Abstract

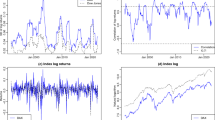

The issues of volatility and risk in recent times have gained importance for financial practitioners, market participants, regulators and researchers. Volatility is the most basic statistical risk measure instrument. This chapter empirically investigates the pattern of volatility in the Indian and Chinese stock markets during 2006–2011 with reference to its time varying nature, presence of certain characteristics such as volatility clustering and existence of ‘spillover effect’ in the domestic and the US stock markets. This chapter will also try to estimate the persistence of shock in terms of half-life in each sub-period of study. It contributes to the body of knowledge by providing a holistic outlook to the subject of stock market volatility in India and provides evidence on its main features with the help of econometric techniques employing GARCH models. A comparative analysis is made with the Chinese stock market taking Shanghai Composite Index (SCI).

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Aggarwal R, Tandon K (1994) Anomalies or illusions? Evidence from stock markets in eighteen countries. J Int Money Finan 13(1):83–106

Bollerslev T (1986) Generalised autoregressive conditional heteroskedasticity. J Econom 31(3):307–327

Booth GG, Martikainen T, Tse Y (1997) Price and volatility spillovers in Scandinavian stock markets. J Bank Finan 21(6):811–823

Box GEP, Jenkins GM (1976) Time series analysis: forecasting and control, revised edn. Holden-Day, California

Box G, Pierce D (1970) Distribution of residual autocorrelations in autoregressive-integrated moving average time series models. J Am Stat Assoc 65:1509–1526

Chaudhury SK (1991) Seasonality in share returns: preliminary evidence on day of the week effect. Chartered Accountant (India) 40(5):107–109

Fama EF (1965) The Behaviour of Stock Market Prices. J Bus 38(1):34–105

Garman M, Klass M (1980) On the estimation of security price volatilities from historical data. J Bus 53:67–78

Hansda SK, Ray P (2002) BSE and Nasdaq: Globalisation, Information Technology and Stock Prices. Economic and Political Weekly, February 2, 459–468

Hansda SK, Ray P (2003) Stock Market Integration and Dually Listed Stocks: Indian ADR and Domestic Stock Prices. Economic and Political Weekly, February 22, 741–753

Kumar KK, Mukhopadhyay C (2002) A Case of US and India. Paper published as part of the NSE Research Initiative. http//:www.nseindia.com

Lamoureux Christopher G, Lastrapes William D (1990) Heteroskedasticity in Stock Return Data: Volume versus GARCH Effects. J Financ 45(1):221–229

Ljung G, Box G (1978) On a measure of lack of fit in time series models. Biometrika 66:67–72

Lo AW, MacKinlay AC (1988) Stock market prices do not follow random walks: evidence from a simple specification test. Rev Financ Stud 1:41–66

Mandelbrot B (1963) The Variation of Certain Speculative Prices. J Bus 36(4):394–419

Miller MH (1991) Financial innovations and market volatility. Blackwell, pp 1–288

Parkinson M (1980) The extreme value method for estimating the variance of the rate of return. J Bus 53:61–65

Poterba James M, Summers LH (1986) The Persistence of Volatility and Stock Market Fluctuations. Am Econ Rev 1142–1151

Rao BSR, Naik U (1990) Inter-Relatedness of Stock Markets: Spectral investigation of USA, Japanese and Indian Markets – A Note. Arth Vignana 32(3&4):309–321

Sharma JL, Kennedy RE (1977) A Comparative Analysis of Stock Price behavior on Bombay, London and New York Stock Exchange. J Financ Quant Anal 31(3):391–413

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1

GARCH estimate for clustering and half-life calculation

1st period India

Dependent variable: RTINDIA | ||||

|---|---|---|---|---|

Sample: 4/03/2006–12/14/2007 | ||||

Included observations: 422 | ||||

GARCH = C(2) + C(3) * RESID(−1)2 + C(4) * GARCH(−1) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.098926 | 0.029144 | 3.394374 | 0.0007 |

Variance equation | ||||

C | 0.026160 | 0.007093 | 3.688360 | 0.0002 |

RESID(−1)2 | 0.180966 | 0.040497 | 4.468580 | 0.0000 |

GARCH(−1) | 0.775294 | 0.042797 | 18.11582 | 0.0000 |

R-squared | −0.003247 | Mean dependent var | 0.057862 | |

Adjusted R-squared | −0.010447 | S.D. dependent var | 0.721531 | |

GARCH 1st period China

Dependent variable: RTCHINA | ||||

|---|---|---|---|---|

Sample: 4/03/2006–12/14/2007 | ||||

Included observations: 422 | ||||

GARCH = C(2) + C(3) * RESID(−1)2 + C(4) * GARCH(−1) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.128874 | 0.036255 | 3.554664 | 0.0004 |

