Abstract

To reverse the global trends of ecosystem degradation and biodiversity loss, the Convention on Biological Diversity (CBD) was signed in 1992 as a milestone. The Strategic Plan for Biodiversity 2011–2020 issued in the 10th Conference of the parties to the Convention on Biological Diversity (CBD Cop10) in Aichi, Japan, provides 20 targets to halt the loss of biodiversity for the next decade, namely “Aichi targets”. The coming CBD CoP15 to be held in Kunming, China will overview the implementation of the Aichi Targets, summarize the progress of global biodiversity conservation over the past decade and establish the structure and goals for the future 10 years of global biodiversity.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

10.1 Foreword

To reverse the global trends of ecosystem degradation and biodiversity loss, the Convention on Biological Diversity (CBD) was signed in 1992 as a milestone. The Strategic Plan for Biodiversity 2011–2020 issued in the 10th Conference of the parties to the Convention on Biological Diversity (CBD Cop10) in Aichi, Japan, provides 20 targets to halt the loss of biodiversity for the next decade, namely “Aichi targets”. The coming CBD CoP15 to be held in Kunming, China will overview the implementation of the Aichi Targets, summarize the progress of global biodiversity conservation over the past decade and establish the structure and goals for the future 10 years of global biodiversity. However, most of Aichi Targets are expected to fail. From the capital investment perspective, the economic development and resource utilization models that are profitability centered are the main lagging force to shift the devastating global trend on biodiversity. Ecological conservation funds that heavily relied on public finance are very limited which makes it difficult to guarantee the full implementation of biodiversity conservation measures in various fields. Under this context, how to maximize the mobilization of financial resources, through the development of ecological conservation finance to support ecological and biodiversity conservation has become a global concern.

Conservation Finance is interrelated to biodiversity finance, climate finance, green finance and sustainable finance (see Box 10.1). Conservation finance aims to leverage and effectively manage economic incentives, policies, and capital in fields of conservation, restoration, efficient use of natural resource and biodiversity protection, to achieve the long-term wellbeing of nature and the services nature provides to society. Conservation finance includes an array of financing mechanisms, such as grants, taxes and fees, debt-for-nature swaps, credit, bonds, trust funds, and payments for environmental services (PES) [1]. Professionals in this field work with stakeholders ranging from local communities to large multilateral finance institutions and philanthropic organizations, impact funds, private corporations, and governments. They support conservation efforts that extend across terrestrial, freshwater, coastal, and marine areas to protect ecosystem services and cultural values, and increase direct financial revenues through activities that produce positive biodiversity outcomes [2].

Box 10.1. Conservation Finance and Biodiversity Finance, Climate Finance, Green Finance and Sustainable Finance

Biodiversity finance provides financial incentives, manages capital for sustainable biodiversity management. It includes both private and public financial resources for biodiversity conservation, as well as commercial investments in favor of biodiversity conservation and biodiversity-related capital market transactions. The definition of biodiversity in CBD covers the diversity of ecosystems, species and genetic resources. Thus, ecological protection and biodiversity conservation are closely related. Therefore, conservation finance and biodiversity finance shared high similarity.

Climate finance refers to the financial activities supporting climate change mitigation and adaptation. Although the mitigation of climate change is related to ecological conservation, the emphasis of climate finance and ecological conservation finance is still quite different.

Green finance refers to economic activities that support environmental protection, climate change mitigation, and resource saving. Green finance provides investment, operation, risk management, and other financial services to projects in fields of environmental protection, energy saving, clean energy, green transportation, and green building. According to the catalogue of Green Bond Support Projects published in 2015 by the Green Finance Committee of the China Institute of Finance, comprehensive control of soil erosion, ecological rehabilitation and disaster prevention and control, and construction of nature reserves are all part of green projects. As ecological protection is one of the supporting activities of green finance, conservation finance could be viewed as a part of green finance.

Sustainable finance refers to a financial system that is oriented by long-term and sustainable economic activities, in which environmental and social factors are well taken into account in the investment process.

In general, although climate finance and eco-conservation finance are interrelated, their focus differs from one another. Climate finance sheds light on mitigating climate change, while conservation finance is more on ecological conservation field. They both belong to the category of green finance and are also part of what is known internationally as sustainable development finance, as illustrated in the Figure below.

In recent years, conservation finance is growing rapidly while facing challenges at the same time. On the one hand, Funding for conservation efforts globally are broadly acknowledged as insufficient. Between 2014 and 2016 there was a 62% increase in private capital allocated to conservation efforts. With all flow combined, analyses arrive at high estimates of around $120 billion revenues to conservation by 2020. However, this is woefully below the estimated annual requirement of $300–400 billion needed to finance conservation. One the other hand, the economic system that incentivizes and facilitates flows of finance towards conservation has not been established. For instance, for every dollar provided to projects reducing emissions from deforestation, $150 is channeled to activity that drives deforestation. Thus over 99% of our economic engagement with forests is destructive. So even if annual finance flows were increased eight-fold to meet the recommended $400 billion target, it changes the ratio of bad money to good from 150:1 to around 18 or 19:1. We will never succeed by only increasing financing for afforestation and restoration without reducing the overwhelming trend for our broader economic activities to be destructive.

China has a variety of ecosystem types, including forests, wetlands, grasslands and oceans, as well as rich biodiversity. Conservation and biodiversity protection are the important contents of the Eco-civilization in China. In 2015, for example, the value of ecosystem services in China is estimated to be 72.81 trillion yuan, about 1.06 times the GDP of that year [3]. Strengthening conservation and biodiversity protection is not only an important measure to maintain China’s ecological security and improve people’s well-being, but also an important practice to create social welfare and realize President Xi Jinping’s ‘Two Mountains’ theory.Footnote 1

Over the past years, China and the international community have been working on sustainable finance, especially on climate finance. However, the current ecological security situation in China is not optimistic. The recent large-scale outbreak of new coronavirus reveals that there is still considerable work undone in terms of conservation and biodiversity protection. In particular, establishing a financial system that supports restoring and protecting the natural environment, natural resources, and ecosystems is a common challenge facing China and the international community.

The year 2020 is not only the starting of China’s new Five-year Planning, but also dubbed as the ‘Super Year for Nature’.Footnote 2 Supported by CCICED, this report is striving to address two key challenges: (1) Public financing sources along cannot meet the demand of conservation while a large amount of private capital and financial resources have not been effectively used; (2) The key areas for conservation are often underdeveloped areas or poverty-stricken areas at the same time. The conflict between conservation and local development affects the effectiveness of conservation and the security of investment. The purpose of this study is to unlock more effective private finance to conserve ecosystem and biodiversity for China as soon as possible, with a better use and innovate of financial mechanisms.

10.2 Conservation in China: Policy and Practice

Significant progress has been made in China’s ecological and biodiversity conservation in the past decades. To achieve the long-term protection of its important natural ecosystems and resources, China has launched series of laws and regulations, including the Wildlife Protection Law, the Regulations on Protection of Wild Plants, and the Regulations on Nature Reserves, and established 2750 nature reserves (of which 474 are national nature reserves) and 11 pilot national park. In addition, under the support of the Forest Act, the Prairie Act, and the Wetlands Act, China has implemented multiple ecological restoration projects, including ‘Natural Forest Resources Protection Project (NFRPP)’, ‘Returning Farmland to Forests and Grassland Project (RFFGP)’, and ‘Ecological Protection and Restoration of Mountains-Rivers-Forests-Farmland-Lakes-Grasslands’ in key ecological function areas of China (Fig. 10.1).

