Abstract

Local amenities capitalize into housing values and form the foundation for income and preference-based sorting of residents into communities. Ellickson’s single-crossing property establishes how household sorting leads to correlation between income and preferences for amenities. For amenities including urban green, metro stations and centrality, income-based sorting describes the process by which higher-income residents choose to locate in close proximity to higher levels of amenities. Using Vienna as an example, we empirically investigate the role housing policies have on this expected pattern of sorting. We find that the provision of municipality housing and capped rents reduces income gradients between block groups adjacent to amenities and those further away while we do not find a significant effect associated with limited-profit housing. For policymakers, this suggests that policy design plays a critical role in ensuring availability of local amenities across income groups while simultaneously confirming the single-crossing result holds despite the existence of significant market regulations.

Similar content being viewed by others

1 Introduction

Capitalization of urban amenities impacts patterns of urban development and the associated distributional consequences across the urban income gradient (Hilber 2017). Residents are well known to sort into neighborhoods based on the provision of local amenities including schools (Brueckner and Joo 1991; Brunner et al. 2001; Brunner and Sonstelie 2003; Hilber and Mayer 2009; Ihlanfeldt and Mayock 2019), urban green spaces (Choumert 2010; Wüstemann et al. 2017) and public transport connections (Bowes and Ihlanfeldt 2001; Debrezion et al. 2007; Hess and Almeida 2007; Kahn 2007) among others. For residents, the increased demand for locations with high levels of amenities results in increased rents due to capitalization of amenities in housing values. With equal preferences for amenities, higher-income households outbid lower-income households in areas with higher levels of amenities. Banzhaf et al. (2019) label the long-run outcomes of this sorting process as environmental gentrification.

In the absence of market regulation, Tiebout (1956) sorting suggests that residents will compete with each other for access to bundles of local amenities which vary across the urban landscape. Ellickson’s (1971) single-crossing condition is used by Epple and Sieg (1999), to demonstrate the implications for community structure that arise due to sorting. In this framework, they show how sorting will lead to a community ranking based on amenity levels that is increasing in preferences and income. This sorting result implies that in an unregulated real estate market incomes are increasing in the level of amenities provided.

While Tiebout’s (1956) original motivation was to explain the optimal provision of amenities at the local level, Muth and Alonso (Alonso 1964; Muth 1969) were concerned with land prices and income distributions of cities with a dominant center and competitive land markets. In the following years, their theories were empirically tested and extended (Brueckner and Rosenthal 2009; LeRoy and Sonstelie 1983; Wheaton 1977) and it was realized that access to the city center is just one type of amenity comparable to the effect of air quality, crime or noise (Cuberes et al. 2019; Diamond 1980; Glaeser et al. 2008; Wu 2006).

Specifically, the income distribution described by monocentric city Alonso-Muth type models is driven by commuting costs to the workplace. In these models, the location of workplaces is assumed to be in the city center. Model extensions allow workplaces to be located at multiple places across the city by letting households and firms compete for land (Fujita and Ogawa 1982; Lucas and Rossi–Hansberg 2002). Various equilibria (i.e., multiple location of workplaces) can, depending on commuting cost, result from such models. Such a polycentric city model can also be used to explain how commuting costs and amenities jointly explain the spatial income distribution: Gaigné et al. (2022) consider income sorting under heterogeneity in transportation costs across space and income as well as amenities unevenly distributed across space.

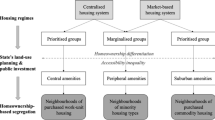

In response to high rents and income sorting, many jurisdictions have instituted various forms of housing policies to ensure lower-income households can afford to live in areas with high levels of amenities (Chapelle et al. 2019; Diamond et al. 2019; Mense et al. 2019; Sun et al. 2017). As Cheshire and Hilber (2018) summarize, the prevalence of housing market regulations in European cities is significantly more common than that in the USA and varies significantly across regions. The exact nature of housing policies can take many different forms usually defined in the laws of countries or regions. Conceptually, one can distinguish demand side measures, supply side measures and direct regulation of housing transaction (e.g., rent control).

There is some evidence from the literature how housing policies affect sorting. The most important demand side measures are housing allowances for renters and interest subsides for buyers. For the USA, it has been shown that housing allowances did not have a large impact on income compositions of neighborhoods (Ellen 2020). For example, Eriksen and Ross (2013) report from an experimental study that those receiving a voucher move to only slightly better neighborhoods. Feins and Patterson (2005) find that neighborhoods voucher recipients move to are not better off on average than the neighborhoods from which participants moved.

Supply side measures can be grouped in municipality housing (also called social housing or subsidized housing) and (subsidized) limited-profit housing provided by cooperatives. In municipality housing, the city serves as a landlord and directly provides houses and can therefore set rents and decide who to rent the apartments to. Typically, social welfare considerations play a role in the decision of who is eligible for municipality housing. In limited-profit housing, the cooperative providing apartments is legally required to charge rents based on costs of construction and administration leading to limited-profits, which are often required to be reinvested into the community. The literature suggests that in countries with small municipality housing sectors, municipality housing can result in clusters of low-income groups (Borg 2019; Schutjens et al. 2002). The effects of such clusters depend on the neighborhoods where the municipality housing projects are located. In low-income neighborhoods, municipality housing can increase house prices and diversity, and in high-income neighborhoods, this can decrease house prices (Diamond and McQuade 2018). In countries with large municipality housing sectors, tenants in municipality housing (who are not necessarily poor) pay low rents, while the poor who cannot rent public housing (e.g., if they only recently moved to the city) face higher market-based rents which results in an insider–outsider problem (Giffinger 1998; Kadi and Musterd 2015).

In the case of rent control, the government (or another administrative body) directly regulates rents (first-generation rent control or capped rents) or limits rent increase (second-generation rent control). To avoid limiting the incentives of investors, rents are typically regulated for houses built prior to a particular date (e.g., 1945) or for houses built with government subsidies. The specific form of rent control, and housing policy in general, differs substantially between countries (Arnott 1995). Rent control has been criticized as causing utilitarian welfare inefficiencies because as a consequence of rent control it is not the willingness to pay which determines sorting across the city (Chapelle et al. 2019; Diamond et al. 2019). Also, rent control has been shown to reduce mobility of households (Krol and Svorny 2005; Munch and Svarer 2002) which (in the short run) impacts sorting and welfare.

The degree to which municipality housing, limited-profit housing and rent control influence sorting with respect to income will depend on the specific form these market designs take, the association between preferences and income, and the implicit rent in the market for amenities. Over time, and given there is no change in the provision of amenities, an equilibrium in sorting will emerge which determines the equilibrium income gradient as one moves toward amenities. In this paper we estimate how the equilibrium income gradient is influenced by local amenities (urban green space, metro connections and the distance to the city center) and how different forms of housing policies influence the equilibrium income gradient at the level of block groupsFootnote 1 using data from Vienna, Austria. Our empirical results show how the income composition of the population differs conditional on the rental market structure. In related work, Fessler et al. (2016) derive non-cash income implicit to housing policy and show that Austrian housing policy results in more equal incomes. While their work focuses on the income distribution in Austria as whole, our work focuses on the impacts of policy on heterogeneous sorting outcomes across space.

The literature on local amenities has widely confirmed that sorting results in capitalization of local public goods in nearby property values (Abbott and Allen Klaiber 2013; Finney et al. 2011; Hobden et al. 2004; Jim and Chen 2006; Netusil et al. 2010). A particularly well-studied form of local public goods is the provision of green space. The literature on the effects of urban green documents their cooling ability (Klaiber et al. 2017; Morawetz and Koemle 2017; Žuvela-Aloise et al. 2016), reduced air pollution (Nowak et al. 2006) and improved heath (Engemann et al. 2019). The extent of capitalization is heterogeneous (Herath et al. 2015; Wu et al. 2017), depending on whether greenspace can be developed (Irwin 2002) and whether green space is privately owned (Cheshire and Sheppard 1995). There is also an interaction of green space with other amenities (Abbott and Klaiber 2010; Anderson and West 2006). In a sorting framework, Klaiber and Phaneuf (2010) demonstrate the existence of demographic heterogeneity in preferences for different types of urban green space while Walsh (2007) documents the role of sorting in response to land protection policies.