Variance equation | ||||

C | 0.013697 | 0.004443 | 3.082556 | 0.0021 |

RESID(−1)2 | 0.061899 | 0.013156 | 4.704891 | 0.0000 |

GARCH(−1) | 0.924676 | 0.012104 | 76.39616 | 0.0000 |

R-squared | −0.000406 | Mean dependent var | 0.145264 | |

Adjusted R-squared | −0.007586 | S.D. dependent var | 0.814575 | |

GARCH 2nd period India

Dependent variable: RTINDIA | ||||

|---|---|---|---|---|

Sample: 12/17/2007–4/01/2009 | ||||

Included observations: 317 | ||||

GARCH = C(2) + C(3) * RESID(−1)2 + C(4) * GARCH(−1) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | −0.058058 | 0.059031 | −0.983521 | 0.3254 |

Variance equation | ||||

C | 0.075185 | 0.039518 | 1.902566 | 0.0571 |

RESID(−1)2 | 0.131614 | 0.049000 | 2.686020 | 0.0072 |

GARCH(−1) | 0.820384 | 0.060157 | 13.63744 | 0.0000 |

R-squared | −0.000696 | Mean dependent var | −0.089802 | |

Adjusted R-squared | −0.010288 | S.D. dependent var | 1.204988 | |

GARCH 2nd period China

Dependent variable: RTCHINA | ||||

|---|---|---|---|---|

Sample: 12/17/2007–4/01/2009 | ||||

Included observations: 317 | ||||

GARCH = C(2) + C(3) * RESID(–1)2 + C(4) * GARCH(–1) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | −0.162750 | 0.028802 | −5.650552 | 0.0000 |

Variance equation | ||||

C | 0.035248 | 0.003274 | 10.76595 | 0.0000 |

RESID(−1)2 | −0.040575 | 0.003209 | −12.64421 | 0.0000 |

GARCH(−1) | 1.018870 | 4.06E-05 | 25064.94 | 0.0000 |

R-squared | −0.001140 | Mean dependent var | −0.123300 | |

Adjusted R-squared | −0.010736 | S.D. dependent var | 1.170177 | |

GARCH 3rd period India

Dependent variable: RTINDIA | ||||

|---|---|---|---|---|

Sample: 4/02/2009–3/31/2011 | ||||

Included observations: 498 | ||||

GARCH = C(2) + C(3) * RESID(−1)2 + C(4) * GARCH(−1) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.050708 | 0.022293 | 2.274645 | 0.0229 |

Variance equation | ||||

C | 0.005644 | 0.002633 | 2.143564 | 0.0321 |

RESID(−1)2 | 0.118561 | 0.021685 | 5.467410 | 0.0000 |

GARCH(−1) | 0.875519 | 0.022526 | 38.86757 | 0.0000 |

R-squared | −0.000017 | Mean dependent var | 0.053451 | |

Adjusted R-squared | −0.006090 | S.D. dependent var | 0.656688 | |

GARCH 3rd period China

Dependent variable: RTCHINA | ||||

|---|---|---|---|---|

Sample: 4/02/2009–3/31/2011 | ||||

Included observations: 498 | ||||

GARCH = C(2) + C(3) * RESID(−1)2 + C(4) * GARCH(−1) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.029746 | 0.031494 | 0.944487 | 0.3449 |

Variance equation | ||||

C | 0.023166 | 0.011189 | 2.070427 | 0.0384 |

RESID(−1)2 | 0.042569 | 0.014948 | 2.847911 | 0.0044 |

GARCH(−1) | 0.905456 | 0.035288 | 25.65900 | 0.0000 |

R-squared | −0.000043 | Mean dependent var | 0.025190 | |

Adjusted R-squared | −0.006116 | S.D. dependent var | 0.699381 | |

Appendix 2

EGARCH estimate For clustering and leverage effect

1st period

Dependent variable: RTINDIA | ||||

|---|---|---|---|---|

Sample: 4/03/2006–12/14/2007 | ||||

Included observations: 422 | ||||

LOG(GARCH) = C(2) + C(3) * ABS(RESID(−1)/@SQRT(GARCH(−1))) + C(4) * RESID(−1)/@SQRT(GARCH(−1)) + C(5) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.069703 | 0.026230 | 2.657399 | 0.0079 |

