Abstract

Economic activities have tremendously globalized as a result of advances in transportation and information and communication technologies. Although business can now be easily conducted across multiple jurisdictions, the rules regulating these economic activities remain local in their scope. Each jurisdiction legislates its own laws in accordance with its respective policy goals. This creates inconsistencies among rules and fosters opportunities for tax avoidance by economic actors. In order to contribute to the exposure of tax avoidance and a better regulatory environment for international taxation, we analyze tax rules, firm-level equity investments, and multinational corporate structures within the framework of network science. We assert that countries must develop countermeasures and international tax rules, and engage in international cooperation in order to combat tax-avoiding behaviors.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

Note that there is controversy regarding the contributions of economic globalization [3].

- 2.

Some legal scholars claim that states are given a wider degree of discretion concerning legislative jurisdiction than the enforcement thereof [6].

- 3.

- 4.

We used the inward and outward FDI stock from and to OECD member countries as the FDI indicator.

- 5.

Note that it is not our intention to claim that the listed affiliates are surely involved in tax planning.

- 6.

GDP data comes from [82, 83] for every country except the following countries. Data is obtained through [84] for Cayman Islands, San Marino, Syria, Anguilla, Curaçao, the British Virgin Islands, the Democratic People’s Republic of Korea, French Polynesia, New Caledonia, Sint Maarten, and Somalia. Data is acquired through [85] for Taiwan and Gibraltar. Data from [86] is used for the Reunion). The same holds true for the conduit outward/inward centralities explained later.

- 7.

The level of public service provision substantially differs, even among OECD countries, which have the world’s richest economies. For instance, in 2018, France spent 55.9% of its GDP in its expenditures, whereas Ireland spent 25.5% [89].

- 8.

As of 2020, 95 jurisdictions joined the MLI and three expressed interest in it [95].

References

Federico, G., Tena-Junguito, A.: A tale of two globalizations: gains from trade and openness 1800–2010. Rev. World Econ. 153, 601–626 (2017)

UNCTAD (2012) World Investment Report 2012—Towards a New Generation of Investment Policies (UNCTAD/WIR/2012)

Wade, R.H.: Is globalization reducing poverty and inequality? World Dev. 32(4), 567–589 (2004)

Inklaar, R., de Jong, H., Bolt, J., van Zanden, J.L.: Rebasing ‘Maddison’: new income comparisons and the shape of long-run economic development. In: GGDC Research Memorandum, GD-174. Groningen Growth and Development Center, Groningen, The Netherlands (2018)

UN (2015) The Millennium Development Goals Report 2015

Oppenheim, L.: International Law 8th edn. Lauterpacht, H. (eds.), Longmans, Green and Co., London, The United Kingdom (1955)

Arnold, B.J.: International Tax Primer, 3rd edn. Wolters Kluwer, Alphen aan den Rijn, The Netherlands (2016)

Slemrod, J., Bakija, J.: Taxing Ourselves, 5th edn. A Citizen’s Guide to the Debate over Taxes. MIT Press, Massachusetts, The United States (2008)

Musgrave, P.B.: The OECD model tax treaty: problems and prospects. Columbia J. World Bus. 10(2), 29 (1975)

Kelly, B., Prokhovnik, R.: Economic Globalization? In: Held DY (eds.) A Globalizing World?—Culture, Economics, Politics. Routledge, London, The United Kingdom (2004)

Bruins, G.W.J., Einaudi, L., Seligman, E.R.A., Stamp, S.J.: Report on Double Taxation (1923)

Cobham, A., Janský, : Global distribution of revenue loss from corporate tax avoidance: re-estimation and country results. J. Int. Dev. 30, 206–232 (2018)

Holmes, K.: International Tax Policy and Double Treaties-an Introduction to Principles and Applications, 2nd revised edn. IBFD, Amsterdam, The Netherlands (2014)

Marchgraber, C.: The avoidance of double non-taxation in double tax treaty law - a critical analysis of the subject-to-tax clause recommended by the European commission. EC Tax Rev. 23(5), 293–302 (2014)

