Abstract

Over the last decades the complexity of R &D processes in the pharmaceutical industry have resulted in a decline in the efficiency of those processes. Despite financial resources used in R &D have increased over time the number of drugs developed has remained almost constant. The phenomenon is known as “Eroom’s Law”. In order to start growing R &D efficiency again, the business models of companies were reviewed by mainly implementing open innovation models that can simplify and shorten the drug development process. Pharmaceutical companies are increasingly outsourcing activities from the external environment. The R &D tasks that firms choose to outsource include a wide spectrum of activities from basic research to late-stage development: genetic engineering, target validation, assay development, hit exploration and lead optimization (hit candidates-as-a-service), safety and efficacy tests in animal models, and clinical trials involving humans. Terms such as crowdsourcing, innovation centers, R &D collaboration, and open source are becoming more and more common in the sector. Almost all the Big Pharma are striving to create collaborative networks that might allow them to be more efficient. Pharmaceutical companies are called upon to make a “make or buy” decision to determine whether it is more convenient to outsource these activities rather than exploiting internal resources for generating innovation. In a global context in which the stochastic view has become more suitable for interpreting phenomena the aim of this kind of decision is mainly related to decrease uncertainty. The aim of the chapter is to explore this topic by also providing data and examples.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Introduction

The Research and Development [R &D] process in the pharmaceutical industry is particularly complex and demanding. The pharmaceutical company’s ability to be innovative and competitive is determined by the success of the R &D process, since the result of research coincides with the organization’s source of profit. In addition to its intrinsically complex nature, the process is very sensitive to economic, technological, and social factors, which leads the pharmaceutical company to face continuous challenges. The world today seems to be moving much faster compared to a few decades ago, with disruptive innovations that must be responded to with a minimum reaction time in order to survive in the market. This requires companies of all sectors to adapt faster, to be flexible, and always ready to seize opportunities and defend themselves against unexpected and unpredictable threats that can emerge in the rapid course of events. In the past, the pharmaceutical sector found it difficult to adapt to these new conditions, remaining rooted in traditional systems and showing a certain reluctance toward the innovations that have totally changed many other industries. This has led to a decreasing trend in the productivity of R &D investments. As Greiner’s theory of evolution shows, crises drive growth. Also in this case, the temporary crisis has given an input to the companies in the sector for a greater opening toward new business models, causing significant changes especially in the R &D structure. However, progress in this direction may not be sufficient to put the pharmaceutical industry in a completely safe position, as it yet has to be apt for new challenges.

2 The Problem of R &D Efficiency of Pharmaceutical Companies

2.1 Eroom’s Law

R &D efficiency is typically measured as the ratio of output to input. The most commonly used outputs are the number of approved NMEs (New Molecular Entities), the number of scientific publications, patent applications, or patents granted (Schuhmacher et al. 2021). The costs of the R &D activity or the number of personnel employed in these activities are typically used as inputs. However, correctly measuring inputs and outputs of pharmaceutical research and development is quite difficult, given the complexity of the process, which includes multiple and heterogeneous sources of knowledge and lasts for several years. Furthermore, the process is more than ever influenced by external sources such as collaborations with public and private institutions, partnerships, and knowledge spillovers.

In recent decades, a sharp decline in R &D efficiency has taken place within the pharmaceutical industry as a result of the increasing complexity of R &D activities. Although investments in pharmaceutical R &D have seen a significant increase in recent years, the production of new approved drugs has instead slowed down. This caused the decline in efficiency that led to the creation of a new term, the “Eroom’s law”, in which the word “Eroom” is “Moore” read backward, to highlight the contrast with the advances of other forms of technology (like transistors) over time. The term was coined by researchers from Sanford Bernstein (UK), following the detection of an exponential increase in the overall cost of research and development on new drugs approved by the FDA over the past 60 years. They discovered that the number of new drugs approved by the US FDA per billion dollars of research and development spending in the pharmaceutical industry has halved approximately every 9 years since 1950 (Scannell et al. 2012) (Fig. 1).

Source Scannell et al. (2012)

R &D efficiency trend in the pharmaceutical industry.

