Abstract

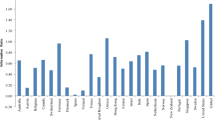

We investigate a global cross-sectional relation between idiosyncratic risk moments and expected stock returns by suggesting three global idiosyncratic volatility, skewness, and kurtosis risk factors. We also suggest two global small minus big and high minus low risk proxies for estimating return residuals of the test assets from a global asset pricing model. To perform robustness checks, we suggest other four global risk factors of momentum, leverage, bid-ask spread, and liquidity. We find a significant negative relation between stock portfolio returns and the global moments, and the cross section of stock returns reflects a significant negative price of risk for global idiosyncratic skewness (−0.13%) and idiosyncratic volatility (−1.85%) and a positive and significant price of risk for global idiosyncratic kurtosis. We find that our suggested risk factors are key drivers of risk premia in stock market and are robust to various checks. These factors also can forecast the gross domestic product growth over the sample period.

Similar content being viewed by others

Notes

This implies that there is not a relationship between expected returns and idiosyncratic risk moments.

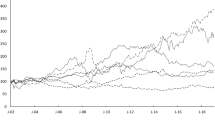

There is no consensus in the literature on the time-series behavior and the forecasting power of idiosyncratic risk. Goyal and Santa-Clara (2003) find a positive relationship between future market return and equal-weighted IV, whereas Bali et al. (2005) do not find the relation for value-weighted IV. Campbell et al. (2001) find an increase in IV since 1962 and Brandt et al. (2010) find that this increase is an episodic phenomenon. In our paper, we tend to investigate not only the time-series behavior and the forecasting power of risk moments, but the idiosyncratic risk premiums and their price.

The intertemporal CAPM presents this prediction (Merton 1973; Campbell 1996; Chen 2003). Stocks that deliver low returns during high volatility add negative skewness to a portfolio. Thus, investors have preferences on skewness so that stocks with a largely negative return sensitivity to volatility demand a larger return in equilibrium.

We label the residuals from these regressions and ignore the U.S. risk and market return components that are uncorrelated to the world risk and market return. We call them as the US-specific risk and market return components, \({\textit{MKT}}_t^{{\textit{M, specific}}} =\widehat{{\alpha }_1}+ \widehat{\varepsilon } _{1t} \), \({\textit{SMB}}_t^{M,{\textit{specific}}} = \widehat{{\alpha }_2}+\widehat{\varepsilon }_{2t} \), and \({\textit{HML}}_t^{{\textit{M, specific}}} =\widehat{{\alpha }_3 } +\widehat{\varepsilon }_{3t} \).

The advantages of selecting these indices are in Atanasov and Nitschka (2014).

A contemporaneous factor model shows high returns over a time period with high contemporaneous co-variation in factor loadings over the same period if the factor constructs a positive risk premium.

This is a lagged factor in the first step of FMB regression. We thus use the coefficients of this factor that is already lagged for the second step regression.

As stated in Campbell et al. (2001), the quarterly series behave very identical to the monthly ones.

References

Amavilah VHS, Asongu SA, Andrés AR (2014) Globalization, peace & stability, governance, and knowledge economy. African Governance and Development Institute Working Paper WP/14/012 (8 August)

Amaya D, Christoffersen P, Jacobs K, Vasquez A (2015) Does realized skewness predict the cross-section of equity returns? J Financ Econ 118:135–167

Andrews DWK (1991) Heteroskedasticity and autocorrelation consistent covariance matrix estimation. Econometrica 59(3):817–858

Ang A, Hodrick R, Xing Y, Zhang X (2006) The cross-section of volatility and expected returns. J Financ 61(1):259–299

Ang A, Hodrick R, Xing Y, Zhang X (2009) High Idiosyncratic volatility and low returns: international and further U.S. evidence. J Financ Econ 91(1):1–23

Atanasov V, Nitschka T (2014) Currency excess returns and global downside market risk. J Int Money Financ 47:268–285

Bali TG, Cakici N (2008) Idiosyncratic volatility and the cross section of expected returns. J Financ Quant Anal 43(1):29–58

Bali TG, Cakici N (2010) World market risk, country-specific risk and expected returns in international stock markets. J Bank Financ 34:1152–1165

Bali TG, Cakici N, Yan X, Zhang Z (2005) Does idiosyncratic risk really matter? J Financ 60(2):905–929

Barberis N, Huang M (2008) Stocks as Lotteries: the implications of probability weighting for security prices. Am Econ Rev 98:2066–2100

Bhootra A, Hur J (2011) High idiosyncratic volatility and low returns: a prospect theory based explanation. Working Paper. California State University, Fullerton

Biger N (1979) Exchange risk implications of international portfolio diversification. J Int Bus Stud 10(2):64–74

Boyer B, Mitton T, Vorkink K (2010) Expected idiosyncratic skewness. Rev Financ Stud 23(1):169–202

