Abstract

The global burden of type 2 diabetes is increasing at an alarming rate, fuelled by the obesity epidemic, with significant associated health and economic consequences and apparent inequalities. Sugar-sweetened beverages (SSBs) are a major source of added sugars in diets worldwide and have been linked to an increased risk of type 2 diabetes through a variety of mechanisms, including excess weight. Taxing SSBs has become a promising public health strategy to reduce consumption and mitigate the burden of type 2 diabetes. A substantial body of evidence suggests that SSB taxes lead to increased prices and subsequent reduced consumption, with a potentially greater effect among lower socioeconomic groups. This highlights the potential for tax policies to have an impact on type 2 diabetes and address health inequalities. Evidence from several ongoing SSB tax schemes, including sales and excise taxes, indicates positive effects on improving consumption patterns, and modelling studies point to health gains by averting type 2 diabetes and other cardiometabolic diseases. In contrast, evidence from empirical evaluation of the impact of SSB tax is scarce. Continued monitoring and the strengthening of evaluation research to develop context-tailored policies are required. In addition, there is a need to implement complementary efforts to amplify the impact of SSB taxation and effectively address the global burden of type 2 diabetes.

Graphical Abstract

Similar content being viewed by others

Introduction

The global burden of diabetes

Globally, an estimated 537 million adults, 10.5% of the adult population, were living with diabetes in 2021, disproportionally affecting low- and middle-income countries that are home to 80% of diabetes cases [1]. The number of people living with diabetes is predicted to rise to 783 million by 2045, and a parallel increase in diabetes-related costs is predicted, projected to reach US$1054 billion by 2045 [2]. The most common form of diabetes is type 2 diabetes, accounting for over 90% of cases and traditionally viewed as a metabolic disorder associated with ageing, albeit incidence is steadily increasing among adolescents and young adults [3]. The elevated burden of type 2 diabetes coexists with the overweight and obesity epidemic, with 52.2% of global type 2 diabetes burden being attributable to excess weight [4].

Risk factors for diabetes

As a metabolic condition with prolonged onset, the factors leading to type 2 diabetes involve a complex combination of genetic, lifestyle and environmental factors. Genetic predisposition increases the risk of type 2 diabetes [5], but its development is thought to largely depend on the accumulation and interaction of lifestyle-related risk factors through the life course [6]. Insulin resistance and the resulting impaired glucose uptake (key underlying mechanisms of type 2 diabetes) are linked to excess body weight, particularly excess abdominal fat, owing to the release of proinflammatory substances that contribute to insulin resistance [7]. Ageing is also associated with an increased risk of type 2 diabetes due to a progressive increase in central and peripheral insulin resistance [8], and the gradual reduction of protective lifestyles (with, for example, a reduction in physical activity and exercise) as we age [9, 10]. Physical inactivity, smoking, alcohol consumption, and unhealthy dietary patterns, characterised by high intakes of free sugars and saturated fats (which are often predominant in processed foods), intertwine with one another, playing a crucial role in the pathogenesis of type 2 diabetes by inducing insulin resistance [11]. Making lifestyle changes, such as adopting a healthy diet, engaging in regular physical activity and maintaining a healthy weight, has been shown to significantly reduce the risk of developing type 2 diabetes, even in individuals with genetic predispositions or other risk factors [12].

Overview of public health approaches to reduce diabetes and its risk factors

Addressing modifiable lifestyle-related risk factors through effective public health interventions is crucial for reducing the burden of type 2 diabetes. Current public health approaches encompass a range of evidence-based strategies, aiming to facilitate lifestyle changes at the individual, health-system and community levels [13] in a way that addresses the proximal and distal determinants of type 2 diabetes. At the community level, strategies to reduce type 2 diabetes risk factors include the implementation of nutrition guidelines and food labelling to encourage healthier food choices, promoting healthy lifestyles through environmental modifications, and community-based interventions, such as school or workplace programmes, marketing restrictions and fiscal policies [14,15,16]. These approaches are complementary and often involve a complex implementation process, requiring alignment among various stakeholders, including governments, healthcare professionals, community organisations and the private sector. While public health efforts that have been implemented in stakeholder partnerships have yielded some successes in reducing risk factors of type 2 diabetes in certain populations [17], the global burden of type 2 diabetes remains alarmingly high [18]. Therefore, it is a priority to explore innovative and evidence-based strategies to address modifiable risk factors in an effective and synergistic manner.

In this paper, I aim to explore the impact of food taxation on modifiable risk factors, specifically taxation targeting the consumption of added sugars in sugar-sweetened beverages (SSBs), as a promising approach to reduce the burden of type 2 diabetes. To do this, I examine the rationale for SSB taxation in the context of the aetiological factors leading to type 2 diabetes. I also discuss the current implementation efforts by national and local policies in a variety of countries, the evidence for effectiveness and effect size of taxation, and further implications of SSB taxation, such as use of revenues (Fig. 1). In addition, the standpoint of international health agencies, barriers for implementation, and research and policy gaps are outlined. I also highlight emerging targets and integrated actions to tackle the global burden of type 2 diabetes effectively.

SSB taxes and type 2 diabetes. Visual overview of the rationale behind selecting SSBs as a target to reduce type 2 diabetes burden, including the aetiological factors of SSBs that lead to type 2 diabetes. Also shown are the key aspects relating to the effectiveness of SSB taxes in terms of reducing SSB consumption and improving health, and important considerations when designing and assessing the impact of SSB taxes. This figure is available as a downloadable slide

SSBs as a taxation target to reduce diabetes burden

Aetiological effects

Added sugar refers to simple sugars, namely glucose and fructose (often from high-fructose corn syrup), that are artificially added to foods and beverages during processing, normally to improve their organoleptic (sweetness, flavour enhancement, flavour balance, palatability) characteristics [19]. Processed foods, including SSBs, are energy-dense but nutrient-poor dietary products and represent the main source of added sugars in diets worldwide [20]. The nutrient-depleted beverages represent ‘empty calories’ and contribute to an imbalance in energy intake and expenditure, providing on average 558–627 kJ (140–150 kcal) and 35.0–37.5 g of sugar per a standard 12 fl oz (355 ml) serving [21]. Diets rich in products with added sugar have been associated with an increased risk of cardiometabolic conditions, including obesity, type 2 diabetes and cardiovascular diseases, as well as non-alcoholic fatty liver disease (NAFLD) and some cancers. These associations occur, in part, due to excess weight and also via independent metabolic effects resulting from glucose and fructose intake [21]. In addition, the consumption of products with added sugar directly contributes to dental caries [22].

