Abstract

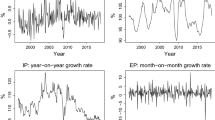

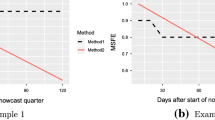

We compare the nowcasting and forecasting performance of different variants of MIDAS models (ADL-MIDAS, TF-MIDAS and U-MIDAS) when predicting the GDP growth of the four largest Euro Area economies between 2011Q4 and 2020Q3. We consider various high-frequency indicators, horizons and sub-periods, each of the latter with a distinct level of uncertainty. A meta-regression, with an average error metric as exogenous variable, is estimated to account for potential differences in performance by country, indicator, sample period or method. The results obtained with the whole sample do not reveal any difference in the predictive accuracy of the models under comparison. The findings are robust to the forecasting error metric used, RMSFE or MAFE.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

The Exponential Almon weighting function was proposed in [24], and it has the following expression, with Q shape parameters:

$$\begin{aligned} b(j;\boldsymbol{\theta })=\dfrac{\exp (\theta _{1}j+...+\theta _{Q}j^{Q})}{\sum _{j=0}^{K_{\max }}\exp (\theta _{1}j+...+\theta _{Q}j^{Q})},\text { where } \boldsymbol{\theta } = \left\{ \theta _1,\theta _2,\dots ,\theta _Q \right\} . \end{aligned}$$(2)Beta weighting function, proposed for the first time in [23], includes only two shape parameters:

$$\begin{aligned} b(j;\boldsymbol{\theta })=\dfrac{\beta (\dfrac{j}{K_{\max }};\theta _{1},\theta _{2})}{\sum _{j=0}^{K_{\max }}\beta (\dfrac{j}{K_{\max }};\theta _{1},\theta _{2})},\text { where } \boldsymbol{\theta } = \left\{ \theta _1,\theta _2\right\} , \end{aligned}$$(3)and \(\beta (\cdot )\) is the Beta probability density function.

- 2.

In order to keep focused on the models’ performance evaluation and comparison, we do not present in this chapter the ML function and its corresponding Kalman filter equations, as these are standard in the state space models literature. However, for readers unfamiliar with this type of formulations, all the equations needed to compute the ML can be found in [7], Sect. 5.3.2, where expression (5.50) specifically shows the log-likelihood function used.

- 3.

Notice that the polynomial \(\hat{\theta }(Z)\) does not include the unit term as \(\hat{\epsilon }_{kT_q+es}\) is not known at period \({T_q k + es}\).

- 4.

GDP data were downloaded from the webpage: https://ec.europa.eu/eurostat/web/national-accounts/data/database.

- 5.

Volume Index of Industrial Production indicators were downloaded from the webpage: https://ec.europa.eu/eurostat/databrowser/view/sts_inpr_m/default/table?lang=en

Consumer Confidence Indicators were downloaded from the webpage: https://ec.europa.eu/info/business-economy-euro/indicators-statistics/economic-databases/business-and-consumer-surveys/download-business-and-consumer-survey-data/time-series_en.

- 6.

In some specific cases, probably due to the presence of outliers, data was adjusted in order to not alter subsequent results and conclusions. In practice, the detection and treatment of these extreme nowcasts/forecasts would be easily addressed by an analyst. In summary, less than 0.9\(\%\) of predictions were adjusted, most of them corresponding to Italy and Spain. Regarding the methods applied, the adjustments distribute uniformly, except for U-M\(_{3}\) and ADL-M\(_{3}\) that account for half of the adjusted values corresponding to each one of the rest of the methods. The exact same estimations have been calculated without these corrections and conclusions do not vary significantly.

- 7.

Matlab code to estimate TF-MIDAS model is available from the authors.

- 8.

The analogous figure for MAFE can be found in [3]. The main conclusions do not differ significantly from those for RMSFE.

- 9.

Analogous figures for RMSFE by countries, indicators and horizons can be found in [3].