Variance equation | ||||

C(2) | −0.373576 | 0.063735 | −5.861376 | 0.0000 |

C(3) | 0.322985 | 0.069004 | 4.680653 | 0.0000 |

C(4) | −0.262083 | 0.040088 | −6.537610 | 0.0000 |

C(5) | 0.864514 | 0.022603 | 38.24711 | 0.0000 |

R-squared | −0.000270 | Mean dependent var | 0.057862 | |

Adjusted R-squared | −0.009865 | S.D. dependent var | 0.721531 | |

Dependent variable: RTCHINA | ||||

|---|---|---|---|---|

Sample: 4/03/2006–12/14/2007 | ||||

Included observations: 422 | ||||

LOG(GARCH) = C(2) + C(3) * ABS(RESID(−1)/@SQRT(GARCH(-1))) + C(4) * RESID(−1)/@SQRT(GARCH(−1)) + C(5) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.146602 | 0.030127 | 4.866224 | 0.0000 |

Variance equation | ||||

C(2) | −0.100532 | 0.018940 | −5.308044 | 0.0000 |

C(3) | 0.134752 | 0.027813 | 4.844927 | 0.0000 |

C(4) | 0.056456 | 0.023697 | 2.382382 | 0.0172 |

C(5) | 0.981920 | 0.006318 | 155.4087 | 0.0000 |

R-squared | −0.000003 | Mean dependent var | 0.145264 | |

Adjusted R-squared | −0.009595 | S.D. dependent var | 0.814575 | |

2nd period

Dependent variable: RTINDIA | ||||

|---|---|---|---|---|

Sample: 12/17/2007–4/01/2009 | ||||

Included observations: 317 | ||||

LOG(GARCH) = C(2) + C(3) * ABS(RESID(−1)/@SQRT(GARCH(−1))) + C(4)*RESID(−1)/@SQRT(GARCH(−1)) + C(5) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | −0.102140 | 0.059328 | −1.721614 | 0.0851 |

Variance equation | ||||

C(2) | −0.110166 | 0.060657 | −1.816224 | 0.0693 |

C(3) | 0.152771 | 0.075284 | 2.029272 | 0.0424 |

C(4) | −0.125305 | 0.028927 | −4.331755 | 0.0000 |

C(5) | 0.955006 | 0.020300 | 47.04521 | 0.0000 |

R-squared | −0.000105 | Mean dependent var | −0.089802 | |

Adjusted R-squared | −0.012927 | S.D. dependent var | 1.204988 | |

Dependent variable: RTCHINA | ||||

|---|---|---|---|---|

Sample: 12/17/2007–4/01/2009 | ||||

Included observations: 317 | ||||

LOG(GARCH) = C(2) + C(3) * ABS(RESID(−1)/@SQRT(GARCH(−1))) + C(4) * RESID(−1)/@SQRT(GARCH(−1)) + C(5) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | −0.136118 | 0.053393 | −2.549352 | 0.0108 |

Variance equation | ||||

C(2) | 0.067374 | 0.008209 | 8.207774 | 0.0000 |

C(3) | −0.073897 | 0.005684 | −13.00042 | 0.0000 |

C(4) | −0.059393 | 0.021711 | −2.735566 | 0.0062 |

C(5) | 0.968566 | 0.005465 | 177.2196 | 0.0000 |

R-squared | −0.000120 | Mean dependent var | −0.123300 | |

Adjusted R-squared | −0.012942 | S.D. dependent var | 1.170177 | |

3rd PERIOD

Dependent variable: RTINDIA | ||||

|---|---|---|---|---|

Sample: 4/02/2009–3/31/2011 | ||||

Included observations: 498 | ||||

LOG(GARCH) = C(2) + C(3) * ABS(RESID(−1)/@SQRT(GARCH(−1))) + C(4) * RESID(−1)/@SQRT(GARCH(−1)) + C(5) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.035054 | 0.021637 | 1.620078 | 0.1052 |

Variance equation | ||||

C(2) | −0.212070 | 0.036652 | −5.785965 | 0.0000 |

C(3) | 0.257810 | 0.041170 | 6.262093 | 0.0000 |

C(4) | −0.102913 | 0.030323 | −3.393880 | 0.0007 |

C(5) | 0.987444 | 0.008039 | 122.8386 | 0.0000 |

R-squared | −0.000786 | Mean dependent var | 0.053451 | |

Adjusted R-squared | −0.008906 | S.D. dependent var | 0.656688 | |

Dependent variable: RTCHINA | ||||

|---|---|---|---|---|

Sample: 4/02/2009–3/31/2011 | ||||

Included observations: 498 | ||||

LOG(GARCH) = C(2) + C(3) * ABS(RESID(−1)/@SQRT(GARCH(−1))) + C(4) * RESID(−1)/@SQRT(GARCH(−1)) + C(5) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.028783 | 0.031867 | 0.903230 | 0.3664 |