Evidence shows that consumption of liquid calories in the form of SSBs leads to decreased satiety with incomplete compensatory reduction of energy intake at subsequent meals, resulting in energy imbalance, weight gain and obesity [23, 24]. The relationship between SSBs and excess body weight has been evidenced in both randomised controlled trials and prospective observational cohorts [25, 26]. In addition to the heightened risk of weight gain and obesity, which are major drivers of insulin resistance and type 2 diabetes [7], simple added sugars are also rapidly absorbed, leading to a quick increase in blood glucose levels and, hence, a high glycaemic load, requiring a comparable insulin response. By contributing to a high-glycaemic-load diet, SSBs can increase insulin resistance and promote inflammation, promoting the development of type 2 diabetes [27]. Several cohort studies have reported positive associations between SSB consumption and type 2 diabetes risk, even when accounting for adiposity [21]. Meta-analyses of the aetiological effects of foods on type 2 diabetes have reported that regular intakes of 8 fl oz (236 ml) per day of SSBs are associated with a 13% greater incidence of type 2 diabetes, even when accounting for excess body weight [28]. Moreover, the direct impact of SSB consumption on blood pressure and plasma lipids have also been evidenced [29], as well as the impact on NAFLD [30], overall cardiovascular disease and certain cancers [31].

SSBs are also the greatest source of fructose-containing sugars in the diet and account for the majority of total fructose intake [24]. Unlike glucose, which is metabolised systemically, fructose is mainly processed in the liver. High-fructose intake (but not glucose intake) has been linked to increased uric acid production, increased visceral, intrahepatic and intramuscular fat, disrupted lipid regulation and increased insulin resistance in overweight adults [32]. In contrast, studies have shown beneficial effects of whole-fruit consumption on the risk of type 2 diabetes, which is opposite to the effects observed with fruit juices [33]. These findings suggest that the faster absorption of fructose from liquid products, such as SSBs, may increase the rate of hepatic extraction of fructose and subsequent metabolic disruption [24], resulting in an acceleration in the development of NAFLD [30, 34].

Caffeine, a natural stimulant found in coffee and tea, is often added to SSBs and has various effects on the body, including increasing alertness and temporarily boosting metabolism [35]. While there is evidence of caffeine’s potential to attenuate insulin sensitivity after acute administration in healthy individuals [36], the association between SSB intake and type 2 diabetes risk has been observed to be consistent when comparing caffeinated and caffeine-free SSBs, preliminarily ruling out a joint effect of caffeine and added sugar in type 2 diabetes [37]. However, in conjunction with the sugar in SSBs, caffeine adds to the increased risk of type 2 diabetes onset by contributing to the development of dependencies on these beverages. Regular and excessive consumption of caffeine can lead to behavioural dependencies due to tolerance and the need for larger amounts of caffeine to achieve the same level of stimulation. This addictive mechanism is further influenced by the high sugar content of SSBs, which triggers reward centres in the brain, primarily due to the rapid absorption of added sugar leading to pleasure and reward [38]. This habit formation and the addictive potential of caffeine and sugar may result in an increase in SSB consumption, along with displacement of nutrient-dense foods from the diet, overall increasing the risk of type 2 diabetes and the other complications mentioned above. The habit-forming potential of SSBs may constitute an actionable item for the implementation of public health policies that are currently applied to addictive substances [39].

SSBs as taxation targets

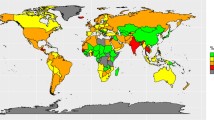

SSBs are consumed on a global scale, with intake levels being above the recommended daily limits for free sugar in many countries. Collectively, SSBs are the largest source of added sugar in the diet [21]. A study of SSB consumption using data from 2010 for adults in 187 countries found that intake was higher in middle-income countries compared with either high- or low-income countries, being particularly high in Latin America and the Caribbean [40].

The discretionary nature of SSBs make them a suitable target for fiscal measures, such as taxation. SSBs are non-essential, optional beverages, meaning they provide no nutritional value and can be easily substituted with healthier alternatives, such as water. An often-used approach to SSB taxation with the explicit intent of improving public health involves leveraging excise taxes, which are incurred by SSB distributors in accordance with the volume or sugar content of the SSBs supplied to retailers [41]. Excise taxes lead to an increase in retail prices for consumers, dependent upon distributors raising the cost of SSBs to retailers, who subsequently pass on this increase by raising the shelf prices of these products. SSB sales taxes, calculated as a percentage of the purchase price and added at the point of sale, have also been enacted prior to the shift towards excise taxes [41]. Compared with an excise tax, a sales tax is less likely to reduce SSB consumption because, in certain countries, a sales tax is added to the receipt after a consumer has already made their purchase decision [42]. In contrast, excise taxes raise shelf prices of SSBs so costs are increased at the moment the customer is making their decision [42, 43]. Further, volume-based excise taxes are anticipated to discourage the purchase of large SSBs by proportionally increasing their prices more than those of smaller sizes [42].

Taxing SSBs can nudge consumers towards making healthier beverage choices. Indeed, research has found that SSBs tend to have a modest elastic demand, meaning that changes in price can have a meaningful impact on quantity demanded. According to recent meta-analyses, there can be up to 12% intake reduction after a 10% increase in price [44, 45]. SSB taxes are generally regressive in nature, having more of an impact on lower-income groups. These groups often have limited access to healthier alternatives, which are normally costly, and opt for inexpensive SSBs [46, 47]. When these beverages are taxed, the additional cost represents a larger burden on the overall budget of individuals with a lower income, compared with individuals with a higher income. While the tax-induced higher costs of SSBs could increase the chance of shifting purchases to healthier alternatives among lower-income groups, the tax design should be structured to offset the regressive nature by introducing balancing measures, such as targeted credits or differential subsidisation of water using tax revenue [48]. These measures could also help to increase the price elasticity of SSBs by counteracting the resistance to change reinforced by the habit-forming potential of SSBs [39]. Nonetheless, the regressive nature of SSB taxes must be contextualised to the setting that they are implemented in and balanced against the much larger regressive nature of type 2 diabetes, which disproportionally affects lower-income strata [1]. It has also been shown that population-wide policies aiming to reduce sugar consumption have the potential to address inequitable access to healthful foods and reduce type 2 diabetes disparities related to added sugar consumption [49, 50]. Furthermore, SSB taxes have the potential to have a positive impact not only on type 2 diabetes burden and related risk factors, but also on other prevalent and serious conditions, such as NAFLD [21] or on oral health [22].

