Abstract

This study examines the impact of liquidity and involuntary excess reserves on interest rate pass-through in China. Employing Error Correction Model estimation based on a sample of 86 banks over the period of 2000–2013, the study finds that liquid banks can better shield against tightening monetary policy and adjust lending rate sluggishly. In contrast, banks with larger involuntary excess reserves tend to increase lending interest rates more rapidly in response to tightening monetary policy. We conclude that unwanted liquidity may lead to risk-taking behaviours which are detrimental to financial stability.

Similar content being viewed by others

References

Acharya V, Naqvi H (2012) The seeds of a crisis: a theory of bank liquidity and risk-taking over the business cycle. J Financ Econ 106(2):349–366

Agenor P-R, Aizenman J, Hoffmaister AW (2004) The credit crunch in East Asia: what can bank excess liquid assets tell us? J Int Money Finance 23(1):27–49

Ahtik M (2012) Bank lending channel in Slovenia: panel data analysis. Prague Econ Pap 1:50–68

Aikaeli J (2011) Determinants of excess liquidity in Tanzanian commercial banks. Afr Finance J 13(1):47–63

Allen F, Qian JQJ, Zhang C, Zhao M (2011) China’s financial system: opportunities and challenges. In: Fan J, Morck R (eds) Capitalizing China. University of Chicago Press, Chicago

Alper K, Binici M, Demiralp S, Kara H, Ozlu P (2016) Reserve requirements, liquidity risk, and bank lending behavior. Koc University-TUSIAD Economic Research Forum

Anderson J (2009) The China monetary policy handbook. In: Barth JR, Tatom JA, Yago G (eds) China’s emerging financial markets—challenges and opportunities. Milken Institute, CA, USA

Angeloni I, Faia E (2009) A tale of two policies: prudential regulation and monetary policy with fragile banks. Kiel Working Paper No. 1569

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M, Bover O (1995) Another look at the instrumental variables estimation of error components models. J Econom 68(1):29–51

Baltensperger E (1972) Costs of banking activities—interactions between risk and operating costs. J Money Credit Bank 4(3):595–611

Baxter M, King RG (1999) Measuring business cycles: approximate band-pass filters for economic time series. Rev Econ Stat 81:575–593

Beck T, Colciago A, Pfajfar D (2014) The role of financial intermediaries in monetary transmission. J Econ Dyn Control 43:1–11

Bernanke BS, Blinder AS (1988) Credit, money, and aggregate demand. Am Econ Rev 78(2):435–439

Bindseil U, Camba-Mendez G, Hirsch A, Weller B (2006) Excess reserves and the implementation of monetary policy of the ECB. J Policy Model 28(5):491–510

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87:115–143

Boateng A, Huang W, Kufuor NK (2015) Commercial bank ownership and performance in China. Appl Econ 47(49):5320–5336

Bouvatier V (2010) Hot money inflows and monetary stability in China: how the People’s Bank of China took up the challenge. Appl Econ 42(12):1533–1548

Brunner K, Meltzer A (1968) Liquidity traps for money, bank credit, and interest rates. J Polit Econ 76:1–37

Chen Y (2008) Chinese economy and excess liquidity. China World Econ 16(5):63–82

Chen H, Chen Q, Gerlach S (2011) The implementation of monetary policy in China: the interbank market and bank lending. HKIMR Working Papers, No. 26

Conway P, Herd R, Chalaux T (2010) Reforming China’s monetary policy framework to meet domestic objectives. OECD Economics Department Working Papers, No. 822

De Graeve F, De Jonghe O, Vander Vennet R (2007) Competition, transmission and bank pricing policies: evidence from Belgian loan and deposit markets. J Bank Finance 31:259–278

Disyatat P (2011) The bank lending channel revisited. J Money Credit Bank 43(4):711–734

Ferderer JP, Zalewski DA (1994) Uncertainty as a propagating force in the Great Depression. J Econ Hist 54(4):825–849

Friedman M, Schwartz AJ (1963) A monetary history of the United States, 1867–1960. Princeton University Press, Princeton

Frost PA (1971) Banks’ demand for excess reserves. J Polit Econ 79(4):805–825

Fungáčová Z, Nuutilainen R, Weill L (2016) Reserve requirements and the bank lending channel in China. J Macroecon 50:37–50

Gambacorta L (2005) Inside the bank lending channel. Eur Econ Rev 49(7):1737–1759

Gambacorta L (2008) How do banks set interest rates? Eur Econ Rev 52(5):792–819

Hadri K, Kurozumi E (2009) A simple panel stationarity test in the presence of cross-sectional dependence. Japan: Institute of Economic Research, Hitotsubashi University. Global COE Hi-Stat Discussion Paper Series 016

He D, Wang H (2012) Dual-track interest rates and the conduct of monetary policy in China. China Econ Rev 23(4):928–947

Hernando I, Martinez-Pages J (2001) Is there a bank lending channel of Monetary Policy in Spain? European Central Bank, Working Paper Series, No. 99

Hodrick R, Prescott EC (1997) Postwar U.S. business cycles: an empirical investigation. J Money Credit Bank 29(1):1–16

Holmstrom B, Tirole J (2011) Inside and outside liquidity. World. The MIT Press, Massachusetts Institute of Technology. Cambridge, Massachusetts 02142

Holton S, Rodriguez d’Acri C (2015) Jagged cliffs and stumbling blocks: interest rate pass-through fragmentation during the euro area crisis. European Central Bank Working Paper, No. 1850

Horvath R, Podpiera A (2012) Heterogeneity in bank pricing policies: the Czech evidence. Econ Syst 36(1):87–108

Kashyap AK, Stein JC (1995) The impact of monetary policy on bank balance sheets. Carnegie Rockester Conf Ser Public Policy 42(1):151–195