References

Andreou, E., Ghysels, E., Kourtellos, A.: Should macroeconomic forecasters use daily financial data and how? J. Bus. Econ. Stat. 31(2), 240–251 (2013). https://doi.org/10.1080/07350015.2013.767199

Aprigliano, V., Foroni, C., Marcellino, M., Mazzi, G., Venditti, F.: A daily indicator of economic growth for the Euro Area. Int. J. Comput. Econ. Econom. 7(1/2), 43–63 (2017). https://ideas.repec.org/a/ids/ijcome/v7y2017i1-2p43-63.html

Bonino-Gayoso, N.: Mixed-frequency models. Alternative comparison and nowcasting of macroeconomic variables. Ph.D. thesis. Universidad Complutense de Madrid (2022). https://docta.ucm.es/entities/publication/4379324f-9ddb-4578-99b3-a971b8fd47ee

Bonino-Gayoso, N., Garcia-Hiernaux, A.: TF-MIDAS: a transfer function based mixed-frequency model. J. Stat. Comput. Simul. 91(10), 1980–2017 (2021). https://doi.org/10.1080/00949655.2021.1879082

Box, G.E.P., Jenkins, G.M.: Time Series Analysis: forecasting and Control. Holden-Day (1976)

Carriero, A., Galvão, A.B., Kapetanios, G.: A comprehensive evaluation of macroeconomic forecasting methods. Int. J. Forecast. 35(4), 1226–1239 (2019). https://doi.org/10.1016/j.ijforecast.2019.02.007

Casals, J., Garcia-Hiernaux, A., Jerez, M., Sotoca, S.: State-Space Methods for Time Series Analysis: theory, Applications and Software. Chapman & Hall (2016)

Castle, J., Hendry, D.: Forecasting and nowcasting macroeconomic variables: a methodological overview. Economics Series Working Paper 674. University of Oxford, Department of Economics (2013). https://ideas.repec.org/p/oxf/wpaper/674.html

Chernis, T., Sekkel, R.: A dynamic factor model for nowcasting Canadian GDP growth. Empir. Econ. 53(1), 217–234 (2017). https://doi.org/10.1007/s00181-017-1254-1

Clements, M.P., Galvão, A.B.: Macroeconomic forecasting with mixed-frequency data: forecasting output growth in the United States. J. Bus. Econ. Stat. 26(4), 546–554 (2008). https://doi.org/10.1198/073500108000000015

Clements, M.P., Galvão, A.B.: Forecasting US output growth using leading indicators: an appraisal using MIDAS models. J. Appl. Econom. 24(7), 1187–1206 (2009). https://doi.org/10.1002/jae.1075

Dogan, B.S., Midiliç, M.: Forecasting Turkish real GDP growth in a data-rich environment. Empir. Econ. 56, 367–395 (2019). https://doi.org/10.1007/s00181-017-1357-8

Duarte, C.: Autoregressive augmentation of MIDAS regressions. Tech. Rep. w201401, Banco de Portugal, Economics and Research Department (2014). https://ideas.repec.org/p/ptu/wpaper/w201401.html

Duarte, C., Rodrigues, P.M.M., Rua, A.: A mixed frequency approach to the forecasting of private consumption with ATM/POS data. Int. J. Forecast. 33(1), 61–75 (2017). https://doi.org/10.1016/j.ijforecast.2016.08.003

Foroni, C., Marcellino, M.: A comparison of mixed frequency approaches for nowcasting Euro Area macroeconomic aggregates. Int. J. Forecast. 30(3), 554–568 (2014). https://doi.org/10.1016/j.ijforecast.2013.01.010

Foroni, C., Marcellino, M., Schumacher, C.: U-MIDAS: MIDAS regressions with unrestricted lag polynomials. CEPR Discussion Paper 8828 (2012). http://econpapers.repec.org/paper/cprceprdp/8828.htm

Foroni, C., Marcellino, M., Schumacher, C.: Unrestricted mixed data sampling (MIDAS): MIDAS regressions with unrestricted lag polynomials. J. R. Stat. Soc. Ser. A 178(1), 57–82 (2015). https://doi.org/10.1111/rssa.12043

Galli, A., Hepenstrick, C., Scheufele, R.: Mixed-frequency models for tracking short-term economic developments in Switzerland. Int. J. Central Bank. 15(2), 151–178 (2019). https://ideas.repec.org/a/ijc/ijcjou/y2019q2a5.html

Garcia-Hiernaux, A., Casals, J., Jerez, M.: Fast estimation methods for time-series models in state-space form. J. Stat. Comput. Simul. 79(2), 121–134 (2009). https://doi.org/10.1080/00949650701617249

Ghysels, E.: Matlab toolbox for mixed sampling frequency data analysis using MIDAS regression models. Tech. rep. (2014)

Ghysels, E., Kvedaras, V., Zemlys-Balevičius, V.: Mixed data sampling (MIDAS) regression models. In: Handbook of Statistics, vol. 42, chap. 4, pp. 117–153. Elsevier (2020). https://doi.org/10.1016/bs.host.2019.01.005

Ghysels, E., Santa-Clara, P., Valkanov, R.: The MIDAS touch: mixed data sampling regression models. Working paper, UNC and UCLA (2002). http://econpapers.repec.org/paper/circirwor/2004s-20.htm

