Abstract

This paper stems from the observation that there are two worldwide trends, pension reform and population ageing, and asks whether the two may be related. Exploring the cases of pension reform in different countries, we find that, although they are very different, the cases share a common characteristic: they shift risks away from workers towards those who are retired. Furthermore, population ageing, by increasing the weight of the elderly relative to working generations, raises the price of intergenerational risk sharing. Combining these findings, we argue and show formally that pension reform can be seen as a welfare-best response to population ageing.

Similar content being viewed by others

Notes

Countries experiencing large capital market volatility are often found to have large unfunded plans (de Menil et al. 2016; Perotti and Schwienbacher 2009). Large public plans may also be the result of the demographic weight of elderly (Browning 1975; Cooley and Soares 1999; Galasso 2006). Historical and cultural factors play a role as well.

The lower coverage ratio is among other things the result of an increase in the statutory and as a consequence also effective retirement age.

References

Ang A, Maddaloni A (2005) Do demographic changes affect risk premiums? Evidence from international data. J Bus 78:341–380

Auerbach AJ, Lee R (2011) Welfare and generational equity in sustainable unfunded pension systems. J Public Econ 95:16–27

Baily MR, Kirkegaard J (2009) US pension reform—lessons from other countries. Peterson Institute for International Economics, Washington DC

Ball L, Mankiw NG (2007) Intergenerational risk sharing in the spirit of Arrow, Debreu, and Rawls, with applications to social security design. J Polit Econ 115:523–547

Barr N, Diamond P (2008) Reforming pensions: principles and policy choices. Oxford University Press, New York and Oxford

Bartelsman E (2013) Passend beleid in tijden van welvaart en overvloed. TPEdigitaal 7:7–20

Berstein S (2010) The Chilean pension system. Superintendence of Pensions, Chile

Blake D (2016) We need a national narrative: building a consensus around retirement income – The Report of the Independent Review of Retirement, The Pensions Institute

Bohn H (2009) Intergenerational risk sharing and fiscal policy. J Monet Econ 56:805–816

Bonenkamp J, Bovenberg L, van Ewijk C, Westerhout E (2010) Report on the effect of the credit crisis on the solvency of Dutch pension funds and its economic consequences, Netspar Discussion Paper 07/2010-035

Bonenkamp J, Meijdam L, Ponds E, Westerhout E (2014) Reinventing intergenerational risk sharing, Netspar Panel Paper, nr. 40

Brooks R (2002) Asset market effects of the baby boom and social security reforms. Am Econ Rev Pap Proc 92:402–406

Browning E (1975) Why the social insurance budget is too large in a democracy. Econ Inq 13:73–88

Cigno A (1992) Children and pensions. J Popul Econ 5:175–183

Cigno A, Casolaro L, Rosati F (2003) The impact of social security on saving fertility in Germany. Finanzarchiv 59:189–211

Ciurilă N, Romp WE (2015) The political arrangement of pay-as-you-go pension systems in the presence of financial and demographic shocks, Netspar Discussion Paper nr. 12/2015-037

Cooley T, Soares J (1999) A positive theory of social security based on reputation. J Polit Econ 107:135–160

Diamond P, Orszag P (2005) Saving Social Security. J Econ Perspect 19 (2):11–32

Draper N, van Ewijk C, Lever M, Mehlkopf R (2014) Stochastic generational accounting applied to reforms of Dutch occupational pensions. De Economist 162 (3):287–307

Ebbinghaus B (2015) The privatization and marketization of pensions in europe: a double transformation facing the crisis. European Policy Analysis 1:2015

European Commission (2012) White paper—an agenda for adequate, safe and sustainable pensions, Brussels, 16-2-2012

European Commission (2015) The 2015 ageing report. Economic and budgetary projections for the 28 EU Member States (2013-2060), European Economy 3/2015

Feldstein M (2005) Structural reform of social security. J Econ Perspect 19 (2):33–55

Fenge R, Scheubel B (2017) Pensions and fertility: back to the roots - Bismarck’s Pension Scheme and the first demographic transition. J Popul Econ 30:93–139

Galasso V (2006) The political future of social security in aging societies MIT Press. Cambride, UK

Hoevenaars R, Ponds EHM (2008) Valuation of intergenerational transfers in collective funded pension schemes. Insurance : Mathematics and Economics 42 (2):578–593

Holzmann R, Palmer E, Robalino D (eds) (2012) Nonfinancial defined contribution pension schemes in a changing pension world, volume 1. Progress, lessons, and implementation. World bank, Washingtonm, DC

Impavido G, Lasagabaster E, García-Huitrón M (2010) New policies for mandatory defined contribution pensions : industrial organization models and investment products. Number 2462 in World Bank Publications. World Bank

de Menil G, Murtin F, Sheshinski E, Yokossi T (2016) A rational, economic model of paygo tax rates. Eur Econ Rev 89:55–72

Mueller C, Raffelhueschen B, Weddige O (2009) Pension obligations of government employer pension schemes and social security pension schemes established in EU countries, by order of the European Central Bank Final Report. Research Center for Generational Contracts, Freiburg

Munnell AH, Sass SA (2013) New Brunswick’s New risk sharing plan, Issue In Brief nr. 33, Center for Retirement Research, August 2013, Boston

OECD (2015) Pensions at a Glance 2015; OECD and G20 indicators

Pensions Policy Institute (2014) Risk sharing pension plans: the Canadian experience PPI briefing note, no. 60, October 2014, United Kingdom

Perotti E, Schwienbacher A (2009) The political origin pension funding. J Financ Intermed 18:384–404