Okamura, T., Sakai, T.: Tax avoidance in Japan. In: Hashimzade, N., Epifantseva, Y. (eds.) The Routledge Companion of Tax Avoidance Research, 3rd edn. Routledge, New York, The United States (2018)

Frecknall-Hughes, J.: Historical and case law perspective on tax avoidance. In: Hashimzade N, Epifantseva Y (eds.) The Routledge Companion of Tax Avoidance Research, 3rd edn. Routledge, London, The United Kingdom (2018)

Loomis, S.C.: The double irish sandwich: reforming overseas tax havens. St. Mary’s Law J. 43(4), 825–854 (2012)

Duhigg, C., Kocientewski, D.: How Apple Sidesteps Billions in Taxes -funneling Earnings to Low-tax Regions. The New York Times (2012). https://www.nytimes.com/2012/04/29/business/apples-tax-strategy-aims-at-low-tax-states-and-nations.html

Drucker, J.: Google 2.4% Rate Shows How \$60 Billion Lost to Tax Loopholes. Bloomberg, 21 October (2010). http://www.bloomberg.com/news/2010-10-21/google-2-4-rate-shows-how-60-billion-u-s-revenue-lost-to-tax-loopholes.html

Biddle, S.: Like Everyone Else, Twitter Hides from U.S. Taxes in Ireland. Valleywag (2013). http://valleywag.gawker.com/like-everyone-else-twitter-hides-from-u-s-taxes-in-ir-1447085830

Sharman, J.C.: Havens in a Storm: The Struggle for Global Tax Regulation. Cornell University Press, New York, The United States (2006)

Christians, A.: Tax activists and the global movement for development through transparency. In: Stewart, M., Brauner, Y. (eds.) Tax, Law and Development. Edward Elgar Publishing, Cheltenham, The United Kingdom (2013)

BBC (2016) Amazon and Starbucks pay less tax than sausage stall, says Austria (2016)

OECD: Addressing Base Erosion and Profit Shifting. OECD Publishing, Paris, France (2013)

Rixen, T.: The Political Economy of International Tax Governance. Palgrave Macmillan, London, The United Kingdom (2008)

Barabási, A.: Network Science. Cambridge University Press, Cambridge, The United Kingdom (2016)

Buchanan, M.: Nexus: Small Worlds and the Groundbreaking Science of Networks. W. W. Norton and Company, New York, The United States (2003)

UNCTAD (2015) World Investment Report 2015—Reforming International Investment Governance (UNCTAD/WIR/2015)

UNCTAD (2016) World Investment Report 2016—Investor Nationality: Policy Challenges (UNCTAD/WIR/2016)

Johansson, A.A., Skeie, Ø., Sorbe, S., Menon, C.: Tax planning by multinational firms: firm- level evidence from a cross-country database. In: OECD Economics Department, Working Paper No. 1355 (2016)

Avi-Yonah, R.S., Panayi, C.H.: Rethinking treaty shopping: lessons for the European union. In: Lang, M., Pistone, P., Schuch, J., Staringer, C., Storck, A., Zagler, M. (eds.) Tax Treaties: Building Bridges between Law and Economics. IBFD, Amsterdam, The Netherlands (2010)

Reinhold, R.L.: What is tax treaty abuse? (Is treaty shopping an outdated concept?) Tax Lawyer 53(3), 663–702 (2000)

Baker, P.: Improper use of tax treaties, tax avoidance and tax evasion. In: Trepelkov, A., Tonino, H., Halka, D. (eds.) United Nations Handbook on Selected Issues in Administration of Double Tax Treaties for Developing Countries. UN, New York, The United States (2013)

UNCTAD (2019) World Investment Report 2019—Special economic zones (UNCTAD/WIR/2019)

World Bank (2015) National accounts data

OECD: Benchmark Definition of Foreign Direct Investment, 4th edn. France, OECD Publishing, Paris (2008)

International Monetary Fund (2015) Balance of Payments Statistics Yearbook and data

