Abstract

From the perspective of policy tools to promote carbon neutrality, constructing a unified national carbon market may be one of the most important measures in 2021. The carbon market has drawn a growing amount of attention since China announced its aim to reach carbon emission peak before 2030 and achieve carbon neutrality before 2060. The Ministry of Ecology and Environment stated in September 2020 that the power generation industry is ready to be included in the national carbon market. Under these circumstances, China should accelerate the establishment of the carbon market over the 14th Five-year Plan period to include other key industries (e.g., the steel, cement, and electrolytic aluminum industries) in the market. As the official launch of the national carbon market is approaching, the topic of carbon market is ever-present in the discussions of policy instruments in promoting carbon neutrality. The carbon market appears to have become key to formulating policies for carbon neutrality. Such an inevitable move may imply that several important issues have been ignored, e.g., is it appropriate to include several different industries in one single carbon market? After carbon emission permits are granted to different production activities, should a unified carbon price be levied against different production activities? Would a unified carbon market produce any unexpected spillover effects? In addition to the carbon market, are there any similar or different carbon neutrality policy instruments that could be considered as more suitable choices? In this chapter, we analyze these issues based on the green premium concept and we draw several conclusions: (1) The power and steel industries are two major industries that are suitable for inclusion in the carbon market, while the carbon tax-based carbon pricing mechanism may be more suitable for the transportation, chemicals and construction materials industries; (2) Unified carbon pricing may not be appropriate, and differentiated carbon pricing should be adopted; (3) Compared with theoretical discounting of the social cost of carbon, “parity carbon cost” may be more suitable to be used as a reference for setting carbon prices in reality. In order to explain the logic behind these conclusions, we also discuss the following issues in this chapter: (1) We distinguish between carbon price concepts related to carbon neutrality, offering the basis for further discussion; (2) We analyze problems in the logic behind the idea of a unified carbon price, and we propose the idea of differentiated carbon prices based on the concept of net social cost; (3) From the perspective of green premium, we explore more realistic calculation methods for differentiated carbon prices; (4) Based on the green premium concept, we discuss carbon pricing mechanisms that are suitable for different industries, and the establishment of trading mechanisms in the carbon market; (5) We discuss the possibility of lowering the green premium from the perspective of social governance.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

3.1 Unified Carbon Price: Social Cost or Net Social Cost?

There are many similar carbon price concepts in different contexts, such as in theories, in policy discussions and on daily basis. The connotations of these concepts are clear in their respective contexts, but some ambiguities may arise in cross-contextual discussions, especially in the discussions of carbon pricing.Footnote 1 Therefore, the World Bank has distinguished and defined different concepts related to carbon price.Footnote 2 Among these concepts, carbon price refers to the price determined by transactions in the carbon market, as well as the carbon tax rate. Unless otherwise specified, the carbon cost in this chapter refers to the “social cost of carbon”, which is the discounted value of the social cost of carbon in each period as Nordhaus et al. measured. US President Biden also used this definition of the carbon price when he announced the social cost of carbon calculation immediately after he took office.

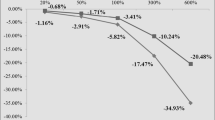

In fact, this is not the first time the US government calculated carbon cost. The Obama administration calculated carbon cost in 2010, and carbon cost in 2020 was about US$26 per tonne of carbon based on the calculation back thenFootnote 3 and US$42 per tonne of carbon based on the updated calculation in 2016 (Fig. 3.1). In 2017, the Trump administration updated the calculation of carbon cost again, and estimated the carbon cost in the US at only around US$7 per tonne of carbon.Footnote 4 US policymakers who oppose or advocate emission reductions both support their views by calculating carbon cost, reflecting the importance of carbon cost for carbon pricing. Since carbon pricing is regarded as the most important policy instrument to achieving carbon neutrality, the calculation of carbon cost can also be considered as an important foundation for carbon neutrality policies to some extent.

Note The “parity carbon cost” is the parity carbon cost in China calculated based on the green premium in 2021. The carbon price (EU ETS) is the arithmetic average of the spot transaction prices in the European Union’s carbon trading market in 2020. The “average carbon tax” is the average value of carbon taxes in each country calculated based on World Bank data in 2020. Source Nordhaus (2016), World Bank, EEX, CICC Global Institute

Carbon cost and carbon price (US dollar per tonne of carbon).Footnote

For the sake of brevity, “tonne of carbon” is used in this chapter to represent “tonne of carbon dioxide.” Unless otherwise stated, carbon prices below are in renminbi terms.

However, policymakers have not reached a consensus on the important fundamental data usage (i.e. carbon cost), and scholars also have different views on the calculation of carbon cost. For example, climate economist William Nordhaus estimated carbon cost at about US$37 per tonne of carbon in 2020.Footnote 6 Nicholas Stern, an economist in the field of carbon cost calculation who hold different views from Nordhaus, estimated the carbon cost at about US$266 per tonne of carbon.Footnote 7 The parity carbon cost in China calculated by us based on the green premium is around Rmb377 (about US$58) per tonne of carbon. Why do different calculation methods derive such different carbon costs for the same carbon emissions? From what perspective should we comprehend carbon cost? Why should we calculate carbon cost from the perspective of green premium? What are the implications for carbon neutrality policies?

To explore these questions, it would be necessary to discuss externalities. In 1920, the British economist Arthur Pigou conducted a groundbreaking study on the issue of externalities. Almost all of the current mainstream carbon cost calculation methods can be traced back to Pigou’s idea of the internalization of social costs. The theory is simple and clear, but the calculation methods at the technical level are very complicated and different. An important difference between Nordhaus and Stern comes from their highly different views on discount rate (see Fig. 3.2). The Obama administration and the Trump administration not only had different views on discount rates but also had different views on the scope of coverage: the former calculated global carbon cost, while the latter only calculated the social cost of carbon in the US.

Note “DICE base” represents the discount rate adopted by Nordhaus in 2016 and the corresponding carbon cost; “Stern” represents the social cost of carbon derived with the discount rate in “The Stern Review”. Source Revisiting the social cost of carbon by William D. Nordhaus, CICC Global Institute

Carbon cost and discount rate.

The Obama administration used three different methods to calculate carbon cost, namely the Dynamic Integrated Climate and Economy (DICE) model, the Policy Analysis of the Greenhouse Effect (PAGE) model and the Climate Framework for Uncertainty, Negotiation, and Distribution (FUND) model. Among them, the DICE model is the most fundamental one. In this endogenous growth model, carbon dioxide affects temperature and thus overall economic output, but it does not factor in the carbon emissions’ impacts on various other economy components. The PAGE model and FUND model make up for this deficiency to a certain extent, and they respectively factor in the structural differences of carbon emissions’ impacts on different geographic regions and different industries.Footnote 8

However, behind these seemingly serious differences, it seems that a question has been intentionally or unintentionally ignored: Should carbon costs be differentiated in different industries? Based on current mainstream calculation methods, there is only one carbon cost among all sectors in an economy. Since carbon cost is an important basis for carbon pricing, such a unified carbon cost calculation that does not factor in differences of industries seems to have produced an important impact on the logic of carbon pricing in reality that a unified carbon cost implies a unified carbon price. For example, as of 2020, the world’s largest carbon trading market, the EU Emissions Trading System (EU ETS), covered 14 industries such as the power and transportation industries, and these industries have a unified carbon price in the same market. There is a similar situation in China. The country’s upcoming national carbon market mainly covers the power industry at present and will also cover industries with high carbon emissions such as the steel, cement, and electrolytic aluminum industries in the future. This seems to mean that these different industries may have a unified carbon price after they are included in the national carbon market.Footnote 9

However, is the idea of a unified carbon price implied by mainstream carbon cost calculation methods appropriate? Pigou’s argument is still useful for thinking about this question. He believes that “All such effects must be included—some of them will be positive, others negative elements— in reckoning up the full physical net product of the marginal increment of any volume of resources turned into any occupation.Footnote 10” In other words, what Pigou is actually discussing is not the social cost, but the net social cost as the difference between social cost and social benefit.

