No transformation | Eurostat |

42. Services confidence indicator (EA19) (SA) | No transformation | Eurostat |

43. Evolution of the current overall order books in construction (EA19) (SA) | No transformation | Eurostat |

44. Employment expectations over the next 3 months in construction (EA19) (SA) | No transformation | Eurostat |

45. Price expectations over the next 3 months in construction (EA19) (SA) | No transformation | Eurostat |

46. Construction confidence indicator (EA19) (SA) | No transformation | Eurostat |

47. Employment expectations over the next 3 months in manufacturing (EA19) (SA) | No transformation | Eurostat |

48. Production expectations over the next 3 months in manufacturing (EA19) (SA) | No transformation | Eurostat |

49. Selling price expectations over the next 3 months in manufacturing (EA19) (SA) | No transformation | Eurostat |

50. Industrial confidence indicator (EA19) (SA) | No transformation | Eurostat |

Foreign trade | ||

51. Imports (EA19) (SCA) (S) | Log-difference | ECB SDW |

52. Exports (EA19) (SCA) (S) | Log-difference | ECB SDW |

53. Capital account (EA19) (NA) (S) | No transformation | ECB SDW |

54. Financial account (EA19) (NA) (S) | No transformation | ECB SDW |

55. Current account (EA19) (NA) (S) | No transformation | ECB SDW |

Money | ||

56. Total assets/liabilities of the Eurosystem (EA) (NA) | Log-difference | ECB SDW |

57. Monetary aggregate M1 (EA) (SCA) | Log-difference | ECB SDW |

58. Monetary aggregate M2 (EA) (SCA) | Log-difference | ECB SDW |

59. Monetary aggregate M3 (EA) (SCA) | Log-difference | ECB SDW |

Stocks | ||

60. Dow Jones Euro Stoxx log-difference 0 Price index (NA) | Log-difference | ECB SDW |

61. Dow Jones Euro Stoxx Price index (NA) | Log-difference | ECB SDW |

62. Dow Jones Euro Stoxx Basic Materials E index (NA) | Log-difference | ECB SDW |

63. Dow Jones Euro Stoxx Consumer Goods index (NA) | Log-difference | ECB SDW |

64. Dow Jones Euro Stoxx Consumer Services index (NA) | Log-difference | ECB SDW |

65. Dow Jones Euro Stoxx Financials index (NA) | Log-difference | ECB SDW |

66. Dow Jones Euro Stoxx Technology E index (NA) | Log-difference | ECB SDW |

67. Dow Jones Euro Stoxx Healthcare index (NA) | Log-difference | ECB SDW |

68. Dow Jones Euro Stoxx Industrials index (NA) | Log-difference | ECB SDW |

69. Dow Jones Euro Stoxx Oil and Gas Energy index (NA) | Log-difference | ECB SDW |

70. Dow Jones Euro Stoxx Telecommunications index (NA) | Log-difference | ECB SDW |

71. Dow Jones Euro Stoxx Utilities E index (NA) | Log-difference | ECB SDW |

72. MSCI gross index of large and middle cap enterprises in Europe (NA) | Log-difference | MSCI |

73. Annual real return of stocks (MSCI), taxation not taken into account. Formula: e^[12*Dln(72. variable)]/[1 + (14. variable)] − 1. (NA) | No transformation | MSCI, Eurostat |

Interest rates | ||

74. Euro area 10-year Government Benchmark bond yield (EA) (NA) | No transformation | ECB SDW |

75. Euro area 3-year Government Benchmark bond yield (EA) (NA) | No transformation | ECB SDW |

76. Euro area log-difference-year Government Benchmark bond yield (EA) (NA) | No transformation | ECB SDW |

77. Real 3-month Euribor (EA) (NA) | No transformation | ECB SDW |

78. Euribor 1-month (EA) (NA) | No transformation | ECB SDW |

79. Euribor 1-year (EA) (NA) | No transformation | ECB SDW |

80. Euribor 6-month (EA) (NA) | No transformation | ECB SDW |

81. Main refinancing operations rate (EA) (NA) | No transformation | ECB SDW |

82. Spread between real 3-month Euribor and the main refinancing operations rate (EA) (NA) | No transformation | ECB SDW |

83. Spread between Euro area 10-year Government Benchmark bond yield and the main refinancing operations rate (EA) (NA) | No transformation | ECB SDW |

84. Real Euribor 1-year. Formula: 79. variable − 14. variable. (EA) (NA) | No transformation | ECB SDW, Eurostat |

Foreign variables | ||

85. CPI-All Urban Consumers (NA) (S) | No transformation | BLS |

86. Federal funds rate (NA) | No transformation | FED |

87. Monetary aggregate M1 in OECD countries (SA) | Log-difference | OECD |

88. Monetary aggregate M3 in OECD countries (SA) | Log-difference | OECD |

89. Bank of Japan interest rate (NA) | No transformation | BoJ |

90. Industrial production in the USA (SCA) (S) | Log-difference | OECD |

Appendix B

The following figure shows some additional impulse response functions. The estimated model includes the MRO, the ECB’s total assets/liabilities, inflation, 5 factors, 3 lags, constant and linear trend. The shock to the MRO is 0.25 percentage points. The response of production in construction is cumulative.

See Fig. 5.

Appendix C

The following figures show the impulse responses when the ECB’s total assets/liabilities are excluded.

The impulse response functions of unemployment rate and industrial production. The solid line represents the response estimated using data from January 1999 to July 2007. The dashed line represents the response estimated using the data from August 2007 to July 2017. The dotted and dotdashed lines around the impulse response functions represent 95% CI

Appendix D

The following figures show the impulse response functions when the order of the observed variables is inflation, MRO, total assets/liabilities.

The impulse response functions of unemployment rate and industrial production. The solid line represents the response estimated using data from January 1999 to July 2007. The dashed line represents the response estimated using the data from August 2007 to July 2017. The dotted and dotdashed lines around the impulse response functions represent 95% CI

Appendix E

The following figures show the impulse response functions when trend is left out.

The impulse response functions of unemployment rate and industrial production. The solid line represents the response estimated using data from January 1999 to July 2007. The dashed line represents the response estimated using the data from August 2007 to July 2017. The dotted and dotdashed lines around the impulse response functions represent 95% CI

Appendix F

The following figures show the impulse response functions when the order of the observed variables is total assets/liabilities, inflation, MRO.

The impulse response functions of unemployment rate and industrial production. The solid line represents the response estimated using data from January 1999 to July 2007. The dashed line represents the response estimated using the data from August 2007 to July 2017. The dotted and dotdashed lines around the impulse response functions represent 95% CI

Appendix G

The following figures show how the impulse responses estimated from the whole sample vary when the number of factors and lags is changed.

Appendix H

The following figures show how the impulse responses estimated using the data are from May 2009 to July 2017 vary when the number of factors and lags is changed.

Appendix I

The following figure shows several impulse responses that are estimated using data from post-crisis period, and the beginnings of the time spans are varied.

See Fig. 26.

The impulse response functions of unemployment rate and industrial production estimated using different time windows. The dotdashed lines represent impulse response functions estimated using the data from January 2008 to July 2017, dashed lines from January 2009 to July 2017, dotted lines from February 2009 to July 2017 and solid lines from May 2009 to July 2017

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Laine, OM.J. The effect of the ECB’s conventional monetary policy on the real economy: FAVAR-approach. Empir Econ 59, 2899–2924 (2020). https://doi.org/10.1007/s00181-019-01739-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01739-9