Empirical studies from North America, Europe and Asia have analyzed the effect of rail stations (metro and train) on property and land prices. A meta-study found price effects between − 45% percent up to 100% with a mean of 8%. The effect was found to be higher in Europe than in North America and the effect of metro was found to be different from train (Mohammad et al. 2013). For Europe, only a few studies analyzed the effect of metro stations. In Warsaw (Trojanek and Gluszak 2018), Helsinki (Laakso 1992) and Vienna (Wieser 2006), a positive effect was documented. For the Atlanta region in the USA, it was shown that the effects of train stations on residential property values varies with distance from downtown and the median income of the neighborhood. In higher-income areas (away from downtown), positive effects are found mainly because retail infrastructure locates close to the stations, while in lower-income areas negative effects (crime, noise and parking lots) dominate (Bowes and Ihlanfeldt 2001). Similarly, for Buffalo, New York, effects of train stations on property values have been found to be positive only in high-income areas while they are negative in poor neighborhoods (Hess and Almeida 2007).

In typical US cities, income increases with distance to the city center (Schuetz et al. 2018). In many European cities, however, this pattern is not observed (Brueckner et al. 1999; Chapelle et al. 2019; Cuberes et al. 2019). This is explained by historic amenities which include listed buildings, monuments, parks and the urban infrastructure from past times. It has been argued that the joint effect of these characteristics is more than the sum of its parts (Koster et al. 2016). Empirical studies from Europe confirm that housing prices are higher next to historical amenities (Ahlfeldt and Maennig 2010; Koster et al. 2016; Lazrak et al. 2014). In many cities, the historic city center also has a particularly dense infrastructure (restaurants, doctors, public administration) and many businesses locate in the city adding another amenity to the city center (Glaeser et al. 2001). Finally, distances to all other location of the city are shorter from the center. Proximity to the city center is consequently found to be one reason for income sorting (Kolko 2007).

In this paper, we examine the impact of housing policy on income sorting associated with proximity to urban green space, public transit and proximity to city center. The results of this paper contribute three primary new insights to the literature on sorting. First, we demonstrate the applicability of the Tiebout sorting framework in an urban setting with housing policies covering a large share of the housing market. Second, we demonstrate that as the share of residents in houses subject to housing policies increases, there exists decreasing evidence of income sorting (i.e., a flatter equilibrium income gradient). Finally, we show how different types of housing policies (municipality housing, limited-profit housing, capped rents) lead to differing patterns of sorting across space. For policymakers, our results provide novel insights into the role of municipality housing, limited-profit housing policies and capped rents on the resulting income patterns. The results also help to understand how beneficiaries of public investments can differ depending on where the investment is placed: If houses next to an amenity are subject to housing policies, renters will benefit; otherwise, current owners (resident and absentee) will benefit. Such considerations may play a role when considering where to develop urban amenities and target funds for public intervention in the housing market.

The remainder of the paper is structured as follows. In Sect. 2, we describe the Vienna housing market and types of housing policies aimed at providing affordable housing to residents of different income levels. In Sect. 3, we present our empirical framework. Section 4 presents our primary results. Section 5 presents a discrete choice model as a robustness check and Sect. 6 concludes.

2 Vienna housing market

Vienna, the capital of Austria, had 1.9 million inhabitants at the beginning of 2020 and is the fifth biggest city of the European Union. The structure of the city is historically grown: the inner districts are densely populated with only a few large green areas in the city center and a dense network of metro stations provide easy access to many private and public facilities (restaurants, doctors, public offices and universities). Outer districts have a more discontinuous urban fabric (i.e., single houses with gardens), some larger parks and only a few metro lines. The outer areas are mainly residential with less private and public facilities, mainly concentrated at the center of their respective districts. The city is surrounded in the west and north by forest and in the east and south by flat agricultural land and industrial areas. Figure 1 shows a map of Vienna highlighting green spaces, metro stations and St. Stephan’s cathedral in the city center.

Vienna has a total of 889,700 dwellings comprised of primarily residential apartments or homes. Between World War I and II, the city of Vienna constructed approximately 65,000 municipality apartments (Ludwig 2017). These were mostly financed through a highly progressive tax on real estate (Czeike 1985), and land was bought at times of low land prices during the great depression. After World War II, the city of Vienna constructed an additional 96,000 municipality owned apartments. Today there are about 220,000 municipality apartments (Ludwig 2017) housing 28% of the Viennese population as shown in Table 1. The city decides, based on social criteria, who can live in municipality housing. The criteria for rental are only checked at the time of move in and are purposefully not restrictive: About 75% of Viennese households are eligible (Ludwig 2017). The monthly rent for municipality housing was 5.7 €/m2 for existing contracts in 2011 (including a 10% tax and operational cost excluding energy). Since these rents are estimated from micro census data, Table 1 provides standard errors of the estimates (Kunnert and Baumgartner 2012). For contracts established in 2011, the monthly rent was 6.7 €/m2. The distinction is important, because rents from existing contracts can increase only by inflation. This second-generation rent control is federal law and applies to municipality housing, limited-profit housing, capped rents and unregulated rental contracts.

From the 1980s onwards, the city of Vienna shifted its housing policy toward subsidizing limited-profit housing (Kunnert and Baumgartner 2012). Limited-profit housing is offered by state audited cooperatives, as regulated in the “Cooperative Act.” In Vienna, 16% of the population lives in limited-profit housing (Table 1). The cooperatives are required to charge tenants no more than is necessary to cover construction and maintenance costs. In Vienna, the average monthly rent for limited-profit housing was 6.0 €/m2 in 2011 for existing contracts and 6.6 €/m2 for new contracts. All eventual profit (i.e., if the original construction costs have fully been repaid) must be invested in additional limited-profit housing development. Tenants usually have to contribute equity capital (typically 500 €/m2) which is discounted by 1% each year. Residual equity capital at the time a tenant moves out is refunded. Equity capital contribution amounts to 0.2 €/m2 to 1 €/m2 on top of the monthly rent, depending on opportunity costs (Kunnert and Baumgartner 2012).

In total, 30% of residents rent apartments or houses from private owners. Of these buildings, 74% were constructed before 1945 and 26% afterward. The distinction is important, because for buildings built before 1945, rental caps apply if the contract was signed after 1994. The basic rent for capped rental housing in 2011 was 4.91 Euro/m2. Based on house facilities (e.g., garage, elevator) and local amenities (e.g., public transport, quietness, green infrastructure, education and health infrastructure), premiums can be added, such that the rent can increase up to 9.02 Euro/m2. Several exceptions exist when the cap does not apply (e.g., for apartments above 130m2 or buildings of historic interest which are expensive for the owner to maintain). If the property owner charges more than the respective cap, the tenant can file a suit against the owner to enforce the rental cap. Since there exist exceptions and many tenants are reluctant to sue their property owner, the average rent for apartments where the cap applies was 8.3 €/m2 for existing contracts and 8.6 €/m2 for new rents in 2011 (Kunnert and Baumgartner 2012), see Table 1.

For apartments with market-based rents (e.g., buildings built after 1945 with a contract signed after 1994), the average rent was 6.9 €/m2 for existing contracts and 10.3 €/m2 for new contracts. It seems surprising that for existing contracts the capped rent is higher than the market-based rent. This is explained by longer contract periods in market-based rental contracts (given increases in rents over time this lowers the average) and differences in the structure and location of buildings where rental caps apply (Kunnert and Baumgartner 2012). For new contracts, capped rents are below market rents which reflects the substantial increase in private rents. The Austrian tenancy law is relatively complex: For private contracts signed before 1994 (about 23% of private rental contracts), different rules apply. For details, see, for example, Kunnert und Baumgartner (2012). Thus, for some of the 22% of Viennese living in buildings built prior to 1945 specified in Table 1, different rental regulations apply. Finally, the percentage of house or apartment owners (and their families or flatmates) living in their own house or apartment is 18% as shown in Table 1.

Figure 2 shows the locations of municipality housing, limited-profit housing and capped rental housing for all 1364 block groups in Vienna. From this figure, we can see that the presence of all three types of housing are disbursed widely across the urban area of Vienna, providing significant variation in housing structure across different locations. The bottom right panel shows the residents per block group to put the importance of the block groups in context.

