Abstract

Tiebout sorting describes people moving to communities that most closely match people's preferences over taxes and public services. This Tiebout equilibrium is disturbed when cities vote to increase taxes and spending. We study the effect of increased taxes and public spending on population growth in growing and declining cities. Using regression discontinuity to compare otherwise similar cities, we find increasing local government taxes and spending by 15% can increase population growth rates. The increase is only evident the year after the vote. For the general sample, the increase is 0.4 percentage points, but it is 0.8 percentage points (25% of a standard deviation) for growing cities with below-median percentages of elderly residents. In cities with declining population, passing large tax levies increases population growth rates by 0.9 percentage points the year after the vote—33% of a standard deviation. Instead of cutting taxes and services, cities with declining population might instead consider providing additional public services to stem population declines. Most migration studies use a fairly large geographical unit like states, counties, and urban areas; our study contributes to the literature by studying migration at the local government level (cities, villages, and townships).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economics used to teach that public budgets were set by legislatures in jurisdictions with a fixed population, and that if tax and spending policies did not match the preferences of constituents, voters would replace the legislators until preferences were met (Leven 2003). Tiebout (1956) changed the way economists think about the optimal provision of taxes and public services, suggesting a mobile population that votes with its feet, sorting into communities that match tax and spending preferences.

Oates (1969) noted that an implication of the Tiebout (1956) hypothesis is that people would migrate toward jurisdictions that increase public services, all else constant, pushing up housing prices. People would move away from jurisdictions that increase taxes, all else constant, depressing housing prices, and the empirical evidence of Oates (1969) set the stage for hundreds of ensuing house price capitalization papers.

Tullock (1971) took a related approach. Instead of studying the implications of Tiebout (1956) sorting for house prices like Oates (1969), Tullock (1971) inspired the study of population migration itself. The 'Tiebout-Tullock' model has provided a springboard for scores of ensuing studies on migration induced by taxes and public services.

The current study fills important gaps in the literature. While there is an ample literature on the effect of public infrastructure spending on employment growth, there is little research about the effect of general government spending on population growth. Most migration research is not done in a causal inference framework. Our use of regression discontinuity attempts to achieve estimates as free from bias as current technology permits. In fact, regression discontinuity provides statistically identical estimates to those achieved by randomized controlled trials, the current ‘gold standard’ in causal inference (Berk, et al. 2010; Moss, Yeaton and Lloyd, 2014), although an important limitation is that estimates are only applicable to a narrow sample of the population. Finally, our focus on factors that affect migration in growing and declining cities is novel, and informs public policy on restoring and enhancing population growth rates. Increased population can increase the tax base and potentially help cities achieve greater economies of scale in the provision of public services, especially in cities that built up infrastructure but later experienced population outflows.

We collect votes from local governments across Ohio from 1991 to 2018 to finance increased spending with higher taxes. These local governments consist of cities, villages, and townships, of which there are a dozen or more within each of the 88 counties of Ohio. We use regression discontinuity to compare population growth rates in otherwise similar sets of cities that do and do not increase taxes and spending. The types of tax issues up for vote range from fire protection to cemetery maintenance and all services in-between.

Our estimates from a narrow window around the 50% vote share cutoff show a short-term 0.4 percentage point increase in population growth rates one year after the votes. Larger tax levies spur larger increases in population growth rates: increasing local taxes and services by 25.5% increases population growth rates by 0.9 percentage points, which represents 33% of a standard deviation, a result driven by cities with declining population. Cities with declining populations may reduce or reverse the decline not by cutting taxes and services but by increasing them, at least temporarily. When we focus instead on votes in cities with a below-median share of residents over age 65, we also find increased local taxes and spending increases population growth rates, this time by 0.7 percentage points the year after the vote, which is just over 1/5th of a standard deviation. This latter effect is driven by cities with growing populations, which means that 'young' cities whose populations are already growing can increase population growth rates even further by increasing balanced-budget spending. Conversely, 'young' cities with growing populations that wish to grow slower should not increase taxes and spending. We also find the increases in population are generally driven by cities outside the six major urban areas of Ohio.

2 Literature review

2.1 Role of taxes in migration

Taxes fund public services, of course, but the migration literature generally focuses on either the taxation side or the spending side. We first discuss taxes. Agrawal and Foremny (2019) find changes in income tax rates in Spanish regions are a significant factor in location choice, especially of the top 1% of income earners. One of its regressions finds a 0.85 elasticity of the number of top taxpayers with respect to taxes. A similar analysis by Young, et al. (2016) of US states looks at the clustering of millionaires along high-tax and low-tax sides of state borders. It shows fewer millionaires on the high-tax side of borders, but not for every subsample. Like Agrawal and Forenmy (2019), it also shows that millionaires are more sensitive to income tax rates than the general population. Kleven, et al. (2020) uses logit regressions to examine the role of income taxes when moving into a Swiss region. It finds taxes matter, especially for younger people and more highly educated people. It finds little link between increased taxes and out-migration of residents, however. While these studies focus on the income tax, ours also looks at property and sales taxation.

