Abstract

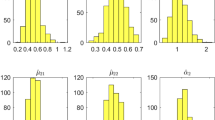

We generalize the Ornstein–Uhlenbeck process to include non-normal innovations. First we study the asymptotic behavior of the ratio estimator of the drift parameter in Gamma-Ornstein–Uhlenbeck volatility process based on observations of the price process. This model captures the stylized facts as it preserves both jumps in the volatility process. We study the behavior of the moment estimators.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Barndorff-Nielsen, O.E. and Shephard, N. (2001): Non-Gaussian Ornstein-Uhlenbeck-based models and some of their uses in financial economics (with discussion), Journal of the Royal Statistical Society, Series B, 63, 167–241.

Benth, F.E. (2003): On arbitrage-free pricing of weather derivatives based on fractional Brownian motion, Applied Mathematical Finance 10, 303–324.

Bishwal, J.P.N. (2007a): A new estimating function for discretely sampled diffusions, Random Operators and Stochastic Equations 15 (1), 65–88.

Brockwell, P.J., Davis, R.A. and Yang, Y. (2007): Estimation for non-negative Levy driven Ornstein-Uhlenbeck processes, Journal of Applied Probability 44, 977–989.

Buchmann, B. and Kluppelberg, C. (2005): Maxima of stochastic processes driven by fractional Brownian motion, Advances in Applied Probability 37, 743–764.

Comte, F., Coutin, L. and Renault, E. (2012): Affine fractional stochastic volatility models with application to option pricing, Annals of Finance, 8, 337–378.

Davis, R.A. and McCormick, W.P. (1989): Estimation for first order autoregressive processes with positive or bounded innovations Stochastic Process. Appl. 31, 237–250.

Haug, S. and Czado, C. (2006a): Quasi maximum likelihood estimation and prediction in the compound Poisson ECOGARCH(1,1) model, Sonderforschungsbereich 386, No. 516.

Haug, S. and Czado, C. (2006b): A fractionally integrated ECOGARCH process, Sonderforschungsbereich 386, No. 484.

Jongbloed, G., van der Meulen, F.H. van der Vaart, A.W. (2005): Nonparametric inference for Levy driven Ornstein-Uhlenbeck processes, Bernoulli 11, 759–791.

Kolmogorov, A.N. (1940): Wiener skewline and other interesting curves in Hilbert space, Doklady Akad. Nauk 26, 115–118.

Levy, P. (1948): Processus stochastiques et movement Brownien, Paris.

Mandelbrot, B. and Van Ness, J.W. (1968): Fractional Brownian motions, fractional noises and applications, SIAM Review 10, 422–437.

Marquardt, T. (2006b): Multivariate fractionally integrated CARMA processes, Journal of Multivariate Analysis 98, 1705–1725.

B. Nielsen, and N. Shephard, (2003): Likelihood analysis of a first order autoregressive model with exponential innovations, Journal of Time Series Analysis, 24 (3), 337–344.

Author information

Authors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Bishwal, J.P.N. (2022). Estimation in Gamma-Ornstein –Uhlenbeck Stochastic Volatility Model. In: Parameter Estimation in Stochastic Volatility Models. Springer, Cham. https://doi.org/10.1007/978-3-031-03861-7_6

Download citation

DOI: https://doi.org/10.1007/978-3-031-03861-7_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-03860-0

Online ISBN: 978-3-031-03861-7

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)