The same researchers who observed this dynamic and who coined the expression “Eroom’s law” also provided an explanation of the main causes of this decreasing trend. The first is called “better than the Beatles problem” referring to the fact that it would be difficult for new pop songs to be successful if they had to be necessarily better than the Beatles. What happens to new drugs is very similar: as the basket of approved and marketed drugs is already rich in effective medicines, it becomes increasingly difficult to develop new ones that are on par or better in terms of effectiveness. This discourages research and development in some areas that have already been explored and instead encourages the search for drugs that treat more difficult diseases and that hence face greater obstacles to approval and adoption. The second cause is the so-called “cautious regulator problem”, which refers to the progressive reduction of risk tolerance by drug regulatory agencies. Whenever there is a negative event such as the removal of a drug from the market for safety reasons, the regulations tighten, making R &D more complex and time consuming, therefore more expensive. While in the past there was less risk aversion, today patient safety comes first, even if this leads to increased costs and a slowdown in innovation. A further cause is the “throw money at it tendency”, namely the tendency by pharmaceutical companies to increase R &D inputs, adding personnel, and investing additional resources with the illusory aim of improving company competitiveness. Today this trend seems to be decreasing, as many R &D costs are being cut, and productivity does not seem to suffer. Finally, the latest cause of Eroom’s law is the “basic research-brute force bias”, or the tendency to think that an improvement in basic research and in screening methods performed in the first steps of the standard discovery and pre-clinical research, can increase the safety and efficiency of clinical trials. However, this belief proved to be fallacious; in fact, the probability that a drug successfully passes clinical studies has remained almost constant for 50 years, and the overall efficiency of R &D activities has therefore decreased (Scannell et al. 2012).

Excessively long lead times mainly affect cost increases and the risk of industry rivalry (Schumacher et al. 2016). The cost increase is due to the cost capitalization, since these costs are incurred many years before the launch of any successful drug. Furthermore, excessively long timescales reduce the probability of being first on the market, since many companies focus on the same targets and compete only on time. The causes of the increasing R &D times are the long and strict regulation procedure to ensure the safety and efficacy of drugs and the interest of research increasingly oriented toward new and complex therapeutic areas aimed to differentiate from the competition. This implies a greater number of failures and therefore increasing costs. Another important consequence is the decrease in production in terms of new approved drugs. The majority of R &D investments are concentrated in therapeutic areas with unmet needs where the risk of failure is very high. With such high attrition rates, to have a good chance of getting at least one successful drug at the end of the process, it is necessary to screen a very large number of molecules.

Furthermore, the expiration of patents on blockbuster drugs, the entry into the market of generic drugs at competitive prices and the increasingly tight budget of the healthcare industry are surrounding conditions that make the challenges for pharmaceutical companies even more difficult and demanding.

Over the past decade, some scholars have noted an inversion of Eroom’s law. As of 2010, there have been an additional 0.7 launches of new molecular entities (NMEs) per million dollars of R &D spending per year by 2018. The main reason is the increase in success rates, mainly due to the availability of better information for decisions (Ringel et al. 2020). However, the efficiency of R &D activities is still a key challenge for this industry (Fig. 2).

Source Ringel et al. (2020)

Number of New Molecular Entities Approved Per US$ Billion R &D Spend.

To outline the challenges the pharmaceutical industry has been facing in recent years, at first the R &D costs trend is analyzed, then the outputs produced, i.e., the number of products in the pipeline, which are considered as a measure of R &D activity.

2.2 Analysis of R &D Costs in the Pharmaceutical Sector

As previously mentioned, the pharmaceutical industry is one of the sectors that boasts the largest investments in R &D. Globally, USD 186 billion was spent on R &D in 2019, for a total of 50 billion more than in 2012 and the trend is strongly growing. Total pharmaceutical R &D spending is estimated to be USD 230 billion in 2026 (EvaluatePharma, 2020).Footnote 1 An increasing use of resources in Research and Development should be an indicator of the greatest commitment of companies in the search for innovations, and therefore be considered positively. However, this is not the case in the pharmaceutical industry, where the greatest investments are the consequence of an increasingly inefficient use of resources (Fig. 3).

Among the major companies are top investors Swiss companies Roche and Novartis, followed by the US Pfizer, Merck and Co., Bristol-Myers Squibb, and Johnson & Johnson (Christel 2021). Roche is the pharmaceutical company that devotes the most resources to R &D (over 14 billion US dollars in 2020) and forecasts for the next few years seem to confirm this hegemony.

To conduct a more in-depth analysis on the trend of R &D costs and on the output of the R &D activity, data relating to 15 pharmaceutical companies were collected, including the global top ten by turnover in 2020 and 5 other smaller companies, but still counted among the Big Pharma, having a total annual production value of more than 10 billion US dollars. They are the most influential companies in the pharmaceutical industry, leading the entire industry and having great power over the global economy. Two clarifications are necessary: Johnson & Johnson is a multinational that does not operate exclusively in the biopharmaceutical sector, but also produces personal care products, self-medications, and medical devices, so the value of production does not refer only to the pharmaceutical sector. Another company could fully fall under Big Pharma, namely the German Boehringer Ingelheim. However, due to the lack of data available, it was excluded from the set of companies.

