Abstract

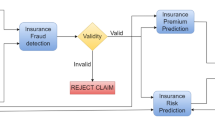

Private insurance is already one of the sectors with the greatest growth potential. For the majority of high-value assets today, including houses, jewelry, cars, and other valuable items, there are insurance solutions available. To maximize profits while handling client claims, insurance firms are leading have adopted cutting-edge operations, procedures, and mathematical models for estimating risks and serving customer best interests, while also maximizing profits. In this work, we aim to develop a machine learning-based automated framework that minimizes human involvement, protects insurance operations, identifies high-risk consumers, uncovers false claims, and lowers financial loss for the insurance industry. This framework consists of fraud detection followed by risk prediction and premium prediction. We trained and tested different machine learning approaches for each of the three insurance processing tasks; the observations are presented in this article.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Yang, W., & Zhang, S. (2021). Research on bootstrapping algorithm for health insurance data fraud detection based on decision tree. In 2021 7th IEEE international conference on big data security on cloud (pp. 57–62). NY, USA. https://doi.org/10.1109/BigDataSecurityHPSCIDS52275.2021.00021.G.

Healthcare Provider Fraud Detection Analysis Dataset. https://www.kaggle.com/datasets/rohitrox/healthcare-provider-fraud-detection-analysis?select=Train_Inpatientdata-1542865627584.csv

Sun, C., Li, Q., Li, H., Shi, Y., Zhang, S., & Guo, W. (2019). Patient cluster divergence based healthcare insurance fraudster detection. IEEE Access, 7, 14162–14170. https://doi.org/10.1109/ACCESS.2018.2886680

Badriyah, T., Rahmaniah, L., & Syarif, I. (2018). Nearest neighbour and statistics method based for detecting fraud in auto insurance. In ICAE (pp. 1–5). Indonesia, Batam.

Muller, D., & Te, Y.-F. (2017). Insurance premium optimization using motor insurance policies-A business growth classification approach. In Proceedings on IEEE international conference on big data (big data) (pp. 4154–4158).

David, M. (2015). Auto insurance premium calculation using generalized linear models. Procedia Economics and Finance.

Dhieb, N., Ghazzai, H., Besbes, H., & Massoud, Y. (2020). A secure AI-driven architecture for automated insurance systems: Fraud detection and risk measurement. IEEE Access. https://doi.org/10.1109/ACCESS.2020.2983300

Goyal, A., Elhence, A., Chamola, V., & Sikdar, B. (2021). A blockchain and machine learning based framework for efficient health insurance management. In SenSys ’21: Proceedings of the 19th ACM conference on embedded networked sensor systems.

Anirban Datta. US Health Insurance Dataset. https://www.kaggle.com/datasets/teertha/ushealthinsurancedataset

Prudential Life Insurance Assessment dataset. https://www.kaggle.com/competitions/prudential-life-insurance-assessment/data

Dutta, K., Chandra, S., Gourisaria, M. K., & Harshvardhan, G. M. (2021). A data mining based target regression-oriented approach to modelling of health insurance claims. In 2021 5th international conference on computing methodologies and communication (ICCMC) (pp. 1168–1175). Erode, India. https://doi.org/10.1109/ICCMC51019.2021.9418038.

Zhang, J., Yang, F., Lin, K., & Lai, Y. (2022). Hierarchical multi-modal fusion on dynamic heterogeneous graph for health insurance fraud detection. In 2022 IEEE international conference on multimedia and expo (ICME), Taipei, Taiwan, 2022 (pp. 1–6). https://doi.org/10.1109/ICME52920.2022.9859871.

Kowshalya, G., & Nandhini, M. (2018). Predicting fraudulent claims in automobile insurance. In ICICCT (pp. 1338–1343). Coimbatore, India.

Jiang, S., & Qian, X. (2022). The impact of commercial insurance on household risk financial asset allocation-study based on CHFS data. In 6th annual international conference on data science and business analytics (ICDSBA). https://doi.org/10.1109/ICDSBA57203.2022.00073.

Luo, S. N., Wu, M., Huang, W. T., & Chen, L. P. (2022). Policyholder behavior prediction Django framework system designed by applying BP neural network. In 2022 2nd International conference on big data, artificial intelligence and risk management (ICBAR). https://doi.org/10.1109/ICBAR58199.2022.00029.

Nemade, S., Kamble, A., Sopal, S., Bhale, P., & Pachghare, V. (2022). Blockchain-based crowdfunding for cyber-product insurance. In 2nd international conference on innovative sustainable computational technologies (CISCT). https://doi.org/10.1109/CISCT55310.2022.10046520.

Moyo, J., Watyoka, N., & Chari, F. (2022). Challenges in the adoption of artificial intelligence and machine learning in Zimbabwe’s insurance industry. In 1st Zimbabwe conference of information and communication technologies (ZCICT). https://doi.org/10.1109/ZCICT55726.2022.10045910

Wȩglarczyk, S. (2018). Kernel density estimation and its application. In ITM web of conferences, January 2018.

Haitovsky, Y. (1969). Multicollinearity in regression analysis: Comment. The Review of Economics and Statistics.

Mishra, S., Sarkar, U., & Datta, S. (2017). Principal component analysis. International Journal of Livestock Research.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Sreegeethi, D., Gorti, S.S., Leela Akshaya, T., Sowmya Kamath, S. (2024). Automated Health Insurance Management Framework with Intelligent Fraud Detection, Premium Prediction, and Risk Prediction. In: Nanda, S.J., Yadav, R.P., Gandomi, A.H., Saraswat, M. (eds) Data Science and Applications. ICDSA 2023. Lecture Notes in Networks and Systems, vol 818. Springer, Singapore. https://doi.org/10.1007/978-981-99-7862-5_21

Download citation

DOI: https://doi.org/10.1007/978-981-99-7862-5_21

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-99-7861-8

Online ISBN: 978-981-99-7862-5

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)