China has been increasing the amount of investment in ecological and biodiversity conservation (as shown in Table 10.1). Among them, RFFGP and NFRPP are the two largest ecological projects in China, with a total investment of 830 billion yuan. In terms of expenditure, the fund were used in multiple areas, including the construction cost of nature reserves, the implementation costs of ecological restoration projects, and other related operation fees. The fund also covers economic incentive expenditures such as ecological compensation for areas that are prohibited or restricted from development and areas that are ecologically rehabilitated. According to statistics, from 2008 to 2015, China has invested 251.3 billion yuan in transfer payment projects for key ecological zones. In addition, with the development of business for public good, more social capital and the general public has participated in ecological conservation field. Social Institutions that are focusing on ecological protection, such as Ant Financial, SEE Conservation, Paradise Foundation, and China Greening Foundation, began to emerge (as shown in Table 10.1).

Through more than 20 years of efforts, China’s vegetation coverage rate has increased significantly, and ecological functions such as water conservation and soil and water conservation have been well improved. The forest coverage rate has increased from 8% in 1970s to 22.96% in 2018, as shown in Fig. 10.2. In the past 20 years, China has added about 25% of the world’s new vegetation cover [10]. The increase in vegetation cover has reduced the area of soil erosion from 3.56 million square kilometers in 2000 to 2.524 million square kilometers in 2018 [11]. Desertification and desertified area achieved “double reduction” for 15 years in a row [12].

10.3 Conservation Challenges and Funding Gaps in China

There are still many problems and challenges existing in China’s ecological protection work. China is one of the countries with the richest ecosystems and biodiversity in the world; at the same time, China has a large distribution of fragile ecosystems and threatened species. According to a survey in 2017, 10,102 species of vascular plant and 2471 species of Vertebrata (excluding marine fish), which respectively accounted for 29.3% and 56.7% of the total number of species assessed, are in need of nationwide attention and protection. In addition, as the world’s second-largest economy, China’s impact on global ecosystems has accelerated. The funding gap of Chinese ecological conservation could be reflected in the following three terms.

10.3.1 Conservation Challenges of Terrestrial Ecosystem

10.3.1.1 Low Conservation Efficiency and Insufficient Funding Resource in Nature Reserves

The construction fund for protected lands is insufficient in general. It is estimated that effectively protecting 18% of land areas and 10% of sea areas in China requires an investment around 0.065–0.2% of its GDP each year (at 2011 price levels, about 30.6–95 billion yuan) [13]. But in 2014, the financial outlay for China’s nature reserves at all levels was only 8.2 billion yuan, or an average of 6119 yuan per square kilometer, far below the estimated request of 42,000 yuan per square kilometer [14].

The lack of investment in protected areas in China led to a reduction in the conservation effectiveness. On the one hand, most of the protected areas are still patrolled manually, and new technologies are rarely used in activities such as evaluation and monitoring of the protected areas. On the other hand, staff salaries and official expenses of nature reserves at all levels are mainly guaranteed by local governments at the same level. Since most of China’s natural reserves located in economically backward areas, financial support for natural reserves here are woefully inadequate. The low wagesFootnote 3 and the lack of basic social security result in the difficulties of constructing high quality local patrol teams.

10.3.1.2 Severe Ecological Degradation Risks in Wetland System

As indicated in the national wetland survey conducted in 1995–2003 and 2009–2013, the overall trend of wetland system ecological degradation has not been reversed yet. The area of wetlands in China has been reduced by 50.9 million mu in the past decade, which is equivalent to the area of two Beijing cities. The ecological environment of the existing wetland system is not optimistic either. Due to the problems of environmental pollutions, overfishing, reclamation, invasive alien species, and the expanding of infrastructure, more than 50% of the surveyed wetlands are classified as ‘poor’ ecological condition. The deterioration of wetland ecosystem has directly destroyed the habitat environment of wetland organisms. The two surveys recorded a sharp decline in bird species, with more than half of the bird population declining significantly.

In order to improve the degradation trend of China’s wetland system, China began to set up special funds for wetland protection in 2009, but the existing funds are still far from enough compared with the actual demand. The results of the second wetland resources survey show that 69% of the surveyed wetlands in China are threatened, and more than 20% of them need to be restored artificially. Based on the restoration cost of $10,000 to $20,000 per hectare, the future cost of wetland restoration in China could be as high as one hundred billion yuan [15].

10.3.1.3 High Remediation Pressure in Soil Environment

A safe soil environment is an important basis for the healthy and stable development of a regional natural ecosystem. The prevention and control of soil pollution in China is still at a starting stage. Facing the serious pollution in soil environment, China has invested 28 billion yuan from the central government budget since 2016 to prevent and control soil pollution nationwide. However, compared the overall investment demand of 7 trillion yuan [16], a big funding gap is still left in China.

The biggest funding pressures are centered in arable land and abandoned mining land, where the soil pollution is extremely serious. According to statistics, the rate of excessive pollution in arable land and abandoned mining land is as high as 19.4% and 34.9% respectively (as shown in Fig. 10.3). In addition, compared with the construction land in urban area, it is especially difficult to identify responsible investors and commercial financing modes for the remediation of these areas.

Source First National Soil Pollution Survey (2005–2013)Footnote

The national survey of soil pollution divides the soil pollution into five levels. If the content of pollutants doesn’t exceed the standard, it is no pollution; if the content of pollutants is between one times to two times (including), it is slightly polluted; if the content is between two times and three times (including) , it is lightly polluted; if the content is between three and five times (including), it is moderate polluted; if the content is above five times, it is severely polluted.

The result of the national soil pollution survey.

10.3.1.4 Severe Challenges for Yangtze River and Yellow River

The Yangtze River and the Yellow River not only offer important supports for China’s sustainable economic and social development, but also serves as the home of rare and endangered animals and plants. However, with the acceleration of urbanization along the economic belt, the ecological environment of the Yangtze and Yellow River basins is facing severe challenges. The extensive development of the coastal area has led to a series of consequences, including the reduction of forest and grassland coverage, the shrinking of the lakes and wetlands in the middle and lower reaches, the continuous decline of the Aquatic Biodiversity Index, and the extinction of many rare species such as the Yangtze River Paddlefish. In order to protect the ecological bottom line of the Yangtze River and the Yellow River, China published the Ecological and Environment Protection Plan of the Yangtze Economic Belt and the Action Plan for the Protection and Restoration of the Yangtze River in 2017 and 2019. In addition, the ecological protection and high-quality development of Yellow River Basin has been put on the national agenda in 2019. Thus, more funding would be needed for conservation activities in these two rivers, including the protection of natural coastline, the construction of ecological buffer zones of rivers and lakes, the management of eutrophic lakes, and the protection of rare and endemic fish species.

10.3.1.5 Urban Biodiversity Conservation is Still in Its Infancy

With the acceleration of global urbanization, the link between human and nature is declining. The protection and promotion of biodiversity in urban areas will be important to reconstruct the link between human and nature. In recent years, urban biodiversity is gradually becoming the global attention, and its importance in China is increasing as well. For example, China has carried out the ‘ecological restoration and urban repair’ project in 2017 to improve living environment and control urban ecological problems. On this basis, how to further integrate biodiversity conservation into China’s urban planning, construction and management, and fully mobilize the resources and strength of enterprises’ and the public’s contribution in ecological conservation, is one of the important questions that need to be addressed in China.