2.1 Data

Data for this analysis are mostly available at the level of block group (“Zählgebiet”). This is larger than block (“Baublock”), but more detailed than the census tract (“Zählbezirk”). There are 1364 block groups in Vienna. The main source of block group data is from the Austrian statistical office (Statistik Austria 2015). These include data on houses and residents. Spatial information as well as data on urban green infrastructure and metro stops are based on information from the City of Vienna publicly available under the “Open Government Data” initiative of the city.

For block groups, the construction date of buildings (grouped by before 1919, 1919 to 1944, 1945 to 1960 and then for each decade until 2000), the owner (municipality, limited-profit cooperative, private) and how many persons in each of these groups are registered as residents is available. This information is used to calculate the number of individuals living in apartments/houses they own, in private apartments/houses built before 1945 and after 1945, in municipality housing, in limited-profit housing and in other accommodations. For a distribution of the housing types, see Fig. 2.

Statistics Austria provides income statistics only on district levels in Vienna. To measure income at the block group level, we use employment by 22 NACE (Nomenclature statistique des activités économiques dans la communauté européenne) classifications of economic activities. For each of the 22 NACE categories, the average gross income of Viennese employees in 2011 is available by gender and employment type (roughly translated as trainee, blue-collar worker, white-collar worker, public official). The data also report the number of residents in each of the 176 income subgroups (NACE category by gender and employment type) for each block group (i.e., for each block group we know the NACE categories, employment types and gender of the residents). Combining the cross-table of NACE gross income with the cross-table of residents in each block group allows us to calculate the gross NACE income by gender. It is an approximation of the average income of the block group, as it only considers income of employees and the income within NACE categories varies substantially. To adjust for differences between districts, we calculate the difference between the district level mean income of Statistics Austria and the mean income we derived from NACE categories. This difference is then used to shift income in each block group. We call this income the “gross NACE income” (or simply “income” for readability) which is derived for each gender separately.Footnote 2

Table 2 shows that average gross NACE incomes differs substantially between block groups: for men, the first quantile is 27,608 €/year while the third quantile is 40, 274 €/year. For women, variation is less pronounced, where the first quantile is 21,232 €/year and the third quantile is 26,925 €/year.

The spatial distribution of NACE income of men and women can be seen in Fig. 3. Income of men is highest in the center and at the northeastern fringe close to the Vienna Woods. Income is lowest in the area surrounding the inner districts. The income of women follows a similar pattern, but absolute levels are substantially lower.

In our analysis, we focus on the impact of proximity to urban green space and metro stations as well as distance to the city center on block group average income. A block group is defined as being “green” (the dummy variable takes the value 1 if the block group is green), if the distance of the block group to a green area of at least 7.5 ha is less than 500 m. Green areas include parks, sport facilities and cemeteries as well as the green belt around Vienna (e.g., Vienna Woods, Danube wetland). Figure 1 shows that urban green is scattered throughout the city but larger areas are only available on the fringes. Using this definition of green block groups, 68% of the block groups are green.

How well a block group is connected by metro is measured by the percentage of the block group area falling within a 750 m radius of a metro station (the variable takes values between 0 and 100). Figure 1 shows that metro stations are very dense in the inner districts. Outer districts are well connected to the city center only if they happen to be close to a metro station. Using this definition, the average area covered by the 750 m radius around metro stations is 59% of block groups.

Distance to the city center is measured in kilometers between the centroid of a block group and St. Stephan’s Cathedral (which is located in the historic city center). As it is preferable to be located at shorter distance to the center, our distance measure is a disamenity rather than an amenity. This disamenity is not necessarily linear and consequently measured in concentric rings around St. Stephan’s at 1, 3 and 5 km: 72 block groups fall in the 0 to 1 km circle (which serves as reference group), 359 block groups fall in the 1 to 3 km donut, 411 in the 3 to 5 km donut and 522 in the area further than 5 km from St. Stephan’s.

To capture additional aspects of block groups we use a rich set of data. The law regulating capped rents requires the City of Vienna to regularly publish a map showing which block groups have land prices that are below average (City of Vienna 2010).Footnote 3 For 2010, the average land price across the whole city is estimated to be 253.50 Euro/m2. The way the law regulates how the average land price is calculated leads to a substantial underestimation of the average land price (Sandrini 2017). Even if this level is too low, it still is informative about relative availability of public goods between block groups. We use this information to construct a dummy variable which equals 1 if land prices are below average. This variable captures block group characteristics not otherwise controlled for which are related to (dis)amenities in the block group as reflected in land prices.Footnote 4 Approximately 25% of our block groups are classified as having below average land prices.

The built structure is captured by the size of apartments (grouped by below 45, 45–59,60–89, 90–130 and above 130 square meters), the number of apartments per km2, the number of street trees per km2, a dummy whether a pedestrian zone is within the block group, the share of area with railway tracks, the share of agricultural land and a typology of buildings (historic center, Cottage houses, single-family houses, Gründerzeit houses, new houses pre-1960, new houses post-1960, mixed commercial use where the historic center serves as reference group) as defined by the city of Vienna (Hauswirth and Gielge 2010). To capture non-built characteristics of block groups, we use the number of gambling establishments (called “Kleines Glückspiel” in German) per km2 and noise. The location of 925 gambling establishments, which have been shown to be associated with low-quality areas in other settings(Grumstrup and Nichols 2021), are obtained from DOSSIER (2014). Noise is measured using the “nighttime noise indicator” constructed as an indicator for sleep disturbance (for details see Appendix I of the “Environmental Noise Directive”) (EU 2002). We measure noise as the percentage of a block group above 60 dB (see Klaiber and Morawetz (2021) for a discussion of this measure). All data are for the year 2011 except for noise data which is only available for 2012.

Table 3 reports summary statistics for each of these variables. The first column shows summary statistics for nongreen block groups while the second column for green block groups. This division shows how the characteristics are distributed between green and nongreen block groups. The other public goods are not equally distributed between green and nongreen block groups: as expected nongreen block groups are closer to metro stations (82% are within a 500 m radius) and are closer to the city center (3.59 km on average). As sorting theory suggests, NACE income is slightly higher in green block groups for men and women (though, for these unconditional figures, not significantly). Municipality housing, limited-profit housing and capped rents for green and nongreen block groups account for between 9 and 36% of all housing. Average land prices in green block groups are more often below average (44%) as these are typically further from the city center than nongreen block groups (17%). With respect to apartment size there are no substantial differences between green and nongreen block groups. As expected the nongreen block groups have more traffic noise, less area with railway tracks, a higher density of gambling establishments, more pedestrian zones and less agricultural land. The standard deviation of apartments per km2, street trees per km2 and the number of residents is remarkably high, suggesting large heterogeneity in these variables.

Before analyzing the data, we identified several block groups which we exclude from the analysis. Observational units with less than 6 persons are blurred by the statistical office and we therefore drop 16 block groups (Statistik Austria 2015). We identified 190 block groups consisting mainly of group living arrangements (for youth, elderly, etc.). We drop these because they would be an additional subgroup of regulated rents. The NACE income for men was unavailable for 29 block groups and the NACE income for women was unavailable for 38 block groups because nobody was registered in these block groups (e.g., industrial areas or forest). In total, 229 (17%) of all potential block group observations were dropped.

3 Empirical model

In our empirical model, we explain mean income of a block group by amenities and housing policies. This reduced from equation describes the equilibrium outcome of the income sorting process. Similar reduced form equations based on related structural models have been used by Heilmann to estimate the effect of rail transit on income distribution in Dallas (Heilmann 2018), Chakrabarti and Roy for the effect of school finance on income distribution in Michigan (Chakrabarti and Roy 2015) and the effect of natural amenities and housing policies on income distribution in Dunedin, New Zealand (Thorsnes et al. 2015). In comparison with a Roback model (Roback 1982), in these (and our) models there is no difference in wage for different neighborhoods since the neighborhoods are geographically close.