Platanakis E, Sutcliffe C (2016) Pension scheme redesign and wealth redistribution between members and sponsor: the USS rule change in October 2011, Insurance: Mathematics and Economics, forthcoming

Ponds EHM, Severinson C, Yermo J (2012) Implicit debt in public sector plans: an international comparison. Int Soc Secur Rev 65(2):75–101

Poterba JM (2001) Demographic structure and asset returns. Rev Econ Stat 83:565–584

Razin A, Sadka E, Swagel P (2002) The aging population and the size of the welfare state. J Polit Econ 110:900–918

Reeves M, Pueschel L (2015) Die another day: what leaders can do about the shrinking life expectancy of corporations. In: BCG Perspectives, 2 july 2015, Boston Consulting Group

Schwarz AM, Arias OM (2014) The inverting pyramid—pension systems facing demographic challenges in Europe and Central Asia, World Bank

Sinn H-W (2005) Europe’s demographic deficit a plea for a child pension system. De Economist 153(1):1–45

UN (2015) World population aging 2015 (report). United Nations, New York, 2015

Whitehouse E (2007) Pensions panorama: retirement-income systems in 53 countries. World Bank, Washington DC

Willis Towers Watson (2016) Global pension assets study 2016

Yaari ME (1965) Uncertain lifetime, life insurance and the theory of the consumer. Rev Econ Stud 32(2):137–150

Acknowledgments

The authors thank Ward Romp for fruitful discussion and two referees and the editor of this journal for useful comments. All remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Responsible editor: Alessandro Cigno

Appendices

Appendix A: The case of a PAYG scheme

This appendix contains the details of the maximization of the social welfare function in the case of a PAYG scheme.

Equation (14) in Section 4.3 expresses social welfare in the case of a PAYG scheme, which we repeat here for convenience:

The first derivative with respect to the policy parametre ϕ p reads as follows:

The expression of the second derivative of W p with respect to ϕ p is derived in a similar way:

This expression shows that the second derivative of W p with respect to ϕ p is unambiguously negative.

Unfortunately, the first-order condition is nonlinear in ϕ p and it is not possible to directly derive an analytical expression for ϕ p . We proceed by writing ∂ W p /∂ ϕ p as a function of μ and r:

Now, we elaborate the second-order Taylor approximation of Ω p around the point (E(μ), E(r)). This produces the following equation,

where Ω p,x refers to the derivative of Ω p to x and Ω p,x y refers to the derivative of Ω p,x to y.

It is easy to see that this reduces to the following condition:

Elaborating this condition gives us the expression for ϕ p in the main text (Eq. (15)).

Appendix B: The case of a funded scheme

This appendix contains the details of the maximization of the social welfare function in the case of a funded scheme.

Equation (22) in Section 4.3 expresses social welfare in the case of a funded scheme, which we repeat here for convenience:

The derivative of W f with respect to ϕ f reads as follows:

The expression of the second derivative of W f with respect to ϕ f is derived in a similar way:

This expression shows that the second derivative of W f with respect to ϕ f is unambiguously negative.

Similar to the case of a PAYG scheme, we proceed by writing ∂ W f /∂ ϕ f as a function of μ and r:

The second-order Taylor approximation of the function Ω f (μ,r) around the point (E(μ),E(r)) implies the following expression that is linear in ϕ f :

Elaborating this condition yields the closed-form expression for ϕ f in the main text (see Eq. (23)).

Appendix C: The case of endogenous private saving

Here, we assume that the household chooses his private savings such as to maximize his intertemporal utility function. This means we have to elaborate the following first-order condition: \(c_{y}^{-\gamma }=(1/(1+\delta ))E((1+r)c_{o,+1}^{-\gamma })\). In our case with stochastic capital income and stochastic non-capital income, an analytical solution for the condition does not exist. We therefore elaborate a first-order Taylor approximation for the term of which the expectation is included in the first-order condition with respect to the two risk factors in the model. Including this approximation in the first-order condition allows us to derive an explicit solution for private savings:

This equation looks intuitive: a higher after-premium wage income increases savings, a high pension benefit due to the PAYG scheme lowers private saving and the intertemporal elasticity of substitution, 1/γ, drives the impact of the rate of return upon savings. Variance and covariance terms do not appear in Eq. (35); the first-order Taylor approximation removes precautionary savings from the model. Also intuitive is that a higher expected survival ratio implies higher private savings and that this effect is smaller the more generous are pension benefits.

Applying the same procedure as in the main text, we now derive the following expression for ϕ p in the case of a PAYG scheme:

where

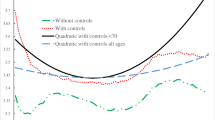

Equation (36) is more complex than its counterpart in the main text, Eq. (15). As a result, we cannot sign ∂ ϕ p /∂ E(μ) and cannot derive analytically that an increase in E(μ) will always decrease ϕ p . Therefore, we resort to numerical simulation. We run 100,000 simulations that combine different values of E(μ), α −1, E(r), \(\tilde {Cov}(\mu ,r)\) and γ. These simulations confirm the earlier result: except for the cases in which ϕ p is zero, all cases imply a negative relationship between E(μ) and ϕ p . Hence, we conclude that our results are not driven by our choice not to derive private savings from optimizing behaviour.

Rights and permissions

About this article

Cite this article

Bonenkamp, J., Meijdam, L., Ponds, E. et al. Ageing-driven pension reforms. J Popul Econ 30, 953–976 (2017). https://doi.org/10.1007/s00148-017-0637-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-017-0637-0