10.3.2 Conservation Challenges of Marine Ecosystem

With the rapid development of marine economy, the deterioration trend of marine ecosystem in China is becoming more and more obvious [17]. In 2018, only 23.8% of China’s monitored marine ecosystems, including estuaries, bays, tidal wetlands, coral reefs, mangroves and seagrass beds, were in a healthy state, and 71.4% and 4.8% of ecosystems were respectively in Sub-optimal healthy and unhealthy states.Footnote 5 The density of phytoplankton in most estuaries and estuaries is high, while the density of fish eggs and larvae is relatively low. In addition, the coverage of coral reef ecosystem is decreasing. The discharge of pollutants from land and near shore and the frequent disturbance of human activities are the main factors affecting China’s marine ecological security. In 2018, 12.4% and 14.9% of the 194 river sections were of Class V and Class V respectively. Except for soluble pollutants, solid wastes also have a high distribution density on the sea surface, the beach, and the seabed, and all of them are mainly plastic wastes. In addition, China is one of the countries in the world most severely affected by marine disasters. According to statistics, in 2018, marine ecological disasters such as coastal erosion, red tides, green tides, seawater intrusion and soil salinization occurred frequently in China, causing direct economic losses of 4.777 billion yuan and 73 people dead (including [18]).

In order to solve the outstanding ecological and environmental problems in the marine ecosystem, China has issued the action plan for the comprehensive treatment of the Bohai Sea in November 2018, which ensures that the ecological environment of the Bohai Sea will not deteriorate again by taking measures to control land-based pollution, marine pollution, ecological protection and restoration, and environmental risk prevention. China has invested 7 billion yuan in comprehensive control of the Bohai Sea in 2019. On this basis, China is exploring the construction of marine national parks to enhance the authenticity and integrity of important marine ecosystems and their biodiversity resources. Under the background of the increasingly sound system and mechanism of marine ecological protection, there would be more financial demand in terms of the development and application of marine ecological protection high-tech, as well as the transformation and upgrading of marine industry.

10.3.3 China’s Impact on Overseas Ecosystem

The Belt and Road Initiative (BRI) is a global cooperation initiative of China through bilateral and multilateral mechanisms, aiming at building a community of use, destiny and responsibility based on political trust, economic integration and cultural tolerance. Within the countries of the BRI, billions of dollars are invested to build transport infrastructure (about 190 billion USD since 2013) and energy infrastructure and supply chains (about 280 billion USD since 2013), as well as mines and agriculture [19]. Investment in BRI infrastructure can contribute to social and green development. Examples include investments in micro-grids in conjunction with clean energy production through wind and solar, water management, waste-water treatments and sustainable agriculture.

Apart from the economic benefits of investments, investors and society should aim to minimize environmental risks in overseas investments in the BRI. For example, any infrastructure construction can directly lead to breaks in landscape and habitat connectivity, as well as to secondary effects such as spread of invasive animal and plant alien species, wind throws, fires, animal kill (e.g. through road kill), pollution, poaching and microclimates.

As the BRI encompasses many countries and their ecosystems (some studies suggest the BRI infrastructure affects 4138 animal and 7371 plant species and that BRI corridors overlap with 265 threatened species and 46 biodiversity hotspots), [20] three issues stick out for biodiversity and ecosystem protection:

-

Investors, project developers and local government should strictly execute stringent environmental impact assessments (EIA) based on Chinese or international best practices (e.g. IFC Performance Standards 6) and stringent project oversight to minimize the negative impacts of projects while protecting ecosystems;

-

Investors, project developers and local governments should include transboundary impact assessments (TIA) (e.g. based on UNECE Convention on Environmental Impact Assessment in Transboundary Context) to ensure cross-border impacts of projects are avoided, mitigated and/or compensated fairly across affected countries;

-

Investors and project developers should support local communities to manage ecosystem services by providing transparent data on ecosystem impacts, which would allow for a better adjustment of ecosystem protection throughout the project lifecycle;

-

Investors and project developers should have environmental liability insurance to be able to compensate for unforeseen events. This should also include end-of life restoration activities.

To support biodiversity protection in the BRI, the ‘Green Development Guidance for Belt and Road Initiative Projects’ (formerly ‘Green Light System’) of the BRI International Green Development Coalition (BRIGC), under the supervision of the Chinese Ministry of Ecology and Environment (MEE) aims to provide an evaluation tool and policy tools to ensure that BRI investments are contributing to green development and are minimizing negative environmental impact [21]. Various other initiatives to reduce biodiversity and environmental risks associated with the BRI have been put forward by Chinese government and non-governmental organizations and their international partners as well as financial institutions. The BRI Green Investment Principles (GIP) include 7 principles to encourage financial institutions to invest in projects that meet the Paris Climate Accord and contribute to the UN Sustainable Development Goals [22]; The Chinese Green Credit Guidelines issued by the CBRC (now CBIRC) in 2012 are applicable to international investments of Chinese institutions in the BRI countries [23]. The Guidelines highlight the role of national laws and thus don’t encourage financial institutions to go beyond possibly weaker national environmental legal frameworks in BRI countries. Overall, coordinated and applied actions that successfully mitigate adverse environmental impacts of BRI investments, particularly in regard to biodiversity loss, should be accelerated.

To sum up, the lack of available funding is one of bottlenecks to the ecological and biodiversity conservation in China. With the downward pressure on China’s economy and the slowdown of fiscal revenue growth, conservation financing mode dominated by public sector has become unsustainable. It has become a matter of priority in China to build channels for private capital and financial resources by forming a diversified, sustainable and high-quality conservation financing system.

10.4 The Financial Model of Conservation and Biodiversity in the World: Experience and Best Practice

The global challenges linked to the steady loss of biodiversity and ecosystem services have, in recent years, begun to take center stage. The 2019 IPBES report leaves no doubt that the risks linked to the degradation of nature and natural resources are so high that the future of human well-being, prosperity and economic stability are under imminent threat. Further, the WEF Global Risk Report 2020 states that the loss of biodiversity ranks as the second most impactful and the third most likely risk for the next decade.

There have long been calls to invest far greater sums of money in conservation activities such as protected areas, species protection and landscape restoration. The sums generated have fallen well below minimum requirements for stemming the downward trend, much less reversing it.Footnote 6 The public sector, with rare exceptions, has failed to rise to the challenge, and efforts to attract substantial private capital into conservation activities have hit up against the requirements of private actors for risk management and adequate return over a relatively brief time horizon. But it is not simply a question of directing more money at conservation priorities. Equally, if not more important, is to reduce financial flows to activities that harm biodiversity.

The dominant financial model, followed over the past few decades in most countries of the world, rewards capital owners and shareholders at the expense of the public policy goals reflected in the 2030 Agenda, with its Sustainable Development Goals, the Paris Agreement on climate change, and the targets regularly set by the Convention on Biological Diversity. Too much financial activity still tolerates—and often rewards—the destruction of natural landscapes or the depletion of scarce natural resources. It is time to rethink the financial model with a view to advancing the world that we would like to see come into being.