Brandt MW, Brav A, Graham JR, Kumar A (2010) The idiosyncratic volatility puzzle: time trend or speculative episodes? Rev Financ Stud 23:863–899

Breeden DT, Gibbons MR, Litzenberger R (1989) Empirical tests of the consumption-oriented CAPM. J Financ 44:231–262

Brockman P, Schutte M (2007) Is idiosyncratic volatility priced? The international evidence. Unpublished working paper. University of Missouri-Columbia

Brunnermeier M, Gollier C, Parker J (2007) Optimal beliefs, asset prices and the preference for skewed returns. Am Econ Rev Pap Proc 97:159–165

Campbell JY (1996) Understanding risk and return. J Polit Econ 104:298–345

Campbell JY, Lettau M, Malkiel BG, Xu Y (2001) Have individual stocks become more volatile? An empirical exploration of idiosyncratic risk. J Financ 56:1–43

Chang BY, Christoffersen P, Jacobs K (2013) Market skewness risk and the cross section of stock returns. J Financ Econ 107(1):46–68

Chen J (2003) Intertemporal CAPM and the cross-section of stock returns. Working paper, UC Davis

Driessen J, Laeven L (2007) International portfolio diversification benefits: cross-country evidence from a local perspective. J Bank Financ 31:1693–1712

Engle RF (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50:987–1008

Fama EF, MacBeth J (1973) Risk, return and equilibrium: empirical tests. J Polit Econ 81:607–636

Fama EF, French KR (1992) The cross-section of expected stock returns. J Financ 47(2):427–465

Fama EF, French KR (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33(1):3–56

Ferreira MA, Gama PM (2005) Have world, country, and industry risks changed over time? An investigation of the volatility of developed stock markets. J Financ Quant Anal 40(1):195–222

Fu F (2009) Idiosyncratic risk and the cross-section of expected stock returns. J Financ Econ 91(1):24–37

Goyal A, Santa-Clara P (2003) Idiosyncratic risk matters!. J Financ 58(3):975–1007

Grubel HG, Fadner K (1971) The interdependence of international equity markets. J Financ 26(1):89–94

Huang W, Liu Q, Rhee SG (2010) Return reversals, idiosyncratic risk, and expected returns. Rev Financ Stud 23(1):147–168

Hueng CJ, Yau R (2013) Country-specific idiosyncratic risk and global equity index returns. Int Rev Econ Financ 25:326–337

Jagannathan R, Wang Z (1996) The conditional CAPM and the cross-section of expected returns. J Financ 51(1):3–53

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: implications for stock market efficiency. J Financ 48:65–92

Johnson T (2004) Forecast dispersion and the cross section of expected returns. J Financ 59:1957–1978

Kryzanowski L, To MC (1982) Asset pricing models when the number of securities held is constrained: a comparison and reconciliation of the Mao and Levy models. J Financ Quant Anal 17(1):63–73

Li K, Sarkar A, Wang Z (2003) Diversification benefits of emerging markets subject to portfolio constraints. J Empir Financ 10:57–80

Liang SX, Wei KCJ (2014) Volatility and Expected Returns around the World. Working paper, Hong Kong University of Science and Technology (15 September)

Menkhoff L, Sarno L, Schmeling M, Schrimpf A (2012) Carry trades and global foreign exchange volatility. J Financ LXVI I(2):681–718

Merton RC (1973) An intertemporal capital asset pricing model. Econometrica 41:867–887

Merton R (1987) A simple model of capital market equilibrium with incomplete information. J Financ 42:483–510

Mitton T, Vorkink K (2007) Equilibrium underdiversification and the preference for skewness. Rev Financ Stud 20(4):1255–1288

Newey W, West K (1987) A simple, positive definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55:703–708

Newey WK, West K (1994) Automatic lag selection in covariance matrix estimation. Rev Econ Stud 61(4):631–653

Pastor L, Stambaugh RF (2003) Liquidity risk and expected stock returns. J Polit Econ 111(3):642–685

Peterson DR, Smedema AR (2011) The return impact of realized and expected idiosyncratic volatility. J Bank Financ 35(10):2547–2558

Rafferty B (2011) Currency returns, skewness and crash risk. Available at SSRN http://ssrn.com/abstract=2022920 or doi:10.2139/ssrn.2022920

Solnik BH (1974) Why not diversify internationally? Financ Anal J 30(4):48–54

Umutlu M (2015) Idiosyncratic volatility and expected returns at the global level. Financ Anal J 71(6):58–71

Xu Y, Malkiel BG (2001) Idiosyncratic risk and security returns. AFA 2001 New Orleans Meetings

You L, Daigler RT (2010) Is international diversification really beneficial? J Bank Finane 34:163–173

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tavakoli Baghdadabad, M., Mallik, G. Global idiosyncratic risk moments. Empir Econ 55, 731–764 (2018). https://doi.org/10.1007/s00181-017-1301-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1301-y