As regards R &D costs, data about the 15 companies were collected from 2015 to 2020. As can be seen in Fig. 4, the trend in R &D spending in recent years has largely been increasing, demonstrating that the majority of pharmaceutical companies are raising their investments in R &D in absolute terms year by year.

It is necessary to take into account the complexity of estimating R &D costs, which in some cases could also contain expenses for the acquisition of external R &D projects. For example, Gilead Sciences incurred R &D cost of approximately US$ 5 billions in 2020. However, this figure does not take into account the purchase of IPR &D (In-process R &D), which would raise the total amount of expenditure to around 10 billion.

In addition to observing an overall growing trend in terms of absolute expenditure, it is also important to relate this expenditure to the total value of production. As shown in Fig. 5, in recent years the percentage has remained almost constant for all the companies considered, except for Gilead Sciences and Abbvie which reached a peak in 2019 and 2018, respectively, and then returned to values similar to those of previous years.

The highest percentage is that of Gilead Sciences, which in 2019 invested 40% of the total value of production to R &D expenses.

2.3 Analysis of Pipeline Drugs

A drug pipeline refers to the set of drugs under development by a pharmaceutical company. A pipeline includes products belonging to all the phases, i.e., pre-clinical phase, clinical test phases, regulatory approval phase, and market launch phase. However, only those in the post-launch monitoring phase are considered to be part of the pipeline, while drugs whose development has stopped or is complete are typically excluded. The size of a company’s drug pipeline is a good indicator of the dynamism of R &D activities. Having a large number of drugs in the pipeline means having more opportunities to obtain successful drugs, thus mitigating the risk of failures. Overall, in recent years, the number of pharmaceuticals in the pipeline of companies around the world has seen and continues to see a slight increase (Informa Pharma Intelligence, 2021),Footnote 2 which is, anyway, less than the growth in R &D investments. However, the annual growth rate is highly variable according to the phase considered. Typically, higher growth rates occur in the pre-clinical phase, while the most “stagnant” phases are always phase II and phase III of clinical trials (i.e., those in which the attrition rate is highest). Among the 15 pharmaceutical companies analyzed, there are many differences in terms of pipeline size; among those with the highest average number of drugs in the pipeline is Novartis, which had 232 drugs in the pipeline in January 2021. Lastly, Gilead Sciences, with an average number of 69 drugs in the pipeline in the last 7 years, has recorded a significant increase in the last year (Fig. 6).

Data source reports by Pharma Intelligence, available at https://pharmaintelligence.informa.com

Number of drugs in the pipeline of the 15 Big Pharma from 2015 to 2021.

With regards to the trend in recent years, in Fig. 7 we can observe variable behavior among different companies. The size of the pipeline has always remained close to the average value for Bayer, Otsuka, Eli Lilly, and Novartis. More significant changes were recorded for Takeda, GlaxoSmithKline [GSK], and AstraZeneca. In particular, GSK and AstraZeneca have recorded a sharp decline in the number of drugs in the pipeline in recent years.

In general, there is a positive correlation between R &D expenditures and the average size of the pipeline: companies that spent more resources in R &D over the 6 years maintained an overall higher average number of drugs in the pipeline than those who invested less. However, there are companies that have proved less efficient, since despite spending a lot, they have not managed to keep a sufficiently high number of drugs in development (Fig. 8). The trend of costs and the trend in the number of pipeline drugs can be jointly observed to get an idea of the efficiency of investments in research and development, considering the totality of all 15 companies analyzed. The results are visible in Fig. 9. As can be seen, the total costs are increasing, while the total number of drugs in the pipeline has a downward trend. In 2020, however, a reversal of direction as far as the number of drugs in development takes place.

Source Pharma Intelligence (https://pharmaintelligence.informa.com) and Bureau van Dijk Orbis

Relation between cumulative R &D expenditure (2015–2020) and average pipeline size (2015–2021).

Source Pharma Intelligence (https://pharmaintelligence.informa.com) and Bureau van Dijk Orbis

Trend of the number of drugs in the pipeline (secondary axis) and R &D expenses in thousands USD (primary axis) of the 15 pharmaceutical companies.