To evaluate the impact of housing policy on income sorting, we focus on areas located in proximity to amenities (urban green space and metro stations) and distance to the city center. To estimate a treatment effects model, we exploit variation both in amenities of block groups and housing policies within each block group. The treatment effect we are primarily interested in is the impact of housing policies on income for block groups adjacent to urban green space, metro stations and on the influence of centrality. This model is given as

where \({\text{Income}}_{j}\) is NACE income for block group j, \({\text{Amenity}}_{j}\) a vector of indicators for block groups adjacent to urban green and metro stations and for centrality, \({\text{Policy}}_{j}\) is a vector of continuous measures for the percentage of residents having rental contracts subject to housing policies. The reference category is the percentage of market-based housing: rental contracts not subject to housing policies and owner-occupied houses. \({\varvec{X}}_{{\varvec{j}}}\) contains additional control variables at the block group level, \(j\). The regression is estimated separately for NACE income of men and women.

To examine the regression coefficients, our primary interest is in the interaction terms estimated as \(\alpha_{3}\). If this estimated coefficient is significant and negative, this means that NACE income is lower in block groups with amenities when those block groups have a higher percentage of residents covered by housing policies. In the case of positive amenities (urban green space and metro stations), we would expect \(\alpha_{3}\) to be negative if income sorting is dampened by the housing policy (i.e., more low-income persons live close to amenities). Said differently, the equilibrium income gradient induced by the amenity is not as steep as it would be without housing policy. In the case of a disamenity, like distance from center, we would expect \(\alpha_{3}\) to be positive (i.e., more high-income persons live more distant from the center). Again, the equilibrium income gradient induced by the disamenity is not as steep as it would be without housing policy.

We estimated a weighted OLS model as the mean values used as explanatory variables are based on different numbers of residents (as detailed, e.g., in Johnston and DiNardo (1997, p. 152))

where \(\hat{\beta }\) are all estimated coefficients stacked vertically above each other and Z are all explanatory variables attached horizontally next to each other. The weighting matrix \({\Omega }\) is diagonal with the standard error of the regression σ divided by number of residents of the respective block group in the diagonal. The explanatory variable y is either male or female mean gross NACE income. We report heteroskedastic robust weighted standard errors as Breusch–Pagan tests indicate heteroscedasticity in the error term.

Given the spatial structure of block groups, it is possible that characteristics of neighboring block groups have an influence on income distributions in the block group of interest. In the case of amenities, this would mean that amenities of neighboring block groups also matter. For example, if a neighboring block group is close to a large green area, the large green area may provide benefits to neighboring block groups (even if it is outside our 500 m cutoff threshold). In the case of housing policies, this would mean that regulated housing in neighboring block groups may also affect income in the block group in question. This would be the case if (large) accumulations of regulated housing generate externalities across space. To address the potential spatial correlations in amenities and housing policy we add spatially lagged explanatory variables and estimate what is known as spatial lag model (SLX) (see, for example, Halleck Vega and Elhorst, (2015) or Gibbons and Overman (2012)). Using notation from above, the SLX model is defined as y = Z γ + WZ θ + ϵ where W is a spatial weighting matrix. We use direct neighbors when constructing the spatial weight matrix (i.e., the borders must be connected at least at one point). In this case, γ coefficients are then called “direct effects,” the θ coefficients “indirect effects” and the sum of these two “total effects” (Golgher and Voss 2016). We again apply weights and estimate γ and θ as shown in Eq. (2).Footnote 5

In the model specifications discussed so far, we combine municipality, limited-profit housing and capped rents as “housing policy.” The coefficient \({\varvec{\alpha}}_{2}\) is thus a scalar as the “housing policy” is measured as percentage regulated housing with percentage market-based housing being the reference category. The coefficient \({\varvec{\alpha}}_{3}\) has five elements since the percentage regulated housing is multiplied with the variables for urban green, metros stations and the three dummies for distance to the city center. To differentiate between different types of housing policy, we use a second specification where we treat municipality, limited-profit housing and capped rents as different types of housing policies. The coefficient vector \({\varvec{\alpha}}_{2}\) thus has three elements (again omitting the percentage of market-based housing as a reference category) and \({\varvec{\alpha}}_{3}\) has 15 elements.

Interpretation of coefficients as causal effects (in the sense of influencing the equilibrium sorting outcome) requires the error term \(\epsilon_{j}\) to be uncorrelated with the explanatory variables. For example, if the percentage of regulated housing is high in areas with disamenities not accounted for in the regression model, this would prohibit a causal interpretation (i.e., \(\alpha_{2}\) for regulated housing would be more negative as compared to a causal effect). The three housing policies analyzed here (municipality housing, limited-profit housing and capped rents) are unlikely to be related to unobserved amenities after inclusion of control variables. First, municipality housing was primarily constructed between 1918 and 1933 and between 1945 and the 1970s. The city of Vienna developed municipality housing not primarily in the outskirts, but also in already developed areas—wherever it could buy land (Pirhofer and Stimmer 2007, p. 22). Importantly, (dis)amenities in the 1930s or 1960s are not necessarily (dis)amenities today (e.g., metro connections change how remote a block group is and traffic noise has made some inner city block groups relatively unattractive).

Second, from the 1980s on, the development of limited-profit housing by cooperatives replaced the development of municipality owned houses. The city designated areas for the development of limited-profit housing. Some of these areas are on the outskirts, but others are in central locations (e.g., in former industrial areas or railway stations). Since the city buys land decades in advance the city can provide high-amenity areas for limited-profit housing at prices making low construction costs feasible (a precondition for subsidies to limited-profit housing).

Third, whether rents are capped is principally determined by the date the building was constructed. High-amenity areas with construction prior to1945, and therefore subject to rental caps, are not necessarily high-amenity areas today. However, redevelopment and transformation to owner-occupied apartments in (today’s) high-amenity areas might lead to correlation with unobserved amenities if it is more likely that high-amenity areas are redeveloped or sold. In this setting, rents and income are potentially higher in non-regulated housing areas developed after 1945. This would mean the estimated effect of regulated housing is lower (less negative) compared to a situation where the cap was randomly assigned to buildings (e.g., if the share of capped rents reduces by 10% and the income increase by 15% due to redevelopment in high-amenity areas, the slope of the estimated coefficient is lower than the unbiased one). Our estimate for capped rents is thus a lower bound in settings where there exist unobserved amenities.

If the observed amenities are provided predominantly in areas with a high level of amenities not accounted for in the model (public goods as well as private goods such as the quality of houses), the coefficient \(\alpha_{1}\) (e.g., the coefficient of urban green) would be biased upwards (for disamenities like noise it would be the biased downwards). At least to some extent, the housing structure and quality of houses will be correlated with amenities as owners will invest more where they can charge higher rents. We control for differences in housing structure by including fixed effect for the size of apartments and fixed effects for housing typology. These spatial fixed effects capture unobservables that if left unaccounted for could bias our results. To further account for potential unobservable, we add a number of additional control variables including the dummy for land value below average, apartment density, traffic noise, the number of gambling establishments as well as land-use variables (agricultural land and rail tracks).Footnote 6 In Sect. 5, we use a discrete choice approach which allows inclusion of alternative (block group) specific constants to check the robustness of the sign of our income regression results.

While households—and not individuals—sort into block groups, we use the average income of individuals as dependent variable in the empirical model. This is due to data availability and could add additional noise to the data: If the correlation of income of men and women in the same household is low or even negative, then the total household income would reflect sorting better than the income of individuals. According to the literature, the correlation between net income of dual-earner couples in Austria is around 0.2. This is comparable to the USA and most European countries (Boertien and Bouchet-Valat 2022). This positive, but rather low correlation suggests higher standard errors of the estimated coefficients compared to using household income. In comparison with a situation with measurement errors in an independent variable, no systematic bias occurs in such a case (Wooldridge 2010).

4 Results

The first column of Table 4 shows the estimated coefficients explaining the average yearly gross NACE income of men. We find block groups adjacent to urban green space have, on average, 4522.48 €/year higher NACE income than those not adjacent to green. Thus, we confirm that urban green space induces a positive equilibrium income gradient as one moves toward urban green space. The coefficient for metro stations tells that for block groups being 100% within the 750 m radius around a metro station the income is 3803 €/year higher than block groups not within 750 m.