Ronald Coase, another economist who has done in-depth research on externalities, questioned the feasibility of Pigouvian tax in his masterpiece article The Problem of Social Cost (published in 1960), but he clearly wrote: “the problem is to devise practical arrangements which will correct defects in one part of the system without causing more serious harm in other parts.Footnote 11” In other words, Coase’s perspective on externalities is still a concept of net social cost.

Due to the difference between social cost and net social cost, it seems that there should be a certain degree of skepticism about the idea of a unified carbon price. Such a carbon cost analysis based on net social cost rather than social cost could be extended in a more general way. This means that different carbon price levels should also be applied to industries with different social benefits. So, can we infer that it may not be appropriate to calculate the same carbon cost for industries with different net social costs? Then a more practical question may emerge: For carbon pricing in reality, is it appropriate to include industries with different net social costs in a unified carbon market to bear the same carbon price determined by transactions, or is it appropriate to set the same carbon tax rate for different industries with different net social costs?

So far there is a big controversy over the differentiated carbon prices system. There are two major issues. First is the argument about efficiency: why do products such as gas and automobiles use a unified carbon price decided by the market, but products such as the carbon mission rights use differentiated carbon prices? Second is the argument about fairness, which indicates that the differentiated carbon prices violate the principle of fairness, and lead to arbitrage problems such as carbon leakage.

For the first issue, we recommend thinking from the externality perspective. When we talk about ordinary goods such as gas and automobiles, we don’t have to consider the externality issue because the market is efficient for these products, so it is logical to let the market determine the price. However, when carbon emission rights become a special good in an inefficient market, the pricing of such a good needs to consider its externalities. Externalities exist when the free market fails or when the market cannot determine the price, so it is not suitable to compare carbon emission rights with general goods in the market. More importantly, when we consider these externalities, why should we only account for the negative externality and neglect the positive externality? Of course, if we don’t take the externality effect into account, then the social return problem doesn’t exist either, and we can simply use the free market to determine the price for general goods. Thus, an economic activity with externalities that has different net social costs in different industries may require differentiated pricing.

From the perspective of new institutional economics, another problem worth mentioning is that market pricing is not necessarily efficient. Whether we use administrative or market allocation to allocate resources, the transaction cost will greatly affect the efficiency of pricing. For an ordinary good, the market is efficient due to the lack of externalities. Nonetheless, carbon emissions are different. EU ETS was not formed because of the economic incentives. Instead, the establishment of the market itself can be considered as the correction of excessive spontaneous profit-seeking behaviors. Furthermore, the operations of the market mainly rely on the compulsory forces from the government. As a result, the transaction cost is higher under the EU ETS than that of the carbon tax. In this context, it is hard to say the carbon market has higher pricing efficiency than that of the carbon tax.

Therefore, to simply regard carbon emission as an ordinary good, or to overemphasize a unified carbon price may be questionable. If we disregard the fact that the carbon price derives from the externality of carbon emissions, and consider the carbon emission as an ordinary good that lacks externality, it may cause a theoretical dilemma: now that a unified carbon price is justifiable in one economy, why can’t we have a unified carbon price among different economies? On a practical level, if we match the carbon price among developing countries and developed countries, it would impose extensive cost to developing countries. From a solely theoretical point of view, although the social costs imposed to all countries are the same from carbon emissions as a global externality, developing countries have larger populations and more urgent needs to improve their living environments through economic growth. Therefore, the social benefits of carbon emissions for these countries are higher than those of developed countries. This means that although the social cost of the same carbon emissions in different countries is the same, the net social cost of developing countries should be lower. Thus, it is logical to say that simply requiring developing and developed countries to use a single unified carbon price is unreasonable.

For the second question we mentioned above, it involves a value judgement question: what is fairness? Fairness has two perspectives: the private economic perspective and the public economic perspective. We can take one question into consideration: if we see carbon emission price as a punishment, does it mean that carbon emissions from different economic activities should bear various degrees of punishment? For example, let’s compare a person mining bitcoin and a large number of people who burn coal for heating on cold winter days. In this case, both actions create emissions. Should both of them be covered in the carbon market to get the same carbon price and level of punishment? From the social cost perspective, one unit of carbon leads to the same level of harm to society, and thus calls for the same punishment regardless of energy use for heating or bitcoin mining. If they are punished differently, from the private economic perspective, it indeed seems unfair. However, it is obvious that emitting large amount of carbon to “dig” a currency that could have been easily printed produces very different social benefits from saving lives under extreme temperatures. Hence, punishing the two activities in the same way is unfair from the public perspective.

In addition, the so-called carbon leakage seems like an inequality issue caused by the differential price. However, it is one of the most common industrial policies to promote balanced regional development through differential pricing of production factors, such as regional tax incentives, export tax rebates for different industries, and distorting polices as differentiated pricing for inclusive finance. These policies seem to distort the fairness in market competition, but they actually contribute to social fairness in a broader sense. The question is, in reality, how can we achieve optimal carbon pricing arrangements? In the next section, we apply this question to green premium.

3.2 Green Premium and the Choice of Carbon Pricing Mechanisms

As mentioned earlier, it is reasonable to think about carbon pricing in terms of social net cost rather than social cost. However, whether it is based on social cost or net social cost, carbon price is a concept that is theoretically feasible. In reality, it is difficult to calculate and possibly subject to large errors. In addition to the above-mentioned discount rate, the greater dispute lies in how to define the social cost. As Stern has put forward: (1) Causes and consequences of climate change are global, and the economic harm caused by the emission of the same equivalent of carbon dioxide has nothing to do with regions. (2) Greenhouse gases may remain in the atmosphere for hundreds of years and there will be a lag in the impact of accumulated emissions. (3) Greenhouse gases’ potential impacts on human society are uncertain and difficult to estimate.Footnote 12

Even after making various assumptions about the discount rate and social cost, calculation is still very difficult. Taking the calculations by the Obama administration as examples, three models not only simulate the scenarios of three discount rates (5%, 3%, and 2.5%), but the initial settings of each specific calculation model also contain some randomly generated parameters. To alleviate the unreliability of results caused by this, each model has repeated calculations 10,000 times. President Biden intends to spend a year and a half updating the carbon cost calculation.Footnote 13 This not only reflects the importance of carbon cost calculation under mainstream frameworks, but could also be because that the calculation process is highly complicated and uncertain, and requires a high input cost.

It is already so difficult to calculate one unified carbon cost based on social cost. If differentiated carbon costs of various industries are calculated from the perspective of net social cost, the related disputes in definition of carbon costs, and the time and resources required in the calculation process may be much greater than those for the unified carbon cost. However, despite of the difficulty in calculation, the above analysis on net social cost shows that it is indeed necessary to calculate different carbon costs for different industries. Therefore, it is necessary to think about how to calculate differentiated carbon costs in a more feasible way outside the mainstream framework and how to promote it in reality.