SSB taxes around the world

According to the NOURISHING policy database of World Cancer Research Fund International [51], up to 2021, a total of 50 governments around the world had enacted SSB taxes (electronic supplementary material [ESM] Table 1). As stated, overall these strategies aim to reduce the consumption of this type of beverage at the population level by shifting populations to healthier choices, reducing the burden of type 2 diabetes and related conditions, such as obesity. Indirectly, SSB taxes should ideally contribute to potential savings on healthcare expenditure by means of preventing illness, and reuse of tax revenue on health promotion and care actions. Schemes have been proposed since the early 1900s, when Nordic countries imposed taxes on non-alcoholic beverages and confectionary food products, classifying these as luxury items; this was mostly intended to raise revenue. SSB-specific taxation started to appear from 2011.

In 2011, the Hungarian Parliament implemented a public health product tax (PHPT), which includes an excise levy specifically targeting the salt, sugar and caffeine content of pre-packaged foods that have healthier alternatives available, such as SSBs (€0.018/l) [52]. In 2012, France introduced an excise SSB tax that has evolved into a volume-based tax on SSBs (€3.63 for 2 kg of added sugar per 100 l) as part of its current efforts to address the rising rates of obesity and related health issues [52]. Since these first examples, SSB taxes have been put in place at similar levels across Europe, in Belgium (€0.119/l), Catalonia (€0.12/l), Spain (21% tax), Croatia (tiered tax up to €0.0796/l), Ireland (€0.30/l), Latvia (€0.14/l), Poland (€0.11/l), Portugal (€0.20/l) and the UK (approximately €0.28/l). Finland has had an excise duty tax on soft drinks since 1940, with rates currently reaching up to €0.22/l, for beverages with >0.5% sugar. Similarly, Norway, implemented taxes on non-alcoholic beverages as luxury items as early as 1922, with SSBs taxed at 3.34 Norwegian krone (NOK)/l (approximately €0.37/l).

In the region of the Americas, Mexico pioneered an initial tax scheme in 2011 in which a 25% tax was applied to energy drinks with more than 20 mg of caffeine per 100 ml. Later, in 2013, this was complemented with an excise duty of 1 Mexican peso (Mex$)/l (approximately US$0.05/l) being applied to sugary drinks [53] which has largely influenced the later development of SSB tax schemes in other parts of America. Countries such as Chile (13% tax), Peru (25% tax) and Ecuador (US$0.0018/g sugar), and Bermuda (50% tax) and the Caribbean (Barbados [20% tax] and Dominica [10% tax]) all have ongoing taxes on SSBs. In the USA, in 2014, Berkeley (CA) became the first city in the country to implement a local tax on SSBs (US$0.01/fl oz or ~US$0.35/l), serving as a reference model for other cities across the country; nowadays the same level of taxation is applied in San Francisco and Oakland (both in CA), Albany (NY) and the Cook County (IL), while a greater level of taxation is implemented in Philadelphia (PA) (US$0.015/fl oz [~US$0.51/l]), Seattle (WA) (US$0.0175/fl oz [~US$0.35/l]), and Boulder (CO) (US$0.02/fl oz [~US$0.67/l]).

In 2017, a 50% tax on SSBs was introduced in Bahrain, Saudi Arabia and the United Arab Emirates. In 2020, Morocco implemented a tax of US$0.0466/l on beverages with <10% juice content. Only a few other countries in the African region have taxes at various levels and schemes, including Ethiopia (25%), Mauritius (US$0.0008/g sugar), Seychelles (US$0.30/l) and South Africa (US$0.0011/g sugar).

In the South-East Asian region, Thailand opted for volume-based tax (US$0.15/l), while India applies a 40% tax on any beverage with added sugar or sweetener, with this being one of the highest goods and services taxes in the country. Several countries in the Western Pacific region have adopted SSB taxes, including Malaysia (US$0.095/l), the Philippines (US$0.24/l), Brunei (US$0.28/l), the Cook Islands (15% tax plus 2% rise per year since 2013), Fiji and Samoa (both US$0.17/l), Tonga (US$0.50/l), Vanuatu (US$0.47/l), French Polynesia (US$0.68/l) and Kiribati (40% tax).

Effectiveness of SSB taxes

The effectiveness of food tax policies can vary depending on various factors, such as the specific design of the tax, the target population, cultural norms and enforcement mechanisms. Further, the effectiveness of taxation schemes can be looked at from different angles, from the impact on planned, direct targets, such as reduction of SSB consumption and health gains, to the potential indirect impact resulting in alleviation of the burden on health systems, use of revenues for preventive and reinforcing programmes, and incentivising the industry to reformulate products to reduce their sugar content. With regard to assessing the policy impact on direct targets, it must be noted that assessing the effectiveness of an SSB tax based on immediate health gains, such as reduction in type 2 diabetes incidence shortly after implementation, would be inadequate. In fact, it takes several years for health tax-induced dietary changes to have a measurable impact on health. Instead, it is more feasible to examine intermediate outcomes, such as decreased sales of SSBs and increased purchases of healthier alternatives, which can be used as an approximation for improved dietary intake (specifically, reduced SSB consumption). These estimates can then be utilised to assess the potential health impacts, including reductions in the prevalence of overweight and the incidence and prevalence of type 2 diabetes, and associated mortality rates.

