Abstract

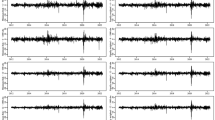

In portfolio management theory, the principle of separation states that with the same input, all investors will have the same optimal risk portfolio. Whether the portfolio will actually be optimal depends on how accurate the results of the technical analysis conducted by the portfolio manager, or the investor is in order to predict the rate of return on the financial assets included in the portfolio. In this article, Autoregressive Integrated Moving Average (ARIMA) models have been used to predict assets’ prices of four Bulgarian companies. Estimated rates of return have been calculated from the models. An optimal risk portfolio has been organized based on the Markowitz model. The resulting portfolio has been compared with a similar one obtained on the same data, using Modified Ordinary Differential Equations (ODE) to derive the forecast rates of return of the assets.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Bodie, Z., Kane, A., Marcus, A.: Investments. 10th global ed. McGraw-Hill Education, Berkshire (2014).

Markova, M.: Convolutional neural networks for forex time series forecasting. In: New Trends in the Applications of Differential Equations in Sciences, vol. 2459, pp. 030024–1–9, AIP Publishing (2022).

Hyndman, R. J., Athanasopoulos, G.: Forecasting: principles and practice. 2nd ed. OTexts (2018).

Raeva, E., Nikolaev, I.: Retrospective Review of the Bulgarian Insurance Market Using Time Series Analysis. In: Application of Mathematics in Technical and Natural Sciences, vol. 2522, pp. 1–10, AIP Publishing (2022).

Centeno, V., Georgiev, I., Mihova, V., Pavlov, V.: Price forecasting and risk portfolio optimization. In: Application of Mathematics in Technical and Natural Sciences, vol. 2164, pp. 060006–1–15, AIP Publishing (2019).

Georgiev, I., Centeno, V., Mihova, V., Pavlov, V.: A Modified Ordinary Differential Equation Approach in Price Forecasting. In: New Trends in the Applications of Differential Equations in Sciences, vol. 2459, pp. 030008–1–7, AIP Publishing (2022).

Ngo, T. H. D., Bros, W.: The Box-Jenkins methodology for time series models. In: Proceedings Of The Sas Global Forum 2013 Conference, vol. 6, pp. 1–11, (2013).

Tabachnick, B., Fidell, L., Ullman, J.: Using multivariate statistics (Vol. 5, pp. 481–498). Boston, MA: Pearson (2007).

Xue, M., Lai, C. H.: From time series analysis to a modified ordinary differential equation. Journal of Algorithms & Computational Technology 12(2), pp. 85-90 (2018).

Lascsáková, M. The analysis of the numerical price forecasting success considering the modification of the initial condition value by the commodity stock exchanges. Acta Mechanica Slovaca 22(3), pp. 12-19 (2018).

Mihova, V., Centeno, V., Georgiev, I., Pavlov, V.: An Application of Modified Ordinary Differential Equation Approach for Successful Trading on the Bulgarian Stock Exchange. In: New Trends in the Applications of Differential Equations in Sciences, vol. 2459, pp. 030025–1–9, AIP Publishing (2022).

Acknowledgements

This paper contains results of the work on project No 2022-FNSE-04, financed by “Scientific Research” Fund of Ruse University.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Mihova, V., Centeno, V., Georgiev, I., Pavlov, V. (2023). Comparative Analysis of ARIMA and Modified Differential Equation Approaches in Stock Price Prediction and Portfolio Formation. In: Slavova, A. (eds) New Trends in the Applications of Differential Equations in Sciences. NTADES 2022. Springer Proceedings in Mathematics & Statistics, vol 412. Springer, Cham. https://doi.org/10.1007/978-3-031-21484-4_30

Download citation

DOI: https://doi.org/10.1007/978-3-031-21484-4_30

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-21483-7

Online ISBN: 978-3-031-21484-4

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)