Cebula (1974) examines urban areas in the USA. It finds higher property taxes deter in-migration by White Americans but draw Black Americans. Cebula (2023) and Cebula and Clark (2013) use instrumental variables to find population migration into states that have low income and property tax rates. Unlike Cebula (1974, 2023, and Clark, 2013), our dataset also includes sales taxes. Conway and Houtenville (2001) look at elderly migration caused by fiscal factors. It finds the elderly are attracted to states that have low personal income taxes, low death taxes, and states that exempt food from sales taxes. Unlike Conway and Houtenville (2001), our study excludes death taxes from consideration but considers municipal sales taxes.

Schmidheiny and Slotwinski (2018) study the special foreigner income tax regime in Switzerland. For their first five years of residence, foreigners with incomes less than 120,000 Swiss francs are subject to a particular tax regime. After five years, individuals are subject to the local canton tax rate, which may be higher or lower than the special tax regime. Schmidheiny and Slotwinski (2018) use regression discontinuity to find that higher income earners living in cantons with high local tax rates are much more likely to move when the special tax regime expires. Kleven, et al. (2020) review additional literature on taxes and migration.

2.2 Role of public services in migration

Like the current study, others have examined the role of public expenditures in migration decisions. Much of this literature focuses on welfare spending. Abramitzky (2009) constructs a theoretical model that predicts that redistribution draws in-migration by low-skilled people. Its empirical model shows that engaging in income redistribution induces out-migration by high-productivity people and in-migration by less productive people. De Jong and Donnelly (1973) find a positive relationship between welfare payments and net in-migration for non-White persons aged 25–29, which is driven by larger Northern and Western urban counties in the USA. Cebula (1974) finds welfare payments and other types of local government spending positively related to in-migration by Black Americans, but not White Americans. Cebula and Clark (2013) find migration into states with higher Medicaid benefits per recipient.

Azzoni and Servo (2002) find evidence for welfare in-migration in its Appalachian sample. It also suggests that growth in local government expenditures that are financed through property taxes deters in-migration and encourages out-migration. Conway and Houtenville (2001) find that high spending on welfare is a push factor in the out-migration of the elderly. Ruyssen et al. (2014) find support for welfare migration between advanced and developing OECD nations. Day (1992) uses multinomial logit analysis to find that various types of public expenditures like health, social services, and education help predict destination choice between Canadian provinces.

Borjas and Trejo (1991) show that recent immigrant cohorts use welfare systems more extensively than earlier cohorts, and Borjas (1999) shows that welfare spending attracts foreign-born immigrants. The latter paper uses household-level data on cash-based welfare receipts and state-level data on welfare participation rates. On the other hand, Soroka, et al. (2016) find total social spending is not related to a change in the fraction of foreign-born population when controls are included. It also finds old age is related to social spending in cross-sectional models but not in time series cross-sectional models with fixed effects. Levine and Zimmerman (1999) use difference in differences estimation of welfare benefits on the probability of moving to a different state or a higher benefit state, finding little evidence for the welfare magnet hypothesis. Neumark and Powers (2006) suggest a similar null finding for elderly migration, also using difference in differences (and triple differences).

Some of the preceding papers look at government expenditures other than welfare (Day 1992; Conway and Houtenville 2001; Cebula and Clark 2013). Additional studies, too, look at migration caused by factors other than welfare, like environmental quality (Banzhaf and Walsh 2008), perceived changes in school quality (Gerdes 2013), general quality of government (Ketterer and Rodriguez-Pose, 2015), and the amount of general local government spending (Zhang, Lu and Chen, 2017). But none of these studies looks at migration in places with declining population. And while some studies use causal inference techniques like instrumental variables panel data models (Agrawal and Foremny 2019; Ketterer and Rodriguez-Pose, 2015) and difference in differences (Neumark and Powers 2006; Levine and Zimmerman 1999), the use of regression discontinuity as a causal inference technique sets it apart from the literature on public spending-induced migration.