Evidence on the impact of SSB tax is accumulating as multiple evaluations are ongoing through simulation models and, more recently, by natural experiments or randomised trials tailored to the setting, the specific tax implementation and outcome being explored [54]. The SSB tax policies that were implemented first show promising results in terms of their impact on consumption patterns, health gains and revenue use. For example, since the implementation of the PHPT in Hungary in 2011, targeting the salt, sugar and caffeine content of pre-packaged foods that have healthier alternatives available [52], the prices of taxed products have increased, leading to a decline in their sales. Food manufacturers have responded by reformulating their products to reduce levels of the taxed ingredients. As a result, consumers have made changes in their eating habits, opting to consume less of the unhealthy products or switching to healthier alternatives [55]. In line with this, assessment of the impact of the sugar tax in France indicated that the tax has led to a decrease in the consumption of sugary drinks, particularly among certain population groups, such as children and adolescents, as well as a shift in consumer preferences towards healthier beverage options, including water [56]. Mexico's SSB tax is perhaps the one strategy with the most evidence accumulated for the effectiveness of this type of policy [57,58,59,60,61]. Since its implementation in 2011, and update in 2013, the tax has led to a reduction in consumption of SSBs vs pre-tax consumption ranging between 10.8 ml and 13.8 ml (21-92 kJ [5–22 kcal]) per person per day [57], particularly among households with low-socioeconomic status [59]. This is likely owing to the observed 6.3% reduction in purchases of SSBs. This decrease in SSB purchases indirectly led to a 16.2% increase in sales of untaxed beverages, such as bottled water, again with greater effects being observed among lower-income households and urban residents [58]. Further research has evidenced a significant purchase reduction specifically in middle-priced (around Mex$10 or US$0.58) SSBs (accounting for about 30% of overall SSB purchases in urban Mexico) [57], suggesting the need for additional efforts to reformulate the policy and maximise its effectiveness across price levels. Using the reduction in SSB consumption observed in Mexico, a simulation study estimated that the SSB tax of Mex$1/l could lead to a 2.45% relative reduction in obesity prevalence and prevent 89,000–136,000 cases of type 2 diabetes over a 10 year period in Mexico [61]. Policies that have been implemented more recently are reported as having less impactful effects; for example, the data projected for Portugal by modelling the combination of reduced SSB purchases and decreased sugar content in SSBs as a result of reformulation estimates 40–78 new cases of obesity annually, between 2016 and 2018 [62].

In contrast, more optimistic effects have been modelled for type 2 diabetes-related mortality rates: if assuming a nationwide 10% price increase is applied for SSBs via use of an excise tax across the USA, a 1.5% annual reduction in diabetes-related deaths was estimated [50]. A recent modelling study examining the global health impact of increases in excise taxes estimated that a one-time tax increase that resulted in a 50% price hike for SSBs could prevent 2.2 million premature deaths worldwide over the next 50 years [63]. However, an important limitation of modelling studies is the difficulty in fully accounting for potential substitution effects, where consumers may shift to other high-energy, but untaxed food items [64]. A study in the USA that considered potential substitution effects estimated that a 20% tax on SSBs would reduce their purchase by around 10%, but energy intake would decrease by only 4.8% [65]. In a systematic review of literature published between 2009 and 2012 investigating the effect of food taxes on consumption, 38 studies representing mostly modelling studies and two randomised controlled trials showed that price changes were effective in both grocery store purchasing and away-from-home food purchasing contexts [66]. The most robust modelling studies (which considered substitution) showed larger effects for taxes on non-staple foods or beverages for which there are similar untaxed substitutes (e.g. SSBs) [66]. Through modelling studies, it has been suggested that SSB taxes can lead to reductions in energy intake ranging from 0.01% to 0.04% for every 1% increase in price [64]. At the population level, these small changes in consumption can have a significant impact in the medium-to-long term.

A recent meta-analysis of 62 studies that used natural experiment designs (e.g. interrupted time series, controlled and uncontrolled before and after studies, quasi-experimental studies) to evaluate the impact of SSB tax observed that most studies assessed changes in price (tax pass-through) or SSB sales, while there were only 15 studies reporting on SSB consumption, and only five studies reporting changes in BMI resulting from the implementation of SSB sales taxes in the USA. None of the studies included evaluated the effect of SSB tax on type 2 diabetes or any other chronic disease [67]. This meta-analysis estimated an overall tax pass-through (the extent to which taxes were passed on to consumers in the form of higher prices) of 82%. In other words, a 10% SSB tax was linked to an 8.2% increase in consumer prices of taxed beverages, suggesting an incomplete pass-through [67]. In addition, an overall 15% reduction in SSB sales was estimated across all studies, with no evidence of significant substitution with sales of untaxed beverages [67].

Overall, the body of evidence accumulated to date points to SSB taxation potentially providing greater benefit for lower-income groups [50, 64], thus indicating the potential for SSB taxes to be classed as equitable policies. However, while modelling studies have estimated greater effects for lower socioeconomic groups [50, 68], evidence from empirical evaluation appears disparate between countries [67], with some countries, like Mexico, consistently reporting higher reductions in SSB sales for low-socioeconomic households [58, 59], while others, such as Spain, report greater declines in SSB sales among higher-income groups [69]. A recent study on the impact of the implementation of SSB taxes in Finland, France, Belgium and Portugal investigated differences in the consumption of sugary drinks among adolescents based on family affluence. This study showed that SSB consumption was reduced across all socioeconomic levels in all countries except in France, where reductions were only observed among adolescents belonging to families with the lowest affluence [47].