There are two ways to set the carbon prices. One method still uses the carbon market as the only pricing mechanism and complemented by operational design to arrive at a differential carbon price, e.g., issuing more quotas for industries with lower net social cost, or transfer the auction revenue to the industries with lower net social costs. Obviously, these approaches contribute to the de facto differential carbon price, but also distort the so-called fair competition. In other words if the distorted mechanism is used to realize the differential carbon price, then the questioning of the differentiated carbon prices system may be untenable in the first place.Footnote 14

The other way is to rethink the single pricing approach relying on carbon market. In this aspect, the green premium could give us some hints. The green premium is essentially a kind of carbon cost parity which requires emitters to pay additional costs for carbon emissions to ensure that the emitters’ production costs are equal to the production costs with the clean energy and put emphasis on using carbon neutrality technologies to solve the problem of carbon emissions in the future.

Therefore, green premium based on reality seems to have greater practical significance than mainstream carbon costs in theory. More importantly, green premium can reflect the policy implications of differentiated carbon costs and differentiated carbon pricing from the perspective of net social cost. Next, we will discuss how to achieve carbon pricing based on the framework of green premium, which mainly includes three aspects: (1) Should different industries adopt different carbon pricing mechanisms? (2) Should different industries have different carbon price levels? (3) If there is a need to set differentiated carbon prices, is there a differentiated carbon price benchmark for each industry?

3.2.1 Pigou Versus Coase: Similarities and Differences Between Carbon Tax and Carbon Market

The theoretical foundations of carbon tax and carbon market, two basic carbon pricing mechanisms, come from Pigou and Coase separately. Although both analyze externalities from the perspective of net social cost, their views on how to realize the internalization of net social cost are not the same. Pigou’s solution is Pigouvian tax. Coase believes that the Pigouvian tax is an idea that is difficult to realize, because it is difficult to know what the right tax rate is. He proposes the pricing of externalities through free-market transactions after clarifying property rights.

In practice, as of 2019, there were 31 carbon trading mechanisms and 30 carbon tax mechanisms implemented or scheduled around the world. Specifically, the representative countries that levy carbon taxes were mainly the Nordic countries like Finland and Norway.Footnote 15 Currently, the largest carbon market in the world is EU ETS, and the Regional Greenhouse Gas Initiative (RGGI) in the US is also a carbon trading mechanism. We analyze the similarities and differences between the two pricing mechanisms from three perspectives, i.e., emission reduction effects, transaction costs, and the use of public revenue. In the end, we explore the applicability of the two pricing mechanisms to China in light of green premiums.

Carbon tax rates in different countries or regions are shown in Fig. 3.3, and prices of carbon emission allowance futures in the EU ETS are displayed in Fig. 3.4.

3.2.1.1 Compared to Carbon Tax, Carbon Trading Has More Certain Effects on Emissions Reduction

Both carbon tax and carbon trading could help reduce carbon emissions by increasing the cost of carbon emissions. However, there are still some differences between the two from the perspective of internal logic of operating mechanisms. Carbon tax is essentially a fixed carbon price determined in advance. Therefore, market participants can form relatively stable expectations for returns on R&D and investment in emissions reduction technologies. The mechanism is conducive to promoting innovation, but it remains uncertain whether such a mechanism can effectively reduce emissions.

Because as long as the benefit of increasing one unit of carbon emissions can cover the cost of carbon tax, enterprises will continue to increase carbon emissions. This situation has also been evidenced by empirical analysis of the emission reductions in Nordic countries such as Sweden and Norway from 1981 to 2007. Compared with the baseline scenario in which no carbon tax is levied, the imposition of carbon tax reduced emissions by approximately 2.8%–5%. In addition, the absolute amount of emissions in the four Nordic countries, i.e., Finland, Denmark, Sweden, and Norway, did not show a significant decline after the imposition of the carbon tax, or the drop was significantly smaller than that after joining the carbon market (Fig. 3.5).

Compared with carbon tax, which lacks constraints on total emissions, the control over total emissions under the carbon trading mechanism provides a better solution in this regard. Since the upper limit of carbon emissions is set in advance, even in the case of an overheating economy, the ultimate amount of carbon emissions is still unlikely to exceed the predetermined cap significantly. Therefore, a big difference between carbon market and carbon tax is that the former provides a relatively definite path to reducing carbon emissions. The EU ETS (Fig. 3.6) and the US RGGI (Fig. 3.7) basically confirm this argument.

However, this does not mean that the carbon trading mechanism is perfect. In fact, compared to carbon tax, as a quantitative carbon pricing mechanism, the carbon market increases the certainty over carbon emission reductions, but creates uncertainties over carbon prices. In a pure carbon market, the supply of carbon emission permits is inelastic. Once economic fluctuations trigger changes in the demand for carbon emission permits, the demand-side shocks will be fully absorbed by carbon prices, which leads to highly volatile carbon prices in the carbon market. Highly volatile carbon prices mean that the expected returns on investment in low-carbon technologies are uncertain; this is not conducive to the development of technologies related to carbon neutrality. The asset yields and standard deviation of the first stage of the EU ETS are shown Fig. 3.8.

EU ETS stage 1 (November 21, 2005–December 31, 2007): yields and standard deviations of several types of assets.Footnote

Yuan Tian, Akimov A, Roca E, et al., 2016, Does the Carbon Market Help or Hurt the Stock Price of Electricity Companies? Further Evidence from the European Context, Journal of Cleaner Production.

3.2.1.2 Compared to Carbon Market, Carbon Tax Mechanism Lowers Transaction Costs

As new institutional economics emphasizes, the operation of the resource allocation mechanism also creates costs. Due to the inconsistent operation logic of the two carbon pricing mechanisms, there is a significant gap between their transaction costs as measured by monitoring, reporting and verification (MRV). As shown in Fig. 3.9, transaction costs in the carbon market are usually higher than those under the carbon tax mechanism. The main reason for such a difference is that the imposition of carbon tax relies on the existing taxation system, so there is no need to build a brand new dedicated MRV system.

Note There are five types of companies participating in the survey: all companies subject to the requirements of the EU carbon tax MRV system, all companies subject to the requirements of the EU ETS MRV system, companies subject to both the EU carbon tax and ETS MRV system requirements, companies that are only subject to the requirements of the EU carbon tax MRV system, and companies that are only subject to the requirements of the EU ETS MRV system. Three types of cost are considered in the survey: the internal costs of management and actual work need to be undertake under MRV, measured by the time and money spent; the external costs, i.e., the costs of consulting services concluded in accordance with MRV regulations, measured by the money spent; capital costs, i.e., the costs of measuring, monitoring, recording, and data storage related to carbon emissions. Source Jessica Coria (2019), Transaction Costs of Upstream Versus Downstream Pricing of CO2 Emissions, CICC Global Institute

MRV cost enterprises need to pay under two carbon pricing mechanisms.

In contrast, the carbon trading market is not an existing market formed spontaneously by profit-seeking economic entities, but a new dedicated market established with mandatory policies, such as legislation, as the institutional basis. Compared to the carbon tax-based pricing mechanism, the effective operation of the carbon trading market as a new deliberately created market requires more market entities besides carbon tax participants to work together, which will generate more coordination and supervision costs. On the one hand, in an artificially created market, the effective operation of the basic system does not depend on the market’s genuine profit-seeking motivation, but on the enforcement of mandatory policies. This may require a large investment of resources. For example, the carbon emission allocation system, regardless of free allocation or fee-based, requires sufficient resources to monitor the process. Otherwise, the allocation process could easily become inefficient. On the other hand, in the carbon market, market participants not only comprise governments, carbon-emitting firms, and exchanges which serve as the infrastructure, but also intermediary institutions, a large number of institutional investors, and even individual investors introduced to improve pricing efficiency. In addition to spot products, there are also products such as futures and options. This means that the carbon market needs a new tailored MRV system to strengthen the supervision over participating entities. Increased interactions between participants also suggest higher transaction costs.