2.3 Use of regression discontinuity in migration studies

Regression discontinuity has been applied to migration studies outside of taxes and spending, however. The discontinuity of some of these studies is of a geographical nature. Cho (2022) investigates the 100-mile border zone between the USA and Mexico, an area in which Border Patrol can conduct warrantless searches. It finds a higher proportion of Hispanics outside the border zone than within it, but no such effect when it looks at within-county differences. Artz, et al. (2016) examine economic growth at state borders, which is related to the extent that population migration follows employment. It finds business climate indicators have little to no ability to predict differences in economic growth, no matter how growth is measured. Guzi et al. (2021) look at the population exchange that took place in the Sudetenland of the Czech Republic after World War II. It finds lower levels of social capital even multiple decades later. Unlike these studies, ours relies on a numeric cutoff rather than a geographic boundary to determine treatment and control groups.

Other studies, like ours, use cardinal numbers as running variables rather than a geographic boundary. These include migration caused by eligibility for a minimum-income program (Howell 2023) and eligibility for pension payments (Chen 2016). Sajons (2016) finds a reform to grant citizenship to children born in Germany after a certain cutoff date causes immigrant parents to stay in Germany. Slotwinski and Stutzer (2019) use regression discontinuity with an unknown cutoff to find that Swiss municipal votes to restrict mosque prayer towers cause a steep initial drop in foreign in-migration and housing prices. Like the current study, Beland and Unel (2018) use regression discontinuity with voting data. It finds barely electing Democratic governors causes higher immigrant employment and earnings compared to states that barely elect Republican governors.

3 Methodology

Section 2.3 documents the growing use of regression discontinuity in migration studies in recent years. Regression discontinuity relies on a running variable, which in our case is vote share: the proportion of votes in favor of increased taxes and local government spending. The technique of Calonico, et al. (2017, 2019) uses all the observations in the full sample to generate an optimal estimated bandwidth h of the running variable around the cutoff c. The observations that fall within this range [c-h, c + h] form the effective bandwidth used to estimate the treatment effect \(\widehat{\beta }\), as in Eq. (1):

In Eq. (1) y is the outcome variable, cities are indexed by i, and years are indexed by t. Next, migration may not be instantaneous but appear with a lag. The symbol τ indexes the number of years after a vote that the outcome variable is observed. The D is a treatment dummy: whether a city increases tax funding for public services (D = 1) or not (D = 0). The X is the running variable. Because cities with the same value of the running variable have essentially the same value of characteristics, X encapsulates all of the information necessary to consistently estimate β. Still, researchers sometimes include covariates W to help improve the precision of \(\widehat{\beta }\). Finally, ϵ is a Gaussian error term.

4 Data and institutional background

4.1 Running variable % voting in favor

Our running variable is the proportion of votes in favor of increased local taxes and spending. Because local governments must satisfy a balanced-budget constraint, when additional taxes are approved, local government spending increases, too. In Ohio, a simple majority is required to approve a local tax levy, which means 0.50 is the critical value c. Registration to vote is based on residency in the local government sponsoring the vote, along with other requirements like being a US citizen and being at least 18 years of age.

We wish to assess the impact of local taxes and spending as a whole on migration, so we collect 10,957 votes by cities, villages, and townships ('cities') to increase spending on a wide range of public services. This broad-based approach also enhances statistical power, as regressions discontinuity studies, by focusing on a narrow bandwidth around the cutoff, often have small sample size. Fully 89.9% of the sample consists of property taxes, with sales and income taxes filling the balance. The most common purposes are to increase spending on fire protection (3245 votes), current operating expenses for general purposes (1670), emergency medical services (1639), police protection (1160), and roads (1410), although other purposes include cemeteries, garbage collection, libraries, health, flood protection, ports, parks and recreation, water systems, senior citizen services, public transit, and general construction.

Requests for additional funding usually pass. The mean vote share is 53% both in cities with growing and declining populations, with a standard deviation of 5.3 percentage points. The taxing authority must state the duration of the proposed tax. The most common durations are five years (58%) and a ‘continuing period of time’ (23%). The proposed tax levies are fairly modest in size. From a publication of the Ohio Department of Taxation called ‘Tax Rates by Taxing District,’ we sample class 1 (residential and agricultural) municipal property tax rates for the year 2018. We find a median tax rate of 9.82 mills. The median proposed tax increase is 1.5 mills, which therefore represents an approximately 1.5/9.82 = 15% increase in tax revenues.

We investigate potential manipulation of the running variable with the density test of Cattaneo et al. (2018), which has better size and power properties than traditional techniques like McCrary (2008). The test yields a p-value of 0.46, failing to reject the null hypothesis of no discontinuous jump, suggesting that the votes have not been manipulated. A confidence interval graph of the test is found in Appendix Figure A1.

4.2 Outcome variable population growth rates

The outcome we study is the year-over-year population growth rate of a city, village, or township. For year t + 1, for example, % Change Population = (Populationit+1—Populationit)/Populationit. The median pre-treatment population growth rate is essentially zero, with a mean of 0.0045, median of 0.0022, and a standard deviation of 0.032. We remove 1% tails in population change before each estimation to limit the influence of outliers.