A recent paper by the Finance for Biodiversity (F4B) initiative proposes a new framing of the conservation finance challenge—a way of thinking about both the challenges and opportunities. It represents an example of the new thinking that is going on at the interface between the pressing needs of nature conservation and the operations of the financial system.

In the sections below, we set out international best practice in conservation finance in three streams:

-

Efforts to direct more finance—in particular private capital—towards activities compatible with conservation

-

The need for rule change to ensure a more favourable environment for conservation; and

-

The importance of creating a greater public demand for conservation results—and the attendant intolerance of activities that undermine nature.

Recommendations in these three areas are to be found in Chap. 7.

10.4.1 Expanding Finance Directed at Conservation

A great many efforts are underway internationally to address this shortfall. In response to the growing interest in responsible and impact investment, and the rapidly growing demand for conservation-friendly options, a series of specialized investment houses have sprung up to structure this new market.Footnote 7 These include:

-

Fund building efforts, for instance numerous existing funds such as Althelia and Mirova, Conservation Capital or Encourage Capital. The Meloy Fund, implemented by Conservation International (CI) and RARE, established the first fund for sustainable small-scale fisheries in Southeast Asia to improve the conservation of coral reef ecosystems by providing financial incentives to fishing communities in the Philippines and Indonesia to adopt sustainable fishing practices and rights-based management regimes. Althelia, with the support of CI and with technical and scientific advice from the Environmental Defense Fund, launched the Sustainable Ocean Fund as an impact investment vehicle that can deliver marine conservation, improved livelihoods, and attractive economic returns.

-

These efforts are accompanied by efforts from the public sector, or through public–private partnerships, to clear the obstacles facing conservation finance and to ensure that those wishing to build this field have access to assistance and advice. This includes:

-

Fund aggregation functions, such as the UNDP Finance for Nature team’s efforts to build an Exchange Traded Fund (ETF), or the UK Government’s exploration of interventions to build the field (via the International Climate Finance team at the Department for Business, Energy and Industrial Strategy—BEIS). It also includes efforts to create intermediaries between capital seeking responsible nature-based investments and those with projects under development. A prominent example of this is The Nature Conservancy’s NatureVest.

-

-

These efforts seek to identify “investor grade” activities that meet the risk and return profiles required by investors, including the use of public contributions to lower perceived risk and to analyze and disseminate “best practice” in this field.

-

They have now moved beyond development of projects for investors to look at a range of issues at the interface between finance and nature conservation, including refinement of tools to value the contribution of natural capital to overall economic performance and to bring together professionals in these fields to exchange experience, including:

-

Organizations engaged in building knowledge bases and providing tools to facilitate improved conservation finance related activity, including the Natural Capital Finance Alliance, Forest Trends, Global Canopy and the Biodiversity Finance Initiative. The World Bank’s Global Program on Sustainability (GPS) has also generated a good deal of data in this area. Best practice guidance on conservation finance is also available through the Conservation Finance Alliance’s ‘Conservation Finance: a framework’.

-

Landscape mapping initiatives, most notably the Forest Trends-authored State of Private Investment in Conservation 2016, Global Canopy’s Little Biodiversity Handbook (presently being updated) and the various publications that are commissioned by and cluster around the CPIC and Crédit Suisse events.

-

Convening and networks, especially the CPIC and Crédit Suisse events, that play an important role in community and network building and information exchange. The OECD is also preparing a publication on biodiversity finance to be published in the first half of 2020.

-

-

Related efforts to develop the concept and practice of regarding natural resources and ecosystems as an important form of—and contributor to—sustainable infrastructure development. The work of the World Resources Institute, for example on natural water infrastructure, has emphasized the highly cost-effective contribution of natural ecosystems to improved human well-being.

-

A major effort is underway to strengthen the base of knowledge and data accessible to finance professionals, both to assess the impact of investments on biodiversity parameters and to strengthen the locally relevant data needed to take sound investment decisions. These include:

-

Data providers, such as the UN Biodiversity Lab, Global Forest Watch, ENCORE from the Natural Capital Finance Alliance, the work of CDP and integrations into mainstream data providers such as Bloomberg from organisations such as Sustainalytics. New specialist approaches are also emerging, for example the Sustainable Digital Finance Alliance’s recent ‘Fintech for Biodiversity Challenge’.

-

-

While there is still an absence of robust and widely accepted norms and standards—or even of broadly—accepted definitions of conservation or biodiversity finance—a series of guidelines and standards are emerging in major areas of conservation-related investments and the movement to accelerate the uptake of these is accelerating. The EU has recently added a focus on biodiversity finance in its work on sustainable finance taxonomy. Examples of work in this area include:

-

Guidelines, commitments and standards, such as the New York Declaration on Forests, and the ZUG Faith Consistent Investing Guidelines. Other initiatives include: Investors Group on Climate Change, Disclosure Insight Action, Principles for Responsible Investment and the Institutional Investors Group on Climate Change.

-

Relevant in this area are the Green Investment Principles for the Belt and Road initiative developed by the City of London Corporation’s Green Finance Initiative with strong cooperation from China.

-

Finally, taking a leaf from the book of climate change action, efforts are underway to increase the transparency of corporations and investors in terms of the impact of their investments on biodiversity. This effort is both general and specific.

At the general level, a series of international public and private players are considering the establishment of a Task Force for Nature-related Financial Disclosure (TNFD). Modelled on the successful Task Force on Climate-related Financial Disclosure operated by the Financial Stability Board, it would develop a standard and a requirement for corporations and investors to disclose the impact on biodiversity of their actions. This would supply investors with the basis for better assessing the risks to their investments related to biodiversity and ecosystems, and for them and governments to insist on such disclosure as a condition of access to capital. A proposal in this regard is likely to be discussed at CBD COP 15 in early 2021.

In terms of public finance instruments, a renewed interest is being shown in Debt for Nature Swaps. First developed in the 1980s, they enabled bilateral debt under the Paris Club to be drawn down or eliminated in exchange for an agreed level of investment in nature conservation by the indebted country in its national currency. This conditional debt draw-down removed a hard currency repayment obligation in exchange for a more manageable deployment of national currency with a conservation benefit. With the prospect of developed and emerging economies once more likely to sink deeply into debt as a result of the COVID-19 pandemic, there is a renewed interest in the potential of Debt for Nature Swaps and related instruments (e.g. Green bonds for nature-related investments, blue bonds for ocean conservation) to offer an incentive for nature conservation in exchange for debt relief.

At the more specific level, efforts are focused on improving the metrics that relate to measuring the impact of corporate activity and investment on biodiversity-related factors. Disclosure must yield reliable and comparable impact data and the metrics for this are still at an early stage. The French Caisse des Dépots Group are developing and refining a ‘Global Biodiversity Score’ WWF and IUCN have similar tools. However, the set of metrics for measuring the biodiversity impact of economic activity requires rapid further development and alignment among the standards used by different countries.

All of the above describes a wide range of creative efforts underway internationally to channel funding into activities compatible with nature conservation, whether these activities have as their principal purpose the setting aside of natural resources or their exploitation within acceptable limits. It focuses very centrally on matching a growing interest on the part of investors for conservation-compatible activities through increasing the supply and quality of investment opportunities available to investors.