3 New R &D Open Innovation Models for Pharmaceutical Companies

The imbalance between inputs and outputs has put a question mark over the long-term sustainability of the R &D model of the pharmaceutical sector and has forced large companies to seek solutions that allow them to improve their productivity. On the one hand, there are compelling and established reasons behind the choice of a closed R &D process—which basically consists in preventing the disclosure of all the important information to the outside. The most notable motivations are the fear of the competition (that could use this information to be the first in the market), the need to protect the intellectual property, and the confidentiality of the patients’ data (Au 2014). On the other hand, this closed model did not prove to be the most effective because of the evidence previously provided. This is critical for all the companies in the industry, which are impelled by the imperative of continuously innovating and staying competitive. Therefore, all the pharmaceutical companies are changing their business models, in particular their strategies for R &D, moving toward more “open” models, where the knowledge is shared between different actors. The newly developed business model features collaborations with a variety of actors, including academic research institutions, private and public organizations, and other companies operating in the healthcare environment at every stage of the R &D process.

In recent times and with ever-increasing intensity, Big Pharma is among the main players in transactions such as mergers and acquisitions [M &A], partnerships and collaborations, and outsourcing of products and processes, which involve a complete restructuring of the R &D. Following the example of other industries which pioneered the sharing of knowledge, pharmaceutical multinationals have started to realize the full potential of open innovation. Companies can therefore acquire products, processes, or entire companies to fill any gaps in their product portfolio or simply to enrich their pipeline of candidate drugs, or they can access external know-how in outsourcing, to broaden their knowledge and contribute to the discovery of new compounds. Also, FDA and EMA decided to give free access to their clinical trial database in order to let anyone use the data to help accelerate the new drug development process and make the approval process more efficient (Au 2014).

The open innovation in the pharmaceutical industry is linked to the important concept of “absorptive capacity”, which is defined as a firm’s “ability to recognize the value of external knowledge, assimilate it, and apply it to commercial ends” (Cohen and Levinthal 1990). The new business models promoted by pharmaceutical companies are based on this ability. Pharmaceutical companies benefit from absorbing external knowledge from other practitioners in the field in order to best adapt to the latest technologies and innovations (Romasanta et al. 2022). Patterson and Ambrosini (in Patterson and Ambrosini (2015)) defined the absorption process of the pharmaceutical industry as follows: search and recognize the value of new knowledge (through connections with universities, research organizations, and so on), assimilate it (namely, process and interpret it), acquire the rights of using this knowledge, transform the knowledge further developing it and combining it with the existing knowledge of the company and at the end exploit this knowledge to obtain important results (Patterson and Ambrosini 2015). In general, pharmaceutical companies have several options available to access external knowledge. They can apply traditional strategies such as M &A, licensing agreements, and partnerships with research institutes or universities, in order to strengthen the internal R &D efforts, and/or take advantage of opportunities throughout the R &D value chain to access external sources of innovation. Open innovation models are increasingly popular: they consist of new ways of carrying out R &D activities within the organizations, actively involving external actors, whether they are experienced researchers from academic institutions or scientists. A growing number of pharmaceutical companies are turning to these alternative models of open innovation, breaking down the barriers between the internal organization and the environment that surrounds it, populated by a large number of actors that can bring significant value to the company. The companies are required to integrate different strategies, both traditional and innovative, so as to build new and more efficient R &D models. Currently, the standard for pharmaceutical multinationals consists in having a portfolio mainly containing externally generated projects (Schuhmacher et al. 2013). Two different types of R &D partnerships, related to different kinds of resource outsourcing, can be identified:

-

Outsourcing of products within different stages of the R &D process or of entire processes, through license agreements or M &A (direct partnerships).

-

Outsourcing of knowledge, consisting in the integration of external knowledge within the organization through collaborations, partnerships, and open knowledge platforms (indirect partnerships).

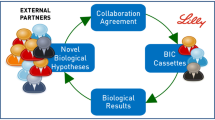

Direct outsourcing, obtained through direct partnerships, brings more immediate benefits, such as a rapid increase of drug candidates in the pipeline, but it is more expensive and therefore riskier. Furthermore, through direct outsourcing the company could risk losing its ability to innovate, excessively relying on external sources. Indirect outsourcing, via indirect partnerships, can lead to greater difficulties in the immediate term, as integrating internal and external knowledge is not always easy, but in the long term it can bear fruit at much lower costs than direct outsourcing (Fig. 10).

The models included in both the categories of direct and indirect partnerships will be described.