The population data come from the US Census Bureau. Estimates come from census years 1990, 2000, 2010, and yearly estimates from 2011 through 2018. Linear interpolation is necessary between census years. This will make it harder for the data to pick up discrete shocks, especially from votes in the middle of interpolated census years, but if there is a strong effect the Census data should be able to pick up general trends. We have more to say about this in Sect. 5.1.

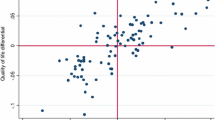

It is customary in regression discontinuity studies to graph the outcome variable as a function of the running variable. We do so in Fig. 1 for the year after the vote, the only year our estimates show statistical significance.

While the figure might suggest a discrete jump in population growth rates at the cutoff, formal regression analysis is required to confirm whether this is statistically true, because the dots in Fig. 1 represent binned averages, not actual data points.

4.3 Covariates

Researchers sometimes include covariates to improve the efficiency of estimates, and this proves useful in one of our samples: the sample of cities with a below-median share of persons aged 65 and older.

Table 1 shows the covariates used in the analysis. Table 1 shows the means within the effective bandwidth are highly similar between the groups of cities that fail and pass tax levies. The covariates include the poverty rate, the proportion of persons who do not have a high school diploma, and the proportion of persons whose highest educational attainment is a high school diploma.

Because we require so few covariates, it is instructive to show additional characteristics of these cities. This lets readers further assess how similar the group of cities that votes against new tax funding is to the group that votes for new tax funding. The additional characteristics include levels of population, the proportion of households with children, the proportion of single-parent households, the unemployment rate, median family income, the proportion of renter-occupied households (as opposed to owner-occupied), the proportion of households aged 18 to 64, the proportion of households aged 65 and older, the proportion of married persons, and the labor force participation rate. Demographically and economically, the two sets of cities are similar to each other near the cutoff.

Covariate similarity between groups is important, but even with overall similarity a covariate could jump markedly in value across the threshold. A significant treatment effect estimate under these circumstances might actually be caused by a covariate instead of treatment. To assess this possibility, we take our set of cities with below-median proportion of persons age 65 or older (the only sample for which we use covariates) and use each covariate as an outcome. No treatment effect estimate is significant, with p-values of 0.23 for poverty rate, 0.70 for % no high school diploma, and 0.48 for % high school only, suggesting that voting for additional taxes and government spending does not change poverty rates or educational attainment in the short run, and clearing these covariates for use in regressions. Any significant treatment effect we obtain in the results section should therefore indeed stem from a change in levels of taxes and local government spending.

It is also customary in regression discontinuity studies to graph the covariates as a function of the running variable. While the graphs cannot formally test for covariate smoothness at the cutoff, they allow readers to visually assess whether or not there is a gap at the critical value. These graphs are provided in Fig. 2.

5 Results

5.1 Baseline results

The main results are found in Table 2.

Confidence intervals associated with Table 2 are found in Fig. 3.

We find a higher population growth rate in cities that barely vote for new local government spending relative to otherwise similar cities that barely vote against new funding. The increased population growth is evident the year after the vote, after which similar rates of population growth are found between the two groups of cities. The 0.004 magnitude of the estimate implies a fourth tenths of one percentage point difference in population growth rates, which is 12.5% of a standard deviation.

In Sect. 4.2 we mention the possibility that linear interpolation between census years might mute treatment effect estimates. We now assess this possibility formally. Reducing the sample to the years 2010–2018 that have yearly population estimates should have two effects. The smaller number of observations should reduce the precision of the estimates, but the lack of interpolation should enhance the effect of any sharp jumps in population growth. We find the latter effect dominates. Focusing only on the years 2010–2018, we find the year after the vote, population growth rates are 2.2 percentage points higher in cities that vote for additional balanced-budget spending (p-value 0.01). As with the full sample, the effect is only evident one year after the vote.

We then split the sample into declining cities and growing cities based on whether the city has less or more residents five years after the vote and run the regressions again. The mean % change in population is − 0.008 with a standard deviation of 0.027 for the declining cities sample, and 0.012 with a standard deviation of 0.034 for the growing cities sample. The lower bound of the confidence interval for the growing cities sample for t + 1 is − 8.8E-06, barely failing to register a positive effect. We conclude that passing tax levies for additional local government spending does not affect the population growth rates of growing and declining cities differently. It is possible, however, that increased statistical power would register a difference. And while we find no effect in growing cities, the 2010–2018 sample does show a statistically significant (p-value 0.02) treatment effect estimate of 0.017 one year after the vote for declining cities. The 1.7 percentage point increase represents 53% of a standard deviation.