The main barriers for scaling up conservation finance include lack of capacity, small size of projects, the heterogeneous nature of projects, and lack of enabling environment.

Conservation finance needs to include sourcing and structuring investments so they are consistent with the asset-allocation protocols of institutional investors, preferably with competitive, risk-adjusted returns and with the most efficient practicable application of increasingly scarce public and philanthropic credit through blended finance (i.e., DFI loans/guarantees/grants, sovereign loans/guarantees/subsidies, and philanthropic grants). Opportunities to expand use of blended finance will require continued innovation to help countries and private sector partners match the right types of financial instruments to specific projects goals and objectives, including in the natural resource management sectors. Support for project preparation, along with aggregation and bundling of projects that can attract large scale investors will also be needed in many cases.

Increasingly, however, two things are becoming clear. First, despite encouraging growth in finance devoted to conservation-compatible activities, the proportion of investments that seek conservation-related projects remains very small and is likely to plateau at a modest level. Second, many aspects of the policy and regulatory framework within which investment decisions are taken at best do not encourage conservation-friendly investment and, in a great many cases, serve as a strong counterincentive to linking finance and conservation.

10.4.2 Reform and Rule Change

So, a second field of activity in conservation finance is the review and reform of policy and regulatory measures to eliminate obstacles and counterincentives facing the flow of finance to conservation priorities. These obstacles exist at the “hard policy” end of the spectrum—e.g. the laws that impose tight risk-limitation requirements on large-scale institutional investors—to the soft end around perverse incentives (e.g. subsidizing the use of agricultural chemicals or damaging technology on fishing fleets); and even into corporate cultural practices (e.g. rewards to CEOs for short-term growth even when it is at the expense of long-term financial help).

Despite all of the initiatives highlighted above, it is clear that the challenge of aligning finance with conservation cannot be limited to setting aside resources and landscapes from exploitation and restoring those already degraded—the traditional heartland of conservation organizations. Instead, nature is threatened by the form and dimensions of economic activity. Addressing the challenge will require ensuring that regular economic activity does not continue to undermine biodiversity and ecosystem health while seeking to align the economy with the boundaries and requirements of natural systems.

Policy-making is largely the task of public authorities, whether at the international, national or local levels. New policies and rules are crafted, and old ones are reformed in a constant process aimed at advancing public policy goals. As new priorities—like biodiversity conservation—come on-stream, existing policies and regulations are reviewed and updated to ensure that they address these priorities. Many countries have reformed the policy framework in order to address the climate challenge. The process is now beginning for conservation of nature and ecosystems.

With conservation finance a new topic, the process of policy reform is only just taking shape, but all signs are that it will accelerate sharply in the coming years. A high priority is to review existing policies and regulations—particularly those affecting finance—to ensure that they do not offer perverse incentives to undermine biodiversity, as in the examples offered above.

International networks grouping public sector actors are also active. The Network for the Greening of the Financial Sector (NGFS) has grown rapidly since its foundation in December 2017, pulling together central banks and financial supervisors to accelerate the transition towards green finance solutions. Focused first on climate risk, they are now turning their attention to biodiversity. Their guidance to central banks on how responsibly to invest their endowments is already having a strong positive effect. The European Union has adopted an action plan on sustainable finance—including green labelling of financial products and the development of a new EU Biodiversity Strategy.

In addition, the European Commission has put forward a European Green Deal that includes a chapter on biodiversity. And the recently formed Coalition of Finance Ministers for Climate Action, though not yet focused on biodiversity, could provide a model for the future.

However, it is a broadly-shared view that progress, while encouraging, is still inadequate in pace and scale. Policy reforms are welcome but often move at a slow pace due to the complexities of the policy process, the requirement for political compromise and strong resistance from incumbent interests. The CBD process, involving the global community of States, moves at a pace that simply cannot keep up with the rate at which the problems grow more menacing. Given the trends in biodiversity loss and the breakdown in ecosystem services, it is important to move with urgency.

Support is growing for new norms and standards that will, it is hoped, quickly become widespread in public policy and a requirement for corporate value chains. One of the most promising is the proposal to develop a “Net Gain” pledge in which corporations (and, possibly, public works projects) would pledge that biodiversity and ecosystem services would be better off following the activity than it was before—either in the area where the activity takes place or, through offsets, in another location. Such new standards could rapidly become an expectation of investors or governments, including through their public procurement programmes. The idea of a “Net Gain” norm builds on the Mitigation Hierarchy in that it moves from an analytic and measurement approach towards an increasingly directive norm. In cases where net gain is secured through the purchase of biodiversity offsets, the IUCN policy on the subject provides useful guidance.

10.4.3 Positive Disruption

For the challenges to be met at a scale and pace commensurate with the scale of biodiversity loss and the pace of negative trends, action by the public sector and by capital markets must be subject to a far higher level of demand from civil society and the public. This ‘disruptive’ action rejects the patient and linear approaches to change in favour of moves that have a transformative effect. The attention of these actors is increasingly focusing in on the impact of finance on biodiversity and a wide range of tools is being used. Voluntary action by private actors, often impelled and encouraged by civil society, can be a necessary accelerator of transformation. Earlier in this chapter, the slow and tedious pace of progress in international negotiation and consensus-building was lamented. To stimulate that pace, it has been argued that policy and rule-change are necessary; but the reality is that present policies and rules benefit strong incumbent interests, and these defend their short-term privilege over the wider public benefit of change. The simple fact is that serious change only comes at that point where the advantages of the change are seen by political powers to outweigh the political advantages of the status quo. However, at that stage, change can come quickly.

In the meantime, a range of things are happening which suggest that fundamental shift may be on its way. The decision by eight major insurance companies no longer to insure fishing fleets that indulge in illegal fisheries is one telling example. So, too, are the moves by large-scale institutional investors—for example the decision by the Norwegian State Pension fund to divest from fossil fuel companies. Another example is a certification from the Marine Aquarium Council (MAC) for trade in ornamental fish designed for insurance and air cargo companies. This trade is significant in the Asia Pacific region.

On the civil society end of the spectrum there is a wide range of activities. Some are cooperative—such as the effort to promote and launch a ‘No Net Loss’ or ‘Net Gain’ standard for corporations and value chains, mentioned above. Others channel the frustration, fear and impatience of the general population at the slow pace of progress. Movements like the Extinction Rebellion that have recently been attracting attention, particularly in Europe, specifically call for disruptive action; their membership is not just made up of those who block bridges or public squares, but increasingly by doctors and lawyers ready to use the full arsenal of tools at their disposal to push for early change. Many other examples exist or have flared up at times, only to die back as quickly—such as the Occupy Wall Street movement after the global financial crisis in 2008/2009.

Disruptive action can be positive if it levels the playing field and counters the weight of industrial lobbies. It often represents genuine concern asking only to be channeled into positive pathways of change.

Other NGOs are mounting “name and shame” campaigns aimed specifically at financial institutions—for example those who fund land clearance for beef and soy development in Brazil or those that manufacture and promote carcinogenic pesticides in European countries. Fish Tracker, for example, supplies investors with detailed and accurate data on the fishing companies in which they are thinking of investing, thus giving them the chance, through their investment decisions, to reward responsible companies and punish those that undermine ocean biodiversity.