Revenues

Taxes on SSBs can generate significant revenue that can be directed towards public health programmes, health promotion campaigns, or initiatives to address the burden of obesity and related diseases. Tax revenues can support interventions aimed at preventing and managing chronic conditions. Further, the revenue generated from health taxes is the most immediate measure of the impact of the policy, and it can serve as an indicator to track changes in sales once the tax is implemented. Still, SSB taxes are relatively new and evidence of their revenue-enhancing benefits is still emerging; thus, while some tax policy designs describe the use of budgets generated through revenues, there are few reports monitoring the intended use of revenues from SSB taxes. According to the NOURISHING policy database [51], during the first year of the tax's implementation in Mexico, it was estimated to have generated around Mex$18 billion (approximately US$930 million) in revenue. This revenue should have been allocated to fund programmes addressing malnutrition, obesity and obesity-related chronic diseases, as well as access to drinking water, according to the sixth transitory article of the Federal law on income for the fiscal year 2017 [70]. Revenue from the 10% excise tax applied to SSBs in the island of Dominica will go to health promotion campaigns and, similarly, most (80%) of the revenues from taxing SSBs in French Polynesia between 2002 and 2006 were earmarked for health promotion or for providing free and healthy breakfasts for primary school children in Malaysia [51]. Other countries, such as Fiji, are directing revenues directly to the state budget. In Poland, most revenues from the sugar tax levy introduced in 2020 (approximately €7 million) should go to the National Health Fund for the implementation of educational and preventive activities, while only the remaining part (3.5%) will be transferred to the state budget [51]. In Hungary, during the first four years of its operation, the PHPT generated approximately US$219 million in revenue. This revenue has been utilised to increase the wages of 95,000 healthcare workers. Additionally, since 2016, companies have been incentivised to invest in health promotion activities in exchange for a deduction in their PHPT liability [51]. In the USA, as aforementioned, a number of state- or city-level tax policies are currently in place, with revenue from the oldest SSB tax in the USA, in Berkeley, CA, being directed into the city's general fund, which sponsors community health and nutrition programmes. The revenue from the tax implemented in San Francisco, CA, is handled by an advisory committee, which makes recommendations on the potential establishments and/or funding of programmes that should receive funding to reduce the consumption of SSBs. Similarly, the cities of Boulder, CO, and Philadelphia, PA, plan to use revenues from the SSB taxes installed in 2017 respectively, and 2018, to help fund community-based initiatives on health promotion [51].

Recommendations and outlook

According to the WHO [71], health taxes imposed on products that have adverse effects on public health, such as SSBs, offer multiple benefits, making them win–win policies. They contribute to reduced cases of preventable mortality (the United Nation’s Sustainable Development Goal [SDG] 3, target 3.4) [72], preventing diseases, promoting health equity and generating revenue for government budgets. The revenue generated from these taxes can be allocated to various priorities, financing universal health coverage and implementing highly cost-effective population health measures that are currently underutilised, thereby alleviating the burden on health systems. The WHO aids with framing, designing, implementing and administering these policy measures, and, in 2022, they commissioned and published a guidance manual on SSB taxation policies to promote healthy diets [73]. Considering the WHO’s guidance and drawing from existing evidence, a set of recommendations for the future of SSB taxation is presented in the Text box. These recommendations may positively contribute to reducing the burden of type 2 diabetes.

The effectiveness of SSB taxes depend on various factors, including the magnitude of the intervention, public awareness and industry response [74]. Considering recent trends and accumulating evidence on precision medicine and prevention, it is crucial to emphasise the need for both individual- and population-level strategies in the prevention and management of type 2 diabetes. While population-wide strategies, such as SSB taxes, overall play a fundamental role in promoting healthy eating and lifestyle habits in our societies, and therefore have an impact on big numbers of people, these strategies are generally of modest impact at an individual level. It is increasingly recognised that interventions should be tailored and adapted to specific groups of individuals who would benefit the most. The concept of precision medicine acknowledges that individuals may respond differently to diet and lifestyle interventions. By tailoring strategies to individual characteristics, such as genetics, metabolic profile or other relevant factors, we can optimise the effectiveness of interventions and improve outcomes. This personalised approach, also in population health, recognises that not all individuals will have the same response to a given intervention and allows for more precise and targeted care. However, it is important to note that individual-level approaches should not overshadow the importance of population-wide strategies that should be the backbone of prevention. Public health initiatives, such as taxation policies, educational campaigns and environmental changes, can create a supportive environment for healthy eating and living. These strategies address social determinants of health and can benefit entire populations by promoting healthier behaviours and reducing the overall burden of type 2 diabetes, constituting the first tier in the prevention continuum. To achieve optimal results, there needs to be a synergy between individual-level approaches and population-level strategies. Individual interventions should be aligned with public health efforts to ensure coherence and reinforce positive behaviour changes. By combining personalised approaches with broader public health initiatives, we can create a comprehensive and integrated approach to type 2 diabetes prevention and management.

Conclusions

The potential impact of reducing added sugar intake through SSB taxation is significant. Studies suggest that a reduction in added sugar consumption can lead to improvements in the risk of type 2 diabetes. However, the effectiveness of taxes targeting SSBs have been, up to now, mostly assessed by evaluating purchase reduction and decrease in consumption, while evidence on the impact of reducing the burden of type 2 diabetes is only available through modelling studies. Overall, addressing modifiable risk factors through comprehensive public health approaches, including innovative strategies such as taxation, is crucial for reducing the global burden of type 2 diabetes and promoting better health outcomes for individuals and communities.

Abbreviations

- Mex$:

-

Mexican peso

- NAFLD:

-

Non-alcoholic fatty liver disease

- PHPT:

-

Public health product tax

- SSB:

-

Sugar-sweetened beverage

References

Chan JCN, Lim L-L, Wareham NJ et al (2020) The lancet commission on diabetes: using data to transform diabetes care and patient lives. Lancet 396(10267):2019–2082. https://doi.org/10.1016/S0140-6736(20)32374-6

Sun H, Saeedi P, Karuranga S et al (2022) IDF Diabetes Atlas: global, regional and country-level diabetes prevalence estimates for 2021 and projections for 2045. Diabetes Res Clin Pract 183:109119. https://doi.org/10.1016/j.diabres.2021.109119

Xie J, Wang M, Long Z et al (2022) Global burden of type 2 diabetes in adolescents and young adults, 1990–2019: systematic analysis of the Global Burden of Disease Study 2019. BMJ 379:e072385. https://doi.org/10.1136/bmj-2022-072385

Ong KL, Stafford LK, McLaughlin SA et al (2023) Global, regional, and national burden of diabetes from 1990 to 2021, with projections of prevalence to 2050: a systematic analysis for the Global Burden of Disease Study 2021. Lancet 402(10397):203–234. https://doi.org/10.1016/S0140-6736(23)01301-6