OECD: Tax Challenges Arising from Digitalisation—Interim Report 2018: Inclusive Framework on BEPS, OECD/G20 Base Erosion and Profit Shifting Project. OECD Publishing, Paris, France (2018)

Ciacci, A., Sueshige, T., Takayasu, H., Christensen, K., Takayasu, M.: The microscopic relationships between triangular arbitrage and cross-currency correlations in a simple agent based model of foreign exchange markets. PLOS ONE 15(6) (2020)

Aoyama, H., Fujiwara, Y., Ikeda, Y., Iyetomi, H., Souma, W., Yoshikawa, H.: Macro-Econophysics: New Studies on Economic Networks and Synchronization. Cambridge University Press, Cambridge (2017)

Dijkstra, E.W.: A note on two problems in connection with graphs. Numerische Math. 1, 269–271 (1959)

Gérard, M., Gillard, M.: Taxation, financial intermodality and the least taxed path for circulating income within a multinational enterprise. Annales D’Économie Et De Statistique 75(76), 89–107 (2004)

Freeman, L.C.: Centrality in social networks: I conceptual clarification. Social Netw. 1, 215–239 (1979)

Polak, S.: Algorithms for the Network Analysis of Bilateral Tax Treaties. Master Thesis, Universiteit van Amsterdam, 23 (2014)

Ernst and Young: Worldwide corporate tax guide 2017

Goh, K., Kahng, B., Kim, D.: Universal behavior of load distribution in scale-free networks. Phys. Rev. Lett. 87(27), 1–4 (2001)

Brandes, U.: On variants of shortest-path betweenness centrality and their generic computation. Social Netw. 30(2), 136–145 (2008)

Newman, M.E.J., Girvan, M.: Finding and evaluating community structure in networks. Phys. Rev. E 69, (2004)

Blondel, V.D., Guillaume, J.L., Lambiotte, R., Lefebvre, E.: Fast unfolding of communities in large networks. J. Stat. Mech. P10008 (2008)

Diamond, W.H., Diamond, D.B., Byrnes, W.H., Munro, R.J.: Tax Havens of the World. Matthew Bender and Company Inc, New York, The United States (2017)

Beer, S., Loeprick, J.: The cost and benefits of tax treaties with investment hubs: findings from sub-saharan Africa. In: IMF Working Paper WP/18/227 (2018)

OECD (2015) International direct investment database

OECD (2015) National Accounts data

OECD: Measuring and Monitoring BEPS, Action 11–2015 Final Report, OECD/G20 Base Erosion and Profit Shifting Project. OECD Publishing, Paris, France (2015)

UNESCO Institute for Statistics. http://uis.unesco.org/

Dharmapala, D.: What do we know about base erosion and profit shifting? A review of the empirical literature. Fiscal Studies 35(4), 421–448 (2014)

Hines Jr., J.R., Rice, E.M.: Fiscal paradise: foreign tax havens and American business. Q. J. Econ.109(1), 149–182 (1994)

UK Parliament: House of Commons Committee of Public Accounts, HM Revenue and Customs: Annual Report and Accounts 2011–2012, Nineteenth Report of Session 2012–2013, the Stationary office, London, The United Kingdom (2012)

US Senate: Offshore Profit Shifting and the US Tax Code. Part 1—Microsoft and Hewlett Packard. Part 2—Apple, Inc., Hearings before the Permanent Subcommittee on Investigations of the Committee on Homeland Security and Governmental Affairs. US Congress, Washington D.C., The United States (2013)

Lewellen, K., Robinson, L.A.: Internal Ownership Structures of U.S. Multinational Firms. Social Science Research Network, New York, The United States (2013)

van Dijk, B.: Orbis 2015 database (2015). http://orbis.bvdinfo.com. Accessed 6 Jan 2016

International Monetary Fund: Balance of payments and international investment position manual. IMF Multimedia Services Division, Washington, D.C., The United States (2009)

Nakamoto, T., Chakraborty, A., Ikeda, Y.: Appl. Netw. Sci. 4(58), 1–26 (2019)