Table 2 shows statistical significance for a year-over-year population increase between the time of the vote and one year later, but no other significant year-over-year treatment effects. We now test for persistence of effects with a difference in discontinuities exploration. In unreported regressions, we redefine the outcome variables to be changes in population between the year of the vote and subsequent years. The initial periods will have the same treatment effect, but the two-year change in population will differ from the estimates in Table 1. The two-year population change estimates are statistically insignificant for all three samples, suggesting the increase in population is temporary.

The temporary nature of the population growth begs the question of whether the increase in taxes and services is permanent or temporary. Noting that all levies to renew an existing tax started out as new taxes, we examine the passage rate of tax renewals. Out of a total of 24,925 levies to renew an existing tax, 21,117 passed, for an 85% renewal rate, so tax increases usually persist. Only 6.4% of additional tax levies are for a duration of one year, so an overwhelming proportion of tax and service increases are in effect after the initial one-year spike in population growth rates.

5.2 Large tax levy results

We next focus attention on large tax levies: those above the median 1.5 millage rate. This will allow us to investigate a dose–response mechanism, and with larger balanced-budget increases in funding at stake, it may elucidate significant treatment effects for later periods that are not evident with smaller tax levies. The median tax levy in the large levy sample represents a 25.5% increase in balanced-budget funding. The results are found in Table 3, and the associated confidence intervals are found in Fig. 4.

One year after the vote, we find a difference in population growth rates between cities that pass additional taxes and spending compared to those that do not. The treatment effect has more than doubled from 0.004 in Table 2 to 0.009, showing a 0.9 percentage point increase in population growth rates. This large tax levy sample again shows no effects after the first year.

We then split our sample into cities with declining and growing populations. The set of cities with shrinking population shows a positive treatment effect the year after the vote. The 0.009 treatment effect estimate means that declining cities that vote for additional local government spending have 0.9 percentage point faster population growth rates than declining cities that vote against spending increases. This is the most exciting policy-relevant finding in our paper. Struggling cities may be tempted to cut taxes to spur economic development and lure residents, but our study suggests that residents value additional services more than they dislike the additional taxes. This does not mean that tax increases can turn around the population decline for all cities, although it could for some, but it does mean that providing additional valued services can stem the population decline. The boost only lasts for one period, however, because no difference in population growth rates is found beyond the first year after the vote.

Growing cities show no effect. When focusing on the large tax levies, we find that passing additional tax levies for local government spending does not affect population growth rates for cities whose population is already growing.

5.3 Low % elderly results

Elderly mobility may be different than mobility for other age groups (Plane and Heins 2003; Schaffar, Dimou and Moulhoud, 2019; Stockdale and MacLeod 2013). Ohio has special tax treatment called a homestead exemption. Low-income residents aged 65 or older receive a $25,000 exemption from the appraised value of their primary residence when paying property taxes. It is possible that cities with a lower percentage of persons aged 65 and above exhibit a stronger migration responses to changes in taxes and spending. To this end, we focus on the set of 'young' cities in our sample, those with a below-median proportion of elderly residents, and run our regressions again. The results are found in Table 4, and the associated confidence intervals are found in Fig. 5.

The same treatment effect estimate that was significant in Tables 2 and 3 is significant again in Table 4. One year after the vote, cities that barely approve additional taxes and local government spending have higher population growth rates than comparable cities that barely vote against. The magnitude of the effect is 0.007, suggesting that the response to increased taxes and spending is stronger for the younger population groups than it is for the full sample (0.7 vs. 0.4 percentage points).

Splitting the sample into cities with declining and growing population, we see that the additional population growth is driven by cities with increasing population. The 0.008 estimate means that passing additional taxes for local government services increases population by 0.8 percentage points in cities that are already growing and have a below-median proportion of elderly residents, relative to the set of 'young' cities that vote against increasing taxes. As with the other significant treatment estimates, the effect occurs the year after the vote, after which no effects on population growth are found. One year of statistical significance could be a false positive, but we suggest that five significant treatment effects in the same year, with no effects in subsequent years, forms a fairly convincing pattern of results.

6 Extensions

We split our sample in five additional ways. Rather than fill the paper with tables of statistically insignificant results, we discuss statistically significant results here and offer to show the full set of results for which p-values exceed 0.05 to readers who request them.

