Abstract

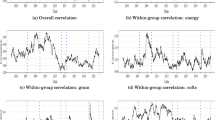

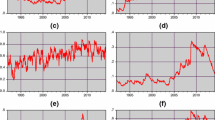

In this paper, we performed a stress-testing for a portfolio of commodity futures, which mimics the dynamics of the DJ-UBS index. We identified extreme events that impacted commodity prices over time, and looked at correlation structures in a dynamic way, with copula functions. In line with Basel III financial regulations, we derived baseline, historical, and hybrid scenarios and discussed their advantages and shortfalls. We found that the financialization of commodity markets led to an increase in correlations and in the probability for joint extremes. However, we identified structural breaks in commodity markets that temporarily led to a breakdown of expected statistical patterns and of traditional dependence structures among commodities. This fact shows the need for forward-looking stress testing techniques, like hybrid and hypothetical scenarios, as encouraged by financial regulators.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Bank for International Settlements: Principles for Sound Stress Testing Practices and Supervision. Basel Committee on Banking Supervision, Basel (2009)

Demarta, S., McNeil, A.: The t copula and related copulas. Int. Stat. Rev. 73(1), 111–129 (2005)

Embrechts, P., Klüppelberg, C., Mikosch, T.: Modeling extremal events: for insurance and finance, 4th printing edn. Springer, Berlin (2003)

Gencay, R., Selcuk, F.: Extreme value theory and value-at-risk: relative performance in emerging markets. Int. J. Forecast. 20(2), 287–303 (2004)

Haile, F., Pozo, S.: Exchange rate regimes and currency crises: an evaluation using extreme value theory. Rev. Int. Econ. 14(4), 554–570 (2006)

McNeil, A.J., Frey, R., Embrechts, P.: Quantitative Risk Management: Concepts, Techniques and Tools. Princeton University Press, Princeton (2005)

Patton, A.: Modelling asymmetric exchange rate dependence. Int. Econ. Rev. 47(2), 527–556 (2006)

Tang, K., Xiong, W.: Index investment and the financialization of commodities. Financ. Anal. J. 68(6), 54–74 (2012)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer International Publishing Switzerland

About this paper

Cite this paper

Mudry, PA., Paraschiv, F. (2016). Stress-Testing for Portfolios of Commodity Futures with Extreme Value Theory and Copula Functions. In: Fonseca, R., Weber, GW., Telhada, J. (eds) Computational Management Science. Lecture Notes in Economics and Mathematical Systems, vol 682. Springer, Cham. https://doi.org/10.1007/978-3-319-20430-7_3

Download citation

DOI: https://doi.org/10.1007/978-3-319-20430-7_3

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-20429-1

Online ISBN: 978-3-319-20430-7

eBook Packages: Business and ManagementBusiness and Management (R0)