Ghysels, E., Santa-Clara, P., Valkanov, R.: Predicting volatility: getting the most out of return data sampled at different frequencies. Anderson School of Management working paper and UNC Department of Economics working paper (2003). https://papers.ssrn.com/abstract=440941

Ghysels, E., Santa-Clara, P., Valkanov, R.: There is a risk-return trade-off after all. J. Financ. Econ. 76(3), 509–548 (2005). https://doi.org/10.1016/j.jfineco.2004.03.008

Ghysels, E., Santa-Clara, P., Valkanov, R.: Predicting volatility: getting the most out of return data sampled at different frequencies. J. Econom. 131(1), 59–95 (2006). https://doi.org/10.1016/j.jeconom.2005.01.004

Ghysels, E., Sinko, A., Valkanov, R.: MIDAS regressions: further results and new directions. Econom. Rev. 26(1), 53–90 (2007). https://doi.org/10.1080/07474930600972467

Giacomini, R., Rossi, B.: Forecast comparison in unstable environments. J. Appl. Econom. 25, 595–620 (2010). https://doi.org/10.1002/jae.1177

Jansen, W.J., Jin, X., de Winter, J.M.: Forecasting and nowcasting real GDP: comparing statistical models and subjective forecasts. Int. J. Forecast. 32(2), 411–436 (2016). https://doi.org/10.1016/j.ijforecast.2015.05.008

Kim, H.H., Swanson, N.R.: Methods for backcasting, nowcasting and forecasting using factor-MIDAS: with an application to Korean GDP. J. Forecast. 37(3), 281–302 (2017). https://doi.org/10.1002/for.2499

Koenig, E.F., Dolmas, S., Piger, J.: The use and abuse of real-time data in economic forecasting. Rev. Econ. Stat. 85(3), 618–628 (2003). https://doi.org/10.1162/003465303322369768

Kuck, K., Schweikert, K.: Forecasting Baden-Württemberg’s GDP growth: MIDAS regressions versus dynamic mixed-frequency factor models. J. Forecast. 40(5), 861–882 (2020). https://doi.org/10.1002/for.2743

Kuzin, V., Marcellino, M., Schumacher, C.: MIDAS versus mixed-frequency VAR: nowcasting GDP in the Euro area. Int. J. Forecast. 27(2), 529–542 (2011). https://doi.org/10.1016/j.ijforecast.2010.02.006

Lehrer, S., Xie, T., Zhang, X.: Social media sentiment, model uncertainty, and volatility forecasting. Econ. Modell. 102(105556) (2021). https://doi.org/10.1016/j.econmod.2021.105556

Mariano, R.S., Ozmucur, S.: Predictive Performance of Mixed-Frequency Nowcasting and Forecasting Models (with Application to Philippine Inflation and GDP Growth). SSRN Pap. (2020). https://doi.org/10.2139/ssrn.3666196

Mulero, R., Garcia-Hiernaux, A.: Forecasting Spanish unemployment with Google Trends and dimension reduction techniques. SERIEs 12(3), 329–349 (2021). https://doi.org/10.1007/s13209-021-00231-x

Schumacher, C.: MIDAS regressions with time-varying parameters: an application to corporate bond spreads and GDP in the euro area. In: Annual Conference 2014 (Hamburg): evidence-Based Economic Policy, Verein für Socialpolitik/German Economic Association (2014). http://econpapers.repec.org/paper/zbwvfsc14/100289.htm

Schumacher, C.: A comparison of MIDAS and bridge equations. Int. J. Forecast. 32(2), 257–270 (2016). https://doi.org/10.1016/j.ijforecast.2015.07.004

Tsui, A.K., Yang, Xu., C., Zhaoyong, Z.: Macroeconomic forecasting with mixed data sampling frequencies: evidence from a small open economy. J. Forecast. 37(6), 666–675 (2018). https://doi.org/10.1002/for.2528

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Bonino-Gayoso, N., Garcia-Hiernaux, A. (2023). Macroeconomic Forecasting Evaluation of MIDAS Models. In: Valenzuela, O., Rojas, F., Herrera, L.J., Pomares, H., Rojas, I. (eds) Theory and Applications of Time Series Analysis. ITISE 2022. Contributions to Statistics. Springer, Cham. https://doi.org/10.1007/978-3-031-40209-8_10

Download citation

DOI: https://doi.org/10.1007/978-3-031-40209-8_10

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-40208-1

Online ISBN: 978-3-031-40209-8

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)