As expected, the coefficients for distance to the city center are negative: The income of men living 1 to 3 km from the city center has on average 19,222 €/year lower income than those living within one kilometer of St. Stephen’s. Those living 3 to 5 km away have on average 15,387 €/year less and those more than 5 km away 16,748 €/year less. Thus, there is a steep and statistically significant income gradient between the city center and surrounding areas but little difference as one moves further out (these coefficients are statistically not significantly different). This is noteworthy, because according to the unconditional spatial income distribution in Fig. 3, one would suggest that distance matters beyond the city center. This difference between the conditional effects of distance (i.e., the estimated coefficients) and the unconditional spatial income distribution (i.e., what we see in Fig. 3) indicates that our control variables indeed control for differences in structure. Control variables for land prices below average, apartment size, gambling establishments and urban typology are significant and have the expected signs.

Turning to our housing policy variables, the coefficient for regulated housing (i.e., pooled municipality, limited-profit and capped rent) is − 161.06 €/year. This coefficient implies that if there are 10% points more residents covered by housing policies in a block group, the average NACE income of men in that block group would be 1610.60 €/year lower than if there were no changes in housing policy coverage. The amenity interaction terms capture the degree to which the effect of amenities on average income is moderated by housing policies. For block groups adjacent to urban green, 10% points more residents covered by housing policies reduces the income gradient associated with urban green by 581.20 €/year (i.e., the income gradient is flatter with housing policies). Given urban green is associated with an increase of 4522 €/year, a 10% points increase in housing policies reduces the income gradient by 12.8% (see Table 7 for an overview of relative reduction of income gradients for different housing polices). For block groups 100% within the 750 m radius of a metro station, 10% points more residents covered by housing policies reduces the equilibrium income gradient of proximity to metro stations by 550.00 €/year, or 14.3%. The income gradient toward the city center, for example 2 km from the city center, is reduced by 1890.20 €/year if there are 10% points more residents covered by housing policies, or 9.8%. For the other two distance ring dummies we find a reduction of income the income gradient by 8.8% and 10.1%. Overall, the relative moderation of income gradients associated with housing policies is remarkably stable across amenities.

Repeating the above regression using NACE income of women instead of men, we find coefficients to have the same signs (see, second column of Table 4). Given female income is lower, the coefficients are lower for all variables as well. The relative reduction of sorting due to an increase of 10% points more residents living in apartments subject to a housing policy is 14.1% for urban green space, 15.1% for metro and 10.8%, 8.8% and 10.2% for the distance to the city center dummies (see Table 7).

We next turn our attention to the SLX model with spatially lagged explanatory variables, see Table 5. The results are qualitatively similar to those reported above (the results for women follow the same patterns and are shown in the Appendix Table 9). The first column shows the direct effects (i.e., the effect of the variable of the own block group), the second column shows the indirect effect (i.e., the effect of the variable in the neighboring block groups) and the third column shows the total effect (i.e., the sum of both effects). As expected, estimated coefficients of the direct effect all have a lower magnitude compared to the OLS model. Instead, indirect effects pick up amenities in neighborhoods (which are mostly correlated between neighbors) and the total effect of amenities is always higher than in the OLS model. The OLS model thus underestimates the effect of amenities. Interestingly, the coefficient for regulated housing in neighboring block group is significantly larger in magnitude (− 500 €/year) compared to the direct effect (− 94 €/year). This suggests large negative externalities if spatial correlation of regulated housing is high. Interaction terms again confirm that income gradients are moderated by regulated housing. The relative reduction of income gradients due to a 10% points increase of residents living under housing policies is again of similar magnitude: 12.9% for urban green, 14.9% for metro and 18.9%, 20.8% and 21.1% for the three distance to the center dummies. These results carry over to the income for women (see Table 9) and when considering spatial autocorrelation of errors (see Table 10 for men and Table 11 for women).

To distinguish between different housing policies we divide them into three categories: municipality, limited-profit and capped rents. Table 6 shows the SLX model explaining the yearly NACE income of men (for OLS results without spatially lagged explanatory variables see Table 12 and for results for women see Table 13). The (total) effects of amenities are comparable in magnitude to the model with combined housing policies. Municipality housing again has a total coefficient of − 846.97 €/year, largely driven by the indirect effects of − 773.32 €/year (i.e., income is particularly low in clusters of municipality housing). Limited-profit housing has in total a positive, but insignificant coefficient with a very large standard error. While it is interesting that the direct effect is negative and the indirect one positive, both are insignificant. This reflects the ambiguity of limited-profit housing due to policy design. On the one hand tenants are required to contribute equity capital when moving in which suggests higher-income tenants, while on the other hand rents are low and the city can allocate low-income households to subsidized limited-profit housing. For capped rents, the coefficient for the total effect is − 391.14 €/year. The large indirect effect (− 289.61 €/year) likely reflects the strong clustering of capped rents.

Interaction terms have the expected signs. Similar to the main effects above, the terms associated with limited-profit housing are insignificant. The relative reduction of income gradients from 10% points more residents living in municipality housing is 15.4% for urban green space, 21% for metro and between 25.3% and 29.8% for the distance to the city center. The relative reduction of income gradients from 10% points more residents living in capped rents housing is 14.6% for urban green space, 26.1% for metro and between 14.1% and 19.8% for the distance to the city center (see Table 7). The control variables again have the expected signs. The results for women follow the same patterns (see Table 13).

5 Equilibrium sorting and preference heterogeneity

The estimated income equations discussed so far represent a reduced form model of an equilibrium resulting from an inhabitants’ choice of a block group. An alternative approach to examine the location choice decision directly is to explicitly model this choice in an equilibrium sorting discrete choice framework (Bayer et al. 2004; Bayer and Timmins 2007; Klaiber and Kuminoff 2014; Kuminoff et al. 2013). The linear in income random utility sorting model assumes that person i living in a block group j maximizes Utility Uij by choosing a location that provides the optimal bundle of public goods given the existing amenities, housing policies, income, market house prices (or market-based rents) and unobserved attributes of the block group. This utility can be expressed as

where \(\alpha_{k}\), \(\alpha_{g}\) and \(\xi_{j}\) are parameters to be estimated and \(\epsilon_{ij}\) is an idiosyncratic error term. \(X_{j}\) is a vector of location specific amenities including housing policy prevalence, and \(I_{i} X_{j}\) are interactions between individual incomes and amenities. An individual is assumed to maximize utility by choosing alternative j if and only if

Two features of this utility specification deserve additional discussion. First, as the utility function is assumed linear in income, as is the case in all the existing random utility sorting literature, it is not possible to identify individual preference parameters associated with individual demographic attributes such as income as they do not vary across alternative \(j\) and drop out of the model (Train 2009). However, interacting these demographics with amenities, \(X_{j}\), provides additional variation which enables identification of preference heterogeneity associated with these interaction terms. A second feature of the model is the inclusion of an alternative specific unobservable, \(\xi_{j}\), following Berry et al. (1995). Inclusion of these terms absorbs any potential confounding elements of choice alternative j allowing clean identification of the interaction terms \(I_{i} X_{j}\). As Berry et al. (1995) show, this requires estimation of the utility model in two stages.

The two stage estimation of the utility specification is given as

where \(\theta_{j}\) is included as an alternative specific constant and absorbs all observable alternative varying attributes \(X_{j}\) as well as unobserved attributes \(\xi_{j}\). The linear second stage then decomposes these alternative specific constants to recover estimates of \(\alpha_{k }\) where an intercept is included to account for the required normalization of one alternative specific constant during estimation. This decomposition ensures that the first stage estimates of \(\alpha_{g}\) are free of unobservable alternative specific contaminants, whereas the second stage estimation still must confront this issue if \(\xi_{j}\) is correlated with \(X_{j}\).

Forgoing second stage estimation precludes recovery of elasticity and marginal willingness to pay measures. However, we can test a key assumption of our reduced form models form the first stage estimation, namely, whether households sort based on income across the public goods in our model.Footnote 7 In our application, the key variables we are interested in are the interaction terms \(I_{i} X_{j}\) and the sign on the associated marginal utility coefficient, \(\alpha_{g}\). These marginal utility parameters identify whether households have heterogeneous preferences based on income for housing policies and other public goods and serve as an empirical test of the amenity-based sorting underlying our reduced form models.

Our data enable us to simulate individual incomes for 304,443 men. These residents would then maximize utility by sorting over 1135 block groups to select a location. Running a logit or probit model with such data, though, is computationally challenging as the choice set consists of all 1135 potential residential locations. To estimate a model with such a large choice set, we employ a computational trick in the logit specification called “Berry contraction mapping” (Berry 1994; Klaiber and von Haefen 2019) using a self-written MATLAB code to estimate an alternative specific constant for each location alongside income interaction terms in a multinomial logit model.