China has seen a growth in civilian actions a large part of which relate to complaints about lack of compliance with environmental regulations or the impact of industrial pollution or to unsustainable or inequitable use of natural resources.

Disruptive action can be positive if it levels the playing field and counters the weight of industrial lobbies. It often represents genuine and widely shared concern asking only to be channeled into positive pathways of change.

10.4.4 China Overseas and International

Developments at the international level must, of course, include the actions of China beyond its frontiers. As a massively important investor, the role of Chinese finance-sector players is a key factor in determining the chances for a rapid transition to sustainable financial practices linked to biodiversity. China’s overseas investment takes many forms and operates across a wide spectrum comprising the Chinese government, policy banks, State-Owned Enterprises and private sector financial actors. Especially since its adoption of strong green finance measures, China is looking increasingly both at best practice internationally in the full range of norms and standards linking finance with biodiversity conservation, and extending the standards required in China to the investment of Chinese investors across the globe. Increasingly, the “social license to operate” will depend on value chains that respect and restore biodiversity and invest in the resilience of natural systems. Increasingly, also, those that ignore these requirements risk facing an ever-stiffer backlash.

10.5 Framework, Main Tools and Challenges of China’s Conservation Finance

The green financial system in China has developed rapidly since 2015. The concept of green finance has not only permeated the national development plan and policy, but also received a wide response at the local government level. The green financial policy system is becoming more and more abundant, and the construction of relevant market infrastructure is also advancing. For Financial Institutions and investors, more and more attention has been paid to green development and green industry. Green investment action has become a new hotspot, and the active development of green financial instruments and green financial products has become a new option for the industry. As a part of the green financial system, conservation finance and its importance have been gradually recognized by people, while still facing many challenges.

10.5.1 Conservation Funding Sources in China

Despite the gradually increasing in private capital investment, the current funding for China’s conservation activities is still heavily dependent on public sectors, including government finance and bank loans based on government credit.

10.5.1.1 Government Finance

Government finance include special funds from the central government, funds, investment, and appropriations (mainly in provincial or local governments). Taking the soil remediation as an example, the specialized fund for preventing soil pollution has been set up in 2016 and its total investment number in 2019 is 5 billion yuan. Any soil remediation projects are capable to share the specialized fund for preventing soil pollution as long as it has been included in the ‘program library’ of the Ministry of Ecology and Environment (MEE). When the funding has been allocated from central to local, the finance department at provincial level will be jointly with the local environmental protection department in charge of the funding using, and supply some funds depending on the local fiscal situation Footnote 8(Table 10.2).

10.5.1.2 Financing with Local Government Credit in Financial Markets

There are two ways of financing with local government credit:

The first way is bonds issued by local government. They can be divided into general bonds and special bonds. General bonds are included in the public budget to balance the deficit; special bonds are included in the government funding budget, mainly investing in public welfare projects. The special bonds for local governments planned to issue in 2019 increases by nearly 60% compared with 2018 (1.35 trillion yuan). These special bonds not only invest in key national strategies, infrastructure project in extreme poverty areas, and major projects including railway, highway, and water conservancy projects, but also in ecological conservation and environmental protection projects.

The second way is bank loan. These loans are basically invested in companies that are included in the Public–Private Partnership (PPP) programs. The loans are accommodated by policy banks or commercial banks according to the result of risk evaluation.Footnote 9

10.5.1.3 Corporate Financing from Financial Markets

There are two kinds of corporate financing models. First is to borrow from banks or to issue stock or bonds in the financial market based on corporate credit, which is currently the mainstream. Second is project-based financing from the market, mainly used for projects with stable cash flow.Footnote 10 Industrial Bank, for example, helped a state-owned water company obtain project funding in a relatively low cost by issuing 800 million yuan of green sustainable medium-term bonds in the China Inter-bank Bond Market.

In the capital market, the issuance of Green Bond has expanded rapidly in recent years. In 2016, domestic green bond markets had 51 bonds and 205.2 billion yuan in total. The number has increased to 222.2 billion yuan in 2018 with 139 bonds, and reached 360 billion yuan of green bonds in 2019. With the rapid development of the Green Bond Market, some large enterprises are easier to financing by issuing bonds.

In general, the difficulty of financing for ecological and biodiversity conservation is still widespread.

-

Ecological restoration and biodiversity projects often require massive investments. Take soil remediation for example, the general investment amount around one to ten billion yuan for each soil remediation project is totally over the capacity of most private capitals. Due to the lack of business models, well knowledge, and policy guidance, few private equity and venture capital funds have entered the field of conservation investment. In addition, insurance product design and service are facing difficulties due to the lack of specific operability tools and methods, which also hinder the development and innovation of financing model.

-

Green funds have limited investment in ecological protection. In recent years, some provincial and municipal governments have established government-led guiding green funds, and some market-oriented green funds have also emerged. But these two types of investment funds are not sufficient in supporting ecological protection investment. There are also some non-profit funds that invest little in this area due to their widespread attention and limited funding sources. Take the China Environmental Protection Foundation as an example. In 2018, the total assets of the foundation were less than 200 million yuan, and the amount of donations accepted in 2018 was only 120 million yuan. At the same time, the foundation’s focus is quite extensive, including green recycling, green travel, green innovation, and ecological poverty alleviation. The funds that can support ecological protection is quiet limited.

-

Investment from green credit and green bonds are insufficient. Since 2015, green development has been put on the central and local governments’ agenda. The central bank, financial supervision department, and local government have introduced measures to encourage and support banks to launch green credit service. Some large and medium-sized banks have increased their green credit. Till June 2019, the green credit balance in 21 banks in China has surpassed 10 trillion yuan. However, regardless of the increasing amount of green credit, the investment is mainly focused in infrastructure such as transportation and energy. Although big banks have already been paying attention to ecological conservation, the green finance principle is hard to translate into practice due to the poor analysis ability on conservation projects of loan officers. In terms of the use of green bonds in 2018, only 5.3% of the funds were invested in pollution prevention, ecological protection and climate change, and the amount was only about 10.6 billion yuan.Footnote 11

-

Most ecological restoration projects are carried out by small and medium-sized private enterprises, who are difficult in obtaining qualifications on issuing green bonds in the market. Bank loans for ecological protection mainly rely on the credit of enterprises, and most of the loans are working capital loans lasting for one year, which do not match the implementation cycle of investment projects.

-

Due to the shortage of supply in the finance market, it is quite common for large upstream enterprises to default on payment to small and medium-sized downstream enterprises in the ecological conservation industry. There are also companies engaged in ecological conservation, which only rely on profits from other businesses to subsidize their ecological conservation investments (Table 10.3).

10.5.2 Challenges in Conservation Financing in China

10.5.2.1 How to Establish a Sustainable Business Model to Attract Private Capital

As a matter of fact, there is still a lack of effective business models in the field of ecological conservation. Conservation finance has the nature of positive externality, while the difficulty of attracting private capital lies in how to establish a stable and sustainable business model. From the perspective of international experience, some conservation projects have certain investment incentives, but the significance of such incentives is not universal. Taking soil pollution governance as an example, recent years, due to intensified legal enforcementFootnote 12 under the pressure of legislation and environmental regulation, some enterprises (especially foreign-funded enterprises) take the initiative to control contaminated soil within their capacity.