Khera AV, Chaffin M, Aragam KG et al (2018) Genome-wide polygenic scores for common diseases identify individuals with risk equivalent to monogenic mutations. Nat Genet 50(9):1219–1224. https://doi.org/10.1038/s41588-018-0183-z

Kuh D, Ben-Shlomo Y, Lynch J, Hallqvist J, Power C (2003) Life course epidemiology. J Epidemiol Community Health 57(10):778–783. https://doi.org/10.1136/jech.57.10.778

Kahn SE, Hull RL, Utzschneider KM (2006) Mechanisms linking obesity to insulin resistance and type 2 diabetes. Nature 444(7121):840–846. https://doi.org/10.1038/nature05482

Gong Z, Muzumdar RH (2012) Pancreatic function, type 2 diabetes, and metabolism in aging. Int J Endocrinol 2012:1–13. https://doi.org/10.1155/2012/320482

Tuomilehto J, Lindström J, Eriksson JG et al (2001) Prevention of type 2 diabetes mellitus by changes in lifestyle among subjects with impaired glucose tolerance. N Engl J Med 344(18):1343–1350. https://doi.org/10.1056/NEJM200105033441801

Mozaffarian D, Kamineni A, Carnethon M, Djoussé L, Mukamal KJ, Siscovick D (2009) Lifestyle risk factors and new-onset diabetes mellitus in older adults: the Cardiovascular Health Study. Arch Intern Med 169(8):798–807. https://doi.org/10.1001/ARCHINTERNMED.2009.21

Malik VS, Popkin BM, Bray GA, Després JP, Willett WC, Hu FB (2010) Sugar-sweetened beverages and risk of metabolic syndrome and type 2 diabetes: a meta-analysis. Diabetes Care 33(11):2477–2483. https://doi.org/10.2337/DC10-1079

Rank F, Nn JOA, Anson EM et al (2001) Diet, lifestyle, and the risk of type 2 diabetes mellitus in women. N Engl J Med 345(11):790–797. https://doi.org/10.1056/NEJMoa010492

Mozaffarian D, Peñalvo JL (2016) The global promise of healthy lifestyle and social connections for better health in people with diabetes. Am J Kidney Dis 68(1):1–4. https://doi.org/10.1053/j.ajkd.2016.04.009

Afshin A, Penalvo J, Del Gobbo L et al (2015) CVD prevention through policy: a review of mass media, food/menu labeling, taxation/subsidies, built environment, school procurement, worksite wellness, and marketing standards to improve diet. Curr Cardiol Rep 17(11):98. https://doi.org/10.1007/s11886-015-0658-9

Micha R, Karageorgou D, Bakogianni I et al (2018) Effectiveness of school food environment policies on children’s dietary behaviors: a systematic review and meta-analysis. PLoS One 13(3):e0194555. https://doi.org/10.1371/journal.pone.0194555

Peñalvo JL, Sagastume D, Mertens E et al (2021) Effectiveness of workplace wellness programmes for dietary habits, overweight, and cardiometabolic health: a systematic review and meta-analysis. Lancet Public Health 6(9):e648–e660. https://doi.org/10.1016/S2468-2667(21)00140-7

Bergman M, Buysschaert M, Schwarz PE, Albright A, Narayan KV, Yach D (2012) Diabetes prevention: global health policy and perspectives from the ground. Diabetes Manag 2(4):309–321. https://doi.org/10.2217/dmt.12.34

Cho NH, Shaw JE, Karuranga S et al (2018) IDF Diabetes Atlas: global estimates of diabetes prevalence for 2017 and projections for 2045. Diabetes Res Clin Pract 138:271–281. https://doi.org/10.1016/j.diabres.2018.02.023

Goldfein KR, Slavin JL (2015) Why sugar is added to food: food science 101. Compr Rev Food Sci Food Saf 14(5):644–656. https://doi.org/10.1111/1541-4337.12151

Johnson RK, Appel LJ, Brands M et al (2009) Dietary sugars intake and cardiovascular health. Circulation 120(11):1011–1020. https://doi.org/10.1161/CIRCULATIONAHA.109.192627

Malik VS, Hu FB (2022) The role of sugar-sweetened beverages in the global epidemics of obesity and chronic diseases. Nat Rev Endocrinol 18(4):205–218. https://doi.org/10.1038/s41574-021-00627-6

Valenzuela MJ, Waterhouse B, Aggarwal VR, Bloor K, Doran T (2021) Effect of sugar-sweetened beverages on oral health: a systematic review and meta-analysis. Eur J Public Health 31(1):122–129. https://doi.org/10.1093/eurpub/ckaa147

Pan A, Hu FB (2011) Effects of carbohydrates on satiety: differences between liquid and solid food. Curr Opin Clin Nutr Metab Care 14(4):385–390. https://doi.org/10.1097/MCO.0b013e328346df36

Malik VS, Hu FB (2015) Fructose and cardiometabolic health. J Am Coll Cardiol 66(14):1615–1624. https://doi.org/10.1016/j.jacc.2015.08.025

Te Morenga L, Mallard S, Mann J (2013) Dietary sugars and body weight: systematic review and meta-analyses of randomised controlled trials and cohort studies. BMJ 346:e7492. https://doi.org/10.1136/bmj.e7492

Micha R, Shulkin ML, Peñalvo JL et al (2017) Etiologic effects and optimal intakes of foods and nutrients for risk of cardiovascular diseases and diabetes: systematic reviews and meta-analyses from the nutrition and chronic diseases expert group (NutriCoDE). PLoS One 12(4):e0175149. https://doi.org/10.1371/journal.pone.0175149

Defronzo RA (2009) From the triumvirate to the ominous octet: a new paradigm for the treatment of type 2 diabetes mellitus. Diabetes 58(4):773–795. https://doi.org/10.2337/DB09-9028

Imamura F, O’Connor L, Ye Z et al (2015) Consumption of sugar sweetened beverages, artificially sweetened beverages, and fruit juice and incidence of type 2 diabetes: systematic review, meta-analysis, and estimation of population attributable fraction. BMJ 351:h3576. https://doi.org/10.1136/bmj.h3576