3.2.1.3 Distribution of Carbon Pricing Revenue: Carbon Tax Could Promote Fairness, While Carbon Trading Focuses More on Enhancing Efficiency

Regardless of whether the carbon tax or the carbon trading mechanism is adopted, there will be a carbon emission price. This, coupled with the transaction costs involved in the operations of the pricing mechanism, will cause two problems, i.e., weakening competitiveness of enterprises at the micro level, and carbon leakage at the macro level. A possible solution to these problems is to use the public revenue from carbon pricing reasonably. Public revenue is reflected as the government’s tax revenue under the carbon tax mechanism, and the government’s public revenue from the auction of carbon emission permits under the auction system. Theoretically, although these two types of revenues flow into the government through different channels, both can be used to solve the issues of weakening corporate competitiveness and carbon leakage caused by carbon pricing.

However, in practice, the use of public revenues from carbon taxes and the carbon market can still be somewhat different in terms of method of use. Concerning the use of revenues, as auction revenues from the carbon market are not directly included in fiscal revenues like carbon tax, the use of 78% of the auction revenues from the carbon market is subject to constraints in the form of legislation to avoid improper use of public revenues due to lack of fiscal discipline. However, the use of carbon taxes does not face such stringent constraints. Only about 43% of carbon taxes are used in legally stipulated ways. Because carbon taxes enter the government’s fiscal system and are subject to existing fiscal disciplines, compared with the carbon market, there is no such strong need to impose additional constraints.

There are also some differences between the two in the final direction of revenue use. As the carbon tax directly enters the taxation system, they also reflect the attributes of public finance in terms of the final direction of use. More than half of the EU’s carbon tax revenues in 2016 were used to support tax policies such as tax cuts and rebates (Table 3.1), with a portion used to reflect the pursuit of fairness in public finance. For example, Norway reduces taxes from other sectors when levying carbon taxes, and a portion of carbon tax revenues flow to government-funded projectsFootnote 17 such as pension funds. The Canadian province of British Columbia stipulates that carbon tax revenues can be used to support low-income groups in a one-off tax rebate, which works as transfer payment.Footnote 18 The Climate Action Rebate Act of 2019 introduced by the US Congress proposed to return 70% of the carbon fee to low- and middle-income residents through tax rebates.Footnote 19

Unlike carbon taxes with public finance features, revenues from the carbon market are earmarked for specific uses. The auction revenues generated to reduce carbon emissions are mainly used to promote emissions reduction. According to OECD research, 86% of the carbon market’s auction revenues face clear constraints on the direction of revenue use (78% through legal earmarking, 8% through political commitment). The No. 1 expenditure is the promotion of green travel (22%). For example, Canada promotes electrified mobility, Italy subsidizes low-carbon mobility, and California has started to build high-speed rail connecting major cities in the state. The second largest expenditure is to improve energy efficiency. For example, France and Italy have adopted energy-saving renovations for buildings for public institutions such as schools. In addition, a considerable proportion of revenues are used to support the development of renewable energy resources and subsidize green R&D. For example, half of the funds for the UK’s Renewable Heat Incentive in 2016 came from auction revenues.Footnote 20

The use of carbon taxes is not limited to the field of carbon neutrality. Carbon tax revenue has certain characteristics of public finance, and part of it can be used to support tax cuts in other areas, or transfer payments, etc., helping to promote fairness. Revenues generated by auctions in the carbon market are from carbon reduction, and used on carbon reduction. Expenditure mainly focuses on improving the efficiency of carbon neutrality, and to a certain extent, it helps reduce sharp price fluctuations’ negative impacts on green investment and reduce the lack of motivation to innovate.

3.2.2 Carbon Pricing from the Perspective of Green Premium: Carbon Market to Be the Mainstay, with Carbon Tax as a Complement

Current choices of carbon pricing mechanisms seem to only focus on the share of emissions and emphasize the restriction of high-emission industries through the carbon market, which does not meet the requirement of differentiated carbon prices from the perspective of net social cost. Moreover, carbon tax and carbon pricing mechanisms have their respective advantages and disadvantages from the perspective of comprehensive emission reduction effects, transaction costs, and the use of public revenues, and there is no definite conclusion that one is better than the other (Table 3.2). As shown in the table below, it seems that carbon trading is indeed an ideal choice from the perspective of increasing the certainty of emission reductions alone. However, this also means that higher transaction costs may need to be paid

, and in a society where the gap between the rich and the poor is widening, the opportunity to promote fairness through carbon tax would thus be lost.

More importantly, restricting carbon emissions through carbon market means that related industries will face greater uncertainty in carbon prices, which is less conducive to green investment and technological progress than under carbon tax. From the perspective of achieving carbon neutrality, carbon pricing is certainly one of the most important policy measures, but technological progress may be more decisive for ultimate success. In this sense, it is necessary for us to re-examine the logic of achieving carbon pricing through carbon market alone.

In this regard, the calculation of green premium can still give us some meaningful inspirations. The significance of green premium for carbon pricing is not only to support the concept of differentiated carbon prices under the net social cost theory, but also to measure the maturity of carbon neutrality technologies in various industries. Generally speaking, if an industry’s green premium is high, it means that the industry’s carbon neutrality technologies are not mature enough and that the industry is in urgent need of promoting technological innovation. In this way, we can think about how to choose a carbon pricing mechanism from the dimension of green premium and share of emissions, to make better use of the advantages of the two pricing mechanisms to create a policy combination that is more conducive to promoting carbon neutrality in related industries.

Specifically, from the perspective of choosing carbon pricing mechanism, the above-mentioned 8 industries can be classified into 4 categories: the power and steel industries with high emissions and low green premiums, the construction material industry with high emissions and high green premiums, the transportation and chemical industries with low emissions and high green premiums, and the nonferrous metals, petrochemicals, and the papermaking industries with low emissions and low green premiums.

For the power and steel industries with high emissions and low green premiums, the two industries respectively have a green premium of 17% and 15.4%. This implies that carbon neutrality technologies in the two industries are relatively mature from an economic perspective, and the needs for technological innovation in these industries are not as urgent as those in industries with high green premiums. At the same time, emissions of these two industries account for 44% and 18% of total emissions, respectively, and their combined emissions account for 62% of the total (Fig. 3.10). Therefore, the power and steel industries are more suitable for adopting the carbon market-based carbon pricing mechanism. Such a carbon pricing mechanism can effectively promote the reduction of overall emissions, and there is no need to worry too much about the fact that innovation incentives are weakened under uncertain carbon prices.

As shown in Fig. 3.11, the green premium ratios of the low-emission, high-premium transportation and chemical industries in 2021 are 68% and 53% respectively, indicating that carbon neutrality technologies in these two industries have a long way to go before reaching maturity, and there is an urgent need to promote related research and development and technological progress. In the meantime, the combined emissions of these two industries account for only 10% of total emissions. This means that even if restrictions on total emissions are imposed on these two industries, their contribution to overall emissions reduction may not be as obvious as that of the power and steel industries. Meanwhile, highly volatile carbon prices in the carbon market may not be conducive to the technological progress in the transportation and chemical industries. Therefore, weighing the pros and cons, it may be more suitable to adopt the carbon tax-based carbon pricing mechanism for the transportation and chemical industries with low emissions and high green premiums. The construction material industry’s emissions account for 12.6% of the total, ranking No. 3 among the 8 industries and roughly near the average level of 11%. In the meantime, the industry’s green premium is as high as 138%, much higher than the 68% of the transportation industry, which ranks No. 2. Relatively speaking, the construction material industry needs more incentives for innovation and technological progress. Therefore, the carbon tax-based carbon pricing mechanism may also be suitable for the construction material industry.