In first-tier cities and some second-tier cities, the value of the lands is high enough for investors to recover their investment or even gain profits in soil pollution remediation projects through land transfer. Therefore, both local governments and enterprises have the incentive to invest. Even though, the cost of remediation of contaminated soil is still very high so that local governments or enterprises can only manage those issues by installments.Footnote 13 The issues are more serious in some third tiers and fourth-tier cities, especially in rural areas. With limit space for land appreciation and widespread local financial constraints, plus the fact that it is hard to identify the liability or the entities are incapable of paying (for example, some mining enterprises have been dissolved or gone bankrupt), the lack of funding has become a huge obstacle to the remediation of contaminated soil.

10.5.2.2 How to Establish Incentive and Restraint Mechanisms for Financial Institutions and Large Institutional Investors

From the perspective of a few successful cases in China, we found a common feature that financial institutions failed to play a supportive role in deploying comprehensive utilization of resources to raise funds for the operation of conservation projects. For example, in Sishui, Shandong province, a company has invested more than 200 million yuan in the restoration of abandoned mines. This investment is mainly covered through the comprehensive utilization of tailings and waste resources and the development of ecological agriculture and tourism industries. Another example is that a company has invested 6 billion yuan in Kubuqi desert’s management over the past 30 years. It has also made up for the cost of desert management and ecological restoration with the profits from agriculture, animal husbandry, health and well ness, ecological industry, photovoltaics, and ecological tourism. In this business model, financial institutions fails to play a role because firstly, in the risk management framework of existing financial institutions, green assets created cannot be valued or used for mortgage guarantee. Secondly, financial institutions lack reorganization and management capability on this integrated business model. Thirdly, the financial institutions lack awareness of the challenges brought by future environmental changes to their own and lack motivation to actively participate in environmental risk management.

Financing is even more complicated for projects involving biodiversity conservation, as biodiversity conservation involves a wider range of sectors and policy tools, and it is harder to measure the externalities. For financial institutions and large institutional investors, on the one hand, identifying and managing environmental risks is a new topic.

10.5.2.3 How to Mobilize the Whole Society to Support Ecological Protection and Biodiversity Conservation Activities

Ecological protection and biodiversity conservation are systematic efforts, which closely relate to public recognition on ecological protection and sciences, investors’ social responsibility, scientific research ability, public education, and the role of NGOs. Ecological protection and biodiversity conservation not only require coordination of different policies, but also need further systematic governance and regulatory innovation.

-

How to resolve the conflicts among ecological and biodiversity conservation, and the development of local economic and residents’ individual interests. As it concerns the vital interests of residents, conservation activities often produce such conflicts as “man and animal fighting for land” and “man and animal fighting for food”. Especially for the less developed areas, this kind of conflict is more prominent. For local governments, they lack intentions to address problems of climate change, environmental protection and biodiversity conservation, while institutions and volunteers who are specifically responsible for conserving biodiversity lack the power or capacity to deploy resources.

-

How to restrain enterprises’ investment on non-green projects or environmentally damaging projects. As the main participants of the market, enterprises play an important role in conservation. At present, many enterprises still take profit and investment payback period as the primary basis for investment decision-making, and rarely consider the impact on the ecosystems and the environment. Only by adjusting current fiscal and finance policies promptly and reducing financial investment activities that are not conducive to ecological protection, including internalization of environmental externalities costs, reduction of output and increase of costs, so as to reduce the return on investment of polluting and damaging ecological projects, can a green capital flow direction be formed in the whole society.

-

How to attract philanthropic foundations and other non-profit organizations to participate in ecological conservation activities. As of April 8, 2019, there were 5599 charitable organizations in China, of which 1521 were eligible for public offering. Public attention to charity activities is very high. 20 Internet fundraising information platforms designated by the ministry of civil affairs received more than 8.46 billion hits, followers and participants in 2018. For non-profits organizations, the return on investment and the recoverability of funds are not their focus. The key to attracting them to enter the field of ecological conservation is to let investors to know the use of funds and social value timely. Therefore, transparency and validity of information should be guaranteed. Meanwhile, by relying on their expertise and financial strength in the field of ecological conservation, these institutions can serve as a bridge for the government to open up private capital and financial institutions. These institutions can not only provide professional advice for project planning and program implementation, but also provide innovative models and approaches for the investment and financing participants. In this aspect, some successful experiences from abroad can be used for reference by China.

-

How to improve the understanding of ecological conservation in the whole society. The conservation of ecology and biodiversity by governments alone is clearly not enough and requires the participation of society as a whole. At present, China has reached a social consensus on environmental and ecological protection while without being a priority. In China’s practice of conservation investment, the funds are mainly invested in ecological restoration activities (after-treatment), with little investment in pre-prevention; the relevant government departments attach great importance to pollution control in special fields such as soil, water and atmosphere, but pay less attention to the conservation of whole ecosystems, including biodiversity. On the other hand, the lack of expertise and capacity of local governments makes it difficult to improve efficiency of the use of ecological protection funds. At the same time, community publicity and education to the public are also relatively weak, so that the volunteers’ activities of ecological conservation lack a broad social foundation.

10.5.2.4 How to Incorporate Gender Perspective into the Development of Conservation Finance and Let Women Play a Role

In view of the extensive knowledge and practice of climate finance, a wealth of ideas and suggestions for examining climate finance from a gender perspective have emerged, which are worth learning from, but also reflect significant gaps and problems:

First, the international community has paid long-term attention to climate finance and developed a series of mature financial mechanisms, tools and methods to address the mitigation and adaptation needs of climate change. Based on the specific detailed data and practical cases regarding climate finance sources and channels, as well as the corresponding projects and participants, the integrating of gender perspective is more smooth and systematic in climate finance. However, conservation finance is still in the initial stage of research and practice, and there is still no broad consensus on its basic definitions, standards, concrete mechanisms, tools, and methods. At present, we can only affirm the importance of gender perspective in principle. Further demonstration and implementation are still needed to include gender perspective in the long-term research scope.

Second, the current focus on gender equality in climate finance starts with ensuring women have a voice and priority in accessing climate finance support, and ensuring that available climate fund is used and allocated fully regarding to the needs of female groups (which is also in line with the requirements of most funders). At present, conservation finance is in urgent need of solving the problem of leveraging more funding, especially establishing the close cooperation mechanism with all sectors of society. Therefore, we believe that the gender perspective in conservation finance should focus on how to promote the use of gender equality concepts and principles in investment and financing decision-making in financial sectors, and make full use of women’s attention and cognitive advantage on ESG issues, so as to achieve two objectives: (1) to make ecological conservation a priority issue for the entire financial system; (2) based on the existing experience and practice of climate finance, the needs of different vulnerable groups (including women) should be fully considered in the use and allocation of financial resources, and the principle of gender equality should be incorporated into the whole process of planning, implementation, monitoring and assessment of conservation specific projects.

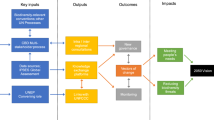

10.6 Overall Plan to Promote Conservation and Biodiversity Finance in China

Ecological Conservation (restoration) has several characteristics including large-scale investment, long payback period and indirect income. The externalities of biodiversity conservation projects are more extensive, involving more individuals, more complex situation, and the environmental benefits are more difficult to measure. At present, financial institutions and large institutional investors generally pay little attention to the protection of ecosystems and biodiversity and lack the proficiency to identify the benefits and risks of projects. In order to make the ecological protection investment more attractive and reduce the damage of traditional financial activities to the ecological environment, a financial framework is needed to establish from the dimensions of financial institutions, administrative departments, relevant policies and financial markets, This study seeks to propose plans on establishing an environment for conservation finance, and stimulate the incentives for financial institutions and large-scale institutional investors from internal motivations and external restraints.