Variance equation | ||||

C(2) | −0.179784 | 0.069434 | −2.589290 | 0.0096 |

C(3) | 0.077045 | 0.048245 | 1.596959 | 0.1103 |

C(4) | −0.120139 | 0.040140 | −2.993006 | 0.0028 |

C(5) | 0.846203 | 0.059197 | 14.29467 | 0.0000 |

R-squared | −0.000026 | Mean dependent var | 0.025190 | |

Adjusted R-squared | −0.008140 | S.D. dependent var | 0.699381 | |

Appendix 3

EGARCH estimate for Spillover

1st sub-period

Dependent variable: RTINDIA | ||||

|---|---|---|---|---|

Sample: 4/03/2006–12/14/2007 | ||||

Included observations: 422 | ||||

LOG(GARCH) = C(3) + C(4) * ABS(RESID(−1)/@SQRT(GARCH(−1))) + C(5) * RESID(−1)/@SQRT(GARCH(−1)) + C(6) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.078013 | 0.024172 | 3.227418 | 0.0012 |

RTUSA | 0.160136 | 0.061943 | 2.585198 | 0.0097 |

Variance equation | ||||

C(3) | −0.352640 | 0.083664 | −4.214963 | 0.0000 |

C(4) | 0.314144 | 0.090026 | 3.489479 | 0.0005 |

C(5) | −0.264987 | 0.056315 | −4.705423 | 0.0000 |

C(6) | 0.892383 | 0.029893 | 29.85266 | 0.0000 |

GED parameter | 1.341309 | 0.132189 | 10.14687 | 0.0000 |

R-squared | 0.013994 | Mean dependent var | 0.057862 | |

Adjusted R-squared | −0.000262 | S.D. dependent var | 0.721531 | |

S.E. of regression | 0.721626 | Akaike info criterion | 1.860797 | |

Dependent variable: RTCHINA | ||||

|---|---|---|---|---|

Sample: 4/03/2006–12/14/2007 | ||||

Included observations: 422 | ||||

LOG(GARCH) = C(3) + C(4) * ABS(RESID(−1)/@SQRT(GARCH(−1))) + C(5) * RESID(−1)/@SQRT(GARCH(−1)) + C(6) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.152740 | 0.026043 | 5.864823 | 0.0000 |

RTUSA | 0.105099 | 0.073655 | 1.426903 | 0.1536 |

Variance equation | ||||

C(3) | −0.153487 | 0.051721 | −2.967602 | 0.0030 |

C(4) | 0.192909 | 0.071931 | 2.681846 | 0.0073 |

C(5) | 0.009560 | 0.049847 | 0.191793 | 0.8479 |

C(6) | 0.958284 | 0.023377 | 40.99332 | 0.0000 |

GED parameter | 1.049438 | 0.095773 | 10.95762 | 0.0000 |

R-squared | 0.001252 | Mean dependent var | 0.145264 | |

Adjusted R-squared | −0.013188 | S.D. dependent var | 0.814575 | |

S.E. of regression | 0.819929 | Akaike info criterion | 2.221829 | |

2nd sub-period

Dependent variable: RTINDIA | ||||

|---|---|---|---|---|

Sample: 12/17/2007–4/01/2009 | ||||

Included observations: 317 | ||||

LOG(GARCH) = C(3) + C(4)*ABS(RESID(−1)/@SQRT(GARCH(−1))) + C(5) * RESID(−1)/@SQRT(GARCH(−1)) + C(6) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | −0.105695 | 0.060773 | −1.739173 | 0.0820 |