As for the nonferrous metals, petrochemicals, and papermaking industries, their emissions account for 0.68%, 1.46%, and 0.26% of the total, respectively, and the green premiums in these three industries are 3.7%, 7.4%, and 10.9%. As their green premiums and share of emissions are relatively low, it seems that either pricing mechanism can work in the three industries. However, considering the transaction cost of the emission market is much higher than the carbon tax, from the perspective of reducing the unnecessary burden of emission reduction on companies, the carbon tax is an ideal choice.

3.2.3 Establishing a Carbon Market Trading Mechanism with Auctions and Futures at the Core

The analysis based on green premium shows that the power and steel industries are more suitable for adopting the carbon market-based carbon pricing mechanism, which together account for 62% of total emissions. Therefore, although the carbon market is not suitable to be the sole pricing mechanism, it is indeed the most important carbon pricing mechanism. To deal with issues like price uncertainty and insufficient innovation incentives, we recommend building an carbon market trading mechanism with “auction + carbon futures”, implementing an auction-based mechanism in the allowances allocation and introduce options, futures and other derivatives in trading procedure.

3.2.3.1 Allocation of Emission Allowances: We Should Gradually Increase the Proportion of Paid Allocation via Auctions

According to the Coase Theorem, in a market mechanism with transaction costs, the initial allocation of property rights is directly related to the efficiency of market transaction. Therefore, whether the allocation of carbon emission allowances is reasonable provides the basis for the effective operation of the entire carbon market. In theory, there are mainly two ways of allocating carbon emission allowances, namely, free allocation based on the grandfathering method and the benchmarking method, and paid allocation, mainly by auctions.

China released Measures for the Management of Carbon Emission Permits Trading (trial) on October 28, 2020 and proposed to “introduce paid allocation of emission allowances in due course and gradually increase the proportion of paid allocation”. In the document officially released on December 31, 2020, the wording was changed to “free allocation would be the mainstay, and paid allocation can be introduced in a timely manner per relevant government requirements”. Looking at the wording alone, it seems that in the officially released document, greater emphasis is placed on the free allocation-based approach.

At the same time, the US RGGI uses auctions to allocate allowances and EU ETS has mainly adopted the auction approach in its third stage, as paid allocation of emission allowances could help to promote fairness. As mentioned above, the carbon market is a pricing mechanism with relatively high transaction costs. If there is no public revenue from auctions, the government, as a representative of public interest, will pay more using public funds to support the operation of the carbon market. If there is no revenue from auctions to cover the costs, it would be unfair for the public.

More importantly, auctions can help improve pricing efficiency and promote innovation. Regardless of whether the grandfathering method or the benchmarking method is adopted to allocate emission allowances, free emission allowances mean the absence of a price discovery mechanism in the allocation of emission allowances. Participants in the trading of emission allowances would bear all risks in price discovery and volatility. For example, during 2009–2013 when the EU ETS mainly focused on free allocation, the problem of excessive free allocations often occurred due to the lack of price signals in free allocation, which at one time led to a sharp drop in carbon prices and affected market activity.

In terms of mitigating the carbon market’s adverse impact on innovation, it is more important to establish a price stabilization mechanism based on auctions and support renewable energy investment and green R&D through revenues from auctions. For example, in the EU ETS, if the auction clearing price is lower than the reserve price, the auction is cancelled, and a new auction is held.Footnote 21 In the RGGI in the US, the upper and lower limits of auction clearing prices are set through two different mechanisms: cost containment reserve (CCR) and emissions containment reserve (ECR). When the auction clearing price exceeds the trigger price, regulators release the CCR allowances to make the auction clearing price the CCR trigger price. When all the CCR allowances specified by policies are released, CCR allowances are no longer be released even if the auction clearing price is higher than the CCR trigger price; when the auction clearing price is lower than the ECR trigger price, regulators withdraw part of the auction allowances to make the auction clearing price the ECR trigger price.Footnote 22

3.2.3.2 Emission Allowances Trading: Introduction of Futures and Other Financial Derivatives Should Be Taken into Consideration

As mentioned above, due to the low supply elasticity of carbon emission permits, the relatively large volatility of carbon prices has become a significant problem in the carbon market. How to control excessive volatility in carbon prices has also become one of the core issues in the design of the trading mechanism. The Measures for the Management of Carbon Emission Permits Trading released on December 31, 2020 proposed that trading of carbon emission permits should be conducted through a national carbon emission permits trading system, and agreed transfer, one-way bidding or other methods that meet requirements could be adopted in the system; excessive speculative trading behavior should be prevented. Judging from the previous pilot projects in 8 provinces and municipalities in China, control on spot prices of transactions such as upper and lower limits on price fluctuations is the main way to prevent excessive fluctuations in carbon trading prices. Only the Shanghai Environment and Energy Exchange has launched forward contracts for carbon, but trading of financial derivative products for carbon is not due to constraints from China’s carbon market not yet reaching maturity.

In fact, setting price limits for the spot market is just a way of delaying the release of real price signals and it is not a truly effective price stabilization mechanism, nor is it an effective way to help relevant companies avoid the risk of price fluctuations. Looking at EU ETS as an example, the EU launched a carbon futures product linked to the European Union Allowance (EUA) in April 2005, and a EUA options product in October 2006. In March and May 2008, carbon futures and options products linked to Certified Emission Reduction (CER) were launched. In 2019, the trading volume of carbon financial derivatives on the European Energy Exchange reached 426mn tonnes, of which the trading volume of EUA futures was 167mn tonnes, while the trading volume of carbon emission allowances in the spot market was only 50mn tonnes.Footnote 23

In fact, financial derivatives such as carbon futures may be more important price risk hedging methods for emitting companies, as carbon emission allowances are a kind of artificially created emission rights product, and there are relatively concentrated delivery deadlines for such products. For companies engaged in production activities, carbon emission allowances as an asset cannot be directly put into production. If held until expiry, they will incur economic costs or opportunity costs, which could put a burden on the liquidity of companies. If carbon futures are introduced, companies will be given a choice: They can choose to sell the carbon emission allowances held by them in the spot market and buy futures for carbon emission allowances. This not only helps them hedge against the risk of price fluctuations, but also helps to unleash the liquidity occupied by carbon emission allowances to support the development of companies. For investors, carbon futures and other financial derivatives with carbon emission allowances as the target have more attributes of financial products than carbon emission allowances in the spot market, which could help attract more financial institutions to trade in the carbon market, and is conducive to improving the liquidity and pricing efficiency of the entire carbon market.

3.3 What Carbon Market Can and Cannot Do: Regional Transfer of Pollutants Under Carbon Trading

This section is co-written by CICC Global Institute and Guojun He, Assistant Professor of the Hong Kong University of Science and Technology. Mr. He is appointed jointly at Division of Social Science, Division of Environment and Sustainability, and Department of Economics at the Hong Kong University of Science and Technology. In addition, he holds a concurrent appointment at Energy Policy Institute at the University of Chicago (EPIC) and serves as the research director of its China center (EPIC-China).