3.1 Mergers and Acquisitions

The pharmaceutical sector has always been characterized by an intense M &A activity, in which large multinationals acquire smaller companies with the aim of increasing size and quality, as well as diversifying their drug pipeline. Through these types of operations, pharmaceutical companies seek to promote better financial and operational performance. The term M &A refers to transactions that take place between two entities that combine in some way. Even if, usually, the two terms “merger” and “acquisition” are used interchangeably, they refer to two distinct operations. In a merger, two companies of similar size merge to form a single entity, while an acquisition takes place when a larger company buys a smaller company, completely absorbing it. Both types of operations can be hostile or friendly.

The most common reasons why pharmaceutical companies frequently resort to this type of transaction are the following:

-

Offset the loss of revenue due to the expiration of blockbuster drugs and the entry into the market of generic drugs;

-

Expand its research scope to include new therapeutic areas;

-

Access patented technologies of strategic importance;

-

Expand the drug pipeline;

-

Enter new markets.

In the pharmaceutical industry, M &A transactions are usually of the horizontal type. It means they take place between companies both producing drugs, but which differ, for example, by therapeutic areas treated or by type of drugs developed. The most popular acquisitions are those that large pharmaceutical companies operate toward small biotech companies, in order to include in their R &D project portfolio, not only drugs obtained from chemical or artificial products, but also drugs produced from living organisms. Pharma Intelligence (2020) reports that from 2010 to 2019 there were over 700 M &A transactions in the pharmaceutical and biotech industries, with Abbvie, Takeda, and Bristol-Myers Squibb in the top three by number of agreements signed. Indeed, in 2018, Takeda acquired Shire for $62 billion, while in 2019, Bristol-Myers Squibb acquired Celgene ($74 billion) and Abbvie Allergan (for $63 billion) (Statista, 2021).Footnote 3

3.2 In-licensing Agreements

Pharmaceutical companies can acquire the right to dispose of a drug patented by another company (or a research laboratory) through a licensing agreement, in exchange for paying royalties to the licensor company. Pharmaceutical and biotechnology companies are turning to the in-licensing agreements with increasing frequency. This leads to considerable advantages on both sides: the in-licensing allows pharmaceutical companies to enrich their pipeline and to market new drugs in authorized countries. On the other hand, the advantage for the biotechnology companies is that they can access the resources needed for the development of the final stages of the development process, for clinical trials, for the production and distribution, sharing the risk with companies that are larger and more solid from a financial point of view. Today many of the candidate drugs included in the big pharma pipeline are not developed in-house, but outsourced to other companies, typically smaller and more research-focused, just like biotechnology companies. Pharmaceutical companies that own most internally developed drugs are commonly referred to as “research-based”. A drug obtained via a licensing agreement can be in different stages of development, so it can also be ready to market. In this case, the license covers only the sale of the drug. If the drug is still under development, the company that purchased the license will have to take care of the continuation of this process. The achievement of certain milestones in development can involve the payment of additional royalties to the licensor.

In some respects, licensing agreements are much more convenient compared with the traditional drug discovery process, in which a company embarks on a project by investing large sums and taking a very high risk. Furthermore, in-licensing is more attractive than M &A operations. This is because the licenses allow pharmaceutical companies to purchase the rights to experimental drugs without having to carry the entire baggage of another organization. According to an analysis carried out by KPMG (2021),Footnote 4 593 licensing agreements were signed between pharmaceutical companies around the world in 2020, with a substantial growth compared to the 360 of the previous year. Among the top deals of 2020 we find the $1.7 billion worth deal between Roche and Blueprint. With this agreement, Roche has added Blueprint medicine RET inhibitor pralsetinib to its cancer drug portfolio. Another remarkable licensing agreement is the one signed by AstraZeneca and Daiichi Sankyo for one of the Japanese pharmaceutical company’s antibody-drug conjugates (ADCs). Further agreements were signed by Sanofi, Merck and Co., Abbvie and Eli Lilly (Taylor, 2021).Footnote 5