Mintz, J., Weichenrieder, A.: The Indirect Side of Direct Investment: Multinational Company Finance and Taxation. The MIT Press, Cambridge, Massachusetts, The United States (2010)

van Dijk, B.: A-Z guide Corporate ownership and compliance terms (2017)

Garcia-Bernardo, J., Fichtner, J., Takes, F.W., Heemskerk, E.M.: Uncovering offshore financial centers: conduits and sinks in the global corporate ownership network. Sci. Rep. 7, 6246 (2017)

Maine, J.A., Nguyen, X.: The Intellectual Property Holding Company: Tax Use and Abuse from Victoria’s Secret to Apple. Cambridge University Press, Cambridge, The United Kingdom (2017)

Watts, D.J., Strogatz, S.H.: Collective dynamics of ‘small-world’ netwoeks. Nature 393, 409–410 (1998)

Ravasz, E., Barabási, A.L.: Hierarchical organization in complex network. Phys. Rev. E 67 (2003)

Pastor-Satorras, R., Vázquez, A., Vespignani, A.: Dynamical and correlation of the Internet. Phys. Rev. Lett. 87 (2001)

Boguñá, M., Pastor-Satorras, R., Vespignani, A.: Cut-offs and finite size effects in scale-free networks. Eur. Phys. J. B 68 (2004)

Csermely, P., Korcsmáros, T., Kiss, H.J.M., London, G., Nussinov, R.: Structure and dynamics of biological networks: a novel paradigm of drug discovery. A Comprehensive Rev. Pharmacol. Therapeutics 138(3), 333–408 (2013)

Fortune Global 500: Fortune Media Group Holdings. New York (2015). http://fortune.com/global500. Cited 13 Sept 2018

Eicke, R.: Tax Planning with Holding Companies: Repatriation of US Profits from Europe Taxation. Kluwer Law International, London, The United Kingdom (2009)

Kalemli-Özcan, Ş., Sørensen, B.E., Villegas-Sanchez, C., Volosovych, V., Yeşiltaş, S.: How to Construct Nationally Representative Firm Level Data from the Orbis Global Database: New Facts and Aggregate Implications. Tinbergen Institute Discussion Paper, TI 2015-110/IV (2019)

Damgaard, J., Elkjaer, T., Johannesen, N.: What Is Real and What Is Not in the Global FDI Network? IMF Working Paper, WP/19/274 (2019)

Casella, B.: Looking through conduit FDI in search of ultimate investors—a probabilistic approach. Transnational Corporations 26(1), 109–146 (2019)

Nakamoto, T., Rouhban, O., Ikeda, Y.: Location sector analysis of international profit shifting on a multilayer ownership tax network. Evolut. Inst. Econ. Rev. 17, 219–241 (2019)

Kivelä, M., Arenas, A., Barthelemy, M., Gleeson, P.J., Moreno, Y., Porter, M.A.: Multilayer networks. J. Complex Netw. 2(3), 203–271 (2014)

eurostat: NACE Rev.2—Statistical classification of economic activities in the European Community, Methodologies and Working papers (2008)

van’t Riet, M., Lejour, A., Hanappi, T.: Network Analysis of Tax Treaty Shopping using dividend-based weights. CPB Communication (2015)

World Bank (2011) National accounts data

National accounts data

United Nations Statistics Division (2010) National Accounts Estimates of Main Aggregates

Central Intelligence Agency (2016) The World Factbook 2020. Washington, DC, The United States

National Institute of Statistics and Economic Studies (2011) Website https://www.insee.fr/en/accueil

Nakamoto, T., Ikeda, Y.: Identification of conduit jurisdictions and community structures in the withholding tax network. Evolut. Inst. Econ. Rev. 15, 477–493 (2018)

Rosenbloom, H.D., Langbein, S.: United States Tax Treaty Policy: An Overview. J. Transnat’l L. 359 (1981)

OECD: General government spending (indicator) (2020). https://data.oecd.org/gga/general-government-spending.htm. Cited on 08 September 2020

Dagan, T.: International Tax Policy Between Competition and Cooperation. Cambridge University Press, Cambridge, The United Kingdom (2018)