A unified carbon market can help reduce the distortions caused by externalities of carbon emissions and improve the overall welfare of the country. However, it may also cause some unexpected problems in absence of other complementary policies. The strong correlation between emissions of carbon dioxide and air pollutants will lead to changes in the environmental quality in different regions after the establishment of the national carbon market, and may affect the benefits brought by the establishment of the carbon market in two specific aspects.

First, from a national point of view, for the same pollutant, even if the correlation between carbon dioxide and air pollutant emissions is positive, the overall carbon emission reduction may actually lead to an increase in the ultimate volume of pollutant emissions due to the differences in the elasticity coefficients between carbon and pollutant emissions in different provinces.

Second, from a regional (inter-provincial) perspective, when the carbon emissions of a region increase or decrease, emissions of air pollutants in the region are likely to change simultaneously due to the positive correlation between pollutants and emissions. However, as a kind of greenhouse gas, carbon dioxide is completely different from traditional air pollutants. Specifically, the externality of greenhouse gases is global, and greenhouse gases affect the changes in temperature of the entire planet and thus the welfare of all of humanity. However, the externality of air pollutants is regional, and emissions of air pollutants in a region mainly affect the region alone (transboundary air pollution does exist but its externality will be greatly reduced with the increase of distance). Therefore, if a province substantially increases its carbon emissions through emission permits trading, air pollutants that move along with carbon emissions have a great impact on the province’s environment.

For example, we estimated changes in sulfur dioxide emissions in each province based on the changes in carbon emissions and the correlation coefficient between carbon and sulfur dioxide emissions under a unified carbon trading market. If carbon intensity drops by 4.5%, not all regions see increasing sulfur dioxide emissions when carbon emissions in these regions increase. On the contrary, carbon emission permits trading could lead to a decrease in sulfur dioxide emissions in some regions. Regions such as Henan in central China and Sichuan and Yunnan in western China have lower marginal costs for emission reduction. By selling carbon emission permits, sulfur dioxide emissions could decline by more than 10,000 tonnes in all these regions. However, in the Beijing-Tianjin-Hebei region and coastal regions, we can generally observe an increase in sulfur dioxide emissions. Combined with the above figure, we can see that if carbon emissions increase by about 2% under this scenario, sulfur dioxide emissions are likely to increase by more than 10% nationwide. Under strict policy constraints (the 7.5% scenario), sulfur dioxide emissions in coastal regions of eastern China and regions of central China would be reduced substantially. However, in the Beijing-Tianjin-Hebei region and a few provinces in western China, sulfur dioxide emissions would still increase. In particular, it can be seen that regions with increasing sulfur dioxide emissions would be concentrated in some regions of northern China such as the Beijing-Tianjin-Hebei region, where environmental pollution is more serious at present. For regions in southern China with better environmental conditions, carbon market could further improve the local environment. The above results may have two implications.

First, the movement of carbon emissions may cause unexpected movement of pollution, which could lead to distortions in pollutant emissions. The carbon market optimizes the allocation of cross-industry and cross-regional carbon resources in a market-based way so as to allow industries with higher emission reduction costs to reduce emissions less and encourage those with lower emission reduction costs to reduce emissions more, hence reducing distortions in carbon emissions. Corresponding to the carbon market is the potential pollutants market. In the absence of a pollutants market, if carbon emissions and pollutant emissions are highly correlated, but as the cost of pollutant emission reduction is inconsistent with the cost of carbon dioxide emission reduction, it may cause industries with higher pollutant emission reduction costs to reduce emissions more, and those with lower pollutant emission reduction costs to reduce emissions less. A certain degree of pollutants emission distortion cannot be avoided. To solve such problems, it is necessary to correctly evaluate pollutants emission reduction cost, understand the substitutive and complementary relationships between pollutants and carbon emission reduction costs and between emission reduction costs of different pollutants, and use the appropriate methods to coordinate the relationship between the carbon market and the potential pollutants market.

Second, there may be lack of compatibility in incentives between the national unified carbon market and environmental policies. At the national level, due to the heterogeneity of the relationship between carbon emissions and pollutants in different regions, increasing (or decreasing) total carbon emissions in a national unified carbon market does not mean that the total volume of pollutants in the country will increase (or decrease). At the regional level, greenhouse gas emissions are a global problem, while pollutant emissions are a local problem. The central government and local governments may have different preferences and requirements for regulatory policies on these two types of problems, resulting in different regulatory motives. As pollutants and carbon emissions are highly correlated, existing regional environmental policies may affect the carbon market in the form of “cross subsidies”, making carbon emissions subject to both the regulation of the carbon market and the impact of pollutant regulation. Based on the above results, a national carbon market may not be able to promote emissions reduction for all pollutants. More importantly, a national carbon market may exacerbate the air pollution problem in some regions of northern China such as the Beijing-Tianjin-Hebei region, which may be incompatible with many existing environmental protection goals. Therefore, it is necessary to clarify the relationship between various environmental protection policies and climate governance policies to avoid the emergence of many repetitive and contradictory policies, which would not only increase the various transaction costs of companies and administrative costs of the government, but also negatively affect efficiency and welfare levels.

In addition to the contradiction between environmental policies and a unified carbon market, such problems may be widespread in industries and policies related to carbon emissions. For example, in view of power industry emission reduction’s key role in carbon emission reduction, achieving coordinated advancement of the carbon market and the electricity price reform may require prudent design of price mechanisms and the consideration of additional targeted regulatory policies. Therefore, while promoting carbon emission reduction through the carbon market, it is also necessary to jointly analyze the effects of interaction between related markets as soon as possible, assess the true cost of various regulations, and avoid the externalities that are counterproductive to the regulation of a specific market.

3.3.1 Social Governance: A Policy Instrument to Lower Green Premium in Addition to Carbon Pricing

Three Types of Carbon Neutrality Policies and Two Types of Carbon Emissions

Based on the discussion of carbon pricing from the perspective of green premium, we have observed that technological progress is important or even decisive for carbon neutrality. However, according to the Holocene time series data (see Fig. 3.12), the rate of increase in carbon dioxide concentration in the air has accelerated because of the Industrial Revolution, but such an upward trend began when human civilization became increasingly sophisticated starting 6,000–7,000 years ago. In other words, technology has been an important accelerator for the upward trend of greenhouse gas concentration for thousands of years, but the root cause lies in the economic activities of humankind. Looking at the road to carbon neutrality from this perspective, it is important to promote progress in clean technology, but it is also necessary to strengthen social governance that regulates human economic activities.

Source Samantha Bova, Seasonal origin of the thermal maxima at the Holocene and the last interglacial, Nature, 2021, CICC Global Institute

The process of temperature evolution during the Holocene epoch.Footnote

Samantha Bova, Seasonal origin of the thermal maxima at the Holocene and the last interglacial, Nature (2021).

In order to regulate human economic activities, we can take reference from the classification method for environmental protection policies and classify carbon neutrality policy instruments into three types: mandatory policies, price-based policies and advocacy policies. Price-based polices are considered the most important type of carbon neutrality policy. Mandatory policies mainly refer to policies that rely on the government’s compulsory orders or laws and regulations. Such policies include institutionalized formulation and implementation of emission standards and routine administrative intervention for emission behavior. Production shutdown or curtailment and the license plate policy that restricts the use of cars also belong to the category of mandatory policies. Advocacy policies influence human emission behavior via methods such as information disclosures and advocacy targeting public opinions. Such policies are usually not mandatory and offer no material incentives, and they promote carbon neutrality by raising people’s awareness of emission reduction.