3.3 Outsourcing R &D Processes from CROs

Contract Research Organizations [CROs] are organizations that operate in the service sector providing support to pharmaceutical and biotechnology companies. The latter can outsource research services for new drugs or medical devices, avoiding the huge costs that these processes would require if carried out internally. Research services range from drug discovery to commercialization, with a particular focus on the clinical phase. Rather than hiring permanent employees with the specialist knowledge necessary to perform some of the activities included in the development process in-house, pharmaceutical companies can pay a CRO to carry out these activities externally. The CRO, acting as an independent contractor with specialist knowledge, performs a number of tasks to help complete the new drug development process faster, more efficiently, and at a lower cost. CROs can be large multinationals or small specialized companies. Leading Contract Research Organizations worldwide include the Laboratory Corporation of America Holdings, IQVIA, Syneos Health, and Pharmaceutical Product Development. The global CRO market in 2015 began a period of unstoppable growth, reaching a total value of over 40 billion US dollars in 2020 which is estimated to exceed 60 billion by 2024 (HKExnews, 2020).Footnote 6

3.4 R &D Collaborations

R &D collaborations belong to the category of indirect partnerships, as they do not involve the direct purchase of outsourced products or services from a third party, but instead the sharing of knowledge that leads to the development and marketing of new drugs. In the pharmaceutical industry collaborations with third parties are aimed to access specialized know-how, whether it is from other companies, such as biotechnology companies, or from entities belonging to the academic world, such as universities and private or public institutions. Given the growing complexity of the R &D of new drugs, today, collaborations have increased considerably, creating real ecosystems in which knowledge can be shared much more simply. Collaborations are used to access knowledge, concerning for example new drug targets, biomarkers, animal models, and translational medicine. Alliances, collaborations, and partnerships can bring substantial improvements in clinical success, while reducing long development times and total expense. Through them, each company can maintain only its own core competencies and rely on third parties just to acquire knowledge regarding areas of non-competence. Indeed, in recent years, R &D leaders have realized that by maintaining the total depth and breadth of research projects, the totality of activities cannot be done through internal efforts alone. Numerous pharmaceutical companies have moved R &D locations close to the finest academic institutions. One example is Pfizer, which in 2014 opened a new research facility in Cambridge (Massachusetts), where two of the world’s most famous academic institutes are based, Harvard University and the Massachusetts Institute of Technology (MIT). The advantages are reciprocal: pharmaceutical companies can benefit from the flows of knowledge promoted by the academic environment and academic partners can count on the economic support of the large pharmaceutical multinationals. In addition to Pfizer, GSK and Merck & Co. have also initiated massive collaborative operations (Schumacher et al. 2016). Roche Holdings official website writes: “As a pioneer in healthcare we are committed to driving groundbreaking scientific and technological advances that have the potential to transform the lives of patients worldwide. But we can’t accomplish this on our own. Only by partnering with the brightest minds in science and healthcare can we serve the needs of patients” (Roche Website). On the same page, Roche reports some useful data to understand the company’s effort in enforcing external collaborations: 40% of total sales come from a partner or in-licensed products, 50% of the pipeline comes from outside the organization and there are 220 active global partnerships. Over time, this has certainly contributed to making the company one of the world leaders in the industry.

3.5 Public-Private Partnerships

Public-Private Partnerships (PPPs) consist of collaborations between public organizations and private companies with the purpose of carrying out different projects. Typically, these agreements are used to finance projects such as the construction of public transport networks, and parks. In the pharmaceutical industry, these agreements provide for the financing of R &D activities through public funds or charities aimed at discovering new drugs, especially in therapeutic areas where there are unmet medical needs and where pharmaceutical research is less active. An example of a successful PPP is IMI [Innovative Medicines Initiative], a public-private partnership between the European Union and the European Federation of Pharmaceutical Industries and Associations [EFPIA], which aims to speed up drug development, making it better and safer, especially in areas of particular need. IMI creates a real network of experts to promote pharmaceutical innovation in Europe, bringing together universities, small- and medium-sized enterprises, pharmaceutical multinationals, research centers, patient organizations, and regulatory authorities (European Commission, 2020).Footnote 7 Funding comes from both the European Union and the EFPIA. From 2004 to 2020, funds were raised for a total of over 3 billion euros (IMI Europe). EFPIA member companies do not receive money through IMI but contribute to the partnership by providing staff, funds, clinical data, samples, compounds, etc. The beneficiaries of these resources are universities, research organizations, small- to medium-sized companies, and all the entities listed above, which work to achieve common goals. Among the most famous multinationals, Sanofi, GSK, J &J, and AstraZeneca are the ones that contributed the most, providing several teams working on numerous projects. Public-private partnerships are an open innovation model that helps companies improve business competitiveness and reduce R &D costs. Furthermore, they mitigate competition and help reduce the fragmentation of knowledge typical of the pharmaceutical sector (Schumacher et al. 2018).