Table 8 shows the results of the first stage of the equilibrium sorting discrete choice models. The coefficients can be interpreted as marginal utility. The base model (column 1) does not include interactions with amenities. The significant negative sign on the interaction between income and regulated housing shows that households with higher income are less likely to sort into block groups with regulated housing. The extended model (column 2) has interactions with amenities included and a higher goodness of fit as shown by the likelihood ratio (LR) test. The signs on the income interaction terms are significant and match those from our reduced form models. Preference heterogeneity is significant across these interaction terms, for example, the marginal utility of locating in block groups with urban green space increases for higher-income residents. We again find that the marginal utility associated with locations containing regulated housing decreases for higher-income residents. To interpret the amenity and regulation interactions with income, we see, as an example, that the marginal utility for locations with urban green space is lower for higher-income residents if those locations also contain regulated housing. Overall, these income interaction terms provide strong evidence of income and amenity-based sorting and are consistent with the reduced form equilibrium income analysis presented previously.

6 Conclusion

Eliciting how urban green space, metro stations and centrality influence the average NACE income in Viennese block groups, we find statistically significant effects with expected signs: for men this effect is 5569 €/year for proximity to urban green, 7111 €/year for proximity to metro stations and a difference of 27,204 to 36,742 €/year across distance rings from the city center. These equilibrium income gradients represent a strong confirmation of sorting theory that implies income-based sorting over amenities. Additionally, our outcome variable is NACE income (which is an industry average of wage) and likely does not account for the full extent of heterogeneity of income across block groups. Thus, finding a significant effect at all is evidence for pronounced income sorting.

The second important result that emerges from this research is that housing policies in Vienna reduce income gradients. Across all three analyzed policies (municipality housing, limited-profit housing and apartments subject to a rental cap), a block group with 10% points more residents covered by the policies has a 5940 €/year lower average income with respect to income of men and 2340 €/year with respect to income of women. This difference is substantial and represents an equilibrium income gradient reduction of 17% of average yearly income for men and 10% of average yearly income for women.

A third contribution of this paper is measuring the interaction between amenities and housing market regulation. We find that regulating housing moderates income gradients associated with urban green space, metro stations and centrality. For the NACE income of men, we find that 10% points more residents covered by housing policies in proximity to urban green space is associated with a 716 €/year lower-income gradient (the income gradient is estimated to be 5569 €/year). In relative terms, this is a 13% (= 716/5569) reduction. For income of women, this relative reduction of the income gradient is also estimated to be 13%. For metro stations, we find a 10% points increase in residents covered by housing policies reduces the income gradient by 15% (for men and women). For distance to the city center, a 10% points increase in housing policies reduces the income gradient to the inner city between 19 and 22%. We are thus able to link income composition of a neighborhood in proximity to amenities to housing policies.

Municipality housing, limited-profit housing and capped rents are fundamentally different housing policies, and we find that their effects on sorting are indeed different. Municipality housing in Vienna has a high maximum income requirement with approximately 75% of Viennese eligible to live in municipality housing. As a result, it is surprising the income effect is so large (for a 10% points increase in municipality housing average income in the block group is reduced by 8470 €) given the substantially lower rents per m2 associated with municipal housing. Helping to explain this effect, the results from the spatial regression suggest that municipality housing is associated with negative externalities, which might explain why higher-income groups are averse to living in municipality housing despite the substantial rental savings. Turning to capped rents, the policy in Vienna is such that rental caps are block group specific (rents are higher if public goods are in the neighborhood and adjusted to the quality of the apartment) and apartment specific (the cap is lower for lower standard apartments). In addition, the cap must be enforced by legal action by tenants and there is no means testing (everybody is eligible). Thus, it is not surprising the income effect is lower than for municipality housing (for a 10% points increase in capped rents average income in the block group is reduced by 3911 €). As we discuss above, the estimated effect of capped rents is potentially a lower bound estimate. Examining limited-profit cooperatives, a key policy design element is that inhabitants need to contribute capital equity. This likely restricts the pool of potential residents to ones with greater wealth and income. We do not find significant effects of limited-profit housing on the average income of a block group. As we can see from this discussion, the empirical results we obtain appear rooted in policy design choices highlighting the important role of policy design in influencing income sorting outcomes.

Theoretical models of the spatial income distribution of cities are driven by the influence of commuting costs and amenities (Brueckner et al. 1999; Gaigné et al. 2022; Wu 2006). We find income to be higher close to amenities (e.g., green areas or metro). We also find income in the historic city center to be substantially higher than in the districts further out. This most likely is because of amenities in the city center and because commuting costs are lower in these areas. Moving further from the city center, we do not find a pronounced effect of distance. This may have to do with the rather limited total spread of Vienna as well as the well-developed public transport system.

Worldwide, cities are in the process of making significant investments to reduce the impacts of climate change and reduce CO2 emissions. Many of these investments have local impacts (e.g., urban green spaces, water access, public transport, heating systems) affecting income sorting. The international literature on income sorting provides limited information about how different housing policies affect income sorting. The literature focused on housing policies, on the other hand, provides only limited information on the role amenities play (we list some exceptions in the introduction). Our findings are specific to the Vienna context but should invite decision makers and researchers to take a closer look at the interplay of housing policies and income sorting. Recognizing the interconnectivities between housing policy and income sorting offers a chance for decision makers to tackle issues of climate change jointly with those of income sorting and environmental gentrification.

While there are many well-known negative impacts associated with housing policies such as those in Vienna (see, e.g., Arnott (1995) or Diamond et al (2019)), the potential reductions in income gradients reveals a trade-off: from a utilitarian welfare economic perspective the dampening of sorting can be interpreted as spatial misallocation (Chapelle et al. 2019). However, given that property owners and (absentee) landlords are typically from higher-income groups than renters, capitalization of publicly financed investments in local public goods have important distributional implications (Hilber 2017). For the housing policies analyzed in this paper, there exist utilitarian welfare inefficiencies. However, these inefficiencies reduce wealth transfers toward property owners due to capitalization. These findings provide new insights into the potential joint impacts of amenity investment and housing market policy on local community composition and well-being.

Notes

A block group is an administrative unit and consists of several blocks of buildings. Vienna consists of 1364 block groups.

For a detailed description see also Klaiber and Morawetz (2021)

Additionally, the block groups having above average land prices are categorized into six groups based on public transport-, education-, health-, shopping-, urban green-infrastructure, land prices and expert knowledge from the City of Vienna. Since (1) the categorization is available only for block groups above average, (2) at least health- and shopping- infrastructure is influenced by residents’ income (and therefore endogenous) and 3) the exact procedure of categorization is unknown, we disregard this categorization in the econometric models.

As expected, the dummy is correlated with other amenities: green area − 0.31, metro 0.22 and distance from city center 1 to 3 km 0.06, distance 3 to 5 km 0.43, distance 5 km and above − 0.39. These correlations are statistically significant for the 1135 block groups analyzed. Multicollinearity increases standard errors, but does not bias results (Wooldridge 2010).

Since the errors of the SLX model can be spatially autocorrelated, we also estimate the Spatial Durbin Error Model (SDEM) where \(y = Z \gamma + WZ \theta + u\) with \(u = \lambda Wu + \epsilon\) and report it in the appendix.

Given the block group nature of our data, the effect of housing policy on income sorting is not an exact measure: block groups differ in size, it is unknown where in the block group the houses subject to the policy are located and the effect of amenities and disamenities may go beyond the border of the block group.

Estimation of the second stage is further hampered by the lack of micro-level housing rent information which would be required if one were interested in recovering marginal willingness to pay measures.

References

Abbott JK, Allen Klaiber H (2013) The value of water as an urban club good: a matching approach to community-provided lakes. J Environ Econ Manag 65:208–224. https://doi.org/10.1016/j.jeem.2012.09.007

Abbott JK, Klaiber HA (2010) Is all space created equal? Uncovering the relationship between competing land uses in subdivisions. Ecol Econ Spec Sect Ecol Distrib Conflicts 70:296–307. https://doi.org/10.1016/j.ecolecon.2010.09.001

Ahlfeldt GM, Maennig W (2010) Substitutability and complementarity of urban amenities: external effects of built heritage in Berlin. Real Estate Econ 38:285–323. https://doi.org/10.1111/j.1540-6229.2010.00268.x

Alonso W (1964) Location and land use: toward a general theory of land rent. Harvard University Press, Cambridge (Mass.)