Viewing from lowering the green premium, the differences between these three types of carbon neutrality policies are not clear-cut. For example, carbon pricing mechanisms, whether carbon tax or carbon market, must be built on the MRV system based on mandatory policies. If there is no compulsory force to promote the actual implementation of relevant systems and effectively deter violations, the design of carbon pricing mechanisms would be in vain. The same applies to the field of green finance. How to identify and confirm the authenticity of green projects also needs to be established based on a series of rules and regulations. In an economy where the habit of paying for carbon emissions has not been developed, if we want the general public to accept the carbon pricing mechanism as soon as possible and reduce frictions in the operation of the carbon pricing mechanism as much as possible, it would be necessary to step up efforts to advocate and raise the awareness of carbon neutrality among the general public. According to OECD research (2020), 16% of revenues from auctions in the carbon market were invested in carbon neutrality-related education, training and other fields.Footnote 25 Therefore, social governance policies such as mandatory and advocacy policies are also important tools to help to lower the green premium.

Moreover, mandatory and advocacy policies have their own policy implications from the perspective of social governance. Here, we need to distinguish between two types of carbon emission behavior, namely reasonable carbon emissions and unreasonable carbon emissions. So-called reasonable carbon emissions refer to carbon emissions that are necessary for meeting the needs of the survival and development of human society. Without such emissions, human society would suffer relatively serious welfare losses. For example, Japan launched large-scale energy conservation campaigns after the nuclear accident at the Fukushima nuclear power plant, but research indicates that this led to an increase in mortality rate during summer, largely because energy conservation reduced the use of air-conditioning in high-temperature weather.Footnote 26 In this example, if sufficient energy supply was to be provided despite increasing carbon emissions and thereby lower the mortality rate of humans, such carbon emissions can be considered as reasonable carbon emissions. It is more appropriate to use price-based policies to reduce green premiums and promote carbon neutrality for reasonable emission behavior.

So-called unreasonable carbon emissions refer to emissions caused by economic activities that are not necessary for human survival and development. Waste is the most typical type of unreasonable carbon emissions. The waste discussed here includes waste in the physical world such as food waste, which has raised widespread concerns, and waste of financial resources as seen in bitcoin mining (Fig. 3.13). The wasteful behavior in the financial sector could generate large returns, and price-based policies may not be effective enough to curb such behavior; the wasteful behavior in the residential sector involves a wide range of various aspects and pushing price-based policies too hard may cause greater social friction if awareness of carbon neutrality is weak. Therefore, for such unreasonable carbon emissions, it may be more suitable to adopt mandatory or advocacy social governance policies.

Annualized power consumption by bitcoin mining ranks 27th among economies in the world.Footnote

If the annualized electric power consumption by bitcoin mining is regarded as the electric power consumption of an economy, annualized power consumption by bitcoin mining would rank 27th in the world. Power consumption of economies is based on data in 2018, and power consumption by bitcoin is the annualized power consumption data as of February 2021.

3.3.2 Mandatory Policies Can Be Used to Regulate Waste of Financial Resources as Seen in Bitcoin Mining

Due to the low administrative costs of implementation, mandatory policies are the earliest type of environmental protection policies from a global perspective, and also the most common policy instrument for environmental protection in China. Examples of such policies include restrictions on purchasing and driving cars and restrictions on the use of electricity to meet requirements on emissions. However, mandatory policies have also exposed some problems in the long-term process of implementation. Due to information asymmetry, mandatory policies may produce unexpected effects. For example, the use of chlorofluorocarbons (CFCs) has been banned in order to protect the ozone layer, which has promoted the use of hydrochlorofluorocarbons (HCFCs), and this ultimately “unexpectedly” exacerbated the problem of global warming.Footnote 28 Meanwhile, mandatory policies also usually present problems such as lack of openness in the decision-making process, complicated approval process, and overly rigid enforcement process. If policies with such characteristics are applied to reasonable carbon emissions, it may cause additional transaction costs or opportunity costs.

It should be noted that some of the above-mentioned problems are mainly due to the decision-making mechanism of mandatory policies, and this does not mean that mandatory policies are undesirable. In fact, if more opinions from all relevant parties in the decision-making process can be solicited and mandatory policies can be implemented through a rule-based system rather than through discretionary administrative methods, the effect of such policies may be greatly improved. More importantly, although such policies have been criticized for their rigidity and lack of flexibility, they may be an ideal method to deal with unreasonable carbon emission activities such as bitcoin mining.

We assume that bitcoin will become a real currency, and that more and more people will rely on bitcoin mining instead of producing general goods and services to make money. Will this be a waste of social resources?Footnote 29 In fact, bitcoin mining consumes about 130 gigawatt-hours of electricity annually. Given about 0.529kg of carbon dioxide is produced per kilowatt-hour of electricity consumption in China, annual electricity consumption by bitcoin could generate 68.77mn tonnes of carbon dioxide emissions. From the perspective of currency creation, the 68.77mn tonnes of carbon emissions do not need to be generated. In the meantime, bitcoin mining could generate attractive profits, and ordinary price-based policy instruments may not be effective in preventing such wasteful behavior. Therefore, we could consider prohibiting such activities through mandatory policies for unreasonable carbon emissions with financial characteristics such as bitcoin mining.

From the perspective of lowering green premium, mandatory policies also have great significance for the sustainable reduction in green premium in the future. The large-scale use of zero-emission technologies may cause a decline in the demand for emission-generating technologies. For example, large-scale launches of clean-energy power generation projects may affect the demand for thermal power generation and lower the price of fossil energy and the production cost of emission-generating technologies.Footnote 30 This may lead to a rebound in green premium, which could reduce the entire society’s motivation to move towards carbon neutrality. Therefore, it is necessary to define the production supported by emission-generating technologies as unreasonable carbon emissions through administrative orders when it is economically feasible to use zero-emission technologies on a large scale, and to prohibit the re-expansion of the production capacity supported by emission-generating technologies through administrative orders.

3.3.3 Advocacy Policies as Necessary Move to Control Waste of Resources in the Real Economy

In the field of environmental protection, the importance of advocacy policies has been increasingly emphasized globally in recent years. The main reason for this is that policymakers are increasingly aware that whether it is environmental protection in a broad sense or carbon emissions in a narrow sense, it is a problem that involves the entire human race, and it is not only related to the contemporary era but also involves the welfare of humans in the future. It is necessary to raise awareness on environmental protection and emission reduction among the general public. In terms of the nature of means, advocacy policies are less compulsory and binding than mandatory policies, and their effectiveness is generally considered to be lower than material incentive effects of price-based policies. Nonetheless, this does not mean that advocacy policies are ineffective. For example, studies have shown that the automatic disclosure of PM10 concentration data has substantially increased online searches for face masks and air purifiers.Footnote 31 To a certain extent, this reflects environmental protection information disclosure’s effects on people’s behavior by improving the level of welfare as measured by people’s health. More importantly, advocacy policies could help raise the awareness on environmental protection among the general public. This means that subtle influence for a long period of time could promote gradual low-carbon evolution of the utility function among the general public, which improves the acceptance of price-based policies and mandatory policies by the general public, and lays the foundation for promoting price-based policies and mandatory policies.

For China, raising awareness on anti-waste practices among the general public may be an important direction for the use of advocacy policies at present. In fact, waste of resources does not only exist in bitcoin mining in the financial sector, but is even more common in the real economy. If solid waste is used as a measure of waste of resources,Footnote 32 the global volume of solid waste generated in 2016 was as high as 2.01bn tonnes, and the solid waste spread almost all over the world. Such a broad group of waste is very different from a small group of people’s wasteful behavior such as bitcoin mining. China has a large population and the country’s overall waste generation volume is large. However, as GDP per capita in China is not high, the current per capita solid waste generation volume is not at a high level in the country. On the one hand, these characteristics and facts mean that China should adopt policies to control waste at the current stage. This is because the country’s GDP per capita is likely to double in the next 15 years as China gradually grows from an upper middle-income country to a high-income country, implying that China’s per capita solid waste generation volume and total solid waste generation volume are still likely to grow rapidly (Fig. 3.14).