Te Morenga LA, Howatson AJ, Jones RM, Mann J (2014) Dietary sugars and cardiometabolic risk: systematic review and meta-analyses of randomized controlled trials of the effects on blood pressure and lipids. Am J Clin Nutr 100(1):65–79. https://doi.org/10.3945/AJCN.113.081521

Asgari-Taee F, Zerafati-Shoae N, Dehghani M, Sadeghi M, Baradaran HR, Jazayeri S (2019) Association of sugar sweetened beverages consumption with non-alcoholic fatty liver disease: a systematic review and meta-analysis. Eur J Nutr 58(5):1759–1769. https://doi.org/10.1007/s00394-018-1711-4

Bentham J, Di Cesare M, Bilano V et al (2017) Worldwide trends in body-mass index, underweight, overweight, and obesity from 1975 to 2016: a pooled analysis of 2416 population-based measurement studies in 128.9 million children, adolescents, and adults. Lancet 390(10113):2627–2642. https://doi.org/10.1016/S0140-6736(17)32129-3

Stanhope KL, Schwarz JM, Keim NL et al (2009) Consuming fructose-sweetened, not glucose-sweetened, beverages increases visceral adiposity and lipids and decreases insulin sensitivity in overweight/obese humans. J Clin Investig 119(5):1322–1334. https://doi.org/10.1172/JCI37385

Muraki I, Imamura F, Manson JE et al (2013) Fruit consumption and risk of type 2 diabetes: results from three prospective longitudinal cohort studies. BMJ 347:f5001. https://doi.org/10.1136/bmj.f5001

Ouyang X, Cirillo P, Sautin Y et al (2008) Fructose consumption as a risk factor for non-alcoholic fatty liver disease. J Hepatol 48(6):993–999. https://doi.org/10.1016/j.jhep.2008.02.011

Cappelletti S, Piacentino D, Sani G, Aromatario M (2015) Caffeine: cognitive and physical performance enhancer or psychoactive drug? Curr Neuropharmacol 13(1):71–88. https://doi.org/10.2174/1570159X13666141210215655

Shi X, Xue W, Liang S, Zhao J, Zhang X (2016) Acute caffeine ingestion reduces insulin sensitivity in healthy subjects: a systematic review and meta-analysis. Nutr J 15(1):103. https://doi.org/10.1186/s12937-016-0220-7

Bhupathiraju SN, Pan A, Malik VS et al (2013) Caffeinated and caffeine-free beverages and risk of type 2 diabetes. Am J Clin Nutr 97(1):155–166. https://doi.org/10.3945/ajcn.112.048603

Mysels DJ, Sullivan MA (2010) The relationship between opioid and sugar intake: review of evidence and clinical applications. J Opioid Manag 6(6):445–452. https://doi.org/10.5055/jom.2010.0043

Gearhardt AN, Grilo CM, DiLeone RJ, Brownell KD, Potenza MN (2011) Can food be addictive? Public health and policy implications. Addiction 106(7):1208–1212. https://doi.org/10.1111/j.1360-0443.2010.03301.x

Singh GM, Micha R, Khatibzadeh S et al (2015) Global, regional, and national consumption of sugar-sweetened beverages, fruit juices, and milk: a systematic assessment of beverage intake in 187 countries. PLoS One 10(8):e0124845. https://doi.org/10.1371/JOURNAL.PONE.0124845

Falbe J (2020) The ethics of excise taxes on sugar-sweetened beverages. Physiol Behav 225:113105. https://doi.org/10.1016/J.PHYSBEH.2020.113105

Falbe J, Lee MM, Kaplan S, Rojas NA, Ortega Hinojosa AM, Madsen KA (2020) Higher sugar-sweetened beverage retail prices after excise taxes in Oakland and San Francisco. Am J Public Health 110(7):1017–1023. https://doi.org/10.2105/AJPH.2020.305602

Chriqui JF, Chaloupka FJ, Powell LM, Eidson SS (2013) A typology of beverage taxation: multiple approaches for obesity prevention and obesity prevention-related revenue generation. J Public Health Policy 34(3):403–23. https://doi.org/10.1057/jphp.2013.17

Andreyeva T, Long MW, Brownell KD (2010) The impact of food prices on consumption: a systematic review of research on the price elasticity of demand for food. Am J Public Health 100(2):216–222. https://doi.org/10.2105/AJPH.2008.151415

Cabrera Escobar MA, Veerman JL, Tollman SM, Bertram MY, Hofman KJ (2013) Evidence that a tax on sugar sweetened beverages reduces the obesity rate: a meta-analysis. BMC Public Health 13(1):1072. https://doi.org/10.1186/1471-2458-13-1072

Briggs ADM, Mytton OT, Kehlbacher A, Tiffin R, Rayner M, Scarborough P (2013) Overall and income specific effect on prevalence of overweight and obesity of 20% sugar sweetened drink tax in UK: econometric and comparative risk assessment modelling study. BMJ 347:f6189. https://doi.org/10.1136/bmj.f6189

Chatelan A, Rouche M, Kelly C et al (2023) Tax on sugary drinks and trends in daily soda consumption by family affluence: an international repeated cross-sectional survey among European adolescents. Am J Clin Nutr 117(3):576–585. https://doi.org/10.1016/J.AJCNUT.2023.01.011

Mozaffarian D, Afshin A, Benowitz NL et al (2012) Population approaches to improve diet, physical activity, and smoking habits: a scientific statement from the American Heart Association. Circulation 126(12):1514–1563. https://doi.org/10.1161/CIR.0b013e318260a20b

Shangguan S, Mozaffarian D, Sy S et al (2021) Health impact and cost-effectiveness of achieving the national salt and sugar reduction initiative voluntary sugar reduction targets in the United States: a microsimulation study. Circulation 144(17):1362–1376. https://doi.org/10.1161/CIRCULATIONAHA.121.053678

Peñalvo JL, Cudhea F, Micha R et al (2017) The potential impact of food taxes and subsidies on cardiovascular disease and diabetes burden and disparities in the United States. BMC Med 15(1):208. https://doi.org/10.1186/s12916-017-0971-9

World Cancer Research Fund International (2023) NOURISHING and MOVING policy database. Available from https://policydatabase.wcrf.org. Accessed 11 November 2023