Section 5 shows some evidence of differences in the population growth rate from increased taxes and services in growing and declining cities with various characteristics. Ohio has three metropolitan statistical areas (MSAs) of about two million residents each: Cincinnati, Columbus, and Cleveland; three other sizeable MSAs contain about 700,000 residents each. Our first extension is to compare cities in the largest three MSAs to cities in the rest of the state. We find no difference in population growth rates for cities in the largest three MSAs that pass additional local tax levies. On the other hand, we find effects outside the largest three MSAs. The year after the vote, we find a 0.6 percentage point increase in population growth from passing tax levies for additional funding. Subsequent years show no differential population growth rates. We next focus attention on the geographies with the greatest possibility for Tiebout sorting: the suburbs of the three largest MSAs. Dropping the three large central cities makes a difference. Treatment effect estimates go from statistically insignificant to showing a 0.4 percentage point increase in population one year after the vote, nearly the same magnitude as the 0.6 percentage points for cities outside the largest three MSAs. We interpret this as statistical evidence for Tiebout sorting in the suburbs of large urban areas following a change in tax and service levels.

Our third experiment expands the first. Instead of focusing on the largest three MSAs, we create a dummy variable for whether each city in our sample belongs to any of the six largest MSAs in the state. The results again show no change in population growth rates from passing tax levies for additional funding in the largest population centers, but a difference in the smaller ones. One year after passing tax levies for additional local government funding, population growth rates are 0.6 percentage points higher, relative to cities outside the six largest MSAs that vote against increases in local taxes and sending. The policy implications are that local governments outside the largest population centers can spike population growth rates by raising taxes and local government spending. The magnitude of the increase is fairly modest, however, amounting to about 18.8% of a standard deviation of population growth.

The fourth experiment is to split the sample into cities with above- and below-median income. We find no difference in year-over-year population growth from increasing taxes and public services in high-income cities. On the other hand, low-income cities that pass additional taxes have higher population growth the year after the vote than low-income cities whose taxes and public service levels stay the same. The magnitude of the effect is six-tenths of a percentage point.

The final extension we perform is related to city size. Being in one of the largest MSAs in the state does not mean that a local government has a large population. There are numerous sizeable factory towns dotting the landscape of Ohio, and there are even more numerous farming-oriented townships with sparse population. Within the largest urban areas, there are large suburban cities as well as small villages. We therefore more directly examine the role of city size by splitting the sample into cities with above and below 5000 population. We find no difference in population growth rates from passing additional tax levies in either large cities or small cities.

7 Falsification and placebo testing

There are other possibilities to consider before accepting the estimates of Eq. (1) as valid. For example, economic conditions of a city make tax passage more or less likely, but the only economic covariate considered is the poverty rate, and this only for the regressions that exclude cities with an above-median proportion of residents over age 65. Our first response is that regression discontinuity requires no covariates, so this should not be an issue. Our second response is that, close to the cutoff, all variables—even those not used as covariates—should have similar values between treatment and control groups. Table 1 shows this is indeed the case for other variables we can measure like population (2820 vs. 2790), median family income ($58,200 vs. $59,900), the proportion of renters (0.24 vs. 0.24), and the proportion of households with children (0.39 vs. 0.39). The theory of regression discontinuity states that if observable characteristics are similar between groups near the cutoff, unobservable characteristics should be, too (e.g., Mitchell, et al. 2017).

Another possibility is that the significant treatment effects are random. This argument holds less water because of the repeated pattern of significance when τ = 1 and not, but it is still important to consider the possibility that the data contain random breaks that look like treatment effects but that are not. To this end, we replace c = 0.50 with false cutoffs. These false cutoffs must be outside the 0.12 effective bandwidth, so we consider false cutoffs of 0.38, 0.35, 0.62, and 0.70. Re-estimating Eq. (1) for the full, declining, and growing city samples of Table 2, we find no statistically significant treatment effects one year after the vote, the only period for which significant treatment effects were found. The results suggest that the significant treatment effects are more likely legitimate than due to random breaks in the data.

Yet another possibility is that omitted variables are responsible for the treatment effects beyond the characteristics we measure. These would have to be factors that are imbalanced between treatment and control groups, and they would have to affect population growth rates one year after the vote but not in other years. This alone, we argue, is a high hurdle. We nevertheless test whether there could be a significant treatment effect caused by some factor before the vote even occurs, as in Lee and Lemieux (2010, p. 330). If we find significant treatment effect estimates for year τ = − 1, it would seriously cast into question our results, because a vote at time t cannot affect an outcome in the past. The results are reassuring. Tables 2, 3, and 4 show treatment effect estimates for year-over-year population growth one year before the vote, and none of the fifteen estimates is significant, with p-values that range from 0.27 to 0.74.

8 Conclusion

The Tiebout (1956) hypothesis suggests people sort to communities that most closely match their preferences over taxes and public services. A disruption of this Tiebout equilibrium could make it more likely for people to want to move when tax and service bundles change (Tullock 1971).