Anderson ST, West SE (2006) Open space, residential property values, and spatial context. Reg Sci Urban Econ 36:773–789. https://doi.org/10.1016/j.regsciurbeco.2006.03.007

Arnott R (1995) Time for revisionism on rent control? J Econ Perspect 9:99–120. https://doi.org/10.1257/jep.9.1.99

Statistik Austria (2015) Standard-Dokumentation Metainformation (Definitionen, Erläuterungen, Methoden, Qualität) zur Registerzählung 2011. Austria, Vienna

Banzhaf S, Ma L, Timmins C (2019) Environmental justice: the economics of race, place, and pollution. J Econ Perspect 33:185–208. https://doi.org/10.1257/jep.33.1.185

Bayer P, McMillan R, Rueben K (2004) An equilibrium model of sorting in an urban housing market. National Bureau of Economic Research Working Paper 10865

Bayer P, Timmins C (2007) Estimating equilibrium models of sorting across locations. Econ J 117:353–374

Berry S (1994) Estimating discrete-choice models of product differentiation. RAND J Econ 25:242–262

Berry S, Levinsohn J, Pakes A (1995) Automobile prices in market equilibrium. Econometrica 63:841–890. https://doi.org/10.2307/2171802

Boertien D, Bouchet-Valat M (2022) Are increasing earnings associations between partners of concern for inequality? A comparative study of 21 countries. Soc Forces. https://doi.org/10.1093/sf/soab158

Borg I (2019) Universalism lost? The magnitude and spatial pattern of residualisation in the public housing sector in Sweden 1993–2012. J Hous Built Environ 34:405–424. https://doi.org/10.1007/s10901-018-09638-8

Bowes DR, Ihlanfeldt KR (2001) Identifying the impacts of rail transit stations on residential property values. J Urban Econ 50:1–25. https://doi.org/10.1006/juec.2001.2214

Brueckner JK, Joo M-S (1991) Voting with capitalization. Reg Sci Urban Econ Spec Issue Theor Issues Local Public Econ 21:453–467. https://doi.org/10.1016/0166-0462(91)90067-W

Brueckner JK, Rosenthal SS (2009) Gentrification and neighborhood housing cycles: will America’s future downtowns be rich? Rev Econ Stat 91:725–743. https://doi.org/10.1162/rest.91.4.725

Brueckner JK, Thisse J-F, Zenou Y (1999) Why is central Paris rich and downtown Detroit poor?: An amenity-based theory. Eur Econ Rev 43:91–107. https://doi.org/10.1016/S0014-2921(98)00019-1

Brunner E, Sonstelie J (2003) Homeowners, property values, and the political economy of the school voucher. J Urban Econ 54:239–257. https://doi.org/10.1016/S0094-1190(03)00063-9

Brunner E, Sonstelie J, Thayer M (2001) Capitalization and the voucher: an analysis of precinct returns from California’s proposition 174. J Urban Econ 50:517–536. https://doi.org/10.1006/juec.2001.2232

Chakrabarti R, Roy J (2015) Housing markets and residential segregation: impacts of the Michigan school finance reform on inter- and intra-district sorting. J Public Econ 122:110–132. https://doi.org/10.1016/j.jpubeco.2014.08.007

Chapelle G, Wasmer E, Bono P-H (2019) Spatial misallocation and rent controls. AEA Papers Proc 109:389–392. https://doi.org/10.1257/pandp.20191024

Cheshire PC, Hilber CAL (2018). Housing in Europe: a different continent—a continent of differences. J Hous Econ Hous Eur 42:1–3. https://doi.org/10.1016/j.jhe.2018.11.001

Cheshire PC, Sheppard S (1995) On the price of land and the value of amenities. Economica 62:247–267. https://doi.org/10.2307/2554906

Choumert J (2010) An empirical investigation of public choices for green spaces. Land Use Policy 27:1123–1131. https://doi.org/10.1016/j.landusepol.2010.03.001

City of Vienna (2010) Lagezuschläge in Wien ab 1. April 2010

Cuberes D, Roberts J, Sechel C (2019) Household location in English cities. Reg Sci Urban Econ 75:120–135. https://doi.org/10.1016/j.regsciurbeco.2019.01.012

Czeike F (1985) Geschichte der Stadt Wien. Jugend und Volk, Wien, München

Debrezion G, Pels E, Rietveld P (2007) The impact of railway stations on residential and commercial property value: a meta-analysis. J Real Estate Finan Econ 35:161–180. https://doi.org/10.1007/s11146-007-9032-z

Diamond DB (1980) Income and residential location: muth revisited. Urban Studies 17:1–12

Diamond R, McQuade T (2018) Who wants affordable housing in their backyard? An equilibrium analysis of low-income property development. J Polit Econ 127:1063–1117. https://doi.org/10.1086/701354

Diamond R, McQuade T, Qian F (2019) The effects of rent control expansion on tenants, landlords, and inequality: evidence from San Francisco. Am Econ Rev 109:3365–3394. https://doi.org/10.1257/aer.20181289

DOSSIER (2014) Karte der Glücksspielautomaten. Wo in Wien (noch) Glücksspielautomaten stehen und wer diese betreibt. DOSSIER

Ellen IG (2020) What do we know about housing choice vouchers? Regional Science and Urban Economics. Spec Issue Hous Afford 80:103380. https://doi.org/10.1016/j.regsciurbeco.2018.07.003

Ellickson B (1971) Jurisdictional fragmentation and residential choice. Am Econ Rev 61:334–339

Engemann K, Pedersen CB, Arge L, Tsirogiannis C, Mortensen PB, Svenning J-C (2019) Residential green space in childhood is associated with lower risk of psychiatric disorders from adolescence into adulthood. PNAS 116:5188–5193. https://doi.org/10.1073/pnas.1807504116

Epple D, Sieg H (1999) Estimating equilibrium models of local jurisdictions. J Polit Econ 107:645–681. https://doi.org/10.1086/250074

Eriksen MD, Ross A (2013) The impact of housing vouchers on mobility and neighborhood attributes. Real Estate Econ 41:255–277. https://doi.org/10.1111/j.1540-6229.2012.00342.x

EU (2002) Directive 2002/49/EC of the European parliament and of the council of 25 June 2002 relating to the assessment and management of environmental noise (OJ L 129, 18.7.2002, pp. 12–25)

Feins JD, Patterson R (2005) Geographic mobility in the housing choice voucher program: a study of families entering the program, 1995–2002. Cityscape 8:21–47

Fessler P, Rehm M, Tockner L (2016) The impact of housing non-cash income on the household income distribution in Austria. Urban Studies 53:2849–2866. https://doi.org/10.1177/0042098015596116

Finney MM, Goetzke F, Yoon MJ (2011) Income sorting and the demand for clean air: evidence from southern California. Land Econ 87:19–27. https://doi.org/10.3368/le.87.1.19

Fujita M, Ogawa H (1982) Multiple equilibria and structural transition of non-monocentric urban configurations. Reg Sci Urban Econ 12:161–196. https://doi.org/10.1016/0166-0462(82)90031-X

Gaigné C, Koster HRA, Moizeau F, Thisse J-F (2022) Who lives where in the city? Amenities, commuting and income sorting. J Urban Econ 128:103394. https://doi.org/10.1016/j.jue.2021.103394

Gibbons S, Overman HG (2012) Mostly pointless spatial econometrics? J Reg Sci 52:172–191. https://doi.org/10.1111/j.1467-9787.2012.00760.x

Giffinger R (1998) Segregation in Vienna: Impacts of market barriers and rent regulations. Urban Studies; London 35, 1791–1812. https://doi.org/10.1080/0042098984150

Glaeser EL, Kolko J, Saiz A (2001) Consumer city. J Econ Geogr 1:27

Glaeser EL, Kahn ME, Rappaport J (2008) Why do the poor live in cities? The role of public transportation. J Urban Econ 63:1–24. https://doi.org/10.1016/j.jue.2006.12.004