3.6 Crowdsourcing

The term crowdsourcing refers to a type of activity carried out online in which a company, an organization, an institution, or a private individual proposes a problem and requests opinions, suggestions, and ideas to solve it from internet users. It is a valid economic model for the development of projects, which promotes the meeting between supply and demand. Crowdsourcing has become a very common practice in the pharmaceutical industry: companies create platforms on which to post problems and questions, inviting all experts to find solutions in exchange for a cash prize. The basic concept is always that of the absorption of knowledge from the external environment, as in partnerships and collaborations. Crowdsourcing is an extremely open, highly innovative, and inexpensive model that brings different benefits to the organizations. Through it, pharmaceutical companies can have access to a broad solution diversity and specialized skills can mitigate the risk that competitors would exploit the same openness and increase the brand visibility (Christensen and Karlsson 2019). Sanofi, Eli Lilly, Bayer, and AstraZeneca are just some of the companies that have fully exploited the potential of crowdsourcing by creating specific platforms, directly accessible from their websites. On these platforms, it is also possible to access a large set of data to deepen one’s knowledge on human diseases, collections of targeted molecules, and compounds at various stages of the development process. In this way, a bilateral sharing of knowledge is created and innovation is easily promoted. One of the best-known Open Innovation platforms is InnoCentive,Footnote 8 a global network where experts from different industries propose solutions to problems posted by public and private companies, government institutes, non-profit organizations, research institutes, and public and private laboratories. InnoCentive is a startup born from the multinational Eli Lilly, with the aim of seeking outside the company solutions to problems that internal experts were unable to solve. Among the most well-known challenges is that of TB Alliance, a non-profit organization that deals with discovering and developing new economic drugs for the treatment of tuberculosis. To involve as many people as possible, the TB Alliance proposed a contest on InnoCentive in which it sought a solution to reduce the process cost of an existing drug. Ultimately, the solution was found by two scientists, benefiting millions of people with the disease, particularly in developing countries. Other companies have, instead, a more cautious approach to crowdsourcing. They promoted initiatives like challenges, calls for tenders, and real contests. It is the case of Roche, Takeda Italia, and Pfizer.

3.7 Innovation Centers

Another model of open innovation is innovation centers, i.e., real centers that bring together scientists belonging to pharmaceutical multinationals and academic experts from all over the world, with the aim of promoting intense collaborations that can lead to innovative solutions. This model can be considered as a hybrid between a centralized R &D model with elements of open innovation (Schumacher et al. 2018). Merck has built its innovation center in Darmstadt, Germany, creating a welcoming and inspiring environment where both employees and partners can grow their ideas. An academy is also held in the center, where talented young people are guided in a training process aimed at building solid and profitable knowledge. Roche owns 7 innovation centers around the world (Zurich, Shanghai, New York, Munich, Basel, Copenhagen, Welwyn) where the sharing of skills, information, and technologies is encouraged. J &J also boasts 4 innovation centers in San Francisco, Boston, London, and Shanghai, where integrated teams of experts continuously collaborate with entrepreneurs and scientists from around the world contribute to progress in the pharmaceutical field. Innovation centers, therefore, form ecosystems in which knowledge can circulate more quickly and efficiently, bringing numerous benefits to all the players involved and promoting scientific progress on a global level.

3.8 Open Source

Open source is a widely used model in the software industry, where it has gained tremendous success in the last few years. The model consists in making source code, blueprints, or documentation available free of charge to anyone, so that it can be further developed or modified and then shared with the community. Open source is therefore based on transparency, it promotes free access to knowledge to obtain collaborative improvements without any financial compensation in return. All these concepts seem to clash with the general principle of the pharmaceutical industry, which is rather closed and highly competitive. However, the ultimate goal of pharmaceutical companies should be to create drugs that can improve people’s living conditions, and not to make the highest profits possible. Therefore, open-source models would fit well with the principles that, in theory, the pharmaceutical industry should adhere to. The issue is actually more complex, because if the information on the development of new drugs was shared without any form of protection, pharmaceutical companies would hardly be able to obtain profits so as to recover research costs and, therefore, would be discouraged and probably R &D would suffer a major setback. For this reason, open source in the pharmaceutical sector has not had the same success as in the software industry. However, several open-source initiatives have been promoted by pharmaceutical companies such as GlaxoSmithKline, which together with MIT and Alnylam Pharmaceuticals, formed the “Pool for Open Innovation against neglected tropical diseases”, which allows free access to 2,300 patents on drugs that treat tropical diseases. Another example is the “Drugs for Neglected Diseases Initiative”, a free platform on which information on the discovery and development of drugs for the treatment of diseases such as sleeping sickness, pediatric HIV, and Chagas disease is shared by AstraZeneca, Bayer, Bristol-Meyers-Squibb, Novartis, GSK, Pfizer, Sanofi, and Takeda (Schumacher et al. 2018). Open source in the pharmaceutical field is therefore mainly used to promote the development of drugs intended for the treatment of widespread diseases, especially in developing countries.