RTUSA | −0.045623 | 0.063101 | −0.723027 | 0.4697 |

Variance equation | ||||

C(3) | −0.106505 | 0.063488 | −1.677548 | 0.0934 |

C(4) | 0.147896 | 0.079577 | 1.858535 | 0.0631 |

C(5) | −0.129890 | 0.030174 | −4.304656 | 0.0000 |

C(6) | 0.954788 | 0.022615 | 42.21920 | 0.0000 |

GED parameter | 1.944783 | 0.245918 | 7.908260 | 0.0000 |

R-squared | −0.004109 | Mean dependent var | −0.089802 | |

Adjusted R-squared | −0.023544 | S.D. dependent var | 1.204988 | |

Dependent variable: RTCHINA | ||||

|---|---|---|---|---|

Sample: 12/17/2007–4/01/2009 | ||||

Included observations: 317 | ||||

LOG(GARCH) = C(3) + C(4) * ABS(RESID(−1)/@SQRT(GARCH(−1))) + C(5) * RESID(−1)/@SQRT(GARCH(−1)) + C(6) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | −0.096887 | 0.046488 | −2.084100 | 0.0372 |

RTUSA | −0.097534 | 0.065605 | −1.486692 | 0.1371 |

Variance equation | ||||

C(3) | 0.075368 | 5.38E−08 | 1400563. | 0.0000 |

C(4) | −0.088226 | 0.004521 | −19.51454 | 0.0000 |

C(5) | −0.066091 | 0.029370 | −2.250329 | 0.0244 |

C(6) | 0.969752 | 0.005868 | 165.2748 | 0.0000 |

GED parameter | 1.462581 | 0.180404 | 8.107258 | 0.0000 |

R-squared | −0.001916 | Mean dependent var | −0.123300 | |

Adjusted R-squared | −0.021307 | S.D. dependent var | 1.170177 | |

3rd Sub-period

Dependent variable: RTINDIA | ||||

|---|---|---|---|---|

Sample (adjusted): 4/02/2009–3/24/2011 | ||||

Included observations: 493 after adjustments | ||||

LOG(GARCH) = C(3) + C(4) * ABS(RESID(−1)/@SQRT(GARCH(−1))) + C(5) * RESID(−1)/@SQRT(GARCH(−1)) + C(6) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.040485 | 0.020647 | 1.960833 | 0.0499 |

RTUSA | −0.027055 | 0.040936 | −0.660907 | 0.5087 |

Variance equation | ||||

C(3) | −0.198975 | 0.055644 | −3.575880 | 0.0003 |

C(4) | 0.222863 | 0.059845 | 3.723999 | 0.0002 |

C(5) | −0.115798 | 0.041855 | −2.766615 | 0.0057 |

C(6) | 0.977461 | 0.015055 | 64.92544 | 0.0000 |

GED parameter | 1.362674 | 0.090024 | 15.13686 | 0.0000 |

R-squared | −0.003205 | Mean dependent var | 0.053993 | |

Adjusted R-squared | −0.015590 | S.D. dependent var | 0.659994 | |

Dependent variable: RTCHINA | ||||

|---|---|---|---|---|

Sample: 4/02/2009–3/31/2011 | ||||

Included observations: 498 | ||||

LOG(GARCH) = C(3) + C(4) * ABS(RESID(−1)/@SQRT(GARCH(−1))) + C(5) * RESID(−1)/@SQRT(GARCH(−1)) + C(6) * LOG(GARCH(−1)) | ||||

Coefficient | Std. error | z-Statistic | Prob. | |

C | 0.070085 | 0.026711 | 2.623857 | 0.0087 |

RTUSA | −0.091560 | 0.047075 | −1.944979 | 0.0518 |

Variance equation | ||||

C(3) | −0.219788 | 0.110867 | −1.982449 | 0.0474 |

C(4) | 0.016437 | 0.086411 | 0.190224 | 0.8491 |

C(5) | −0.202779 | 0.077343 | −2.621820 | 0.0087 |

C(6) | 0.749673 | 0.109840 | 6.825106 | 0.0000 |

GED parameter | 1.262590 | 0.114267 | 11.04950 | 0.0000 |

R-squared | −0.003006 | Mean dependent var | 0.025190 | |

Adjusted R-squared | −0.015262 | S.D. dependent var | 0.699381 | |

Rights and permissions

Copyright information

© 2016 Springer India

About this chapter

Cite this chapter

Sarkar, A., Roy, M. (2016). An Empirical Investigation of Volatility Clustering, Volatility Spillover and Persistence from USA to Two Emerging Economies India and China. In: Roy, M., Sinha Roy, S. (eds) International Trade and International Finance. Springer, New Delhi. https://doi.org/10.1007/978-81-322-2797-7_20

Download citation

DOI: https://doi.org/10.1007/978-81-322-2797-7_20

Published:

Publisher Name: Springer, New Delhi

Print ISBN: 978-81-322-2795-3

Online ISBN: 978-81-322-2797-7

eBook Packages: Economics and FinanceEconomics and Finance (R0)