Golgher AB, Voss PR (2016) How to interpret the coefficients of spatial models: spillovers, direct and indirect effects. Spat Demogr 4:175–205. https://doi.org/10.1007/s40980-015-0016-y

Grumstrup E, Nichols MW (2021) Is video gambling terminal placement and spending in Illinois correlated with neighborhood characteristics? Ann Reg Sci. https://doi.org/10.1007/s00168-021-01048-z

Halleck Vega S, Elhorst JP (2015) The SLX model. J Reg Sci 55:339–363. https://doi.org/10.1111/jors.12188

Hauswirth R, Gielge J (2010) Neudefinition der Gebeitstypen. Beträge zur Stadtenwicklung 23:1–4

Heilmann K (2018) Transit access and neighborhood segregation. Evidence from the Dallas light rail system. Reg Sci Urban Econ 73:237–250. https://doi.org/10.1016/j.regsciurbeco.2018.10.007

Herath S, Choumert J, Maier G (2015) The value of the greenbelt in Vienna: a spatial hedonic analysis. Ann Reg Sci 54:349–374. https://doi.org/10.1007/s00168-015-0657-1

Hess DB, Almeida TM (2007) Impact of proximity to light rail rapid transit on station-area property values in Buffalo, New York. Urban Stud 44:1041–1068. https://doi.org/10.1080/00420980701256005

Hilber CAL (2017) The economic implications of house price capitalization: a synthesis. Real Estate Econ 45:301–339. https://doi.org/10.1111/1540-6229.12129

Hilber CAL, Mayer C (2009) Why do households without children support local public schools? Linking house price capitalization to school spending. J Urban Econ 65:74–90. https://doi.org/10.1016/j.jue.2008.09.001

Hobden DW, Laughton GE, Morgan KE (2004) Green space borders—a tangible benefit? Evidence from four neighbourhoods in Surrey, British Columbia, 1980–2001. Land Use Policy 21:129–138. https://doi.org/10.1016/j.landusepol.2003.10.002

Ihlanfeldt K, Mayock T (2019) Affordable housing and the socioeconomic integration of elementary schools. J Real Estate Finan Econ 58:567–595. https://doi.org/10.1007/s11146-018-9665-0

Irwin EG (2002) the effects of open space on residential property values. Land Econ 78:465–480. https://doi.org/10.3368/le.78.4.465

Jim CY, Chen WY (2006) Impacts of urban environmental elements on residential housing prices in Guangzhou (China). Landsc Urban Plan 78:422–434. https://doi.org/10.1016/j.landurbplan.2005.12.003

Johnston J, DiNardo JE (1997) Econometric methods, fourth edition-internation editions, 1997th edn. McGraw-Hill, New York

Kadi J, Musterd S (2015) Housing for the poor in a neo-liberalising just city: still affordable, but increasingly inaccessible. Tijdschr Econ Soc Geogr 106:246–262. https://doi.org/10.1111/tesg.12101

Kahn ME (2007) Gentrification trends in new transit-oriented communities: evidence from 14 Cities that expanded and built rail transit systems. Real Estate Econ 35:155–182. https://doi.org/10.1111/j.1540-6229.2007.00186.x

Klaiber HA, Morawetz UB (2021) The welfare impacts of large urban noise reductions: implications from household sorting in Vienna. Environ Resour Econ 78:121–146. https://doi.org/10.1007/s10640-020-00527-9

Klaiber HA, Phaneuf DJ (2010) Valuing open space in a residential sorting model of the Twin Cities. J Environ Econ Manag 60:57–77. https://doi.org/10.1016/j.jeem.2010.05.002

Klaiber HA, von Haefen RH (2019) Do random coefficients and alternative specific constants improve policy analysis? An empirical investigation of model fit and prediction. Environ Resour Econ 73:75–91. https://doi.org/10.1007/s10640-018-0250-z

Klaiber HA, Abbott JK, Smith VK (2017) Some like it (less) hot: extracting trade-off measures for physically coupled amenities. J Assoc Environ Resour Econ 4:1053–1079. https://doi.org/10.1086/692842

Klaiber HA, Kuminoff NV (2014) Equilibrium sorting models of land use and residential choice. In: Duke JM, Wu J (eds) The Oxford handbook of land economics. https://doi.org/10.1093/oxfordhb/9780199763740.013.011

Kolko J (2007) The determinants of gentrification (SSRN scholarly paper no. ID 985714). Social Science Research Network, Rochester, NY

Koster HRA, van Ommeren JN, Rietveld P (2016) Historic amenities, income and sorting of households. J Econ Geogr 16:203–236. https://doi.org/10.1093/jeg/lbu047

Krol R, Svorny S (2005) The effect of rent control on commute times. J Urban Econ 58:421–436. https://doi.org/10.1016/j.jue.2005.03.002

Kuminoff NV, Smith VK, Timmins C (2013) The new economics of equilibrium sorting and policy evaluation using housing markets. J Econ Liter 51:1007–1062. https://doi.org/10.1257/jel.51.4.1007

Kunnert A, Baumgartner J (2012) Instrumente und Wirkung der österreichischen Wohnungspolitik. Austrian Institute of Economic Research (WIFO), Vienna

Laakso S (1992) Public transport investment and residential property values in helsinki. Scand Hous Plann Res 9:217–229. https://doi.org/10.1080/02815739208730308

Lazrak F, Nijkamp P, Rietveld P, Rouwendal J (2014) The market value of cultural heritage in urban areas: an application of spatial hedonic pricing. J Geogr Syst 16:89–114. https://doi.org/10.1007/s10109-013-0188-1

LeRoy SF, Sonstelie J (1983) Paradise lost and regained: transportation innovation, income, and residential location. J Urban Econ 13:67–89. https://doi.org/10.1016/0094-1190(83)90046-3

Lucas RE, Rossi-Hansberg E (2002) On the internal structure of cities. Econometrica 70:1445–1476. https://doi.org/10.1111/1468-0262.00338

Ludwig M (2017) Das Wiener Modell—der soziale Wohnungsbau in Wien. In: Bund Deutscher Baumeister, Architekten und Ingenieure e.v. (ed) Qualitätvoll Und Preiswert Wohnen. BDB Jahrbuch 2017 Mit Sachverständigenverzeichnis. Berlin, pp 22–35

Mense A, Michelsen C, Kholodilin KA (2019) The effects of second-generation rent control on land values. AEA Papers Proc 109:385–388. https://doi.org/10.1257/pandp.20191023

Mohammad SI, Graham DJ, Melo PC, Anderson RJ (2013) A meta-analysis of the impact of rail projects on land and property values. Transp Res Part A Policy Pract 50:158–170. https://doi.org/10.1016/j.tra.2013.01.013

Morawetz UB, Koemle DBA (2017) Contingent valuation of measures against urban heat: limitations of a frequently used method. J Urban Plan Dev 143:04017005. https://doi.org/10.1061/(ASCE)UP.1943-5444.0000384

Munch JR, Svarer M (2002) Rent control and tenancy duration. J Urban Econ 52:542–560. https://doi.org/10.1016/S0094-1190(02)00502-8

Muth RF (1969) Cities and housing. University of Chicago Press

Netusil NR, Chattopadhyay S, Kovacs KF (2010) Estimating the demand for tree canopy: a second-stage hedonic price analysis in Portland, Oregon. Land Econ 86:281–293. https://doi.org/10.3368/le.86.2.281

Nowak DJ, Crane DE, Stevens JC (2006) Air pollution removal by urban trees and shrubs in the United States. Urban for Urban Green 4:115–123. https://doi.org/10.1016/j.ufug.2006.01.007

Pirhofer G, Stimmer K (2007) Pläne für Wien—Theorie und Praxis der Wiener Stadtplanung 1945 bis 2005

Roback J (1982) Wages, rents, and the quality of life. J Polit Econ 90:1257–1278. https://doi.org/10.1086/261120

Sandrini H (2017) Die Bedeutung des Grundkostenanteils der Richtwertwohnung für die Ermittlung des Lagezuschlags. Immolex 7–8:197–228

Schuetz J, Larrimore J, Merry EA, Robles BJ, Tranfaglia A, Gonzalez A (2018) Are central cities poor and non-white? J Hous Econ Race City 40:83–94. https://doi.org/10.1016/j.jhe.2017.11.001