We study cities that vote on tax levies to increase local public spending in Ohio. We find that increasing balanced-budget spending by 15% increases population growth rates. This is true only the year after the vote, and it is true for the set of cities overall, for cities with declining population that vote for large tax increases, for growing cities that have younger than average populations. Our results are generally driven by cities outside the six largest urban areas in Ohio. However, when we exclude central cities and focus on the suburbs of the three largest MSAs, the geography with the most opportunity for Tiebout sorting, we find some evidence that increasing local taxes and spending increases population growth. The magnitude of the increase in population growth rates ranges from 0.4 to 0.9 percentage points—12.5–28.1% of a standard deviation for the interpolated sample. The effect is as high as 53% of a standard deviation when we restrict our sample to 2010–2018, years for which yearly population estimates are available.

Some results are what one would expect: the young are more mobile than the elderly, larger tax changes lead to larger population changes. The most surprising result may be the responsiveness of population for smaller cities: those outside the largest six MSAs. The most encouraging finding is probably that cities with declining populations, of which Ohio has many, can spike population growth by increasing local taxes and services, but only with large increases in taxes and services. And it may be a surprise that increasing local taxes and spending boosts rather than cuts population growth, a finding that may stem from Ohio's system of tax limits that generally reduces real local revenues over time.

Future research should see if increasing specific types of spending, like police, has a greater effect on population growth rates than other types of spending increases. It should also see if the population increases are greater in more highly educated cities, or if increased levels of local public goods increase not just population growth but wages, employment growth, house prices, and the number of retail establishments. We also argue that the use of migration data at the city level can shed additional light over migration studies at the geographic level of county and urban area. Future research could survey individual respondents about moves and any public finance factors that help inspire the move, including not just taxes and public service spending but quality of public services, too.

It is important to note that our results only apply to migration between the smallest levels of government. We can say nothing about whether increased taxes and services would lead to population growth at the county or state level. Future research could use voting data with regression discontinuity at these levels of geography, but we would expect weaker effects. Townships in a rural area are close substitutes for each other, as are suburban communities within the same urban area, so we suspect a lot of the in-migration into a community comes at the expense of neighboring communities, but future research is needed to investigate this important question. In fact, we encourage future researchers to analyze the spatial pattern of population change when a community votes for additional taxes and spending.

Data availability

The data that support the findings of this study are available upon request from the author.

References

Abramitzky R (2009) The effect of redistribution on migration: evidence from the Israeli kibbutz. J Public Econ 93(3–4):498–511

Agrawal DR, Foremny D (2019) Relocation of the rich: migration in response to top tax rate changes from Spanish reforms. Rev Econ Stat 101(2):214–232

Artz GM, Duncan KD, Hall AP, Orazem PF (2016) Do state business climate indicators explain relative economic growth at state borders? J Reg Sci 56(3):395–419

Azzoni CR, Servo L (2002) Education, cost of living and regional wage inequality in Brazil. Pap Reg Sci 81(2):157–175

Banzhaf HS, Walsh RP (2008) Do people vote with their feet? An empirical test of Tiebout’s mechanism. Am Econ Rev 98(3):843–863

Beland LP, Unel B (2018) The impact of party affiliation of US governors on immigrants’ labor market outcomes. J Popul Econ 31(2):627–670

Berk R, Barnes G, Ahlman L, Kurtz E (2010) When second best is good enough: a comparison between a true experiment and a regression discontinuity quasi-experiment. J Exp Criminol 6(2):191–208

Borjas GJ (1999) Immigration and welfare magnets. J Law Econ 17(4):607–637

Borjas GJ, Trejo SJ (1991) Immigrant participation in the welfare system. ILR Rev 44(2):195–211

Calonico S, Cattaneo MD, Farrell MH, Titiunik R (2017) rdrobust: software for regression-discontinuity designs. Stand Genom Sci 17(2):372–404

Calonico S, Cattaneo MD, Farrell MH, Titiunik R (2019) Regression discontinuity designs using covariates. Rev Econ Stat 101(3):442–451

Cattaneo MD, Jansson M, Ma X (2018) Manipulation testing based on density discontinuity. Stand Genom Sci 18(1):234–261

Cebula RJ (1974) Local government policies and migration: an analysis for SMSA’s in the United States, 1965–1970. Public Choice 19(1):85–93

Cebula RJ (2023) The Tiebout–Tullock hypothesis re-examined using tax freedom measures: the case of post-great recession state-level gross in-migration. Public Choice. https://doi.org/10.1007/s11127-022-01038-5

Cebula RJ, Clark JR (2013) An extension of the Tiebout hypothesis of voting with one’s feet: the Medicaid magnet hypothesis. Appl Econ 45(32):4575–4583

Chen X (2016) Old-age pension and extended families: How is adult children’s internal migration affected? Contemp Econ Policy 34(4):646–659