Bíró A (2015) Did the junk food tax make the Hungarians eat healthier? Food Policy 54:107–115. https://doi.org/10.1016/j.foodpol.2015.05.003

Carriedo A, Lock K, Hawkins B (2020) Policy process and non-state actors’ influence on the 2014 Mexican soda tax. Health Policy Plan 35(8):941–952. https://doi.org/10.1093/HEAPOL/CZAA060

Ng SW, Colchero MA, White M (2021) How should we evaluate sweetened beverage tax policies? A review of worldwide experience. BMC Public Health 21(1):1941. https://doi.org/10.1186/s12889-021-11984-2

Csakvari T, Elmer D, Nemeth N, Komaromy M, Mihaly-Vajda R, Boncz I (2023) Assessing the impact of Hungary’s public health product tax: an interrupted time series analysis. Cent Eur J Public Health 31(1):43–49. https://doi.org/10.21101/cejph.a7284

Capacci S, Allais O, Bonnet C, Mazzocchi M (2019) The impact of the French soda tax on prices and purchases. An ex post evaluation. PLoS One 14(10):e0223196. https://doi.org/10.1371/JOURNAL.PONE.0223196

Salgado Hernández JC, Ng SW, Colchero MA (2023) Changes in sugar-sweetened beverage purchases across the price distribution after the implementation of a tax in Mexico: a before-and-after analysis. BMC Public Health 23(1):1–9. https://doi.org/10.1186/S12889-023-15041-Y/TABLES/2

Colchero MA, Molina M, Guerrero-López CM (2017) After Mexico implemented a tax, purchases of sugar-sweetened beverages decreased and water increased: difference by place of residence, household composition, and income level. J Nutr 147(8):1552–1557. https://doi.org/10.3945/jn.117.251892

Colchero MA, Popkin BM, Rivera JA, Ng SW (2016) Beverage purchases from stores in Mexico under the excise tax on sugar sweetened beverages: observational study. BMJ 352:h6704. https://doi.org/10.1136/BMJ.H6704

Sánchez-Romero LM, Canto-Osorio F, González-Morales R et al (2020) Association between tax on sugar sweetened beverages and soft drink consumption in adults in Mexico: open cohort longitudinal analysis of Health Workers Cohort Study. BMJ 369:m1311. https://doi.org/10.1136/BMJ.M1311

Barrientos-Gutierrez T, Zepeda-Tello R, Rodrigues ER et al (2017) Expected population weight and diabetes impact of the 1-peso-per-litre tax to sugar sweetened beverages in Mexico. PLoS One 12(5):e0176336. https://doi.org/10.1371/journal.pone.0176336

Goiana-Da-Silva F, Severo M, Cruz e Silva D et al (2020) Projected impact of the Portuguese sugar-sweetened beverage tax on obesity incidence across different age groups: a modelling study. PLoS Med 17(3):e1003036. https://doi.org/10.1371/JOURNAL.PMED.1003036

Summan A, Stacey N, Birckmayer J, Blecher E, Chaloupa FJ, Laxminarayan R (2020) The potential global gains in health and revenue from increased taxation of tobacco, alcohol and sugar-sweetened beverages: a modelling analysis. BMJ Glob Health 5(3):e002143. https://doi.org/10.1136/BMJGH-2019-002143

Eyles H, Ni Mhurchu C, Nghiem N, Blakely T (2012) Food pricing strategies, population diets, and non-communicable disease: a systematic review of simulation studies. PLoS Med 9(12):e1001353. https://doi.org/10.1371/journal.pmed.1001353

Harding M, Lovenheim M (2017) The effect of prices on nutrition: comparing the impact of product- and nutrient-specific taxes. J Health Econ 53:53–71. https://doi.org/10.1016/j.jhealeco.2017.02.003

Thow AM, Downs S, Jan S (2014) A systematic review of the effectiveness of food taxes and subsidies to improve diets: understanding the recent evidence. Nutr Rev 72(9):551–565. https://doi.org/10.1111/NURE.12123

Andreyeva T, Marple K, Marinello S, Moore TE, Powell LM (2022) Outcomes following taxation of sugar-sweetened beverages: a systematic review and meta-analysis. JAMA Netw Open 5(6):e2215276. https://doi.org/10.1001/jamanetworkopen.2022.15276

Backholer K, Sarink D, Beauchamp A et al (2016) The impact of a tax on sugar-sweetened beverages according to socio-economic position: a systematic review of the evidence. Public Health Nutr 19(17):3070–3084. https://doi.org/10.1017/S136898001600104X

Vall Castelló J, Lopez Casasnovas G (2020) Impact of SSB taxes on sales. Econ Hum Biol 36:100821. https://doi.org/10.1016/j.ehb.2019.100821

Secretaría de Hacienda y Crédito Público (2016) Decreto por el que se expide la ley de ingresos de la Federación para el Ejercicio Fiscal de 2017. Available from http://www.diputados.gob.mx/LeyesBiblio/abro/lif_2017/LIF_2017_orig_15nov16.pdf. Accessed 11 November 2023 [article in Spanish]

World Health Organization (2023) Health taxes. Available from http://www.who.int/health-topics/health-taxes#tab=tab_1. Accessed 17 September 2023

United Nations General Assembly (2015) Transforming our world: the 2030 agenda for sustainable development. Available from https://sdgs.un.org/2030agenda. Accessed 11 November 2023

World Health Organization (2022) WHO manual on sugar-sweetened beverage taxation policies to promote healthy diets. Available from: http://www.who.int/publications/i/item/9789240056299. Accessed 17 September 2023

Popkin BM, Hawkes C (2016) Sweetening of the global diet, particularly beverages: patterns, trends, and policy responses. Lancet Diabetes Endocrinol 4(2):174–186. https://doi.org/10.1016/S2213-8587(15)00419-2

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Author’s relationships and activities

The author declares that there are no relationships or activities that might bias, or be perceived to bias, their work.

Contribution statement

The author was the sole contributor to this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Peñalvo, J.L. The impact of taxing sugar-sweetened beverages on diabetes: a critical review. Diabetologia 67, 420–429 (2024). https://doi.org/10.1007/s00125-023-06064-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00125-023-06064-6