OECD: Harmful Tax Competition: An Emerging Global Issue. OECD Publishing, Paris, France (1998)

OECD: Countering Harmful Tax Practices More Effectively, Taking into Account Transparency and Substance, Action 5–2015 Final Report, OECD/G20 Base Erosion and Profit Shifting Project. OECD Publishing, Paris, France (2015)

OECD: Programme of Work to Develop a Consensus Solution to the Tax Challenges Arising from the Digitalisation of the Economy, OECD/G20 Inclusive Framework on BEPS. France, OECD, Paris (2019)

OECD: Developing a Multilateral Instrument to Modify Bilateral Tax Treaties, Action 15–2015 Final Report, OECD/G20 Base Erosion and Profit Shifting Project. OECD Publishing, Paris, France (2015)

OECD: Signatories and Parties to the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting, Status as of 27 November 2020

OECD: Preventing the Granting of Treaty Benefits in Inappropriate Circumstances, Action 6–2015 Final Report, OECD/G20 Base Erosion and Profit Shifting Project. OECD Publishing, Paris, France (2015)

OECD: Prevention of Treaty Abuse -Second Peer Review Report on Treaty Shopping. France, OECD, Paris (2020)

OECD: Jurisdictions Participating in the Convention on Mutual Administrative Assistance in Tax Matters, Status (2020)

OECD: Transfer Pricing Documentation and Country-by-Country Reporting, Action 13–2015 Final Report, OECD/G20 Base Erosion and Profit Shifting Project. OECD Publishing, Paris, France (2015)

OECD: Corporate tax statistics, 2nd edn. (2020)

OECD: Mandatory Disclosure Rules, Action 12–2015 Final Report, OECD/G20 Base Erosion and Profit Shifting Project. OECD Publishing, Paris, France (2015)

Foley, S., Martin, M.R., Plowgian, M.H., DerOhanesian, J., Lund, H., Bodapati, R., McConkey, J.: The State of Country-by-Country Reporting, Tax notes international, pp. 1163–1170 (2020)

Acknowledgements

This work was supported by JSPS KAKENHI Grant Number JP17KT0034.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

A. Appendix

A. Appendix

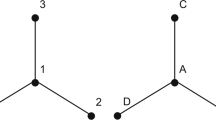

As part of the result of the analysis described in Sect. 4, Tables A.1, A.2, and A.3 show the top 10 US, Europe, China-based multinationals’ affiliates that the model identified as a key company. In the column of the name, the name written in bold indicates a multinational group’s name, and the number in parenthesis indicates the number of affiliates listed in the tables. The column of type indicates the categories of the key companies. The multinationals that ranked in the top 10 in 2015 but were not analyzed are written in the tables’ notes.

Due to the limited number of pages, we only list the affiliates that fulfill the following three conditions. The first condition is that a holding company is not a listed company. If it is a listed parent company, we exclude itself and the conduit companies directly linked with it because they seldom minimize their tax payment. The second condition is that a holding company is directly linked with more than one conduit company. A holding company with a conduit company usually has more risk of being used for tax purposes than a holding company without any conduit company. The third condition is that a holding company’s jurisdiction is different from its conduit companies’ jurisdictions. A holding company with a foreign conduit company is more suspected of involving an attempt to avoid tax payments than a holding company without any foreign conduit company.

The tables include more key companies regarding European-based multinationals than the US and China-based multinationals. This probably is because the database used for the analysis covers the companies located in Europe much well than the rest of the world. Note that we do not have any intention that the listed affiliates are surely involved in multinationals’ tax strategies.

Rights and permissions

Copyright information

© 2021 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Nakamoto, T., Ikeda, Y. (2021). International Tax Avoidance Investigated from A Network Science Perspective. In: Ikeda, Y., Iyetomi, H., Mizuno, T. (eds) Big Data Analysis on Global Community Formation and Isolation. Springer, Singapore. https://doi.org/10.1007/978-981-15-4944-1_9

Download citation

DOI: https://doi.org/10.1007/978-981-15-4944-1_9

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-15-4943-4

Online ISBN: 978-981-15-4944-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)