Cho H (2022) Border enforcement and the sorting and commuting patterns of Hispanics. J Reg Sci 62(4):938–960

Conway KS, Houtenville AJ (2001) Elderly migration and state fiscal policy: evidence from the 1990 census migration flows. Natl Tax J 54(1):103–123

Day KM (1992) Interprovincial migration and local public goods. Can J Econ 25(1):123–144

De Jong GF, Donnelly WL (1973) Public welfare and migration. Soc Sci Q 54(2):329–344

Gerdes C (2013) Does immigration induce “native flight” from public schools? Evidence from a large-scale voucher program. Ann Reg Sci 50:645–666

Guzi M, Huber P, Mikula Š (2021) The long-term impact of the resettlement of the Sudetenland on residential migration. J Urban Econ 126:103385

Howell A (2023) Impact of a guaranteed minimum income program on rural–urban migration in China. J Econ Geogr 23(1):1–21

Ketterer TD, Rodríguez-Pose A (2015) Local quality of government and voting with one’s feet. Ann Reg Sci 55:501–532

Kleven H, Landais C, Munoz M, Stantcheva S (2020) Taxation and migration: evidence and policy implications. J Econ Perspect 34(2):119–142

Lee DS, Lemieux T (2010) Regression discontinuity designs in economics. J Econ Lit 48(2):281–355

Leven C (2003) Discovering “voting with your feet.” Ann Reg Sci 37(2):235

Levine PB, Zimmerman DJ (1999) An empirical analysis of the welfare magnet debate using the NLSY. J Popul Econ 12(3):391–409

McCrary J (2008) Manipulation of the running variable in the regression discontinuity design: a density test. J Econom 142(2):698–714

Mitchell O, Cochran JC, Mears DP, Bales WD (2017) The effectiveness of prison for reducing drug offender recidivism: a regression discontinuity analysis. J Exp Criminol 13:1–27

Moss BG, Yeaton WH, Lloyd JE (2014) Evaluating the effectiveness of developmental mathematics by embedding a randomized experiment within a regression discontinuity design. Educ Eval Policy Anal 36(2):170–185

Neumark D, Powers ET (2006) Supplemental security income, labor supply, and migration. J Popul Econ 19(3):447–479

Oates WE (1969) The effects of property taxes and local public spending on property values: an empirical study of tax capitalization and the Tiebout hypothesis. J Polit Econ 77(6):957–971

Plane DA, Heins F (2003) Age articulation of US inter-metropolitan migration flows. Ann Reg Sci 37(1):107–130

Ruyssen I, Everaert G, Rayp G (2014) Determinants and dynamics of migration to OECD countries in a three-dimensional panel framework. Empir Econ 46(1):175–197

Sajons C (2016) Does granting citizenship to immigrant children affect family outmigration? J Popul Econ 29(2):395–420

Schaffar A, Dimou M, Mouhoud EM (2019) The determinants of elderly migration in France. Pap Reg Sci 98(2):951–972

Schmidheiny K, Slotwinski M (2018) Tax-induced mobility: evidence from a foreigners’ tax scheme in Switzerland. J Public Econ 167:293–324

Slotwinski M, Stutzer A (2019) The deterrent effect of an anti-minaret vote on foreigners’ location choices. J Popul Econ 32(3):1043–1095

Soroka SN, Johnston R, Kevins A, Banting K, Kymlicka W (2016) Migration and welfare state spending. Eur Polit Sci Rev 8(2):173–194

Stockdale A, MacLeod M (2013) Pre-retirement age migration to remote rural areas. J Rural Stud 32:80–92

Tiebout CM (1956) A pure theory of local expenditures. J Polit Econ 64(5):416–424

Tullock G (1971) Public decisions as public goods. J Polit Econ 79(4):913–918

Young C, Varner C, Lurie IZ, Prisinzano R (2016) Millionaire migration and taxation of the elite: evidence from administrative data. Am Sociol Rev 81(3):421–446

Zhang L, Lu KY, Chen MX (2017). The effect of local fiscal expenditures on population migration. In: 2017 2nd International conference on information technology and management engineering.

Acknowledgements

Brasington gratefully acknowledges financial support from the Charles P. Taft Research Center, the Lindner College of Business, and the University of Cincinnati University Research Council. Brasington is grateful for helpful comments from participants at the 2023 Urban Economics Association and the 2024 Western Regional Science Association annual meetings, and especially from Steve Craig.

Funding

Brasington received funding from the Lindner College of Business and the University of Cincinnati University Research Council Third Century Grant.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author has no competing interests to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Brasington, D.M. Population growth in growing and declining cities: the role of balanced-budget increases in local government spending. Ann Reg Sci (2024). https://doi.org/10.1007/s00168-024-01281-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s00168-024-01281-2