10.6.1 Improve the Efficiency of Using Government Financial Funds

10.6.1.1 Identify Key Areas for Conservation

The premise of financial instruments to involve in conservation investment is that the security and profitability of funds will be guaranteed. This requires: (1) the economic benefits of the conservation activities are clear and measurable; (2) The green assets have liquidity; (3) if the first two cannot be achieved, then the investment requires clear social benefits that are helpful to its branding and business strategies. Examples are the Ant Forest of Ant Financial, and some corporate donations to conservation-related funds.

Not all ecological conservation work is amenable to financial institutions, and some work can only be undertaken by governments. Therefore, the government needs to identify the focus areas that finance can support, and establish an enabling policy framework for the sustained investment of financial institutions and private capital. One potential approach is that the MEE can prioritize the social impact of various conservation measures and the urgency of their capital demand, based on the short-and long-term economic and social values of different conservation work. By this way, financial institutions and private capital will be able to identify the key areas of ecological conservation and biodiversity conservation and to choose the direction that suits them. The government department in charge of investment (NDRC) can cooperate with the MEE to draft investment taxonomy of ecological and biodiversity conservation.

10.6.1.2 Establish a Fiscal and Taxation Policy System that Encourages Financial Institutions and Private Capital to Increase Input in Conservation

China has established a quite complete ecological compensation system and formulated special fund management measures for the conservation and rehabilitation of soil, rivers, lakes and natural forests. The next step requires: (1) to test the effectiveness of these compensation funds and special funds; (2) to link some public funds with financial institutions. This includes clarifying that projects supported by special funds can get preferential policy-oriented financial support and informing financial institutions of these projects supported by special funds; granting appropriate interest rates on loans or issuing green bond to some important ecological rehabilitation and conservation projects; considering granting certain tax concessions to financial institutions and investment institutions that have made outstanding contributions in the ecological field; subsidizing part of insurance premiums to enterprises that purchase green insurance in the field of ecological conservation; and allocating more funds to support voluntary actions and education activities for raising knowledge and awareness among public.

10.6.1.3 Other Supporting Policies

Many local governments have set up government industry investment funds. The funds are mainly focused on scientific and technological innovation and large-scale infrastructure construction, with little allocation to conservation. Requirements about allocating a certain proportion of funds to the ecological field should be defined. The assessment requirements of industrial investment funds should be adjusted based on the characteristics of conservation. Local governments should set up green industry funds to stimulate private investment in environmental enterprises and projects. Policy banks should be required to support the development of ecological and biodiversity conservation.

Considering the tight resources of construction land in China, private investment can be directed to conservation through land policy. Several regions with successful ecological management can be selected to pilot on the award and compensation policy for land restoration, and the restored land can be traded across provinces as cultivated land.

In addition, to address the limited capability of collecting and analyzing the environmental cost of the projects, the government can purchase public services to establish public environmental cost information system, and provide a basis for decision-makers and investors in the whole society.

10.6.2 Strengthen the Coordination Between Macro-financial Policies and Financial Regulatory Policies

10.6.2.1 Monetary and Credit Policies

In the current green finance field, the People’s Bank of China has provided some policy support for commercial banks to develop green credit and the construction of green finance reform innovation pilot areas, including (1) re-lending; (2) Green Bill discounting; (3) supporting and open up green channels for enterprises to issue green debt financing instruments; (4) adding green credit indicators in Macro Prudential Assessments; (5) release the ‘Green Financial Development Report’; and (6) establish green credit statistical system. In the future, the People’s Bank of China should give prominence to ecological and biodiversity conservation in its Green Finance support policies. Ecological and biodiversity conservation can also be listed as a separate indicator for policy support.

10.6.2.2 Financial Regulatory Policy

Guide financial institutions and large institutional investors through the adjustment of financial regulatory policies. These include: (1) expanding the scope of green credit instruments, allowing banks to develop eco-asset-backed credit products on a pilot basis; (2) advocating and promoting ESG investment and establishing ESG evaluation system for listed companies; encourage large institutional investors such as sovereign wealth funds, insurance companies and large fund companies to take the lead in developing ESG investments; (3) establish an evaluation index system for green credit, and launch green rating pilots for commercial banks; (4) allow the issuance of green bonds using ecological assets such as restored land and formed ground attachments.

10.6.3 Exert the Role of the Capital Market to Support Conservation Finance

Chinese capital market is still deficient in supporting conservation investment and financing. On the one hand, some objective factors lead to this issue, including long operation cycle of conservation projects, low or no return, small scale of environmental enterprises and instability of cash flow. On the other hand, there are some problems in the capital market itself, including the issuance process of securities, investment incentive, and the proficiency of institutions. To solve these problems, there are several available measures: (1) Strengthen support and services in the listing of environmental enterprises and set up green channels for IPO, refinancing, M and A and reorganization of such enterprises; (2) Take into account that most of the environmental enterprises are asset-intensive, so equity and bond financing can be moderately loosened up on the use of funds raised; (3) Strengthen support for environmental enterprises to be listed on the National Equities Exchange and Quotations (NEEQ) market; (4) enhance the professional and technical capabilities of financial institutions. Securities Companies, fund companies, and other securities industry institutions may set up Conservation Finance Department and Green Commissioner in reference to the bank, to enhance their capability building in the assessment, screening and investment of ecological conservation projects. Improve the incentive mechanism and link environmental project investment with individual performance; (5) improve the professional capabilities and credibility of third-party assessment agencies by unifying the filing process, clarifying the withdrawal rules, and strengthening the credibility of third-party agencies.

10.6.4 Improve the Basic Conditions of Conservation Finance

The development of conservation finance is a systematic work that requires enabling relevant environment and conditions. Conservation finance serves the protection of ecosystems and biodiversity, thus, if the local government does not have a strong motivation in environment protection, and there are not many conservation projects, conservation finance would have nothing to discuss. In other words, the development of conservation finance depends not only on the idea and behavior of financiers, but also on the dynamics of conservation.

10.6.4.1 Strengthen the Rule of Law and Provide Stable Expectations for the Development of Conservation Finance

China has formed a relatively complete system for ecological and environmental protection policies. However, the existing legal framework is not yet perfect, and there is a certain degree of overlapping and lag in authority between the departmental regulations; In addition, interest conflicts are prominent between central and local government, as well as between the government and the market. Under the pressure of the central government’s performance evaluation, local governments have contradictory incentives: On the one hand, there is an urgent need for green development and environmental improvement; on the other hand, in order to maintain a certain economic growth and fiscal revenue, there is also an incentive to tolerate industries that damage the environment but have significant contribution to tax revenues. Thus, local governments are actively developing emerging green industry, while imposes limited environmental regulation on existing enterprises. Under this scenario, we need to further improve the legislation of ecological and environmental protection laws and regulations, clarify and increase the liability of environmental polluters, and strengthen supervision and law enforcement.

10.6.4.2 Addressing the Measurement of the Externality of Ecological Investment