Kashyap AK, Stein JC (2000) What do a million observations on banks say about the transmission of monetary policy? Am Econ Rev 90(3):407–428

Kashyap A, Stein JC, Wilcox D (1993) Monetary policy and credit conditions: evidence from the composition of external finance. Am Econ Rev 83:78–98

Kishan R, Opiela T (2000) Bank size, bank capital, and the bank lending channel. J Money Credit Bank 32(1):121–141

Kishan R, Opiela T (2006) Bank capital and loan asymmetry in the transmission of monetary policy. J Bank Finance 30(1):259–285

Kitamura T, Muto I, Takei I (2015) How do Japanese banks set loan interest rates?: Estimating pass-through using bank-level data. Bank of Japan Working Paper, No. 15-E-6

Lim GC (2001) Bank interest rate adjustments: are they asymmetric? Econ Rec 77(237):135–147

Lin X, Zhang Y (2009) Bank ownership reform and bank performance in China. J Bank Finance 33:20–29

Liu L, Zhang W (2010) A new Keynesian model for analysing monetary policy in Mainland China. J Asian Econ 21(6):540–551

Liu M-H, Margaritis D, Tourani-Rad A (2009) Monetary policy and interest rate rigidity in China. Appl Financ Econ 19(8):647–657

Ma G, Yan X, Liu X (2011) China’s evolving reserve requirements. BIS Working Papers, No. 360

Martin A, McAndrews J, Skeie D (2016) Bank lending in times of large bank reserves. Int J Cent Bank 12(4):193–222

Mishkin FS (1995) Symposium on the monetary transmission mechanism. J Econ Perspect 9(4):3–10

Morrison GR (1966) Liquidity preferences of commercial banks. Univ. Chicago Press, Chicago

Naughton B (1998) China’s financial reform: achievements and challenges. BRIE Working Paper, No. 112

Nguyen VHT, Boateng A (2013) The impact of excess reserves beyond precautionary levels on bank lending channels in China. J Int Financ Mark Inst Money 26(1):358–377

Nguyen VHT, Boateng A (2015) An analysis of involuntary excess reserves, monetary policy and risk-taking behaviour of Chinese banks. Int Rev Financ Anal 37:63–72

Porter N, Xu T (2009) What drives China’s interbank market? IMF Working Paper, WP/09/189

PRC (1995) Law of the People’s Republic of China on Commercial Banks. Retrieved from http://www.china.org.cn/english/DAT/214824.htm

Primus K (2017) Excess reserves, monetary policy and financial volatility. J Bank Finance 74:153–168

Qian JQJ, Strahan PE, Yang Z (2011) The impact of incentives and communication costs on information production: evidence from bank lending. Working Paper. http://www.ccfr.org.cn/cicf2011/papers/20110623060915.pdf

Rajan R (2006) Has finance made the world riskier? Eur Financ Manag 12(4):499–533

Ravn MO, Uhlig H (2002) On adjusting the Hodrick-Prescott filter for the frequency of observations. Rev Econ Stat 84(2):371–376

Sander H, Kleimeier S (2004) Convergence in euro-zone retail banking? What interest rate pass-through tells us about monetary policy transmission, competition and integration. J Int Money Finance 23:461–492

Saxegaard M (2006) Excess liquidity and effectiveness of monetary policy: evidence from Sub-Saharan Africa. Working Paper No. 06/115, International Monetary Fund

Schlitzer G (1995) Testing the stationarity of economic time series: further Monte Carlo evidence. Ricerche Economiche 49:125–144

Stanislawska E (2014) Interest rate pass-through in Poland. Evidence from individual bank data. NBP Working Paper, No. 179

Staub R, Souza G, Tabak B (2010) Evolution of bank effciency in Brazil: a DEA approach. Eur J Oper Res 202(1):204–213

Sun L, Ford JL, Dickinson DG (2010) Bank loans and the effects of monetary policy in China: VAR/VECM approach. China Econ Rev 21(1):65–97

Tabak B, Laizy M, Cajueiro D (2010) Financial stability and monetary policy—the case of Brazil. Central Bank of Brazil, Working Paper Series No. 217

Taylor JB (1995) The monetary transmission mechanism: an empirical framework. J Econ Perspect 9(4):11–26

Wei X, Pan S, Yang S, Zhang M, Chen M (2008) Liquidity management of the participants in Chinese Real Time Gross Settlement Systems. Available at SSRN: http://ssrn.com/abstract=1097533

Weth MA (2002) The pass-through from market interest rates to bank lending rates in Germany. Discussion paper 11/02, Economic Research Centre of the Deutsche Bundesbank

Xu Y (2011) Towards a more accurate measure of foreign bank entry and its impact on domestic banking performance: the case of China. J Bank Finance 35(4):886–901

Zhang C (2010) Sterilization in China: effectiveness and cost. The Wharton School, University of Pennsylvania, Working Paper

Acknowledgements

We are grateful to the Editor - Robert Kunst and the anonymous reviewer for the insightful feedback during the review process.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

See Table 4.

Appendix 2

See Table 5.

Appendix 3

See Table 6.

Appendix 4

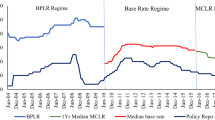

See Fig. 1.

Appendix 5

See Fig. 2.

Appendix 6

See Fig. 3.

Appendix 7

See Fig. 4.

Rights and permissions

About this article

Cite this article

Nguyen, T.V.H., Boateng, A. & Pham, T.T.T. Involuntary excess reserve and heterogeneous transmission of policy rates to bank lending rates in China. Empir Econ 57, 1023–1044 (2019). https://doi.org/10.1007/s00181-018-1468-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1468-x