Abstract

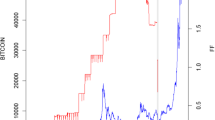

The Federal Reserve has raised interest rates four times in a row, twice by 75 basis points from June to July, totaling 150 basis points, since 2022 in an effort to reduce the rising inflation in the United States. This is the most important development since 1980. After the rate hike in July, the policy rates of the United States have reached a range from 2.25% to 2.50%, which is widely considered by dozens of people as a “neutral rate” level. Since the U.S. dollar is the dominant international currency and controls the world’s financial, monetary, and trade settlement systems, the Fed’s interest rate hike has an impact on the world financial market. Bitcoin has become a financial asset traded on a global scale and has gradually become popular in financial market transactions. With the Fed’s rate hike, a considerable number of investors in the cryptocurrency market are very concerned about the impact of the Fed rate hike on Bitcoin, and then reassess the risks to ensure their own interests. This paper searches and obtains data on the Bitcoin price and USD/CNY exchange rate from June 1, 2021 to August 15 2022. This paper uses VAR and ARMA-GARCH models to study the impact of the USD-CNY exchange rate changes on the rate of return and volatility of Bitcoin.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Carpenter, S., Demiralp, S., Ihrig, J., Klee, E.: Analyzing federal reserve asset purchases: from whom does the fed buy? J. Bank. Finance 52, 230–244 (2015)

Stawska, J., Miszczyńska, K.: The impact of the European central bank’s interest rates on investments in the Euro Area. Gospodarka Narodowa Pol. J. Econ. 291, 51–72 (2017)

Kontonikas, A., MacDonald, R., Saggu, A.: Stock market reaction to fed funds rate surprises: state dependence and the financial crisis. J. Bank. Finance 37, 4025–4037 (2013)

Ciaian, P., Rajcaniova, M., Kancs, D.A.: The economics of bitCoin price formation. Appl. Econ. 48, 1799–1815 (2016)

Estrada, J.C.S.: Analyzing bitcoin price volatility, University of California, Berkeley (2017). http://www.smallake.kr/wp-content/uploads/2017/12/Thesis_Julio_Soldevilla.pdf

Investing homepage (2022). https://cn.investing.com/currencies/usd-cny/historical-data and https://cn.investing.com/crypto/bitcoin/historical-data

Kotzé, K.: Vector autoregression models. https://kevinkotze.github.io/ts-7-var/

Zha, T.: Vector autoregressions. In: Durlauf, S.N., Blume, L.E. (eds.) The New Palgrave: Dictionary of Economics, pp. 6962–6969. Palgrave Macmillan UK, London (2008). https://doi.org/10.1007/978-1-349-58802-2_1788

Md Ghani, I.M., Rahim, H.A.: Modeling and forecasting of volatility using arma-garch: case study on Malaysia natural rubber prices. IOP Conf. Ser. Mater. Sci. Eng. 548(1), 012023 (2019). https://doi.org/10.1088/1757-899X/548/1/012023

Erdas, M.L., Caglar, A.E.: Analysis of the relationships between bitcoin and exchange rate, commodities and global indexes by asymmetric causality test. Eastern Journal of European Studies 9(2) (2018)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Cheng, Z. (2023). The Time-Varying Impact of the Federal Reserve Rate Hike on Bitcoin. In: Dang, C.T., Cifuentes-Faura, J., Li, X. (eds) Proceedings of the 2nd International Conference on Business and Policy Studies. CONF-BPS 2023. Applied Economics and Policy Studies. Springer, Singapore. https://doi.org/10.1007/978-981-99-6441-3_26

Download citation

DOI: https://doi.org/10.1007/978-981-99-6441-3_26

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-99-6440-6

Online ISBN: 978-981-99-6441-3

eBook Packages: Political Science and International StudiesPolitical Science and International Studies (R0)