On the other hand, this also means that it may not be suitable to deal with the problem of waste among residents mainly through compulsory policies or incentive price-based policies at the current stage. Looking at waste sorting as an example, compared to developed countries, China’s per capita solid waste generation volume is still at a relatively low level. In the early stage of controlling wasteful and unreasonable carbon emissions by residents, if mandatory or price-based policies are directly used to intervene, either relevant mandatory or price-based policies may become mere formalities, or such policies may easily increase the friction cost of social governance and cannot be sustained for various reasons (e.g., it may be difficult to implement a new policy among the general public, and residents’ awareness of environmental protection needs to be improved further).

Therefore, currently, we can consider using advocacy policies with the main goal of raising residents’ awareness of low carbon emissions as the main methods of low-carbon governance for residents, such as waste sorting. After the awareness of emission reduction gradually increases among the general public, we could then consider converting relevant advocacy policies into institutionalized, mandatory, or price-based policies. In the meantime, according to World Bank statistics, when an economy grows from an upper high-income economy into a high-income economy, there will be two important structural changes in its waste generation. First, the proportion of food waste will drop sharply, but it will remain the largest source of waste. Second, the proportion of paper and cardboard waste will likely double and become the second largest source of waste (Fig. 3.15). This means that China must step up efforts to advocate the collection of sorted food waste and paper and cardboard waste in the process of controlling waste as soon as possible, and gradually promote institutionalized or price-based waste sorting, collection and treatment.

Notes

- 1.

- 2.

World Bank stated in 2019 that “Carbon pricing puts an explicit price on greenhouse gas emissions expressed as a monetary unit per tonne of carbon dioxide equivalent (CO2e). The effective carbon rate is the sum of market-based instruments (specific energy taxes, carbon taxes and carbon emission permit prices) applied to carbon emissions. Explicit carbon pricing meanwhile puts a price directly on greenhouse gas emissions. Two instruments that fall into this category are the carbon tax, which is a price-based instrument and the emissions trading system, which is a quantity-based instrument. Implicit carbon pricing is used in a variety of ways and refers to policies that impose compliance costs (i.e. an implicit price) on activities that emit greenhouse gases. Internal carbon pricing is when organizations assign a monetary value to greenhouse gas emissions in their policy analysis and decision making.”

- 3.

Technical Support Document: Social Cost of Carbon for Regulatory Impact Analysis Under Executive Order 12866, February 2010.

- 4.

Brad Plumer, Trump put a low cost on carbon emissions. Here’s why it matters. The New York Times. August 2018.

- 5.

For the sake of brevity, “tonne of carbon” is used in this chapter to represent “tonne of carbon dioxide.” Unless otherwise stated, carbon prices below are in renminbi terms.

- 6.

William D. Nordhaus, Revisiting the social cost of carbon, November 2016.

- 7.

William D. Nordhaus, Revisiting the social cost of carbon, November 2016.

- 8.

Pigou A C, The Economics of Welfare. Macmillan, New York, 1920: 193–194.

- 9.

The Ministry of Ecology and Environment stated in September 2020 that the power generation industry is ready to be included in the national carbon emissions trading market, and that China should accelerate the establishment of the carbon emissions trading market over the 14th Five-year Plan period to include other key industries (e.g., the steel, cement, and electrolytic aluminum industries) in the market.

Source: http://www.mee.gov.cn/ywdt/hjywnews/202009/t20200927_800752.shtml.

- 10.

Pigou A C, The Economics of Welfare. Macmillan, New York, 1920: 115–116.

- 11.

Coase R H, The Problem of Social Cost, Classic Papers in Natural Resource Economics. Palgrave Macmillan UK, 1960.

- 12.

Nicholas Stern, The Economics of Climate Change the Stern Review, Cambridge University Press 2007.

- 13.

White House, Executive order on protecting public health and the environment and restoring science to tackle the climate crisis, January 20, 2021.

- 14.

As there are opinions oppose to set the differential carbon price mechanism at first.

- 15.

World Bank, State and Trends of Carbon Pricing 2020, 2020, May 27.

- 16.

Yuan Tian, Akimov A, Roca E, et al., 2016, Does the Carbon Market Help or Hurt the Stock Price of Electricity Companies? Further Evidence from the European Context, Journal of Cleaner Production.

- 17.

OECD, The Use of Revenues from Carbon Pricing, 2019.

- 18.

Michael Maiello & Natasha Gural Illustrations by KELSEY DAKE. (n.d.). The Tax that Could Save the World. Retrieved January 31, 2021.

- 19.

https://taxfoundation.org/carbon-tax-bills-introduced-congress/. The bill was not passed.

- 20.

OECD, The Use of Revenues from Carbon Pricing, 2019.

- 21.

EUROPEAN COMMISSION, EU ETS Handbook, 2015.

- 22.

RGGI Inc, RGGI Model Rule, 2017.

- 23.

EEX Group, Annual Report 2019, 2020.

- 24.

Samantha Bova, Seasonal origin of the thermal maxima at the Holocene and the last interglacial, Nature (2021).

- 25.

OECD, The use of revenues from carbon pricing, 2019.

- 26.

Guojun He, Takano Tanaka (2021), Energy Saving May Kill: Evidence from the Fukushima Nuclear Accident, working paper.

- 27.

If the annualized electric power consumption by bitcoin mining is regarded as the electric power consumption of an economy, annualized power consumption by bitcoin mining would rank 27th in the world. Power consumption of economies is based on data in 2018, and power consumption by bitcoin is the annualized power consumption data as of February 2021.

- 28.

Miranda Schreurs: Perspectives on Environmental Governance, Research of Environmental Sciences, Vol.19, Supplement, 2006.

- 29.

PENG Wensheng: Monetary implications of the financial technology, September 2017.

- 30.

If demand for fossil energy continues to shrink, the decline in prices will also cause the industry to spontaneously enter supply-side contraction, which is specifically reflected in the reduction of investment and the degradation of mining technologies. Therefore, in the case of large-scale promotion of zero-emission technologies, upward and downward pressure on prices of fossil energy will both appear. It may be difficult to judge which will become dominant, but in the face of the risk of reversal of downward trend in green premium, it is still necessary to take mandatory prohibitive measures at some stages.

- 31.

Michael Greenstone, Guojun He, Ruixue Jia, Tong Liu, 2020. Can Technology Solve the Principal-Agent Problem? Evidence from China’s War on Air Pollution, Working Papers 2020–87, Becker Friedman Institute for Research in Economics.

- 32.

Strictly speaking, solid waste is not equal to waste of resources, but generally speaking, their changes are mostly in the same direction. Therefore, the waste of resources can be roughly observed by observing the amount of solid waste generated.

- 33.

World Bank: What a Waste 2.0 A Global Snapshot of Solid Waste Management to 2050, published in 2018.

- 34.

World Bank: What a Waste 2.0 A Global Snapshot of Solid Waste Management to 2050, published in 2018.

Author information

Authors and Affiliations

Consortia

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License (http://creativecommons.org/licenses/by-nc-nd/4.0/), which permits any noncommercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if you modified the licensed material. You do not have permission under this license to share adapted material derived from this chapter or parts of it.