Abstract

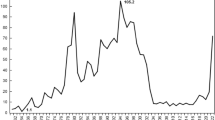

Using data from the first quarter of 1990 until the second quarter of 2013, we performed Bayesian estimation of DSGE model, which was developed from 10 endogenous variables. When we introduced productivity shock, monetary easing shock and preference shock to the estimated DSGE model, we obtained results that were mostly consistent with economic theory. We then analyzed these results to observe what kind of effect the shock of the inflation target, a primal policy of Abenomics, has on the major economic variables, such as employment and the like. To do this, we defined the inflation target’s shock as a shock that leads to the inflation rate deviating in the minus direction from the steady state of expected inflation rate, and calculated the impulse response function. As a result of this analysis, we found that inflation target shock leads to expanded production volume, and higher wage rates and inflation rates. Employment, our subject of focus, also improved. Excluding some parts, these results were also consistent with the trend of the real economy that followed after the start of Abenomics. We also learned that the inflation target’s effect was far more sustainable than monetary easing’s effect.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

- 2.

Sugo and Ueda (2008) and others cite the model of Christiano et al. (2005) as an example of a model applicable to the Japanese economy. See Kato (2007) and Eguchi (2011) for Japanese language texts on DSGE models. Fujiwara and Watanabe (2011) also provide a useful and comprehensive explanatory guide. Iwata (2009, 2012) uses DSGE modeling to analyze Japanese national fiscal policies.

- 3.

“hat” and “tilda” show the change rate and the change level of the variable, respectively.

References

Calvo, G. 1983. Staggered Prices in A Utility-Maximizing Framework. Journal of Monetary Economics 12: 383–398.

Eguchi, M. 2011. Dogakuteki ippan kinko moderu ni yoru zaisei seisaku no bunseki (Analysis of Fiscal Policy Through Dynamic General Equilibrium Modeling), in Japanese, Mitsubishi Economic Research Institute.

Kato, R. 2007. Gendai makurokeizaigaku kōgi (Lecture on Modern Macroeconomics), in Japanese, Toyo Keizai Inc.

Fujiwara, I., and T. Watanabe. 2011. Makuro dōgaku ippan kinkō moderu – sābei to Nihon no makurodēta e no ōyō –, (Dynamic General Equilibrium Model–A Survey with the Application to the Japanese Macroeconomic Date–), in Japanese, Keizai Kenkyu 62 (1): 66–93.

Christiano, L.J., M. Eichenbaum, and C. Evans. 2005. Nominal Rigidities and the Dynamic Effects of a Shock to Monetary Policy. Journal of Political Economy 113 (1): 1–45.

Iwata, Y. 2009. Fiscal Policy in an Estimated DSGE Model of the Japanese Economy: Do Non-Ricardian Households Explain All, ESRI Discussion Paper Series No. 216.

Iwata, Y. 2012. Non-Wasteful Government Spending in an Estimated Open Economy DSGE Model: Two Fiscal Policy Puzzles Revisited, ESRI Discussion Paper Series No. 285.

Smets, F., and R. Wouters. 2003. An Estimated Dynamic Stochastic General Equilibrium Models of the Euro Area. Journal of the European Economic Association 1 (5): 1123–1175.

Smets, F., and R. Wouters. 2007. Shocks and Frictions in US Business Cycles: A Bayesian DSGE Approach. The American Economic Review 97 (3): 586–606.

Sugo, T., and K. Ueda. 2008. Estimating a Dynamic Stochastic General Equilibrium Model for Japan. Journal of the Japanese and International Economies 22 (4): 476–502.

Acknowledgements

We would like to thank seminar participants for helpful comments. Research for this paper was supported financially by JSPS KAKENHI Grant Numbers 26380367. Nevertheless, any remaining errors are the authors’ responsibility.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

13.7 Appendix

13.7 Appendix

Structure of log-linear approximation model

Here, we clearly show the relationship between the model developed in this paper and the DSGE model used for the simulation. The following equations (13.C.1) through (13.C.10) are, respectively, goods market equilibrium equations of (13.3), (13.9), (13.30), log-linear approximated terms or actual terms of (13.B.3), (13.B.1), (13.12), (13.21), (13.31), (13.A.4), (13.B.1) and (13.B.3). Through this process, \({\omega }\) appears, but this is erased using (13.11).

Note, however, that the estimation was further set as follows:

Rights and permissions

Copyright information

© 2018 Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Hayashida, M., Yasuoka, M., Nanba, R., Ohno, H. (2018). Will Abenomics Expand Employment?–Interpreting Abenomics Through DSGE Modeling. In: Hosoe, M., Kim, I., Yabuta, M., Lee, W. (eds) Applied Analysis of Growth, Trade, and Public Policy. Springer, Singapore. https://doi.org/10.1007/978-981-13-1876-4_13

Download citation

DOI: https://doi.org/10.1007/978-981-13-1876-4_13

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-13-1875-7

Online ISBN: 978-981-13-1876-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)