Notes

- 1.

- 2.

- 3.

- 4.

- 5.

- 6.

- 7.

- 8.

References

Au, R. (2014). The paradigm shift to an “open” model in drug development. Applied & Translational Genomics, 3(4), 86–89 (Global Sharing of Genomic Knowledge in a Free Market). https://doi.org/10.1016/j.atg.2014.09.001, https://www.sciencedirect.com/science/article/pii/S221206611400026X

Christel, M. (2021). Pharm exec’s top 50 companies. Pharmaceutical Executive 406. https://www.pharmexec.com/view/pharm-execs-top-50-companies-2020

Christensen, I., & Karlsson, C. (2019). Open innovation and the effects of crowdsourcing in a pharma ecosystem. Journal of Innovation & Knowledge, 44, 240–247. https://doi.org/10.1016/j.jik.2018.03.008, https://www.sciencedirect.com/science/article/pii/S2444569X18300362

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152. http://www.jstor.org/stable/2393553

Patterson, W., & Ambrosini, V. (2015). Configuring absorptive capacity as a key process for research intensive firms. Technovation, 36–37, 77–89. https://doi.org/10.1016/j.technovation.2014.10.003, https://www.sciencedirect.com/science/article/pii/S0166497214001382

Ringel, M. S., Scannell, J. W., Baedeker, M., & Schulze, U. (2020). Breaking Eroom’s law. Nature Reviews Drug Discovery, 19(12), 833–834. https://doi.org/10.1038/d41573-020-00059-3, https://pubmed.ncbi.nlm.nih.gov/32300238/

Romasanta, A. K., van der Sijde, P., & de Esch, I. J. (2022). Absorbing knowledge from an emerging field: The role of interfacing by proponents in big pharma. Technovation, 110, 102363. https://doi.org/10.1016/j.technovation.2021.102363, https://www.sciencedirect.com/science/article/pii/S0166497221001449

Scannell, J.W., Blanckley, A., Boldon, H., & Warrington, B. (2012). Diagnosing the decline in pharmaceutical r &d efficiency. Nature reviews Drug Discovery, 11(3), 191–200. https://doi.org/10.1038/nrd3681, https://pubmed.ncbi.nlm.nih.gov/22378269/

Schuhmacher, A., Germann, P.G., Trill, H., & Gassmann, O. (2013). Models for open innovation in the pharmaceutical industry. Drug Discovery Today, 18(23), 1133–1137. https://doi.org/10.1016/j.drudis.2013.07.013, https://www.sciencedirect.com/science/article/pii/S135964461300247X

Schuhmacher, A., Wilisch, L., Kuss, M., Kandelbauer, A., Hinder, M., & Gassmann, O. (2021). R &d efficiency of leading pharmaceutical companies—A 20-year analysis. Drug Discovery Today, 26(8), 1784–1789. https://doi.org/10.1016/j.drudis.2021.05.005, https://www.sciencedirect.com/science/article/pii/S1359644621002361

Schumacher, A., Gassmann, O., & Hinder, M. (2016). Changing R &D models in research-based pharmaceutical companies. Journal of Translational Medicine, 14(1), 479–5876. https://doi.org/10.1186/s12967-016-0838-4

Schumacher, A., Gassmann, O., & Hinder, M. (2018). Open innovation and external sources of innovation. an opportunity to fuel the R &D pipeline and enhance decision making? Journal of Translational Medicine, 16(1), 479–5876. https://doi.org/10.1186/s12967-018-1499-2

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2023 The Author(s)

About this chapter

Cite this chapter

Iazzolino, G., Bozzo, R. (2023). Partnership Models for R &D in the Pharmaceutical Industry. In: Canci, J.K., Mekler, P., Mu, G. (eds) Quantitative Models in Life Science Business. SpringerBriefs in Economics. Springer, Cham. https://doi.org/10.1007/978-3-031-11814-2_3

Download citation

DOI: https://doi.org/10.1007/978-3-031-11814-2_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-11813-5

Online ISBN: 978-3-031-11814-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)